Banco Btg Pactual Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Btg Pactual Bundle

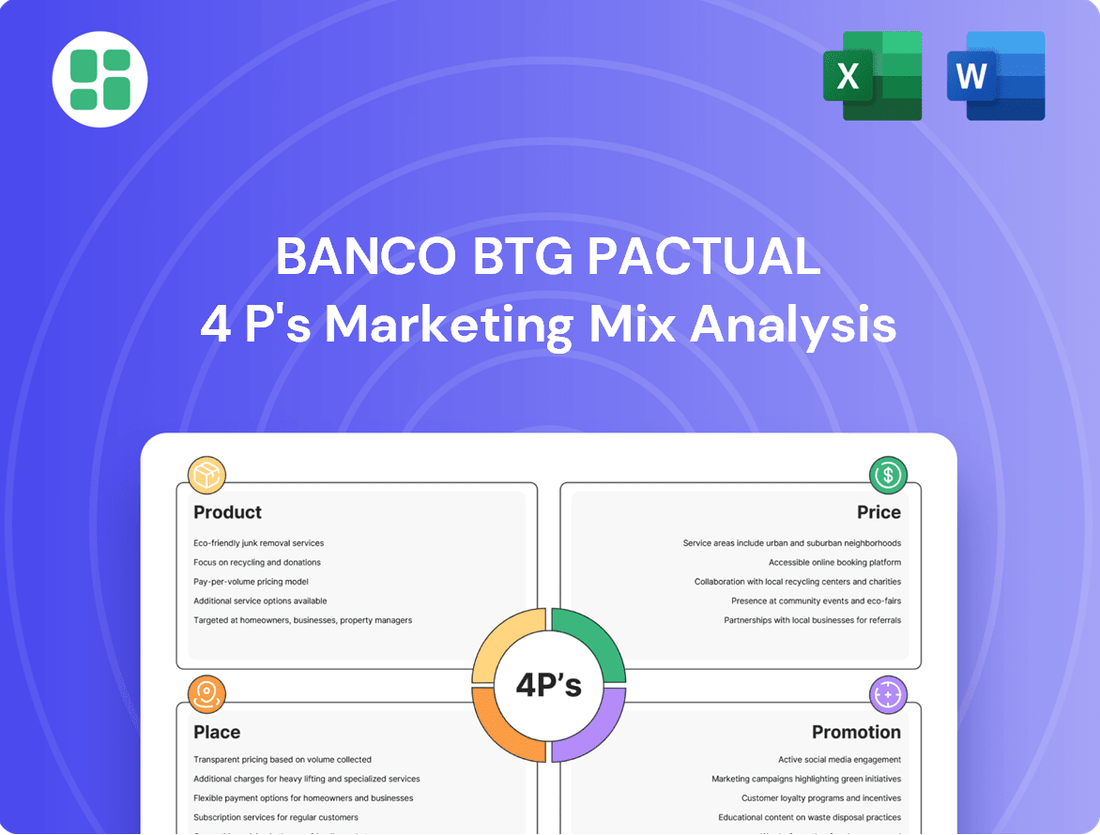

Banco BTG Pactual's marketing strategy is a masterclass in financial services, expertly balancing innovative product offerings with strategic pricing and distribution. This analysis delves into how their promotional efforts amplify their brand's reach and impact in a competitive market.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Banco BTG Pactual's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Banco BTG Pactual's comprehensive financial solutions encompass investment banking, wealth management, asset management, and corporate lending. This broad offering caters to a wide range of clients, from affluent individuals to major corporations, delivering bespoke strategies for intricate financial challenges.

In 2024, BTG Pactual continued to bolster its product suite, a strategy that has seen significant success. For instance, the bank’s wealth management division reported substantial growth, managing over R$200 billion in assets under management by the end of Q3 2024, reflecting client trust and the effectiveness of their tailored advice.

Banco BTG Pactual is aggressively growing its digital retail banking arm, providing a full-service mobile banking experience. This includes easy access to digital accounts, credit cards, and investment tools, all accessible through a user-friendly app.

This digital strategy is designed to make advanced financial products available to everyone, enabling individuals to handle their money and investments with ease. The bank reported a significant increase in digital account openings in 2024, with over 1.5 million new accounts added, highlighting the strong adoption of its digital platforms.

These digital services are enhanced with sophisticated financial management features and tailored advice, aiming to empower users. The platform's investment segment saw a 30% growth in assets under management by retail clients in the first half of 2025, demonstrating the effectiveness of its integrated approach.

BTG Pactual's Specialized Wealth Management segment offers bespoke financial planning and advisory, including intricate cross-border estate and succession strategies, primarily for high-net-worth and ultra-high-net-worth individuals. This focus is designed to navigate complex international tax and regulatory landscapes.

To bolster its capabilities, BTG Pactual has strategically acquired firms like Greytown Advisors and JGP Gestão Patrimonial. These acquisitions aim to expand its service suite for Latin American clients pursuing global investment avenues, enhancing its competitive edge in the wealth management sector.

Corporate and Business Banking

Banco BTG Pactual's Corporate and Business Banking division is a cornerstone of its operations, offering a comprehensive suite of financial solutions. This includes vital corporate lending, structured credit facilities, and essential letters of credit tailored for both large corporations and the crucial SME sector. In 2024, BTG Pactual continued its aggressive expansion in these areas, aiming to capture a larger share of the Brazilian corporate finance market, which saw significant activity in M&A and debt issuance.

The bank's deep involvement in debt capital markets (DCM) and mergers and acquisitions (M&A) advisory underscores its strategic role in facilitating business growth and complex capital structuring. For instance, BTG Pactual advised on several high-profile M&A deals in the agribusiness and technology sectors throughout 2024, demonstrating its advisory prowess and market reach. This advisory capacity is a key differentiator, providing clients with expert guidance beyond simple financing.

Further enhancing its appeal, BTG Pactual is actively integrating Environmental, Social, and Governance (ESG) principles into its product offerings, notably through sustainable financing frameworks. By the end of 2024, the bank had launched new green bond advisory services and increased its portfolio of sustainability-linked loans, reflecting a growing demand from clients for capital that aligns with responsible business practices. This focus positions BTG Pactual as a forward-thinking partner for businesses committed to long-term sustainable growth.

- Corporate Lending & Structured Credit: Providing essential financing and credit solutions to a broad spectrum of businesses.

- DCM & M&A Advisory: Facilitating capital raising and strategic transactions for corporate clients.

- ESG Integration: Offering sustainable financing options, including green bonds and sustainability-linked loans.

- Market Focus: Actively supporting growth in key sectors like agribusiness and technology through tailored financial products and advisory services.

Alternative Investments and ESG Integration

BTG Pactual provides clients with unique access to alternative investments, including hedge funds, private equity, and venture capital. The bank often participates in co-investments alongside its clients, fostering a collaborative approach to wealth growth. This strategy allows clients to tap into opportunities typically reserved for institutional investors.

The bank is at the forefront of sustainable finance, embedding Environmental, Social, and Governance (ESG) principles throughout its investment processes. This commitment is demonstrated through the development of innovative financial products designed with strong ESG considerations.

- Exclusive Alternative Investments: BTG Pactual offers access to a curated selection of alternative assets, often with co-investment opportunities for clients.

- ESG Leadership: The bank actively integrates ESG criteria into its investment strategies and product development.

- Sustainable Products: Examples include green bonds and sustainable time deposits, directly aligning client portfolios with environmental and social objectives.

BTG Pactual's product strategy is multifaceted, aiming to serve diverse client needs from retail to ultra-high-net-worth individuals and corporations. The bank’s digital retail banking arm, launched to democratize financial access, saw over 1.5 million new accounts in 2024, with its investment segment for retail clients growing 30% in assets under management by mid-2025.

| Product Category | Key Offerings | 2024/2025 Data Points |

|---|---|---|

| Digital Retail Banking | Digital accounts, credit cards, investment tools | 1.5M+ new accounts (2024); 30% AUM growth for retail investors (H1 2025) |

| Wealth Management | Bespoke financial planning, cross-border strategies, alternative investments | R$200B+ AUM (Q3 2024); Acquisitions of Greytown Advisors and JGP Gestão Patrimonial |

| Corporate & Investment Banking | Corporate lending, DCM, M&A advisory, ESG financing | Active in agribusiness and tech M&A advisory (2024); Launched green bond services and sustainability-linked loans (2024) |

What is included in the product

This analysis provides a comprehensive breakdown of Banco BTG Pactual's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to reveal its competitive positioning.

Provides a clear, actionable framework to address common marketing challenges for Banco BTG Pactual, turning complex strategies into easily digestible insights.

Simplifies the evaluation of Banco BTG Pactual's marketing efforts, offering a pain-point-relieving solution for identifying and rectifying strategic misalignments.

Place

Banco BTG Pactual leverages its sophisticated digital platform and the BTG Banking mobile app as a primary distribution channel. This digital ecosystem acts as a comprehensive bank, offering clients seamless access to accounts, investments, credit cards, and financial management tools, allowing for transactions and portfolio management on the go.

The bank's digital-first strategy is crucial for enhancing client engagement and expanding its market presence throughout Brazil and internationally. As of early 2024, BTG Pactual reported a significant increase in digital client acquisition, with over 70% of new clients onboarded through digital channels, underscoring the platform's effectiveness.

BTG Pactual boasts a robust global and regional office network, with a significant physical presence in key financial centers. This includes locations across Brazil, Chile, Colombia, the United States, the United Kingdom, Spain, and Luxembourg, underscoring its commitment to international operations. This expansive footprint is crucial for delivering cross-border advisory, wealth management, and investment banking services to a diverse clientele.

The bank's strategic expansion, exemplified by acquisitions such as M.Y. Safra Bank in New York, further solidifies its global reach. As of early 2024, BTG Pactual operates over 100 offices, with a substantial portion dedicated to its core Brazilian market, complemented by a growing international presence designed to serve ultra-high-net-worth individuals and institutional investors worldwide.

Banco BTG Pactual heavily relies on its direct sales force and specialized relationship managers to cater to its wealth management, investment banking, and corporate lending clients. This direct engagement fosters personalized service and bespoke financial solutions, crucial for navigating intricate advisory needs and significant transactions.

These relationship managers serve as the primary client liaison, offering customized guidance and facilitating access to BTG Pactual's comprehensive financial product portfolio. Their expertise ensures clients receive tailored strategies aligned with their specific financial objectives.

Strategic Acquisitions and Partnerships

Strategic acquisitions are a cornerstone of BTG Pactual's growth strategy, significantly enhancing its market position and service offerings. For instance, the acquisition of Greytown Advisors and JGP Gestão Patrimonial in recent years bolstered its wealth management segment, integrating substantial assets under management and specialized expertise. These moves enable BTG Pactual to accelerate its entry into new geographic regions or deepen its penetration in existing markets.

These strategic maneuvers are not just about scale; they are about acquiring talent and specialized capabilities. By integrating firms like Greytown, BTG Pactual gains immediate access to established client relationships and experienced professionals, a far more efficient route to market than organic growth alone. This approach is crucial for staying competitive in the rapidly evolving financial services landscape.

Furthermore, BTG Pactual actively cultivates strategic partnerships to broaden its reach and diversify its product portfolio. Collaborations in areas like sustainable finance, for example, allow the bank to tap into growing investor demand for ESG-focused products and services. These alliances extend BTG Pactual's influence and innovation capacity.

- Acquisition of Greytown Advisors: Strengthened wealth management capabilities and client base.

- Acquisition of JGP Gestão Patrimonial: Expanded assets under management and specialized investment teams.

- Partnerships in Sustainable Finance: Enhanced reach and product offerings in the ESG sector.

Investor Relations Channels

BTG Pactual actively engages with institutional investors and the broader market through its dedicated investor relations website. This platform serves as a central hub for financial reports, strategic insights, and corporate governance information, ensuring transparency. In 2024, the bank continued its practice of hosting quarterly earnings calls and investor presentations, providing direct access to management and detailed financial performance analysis.

These communication channels are critical for fostering investor confidence and meeting stringent regulatory disclosure mandates. For instance, the bank's commitment to regular updates on its financial health, including key metrics like its Return on Equity (ROE) which stood at 22.6% in Q1 2024, reinforces its credibility. This proactive approach to information dissemination is fundamental to its investor relations strategy.

- IR Website: A comprehensive digital portal for financial disclosures and corporate news.

- Earnings Calls: Regular live sessions for discussing financial results and strategic direction.

- Investor Presentations: Detailed briefings on performance, outlook, and key initiatives.

- Transparency: Commitment to open communication regarding financial data and governance.

BTG Pactual's place strategy is multifaceted, combining a strong digital presence with strategic physical locations and a direct sales force. The digital platform and mobile app serve as primary distribution channels, facilitating seamless client transactions and portfolio management. This digital-first approach has proven effective, with over 70% of new clients acquired through digital means as of early 2024.

Complementing its digital reach, BTG Pactual maintains a robust network of over 100 offices globally and regionally, including key financial centers in Brazil, the US, and Europe, supporting its international advisory and wealth management services. Its direct sales force, comprised of specialized relationship managers, provides personalized service and bespoke financial solutions, particularly for wealth management and investment banking clients.

Strategic acquisitions, such as Greytown Advisors and JGP Gestão Patrimonial, have significantly bolstered its market position and service offerings, integrating substantial assets and expertise. Partnerships in areas like sustainable finance further expand its reach and product diversification, demonstrating a commitment to innovation and market responsiveness.

| Component | Description | Key Data/Impact |

| Digital Platform & App | Primary distribution and client engagement channel | 70%+ new clients via digital channels (early 2024) |

| Physical Office Network | Global and regional presence for advisory services | Over 100 offices worldwide (early 2024) |

| Direct Sales Force | Relationship managers for personalized service | Crucial for wealth management and investment banking |

| Strategic Acquisitions | Enhancing market position and service offerings | Greytown Advisors, JGP Gestão Patrimonial |

| Strategic Partnerships | Expanding reach and diversifying products | Focus on sustainable finance |

What You Preview Is What You Download

Banco Btg Pactual 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Banco BTG Pactual's 4P's marketing mix is fully complete and ready for immediate use.

Promotion

Banco BTG Pactual prioritizes client-centric communication, focusing on delivering sophisticated wealth and investment solutions. Their messaging consistently underscores expertise, security, and trustworthiness, core tenets for building enduring client relationships in finance.

Banco BTG Pactual prioritizes digital marketing, leveraging its award-winning mobile app to foster client engagement. The app's design, featuring social media-inspired elements like transaction timelines and news "stories," has proven highly effective, achieving an impressive 83%+ client engagement rate.

BTG Pactual actively cultivates its image as a leader in financial thinking. This is achieved by showcasing its highly-regarded research divisions, which cover crucial areas like macroeconomics, equities, and fixed income. This commitment to insightful analysis underpins their brand.

The bank's standing is further solidified by consistent industry accolades. For instance, Euromoney recognized BTG Pactual as Latin America's best private bank. Participation in significant events, such as the BTG Summit and CEO Conference, amplifies its voice and reinforces its expertise among financial professionals.

Targeted Events and Sponsorships

Banco BTG Pactual strategically leverages targeted events and sponsorships to connect with key audiences. The bank's flagship BTG Summit, for instance, acts as a crucial platform, drawing in high-net-worth investors, corporate decision-makers, and industry executives. This fosters direct engagement, allowing BTG Pactual to showcase its expertise and cultivate valuable business relationships.

These curated events are designed to generate tangible business opportunities. By creating environments conducive to networking and knowledge sharing, BTG Pactual positions itself as a thought leader and a preferred partner. For example, the 2024 BTG Summit saw participation from over 5,000 executives and investors, facilitating numerous high-level discussions.

Furthermore, BTG Pactual extends its reach through sponsorships and collaborations aimed at specific market segments. This includes initiatives supporting women investors and entrepreneurs in the agribusiness sector, demonstrating a commitment to broader market inclusivity and specialized client needs. Such targeted efforts are vital for deepening engagement within these growing niches.

- BTG Summit Attendance: Over 5,000 executives and investors participated in the 2024 event.

- Strategic Audience: Events connect the bank with high-capacity investors and corporate leaders.

- Business Generation: Platforms facilitate networking and the creation of real business opportunities.

- Niche Segment Focus: Sponsorships target specific groups like women investors and agri-business entrepreneurs.

Public Relations and Media Presence

BTG Pactual actively cultivates its public relations and media presence, ensuring regular features in prominent financial news sources. These include announcements of strategic acquisitions, quarterly financial results, and the launch of innovative new services. For instance, in the first quarter of 2024, BTG Pactual reported a net income of R$2.4 billion, a significant increase that was widely covered by major financial publications.

This consistent media engagement is crucial for bolstering brand recognition and shaping public perception. By highlighting key achievements and strategic moves, BTG Pactual reinforces its standing as a dominant financial player across Latin America and on the international stage. Their proactive approach to communication ensures their narrative is consistently presented to a broad audience.

- Strategic Acquisitions: Recent acquisitions, such as the integration of Kinship in early 2024, have been central to their public relations efforts, demonstrating growth and market expansion.

- Financial Transparency: Regular reporting of robust financial results, like the aforementioned R$2.4 billion net income for Q1 2024, builds trust and showcases the institution's financial health.

- Brand Reinforcement: Consistent positive media coverage solidifies BTG Pactual's image as a leading, innovative, and reliable financial institution in the region.

BTG Pactual's promotional strategy is multi-faceted, blending digital engagement with high-profile events and strategic public relations. Their award-winning app, boasting over 83% client engagement, serves as a primary channel for communication and service delivery. The bank also actively cultivates thought leadership through its research divisions and participation in key industry forums.

| Promotional Tactic | Key Feature/Event | Target Audience | Data Point/Impact |

|---|---|---|---|

| Digital Engagement | Award-winning Mobile App | All Clients | 83%+ Client Engagement Rate |

| Thought Leadership | Research Divisions & Publications | Investors, Professionals | Covers Macroeconomics, Equities, Fixed Income |

| High-Profile Events | BTG Summit | HNI Investors, Corp. Leaders | 5,000+ participants in 2024 |

| Public Relations | Media Coverage & Announcements | General Public, Investors | Q1 2024 Net Income: R$2.4 billion |

Price

Banco BTG Pactual employs a value-based pricing strategy for its advisory services, including investment banking and wealth management. This approach directly links fees to the intricate nature of the advice, the specialized knowledge of its professionals, and the customized solutions offered to affluent clients and businesses.

Fee structures commonly involve a percentage of assets under management (AUM) for wealth management clients. For corporate finance activities like mergers and acquisitions, BTG Pactual often utilizes success fees, ensuring that client costs are directly correlated with the tangible value and outcomes achieved.

As of late 2024, BTG Pactual's wealth management division reported significant growth, managing over R$200 billion in assets. This substantial AUM base underscores the effectiveness of their value-based fee model in attracting and retaining high-net-worth clients who recognize the premium associated with expert financial guidance.

BTG Pactual's digital platforms feature competitive pricing, including free digital accounts and reduced fees for self-directed online trades, aiming to draw in a wider audience. For instance, in 2024, many digital banks have eliminated monthly maintenance fees entirely, a trend BTG Pactual aligns with for accounts maintaining a minimum balance, such as R$1,000, making it more accessible.

The bank enhances its appeal with benefits like cashback on credit card spending and waiving account maintenance fees for clients meeting specific balance thresholds, a strategy that balances client acquisition with sustainable profitability in the competitive digital banking landscape.

Banco BTG Pactual understands that a one-size-fits-all fee structure doesn't work. For their larger clients and more complex transactions, fees are often open for negotiation. This flexibility allows them to tailor pricing based on factors like the sheer volume of assets managed, the depth of the client relationship, and the intricate nature of the financial services required. For instance, a major institutional investor might secure more favorable terms on a large capital markets deal than a smaller, less established entity.

The bank also utilizes a tiered pricing approach, a common strategy in the financial services industry. This means clients who bring more assets under management or engage more deeply with BTG Pactual's diverse offerings can unlock preferential fee rates. This tiered system serves as a powerful incentive for clients to consolidate their financial activities with the bank, fostering stronger, long-term partnerships and potentially leading to significant cost savings for the client as their relationship grows.

Interest Rates and Lending Terms

Banco BTG Pactual's pricing for corporate lending and business banking hinges on interest rates and specific lending terms. These are meticulously crafted based on a borrower's creditworthiness and the loan's characteristics. This approach ensures that pricing accurately reflects the risk involved and market dynamics.

The bank's success in maintaining a robust loan portfolio and driving revenue growth in these segments underscores the effectiveness of its pricing strategies. For instance, BTG Pactual consistently demonstrates competitive lending rates, often aligning with or slightly above benchmark rates depending on the client's risk profile and the loan's tenor.

- Interest Rate Competitiveness: BTG Pactual's corporate loan rates in Brazil for 2024 often range from CDI + 2% to CDI + 7%, varying significantly with client credit quality and loan purpose.

- Loan Term Flexibility: Terms can span from short-term working capital facilities to long-term project finance, with repayment schedules and covenants tailored to each specific transaction.

- Risk-Adjusted Pricing: The bank's ability to secure strong revenue growth, exceeding 15% year-over-year in its credit segments through early 2025, reflects a keen understanding of risk assessment and its translation into pricing.

Transparency in Costs and Disclosures

BTG Pactual prioritizes clear fee structures and essential disclaimers, detailing transaction costs, commissions, and any potential extra charges. This transparency is key for fostering client trust and adhering to regulatory requirements, ensuring clients grasp the full cost of their financial dealings.

For instance, in 2024, BTG Pactual's commitment to transparency is reflected in their readily available fee schedules for investment products and advisory services. This allows clients to make informed decisions, understanding the financial implications of their investments. The bank's proactive approach to disclosures, including risk factors and service charges, aligns with global best practices for financial institutions.

Key aspects of BTG Pactual's transparency in costs and disclosures include:

- Detailed Fee Schedules: Providing comprehensive breakdowns of all applicable fees for various financial products and services.

- Clear Disclaimers: Presenting important information about risks, terms, and conditions in an understandable format.

- Regulatory Compliance: Adhering to strict guidelines set by financial regulators to ensure fair practices.

- Client Education: Offering resources and support to help clients understand their financial activities and associated costs.

BTG Pactual's pricing strategy is multifaceted, reflecting its diverse client base and service offerings. For wealth management, a value-based approach, often tied to assets under management (AUM), is prevalent, with significant AUM figures like over R$200 billion in 2024 highlighting its success. Digital services, conversely, adopt competitive pricing, including fee-free accounts for minimum balances, aligning with market trends observed in 2024.

Corporate lending rates are risk-adjusted, typically ranging from CDI + 2% to CDI + 7% in 2024, demonstrating flexibility in terms and pricing. This strategic pricing model supports robust revenue growth, with credit segments showing over 15% year-over-year increases through early 2025.

| Service Segment | Pricing Strategy | Key Data/Notes (2024/2025) |

|---|---|---|

| Wealth Management | Value-Based (AUM Percentage) | Managed over R$200 billion in AUM (late 2024) |

| Digital Banking | Competitive/Freemium | Zero maintenance fees for accounts with minimum balances (e.g., R$1,000) |

| Corporate Lending | Risk-Adjusted Interest Rates | Rates often CDI + 2% to CDI + 7% (Brazil, 2024) |

| Investment Banking (M&A) | Success Fees | Fees linked to tangible client outcomes |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for Banco BTG Pactual leverages a comprehensive blend of official company disclosures, including investor relations materials and annual reports, alongside granular data from financial markets and industry-specific publications. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.