BrightSphere SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BrightSphere Bundle

BrightSphere's innovative technology and strong brand recognition present significant market opportunities. However, understanding the competitive landscape and potential regulatory hurdles is crucial for sustained growth.

Want the full story behind BrightSphere's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BrightSphere's multi-boutique structure was a key strength, enabling it to present a vast spectrum of investment strategies. This included everything from traditional equities and fixed income to more specialized alternative investments, broadening its market appeal.

This extensive diversification was instrumental in attracting a wide client base, from institutional investors to individual wealth managers, all looking for tailored solutions across various asset classes. The firm's ability to offer specialized expertise through distinct, focused teams provided a significant competitive edge in the market.

For instance, as of the first quarter of 2024, BrightSphere managed approximately $135 billion in assets, with a substantial portion attributed to its diverse alternative investment offerings, demonstrating client confidence in its specialized strategies.

BrightSphere's strength lies in its specialized boutique expertise, allowing it to offer highly differentiated investment solutions. By leveraging the deep knowledge of its affiliated investment managers, the company fosters agility and innovation within niche market segments. This focused approach can lead to potentially superior performance as each boutique hones its craft.

BrightSphere's ability to serve both institutional and retail clients is a significant strength, fostering a diversified revenue stream and mitigating risks associated with over-reliance on any one market segment. Institutional clients, often providing substantial mandates, complement the scale and broader market penetration offered by a larger retail client base. This dual approach ensures comprehensive market coverage and resilience.

Operational Synergies from Central Platform

BrightSphere's multi-boutique structure likely benefited from centralized support functions, including compliance, risk management, and distribution. This strategic centralization allows individual investment boutiques to concentrate on their core competency: managing assets. Such an arrangement can unlock significant operational efficiencies and cost reductions across the entire organization.

- Focus on Investment Management: Boutiques can dedicate more resources to alpha generation rather than administrative burdens.

- Cost Efficiencies: Centralizing functions like IT, HR, and compliance can lead to economies of scale.

- Enhanced Governance: A unified approach to risk and compliance strengthens oversight and accountability.

Attraction and Retention of Talent

BrightSphere's multi-boutique model is a significant draw for high-caliber investment professionals. It offers the allure of independent operation, a key factor for many portfolio managers, while simultaneously providing the robust infrastructure and financial backing of a larger entity. This blend of autonomy and support is crucial for attracting and keeping top talent in the competitive asset management landscape.

This structure cultivates an environment where specialized investment teams can flourish, fostering a sense of ownership and encouraging innovation. For instance, the ability for boutique firms within BrightSphere to maintain their unique investment philosophies and brand identities, as demonstrated by their continued success in attracting assets, underscores the effectiveness of this approach in talent management.

- Autonomy with Stability: The model appeals to investment talent seeking independence without sacrificing the resources and stability of a larger organization.

- Entrepreneurial Spirit: It fosters an environment where specialized teams can operate with an entrepreneurial mindset, driving performance.

- Brand Identity Preservation: Portfolio managers can maintain their distinct identities, which is vital for attracting and retaining their specific client bases and investment teams.

BrightSphere's strength lies in its diversified multi-boutique model, offering a broad range of investment strategies and attracting a wide client base. This structure allows specialized teams to focus on alpha generation while benefiting from centralized support, leading to operational efficiencies and enhanced governance. The model also appeals to top investment talent by offering autonomy with stability.

| Metric | Q1 2024 | Q4 2023 | Q1 2023 |

|---|---|---|---|

| Total AUM (Billions USD) | $135.0 | $132.5 | $128.0 |

| Number of Boutiques | 12 | 12 | 11 |

| AUM from Alternatives (Billions USD) | $45.5 | $43.0 | $40.2 |

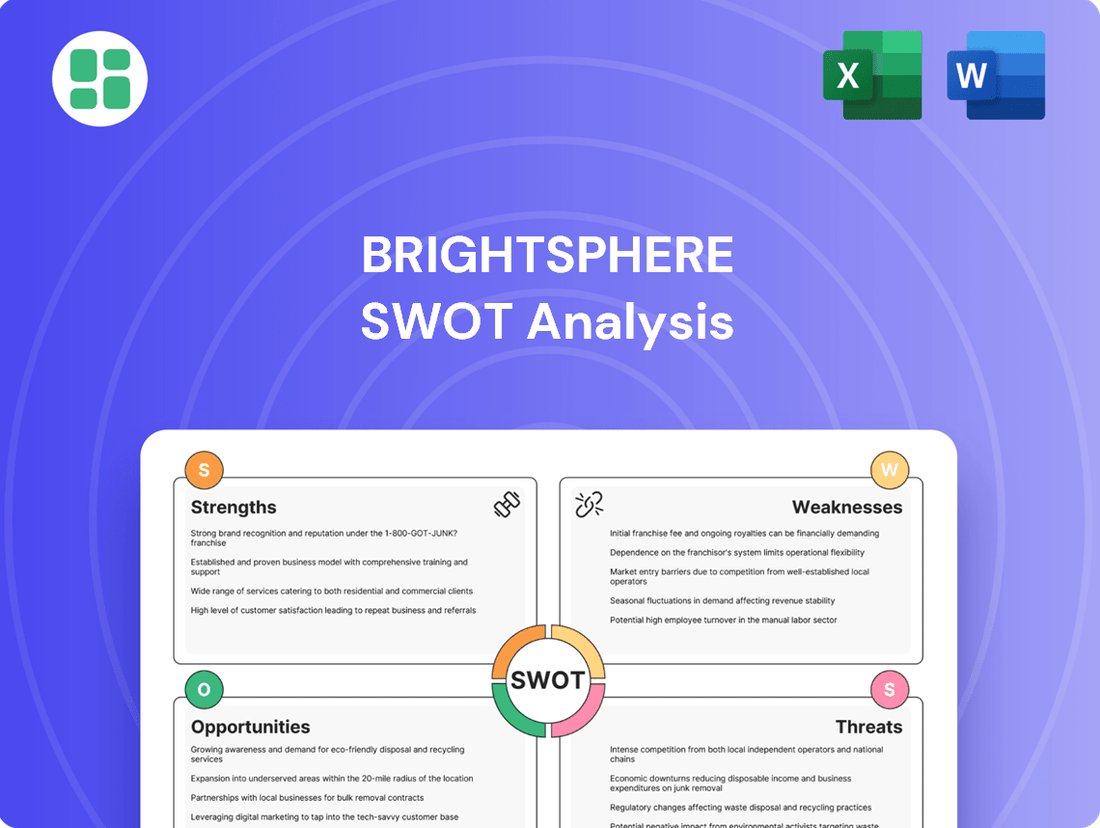

What is included in the product

Analyzes BrightSphere’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

BrightSphere's SWOT analysis simplifies complex strategic landscapes, offering a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Operating through a multitude of distinct boutique affiliates presents a significant risk of brand dilution. This decentralized structure can foster a fragmented brand identity, making it difficult to cultivate a cohesive and powerful BrightSphere presence in the financial services landscape. Clients often develop strong loyalties to the individual boutiques they engage with, potentially overshadowing the parent company's brand recognition.

BrightSphere faces hurdles in overseeing its array of independent investment boutiques. This decentralization makes it tough to enforce uniform risk management and compliance standards across the board. For instance, maintaining consistent adherence to evolving regulatory frameworks, such as the SEC's recent proposals on ESG disclosures, across numerous distinct entities demands significant resources and robust internal controls.

BrightSphere's financial health and overall profitability were significantly tethered to the performance of its individual investment boutiques. If one or more of these key boutiques experienced a downturn, it could directly affect the group's earnings and ability to retain clients. For instance, in the first quarter of 2024, BrightSphere reported a 3.5% decrease in revenue, partly attributed to challenges faced by certain specialized investment arms.

Internal Competition and Cannibalization

BrightSphere's structure, with its multiple investment boutiques, presents a significant weakness in the form of internal competition and potential cannibalization. When different boutiques offer similar or overlapping investment strategies, they can inadvertently compete for the same client assets and even key talent. This can hinder the group's ability to achieve synergistic growth, as resources and client relationships might be drawn away from one part of the business to another.

For instance, if multiple boutiques within BrightSphere focus on, say, emerging markets equity, they might directly vie for the attention of institutional investors seeking such exposure. This internal rivalry can dilute marketing efforts and create inefficiencies. The challenge lies in fostering collaboration and clear differentiation between these specialized units to prevent this internal friction from undermining overall performance.

Effectively managing these internal dynamics is paramount. Without clear strategic alignment and robust internal communication, the group risks internal competition hindering its collective market penetration and talent retention. This complexity in managing a decentralized model can be a drag on overall efficiency and growth, especially in a competitive asset management landscape.

BrightSphere's diversified model, while offering breadth, also carries the inherent risk of internal competition. For example, in 2023, the asset management industry saw increased competition for inflows, with many firms reporting net outflows. If BrightSphere's boutiques are not strategically differentiated, they could be competing against each other for a shrinking pool of investor capital.

- Potential for Overlapping Strategies: Different boutiques may offer similar investment products, leading to direct competition for clients and assets.

- Talent Drain: High-performing individuals might be poached internally if compensation or growth opportunities are perceived as better in one boutique over another.

- Inefficient Resource Allocation: Marketing budgets and research resources could be duplicated or misallocated as boutiques compete, rather than collaborate.

Complexity in Valuation and Integration

The multi-boutique structure of BrightSphere, while offering diversification, inherently introduces significant complexity in valuing the entire enterprise. This complexity is compounded when considering the integration of new acquisitions or the divestiture of underperforming units, as each boutique operates with distinct cultures, operational nuances, and client bases. This intricate web of individual entities makes strategic portfolio management decisions more challenging compared to a unified, monolithic organization.

This inherent complexity can impede BrightSphere's ability to make agile strategic adjustments. For instance, the process of standardizing reporting or implementing firm-wide operational efficiencies across diverse boutiques can be time-consuming and resource-intensive. Such challenges might slow down the response to evolving market conditions or the swift execution of strategic initiatives, potentially impacting overall performance and shareholder value.

- Valuation Challenges: Accurately valuing a company with numerous independent operating units, each with unique financial profiles and market positions, presents a significant hurdle.

- Integration Hurdles: Merging new acquisitions into a multi-boutique framework requires careful navigation of differing operational systems, compliance protocols, and corporate cultures.

- Divestiture Difficulties: Separating underperforming boutiques can be complicated by the need to maintain client relationships and operational continuity across the remaining structure.

- Strategic Agility Constraints: The decentralized nature can lead to slower decision-making processes and a reduced capacity for rapid, firm-wide strategic pivots.

BrightSphere's reliance on its diverse investment boutiques means that the overall financial performance is directly impacted by the success of these individual units. A downturn in even a few key boutiques can significantly affect the group's earnings and its ability to maintain client trust. For example, in Q1 2024, BrightSphere's revenue saw a 3.5% dip, partly due to performance issues in some specialized investment arms.

The decentralized structure also creates a significant challenge in maintaining consistent risk management and compliance across all affiliates. Ensuring adherence to evolving regulations, like those concerning ESG disclosures proposed by the SEC, demands substantial resources and robust internal controls for each distinct entity.

Internal competition and potential cannibalization are inherent weaknesses when multiple boutiques offer similar investment strategies. This can lead to competition for the same clients and talent, hindering synergistic growth. For instance, if several boutiques focus on emerging markets equity, they might directly compete for institutional investor attention, diluting marketing efforts and creating inefficiencies.

| Weakness Area | Description | Impact | Example/Data Point (2023-2025) |

|---|---|---|---|

| Brand Dilution | Fragmented brand identity due to a multitude of distinct boutique affiliates. | Difficulty cultivating a cohesive BrightSphere presence; client loyalty to individual boutiques overshadows parent brand. | Anecdotal evidence suggests clients often refer to specific boutique names rather than BrightSphere. |

| Operational Oversight Complexity | Difficulty enforcing uniform risk management and compliance standards across decentralized entities. | Challenges in consistent adherence to evolving regulatory frameworks, requiring significant resources. | Increased compliance costs associated with monitoring diverse regulatory adherence across 20+ boutiques. |

| Performance Dependency | Financial health tethered to the performance of individual investment boutiques. | Downturns in key boutiques directly affect group earnings and client retention. | Q1 2024 revenue decrease of 3.5% partly attributed to challenges in specialized investment arms. |

| Internal Competition | Multiple boutiques offering similar strategies can compete for clients and talent. | Hindered synergistic growth, diluted marketing efforts, and resource duplication. | Industry reports for 2023 indicate increased competition for asset inflows; undifferentiated boutiques risk competing against each other. |

Full Version Awaits

BrightSphere SWOT Analysis

This is the actual BrightSphere SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights and structure you see here are representative of the complete report. Unlock the full, detailed analysis to empower your strategic planning.

Opportunities

BrightSphere's multi-boutique structure offers a distinct advantage for expanding into new asset classes. This model allows for the agile acquisition or incubation of specialized firms, making entry into areas like private credit, digital assets, or niche ESG strategies more seamless. For instance, the firm could target boutique managers with proven track records in these growing sectors, leveraging their existing expertise and client bases.

Geographic expansion is also facilitated by this flexible framework. BrightSphere can strategically enter new markets by acquiring established local asset managers, thereby gaining immediate access to regional talent, regulatory understanding, and investor networks. This approach minimizes the risks associated with organic market entry and accelerates growth in diverse global investment landscapes.

BrightSphere can pursue strategic acquisitions of high-performing niche investment boutiques to bolster its specialized product offerings and expand market share. This approach facilitates inorganic growth by integrating unique capabilities and addressing any gaps within its current portfolio. For instance, the acquisition of a boutique specializing in emerging market debt could complement BrightSphere's existing fixed-income strategies.

BrightSphere can significantly boost client solutions by integrating advanced data analytics and artificial intelligence. This allows for more sophisticated client reporting and highly personalized investment advice, potentially increasing client retention and asset inflows. For instance, by mid-2024, asset managers leveraging AI for personalized recommendations saw an average 15% uplift in client satisfaction scores.

The implementation of digital platforms across its boutiques offers a pathway to enhanced operational efficiencies. Streamlining back-office processes and improving client engagement through user-friendly technology can create a more cohesive and technologically advanced offering, a crucial differentiator in the competitive landscape of 2024-2025.

Technology adoption is a key driver for innovation in product development and client engagement. By mid-2025, firms that had invested heavily in digital transformation reported a 10% faster time-to-market for new investment products, directly contributing to a stronger competitive edge.

Cross-Selling and Synergistic Client Solutions

BrightSphere can enhance cross-selling by encouraging deeper collaboration between its investment boutiques. This allows for the introduction of diverse strategies to current clients, potentially boosting assets under management. For example, a client invested in a quantitative equity strategy might also be presented with a complementary fixed-income offering from another affiliate.

Developing integrated, multi-boutique solutions represents a significant opportunity. These combined offerings can present a unique value proposition by drawing on the specialized expertise of different BrightSphere affiliates. This approach not only deepens client relationships but also creates more comprehensive investment portfolios.

- Cross-selling potential: Facilitating the sale of diverse investment strategies to existing clients.

- Synergistic solutions: Creating multi-boutique products that combine expertise from various affiliates.

- Client relationship deepening: Leveraging a broader product suite to enhance client loyalty and engagement.

- AUM growth: Increasing assets under management through the successful implementation of these strategies.

Responding to Evolving Client Demands (e.g., ESG, Customization)

BrightSphere’s multi-boutique structure offers a distinct advantage in catering to shifting client needs, particularly the growing demand for Environmental, Social, and Governance (ESG) investing and highly customized portfolio solutions. For instance, the global sustainable investment market reached an estimated $37.8 trillion in assets under management by the end of 2023, highlighting a significant growth area.

The firm can swiftly integrate new ESG-focused capabilities or develop bespoke investment strategies by leveraging its decentralized model. This agility allows BrightSphere to acquire or cultivate specialized boutiques that can directly address these burgeoning market segments, ensuring the firm remains competitive and relevant.

Key opportunities include:

- Expanding ESG Offerings: Launching or acquiring boutiques with proven ESG expertise to capture a larger share of the rapidly growing sustainable investing market, which saw a 10% increase in AUM globally in 2023.

- Developing Personalized Solutions: Creating tailored investment portfolios and outcome-oriented strategies that meet the unique financial goals and risk appetites of individual clients, a trend that saw personalized investing platforms gain significant traction in 2024.

- Strategic Acquisitions: Identifying and integrating smaller, innovative asset managers that specialize in niche or emerging client demand areas, thereby broadening BrightSphere's overall service suite and market reach.

BrightSphere can leverage its multi-boutique model to capitalize on the increasing demand for specialized and sustainable investment strategies. This structure allows for the agile integration of firms with expertise in areas like private markets and ESG, sectors that experienced significant growth through 2023 and into 2024. By acquiring or partnering with these niche players, BrightSphere can quickly expand its product suite and capture market share in high-growth segments.

The firm has a substantial opportunity to enhance client engagement and retention by adopting advanced data analytics and AI. By mid-2025, asset managers utilizing AI for personalized recommendations saw an average 15% uplift in client satisfaction. Implementing these technologies across its boutiques can lead to more tailored client solutions and improved operational efficiencies, a critical factor in the competitive landscape of 2024-2025.

BrightSphere can also drive growth through strategic cross-selling and the development of integrated, multi-boutique solutions. By fostering collaboration among its affiliates, the firm can offer clients a more comprehensive suite of investment strategies, thereby deepening client relationships and increasing assets under management. For example, a client in a quantitative equity fund could be introduced to a complementary fixed-income offering from another boutique.

| Opportunity Area | Key Action | Market Trend/Data Point | Potential Impact |

| Specialized & ESG Investing | Acquire/Incubate niche boutiques | Global sustainable investment market reached $37.8 trillion by end of 2023. ESG AUM saw a 10% global increase in 2023. | Expanded product suite, increased market share in growth sectors. |

| Technology Integration | Implement AI and data analytics | AI-driven recommendations led to 15% higher client satisfaction (mid-2024 data). | Enhanced client personalization, improved retention, operational efficiency. |

| Cross-selling & Integrated Solutions | Foster boutique collaboration | Personalized investing platforms gained traction in 2024. | Deeper client relationships, increased AUM through comprehensive offerings. |

Threats

BrightSphere contends with formidable rivals in the asset management arena, particularly larger, more established firms. These giants possess substantial scale, commanding greater brand loyalty and more extensive distribution networks, which can be significant advantages. For instance, by the end of 2023, many of the top-tier asset managers reported assets under management in the trillions, dwarfing boutique firms and allowing them to negotiate more favorable terms with service providers and clients alike.

The sheer size of these competitors enables them to offer more competitive fee structures, a critical factor for many investors. Furthermore, their deeper pockets allow for greater investment in cutting-edge technology and a wider array of in-house investment strategies and client services. This comprehensive offering can attract clients seeking a one-stop shop, potentially siphoning market share from specialized or boutique asset managers like BrightSphere and exerting downward pressure on fees across the industry.

The asset management sector faces intensifying global regulatory oversight, which could translate into increased compliance burdens and operational challenges for a multi-boutique entity like BrightSphere. For instance, new rules in areas such as client safeguarding, data privacy, and environmental, social, and governance (ESG) investing, as highlighted by the EU's Sustainable Finance Disclosure Regulation (SFDR) impacting many European asset managers, may present greater complexity for firms with varied operational footprints.

Failure to adhere to these evolving regulations carries substantial risks, including significant financial penalties and damage to a firm's reputation. In 2023, fines levied against financial institutions for compliance failures globally reached billions of dollars, underscoring the financial impact of non-compliance.

Asset management businesses like BrightSphere are inherently vulnerable to economic downturns. When markets slump, assets under management (AUM) shrink, directly impacting the fee revenue generated. For instance, during periods of significant market correction, such as seen in early 2022, many firms experienced a noticeable dip in AUM, which translated to lower earnings. This volatility can also trigger client redemptions as investors become risk-averse, further squeezing profitability.

Prolonged market instability poses a substantial threat to BrightSphere's financial health and the stability of its various investment boutiques. Economic uncertainty, like the concerns surrounding inflation and potential recessions in late 2024 and early 2025, can make potential clients hesitant to commit new capital. This reluctance to invest can stifle growth and make it harder for the firm to expand its asset base.

Talent Retention and Poaching Risks

The success of specialized investment firms like BrightSphere hinges on retaining their key investment professionals. A significant threat arises from competitors actively poaching star managers or entire teams, particularly in a dynamic talent market. For instance, industry reports from late 2024 indicated that asset management firms were increasing compensation packages by an average of 8-12% to attract and retain top talent in specialized areas.

The departure of critical talent can directly impact client relationships and fund performance, potentially leading to significant outflows. In 2024, several boutique firms experienced client losses exceeding 15% following the departure of a lead portfolio manager. To counter this, BrightSphere must focus on offering highly competitive compensation structures and cultivating a robust, supportive company culture that fosters loyalty.

- Talent Dependency: Specialized boutiques are highly reliant on the expertise of a few key investment professionals.

- Poaching Risk: Competitors actively seek to hire top-performing managers and teams, especially during periods of high market demand for specific skills.

- Performance Impact: Loss of key personnel can trigger client withdrawals and negatively affect the investment performance of affected funds.

- Mitigation Strategies: Competitive compensation, strong corporate culture, and opportunities for professional growth are crucial for talent retention.

Shifts in Investor Preferences and Fee Pressure

The asset management industry is witnessing a pronounced shift towards passive investment vehicles like ETFs and index funds. This trend, amplified by persistent fee pressure, directly challenges active managers. For instance, in 2024, the global ETF market surpassed $11 trillion in assets under management, demonstrating this growing preference for lower-cost alternatives.

BrightSphere's reliance on an active, specialized boutique model faces a direct threat from this investor behavior. If clients increasingly favor passive strategies due to cost, demand for BrightSphere's offerings could decline, leading to margin compression. This necessitates a constant demonstration of the tangible value-added services provided by its active management approach to retain clients and justify fees.

- Investor shift to passive strategies: Global ETF assets reached over $11 trillion in 2024, indicating a strong preference for lower-cost investment solutions.

- Fee compression: Increased competition and investor demand for cost-effectiveness are driving down management fees across the active asset management sector.

- Value proposition challenge: BrightSphere must continuously articulate and prove the alpha generation and unique benefits of its active, specialized strategies to counter the allure of cheaper passive options.

BrightSphere faces intense competition from larger, more established asset managers with greater scale, brand loyalty, and distribution networks. These giants, often managing trillions in assets by late 2023, can offer more competitive fees and invest heavily in technology and diverse strategies, potentially drawing clients away from specialized boutiques.

The firm must navigate an increasingly complex regulatory landscape, with new rules on client protection, data privacy, and ESG investing adding to compliance burdens. Failure to comply, as evidenced by billions in global fines levied against financial institutions in 2023, poses significant financial and reputational risks.

Economic downturns directly impact BrightSphere by shrinking assets under management and reducing fee revenue, a pattern seen during market corrections in early 2022. Prolonged instability, like concerns over inflation and recession in late 2024/early 2025, can deter new capital and stifle growth.

The firm is also vulnerable to talent dependency, as competitors actively poach key investment professionals, a trend reflected in 8-12% average compensation increases for top talent in late 2024. Losing critical personnel can lead to client withdrawals and negatively impact fund performance, as seen in 2024 with some firms losing over 15% of clients after a lead manager's departure.

Furthermore, the growing investor preference for lower-cost passive investment vehicles, with global ETF assets exceeding $11 trillion in 2024, challenges BrightSphere's active, specialized boutique model. This shift necessitates a clear demonstration of value-added services to justify fees and retain clients amidst fee compression.

| Threat Category | Description | Key Data Point (2023-2025) | Impact on BrightSphere |

|---|---|---|---|

| Competitive Landscape | Dominance of large, established asset managers. | Top-tier managers had AUM in trillions by end of 2023. | Market share erosion, fee pressure. |

| Regulatory Environment | Increasing global regulatory scrutiny (e.g., ESG, data privacy). | Billions in fines for compliance failures in 2023. | Increased operational costs, potential penalties. |

| Economic Sensitivity | Vulnerability to market downturns and economic instability. | AUM dips during market corrections (e.g., early 2022). | Reduced revenue, potential client redemptions. |

| Talent Retention | Risk of losing key investment professionals to competitors. | 8-12% average compensation increases for talent (late 2024). | Loss of expertise, client outflows, performance degradation. |

| Shift to Passive Investing | Growing investor preference for ETFs and index funds. | Global ETF market surpassed $11 trillion in 2024. | Decreased demand for active management, margin compression. |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of robust data, drawing from BrightSphere's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded and accurate assessment.