BrightSphere PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BrightSphere Bundle

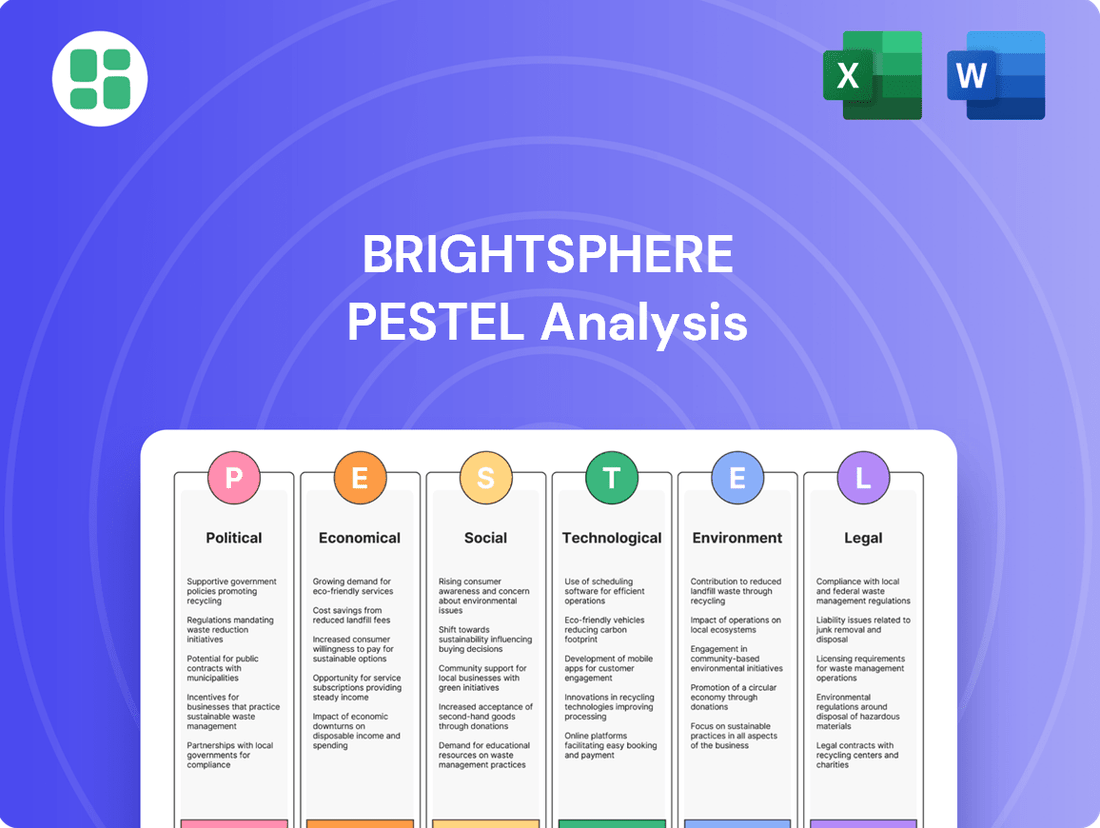

Uncover the critical external forces shaping BrightSphere's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, environmental concerns, and socio-cultural trends are impacting the company's operations and future growth. Arm yourself with actionable intelligence to refine your own strategic planning and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

Governments worldwide are tightening their grip on the financial industry, with asset management firms facing increased scrutiny. This translates to more stringent capital requirements, liquidity mandates, and conduct rules designed to safeguard investors and maintain market order. For BrightSphere, this necessitates careful navigation of these evolving regulations across the diverse markets where its specialized affiliates are active.

Global political tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, directly influence investor confidence and the movement of capital. These events can trigger market volatility. For instance, the S&P 500 experienced significant fluctuations in 2024 due to escalating geopolitical risks.

Shifting trade policies, including the imposition of tariffs and the formation of new trade blocs, create uncertainty for businesses and investors alike. For example, trade disputes between major economies in 2024 led to increased costs for many imported goods, impacting supply chains and corporate earnings.

BrightSphere, managing a broad portfolio, must actively monitor and strategize around these geopolitical shifts. The firm's ability to navigate international disputes and trade policy changes is crucial for mitigating risks and capitalizing on opportunities in various asset classes throughout 2024 and into 2025.

Government fiscal and monetary policies significantly impact BrightSphere's investment landscape. For instance, the US Federal Reserve's decision to maintain a target range for the federal funds rate between 5.25% and 5.50% as of early 2024 influences borrowing costs and economic activity, directly affecting bond yields and equity valuations. Changes in government spending or taxation, such as potential infrastructure investments or adjustments to corporate tax rates, can further reshape market conditions and the profitability of BrightSphere's strategies.

Political Climate and Investor Sentiment

The current political climate, marked by upcoming elections in several key economies throughout 2024 and 2025, is a significant driver of investor sentiment. For instance, the US presidential election in late 2024 is anticipated to create a period of heightened uncertainty, potentially leading to a temporary reallocation of capital towards less volatile assets. BrightSphere must remain attuned to these shifts.

Policy debates surrounding fiscal stimulus, trade agreements, and regulatory frameworks are also influencing market expectations. A shift towards more protectionist trade policies, for example, could impact global supply chains and corporate profitability, necessitating a review of BrightSphere's international investment strategies. The ongoing discussions about energy transition policies in the EU, with targets set for 2030 and beyond, present both opportunities and risks for companies within BrightSphere's portfolio.

- Anticipated volatility: Investor sentiment often reacts to election cycles, with a notable increase in market choppiness observed in the months preceding major elections in 2024.

- Policy shifts: Emerging legislative proposals concerning technology regulation and corporate taxation in major markets could directly affect the valuation of companies within BrightSphere's investment universe.

- Geopolitical stability: Ongoing geopolitical tensions in various regions continue to influence risk premiums, prompting investors to reassess their exposure to emerging markets and potentially favor developed economies with more stable political outlooks.

International Regulatory Cooperation

The degree of cooperation among international financial regulators significantly impacts global asset managers like BrightSphere. Harmonized regulations, such as those being pursued by the International Organization of Securities Commissions (IOSCO) in areas like sustainable finance disclosure frameworks, can streamline compliance and reduce operational costs for firms operating across multiple jurisdictions. For instance, the continued development of common principles for ESG reporting aims to create a more unified global landscape.

Conversely, divergent regulatory approaches present considerable challenges. Differences in capital requirements, investor protection rules, and data privacy laws necessitate complex and costly compliance strategies for multinational firms. As of early 2025, the patchwork of national regulations concerning digital asset oversight continues to illustrate this divergence, requiring substantial resources for BrightSphere to navigate effectively.

- Harmonization Efforts: IOSCO's ongoing work on global sustainability disclosure standards aims to simplify compliance for asset managers.

- Divergent Regulations: Varying national rules on digital assets create compliance complexities for global firms.

- Operational Costs: Navigating diverse regulatory environments increases operational expenses for multinational asset managers.

Political stability and government policies remain paramount for BrightSphere's strategic planning. Anticipated market volatility around major elections in 2024, such as the US presidential election, underscores the need for agile portfolio management. Emerging legislative proposals concerning technology regulation and corporate taxation in key markets could significantly impact company valuations within BrightSphere's investment universe throughout 2024 and into 2025.

Geopolitical stability continues to be a critical factor, with ongoing tensions in various regions influencing risk premiums. Investors are reassessing their exposure to emerging markets, often favoring developed economies with more predictable political outlooks. The degree of cooperation among international financial regulators, such as IOSCO's efforts on global sustainability disclosure standards, aims to streamline compliance for firms like BrightSphere, although divergent national rules on areas like digital assets in early 2025 still create significant operational complexities and costs.

| Political Factor | Impact on BrightSphere | Data/Trend (2024-2025) |

|---|---|---|

| Election Cycles | Increased market volatility and potential capital reallocation | Heightened uncertainty expected around US presidential election (late 2024); observed choppiness in months prior. |

| Regulatory Proposals | Potential impact on company valuations and investment strategies | Focus on technology regulation and corporate tax adjustments in major economies. |

| Geopolitical Tensions | Influence on risk premiums and emerging market attractiveness | Continued reassessment of emerging market exposure; preference for stable developed economies. |

| Regulatory Harmonization | Streamlined compliance and reduced operational costs | IOSCO's work on sustainable finance disclosure standards; ongoing divergence in digital asset regulation. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting BrightSphere, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

BrightSphere's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, eliminating the need to sift through lengthy documents.

Economic factors

Central bank interest rate decisions are a major driver of financial markets. For instance, the Federal Reserve's benchmark federal funds rate, which influences borrowing costs across the economy, has seen significant shifts. In 2024, rates remained elevated compared to the near-zero levels seen post-pandemic, impacting bond prices inversely and increasing the cost of capital for businesses.

These fluctuations directly affect BrightSphere's investment strategies. Higher interest rates, such as those maintained through much of 2024, tend to decrease the present value of future cash flows, negatively impacting bond valuations. Conversely, lower rates can boost equity valuations by making future earnings more valuable and reducing borrowing expenses for companies.

BrightSphere's diversified approach, spanning both fixed income and equities, means it's inherently sensitive to interest rate changes. For example, if rates were to decline in 2025, as some economists predicted, BrightSphere's fixed income portfolio might see appreciation, while its equity holdings could benefit from lower borrowing costs and increased investor appetite for riskier assets.

Rising inflation, a persistent concern throughout 2024 and projected into 2025, directly impacts consumer purchasing power, potentially dampening demand for goods and services. For businesses like those BrightSphere invests in, this translates to increased input costs, from raw materials to labor, squeezing profit margins.

Conversely, robust economic growth, as evidenced by the projected 2.5% GDP growth for the US in 2024, fuels corporate earnings and creates fertile ground for investment. BrightSphere's strategic imperative is to navigate this duality, identifying sectors that can either withstand inflationary pressures or benefit from sustained economic expansion to safeguard and enhance client portfolio returns.

Preserving the real value of client assets amidst inflation is paramount. For instance, if inflation averages 3.5% in 2024, an investment yielding 5% only provides a real return of 1.5%. Therefore, asset managers must actively seek investments offering returns that outpace inflation to ensure genuine wealth creation for their clients.

Global financial markets in 2024 and early 2025 have experienced heightened volatility. This stems from a confluence of factors including persistent inflation concerns, central bank policy shifts, and ongoing geopolitical tensions in Eastern Europe and the Middle East. For instance, the MSCI World Index saw fluctuations of over 5% within single weeks during late 2024, reflecting investor reactions to inflation data and interest rate expectations.

BrightSphere, like other asset managers, must be prepared for these market swings. The ability to quickly adapt portfolios in response to unexpected economic data, such as the US Consumer Price Index (CPI) reports showing a higher-than-anticipated 3.5% year-over-year increase in September 2024, becomes crucial. This agility is key to mitigating downside risk and capitalizing on emerging opportunities amidst uncertainty.

Currency Exchange Rate Movements

Currency exchange rate movements are a critical economic factor for asset managers like BrightSphere, especially those with international investments. When the value of a foreign currency changes relative to BrightSphere's home currency, it directly impacts the reported value of those foreign assets and liabilities. For instance, if the US dollar strengthens significantly against the Euro, BrightSphere's Euro-denominated assets would be worth less when converted back to dollars, potentially reducing overall portfolio returns.

These fluctuations can have a substantial effect on BrightSphere's overall portfolio performance. A strong appreciation of the US dollar in 2024, for example, could have eroded returns from investments held in emerging market currencies that depreciated against the dollar. Conversely, a weaker dollar might boost the value of foreign holdings. The volatility in major currency pairs, such as the EUR/USD or USD/JPY, directly influences the profitability of international asset management.

BrightSphere's global investment mandates mean they must carefully consider and potentially hedge currency exposures to mitigate these risks. For example, if BrightSphere anticipates a weakening of the Japanese Yen against the US dollar, they might use currency forwards or options to lock in a more favorable exchange rate for their Japanese asset conversions. This proactive management is essential for stabilizing returns and protecting capital in a globalized investment landscape.

Key currency movements impacting global investments in late 2024 and early 2025 include:

- US Dollar Performance: The USD experienced fluctuations throughout 2024, influenced by Federal Reserve policy and global economic sentiment. Its strength or weakness directly impacts the conversion of foreign assets.

- Eurozone Economic Health: The Euro's stability is tied to the economic performance of the Eurozone. Any significant divergence in growth or inflation rates compared to the US can lead to substantial EUR/USD movements.

- Emerging Market Volatility: Currencies in emerging markets often exhibit higher volatility. For BrightSphere, managing exposure to currencies like the Brazilian Real or the Indian Rupee requires diligent monitoring of local economic and political developments.

- Yen's Trajectory: The Japanese Yen's movement is closely watched, particularly in relation to the US dollar, affecting the value of Japanese equity and bond holdings for international investors.

Capital Market Liquidity

Capital market liquidity is a vital consideration for investment firms like BrightSphere. It refers to how easily assets can be traded without causing a significant price swing. For BrightSphere, this means being able to buy and sell investments quickly and efficiently to manage its wide array of portfolios and handle client requests for their money.

When market liquidity tightens, it can lead to higher trading expenses and difficulties in executing large trades, impacting overall investment performance. For instance, during periods of economic uncertainty, such as the market volatility experienced in late 2023 and early 2024, liquidity in certain asset classes can decrease, making it more challenging to rebalance portfolios or meet redemption demands without adverse price effects. The average bid-ask spread in the S&P 500, a common measure of liquidity, saw some widening during these periods compared to more stable times.

BrightSphere's operational efficiency and ability to adapt to market conditions are directly tied to the prevailing liquidity levels.

- High liquidity allows for swift portfolio adjustments and efficient execution of large trades, minimizing costs for BrightSphere.

- Low liquidity can increase trading costs, hinder portfolio rebalancing, and make it difficult to meet client redemption requests promptly.

- Market volatility, as seen in 2023-2024, can temporarily reduce liquidity in various asset classes, posing challenges for investment managers.

- The average bid-ask spread in major equity markets serves as an indicator of liquidity, with wider spreads suggesting lower liquidity.

Economic growth, inflation, and interest rates are key drivers of investment performance. In 2024, the US economy showed resilience with a projected GDP growth of around 2.5%, while inflation remained a concern, averaging approximately 3.5% year-over-year. Central banks maintained higher interest rates throughout much of 2024, impacting borrowing costs and asset valuations.

These factors directly influence BrightSphere's investment strategies. Higher interest rates can depress bond prices and increase the cost of capital for businesses, while inflation erodes purchasing power and squeezes profit margins. BrightSphere must navigate these conditions by seeking investments that can outpace inflation and benefit from economic expansion.

Currency fluctuations also play a significant role, particularly for international investments. The US dollar's performance in 2024, for instance, affected the value of foreign assets held by BrightSphere. Managing currency exposure through hedging strategies is crucial for stabilizing returns and protecting capital in a globalized market.

| Economic Factor | 2024 Data/Trend | Impact on BrightSphere | 2025 Outlook/Considerations |

|---|---|---|---|

| US GDP Growth | Projected ~2.5% | Supports corporate earnings, creates investment opportunities | Continued moderate growth expected, but subject to global economic shifts |

| US Inflation Rate | Averaged ~3.5% (YoY) | Increases input costs for businesses, erodes real returns | Inflation expected to moderate but remain a key focus for central banks |

| Federal Funds Rate | Remained elevated through 2024 | Increases borrowing costs, impacts bond valuations | Potential for rate cuts in 2025, depending on inflation trajectory |

| US Dollar Strength | Fluctuated, generally strong | Reduced value of foreign assets when converted | USD performance influenced by Fed policy and global risk sentiment |

Same Document Delivered

BrightSphere PESTLE Analysis

The BrightSphere PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain comprehensive insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BrightSphere.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and actionable strategic overview.

Sociological factors

Developed nations are experiencing an aging population, with the average life expectancy in countries like Japan exceeding 84 years as of 2023. This demographic trend, coupled with a burgeoning middle class in emerging markets, such as India and China, which saw significant GDP growth in 2024, is reshaping demand for financial products. BrightSphere must adapt its offerings to meet the needs of both older populations seeking retirement solutions and younger, growing demographics with increasing disposable income.

The substantial intergenerational wealth transfer, projected to be in the trillions globally over the next decade, is creating new affluent client segments with distinct preferences. For instance, the U.S. is anticipating a significant portion of wealth to transfer from baby boomers to millennials. BrightSphere can capitalize on this by developing tailored investment strategies and advisory services that resonate with the digital-native, socially conscious, and often risk-averse preferences of younger inheritors.

Societal expectations are shifting, with a pronounced increase in the demand for investments that prioritize environmental, social, and governance (ESG) factors. This trend is evident as both large institutions and individual investors actively seek out portfolios that not only aim for financial returns but also reflect their personal values and contribute positively to sustainable development. For instance, a 2024 report indicated that sustainable investment funds saw net inflows of over $150 billion globally in the first half of the year, underscoring this growing preference.

BrightSphere must recognize this evolving landscape. To remain competitive and relevant, the company needs to embed ESG principles deeply within its investment strategies and product development. This means actively incorporating ESG screening, engagement, and impact measurement into its core operations, thereby demonstrating a commitment to responsible investment practices that resonate with today's conscientious investors.

Investor preferences are shifting, with a growing demand for digital, transparent, and personalized financial services. This trend is fueled by increased access to information, as evidenced by the surge in online financial content consumption. For instance, a significant portion of retail investors now rely on digital channels for research and investment decisions, a trend that accelerated in the 2024 period.

Financial literacy levels vary considerably, necessitating tailored communication and education. BrightSphere must develop strategies that resonate with both novice and sophisticated investors, offering accessible educational resources. In 2025, initiatives focused on improving financial literacy are expected to gain further traction, impacting how firms like BrightSphere engage with their client base.

Workforce Diversity and Inclusion

Societal pressure for diversity, equity, and inclusion (DEI) is a significant force shaping corporate behavior, particularly within financial services. Firms are under increasing examination regarding their internal DEI efforts and how these practices influence company culture and the ability to attract skilled professionals. BrightSphere, operating with a multi-boutique structure, must actively cultivate diverse teams across its various affiliates to secure top talent and mirror the diverse clientele it serves.

The financial industry, in particular, is seeing a push for greater representation. For instance, a 2023 report indicated that while women held 25% of senior roles in U.S. financial services, their representation in investment and wealth management roles was even lower. BrightSphere's success in attracting and retaining talent will likely be tied to its demonstrable commitment to DEI across all its boutiques.

- Talent Acquisition: Companies with strong DEI initiatives are often perceived as more attractive employers, leading to a wider pool of qualified candidates.

- Client Representation: A diverse workforce can better understand and serve a diverse client base, potentially leading to increased client satisfaction and market share.

- Innovation and Performance: Research suggests that diverse teams can foster greater innovation and lead to improved financial performance. A 2022 study by McKinsey found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile.

- Regulatory and Social Scrutiny: Increasingly, regulators and the public expect financial institutions to demonstrate progress in DEI, making it a critical factor for maintaining reputation and social license to operate.

Public Trust in Financial Institutions

Public trust in financial institutions remains a critical factor, particularly following the global financial crisis and subsequent scandals. Surveys consistently show a lingering skepticism. For instance, a 2024 Edelman Trust Barometer report indicated that while trust in business is generally higher than in government, the financial services sector often lags behind, with only 60% of respondents globally expressing trust in the industry. This underscores the need for asset managers like BrightSphere to actively cultivate and demonstrate reliability.

Maintaining this trust hinges on tangible actions. Transparency in fees and investment strategies, coupled with unwavering ethical conduct and robust governance frameworks, are non-negotiable. BrightSphere’s ability to foster strong client relationships and safeguard its reputation directly correlates with its commitment to these principles, acting as a fiduciary for its investors.

- Reputation is paramount: Public perception directly impacts client acquisition and retention.

- Transparency builds confidence: Clear communication about fees and investment processes is essential.

- Ethical conduct is a baseline: Adherence to the highest moral standards is expected.

- Strong governance ensures accountability: Robust internal controls and oversight are vital.

Societal shifts towards valuing purpose-driven investments are accelerating, with ESG considerations now a mainstream expectation. This is further amplified by a growing demand for personalized and digitally accessible financial services, reflecting evolving investor preferences. BrightSphere must proactively integrate these sociological trends into its business model to resonate with a modern, values-conscious clientele.

Technological factors

The investment landscape is being reshaped by big data and advanced AI/ML. These technologies allow for deeper pattern identification, more accurate forecasting, and refined risk evaluations, crucial for navigating market complexities.

For instance, AI-powered platforms are increasingly used for sentiment analysis of financial news, with some studies showing correlations between AI-driven sentiment scores and stock price movements. BrightSphere can harness these capabilities to refine its quantitative strategies, leading to more optimized portfolio construction and a sharper competitive edge in identifying market opportunities.

As financial operations increasingly migrate online, the specter of cyberattacks and data breaches looms larger. Protecting sensitive client information and proprietary investment strategies is paramount for maintaining trust and operational integrity in the financial sector.

BrightSphere must invest in and maintain robust cybersecurity infrastructure and protocols to safeguard its systems and data against an ever-evolving landscape of threats. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial implications of inadequate protection.

Clients increasingly expect seamless digital interactions with financial firms, demanding intuitive platforms for managing accounts, viewing performance, and accessing investment guidance. This shift is evident in the rise of robo-advisors and sophisticated online client portals.

BrightSphere must prioritize investment in user-friendly digital interfaces to elevate client experience and optimize service delivery. For instance, by mid-2024, over 70% of retail investors reported using digital channels for at least half of their financial interactions, underscoring the critical need for robust online capabilities.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are poised to reshape financial operations. By streamlining back-office functions and settlement, DLT promises enhanced efficiency, transparency, and cost reduction across the financial sector. For instance, the global blockchain in finance market was valued at an estimated $1.5 billion in 2023 and is projected to grow significantly, reaching over $10 billion by 2028, according to some industry forecasts.

BrightSphere can strategically leverage these advancements. Exploring DLT for internal process optimization, such as trade settlement or record-keeping, could unlock substantial operational efficiencies. Furthermore, the burgeoning digital asset market presents new avenues for investment and service offerings, aligning with the evolving financial landscape.

- Efficiency Gains: DLT can automate and expedite processes like cross-border payments, potentially reducing settlement times from days to minutes.

- Cost Reduction: By eliminating intermediaries and manual reconciliation, DLT can significantly lower transaction costs.

- New Asset Classes: The tokenization of real-world assets on blockchains opens up new investment opportunities and liquidity.

- Regulatory Compliance: DLT's inherent transparency and auditability can aid in meeting stringent regulatory requirements.

Automation of Investment Processes

The investment management industry is rapidly embracing automation. This technological shift impacts everything from how trades are executed and compliance is managed to how reports are generated and accounts are reconciled. For instance, in 2024, many firms reported significant efficiency gains, with some seeing a reduction in operational errors by as much as 30% through automated workflows. This frees up valuable human resources, allowing investment professionals to focus on higher-level analysis and strategic decision-making rather than getting bogged down in routine tasks.

BrightSphere, with its diverse group of investment boutiques, stands to gain considerably from further automating its back-office and middle-office functions. By streamlining repetitive processes, the company can enhance operational resilience and potentially reduce costs. Consider the potential for AI-driven reconciliation tools, which in 2025 are projected to handle over 70% of routine reconciliation tasks, minimizing manual intervention and the associated risks.

- Enhanced Efficiency: Automation reduces the time spent on manual tasks like trade settlement and data entry, leading to quicker processing times.

- Reduced Errors: Algorithmic checks and automated validation systems significantly decrease the likelihood of human error in compliance and reporting.

- Resource Optimization: By automating routine operations, BrightSphere can reallocate its skilled personnel to more value-added activities such as client relations and complex investment research.

- Scalability: Automated processes are inherently more scalable, allowing BrightSphere to handle increased transaction volumes without a proportional rise in operational headcount.

Technological advancements, particularly in AI and big data, are fundamentally altering investment strategies by enabling deeper pattern recognition and more accurate forecasting. The increasing reliance on digital platforms necessitates robust cybersecurity measures, as the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025. Furthermore, evolving client expectations for seamless online interactions, with over 70% of retail investors using digital channels for at least half their interactions by mid-2024, demand continuous investment in user-friendly interfaces. The adoption of blockchain technology promises significant efficiency gains and cost reductions in financial operations, with the global blockchain in finance market expected to grow substantially.

Legal factors

Financial regulatory compliance is a critical operational factor for asset management firms like BrightSphere. These entities must navigate a complex web of rules from agencies such as the U.S. Securities and Exchange Commission (SEC) and the UK's Financial Conduct Authority (FCA), alongside international financial watchdogs. Adherence spans fund registration, marketing practices, detailed reporting obligations, and robust anti-money laundering (AML) protocols.

BrightSphere's multi-boutique model introduces significant regulatory complexity, requiring its various affiliates to comply with a diverse and constantly changing landscape of international and national financial regulations. For instance, in 2024, the global financial services industry saw continued emphasis on ESG (Environmental, Social, and Governance) disclosures, with regulators like the SEC proposing new rules that could impact fund marketing and reporting for all asset managers.

Data privacy laws like GDPR and CCPA are becoming more stringent, requiring companies to be meticulous about how they handle personal information. For instance, in 2023, the EU saw a significant increase in data breach notifications, highlighting the ongoing challenges in compliance. BrightSphere must adhere to these evolving standards for data collection, storage, and processing.

Cybersecurity regulations are equally critical, mandating robust protection for digital assets against ever-present threats. A 2024 report indicated that the average cost of a data breach for businesses globally exceeded $4 million, underscoring the financial risks of non-compliance. BrightSphere's investment in advanced IT security measures is therefore essential to safeguard its operations and client data.

Asset managers like BrightSphere are legally bound by a fiduciary duty, meaning they must prioritize their clients' financial well-being above their own. This principle is reinforced by investor protection laws, such as the Investment Advisers Act of 1940 in the U.S., designed to prevent issues like conflicts of interest and the sale of unsuitable products. For instance, the Securities and Exchange Commission (SEC) actively enforces these regulations, imposing fines for breaches of fiduciary duty; in 2023, the SEC collected over $4.3 billion in monetary relief from investment advisers and firms.

To navigate this legal landscape, BrightSphere must implement robust internal controls and maintain absolute transparency in its operations. This commitment ensures compliance with regulations that safeguard investors from misrepresentation and ensure investment recommendations align with client objectives. Failure to adhere can result in significant penalties and reputational damage, underscoring the critical importance of these legal frameworks for investor trust and market integrity.

Anti-Money Laundering (AML) and Sanctions Compliance

Global efforts to combat financial crime, including money laundering and terrorism financing, are intensifying, requiring robust Anti-Money Laundering (AML) and sanctions compliance programs. For BrightSphere, this translates to implementing stringent client due diligence, continuous transaction monitoring, and timely reporting of suspicious activities across all its investment boutiques. Failure to comply can result in significant penalties; for instance, in 2023, financial institutions globally paid billions in AML-related fines, with some individual cases exceeding hundreds of millions of dollars.

BrightSphere must ensure its AML frameworks align with evolving international standards and national regulations. This includes staying abreast of sanctions lists, which are frequently updated by bodies like the UN, OFAC, and the EU. For example, the US Office of Foreign Assets Control (OFAC) regularly updates its Specially Designated Nationals (SDN) list, impacting transactions with individuals and entities worldwide. Effective compliance requires sophisticated technology and ongoing staff training to prevent illicit financial flows and maintain operational integrity.

- Enhanced Due Diligence: Implementing Know Your Customer (KYC) procedures and Customer Due Diligence (CDD) to verify client identities and assess risks.

- Transaction Monitoring: Utilizing advanced systems to detect and flag unusual or suspicious transaction patterns.

- Sanctions Screening: Regularly checking clients and transactions against global sanctions lists.

- Suspicious Activity Reporting: Establishing clear protocols for reporting potential illicit activities to relevant authorities.

Corporate Governance and Shareholder Rights

Corporate governance laws are fundamental to BrightSphere's operations, defining board duties, executive pay, and shareholder protections. Adherence to these regulations is vital for fostering transparency and building investor trust. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to refine rules around proxy voting and executive compensation disclosures, impacting how companies like BrightSphere communicate with their shareholders.

BrightSphere must align its governance with evolving best practices and regulatory demands to maintain investor confidence. This includes ensuring robust mechanisms for accountability and ethical conduct throughout the organization. As of early 2025, many institutional investors are increasingly scrutinizing ESG (Environmental, Social, and Governance) factors, placing greater emphasis on strong governance as a key indicator of long-term sustainability and risk management.

- Board Independence: Ensuring a majority of independent directors on the board remains a critical governance standard, with many major exchanges requiring this for listed companies.

- Shareholder Engagement: Regulations increasingly encourage direct shareholder engagement on key issues, including executive compensation and board composition.

- Executive Compensation Transparency: Detailed disclosure of executive pay packages and the performance metrics tied to them is mandated, allowing shareholders to assess alignment.

- Audit Committee Oversight: Strong oversight by an independent audit committee is essential for financial reporting integrity and internal control effectiveness.

BrightSphere operates within a heavily regulated financial sector, necessitating strict adherence to evolving legal frameworks. Key areas include investor protection laws, such as the fiduciary duty mandate enforced by agencies like the SEC, which collected over $4.3 billion in monetary relief from investment advisers in 2023. Furthermore, stringent data privacy regulations like GDPR and CCPA, coupled with critical cybersecurity mandates, demand robust data protection measures, especially given the average global data breach cost exceeded $4 million in 2024.

Anti-money laundering (AML) and sanctions compliance are paramount, with global financial institutions paying billions in AML-related fines in 2023 alone. BrightSphere must maintain vigilant client due diligence and transaction monitoring, aligning with frequently updated sanctions lists from bodies like OFAC. Corporate governance laws also dictate board responsibilities and shareholder protections, with ongoing SEC refinements in 2024 concerning proxy voting and executive compensation disclosures, areas increasingly scrutinized by investors for ESG alignment.

Environmental factors

Climate change presents significant physical risks, such as increased frequency of extreme weather events like hurricanes and floods, which can disrupt supply chains and damage physical assets, directly impacting corporate valuations. For instance, the Insurance Information Institute reported that insured losses from natural catastrophes in the U.S. reached $110.6 billion in 2023, highlighting the tangible economic impact.

Transition risks, stemming from policy shifts and technological advancements toward a low-carbon economy, will create distinct winners and losers across sectors. Companies embracing renewable energy and sustainable practices, like those in the solar power sector which saw global installations grow by an estimated 35% in 2023 according to the International Energy Agency, are poised for growth.

BrightSphere must meticulously assess these climate-related risks, evaluating how they might affect portfolio companies' operations and financial health. Simultaneously, identifying investment opportunities in businesses that are actively adapting to or leading the green transition, such as those involved in carbon capture technology or electric vehicle infrastructure, will be crucial for long-term value creation.

Investors are increasingly prioritizing environmental sustainability, with global sustainable investment assets projected to reach $50 trillion by 2025, according to Morningstar. This surge compels companies like BrightSphere to embed environmental, social, and governance (ESG) factors into their core strategies and product offerings.

BrightSphere must bolster its ESG research to accurately assess environmental impacts, such as carbon emissions and resource efficiency. For instance, as of early 2024, the European Union's Sustainable Finance Disclosure Regulation (SFDR) mandates detailed reporting on sustainability risks, influencing investor choices and demanding greater transparency.

Rising global demand and geopolitical tensions are intensifying resource scarcity, impacting critical materials like water, rare earth minerals, and energy. For instance, the International Energy Agency (IEA) projected in late 2023 that global energy demand would increase by 2.5% in 2024, putting further strain on supply. This scarcity directly translates to price volatility and significant supply chain disruptions across numerous sectors.

BrightSphere's investment evaluations must deeply consider how long-term resource scarcity affects company profitability and operational sustainability. Companies heavily reliant on materials facing shortages, such as those in the semiconductor industry that depend on rare earth minerals, could see their margins squeezed and their growth prospects dimmed by these environmental pressures.

Regulatory Pressure for Climate-Related Disclosures

Regulatory bodies worldwide are intensifying their focus on climate-related disclosures. Many jurisdictions, including the EU and the US, are implementing or proposing mandatory reporting requirements for companies concerning their environmental impact and climate resilience. This trend directly impacts financial institutions like BrightSphere, necessitating greater transparency in their own operational emissions and the climate risks embedded within their investment portfolios.

For instance, the Securities and Exchange Commission (SEC) in the United States has proposed rules that would require public companies to disclose climate-related risks and greenhouse gas emissions. Similarly, the European Union's Corporate Sustainability Reporting Directive (CSRD) mandates extensive reporting for a broad range of companies, including those within the financial sector, on sustainability matters. BrightSphere must therefore adapt its reporting frameworks to meet these evolving global standards, potentially impacting its data collection and disclosure processes.

- Increased Disclosure Requirements: Companies, including financial firms, are facing growing mandates to report on carbon emissions, climate risks, and adaptation strategies.

- Global Regulatory Momentum: Jurisdictions like the EU (CSRD) and the US (SEC proposals) are leading the charge in establishing mandatory climate disclosure frameworks.

- Portfolio Risk Assessment: BrightSphere may need to assess and disclose the climate-related risks associated with the assets it manages, not just its own operations.

- Data and Reporting Infrastructure: Compliance will require robust systems for collecting, verifying, and reporting environmental data, potentially leading to increased operational costs.

Impact of Environmental Disasters on Investments

Natural disasters, increasingly severe due to climate change, pose a direct threat to investment portfolios. For instance, the 2023 hurricane season saw insured losses estimated at over $50 billion, impacting sectors like insurance and coastal real estate. These events can cripple supply chains and damage physical assets, leading to significant write-downs for affected companies.

BrightSphere must integrate the financial ramifications of such environmental disruptions into its risk assessments. This includes understanding how events like extreme heatwaves or prolonged droughts can affect agricultural yields and commodity prices, influencing investments in related industries. The potential for widespread infrastructure damage also needs to be factored into valuations.

To mitigate these risks, BrightSphere should bolster its portfolio diversification, potentially by increasing allocations to industries less susceptible to direct environmental impacts or by investing in companies actively developing climate resilience solutions. For example, the market for climate adaptation technologies is projected to reach $1.7 trillion by 2030, offering potential growth areas.

- Increased Frequency of Extreme Weather: The World Meteorological Organization reported that the number of reported weather, climate, and water-related disasters between 2000 and 2019 was five times higher than in the period 1970-1979.

- Economic Losses: The European Environment Agency noted that weather and climate-related disasters cost the EU an estimated €50 billion annually on average between 2000 and 2020.

- Impact on Specific Sectors: Businesses reliant on natural resources, such as agriculture and tourism, are particularly vulnerable to climate-induced environmental changes.

The intensifying focus on climate change necessitates robust environmental, social, and governance (ESG) integration. Global sustainable investment assets are projected to reach $50 trillion by 2025, underscoring investor demand for environmentally responsible portfolios. BrightSphere must enhance its ESG research to accurately quantify environmental impacts, such as carbon emissions, and ensure compliance with evolving disclosure regulations like the EU's SFDR.

Resource scarcity, driven by rising global demand and geopolitical factors, presents a significant challenge. Projections indicate global energy demand will increase by 2.5% in 2024, exacerbating strain on supplies and leading to price volatility. Companies reliant on materials facing shortages, like those in the semiconductor sector, risk squeezed margins due to these environmental pressures.

| Environmental Factor | Impact on Business | Data/Example |

|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruption, asset damage, increased insurance costs | Insured losses from U.S. natural catastrophes reached $110.6 billion in 2023. |

| Transition to Low-Carbon Economy | Creation of new markets (renewables), obsolescence of carbon-intensive industries | Global solar power installations grew by an estimated 35% in 2023. |

| Resource Scarcity (Water, Minerals, Energy) | Price volatility, supply chain disruptions, operational cost increases | Global energy demand projected to increase by 2.5% in 2024. |

| Regulatory Disclosure Requirements | Increased compliance costs, need for enhanced data infrastructure | EU's CSRD mandates extensive sustainability reporting for many companies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including international organizations like the IMF and World Bank, alongside government statistical agencies and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.