Banco Btg Pactual PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Btg Pactual Bundle

Navigate the complex external forces shaping Banco BTG Pactual's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for this leading financial institution. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for an in-depth understanding.

Political factors

The political stability in Brazil is a critical factor for Banco BTG Pactual. A predictable policy environment, especially concerning fiscal management and economic reforms, directly affects investor sentiment and regulatory certainty for financial services. For instance, the Brazilian government's commitment to controlling inflation and pursuing structural reforms, as seen in its efforts to manage public debt, influences long-term economic prospects and the attractiveness of the financial sector to both domestic and international capital. Instability, conversely, can introduce market volatility and policy unpredictability, impacting strategic planning and operational efficiency for institutions like BTG Pactual.

The Central Bank of Brazil (BCB) significantly influences BTG Pactual's operations through its monetary policy and regulatory framework. For instance, the BCB's Selic rate, which stood at 10.50% as of May 2024, directly impacts lending costs and investment returns, shaping the bank's profitability and strategic lending decisions.

Evolving banking regulations, such as adjustments to Basel III capital requirements or new rules for digital financial services, create both compliance challenges and opportunities for BTG Pactual. The bank must adapt its capital structure and technological investments to meet these evolving standards, ensuring continued operational viability and competitive positioning within the Brazilian financial market.

The BCB's independence in managing inflation and interest rates is critical for economic stability, which in turn underpins the financial sector's health. This autonomy allows the BCB to implement policies aimed at controlling inflation, which was observed at 3.70% in the twelve months ending April 2024, fostering a more predictable environment for BTG Pactual's long-term financial planning and risk management.

Perceptions of corruption in Brazil, even if not always reflective of reality, can significantly impact public trust in all institutions, including financial services. For a major player like BTG Pactual, demonstrating unwavering commitment to strong governance and implementing rigorous anti-corruption protocols is paramount for safeguarding its reputation and attracting a broad client base, both within Brazil and globally.

BTG Pactual's proactive stance on transparency and its investment in robust compliance frameworks are crucial differentiators. For instance, the bank consistently invests in technology and training to prevent financial crimes, a move that aligns with increasing global scrutiny of financial institutions. This focus on integrity is vital for maintaining investor confidence, especially as Brazil works to improve its overall investment climate through ongoing anti-corruption initiatives.

International Relations and Trade Policies

Brazil's participation in international trade agreements, such as Mercosur, significantly shapes its economic landscape and, consequently, Banco BTG Pactual's opportunities. For instance, Mercosur's trade facilitation initiatives can boost cross-border investment banking activities. In 2023, Mercosur's total trade volume reached approximately $700 billion, highlighting the potential scale of transactions.

Geopolitical relationships are also critical. Strong ties with major economies can lead to increased foreign direct investment into Brazil, creating demand for BTG Pactual's advisory and capital markets services. Conversely, strained relations or global trade disputes, like those impacting global supply chains in 2024, could dampen international investor sentiment and limit deal flow.

Favorable international relations directly benefit BTG Pactual's investment banking division by opening doors for underwriting, mergers and acquisitions advisory, and cross-border financing. For example, successful bilateral trade deals can spur specific sectors, creating niche opportunities for specialized banking services.

Conversely, protectionist policies enacted by major trading partners could erect barriers to Brazilian companies expanding abroad or foreign entities investing in Brazil. This could reduce the pipeline of international advisory mandates for the bank. The World Trade Organization reported a rise in protectionist measures globally in late 2023 and early 2024, indicating a potential headwind.

Electoral Cycles and Political Risk

Brazil's electoral cycles inherently create periods of elevated political risk and policy uncertainty, directly impacting market sentiment and investor decision-making. The approaching 2026 presidential elections, for instance, are likely to foster cautious behavior among investors and businesses as they await clearer policy directions.

Banco BTG Pactual must adeptly manage these cyclical political shifts. This involves leveraging its diversified business model, which includes investment banking, asset management, and digital banking, to mitigate concentrated risks. Furthermore, the implementation of robust risk management strategies is crucial to navigate potential policy changes and market volatility stemming from electoral outcomes.

- Electoral Uncertainty: Upcoming elections, like the 2026 Brazilian presidential race, often precede periods of policy ambiguity, potentially influencing capital flows and economic forecasts.

- Policy Impact: Changes in government can lead to shifts in fiscal policy, regulatory frameworks, and economic development priorities, all of which have direct implications for the financial sector.

- Strategic Adaptation: BTG Pactual's strategy likely involves scenario planning and maintaining operational flexibility to adapt to various political and economic outcomes, ensuring resilience.

The political landscape in Brazil presents a dynamic environment for Banco BTG Pactual, with government policies and stability directly influencing financial markets. For instance, the Brazilian government's focus on fiscal responsibility and economic reforms, such as those aimed at controlling inflation, which was 3.70% year-on-year as of April 2024, fosters a more predictable climate for investment. Conversely, political instability or shifts in economic policy can introduce volatility, impacting BTG Pactual's strategic planning and the broader investment climate.

The Central Bank of Brazil's (BCB) monetary policy, exemplified by the Selic rate at 10.50% in May 2024, significantly shapes BTG Pactual's lending and investment strategies. Furthermore, evolving banking regulations, including capital adequacy requirements and digital finance rules, necessitate continuous adaptation by the bank to maintain compliance and competitive advantage.

Brazil's international trade agreements, like Mercosur, which facilitated approximately $700 billion in trade in 2023, create opportunities for BTG Pactual's cross-border investment banking activities. However, global protectionist trends, noted by the WTO in late 2023/early 2024, could pose headwinds by limiting international deal flow.

Upcoming electoral cycles, such as the 2026 presidential elections, introduce periods of policy uncertainty that require BTG Pactual to employ robust risk management and scenario planning. The bank's diversified business model is key to navigating potential shifts in fiscal and regulatory frameworks that may arise from changes in government leadership.

What is included in the product

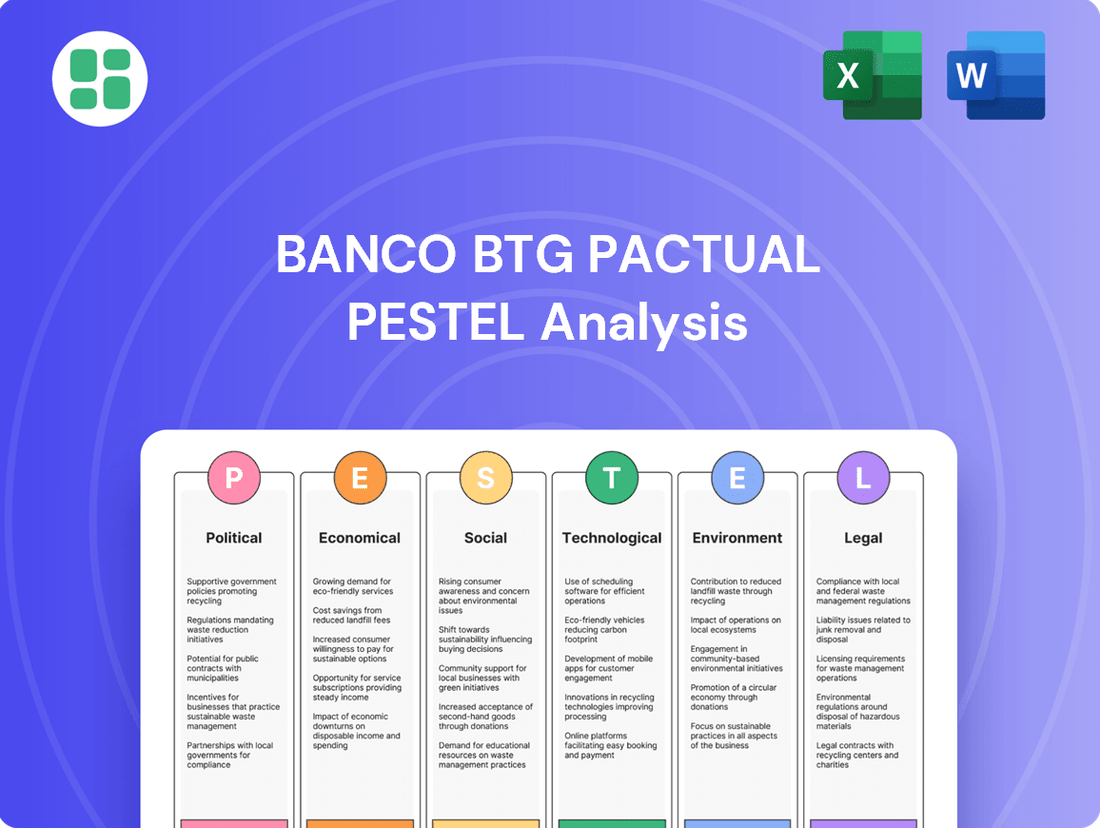

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Banco BTG Pactual, offering a comprehensive overview of its operating landscape.

A concise PESTLE analysis for Banco BTG Pactual acts as a pain point reliever by offering a clear, summarized overview of external factors, enabling swift strategic decision-making during critical planning sessions.

Economic factors

Brazil's persistently high interest rates, exemplified by the Selic rate which stood at 10.50% as of May 2024, directly influence Banco BTG Pactual's core operations. These elevated rates increase the bank's cost of funding and impact the profitability of its lending portfolio.

While higher interest rates can attract more deposits, potentially boosting BTG Pactual's funding base, they also raise the cost of borrowing for its corporate clients. This can dampen demand for loans and slow down activity in investment banking, a key area for the bank, as companies become more cautious about taking on new debt or pursuing M&A deals in a high-cost environment.

Consequently, effective management of interest rate risk is paramount for BTG Pactual's financial health. The bank must navigate the dual impact of higher funding costs and potentially reduced credit demand to maintain its profitability and strategic growth objectives amidst this challenging economic backdrop.

Brazil's GDP growth is a critical indicator for Banco BTG Pactual. For instance, in Q1 2024, Brazil's GDP grew by 0.8% compared to the previous quarter, signaling a positive economic trajectory. This expansion directly fuels demand for BTG Pactual's services, from investment banking deals to wealth management growth.

A stable economic environment, characterized by controlled inflation and predictable policy, further bolsters BTG Pactual's performance. In 2024, the Central Bank of Brazil has been navigating inflation, with projections for the year indicating a manageable rate, which supports a more predictable financial landscape. This stability encourages investment and lending, directly benefiting the bank's core operations.

Conversely, economic slowdowns or instability pose risks. A contraction in GDP or heightened economic uncertainty can dampen capital markets activity and reduce corporate and individual appetite for financial services, potentially impacting BTG Pactual's revenue streams and increasing credit risk exposure.

Currency exchange rate volatility significantly influences BTG Pactual's financial performance. Fluctuations in the Brazilian Real (BRL) against major currencies like the US Dollar (USD) directly affect the cost of international operations and the valuation of foreign assets. For instance, during periods of BRL depreciation, BTG Pactual's investments denominated in foreign currencies become more expensive to acquire and maintain, potentially leading to capital flight from Brazil.

Conversely, a stable or appreciating BRL can unlock greater cross-border opportunities and enhance the value of BTG Pactual's international holdings. As of late 2024, the BRL has experienced notable volatility, trading around R$5.00-R$5.20 against the USD, a level that presents both challenges and opportunities for financial institutions with significant international exposure.

Credit Market Conditions and Liquidity

Credit market conditions significantly influence BTG Pactual's corporate lending and debt capital market operations. The availability and cost of credit directly impact the bank's ability to originate loans and underwrite debt offerings.

For instance, in early 2024, global interest rates remained elevated, increasing borrowing costs for many businesses. This can dampen demand for new loans and make debt refinancing more expensive, potentially affecting BTG Pactual's deal pipeline and profitability in its corporate banking segment.

Conversely, a liquid credit market with readily available and affordable financing fuels business expansion and mergers and acquisitions. BTG Pactual benefits when companies have easier access to capital, as it translates into more advisory and underwriting opportunities. For example, a robust M&A market in Brazil, supported by favorable credit conditions, could lead to increased fee income for the bank.

- Elevated Interest Rates: Global benchmark rates, such as the US Federal Funds Rate, remained at multi-year highs through much of 2024, impacting the cost of capital worldwide.

- Liquidity Levels: While generally stable, the overall liquidity in emerging markets, including Brazil, can fluctuate based on global risk appetite and central bank policies, affecting BTG Pactual's funding costs.

- SME Lending Constraints: Higher borrowing costs and tighter lending standards for small and medium-sized enterprises (SMEs) in 2024 could limit their investment and growth, impacting the volume of corporate lending opportunities for BTG Pactual.

Global Economic Outlook and Commodity Prices

Brazil's economic trajectory is intrinsically linked to the global economic outlook, with commodity prices playing a particularly significant role. A slowdown in major economies like China or the United States, for instance, can dampen demand for Brazilian exports, such as iron ore and soybeans, impacting trade balances and overall economic growth. This dynamic directly influences BTG Pactual's diverse client base, from commodity producers to financial institutions exposed to these markets.

The volatility of commodity prices presents both opportunities and challenges. For example, the International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that while global growth was expected to moderate, commodity markets would remain sensitive to geopolitical developments and supply chain disruptions. This means that fluctuations in prices for key Brazilian exports can significantly affect the financial performance of companies and investment portfolios managed by BTG Pactual.

- Global Growth Forecasts: The IMF's October 2024 forecast indicated a projected global growth rate of 3.1% for 2024, a slight slowdown from previous years, impacting demand for commodities.

- Commodity Price Sensitivity: Brazil's export revenues are heavily reliant on commodities, with iron ore and soybeans being major contributors, making the nation susceptible to global price swings.

- Impact on BTG Pactual: Shifts in global demand and commodity prices directly influence the investment strategies and risk assessments undertaken by BTG Pactual for its clients.

Brazil's economic performance, including GDP growth and inflation, directly shapes Banco BTG Pactual's operational landscape. For instance, Brazil's GDP growth in Q1 2024 was 0.8% quarter-on-quarter, indicating a positive trend that supports demand for financial services. The Central Bank of Brazil's efforts to manage inflation in 2024, with projections for a manageable rate, contribute to a more predictable financial environment, which is crucial for BTG Pactual's investment banking and wealth management divisions.

Currency exchange rates, particularly the Brazilian Real's volatility against the US Dollar, significantly impact BTG Pactual's international operations and asset valuations. With the BRL trading around R$5.00-R$5.20 against the USD in late 2024, the bank must manage the risks and opportunities associated with these fluctuations. This currency environment affects the cost of foreign investments and the attractiveness of Brazil for international capital.

Credit market conditions, influenced by global interest rates, affect BTG Pactual's lending and debt capital market activities. Elevated global rates in 2024 increase borrowing costs for businesses, potentially reducing demand for loans and impacting BTG Pactual's deal pipeline. Conversely, liquid credit markets with affordable financing boost M&A activity, creating more fee-generating opportunities for the bank.

| Economic Factor | 2024 Data/Projection | Impact on BTG Pactual |

|---|---|---|

| Brazilian GDP Growth (Q1 2024) | 0.8% (quarter-on-quarter) | Drives demand for financial services, investment banking, and wealth management. |

| Selic Rate (May 2024) | 10.50% | Increases funding costs and affects lending portfolio profitability; influences credit demand. |

| BRL/USD Exchange Rate (Late 2024) | R$5.00-R$5.20 | Affects international operations, asset valuation, and cross-border investment attractiveness. |

| Global Growth Forecast (2024) | 3.1% (IMF) | Influences commodity demand and prices, impacting BTG Pactual's clients in export-oriented sectors. |

Same Document Delivered

Banco Btg Pactual PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Banco BTG Pactual provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

Brazilian consumers are rapidly shifting towards digital banking, with mobile platforms and instant payment systems like Pix becoming the norm. This digital adoption is fueled by a desire for convenience and efficiency. For instance, by the end of 2023, Pix transactions had already surpassed 10 billion, demonstrating its widespread integration into daily financial life.

Banco BTG Pactual's strategic move into digital retail banking is a direct acknowledgment of this evolving consumer landscape. To thrive, the bank must consistently enhance its digital offerings, focusing on intuitive user experiences and cutting-edge financial technology to capture and hold market share in this competitive digital space.

Brazil has seen significant strides in financial inclusion, with efforts heavily leaning on digital platforms. For instance, by the end of 2023, over 1.5 billion Pix transactions were recorded, a testament to the growing adoption of digital payment systems among Brazilians, including previously unbanked populations.

This expansion, however, brings the challenge of catering to diverse financial literacy levels. Banco BTG Pactual, like other institutions, must develop accessible digital products and robust financial education programs. This is crucial to ensure that newly included customers can effectively manage their finances and leverage digital banking services responsibly, avoiding potential pitfalls associated with a lack of financial knowledge.

Brazil's demographic landscape is shifting, with a growing segment of the population entering their prime earning years. This demographic dividend, coupled with an increasing concentration of wealth, particularly among younger, digitally savvy individuals, directly fuels demand for sophisticated wealth management and investment solutions. BTG Pactual's ability to cater to these evolving preferences, including a rising interest in Environmental, Social, and Governance (ESG) investing, will be crucial for its continued success.

Public Trust and Reputation

Public perception and trust are vital for financial institutions like Banco BTG Pactual, particularly in Brazil's historically volatile economic and political landscape. A strong reputation built on ethical conduct, transparency, and dependable service is key to attracting and keeping clients across all business areas.

Maintaining this trust is an ongoing effort. For instance, in 2024, continued focus on robust compliance measures and clear communication strategies will be essential. BTG Pactual's commitment to these principles directly influences its ability to secure new investments and maintain existing client relationships.

- Ethical Practices: BTG Pactual's adherence to strict ethical guidelines influences investor confidence and client loyalty.

- Transparency: Open communication regarding financial performance and operational procedures builds trust.

- Service Reliability: Consistent delivery of high-quality financial services reinforces a positive public image.

- Market Volatility Impact: Periods of economic uncertainty heighten the importance of a trusted financial partner.

Workforce Dynamics and Talent Acquisition

The availability of skilled talent in finance and technology is a crucial sociological factor influencing BTG Pactual's operations. Attracting and retaining top professionals in areas like investment banking, asset management, and digital development is paramount. This necessitates competitive compensation packages, a robust corporate culture, and significant investment in ongoing employee training and development to stay ahead in the market.

BTG Pactual's success hinges on its ability to navigate evolving workforce dynamics. For instance, the demand for fintech expertise continues to surge, with global fintech employment projected to grow significantly. By 2025, the fintech sector is expected to employ millions worldwide, underscoring the need for BTG Pactual to secure specialized talent in areas such as AI, blockchain, and cybersecurity to drive innovation and maintain a competitive edge.

- Talent Competition: BTG Pactual faces intense competition for finance and tech professionals, requiring strategic talent acquisition and retention initiatives.

- Skill Demand: There's a growing need for specialized skills in areas like digital banking, data analytics, and sustainable finance.

- Employee Development: Investing in continuous learning and career progression is vital for employee satisfaction and retention, particularly in fast-paced sectors.

- Remote Work Impact: The increasing acceptance of remote and hybrid work models presents both opportunities and challenges for talent management and corporate culture building.

Consumer behavior in Brazil is increasingly shaped by digital adoption and a demand for convenience, with platforms like Pix becoming integral to daily transactions. By the end of 2023, Pix had facilitated over 10 billion transactions, highlighting this significant shift. Banco BTG Pactual's strategy must align with these evolving preferences, emphasizing user-friendly digital interfaces and innovative financial technology to remain competitive.

Financial inclusion is expanding rapidly through digital channels, with over 1.5 billion Pix transactions recorded by the end of 2023, indicating broader access to financial services. However, this growth necessitates addressing varying levels of financial literacy through accessible products and educational initiatives to ensure responsible engagement with digital banking.

Brazil's demographic trends, including a growing prime-earning population and wealth concentration among younger, digitally adept individuals, are driving demand for sophisticated wealth management and ESG-focused investment solutions. BTG Pactual's ability to cater to these preferences will be key to its sustained success.

Public trust, built on ethical practices and transparency, is paramount for financial institutions like BTG Pactual, especially given Brazil's economic volatility. Continued focus on robust compliance and clear communication in 2024 will be crucial for maintaining client relationships and attracting new investments.

The availability of skilled finance and technology talent is critical, with fintech employment projected to grow significantly by 2025. BTG Pactual must invest in competitive compensation, a strong culture, and continuous training to attract and retain professionals in areas like AI and cybersecurity.

| Sociological Factor | Description | Impact on BTG Pactual | Relevant Data (2023/2024) |

|---|---|---|---|

| Digital Consumerism | Shift towards digital banking and instant payment systems like Pix. | Need for enhanced digital offerings and user experience. | Over 10 billion Pix transactions by end of 2023. |

| Financial Inclusion | Expansion of access to financial services via digital platforms. | Opportunity to serve new customer segments, challenge of financial literacy. | Over 1.5 billion Pix transactions by end of 2023. |

| Demographic Shifts | Growing prime-earning population and wealth concentration among younger demographics. | Increased demand for wealth management and ESG investing. | Rising interest in ESG investments among Brazilian investors. |

| Public Trust & Ethics | Importance of reputation, transparency, and ethical conduct. | Essential for client acquisition and retention in volatile markets. | Focus on compliance and clear communication in 2024. |

| Talent Availability | Demand for skilled professionals in finance and technology. | Need for competitive talent acquisition and development strategies. | Fintech employment projected to grow significantly by 2025. |

Technological factors

The Brazilian banking landscape is undergoing a significant digital overhaul, with technological advancements acting as key catalysts. BTG Pactual is strategically positioned to capitalize on this shift by prioritizing its digital retail banking initiatives and continuously improving its mobile application. This focus is vital for maintaining a competitive edge in the evolving market.

By investing in its digital platforms, BTG Pactual aims to provide clients with seamless portfolio management and sophisticated financial planning tools. This commitment to enhancing user experience on its mobile app is designed to foster deeper client engagement and loyalty. In 2024, digital banking adoption in Brazil continued its upward trend, with a significant portion of transactions occurring via mobile channels, underscoring the importance of BTG Pactual's digital strategy.

The Brazilian financial sector is experiencing a significant fintech surge, with companies like Nubank challenging established players. This dynamic environment demands continuous innovation from Banco BTG Pactual. For instance, Nubank reported over 100 million customers globally by early 2024, highlighting the rapid adoption of digital financial services and the competitive pressure this creates.

Artificial intelligence (AI) and big data analytics are fundamentally reshaping the financial sector. BTG Pactual is positioned to harness these advancements, which are crucial for offering tailored investment advice, bolstering data protection, and identifying potential fraud. The firm's strategic investment in IT infrastructure is a direct response to the growing need for sophisticated analytical capabilities to predict market movements and understand client preferences.

Cybersecurity and Data Privacy

As financial services migrate further online, the threat of cyberattacks and data breaches escalates for institutions like BTG Pactual. Protecting sensitive client information is paramount, requiring substantial investment in advanced security protocols.

BTG Pactual must navigate a complex regulatory landscape, with Brazil's Lei Geral de Proteção de Dados (LGPD) being a key example. Compliance with such data privacy laws is not just a legal necessity but also crucial for maintaining customer trust and brand reputation in the digital age.

- Increased Spending: Global cybersecurity spending is projected to reach $267 billion in 2024, highlighting the growing importance of these investments for financial institutions.

- LGPD Impact: Non-compliance with LGPD can result in significant fines, potentially reaching 2% of a company's revenue in Brazil, up to a maximum of R$50 million per infraction.

- Reputational Risk: A single major data breach can severely damage a financial institution's reputation, leading to customer attrition and loss of market share.

- Digital Transformation: The ongoing digital transformation in banking necessitates continuous adaptation of cybersecurity strategies to counter evolving threats.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are rapidly evolving, presenting significant opportunities for financial institutions like Banco BTG Pactual. The potential applications extend beyond traditional finance, encompassing virtual assets and the tokenization of various assets, which could unlock new revenue streams and operational efficiencies.

The regulatory landscape is also adapting. In Brazil, the Central Bank is actively shaping the environment for crypto asset services and developing its own digital currency, known as Drex. This proactive stance by regulators creates both a fertile ground for innovation and a need for careful navigation of compliance requirements for BTG Pactual.

- Emerging Opportunities: Blockchain and DLT enable the creation and trading of virtual assets and the tokenization of real-world assets, potentially expanding BTG Pactual's product offerings.

- Regulatory Engagement: The Central Bank of Brazil's work on regulating crypto assets and developing Drex necessitates BTG Pactual's strategic engagement to leverage these advancements compliantly.

- Technological Integration: Exploring and integrating DLT solutions can enhance security, transparency, and efficiency in various banking operations, from settlements to client onboarding.

Technological advancements are revolutionizing Brazil's banking sector, pushing institutions like BTG Pactual towards robust digital strategies. The firm's investment in its mobile app and digital retail banking is crucial, especially as mobile transactions accounted for a significant portion of banking activities in Brazil in 2024. This digital shift is intensified by the rise of fintechs, with companies like Nubank reaching over 100 million global customers by early 2024, demonstrating the rapid adoption of digital financial services and the competitive pressure they exert.

Legal factors

Banco BTG Pactual navigates a stringent banking regulatory landscape, primarily governed by the Central Bank of Brazil (BACEN) and the Securities and Exchange Commission of Brazil (CVM). Adherence to capital adequacy ratios, such as those mandated by Basel III, is critical for maintaining financial stability. For instance, as of the first quarter of 2024, BTG Pactual reported a Tier 1 Capital Ratio of 15.8%, comfortably exceeding regulatory minimums.

These regulations extend to resolution planning, ensuring the bank can be managed in times of financial distress without disrupting the broader financial system. Prudential standards, encompassing liquidity management and risk assessment, are continuously updated, requiring BTG Pactual to adapt its operational strategies to meet evolving compliance demands and safeguard its long-term viability.

Brazil's Lei Geral de Proteção de Dados (LGPD), enacted in 2020, imposes rigorous requirements on how companies handle personal information, impacting financial institutions like BTG Pactual significantly. Failure to comply can result in substantial fines, with penalties potentially reaching up to 2% of a company's gross revenue in Brazil, capped at R$50 million per infraction, as stipulated by the law.

BTG Pactual's commitment to LGPD compliance is crucial for its digital banking and wealth management arms, where vast amounts of sensitive client data are processed daily. Maintaining robust data security protocols and transparent data usage policies is paramount to avoid legal repercussions and preserve the trust of its customer base, which is essential for sustained growth in the competitive Brazilian financial market.

Banco BTG Pactual, like all major financial institutions, operates under stringent Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations. These rules are designed to prevent financial systems from being used for illegal purposes. Failure to comply can result in significant fines and operational disruptions.

In 2024, global efforts to combat financial crime intensified, with regulators focusing on enhanced due diligence and transaction monitoring. BTG Pactual's commitment to robust internal controls, including Know Your Customer (KYC) procedures and suspicious activity reporting, is paramount to navigating this complex legal landscape and safeguarding its reputation.

Consumer Protection Laws and Financial Ombudsman Services

Consumer protection laws are paramount in shaping how financial institutions like BTG Pactual engage with their clientele. These regulations govern everything from how products are advertised to how customer grievances are addressed, directly influencing BTG Pactual's retail and wealth management operations. Compliance ensures fair treatment, transparency in product offerings, and robust dispute resolution processes, all crucial for maintaining customer trust and loyalty.

In Brazil, the Central Bank of Brazil (BCB) and the Brazilian Securities and Exchange Commission (CVM) are key regulators. For instance, BCB Resolution 4.860/2020, which came into effect in 2021, established new rules for the operation of payment accounts, impacting how digital banks and traditional institutions, including BTG Pactual's digital offerings, interact with consumers regarding account management and transparency. Financial ombudsman services, often mandated by these regulations, provide an independent avenue for resolving disputes, adding another layer of accountability for banks.

- Consumer Protection Framework: Laws dictate bank-client interactions, complaint handling, and marketing practices.

- BTG Pactual's Compliance: Essential for fair practices in retail and wealth management, affecting customer service and transparency.

- Regulatory Oversight: Entities like the Central Bank of Brazil and CVM enforce consumer protection standards.

- Dispute Resolution: Ombudsman services offer independent avenues for resolving client issues, enhancing accountability.

Taxation Reforms and Fiscal Policy Legislation

Changes in Brazil's tax laws, particularly potential Value Added Tax (VAT) reforms, significantly impact Banco BTG Pactual's profitability and its clients' investment strategies. The government's fiscal policy, as evidenced by the proposed tax reform aiming for a unified consumption tax, could alter the cost structures for financial services and investment vehicles.

BTG Pactual needs to proactively adjust its financial advisory and wealth planning services. This adaptation is crucial to guide clients through the complexities of evolving tax legislation, ensuring they can optimize their tax positions amidst reforms expected to be implemented gradually, with initial phases targeting 2024 and 2025.

- VAT Reform Impact: Potential shifts in consumption tax could influence the attractiveness of certain investment products and the operational costs for BTG Pactual.

- Fiscal Policy Influence: Government fiscal measures directly affect client investment decisions and the bank's overall financial performance.

- Advisory Services Adaptation: BTG Pactual must enhance its advisory capabilities to help clients manage new tax liabilities and opportunities.

- Profitability Considerations: Changes in tax regulations can lead to adjustments in the bank's net income and capital requirements.

The legal framework governing Banco BTG Pactual is robust, encompassing stringent banking regulations from bodies like the Central Bank of Brazil (BACEN) and the Securities and Exchange Commission of Brazil (CVM). Adherence to capital adequacy, such as Basel III requirements, is paramount; BTG Pactual maintained a strong Tier 1 Capital Ratio of 15.8% in Q1 2024, exceeding regulatory minimums.

Data privacy is a significant legal consideration, with Brazil's LGPD imposing strict rules on personal data handling, carrying potential fines of up to 2% of gross revenue, capped at R$50 million per infraction. BTG Pactual's compliance is vital for its digital operations, necessitating robust security and transparent data policies to maintain customer trust.

Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations are critical, demanding rigorous Know Your Customer (KYC) procedures and transaction monitoring. In 2024, global regulatory focus on these areas intensified, requiring continuous adaptation of internal controls by institutions like BTG Pactual to avoid penalties and reputational damage.

Consumer protection laws, enforced by entities like the BCB and CVM, dictate client interactions, product transparency, and dispute resolution. For example, BCB Resolution 4.860/2020, effective from 2021, updated rules for payment accounts, impacting digital banking services. The implementation of financial ombudsman services further enhances accountability and client recourse.

Environmental factors

The increasing global and local focus on Environmental, Social, and Governance (ESG) criteria is reshaping investment strategies and client expectations. This trend is particularly evident as investors increasingly seek portfolios that align with their values, driving demand for sustainable financial products.

BTG Pactual is actively participating in the sustainable finance landscape, demonstrated by its issuance of green and sustainable debentures. The bank prioritizes financing projects that offer tangible social and environmental advantages, reflecting a commitment to responsible growth.

This proactive approach by BTG Pactual directly caters to the growing investor preference for ESG-integrated portfolios. For instance, by the end of 2023, sustainable debt issuance in Latin America had seen significant growth, with green bonds and social bonds playing a crucial role in funding environmentally and socially beneficial projects, a market BTG Pactual is positioned to serve.

Climate change presents significant physical risks, such as extreme weather events in Brazil potentially impacting BTG Pactual's financed assets, and transition risks from evolving regulations on carbon-intensive sectors. For instance, a severe drought in Brazil's agricultural regions, a key sector for lending, could lead to increased non-performing loans.

BTG Pactual must actively manage these evolving risks across its lending and investment portfolios, which may include stress-testing for climate-related scenarios. The bank's exposure to sectors like agribusiness and energy needs careful evaluation given their susceptibility to climate impacts and policy shifts.

Conversely, substantial opportunities exist in financing the transition to a low-carbon economy. The Brazilian government's commitment to renewable energy, with solar and wind power capacity expected to grow significantly by 2025, offers avenues for BTG Pactual to finance green projects and sustainable infrastructure development.

The Central Bank of Brazil is stepping up its demands for financial institutions, including BTG Pactual, to be more transparent about climate-related risks and opportunities. This push aligns with global efforts to standardize such disclosures, making it crucial for banks to adapt their reporting practices.

BTG Pactual is expected to bolster its reporting on social, environmental, and climate risks, often referred to as GRSAC. This includes detailing how climate change might impact its operations and investments, a growing area of focus for regulators and investors alike.

Furthermore, the bank may need to consider making voluntary commitments, such as aligning with net-zero emissions targets. Such voluntary actions are becoming increasingly important for demonstrating a proactive stance on sustainability and attracting environmentally conscious capital.

Resource Scarcity and Environmental Impact of Operations

While BTG Pactual, as a financial institution, has a lower direct environmental footprint compared to industrial companies, its indirect impacts are significant. These stem from the projects it finances and its internal operational resource consumption, including energy and waste generation. The bank's focus on sustainability means addressing these indirect environmental considerations.

BTG Pactual's commitment to sustainable practices is reflected in its operational efficiency and responsible resource management. This includes efforts to minimize energy consumption within its offices and manage waste effectively. The bank's strategy involves integrating environmental considerations into its financing decisions.

- Financed Projects: BTG Pactual's indirect environmental impact is heavily influenced by the sectors and projects it provides capital for, necessitating due diligence on environmental risks.

- Operational Efficiency: The bank actively pursues energy efficiency measures in its facilities, aiming to reduce its carbon footprint from electricity usage. For instance, in 2024, many financial institutions reported a 5-10% reduction in energy consumption through smart building technologies.

- Waste Management: BTG Pactual implements waste reduction and recycling programs across its operations to minimize landfill contributions.

Reputational Risk and Stakeholder Expectations

Failure to adequately address environmental concerns or demonstrate a commitment to sustainable practices can inflict substantial reputational damage on financial institutions like BTG Pactual, eroding stakeholder trust. This is particularly relevant as global awareness of climate change and environmental impact grows.

BTG Pactual's proactive engagement with Environmental, Social, and Governance (ESG) principles and its active participation in sustainable finance initiatives are crucial for bolstering its brand image. This focus directly appeals to a growing segment of investors and clients who prioritize environmental responsibility in their financial decisions.

- Reputational Impact: In 2024, a significant percentage of global investors indicated that a company's poor environmental record would negatively influence their investment decisions.

- Sustainable Finance Growth: The sustainable finance market saw substantial growth in 2024, with ESG-linked bond issuances reaching record levels, demonstrating a clear market demand for sustainable financial products.

- Stakeholder Trust: Maintaining high ESG standards is directly correlated with higher levels of stakeholder trust, which can translate into stronger client retention and a more robust capital base for BTG Pactual.

Environmental factors present both risks and opportunities for BTG Pactual. Climate change poses physical risks, such as extreme weather impacting financed assets, and transition risks from evolving regulations. For instance, droughts in Brazil's agricultural sector could increase loan defaults. Conversely, the growing demand for sustainable finance and the expansion of renewable energy in Brazil offer significant opportunities for green financing.

BTG Pactual's indirect environmental impact stems from its financed projects and operational resource consumption. The bank is actively pursuing operational efficiency, with initiatives like smart building technologies contributing to energy consumption reductions, often in the range of 5-10% observed in 2024. Effective waste management and recycling programs are also in place.

A strong commitment to ESG principles is crucial for BTG Pactual's reputation, as a significant portion of investors in 2024 indicated that poor environmental records would deter investment. The sustainable finance market continues to grow, with record ESG-linked bond issuances in 2024, highlighting the demand for environmentally responsible financial products.

The Central Bank of Brazil is increasingly requiring financial institutions to disclose climate-related risks and opportunities, pushing BTG Pactual to enhance its reporting on these matters. This includes detailing potential impacts on operations and investments, aligning with global trends in standardized ESG disclosures.

| Environmental Factor | Risk/Opportunity | BTG Pactual Relevance | 2024/2025 Data/Trend |

|---|---|---|---|

| Climate Change (Physical Risks) | Risk | Impact on financed assets (e.g., agriculture, infrastructure) | Increased frequency of extreme weather events in Brazil. |

| Climate Change (Transition Risks) | Risk | Regulatory changes affecting carbon-intensive sectors | Growing pressure for carbon pricing and stricter environmental regulations. |

| Sustainable Finance Demand | Opportunity | Financing green projects, ESG-linked products | Sustainable debt issuance in Latin America grew significantly by end-2023, with continued strong growth projected for 2024-2025. |

| Renewable Energy Growth | Opportunity | Financing solar and wind power projects | Brazil's renewable energy capacity expected to see substantial growth by 2025. |

| Regulatory Disclosure Requirements | Compliance/Risk | Transparency on climate risks and opportunities (GRSAC) | Central Bank of Brazil increasing focus on climate risk disclosure for financial institutions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Banco BTG Pactual is built on a robust foundation of data from key financial institutions like the Central Bank of Brazil and the IMF, alongside reports from reputable market research firms and government economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.