Banca Transilvania Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca Transilvania Bundle

Banca Transilvania's success hinges on a meticulously crafted marketing mix. Their product offerings, from innovative digital solutions to personalized financial advice, cater to diverse customer needs. This strategic approach to product development is a key driver of their market leadership.

Dive deeper into how Banca Transilvania leverages its product portfolio, competitive pricing, extensive distribution network, and impactful promotional campaigns to dominate the Romanian banking sector. Get the full, editable analysis to unlock their strategic secrets.

Product

Banca Transilvania offers a robust suite of business banking solutions, catering to a broad spectrum of companies from burgeoning SMEs to established corporations. This product offering is designed to fuel growth and ensure operational stability.

The bank provides diverse financing options, including investment loans for expansion, working capital loans to manage day-to-day expenses, and flexible credit lines. For instance, in 2023, Banca Transilvania reported significant growth in its loan portfolio for businesses, demonstrating its commitment to supporting the Romanian economy.

Furthermore, businesses can leverage a variety of deposit accounts for efficient liquidity management. These include current accounts for transactional needs, savings accounts for accumulating funds, and term deposits for higher yields on surplus capital, offering tailored solutions for every financial requirement.

Banca Transilvania's digital banking platforms, including BT24 and BT Pay for business, are central to its product strategy, offering entrepreneurs robust tools for remote financial management, payments, and service access.

The bank's commitment to digital transformation is evident, aiming to streamline customer interactions and boost operational efficiency. This focus has led to a significant adoption rate, with over 92% of its 4.3 million active customers actively engaging with at least one digital banking application.

Banca Transilvania actively supports businesses through specialized financing programs, including state-guaranteed initiatives like IMM Invest Plus and Creditul Fermierului. These programs are designed to bolster small and medium-sized enterprises (SMEs) and the agricultural sector, offering crucial capital for growth and operational needs.

These initiatives provide advantageous terms, such as lower collateral requirements and tailored loan amounts, making capital more accessible for a wide range of entrepreneurs. For instance, in 2024, IMM Invest Plus facilitated significant lending to SMEs, with programs often featuring government guarantees that mitigate risk for both the borrower and the bank.

Investment and Advisory Services

Banca Transilvania extends its financial reach beyond standard banking by offering robust investment and advisory services tailored for its corporate clientele. This strategic expansion aims to provide businesses with comprehensive financial solutions, fostering growth and stability.

These services encompass a wide array of investment opportunities, including access to diverse investment funds managed by entities like BT Asset Management. Furthermore, the bank provides specialized consulting to assist corporations in their strategic financial planning, a crucial element for navigating complex market landscapes.

The bank's commitment to enhancing its investment portfolio is evident in its acquisition of OTP Asset Management, now operating as INNO Investments. This move significantly bolsters Banca Transilvania's capabilities, particularly in the management of alternative investment funds, offering clients more sophisticated and potentially higher-yield investment avenues.

- BT Asset Management manages a significant portion of Banca Transilvania's investment fund offerings.

- INNO Investments, formerly OTP Asset Management, strengthens the bank's alternative investment fund management expertise.

- Strategic Financial Planning is a key advisory service offered to corporate clients.

International Trade and Treasury Services

For businesses navigating the complexities of global commerce, Banca Transilvania provides specialized international trade and treasury services. These offerings are designed to streamline cross-border payments, manage currency fluctuations, and ensure adequate liquidity for companies with international operations. In 2023, Banca Transilvania reported a significant increase in its international transaction volumes, reflecting growing client demand for these services.

The bank's commitment to supporting businesses in their global expansion is evident through its comprehensive suite of solutions. These include various trade finance instruments and sophisticated treasury management tools. As of Q1 2024, Banca Transilvania has expanded its network of correspondent banks by 15%, enhancing its ability to facilitate transactions in emerging markets.

Banca Transilvania's international trade and treasury services are crucial for:

- Facilitating secure and efficient cross-border payments and collections.

- Mitigating foreign exchange risk through hedging instruments and strategic advice.

- Providing working capital and liquidity management solutions for international trade activities.

- Leveraging an extensive global network and strategic partnerships to support business growth abroad.

Banca Transilvania's product strategy for businesses centers on a comprehensive digital ecosystem and tailored financing solutions. The bank offers robust digital platforms like BT24 and BT Pay for business, enabling efficient remote financial management. This digital focus is underscored by over 92% of its 4.3 million active customers engaging with digital applications, highlighting strong adoption and user engagement.

The product portfolio includes diverse financing options, such as investment and working capital loans, alongside specialized state-guaranteed programs like IMM Invest Plus, designed to support SMEs and the agricultural sector. In 2023, the bank saw significant growth in its business loan portfolio, demonstrating its active role in the Romanian economy.

Beyond traditional banking, Banca Transilvania provides advanced investment and advisory services through BT Asset Management and its expanded capabilities via INNO Investments. These offerings cater to corporate clients seeking strategic financial planning and access to a wider range of investment opportunities, including alternative funds.

The bank also facilitates international commerce with specialized trade finance instruments and treasury management tools, crucial for managing cross-border payments and currency risks. As of Q1 2024, an increased network of correspondent banks further enhances its global transaction capabilities.

What is included in the product

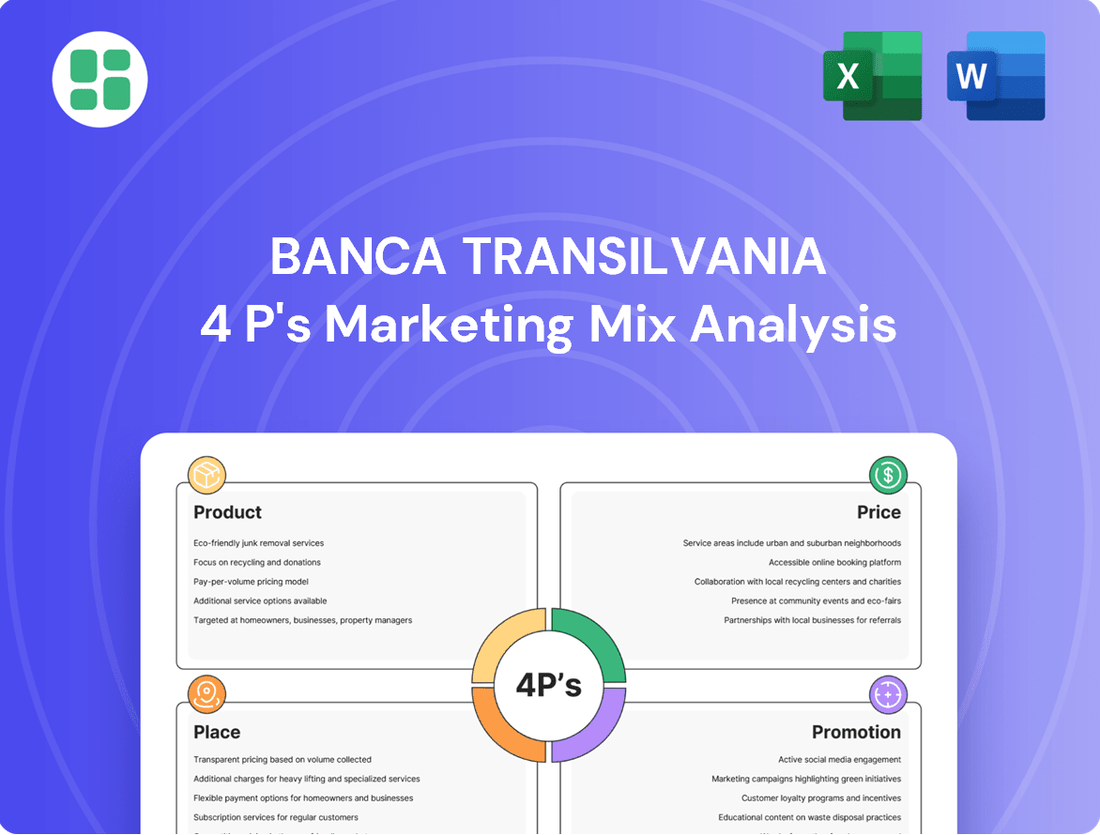

This analysis provides a comprehensive breakdown of Banca Transilvania's marketing strategies, detailing its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking to understand Banca Transilvania's market positioning and benchmark their own strategies against a leading financial institution.

Simplifies Banca Transilvania's marketing strategy, highlighting how their 4Ps address customer pain points for clearer understanding.

Provides a concise overview of Banca Transilvania's 4Ps, demonstrating how they alleviate customer frustrations and build loyalty.

Place

Banca Transilvania's extensive physical branch network is a cornerstone of its marketing strategy, offering unparalleled accessibility across Romania. With over 530 branches strategically located in 180 different localities, the bank ensures that a significant portion of the population, including businesses of all sizes, can access its services conveniently. This vast physical footprint not only facilitates direct customer interaction and personalized service but also provides crucial local support for companies operating within these communities.

Banca Transilvania distinguishes itself by offering dedicated business centers and assigning specialized relationship managers to its SME and large corporate clients. This strategic approach ensures that businesses receive tailored financial advice and solutions designed to meet their unique operational and growth needs. These dedicated teams are crucial for building and maintaining robust, long-term partnerships.

As of the first quarter of 2024, Banca Transilvania reported a significant increase in its loan portfolio for businesses, underscoring the effectiveness of its client-centric strategies. The bank's focus on personalized service through relationship managers aims to deepen client engagement and provide proactive support, which is vital for navigating complex financial landscapes.

Banca Transilvania excels with robust digital distribution, prominently featuring its BT24 online banking and BT Pay mobile app. These platforms are crucial for distributing financial products and delivering customer service, allowing businesses seamless access to transactions and account management.

The bank's digital strategy caters to the increasing demand for self-service, enabling clients to manage their finances anytime, anywhere. This digital-first approach is a key differentiator, especially as digital banking adoption continues to surge across Romania.

By the end of 2023, Banca Transilvania reported that over 2.5 million customers were actively using its digital channels, a testament to the effectiveness and reach of its online and mobile banking solutions.

Strategic Partnerships and Acquisitions

Banca Transilvania actively grows its market presence and capabilities by forging strategic alliances and acquiring other entities. A prime example is its significant expansion through the merger with OTP Bank Romania, finalized in February 2025. This strategic move not only consolidated its position but also substantially increased its customer base and operational scale within Romania.

Furthermore, Banca Transilvania's influence extends beyond national borders. The acquisition of BCR Chisinau by Victoriabank in Moldova, a move supported by Banca Transilvania's strategic interests, broadened its geographical footprint into a new market. This dual approach of organic growth and strategic consolidation is key to its market expansion strategy.

- Merger with OTP Bank Romania (February 2025): Significantly boosted Banca Transilvania's market share and customer numbers in Romania.

- Acquisition of BCR Chisinau by Victoriabank: Extended Banca Transilvania's strategic reach into the Moldovan market, enhancing its regional presence.

- Geographical Expansion: These actions collectively broadened the bank's customer base and geographical footprint, strengthening its competitive position.

Innovative Self-Service Solutions

Banca Transilvania is significantly enhancing its customer service through substantial investments in innovative self-service technologies. Platforms like BT Visual Help and BT Visual Call Center are central to this digital transformation, aiming to provide a seamless and efficient experience for all clients, particularly business customers.

These digital tools are designed to empower customers, allowing them to independently access information, execute transactions, and receive support. This approach not only boosts convenience but also optimizes operational efficiency for the bank by deflecting a considerable volume of routine inquiries from traditional channels.

- BT Visual Help and BT Visual Call Center are key digital self-service initiatives.

- These platforms are designed to handle a significant portion of customer inquiries, improving efficiency.

- Business customers benefit from enhanced convenience and faster access to information and support.

Banca Transilvania's physical presence, bolstered by its merger with OTP Bank Romania in February 2025, now encompasses over 530 branches across 180 localities. This extensive network ensures widespread accessibility for businesses and individuals alike. The bank also strategically operates dedicated business centers and assigns relationship managers to cater specifically to the needs of SMEs and large corporations, fostering deeper client engagement and tailored financial solutions.

| Aspect | Description | Key Data/Initiatives |

|---|---|---|

| Physical Network | Extensive branch presence across Romania | Over 530 branches in 180 localities (post-OTP merger, Feb 2025) |

| Specialized Services | Dedicated support for businesses | Business centers and specialized relationship managers for SMEs and corporates |

| Digital Distribution | Online and mobile banking platforms | BT24 online banking, BT Pay mobile app; over 2.5 million digital users (end 2023) |

| Strategic Expansion | Mergers and acquisitions for market growth | Merger with OTP Bank Romania (Feb 2025); supported Victoriabank's acquisition of BCR Chisinau |

Full Version Awaits

Banca Transilvania 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Banca Transilvania 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know exactly what you're getting.

Promotion

Banca Transilvania leverages targeted advertising campaigns to connect with its business customers. These efforts focus on showcasing specific offerings like business loans and digital banking solutions. For instance, in 2024, the bank saw a significant uptake in its business credit lines, partly attributed to these focused campaigns reaching key decision-makers.

Banca Transilvania (BT) strategically leverages sponsorships and community engagement to bolster its brand as a key supporter of Romania's economic growth. The bank actively backs business events, conferences, and initiatives aimed at entrepreneurs, reinforcing its commitment to the local business ecosystem. For example, BT's involvement in events like the RAD Art Fair demonstrates a commitment to cultural development alongside economic support.

Banca Transilvania actively leverages digital marketing and a robust social media presence to engage its diverse customer base. This strategy is crucial for promoting its suite of digital banking solutions and sharing valuable financial insights. For instance, as of early 2024, the bank reported a significant increase in digital transaction volumes, highlighting the effectiveness of these online channels in driving adoption of its digital offerings.

The bank's social media efforts are particularly focused on connecting with entrepreneurs, offering them resources and fostering a community for business growth. By consistently sharing relevant content and engaging in online discussions, Banca Transilvania aims to build brand awareness and cultivate deeper interest in its specialized business banking products and services, a key component of its 4P's marketing mix.

Direct Marketing and Relationship Management

Banca Transilvania leverages its substantial network of relationship managers to implement direct marketing strategies, particularly for its business clients. This direct approach enables the bank to communicate product advantages and offer bespoke solutions, fostering trust and strengthening client partnerships.

This personalized engagement is key to building lasting relationships and ensuring that clients receive financial products and services that precisely meet their business needs. For instance, in 2024, Banca Transilvania reported a significant increase in digital engagement for business clients, supported by proactive outreach from relationship managers.

- Personalized Outreach: Relationship managers offer tailored advice and product recommendations.

- Targeted Promotions: Direct communication of offers designed for specific business segments.

- Relationship Building: Focus on creating trust and long-term partnerships.

- Digital Integration: Combining direct contact with digital platforms for enhanced client experience.

Public Relations and Thought Leadership

Banca Transilvania actively cultivates its public image through robust public relations efforts, positioning itself as a key thought leader within Romania's financial landscape. The bank consistently issues press releases detailing its financial performance, significant strategic moves like acquisitions, and provides expert analysis on prevailing economic trends. This proactive communication strategy reinforces its standing as a dependable and influential entity in the market.

In 2023, Banca Transilvania reported a net profit of RON 2.2 billion, a significant increase from the previous year, underscoring its financial strength and stability. This performance was bolstered by strategic initiatives and a strong market position.

Key PR and thought leadership activities include:

- Regular dissemination of financial results: Transparent reporting of quarterly and annual earnings, such as the 2023 net profit of RON 2.2 billion, builds investor confidence.

- Announcements of strategic acquisitions: Highlighting growth through acquisitions, like the integration of certain Idea Bank assets in 2023, showcases expansion and market consolidation.

- Expert commentary on economic trends: Providing insights into Romania's economic outlook and financial sector developments positions BT as a trusted advisor and influencer.

Banca Transilvania employs a multi-faceted promotional strategy, blending digital reach with personalized client interaction. This approach aims to highlight its comprehensive suite of banking solutions, particularly for its business clientele.

The bank's commitment to community and economic development is evident through its sponsorships of various business events and cultural initiatives, reinforcing its brand as a supportive pillar of Romania's growth.

Through targeted digital marketing, social media engagement, and direct outreach via relationship managers, Banca Transilvania effectively communicates its value proposition and fosters strong client relationships.

Banca Transilvania's public relations efforts focus on establishing thought leadership, transparently sharing financial performance, and announcing strategic moves to build market confidence.

| Promotional Tactic | Focus Area | Key Engagement Example (2023-2024) | Impact Indication |

|---|---|---|---|

| Targeted Digital Advertising | Business Loans, Digital Banking | Increased uptake in business credit lines | Higher adoption of digital services |

| Sponsorships & Community Engagement | Economic Growth, Entrepreneurship | Support for RAD Art Fair, business conferences | Enhanced brand perception as supporter |

| Public Relations & Thought Leadership | Financial Performance, Economic Trends | 2023 Net Profit: RON 2.2 billion | Strengthened market position and investor confidence |

| Relationship Management | Bespoke Solutions, Trust Building | Proactive outreach to business clients | Increased digital engagement from business clients |

Price

Banca Transilvania actively positions itself with competitive interest rates across its diverse product portfolio, tailoring offers to specific client segments like SMEs and large corporations, and adapting to prevailing market conditions. This strategic pricing is a cornerstone of its customer acquisition and retention efforts.

The bank's financial performance underscores the success of its interest rate strategy. For instance, in the first quarter of 2024, Banca Transilvania reported a net interest income of RON 1.7 billion, a substantial increase driven by its robust lending and deposit-taking activities. This highlights the direct correlation between competitive rates and strong revenue generation.

Banca Transilvania champions transparent fee structures, a crucial element of its marketing mix for business clients. This clarity extends to transaction fees, account maintenance charges, and various service costs, ensuring businesses can accurately forecast their banking expenses. For instance, in 2024, the bank continued to emphasize its straightforward approach to fees, a key differentiator in the competitive Romanian banking landscape.

For its larger corporate clients and those with intricate financing requirements, Banca Transilvania excels at providing customized pricing and bespoke financing solutions. This adaptability is key to meeting diverse business needs.

The bank's approach includes offering flexible terms, crafting structured deals, and facilitating syndicated financing. This demonstrates a commitment to tailoring financial packages to specific project scales and client demands, ensuring optimal financial support.

In 2024, Banca Transilvania continued to strengthen its corporate lending portfolio, with a focus on structured finance deals that often involve bespoke pricing structures. While specific deal values are confidential, the bank's consistent growth in corporate banking services highlights the success of these customized approaches.

Discounted Packages and Partner Benefits

Banca Transilvania actively cultivates customer loyalty and attracts new business through strategically designed discounted packages and partner benefits. These initiatives often target specific market segments, such as small and medium-sized enterprises (SMEs) and burgeoning startups, offering them tailored financial solutions. For instance, in 2024, the bank continued its focus on supporting SMEs, a sector crucial to Romania's economy, with bundled product offerings that can reduce overall banking costs.

These packages frequently involve reduced fees for essential banking services like account management or transaction processing, and may also extend to preferential interest rates on loans or other credit facilities when customers opt for a combination of products. Such bundling not only enhances the perceived value of Banca Transilvania's services but also encourages deeper customer relationships, fostering a more comprehensive banking experience.

Partnerships play a significant role in expanding these benefits. By collaborating with other businesses or service providers, Banca Transilvania can offer its clients exclusive discounts or special access to a wider range of products and services. This symbiotic relationship benefits all parties involved, increasing customer acquisition and retention for the bank while providing added value to its partners and their respective client bases.

- SME Focus: Continued emphasis on discounted packages for SMEs in 2024, recognizing their economic importance.

- Reduced Fees: Offerings often include lower charges for account maintenance and transaction processing.

- Preferential Rates: Bundling services can lead to more attractive interest rates on loans and credit lines.

- Partnership Integration: Leveraging collaborations to extend exclusive benefits and discounts to customers.

Consideration of Market Dynamics and Regulatory Environment

Banca Transilvania's pricing strategies are deeply intertwined with the dynamic Romanian market and its evolving regulatory landscape. The bank actively monitors competitor pricing, aiming to offer competitive rates on loans and deposits, while also factoring in market demand. For instance, during periods of high demand for mortgages in 2024, BT adjusted its rates to remain attractive.

The bank's approach ensures that its product pricing is not only competitive but also supports its overall market positioning and profitability objectives. This includes a keen awareness of the National Bank of Romania's monetary policy decisions, such as the key interest rate, which directly influences lending costs.

- Competitive Interest Rates: Banca Transilvania's average lending rates for corporate clients in Q1 2024 hovered around 8-9%, reflecting market conditions and competitor offerings.

- Deposit Yields: For retail customers, deposit rates for a 12-month term in early 2024 were typically between 5-6%, adjusted based on market liquidity and central bank policy.

- Regulatory Impact: Compliance with Basel III and upcoming Basel IV regulations influences capital requirements, indirectly impacting pricing strategies for riskier assets.

- Economic Sensitivity: Inflationary pressures in Romania during 2024 led to adjustments in both lending and deposit rates to maintain real returns for customers and profitability for the bank.

Banca Transilvania's pricing strategy centers on competitive interest rates and transparent fees, crucial for attracting and retaining clients across all segments. The bank actively adjusts its rates based on market demand and economic conditions, as evidenced by its Q1 2024 net interest income of RON 1.7 billion, a direct result of its lending and deposit activities.

The bank offers tailored pricing for corporate clients, including bespoke financing solutions and flexible terms, which contributed to its strengthened corporate lending portfolio in 2024. Furthermore, discounted packages and partner benefits, particularly for SMEs, enhance customer loyalty by reducing overall banking costs and providing added value.

Banca Transilvania's pricing is responsive to the Romanian market, with lending rates for corporates around 8-9% in Q1 2024 and retail deposit rates for 12-month terms between 5-6% in early 2024, demonstrating an adaptive approach to monetary policy and inflation.

| Metric | Value (Q1 2024/Early 2024) | Context |

|---|---|---|

| Net Interest Income | RON 1.7 billion | Reflects revenue from lending and deposit activities. |

| Corporate Lending Rates (Avg.) | 8-9% | Competitive pricing influenced by market conditions. |

| Retail Deposit Rates (12-month) | 5-6% | Adjusted based on market liquidity and central bank policy. |

4P's Marketing Mix Analysis Data Sources

Our Banca Transilvania 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company communications, including annual reports and investor presentations. We also leverage data from industry publications, competitive analyses, and publicly available information on their product offerings, pricing strategies, distribution channels, and promotional activities.