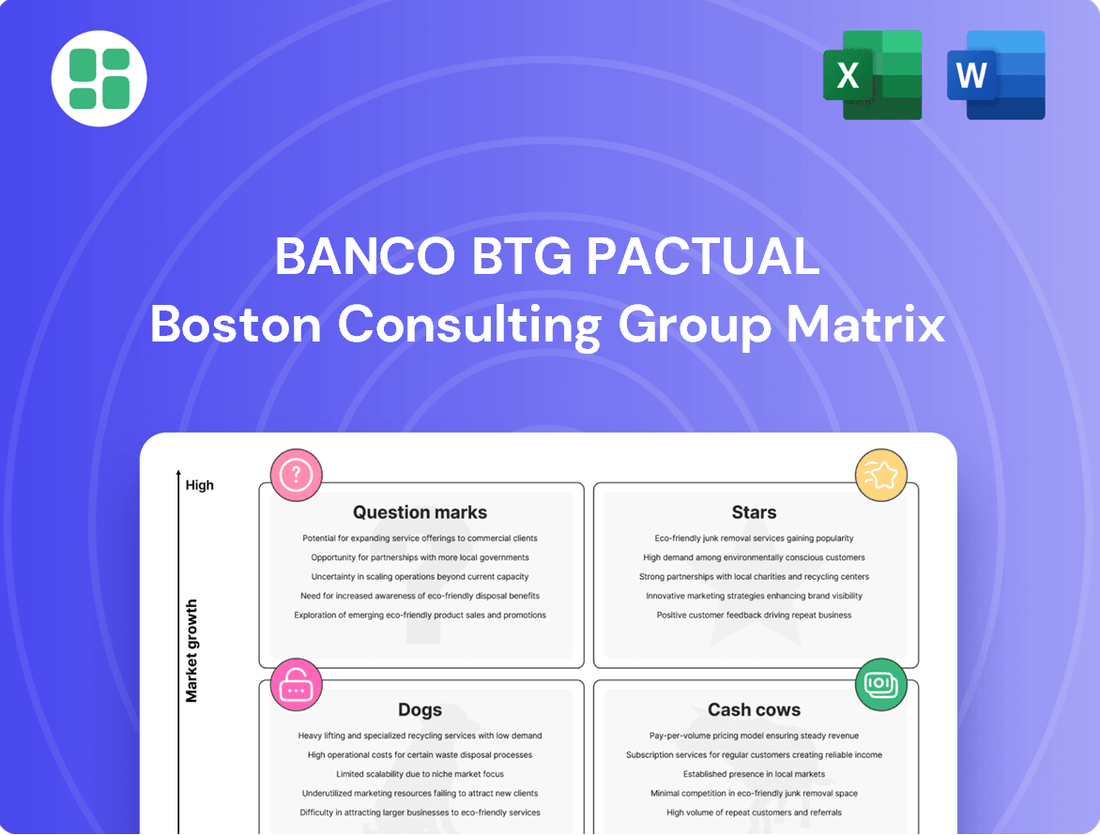

Banco Btg Pactual Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Btg Pactual Bundle

Banco BTG Pactual's BCG Matrix offers a powerful lens to understand its diverse portfolio. See which business units are driving growth and which require strategic attention. This preview is just the beginning; unlock the full potential of your strategic planning by purchasing the complete BCG Matrix report for detailed quadrant analysis and actionable insights.

Stars

BTG Pactual's aggressive push into digital retail banking, exemplified by its BTG Pactual Digital platform, is demonstrating substantial growth potential and a widening market reach. This digital segment is actively attracting new customers and diversifying the bank's income sources away from its traditional investment banking focus, establishing it as a crucial driver of future expansion.

The bank's strategic emphasis on enhancing its digital services throughout 2025 reinforces its dedication to this rapidly expanding sector. By the first quarter of 2024, BTG Pactual Digital had already surpassed 8.8 million clients, a testament to its successful client acquisition strategy and its growing importance within the bank's overall business model.

Banco BTG Pactual's Wealth Management and Personal Banking segment, encompassing its digital offerings, has achieved remarkable growth, setting new revenue records. Assets under management (WuM) have seen substantial expansion, reflecting the division's increasing appeal and market penetration.

This segment's success is further evidenced by its consistent ability to attract significant net new money. Strategic moves, such as the acquisition of Julius Baer's Brazilian wealth management operations, underscore BTG Pactual's commitment to solidifying its leadership in serving affluent clients within a dynamic and expanding market.

BTG Pactual's Corporate Lending and Business Banking division is a clear star in its BCG matrix. This segment has seen impressive revenue growth, fueled by a substantial expansion of its credit portfolio. For instance, in 2024, the bank reported a significant uptick in its corporate loan book, reflecting strong demand from businesses across Brazil.

The division's success is particularly notable due to its strategic focus on small and medium-sized enterprises (SMEs). This segment represents a high-growth area within the Brazilian economy, and BTG Pactual's tailored offerings have resonated well. By capturing a larger share of this market, the bank is solidifying its position as a leader in business banking services.

Strategic Capital Investment Strategy

BTG Pactual's Strategic Capital (Strat Cap) initiative is a key component of its growth strategy, focusing on opportunistic investments in asset-oriented businesses. This program successfully secured over $1 billion in capital commitments, highlighting significant investor confidence and BTG's capacity to deploy substantial capital.

The Strat Cap strategy allows BTG Pactual to be agile and capitalize on emerging high-growth opportunities across diverse sectors. This approach is designed to expand the firm's investment footprint by identifying and investing in businesses with strong asset bases and significant growth potential.

- Capital Raised: Over $1 billion in capital commitments.

- Investment Focus: Opportunistic investments in asset-oriented businesses.

- Strategic Goal: Capitalize on emerging high-growth opportunities and expand investment footprint.

Sustainable and Impact Investing Initiatives

BTG Pactual is significantly expanding its sustainable and impact investing initiatives, demonstrating leadership in a vital and expanding market. The bank has successfully coordinated green and blue bond issuances and provided financing for renewable energy projects, underscoring its commitment to environmental stewardship.

This dedication to ESG principles and impact investing is attracting a growing base of investors who prioritize environmental and social consciousness. This strategic focus is a key driver for BTG Pactual's future growth, tapping into a demand for responsible financial products.

- Green and Blue Bonds: BTG Pactual has been active in coordinating issuances, channeling capital towards environmentally beneficial projects.

- Renewable Energy Financing: The bank is a key financier for renewable energy ventures, supporting the transition to cleaner power sources.

- ESG Commitment: Integrating ESG factors into its operations and investment strategies is a core pillar of BTG Pactual's approach.

- Investor Attraction: The focus on sustainability appeals to a rising segment of conscious investors, expanding the bank's client base.

BTG Pactual's digital transformation, particularly through BTG Pactual Digital, positions it as a star performer. This segment is experiencing rapid client acquisition and revenue growth, significantly contributing to the bank's overall expansion. By Q1 2024, BTG Pactual Digital served over 8.8 million clients, showcasing its strong market penetration and appeal.

The bank's commitment to enhancing digital services through 2025 further solidifies this segment's star status. Its Wealth Management and Personal Banking division, which includes digital offerings, has consistently set new revenue records and seen substantial growth in assets under management, demonstrating its ongoing success and market leadership.

| Segment | Growth Trajectory | Key Performance Indicators (2024 Data) | Strategic Importance |

|---|---|---|---|

| BTG Pactual Digital | High Growth | 8.8M+ Clients (Q1 2024) | Primary driver of new client acquisition and revenue diversification. |

| Wealth Management & Personal Banking | Strong Growth | Record Revenues, Significant AUM Increase | Key contributor to profitability and market share in affluent client segment. |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

The Banco BTG Pactual BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

BTG Pactual's traditional investment banking advisory, encompassing M&A and Debt Capital Markets (DCM), stands as a robust cash cow. The bank has consistently dominated the Latin American landscape in these sectors for over a decade, a testament to its enduring market leadership and deep-seated expertise.

This segment consistently delivers a stable and high-margin revenue stream, fueled by BTG Pactual's extensive client relationships and proven track record. For instance, in 2024, BTG Pactual advised on a significant number of high-profile M&A transactions across various industries in Brazil and other Latin American markets, reinforcing its leading position.

BTG Pactual's Asset Management division stands as a robust cash cow, consistently delivering strong revenue streams and boasting a substantial asset base. As of the first quarter of 2024, the firm reported approximately R$ 293 billion in assets under management (AuM) for this segment, underscoring its significant market presence and client trust.

This segment thrives on its well-established international platforms and deep-rooted research capabilities, which translate into a stable, fee-based income. Even when market conditions fluctuate, the consistent demand for its investment expertise provides a reliable revenue source, a hallmark of a true cash cow.

BTG Pactual's Sales & Trading operations act as a robust cash cow, consistently generating substantial revenue for the bank. In 2024, this segment showcased its resilience by effectively navigating market fluctuations, a testament to BTG's expertise in capitalizing on trading opportunities and its strong client relationships.

This division's performance highlights BTG Pactual's strategic advantage in leveraging market volatility. Despite inherent sensitivity to economic cycles, the segment's established client base and sophisticated risk management frameworks ensure a steady and reliable stream of cash flow, underpinning its cash cow status within the BCG matrix.

Wealth Planning for Ultra-High-Net-Worth Individuals

BTG Pactual's wealth planning for ultra-high-net-worth (UHNW) individuals represents a significant cash cow for the bank. This mature segment boasts high client retention and substantial assets under wealth management, contributing to consistent fee-based revenue streams. The bank's strategic acquisitions further solidify its position and profitability in this lucrative market.

The UHNW wealth planning services are a cornerstone of BTG Pactual's financial strength. For instance, as of the first quarter of 2024, the bank reported significant growth in its wealth management division, with assets under management reaching new highs. This sustained performance underscores the stability and profitability of these services.

- Consistent Fee Generation: The bespoke nature of UHNW wealth planning ensures recurring fee income, providing a stable revenue base.

- High Client Retention: Deep client relationships and tailored solutions foster loyalty, minimizing churn in this valuable segment.

- Significant Assets Under Management: The substantial WuM translates into considerable fee-generating potential, directly impacting profitability.

- Strategic Growth: Acquisitions in the wealth management space have amplified BTG Pactual's reach and capabilities, reinforcing its cash cow status.

Established Corporate Lending to Large Enterprises

Established corporate lending to large enterprises is a cornerstone of Banco BTG Pactual's operations, fitting squarely into the Cash Cows quadrant of the BCG matrix. This segment benefits from the bank's deep relationships and expertise in serving major corporations, ensuring a steady stream of interest income.

While the overall corporate lending market is expanding, this particular niche is characterized by its maturity. Banco BTG Pactual manages stable net interest margins within this segment, supported by prudent risk management and adequate provisioning for potential defaults. This stability is crucial for the bank's consistent financial performance.

- Stable Interest Income: This mature portfolio generates predictable revenue streams for Banco BTG Pactual.

- Adequate Provisioning: The bank maintains sufficient reserves to cover potential credit losses, reflecting conservative risk management.

- Foundational Performance: This core lending business underpins the bank's overall financial strength and profitability.

- Market Maturity: While growth might be slower than in emerging segments, the stability and predictability are key advantages.

BTG Pactual's core investment banking advisory, encompassing M&A and Debt Capital Markets, is a prime example of a cash cow. This segment consistently generates high-margin revenue due to the bank's long-standing market leadership and deep client relationships in Latin America.

The Asset Management division also functions as a significant cash cow, evidenced by its substantial assets under management. As of Q1 2024, BTG Pactual's AuM in this segment reached approximately R$ 293 billion, reflecting consistent client trust and a stable, fee-based income stream.

Sales & Trading operations are another strong cash cow, demonstrating resilience and profitability by effectively navigating market volatility. This segment leverages BTG's expertise and client base to generate reliable cash flow, even amidst economic cycles.

Wealth planning for ultra-high-net-worth individuals is a mature and profitable cash cow for BTG Pactual. The segment benefits from high client retention and substantial assets under management, contributing to consistent fee-based revenue, further bolstered by strategic acquisitions.

Established corporate lending to large enterprises forms a foundational cash cow for BTG Pactual. This mature segment provides stable interest income, supported by prudent risk management and consistent net interest margins.

| Segment | Status | Key Metric (Q1 2024) | Revenue Driver |

| Investment Banking Advisory (M&A, DCM) | Cash Cow | Dominant market share in LatAm | Advisory fees, transaction commissions |

| Asset Management | Cash Cow | R$ 293 billion in AuM | Management fees |

| Sales & Trading | Cash Cow | Resilient performance in volatile markets | Trading profits, commissions |

| Wealth Planning (UHNW) | Cash Cow | Significant assets under wealth management | Management fees, advisory fees |

| Corporate Lending (Large Enterprises) | Cash Cow | Stable net interest margins | Interest income |

Delivered as Shown

Banco Btg Pactual BCG Matrix

The Banco BTG Pactual BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or sample data, only the comprehensive strategic analysis ready for your business planning. You're seeing the exact report, meticulously crafted with market-backed insights, that will be delivered to you, ensuring you get a professional and actionable tool without any surprises.

Dogs

Legacy Niche Financial Products, within Banco BTG Pactual's BCG Matrix, likely reside in the 'Dog' quadrant. These are offerings that have seen minimal growth and hold a small market share, often due to a lack of adaptation to digital advancements or changing client demands.

Maintaining these specialized products can consume significant resources, yielding disproportionately low returns when contrasted with more modern and agile financial solutions. For instance, as of the first quarter of 2024, many traditional wealth management products not integrated with digital platforms have experienced declining client engagement.

Without specific product examples, this category broadly encompasses services that are either being discontinued or have demonstrably lost their competitive advantage in the current financial landscape. This strategic positioning suggests a need for careful evaluation of their continued viability or potential for reinvention.

BTG Pactual, a major investment bank, likely manages a portfolio that includes minority stakes in smaller companies not meeting performance expectations or operating in stagnant industries. These investments, even if individually small, can collectively represent a drag on capital, yielding low returns and offering limited future growth. For instance, in 2023, the Brazilian equity market saw mixed performance, with the Ibovespa index experiencing volatility, highlighting the challenges smaller, less liquid stocks can face.

Outdated proprietary trading strategies, particularly those relying on historical data that no longer reflects current market dynamics, are a prime example of Dogs within Banco BTG Pactual's Sales & Trading division. These strategies might have been successful in the past but have become less effective due to shifts in market structure, technological advancements, or changes in investor behavior. For instance, strategies heavily dependent on arbitrage opportunities that have since disappeared due to increased market efficiency would fall into this category.

These underperforming strategies can lead to minimal profits or even outright losses, effectively consuming valuable capital without contributing to the division's robust performance. In 2024, the global average return on equity for proprietary trading desks that haven't updated their models has been observed to be significantly lower, often in the single digits, compared to their more agile counterparts. This capital drain hinders the ability to invest in newer, more profitable ventures.

Highly Specialized, Low-Demand Advisory Services

Highly specialized advisory services, such as bespoke tax structuring for ultra-high-net-worth individuals or niche distressed debt workouts, often fall into the question mark category initially but can become highly specialized, low-demand services. These services target a very limited clientele or address infrequent, complex market situations. For instance, a firm might offer specialized advice on navigating sanctions regimes for cross-border transactions, a service with minimal but potentially high-paying demand.

While these services can yield substantial fees when engaged, their infrequent nature means they contribute minimally to overall revenue growth. Maintaining the deep expertise required for such offerings can also be resource-intensive, making them less efficient from a broad business perspective. In 2024, financial institutions are increasingly evaluating the cost-benefit of maintaining these highly specialized teams, especially if the demand doesn't materialize consistently.

- Niche Market Focus: Caters to a very small segment of the market or specific, infrequent events.

- Low Growth Potential: Limited client base and infrequent demand restrict overall expansion.

- High Margin, Low Volume: Profitable when utilized, but overall revenue contribution is minimal.

- Resource Intensity: Requires specialized talent and continuous knowledge updates, potentially at a high cost.

Non-Strategic, Non-Core Asset Holdings

Non-Strategic, Non-Core Asset Holdings represent assets within BTG Pactual's portfolio that were acquired through prior restructuring or opportunistic transactions but no longer align with the bank's primary strategic objectives. These holdings may have also underperformed, failing to appreciate in value as anticipated.

These assets often demand continuous management attention but generate minimal returns, positioning them for potential divestiture when market conditions permit a favorable sale. For instance, BTG Pactual might hold legacy real estate or minority stakes in businesses outside its current focus areas.

- Low Return on Assets: These holdings typically exhibit a low return on assets (ROA) compared to core business lines.

- Strategic Mismatch: They do not contribute to BTG Pactual's long-term growth strategy or competitive advantage.

- Divestiture Potential: BTG Pactual actively seeks opportune moments to exit these positions to reallocate capital to more productive uses.

In Banco BTG Pactual's BCG Matrix, 'Dogs' represent offerings with low market share and minimal growth. These are often legacy products or outdated strategies that consume resources without significant returns. For example, as of Q1 2024, certain wealth management products lacking digital integration saw declining client engagement, fitting the 'Dog' profile.

These underperforming assets, like minority stakes in stagnant industries or non-strategic holdings, can collectively drag down overall portfolio performance. In 2023, the volatility in the Brazilian equity market meant that smaller, less liquid stocks, often found in this category, struggled to appreciate.

Outdated proprietary trading strategies, especially those not adapted to current market dynamics, also fall into this quadrant. In 2024, such strategies have shown significantly lower returns, often single digits, compared to more agile approaches, highlighting their capital drain.

BTG Pactual's 'Dogs' also include highly specialized, low-demand advisory services that, while potentially high-margin, contribute minimally to overall growth due to infrequent client engagement.

| Category | Description | Market Share | Growth Rate | Example (Illustrative) |

|---|---|---|---|---|

| Legacy Niche Products | Offerings with minimal adaptation to digital trends or changing client needs. | Low | Low | Non-digitized wealth management solutions |

| Underperforming Investments | Minority stakes in companies in stagnant industries or non-core assets. | Low | Low | Legacy real estate holdings |

| Outdated Strategies | Proprietary trading models no longer effective due to market shifts. | Low | Low | Arbitrage strategies based on historical inefficiencies |

| Specialized Low-Demand Services | Targeting very limited clientele or infrequent complex situations. | Low | Low | Bespoke tax structuring for niche scenarios |

Question Marks

BTG Pactual's acquisition of M.Y. Safra Bank in the United States exemplifies a strategic move into a new geographic market. This venture, while promising high growth potential, currently represents a low market share for BTG in the US banking sector.

Such expansions require substantial capital investment to build brand recognition, develop infrastructure, and compete effectively. The goal is to transform these nascent operations into significant market players over time.

BTG Pactual is actively nurturing emerging fintech ventures, viewing them as potential future stars within its BCG matrix. These nascent partnerships, often in pilot phases, operate in rapidly expanding markets but currently hold a small market share, necessitating significant capital infusion for growth and validation.

For instance, BTG Pactual's investment in a new digital payments platform, while operating in a sector projected to grow significantly, represents a classic 'question mark' due to its initial low penetration and the substantial funding required to compete with established players.

Banco BTG Pactual's foray into entirely new digital credit products, like novel lending solutions or unique credit card offerings, would likely place them in the Question Mark category of the BCG Matrix. These innovative offerings, while targeting a rapidly expanding digital market, would initially possess low market share as they are in their nascent, testing phases.

Significant investment in marketing and product development is crucial for these new digital credit products to gain traction and market acceptance. For instance, in 2024, the digital banking sector saw substantial growth, with fintechs raising billions globally to launch and scale new financial products, indicating the high investment required for unproven digital offerings.

New Thematic Investment Funds (e.g., nascent alternative assets)

The introduction of highly specialized or nascent thematic investment funds, especially those exploring emerging alternative assets, would fall into the question mark category for an asset manager like Banco BTG Pactual. These funds target potentially high-growth investor demand but begin with a minimal market share.

Significant capital investment is necessary to establish a strong track record and attract substantial investor inflows for these new ventures. For instance, the global alternative assets market was projected to reach $23.1 trillion by the end of 2024, with many new sub-sectors emerging.

- Nascent Asset Focus: Funds targeting areas like tokenized real estate or sustainable aviation fuel credits represent examples of nascent alternative assets.

- High Growth Potential, Low Initial Share: While investor interest in these themes is growing, their current market penetration is limited, requiring significant marketing and development efforts.

- Capital Investment Needs: Building credibility and attracting assets under management (AUM) for these specialized funds demands substantial upfront capital for research, marketing, and operational infrastructure.

- Track Record Development: The early stages involve proving the investment thesis and generating consistent returns, which is a crucial step before these funds can become stars or cash cows.

Early-Stage Cross-Border Wealth Solutions

Developing sophisticated, cross-border wealth solutions for specific client segments presents a significant growth opportunity, driven by increasing global wealth mobility. However, BTG Pactual's initial market share in these specialized, emerging offerings may be modest.

These complex solutions necessitate extensive regulatory navigation and highly specialized expertise, requiring substantial investment to achieve scalable growth. For instance, managing cross-border investments often involves navigating diverse tax regimes and compliance requirements across multiple jurisdictions.

- High Growth Potential: Global wealth mobility is on the rise, creating demand for tailored cross-border wealth management.

- Nascent Market Share: BTG Pactual may hold a smaller share in these specialized, developing segments initially.

- Regulatory Complexity: Success hinges on adeptly managing diverse international regulations and compliance standards.

- Investment Needs: Scaling these services demands significant investment in expertise and infrastructure.

Question Marks in Banco BTG Pactual's BCG Matrix represent new ventures with high growth potential but low current market share. These require significant investment to develop and compete effectively.

Examples include nascent fintech partnerships or new digital credit products, which operate in expanding markets but need substantial capital for growth and validation.

BTG Pactual's strategic expansion into new geographic markets, like the US with M.Y. Safra Bank, also fits this category, demanding capital for brand building and infrastructure development.

The key challenge is to nurture these question marks into stars by investing wisely, transforming them into future revenue drivers.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, industry growth forecasts, and competitive market analysis to provide actionable strategic insights.