BrightSphere Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BrightSphere Bundle

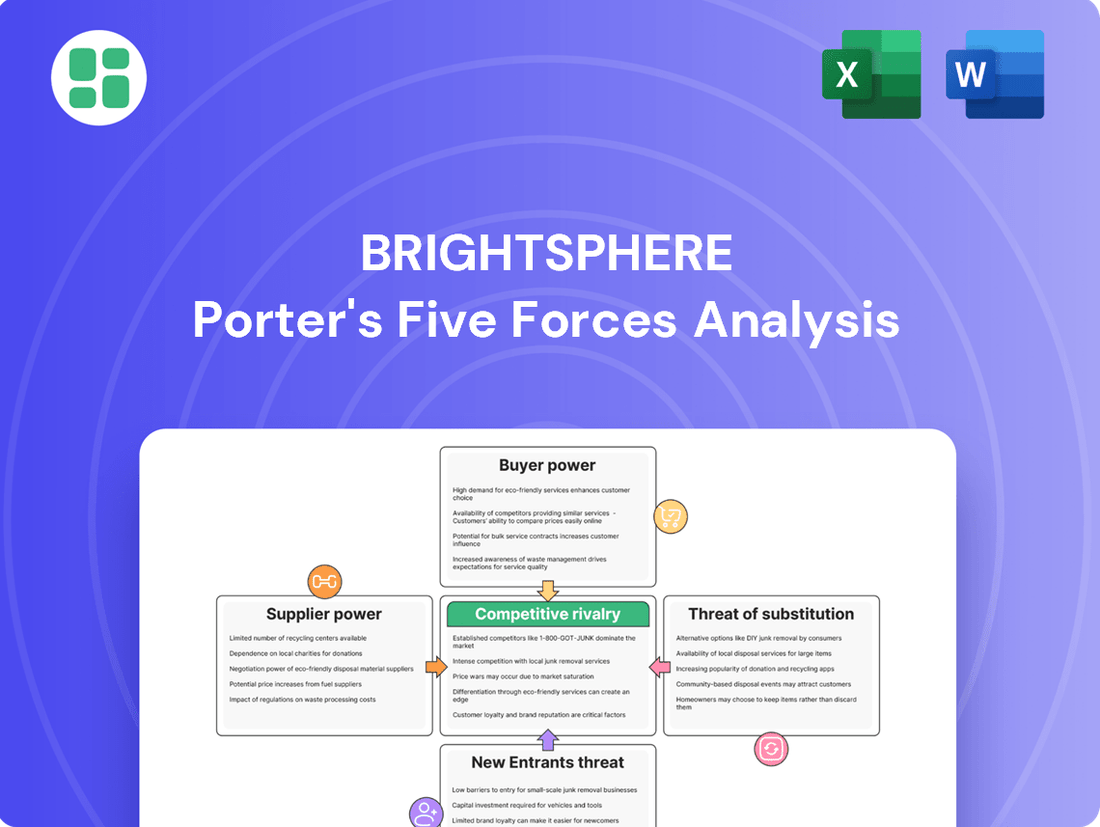

BrightSphere faces moderate buyer power due to differentiated offerings, but intense rivalry among existing players can pressure margins. Understanding the nuances of supplier relationships and potential new entrants is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore BrightSphere’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of key personnel, particularly highly sought-after portfolio managers and analysts, is a significant factor for BrightSphere. The scarcity of specialized talent, especially those with proven track records in niche investment strategies within BrightSphere's multi-boutique structure, can amplify their leverage. For instance, in 2024, the average compensation for a senior portfolio manager in the asset management industry often exceeded $300,000 annually, with top performers commanding much higher figures, reflecting the intense competition for talent.

BrightSphere's reliance on specialized software for trading, data, risk, and security means technology providers hold significant sway. If these platforms are proprietary and difficult to switch from, their bargaining power increases, potentially impacting costs and operational flexibility. For instance, a major cybersecurity suite upgrade in 2024 might represent a substantial investment with limited alternatives, directly influencing BrightSphere's IT expenditure.

The bargaining power of market data and research providers is a significant factor for BrightSphere. Access to high-quality, real-time market data and economic insights is crucial for informed investment decisions and strategic planning. Without this information, BrightSphere's ability to identify opportunities and manage risks would be severely hampered.

The market for specialized financial data can be concentrated, with a few dominant players often controlling access to essential datasets. For instance, in 2024, major financial data terminals like Bloomberg and Refinitiv continued to hold substantial market share, influencing pricing and data availability for firms like BrightSphere. These providers can leverage their market position to negotiate favorable terms, potentially increasing BrightSphere's operational costs.

Operational Service Providers

The bargaining power of operational service providers, such as custody, fund administration, legal, and compliance firms, significantly impacts BrightSphere. High concentration among these specialized providers can lead to increased costs and reduced flexibility. For instance, the global fund administration market, valued at approximately $10 billion in 2023, is dominated by a few key players, potentially giving them leverage.

Switching providers in this sector can be complex and costly due to regulatory requirements and system integration challenges. This difficulty in switching reinforces the suppliers' power. The quality of these services directly affects BrightSphere's operational efficiency and its ability to meet stringent regulatory standards, making provider selection critical.

- Concentration of Providers: A limited number of specialized firms offering custody and fund administration services can exert considerable influence.

- Switching Costs: High integration and regulatory hurdles make changing service providers expensive and time-consuming for BrightSphere.

- Service Quality Impact: The performance and reliability of these providers directly affect BrightSphere's operational efficiency and compliance.

- Pricing Power: Due to the specialized nature and switching costs, providers may have the ability to dictate pricing, impacting BrightSphere's profitability.

Affiliated Boutiques' Autonomy/Influence

The autonomy of BrightSphere's affiliated boutiques significantly impacts supplier power. These independent investment managers, often with distinct brands and strong client loyalty, possess considerable leverage. Their historical performance and direct client relationships can translate into substantial influence over resource allocation and strategic decisions within BrightSphere. For instance, if a boutique consistently outperforms and retains a loyal client base, it can negotiate more favorable terms or resist integration efforts.

- Boutique Autonomy: Individual investment managers within BrightSphere operate with varying degrees of independence.

- Client Relationships: Strong, direct client ties held by boutiques enhance their bargaining position.

- Performance Leverage: Proven track records empower boutiques to negotiate terms regarding resources and strategy.

- Potential for Spin-offs: Significant autonomy and performance can create leverage for boutiques considering separation from the parent company.

BrightSphere's reliance on specialized technology providers means these firms hold significant sway, especially if their platforms are proprietary and difficult to replace. This can impact costs and operational flexibility. For example, in 2024, the investment in advanced trading platforms often involved substantial upfront costs with limited alternative solutions, directly influencing IT expenditures for firms like BrightSphere.

The market for essential financial data and research is often concentrated, with a few key players dictating terms. In 2024, major data providers like Bloomberg and Refinitiv maintained dominant market shares, influencing pricing and access for asset managers. This market concentration grants these suppliers considerable bargaining power over firms such as BrightSphere.

| Supplier Type | Key Considerations | 2024 Impact/Data |

| Technology Providers | Proprietary platforms, switching costs | High investment in specialized trading/data software |

| Data & Research Providers | Market concentration, data quality | Dominance of Bloomberg/Refinitiv impacting pricing |

| Operational Services (Custody, Admin) | Provider concentration, regulatory hurdles | Limited number of global fund administrators |

What is included in the product

This analysis meticulously examines the five competitive forces impacting BrightSphere, offering strategic insights into industry attractiveness and competitive positioning.

Easily identify and quantify the impact of each Porter's Five Forces on your business, providing clear insights to alleviate strategic uncertainty.

Customers Bargaining Power

BrightSphere's client concentration significantly influences customer bargaining power. A high proportion of Assets Under Management (AUM) from a few large institutional clients, such as pension funds or sovereign wealth funds, grants these entities considerable leverage. For instance, if a substantial portion of BrightSphere's 2024 AUM, which stood at $378 billion as of March 31, 2024, was held by a handful of these major players, their ability to negotiate lower fees or demand tailored services would be amplified.

The potential loss of a major institutional mandate, or even a strategic shift in their asset allocation, could disproportionately impact BrightSphere's revenue and profitability. This is because the revenue generated from these large clients often forms a significant chunk of the company's overall income. A concentrated client base means that the departure of even one large client could have a more pronounced effect than the loss of many smaller retail investors.

The bargaining power of customers for BrightSphere is significantly influenced by the availability of alternatives. Clients, especially large institutional investors, have a wide array of choices when seeking investment management services. They can opt for other multi-boutique asset managers, large, diversified firms, or highly specialized single-strategy providers.

The competitive landscape in asset management is robust, with numerous firms offering comparable strategies. For instance, as of early 2024, the global asset management industry manages trillions of dollars, indicating a vast number of players vying for client assets. This abundance of options means clients can readily switch or negotiate terms if they perceive better value elsewhere.

Furthermore, sophisticated institutional clients, such as pension funds or endowments, often possess in-house investment capabilities. This internal expertise further strengthens their bargaining position, as they can choose to manage assets internally rather than outsourcing to external managers like BrightSphere, especially if fee structures are not competitive.

Switching costs for BrightSphere's clients are a key factor in their bargaining power. These costs involve the financial, operational, and administrative difficulties clients encounter when moving their assets to a different investment manager. For instance, if clients are locked into long-term contracts or have complex investment mandates, their ability to switch easily is reduced, thereby lowering their bargaining power.

Assessing these hurdles is crucial for understanding client stickiness. Factors like specific reporting requirements that a new manager might not easily replicate, or the perceived disruption to the continuity of their investment strategy, can significantly increase the perceived cost of switching. This makes clients less likely to move their business, even if they find slightly better terms elsewhere.

Performance Transparency & Comparison

BrightSphere's clients can easily compare its investment performance and fees against industry benchmarks, thanks to readily available data from providers and consultants. This accessibility empowers them to seek better terms or switch to more cost-effective options.

In 2023, the average expense ratio for actively managed equity mutual funds was 0.73%, while passive funds averaged 0.06%. This significant difference highlights the pressure customers can exert for lower fees, especially when performance is comparable.

- Performance Benchmarking: Clients can directly compare BrightSphere's fund returns against indices like the S&P 500, which returned approximately 26.3% in 2023.

- Fee Scrutiny: Increased transparency allows investors to scrutinize management fees, potentially driving negotiations for reduced costs, particularly for larger asset allocations.

- Asset Reallocation: A client dissatisfied with BrightSphere's fee structure or performance relative to peers might shift assets to lower-cost ETFs or index funds, which saw substantial inflows in 2023.

Client Sophistication & Knowledge

BrightSphere's institutional clients, a significant portion of its revenue base, demonstrate a high degree of financial sophistication. This means they possess a deep understanding of investment strategies, market dynamics, and fee structures. For instance, a substantial percentage of institutional investors, often exceeding 80% in major markets by 2024, engage independent consultants to vet investment managers, directly impacting fee negotiations.

This heightened client knowledge translates into increased bargaining power. Sophisticated clients are more inclined to scrutinize performance metrics, demand tailored solutions, and actively negotiate management fees, potentially squeezing profit margins for asset managers like BrightSphere. This trend is amplified as more investors gain access to advanced analytical tools and independent research, leveling the playing field.

- Informed Decision-Making: Clients with high financial literacy can effectively compare offerings and negotiate better terms.

- Fee Pressure: Sophisticated investors are adept at identifying opportunities to reduce management fees.

- Demand for Customization: Advanced clients often require bespoke investment solutions, increasing service complexity and cost for the provider.

- Performance Scrutiny: Well-informed clients rigorously evaluate investment outcomes, demanding accountability and potentially shifting assets if expectations aren't met.

BrightSphere's customer bargaining power is shaped by several key elements, including client concentration, the availability of alternatives, and switching costs. Large institutional clients, holding a significant portion of BrightSphere's $378 billion in AUM as of March 31, 2024, possess considerable leverage. This concentration means that the loss of even one major client can have a substantial impact.

The asset management industry is highly competitive, offering clients numerous alternatives, from multi-boutique firms to specialized providers. In 2023, the average expense ratio for actively managed equity funds was 0.73%, compared to 0.06% for passive funds, illustrating the fee pressure customers can exert, especially when performance is comparable. For instance, the S&P 500 returned approximately 26.3% in 2023, providing a benchmark for performance comparison.

Switching costs, such as contractual obligations or the need for specific reporting, can reduce client bargaining power. However, the widespread availability of performance data and fee transparency empowers clients to scrutinize offerings and negotiate for better terms or shift assets to lower-cost options.

Institutional clients, often exceeding 80% in major markets by 2024, are highly financially sophisticated, frequently engaging consultants to vet managers. This sophistication enhances their ability to negotiate fees and demand customized solutions, directly influencing BrightSphere's profit margins.

| Factor | Impact on Bargaining Power | Supporting Data/Example (as of early-mid 2024) |

| Client Concentration | High | Significant portion of $378B AUM from a few large institutional clients. |

| Availability of Alternatives | High | Numerous asset managers globally; S&P 500 return ~26.3% in 2023. |

| Switching Costs | Variable (can be low to moderate) | Contractual terms and reporting needs influence ease of switching. |

| Customer Sophistication | High | >80% institutional investors use consultants; fee pressure evident (0.73% vs 0.06% expense ratios). |

What You See Is What You Get

BrightSphere Porter's Five Forces Analysis

This preview showcases the complete BrightSphere Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. This detailed report is ready for immediate use, providing actionable insights into market dynamics without any hidden surprises or placeholders.

Rivalry Among Competitors

BrightSphere faces intense competition from a wide array of asset managers. Global giants like BlackRock and Vanguard, managing trillions in assets, directly vie for similar client mandates.

The landscape also includes other multi-boutique platforms, specialized niche players focusing on specific asset classes, and rapidly growing fintech firms offering digital wealth management solutions. This diversity in competitors, each with different strengths and business models, significantly escalates the competition for market share.

The active asset management industry is experiencing a mixed growth environment. While some areas, like alternatives and thematic strategies, show promise, traditional active equity segments face headwinds. For instance, in 2023, net inflows into active equity funds globally were negative, highlighting a shift in investor preferences towards passive strategies.

This dynamic intensifies competition among active managers like BrightSphere. When overall industry growth slows, or specific segments contract, firms often fight harder for a shrinking pool of assets. This can manifest as increased price competition, with pressure on management fees, and a greater emphasis on marketing and sales efforts to retain and attract clients.

BrightSphere's multi-boutique structure is a key differentiator, enabling it to offer highly specialized investment strategies. This specialization creates unique value propositions that can insulate the firm from direct price competition.

However, the effectiveness of this differentiation is challenged as many investment strategies become commoditized. This trend intensifies rivalry, shifting the focus from unique offerings to competitive fees and short-term performance metrics, a dynamic observed across the asset management industry.

Client Switching Costs for Competitors

The ease with which clients can switch asset managers significantly impacts competitive rivalry. For BrightSphere, understanding these client switching costs is crucial. High switching costs can create sticky client relationships, thereby reducing direct rivalry among asset managers.

Factors contributing to high switching costs include the depth of existing relationships, the complexity of reporting requirements, and the specificity of investment mandate requirements. These elements make it cumbersome and potentially costly for clients to move their assets. For instance, a client with highly customized reporting needs or a long-standing, trusted relationship with a particular manager may face significant hurdles in transitioning to a new provider.

Conversely, if switching costs are low, clients are more likely to re-evaluate their asset managers frequently. This can lead to more dynamic fund flows and a more intense competitive landscape as managers constantly vie for client attention and assets. In 2024, the asset management industry saw continued pressure on fees, which can incentivize clients to explore alternatives if the perceived value proposition diminishes, even with some level of complexity in switching.

- High switching costs: Foster client loyalty and reduce the intensity of direct competition.

- Low switching costs: Encourage frequent client re-evaluation and increase competitive pressure.

- Factors influencing switching costs: Include relationship depth, reporting complexity, and mandate specificity.

- 2024 Market Trend: Fee compression can heighten the impact of lower switching costs, driving more active client transitions.

Exit Barriers & Industry Consolidation

Struggling asset managers often face significant hurdles to exiting the market. These can include substantial sunk costs in proprietary technology platforms and data infrastructure, which are difficult to recoup. Additionally, stringent regulatory obligations related to client asset management and reporting can make a clean exit complex and time-consuming.

The challenge of divesting intricate or underperforming portfolios also acts as a major exit barrier. These assets may lack readily available buyers or require considerable effort to restructure before sale, tying up capital and management attention. In 2024, the asset management industry continued to see a trend where firms with high exit barriers, rather than closing down, were more likely to be acquired or merge.

- High Sunk Costs: Investments in specialized trading systems and data analytics can run into millions, making them hard to recover upon exit.

- Regulatory Hurdles: Compliance requirements for client fund transfers and reporting during an exit can be extensive and costly.

- Portfolio Divestment: Selling off illiquid or underperforming assets often involves significant discounts or extended sale periods.

- Consolidation Driver: These barriers encourage mergers and acquisitions, as larger firms absorb struggling competitors, leading to industry consolidation rather than widespread failures.

BrightSphere operates in a highly competitive asset management sector, facing pressure from global behemoths like BlackRock and Vanguard, alongside specialized boutique firms and emerging fintech players. This crowded field intensifies the fight for assets, particularly as traditional active equity segments saw negative net inflows in 2023, pushing managers to compete more aggressively on fees and performance.

The firm's multi-boutique model offers specialized strategies, which can differentiate it. However, the increasing commoditization of investment strategies means this differentiation is constantly tested, leading to a greater focus on competitive pricing and short-term results. Low client switching costs further exacerbate this, as clients can more readily move assets, especially when fee compression, evident in 2024, reduces the perceived value of existing relationships.

| Competitor Type | Key Characteristics | Impact on BrightSphere |

|---|---|---|

| Global Asset Managers (e.g., BlackRock, Vanguard) | Massive scale, broad product offerings, strong brand recognition, significant marketing budgets. | Direct competition for large institutional mandates and retail assets; pressure on fees due to scale efficiencies. |

| Multi-Boutique Platforms | Similar decentralized structure, offering specialized alpha-generating strategies. | Competition for niche client segments and institutional mandates where specialized expertise is valued; potential for talent poaching. |

| Specialized Niche Players | Deep expertise in specific asset classes (e.g., private credit, impact investing) or strategies. | Competition for specific client mandates where deep specialization is paramount; can capture market share in growing alternative segments. |

| Fintech/Digital Wealth Managers | Technology-driven platforms, lower fee structures, focus on digital client experience, often passive or robo-advisory models. | Competition for retail and mass affluent segments; pressure to adopt technology and streamline operations to remain competitive on cost and user experience. |

SSubstitutes Threaten

The rise of passive investment vehicles like ETFs and index funds presents a significant threat to active asset managers such as BrightSphere. These products offer broad market exposure at a fraction of the cost of actively managed funds, making them increasingly attractive to investors seeking value. In 2024, the global ETF market continued its robust growth, with assets under management projected to exceed $15 trillion, underscoring their competitive pressure on traditional active strategies.

The rise of direct investing and robo-advisors presents a significant threat to traditional asset managers like BrightSphere. Investors, armed with readily available information and user-friendly platforms, can increasingly bypass intermediaries for simpler investment needs. For instance, the global robo-advisory market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear shift towards self-directed and automated solutions.

Investors might shift capital to alternative asset classes that BrightSphere doesn't directly manage, such as venture capital or private credit, potentially siphoning funds from its core offerings. For instance, the global private equity market reached an estimated $12.1 trillion in assets under management by the end of 2023, a significant pool of capital that could represent a substitute for traditional managed funds.

Emerging investment themes like sustainable infrastructure or digital assets also present a threat. As of early 2024, sustainable investing continues to gain traction, with global sustainable investment assets projected to exceed $50 trillion, indicating a growing appetite for strategies outside conventional managed portfolios.

Distinct investment approaches, such as direct real estate investments or even sophisticatedly managed index funds, can also serve as substitutes. The increasing accessibility and performance of passive investing strategies, which saw global ETF assets climb to over $10 trillion by late 2023, demonstrate how different, often lower-cost, methods can divert capital from actively managed solutions.

In-house Asset Management by Institutions

Large institutional clients, including significant pension funds and endowments, are increasingly developing or enhancing their in-house asset management capabilities. This trend directly challenges external asset managers like BrightSphere by offering an alternative to traditional outsourced investment services.

By managing assets internally, these institutions can significantly reduce or eliminate external management fees, which can represent a substantial cost saving. For instance, a report from the Council of Institutional Investors in 2023 highlighted that public pension funds alone saved billions annually by insourcing investment management. This allows them to retain more of their investment returns.

Furthermore, building internal teams grants these institutions greater control over their investment strategies and decision-making processes. This enhanced control can lead to better alignment of interests between the investment managers and the beneficiaries of the fund, as internal teams are directly accountable to the institution's objectives rather than external profit motives. This shift reduces the perceived need for external firms, thereby increasing the threat of substitutes.

- Reduced Fees: Institutions aim to cut down on the 0.5% to 1.5% typically charged by external asset managers.

- Greater Control: In-house teams offer direct oversight of investment strategies and risk management.

- Alignment of Interests: Internal teams are intrinsically motivated by the institution's success, not external profitability.

- Growing Trend: A 2024 survey indicated that over 60% of large pension plans are considering or have already expanded their internal investment teams.

Cash/Liquidity as an Investment Alternative

Investors often opt for cash or highly liquid assets during times of economic uncertainty. This preference effectively diverts capital that might otherwise be invested in managed strategies, acting as a significant substitute.

For instance, in early 2024, many investors increased their allocation to money market funds, which saw substantial inflows. This trend suggests a cautious approach, prioritizing capital preservation over potential growth from riskier assets.

- Capital Preservation: Holding cash offers a safe haven, protecting principal during market downturns.

- Liquidity Needs: Immediate access to funds is crucial for unexpected expenses or opportunistic investments.

- Opportunity Cost: While safe, holding cash means foregoing potential returns from other asset classes.

- Market Volatility: Periods of high market volatility often see a surge in demand for cash and equivalents.

The threat of substitutes for BrightSphere arises from various investment avenues that fulfill similar investor needs, often at lower costs or with greater control. These substitutes range from passive investment vehicles and direct investing platforms to alternative asset classes and in-house asset management by institutional clients.

For example, the continued growth of exchange-traded funds (ETFs) and index funds, which saw global assets surpass $10 trillion by late 2023, offers a cost-effective alternative to actively managed funds. Similarly, the burgeoning robo-advisory market, valued at around $2.5 billion in 2023, empowers individuals to manage their investments directly, bypassing traditional advisors.

| Substitute Type | Key Characteristics | Market Trend/Data (as of late 2023/early 2024) | Implication for BrightSphere |

|---|---|---|---|

| Passive Investment Vehicles (ETFs, Index Funds) | Lower fees, broad market exposure, diversification | Global ETF assets exceeded $10 trillion. | Direct competition for investor capital, pressure on active management fees. |

| Robo-Advisors & Direct Investing | Low cost, accessibility, user-friendly platforms, self-directed | Robo-advisory market valued at ~$2.5 billion (2023), projected growth. | Disintermediation for simpler investment needs, reduced reliance on traditional managers. |

| Alternative Asset Classes (Private Equity, Venture Capital) | Higher potential returns, diversification, illiquidity | Global private equity AUM estimated at $12.1 trillion (end of 2023). | Siphons capital from traditional managed portfolios, requires specialized expertise. |

| Cash & Highly Liquid Assets | Capital preservation, liquidity, safety | Significant inflows into money market funds observed in early 2024. | Diversion of capital during economic uncertainty, foregoing potential growth. |

Entrants Threaten

The asset management industry faces substantial regulatory hurdles, acting as a significant deterrent to new entrants. Obtaining the necessary licenses and adhering to ongoing compliance mandates, such as those from the SEC in the United States, requires considerable time, expertise, and financial investment. For instance, in 2024, firms seeking to manage significant assets must navigate complex registration processes and maintain rigorous operational standards, effectively raising the cost of entry.

Launching an asset management firm demands substantial capital. Seed funding for initial funds, building robust operational infrastructure, and significant marketing to attract clients are all critical. For example, in 2024, many new fintech-driven asset managers sought to raise tens of millions in seed capital to cover technology development, regulatory compliance, and initial marketing campaigns.

For asset managers like BrightSphere, a strong reputation and a history of consistent performance are paramount. Building this takes years, often decades, of delivering positive returns and nurturing client relationships. This deep-seated trust is incredibly difficult for newcomers to replicate, creating a significant barrier to entry.

New entrants struggle to overcome the established credibility of firms like BrightSphere. Consider that in 2024, reports indicated that over 70% of institutional investors prioritize a manager's track record when selecting an asset manager, and a significant majority are hesitant to allocate capital to firms with less than five years of verifiable performance history. This lengthy incubation period for trust and proven results inherently limits the immediate threat from new players.

Access to Key Talent

The financial services industry faces a significant hurdle in attracting and retaining top-tier talent, particularly portfolio managers, research analysts, and client-facing professionals. These individuals possess specialized investment expertise and, crucially, established client relationships, making them highly sought after.

The scarcity of such high-caliber talent can severely impede new firms' ability to build competitive offerings and gain market traction. For instance, in 2024, the demand for experienced ESG (Environmental, Social, and Governance) analysts saw a surge, with some reports indicating a 20-30% increase in job postings for these specialized roles compared to the previous year, highlighting the competitive landscape for niche expertise.

- Talent Scarcity: High demand for specialized financial professionals, especially those with proven track records and client books, creates a barrier for new entrants.

- Retention Challenges: Existing firms often offer lucrative compensation packages and established platforms, making it difficult for new players to poach or retain key personnel.

- Impact on Offerings: Without access to skilled talent, new firms struggle to develop sophisticated investment strategies and build the trust necessary to attract significant assets under management.

Distribution Channels & Client Relationships

Building strong distribution channels and fostering deep relationships with institutional consultants, financial advisors, and retail clients is a significant hurdle for new entrants in the asset management industry. Established firms have spent years cultivating trust and access, making it difficult for newcomers to gain traction.

Existing client trust and extensive networks represent a formidable barrier. For instance, in 2024, major asset managers continued to leverage their long-standing relationships, with firms like BlackRock reporting trillions in assets under management, largely built on decades of client engagement and advisor networks.

- Distribution Network Difficulty: Newcomers face substantial challenges in replicating the extensive reach of incumbent firms' distribution networks, which are crucial for accessing a broad client base.

- Client Relationship Barriers: Cultivating the deep, trust-based relationships that established players enjoy with consultants and advisors takes considerable time and resources, creating a significant entry barrier.

- Competitive Advantage of Incumbents: Existing client loyalty and established advisor relationships provide incumbent firms with a powerful competitive advantage, making it harder for new entrants to acquire assets and market share.

The threat of new entrants into the asset management space, including for firms like BrightSphere, is generally considered moderate to low due to several significant barriers. These barriers, including substantial regulatory requirements, high capital needs, and the critical importance of reputation and talent, collectively make it challenging for newcomers to establish themselves effectively. The established trust and extensive distribution networks of incumbent firms further solidify their competitive positions.

| Barrier Type | Description | 2024 Data Point/Example |

| Regulatory Hurdles | Complex licensing and ongoing compliance mandates | Firms seeking to manage significant assets in 2024 faced intricate registration processes and stringent operational standards. |

| Capital Requirements | Seed funding, infrastructure, and marketing costs | New fintech asset managers in 2024 aimed to raise tens of millions for technology, compliance, and initial outreach. |

| Reputation & Track Record | Building trust and demonstrating consistent performance | In 2024, over 70% of institutional investors prioritized manager track record, with hesitancy towards firms under five years old. |

| Talent Acquisition | Attracting and retaining specialized professionals | Demand for ESG analysts in 2024 saw a 20-30% increase in job postings year-over-year. |

| Distribution & Relationships | Accessing clients through consultants and advisors | Major asset managers like BlackRock continued to leverage decades of client engagement and advisor networks in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive array of data, including company annual reports, industry-specific market research, and government economic data. This blend ensures a robust understanding of competitive intensity and market dynamics.