Banque Saudi Fransi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banque Saudi Fransi Bundle

Navigate the dynamic Saudi Arabian financial landscape with our comprehensive PESTLE analysis of Banque Saudi Fransi. Uncover how political stability, economic growth, evolving social demographics, technological advancements, stringent regulations, and environmental considerations are shaping its strategic trajectory. Arm yourself with critical insights to identify opportunities and mitigate risks. Download the full PESTLE analysis now for actionable intelligence that will empower your strategic decision-making.

Political factors

The Saudi government's Vision 2030 framework is a powerful catalyst for economic transformation, significantly shaping the banking sector's landscape and encouraging diversification away from oil dependency. This ambitious national strategy directly influences institutions like Banque Saudi Fransi (BSF) by steering their lending and investment portfolios towards burgeoning non-oil sectors and large-scale development projects.

This strategic alignment translates into substantial business and lending opportunities for BSF, as it actively participates in financing key Vision 2030 initiatives. For instance, the Kingdom's commitment to mega-projects like NEOM, Red Sea Global, and Qiddiya is creating a robust demand for project finance and corporate lending, areas where BSF is strategically positioned to capitalize. In 2024, Saudi Arabia's non-oil GDP growth was projected to remain strong, around 3.7%, underscoring the expanding opportunities in these sectors.

The Financial Sector Development Program (FSDP), a cornerstone of Saudi Arabia's Vision 2030, is actively reshaping the Kingdom's financial landscape. Launched with the aim of modernizing and expanding the sector, it directly influences Banque Saudi Fransi (BSF) by driving regulatory evolution, encouraging digital advancements, and improving capital accessibility. The FSDP's objective is to cultivate a financial ecosystem that is diverse, inclusive, and technologically forward, offering significant advantages to institutions like BSF that align with its strategic goals.

The Saudi Central Bank (SAMA) is pivotal in ensuring financial stability, enforcing strict prudential ratios and liquidity management. SAMA's decisions on interest rates and capital adequacy directly shape the banking sector's operational landscape.

For Banque Saudi Fransi (BSF), a predictable regulatory framework is essential for effective strategic planning and sustained operations. In 2024, SAMA continued its focus on strengthening the financial sector, with key policy rates closely mirroring global trends, impacting lending and deposit costs for banks like BSF.

Geopolitical Landscape and Regional Stability

The geopolitical landscape significantly impacts Banque Saudi Fransi (BSF) and the broader Saudi banking sector. Regional tensions, such as those in the Middle East, and global economic uncertainties create potential risks to stability and growth. For instance, the ongoing conflicts and political shifts in neighboring countries can affect investor confidence and capital flows into Saudi Arabia.

While Saudi Arabia's Vision 2030 initiative aims to diversify the economy and attract foreign investment, geopolitical factors can still influence this process. For example, a sudden escalation of regional disputes could dampen foreign direct investment (FDI) sentiment, which is crucial for the banking sector's expansion and the financing of large-scale projects. In 2023, Saudi Arabia attracted significant FDI, but the trajectory remains sensitive to external political developments.

BSF must remain vigilant in monitoring these external political dynamics. Understanding how geopolitical events might affect investor sentiment, currency stability, and overall economic growth is essential for assessing potential impacts on its operations, loan portfolios, and client base. The bank's strategic planning needs to incorporate scenarios that account for these evolving political risks.

- Regional instability can lead to increased economic volatility, impacting loan demand and credit quality for banks like BSF.

- Global economic uncertainties, often linked to geopolitical events, can affect interest rates and capital market performance, influencing BSF's profitability.

- Foreign investment flows into Saudi Arabia are directly correlated with perceived regional stability, a key factor for BSF's growth strategies.

- Diplomatic relations with major global powers and regional actors can shape trade agreements and investment treaties, indirectly benefiting or hindering BSF's international banking services.

Anti-Corruption and Governance Reforms

Saudi Arabia's Vision 2030 includes a strong focus on anti-corruption and governance enhancements, aiming to create a more transparent and accountable business landscape. This commitment directly impacts financial institutions like Banque Saudi Fransi (BSF) by fostering a more stable and predictable operating environment.

These reforms are designed to boost investor confidence, both domestic and international. By strengthening regulatory frameworks and enforcing stricter governance, the government signals its dedication to a fair and ethical marketplace, which is essential for attracting and retaining capital. For BSF, aligning with these principles solidifies its reputation as a reliable and well-governed entity.

The ongoing efforts to combat corruption and improve governance contribute to a reduction in business risks. This can translate into lower compliance costs and a more efficient operational model for banks. In 2023, Saudi Arabia continued to advance its anti-corruption drive, with notable actions taken against individuals involved in illicit activities, underscoring the seriousness of these initiatives.

- Enhanced Transparency: Reforms aim to increase visibility in government and corporate dealings, reducing opportunities for corruption.

- Investor Confidence: A commitment to good governance signals a safer investment climate, crucial for financial sector growth.

- Operational Integrity: BSF's adherence to these standards reinforces its credibility and strengthens its market position.

- Reduced Risk: Improved governance frameworks can lead to a more stable economic environment, mitigating operational and financial risks for banks.

Political stability within Saudi Arabia is a cornerstone for Banque Saudi Fransi's operations, directly influenced by the government's Vision 2030 and its commitment to economic diversification. The proactive stance on anti-corruption and governance reforms, evidenced by ongoing enforcement actions in 2023, fosters a more predictable and trustworthy business environment.

Regional geopolitical dynamics, however, introduce a layer of complexity. While Saudi Arabia strives for stability, neighboring conflicts and global uncertainties can impact investor sentiment and capital flows, as seen in the sensitivity of foreign direct investment to external political developments in 2023. Consequently, BSF must continuously monitor these external factors to manage potential risks to its growth strategies and client base.

The Saudi Central Bank (SAMA) plays a crucial regulatory role, with its policies on capital adequacy and liquidity management directly shaping the banking sector. SAMA's continued focus on financial sector strengthening in 2024, mirroring global interest rate trends, influences operational costs and lending capacities for institutions like BSF.

What is included in the product

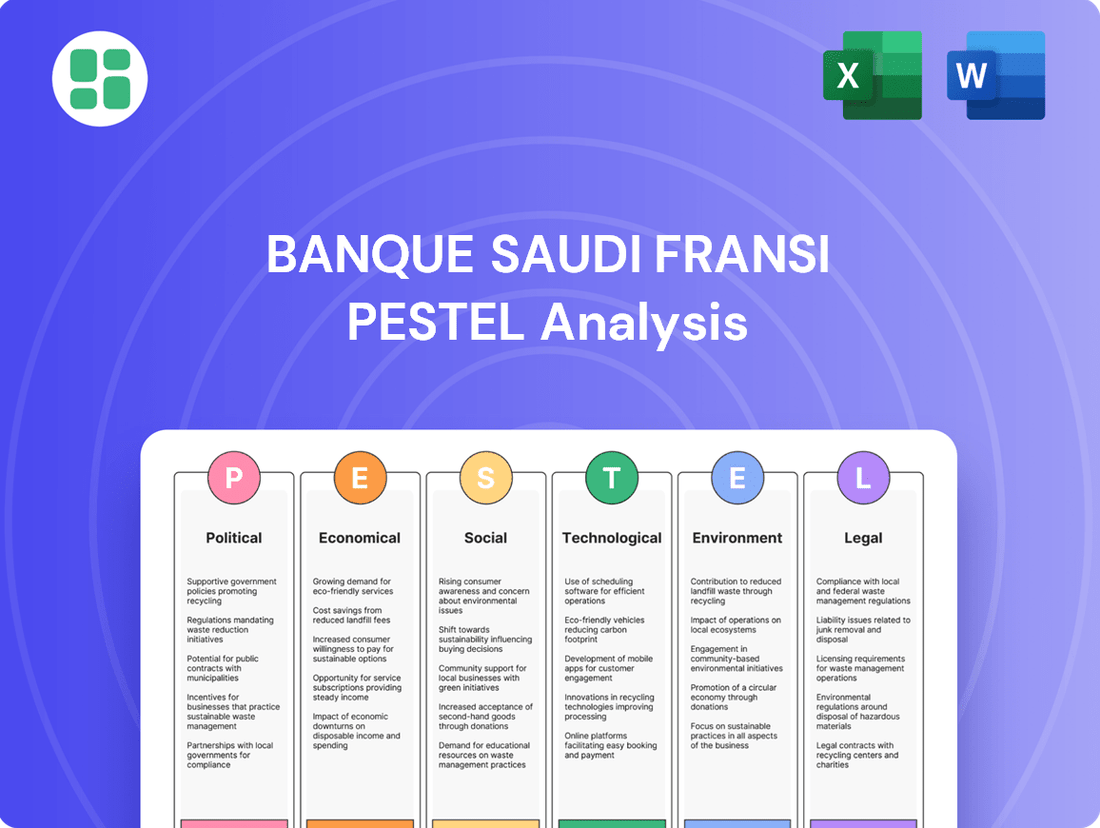

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Banque Saudi Fransi, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces create both threats and opportunities, aiding strategic decision-making for the bank.

This PESTLE analysis for Banque Saudi Fransi acts as a pain point reliever by offering a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

It provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, effectively relieving the pain of sifting through extensive data.

Economic factors

While Saudi Arabia actively pursues economic diversification, fluctuations in oil prices continue to shape government expenditure and broader economic expansion, consequently affecting the banking sector. For instance, Brent crude oil prices saw significant swings in late 2023 and early 2024, impacting fiscal revenues and investment appetite.

Banque Saudi Fransi (BSF) is experiencing a notable shift, with lending growth increasingly fueled by non-oil industries such as construction, tourism, and various services. This trend underscores the Kingdom's successful diversification initiatives, as evidenced by the growing contribution of these sectors to the national GDP.

This evolving economic landscape presents BSF with fresh opportunities for credit expansion, thereby lessening the sector's dependence on financing tied directly to traditional oil-related activities.

Interest rate movements, heavily influenced by global trends and the Saudi Central Bank's (SAMA) peg to the US dollar, directly impact Banque Saudi Fransi's net interest margins and overall lending demand. For instance, if the US Federal Reserve maintains higher rates, SAMA is likely to follow suit, potentially leading to tighter lending conditions in Saudi Arabia.

A scenario of lower interest rates, conversely, could significantly stimulate corporate and mortgage lending, which would directly benefit BSF's loan portfolio growth. This could translate into increased business activity and a stronger housing market, both positive for bank lending.

Looking ahead to 2025, banks like BSF are anticipated to achieve stable profitability. This stability is expected to arise from a volume effect, where an increase in the total amount of loans issued compensates for potentially narrower margins on each individual loan due to interest rate dynamics.

Saudi Arabia's economy is showing robust real GDP growth, with a significant push from its non-oil sectors. This expansion is creating a very positive environment for banks like Banque Saudi Fransi. For instance, in 2023, the non-oil GDP grew by an impressive 4.4%, setting a strong foundation for the banking sector's activities.

Vision 2030 initiatives are a major driver of this non-oil growth, particularly in construction, services, and consumer spending. This translates directly into increased demand for credit, which BSF is well-positioned to meet. The Kingdom's commitment to diversifying its economy means sustained opportunities for lending and financial services.

This ongoing non-oil sector expansion is crucial for the overall health and growth of Saudi Arabia's financial industry. As these sectors mature and require more sophisticated financial solutions, banks like BSF will see continued opportunities for business development and increased profitability.

Inflation and Consumer Spending

Inflationary pressures, particularly concerning housing rent increases, directly impact consumer purchasing power and the demand for financial products in Saudi Arabia. For instance, the Saudi Consumer Price Index (CPI) showed a 3.1% year-on-year increase in April 2024, with housing, water, electricity, gas, and other fuels contributing significantly to this rise. This trend affects how much disposable income households have for discretionary spending and financial services.

Contained inflation generally fosters stable consumer spending and robust economic activity, which is a positive environment for retail banking services offered by Banque Saudi Fransi (BSF). When prices are predictable, consumers are more likely to engage in borrowing, saving, and investment activities, all of which are core to BSF's operations.

BSF must closely monitor inflationary trends and consumer confidence indicators to effectively tailor its product offerings and financial advice. Understanding these dynamics allows the bank to adapt its strategies, ensuring its services remain relevant and attractive to customers navigating changing economic conditions.

- Saudi CPI recorded 3.1% in April 2024.

- Housing, water, electricity, and fuels are key drivers of inflation.

- Stable inflation supports consumer spending and demand for banking services.

- BSF needs to adapt offerings based on inflation and consumer sentiment.

Liquidity and Capital Adequacy

Banque Saudi Fransi (BSF) operates within a Saudi banking sector characterized by robust capitalization. Saudi banks, including BSF, consistently maintain capital adequacy ratios well above the minimum regulatory requirements, reflecting a healthy financial foundation. For instance, as of Q1 2024, the Saudi banking sector's average Capital Adequacy Ratio (CAR) stood at a strong 19.5%, significantly exceeding the Basel III minimum of 10.5%.

These strong liquidity conditions and consistent earnings generation are crucial enablers for asset growth and underpin BSF's creditworthiness. Adequate liquidity ensures banks can meet their obligations and fund new lending opportunities, which is particularly important for supporting the Kingdom's ambitious Vision 2030 initiatives. The Saudi Arabian Monetary Authority (SAMA) reported that the banking sector's liquidity coverage ratio (LCR) remained healthy throughout 2023, averaging around 190%, indicating ample liquid assets to cover net cash outflows over a 30-day stress period.

To fuel the substantial investments required by Vision 2030 projects, BSF and its peers may continue to tap into international capital markets. This strategic move allows banks to secure the necessary funding for large-scale infrastructure and development projects, thereby enhancing their capacity to support economic diversification and growth. In 2023, Saudi banks raised approximately $10 billion through international debt issuances, demonstrating continued access and reliance on global funding sources.

- Strong Capital Adequacy: Saudi banks, including BSF, boast capital adequacy ratios significantly above regulatory minimums, with the sector averaging 19.5% in Q1 2024.

- Healthy Liquidity: Ample liquidity, evidenced by an average LCR of 190% in 2023, supports asset growth and creditworthiness.

- International Funding: Access to international capital markets, with Saudi banks raising around $10 billion in 2023, is vital for funding Vision 2030 projects.

Saudi Arabia's economic diversification under Vision 2030 is a significant tailwind for Banque Saudi Fransi (BSF). The Kingdom's non-oil GDP growth, which stood at 4.4% in 2023, signals a robust environment for lending beyond traditional oil sectors. This expansion in areas like construction and services directly translates into increased demand for credit, creating substantial opportunities for BSF's loan portfolio growth.

Interest rate policies, guided by the Saudi Central Bank's (SAMA) dollar peg, will continue to influence BSF's net interest margins. While higher rates could temper lending demand, the projected stable profitability for banks in 2025, driven by loan volume, suggests resilience. For instance, if the US Federal Reserve maintains elevated rates through 2025, SAMA's response will shape the lending landscape.

Inflationary pressures, particularly in housing, impact consumer spending and the demand for financial products. Saudi CPI recorded 3.1% in April 2024, with housing costs being a key contributor. Managing these pressures is crucial for BSF to tailor its offerings and maintain customer engagement in a dynamic economic climate.

| Economic Factor | Data Point | Impact on BSF |

| Non-Oil GDP Growth | 4.4% (2023) | Drives demand for credit in diversified sectors. |

| Interest Rate Environment | SAMA's USD peg | Influences net interest margins and lending demand. |

| Inflation (CPI) | 3.1% (April 2024) | Affects consumer purchasing power and demand for financial products. |

Full Version Awaits

Banque Saudi Fransi PESTLE Analysis

The preview shown here is the exact Banque Saudi Fransi PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into the strategic landscape for Banque Saudi Fransi.

Sociological factors

Saudi Arabia boasts a notably young population, with approximately 60% of its citizens under the age of 30 as of 2024. This demographic is highly attuned to digital advancements, creating a strong appetite for innovative financial services and mobile-first banking solutions. Banque Saudi Fransi (BSF) recognizes this trend, prioritizing the enhancement of its digital platforms to cater to the preferences of this tech-savvy segment, which is key for future growth.

Consumer preferences are rapidly evolving, with a strong inclination towards digital payment methods and online banking services. This trend is a significant driver in the move towards a cashless economy. For Banque Saudi Fransi (BSF), this means a critical need to bolster its digital infrastructure, including mobile banking applications and online platforms, to cater to the growing demand for seamless and immediate financial transactions.

The COVID-19 pandemic acted as a powerful catalyst, accelerating the adoption of contactless payments and digital wallets. In Saudi Arabia, for instance, the value of e-commerce transactions surged by over 40% in 2023 compared to the previous year, highlighting the deep integration of digital solutions into daily life. This societal shift necessitates that BSF not only keeps pace but also innovates its digital offerings to maintain relevance and customer engagement in this evolving landscape.

Saudi Arabia's Vision 2030 places a strong emphasis on financial inclusion, aiming to increase the percentage of the population with access to formal financial services. This societal shift creates a fertile ground for Banque Saudi Fransi (BSF) to broaden its reach. By embracing digital channels, BSF can tap into segments previously underserved by traditional banking, potentially reaching millions more individuals and small businesses.

Initiatives focused on financial literacy are also gaining momentum. For instance, the Saudi Central Bank (SAMA) has been actively promoting financial awareness programs. In 2023, SAMA reported significant progress in its financial literacy drive, with a notable increase in public engagement with educational resources. This growing understanding of financial concepts empowers customers to make more informed decisions, leading to increased demand for sophisticated banking products and services offered by BSF.

Urbanization and Infrastructure Development

Saudi Arabia's Vision 2030 is fueling rapid urbanization, with significant investment in new mega-cities like NEOM and the expansion of existing urban centers. This demographic shift is directly impacting the financial sector, creating a burgeoning demand for a wide array of banking services.

The burgeoning population in these developing areas translates into increased demand for mortgages, personal banking products, and wealth management services. Furthermore, the massive infrastructure projects, such as those announced for 2024 and 2025, are driving substantial corporate lending opportunities for construction firms, real estate developers, and related industries. For example, the Public Investment Fund (PIF) has committed billions to these giga-projects, creating a fertile ground for financial institutions.

- Increased Demand for Mortgages: As new residential areas are developed, the need for home financing is expected to surge, with mortgage lending projected to grow significantly in the coming years.

- Growth in Personal Banking: Urban populations typically have higher disposable incomes and a greater need for diverse personal banking services, including savings accounts, loans, and digital payment solutions.

- Corporate Lending Opportunities: The construction and development of infrastructure, including transportation networks and new city districts, present substantial opportunities for corporate lending and project finance.

- Digital Expansion: To effectively serve these growing urban and developing areas, Banque Saudi Fransi can strategically enhance its digital banking platforms and establish a targeted physical presence in key growth corridors.

Cultural Norms and Personal Interaction

Despite the increasing digital transformation in Saudi Arabia, a considerable segment of consumers still prefers face-to-face interactions for significant financial decisions like securing loans or mortgages. This cultural inclination means that Banque Saudi Fransi (BSF) must maintain a robust omnichannel approach.

This strategy involves not only offering advanced digital services but also ensuring a high-quality, personalized experience at their physical branches, complete with expert advisory services. Building and nurturing personal relationships remains a cornerstone for fostering trust within the Saudi banking sector, a fact underscored by continued branch traffic for complex financial products.

For instance, while digital banking adoption is growing, surveys from 2024 indicate that over 60% of Saudi respondents still find in-person interactions crucial for high-value financial transactions. This highlights the ongoing importance of BSF’s physical presence and its role in customer relationship management.

- Cultural Preference for In-Person Transactions: A significant portion of Saudi consumers, particularly for major financial decisions, still value direct, face-to-face interactions.

- Omnichannel Strategy Necessity: BSF must balance sophisticated digital platforms with accessible, personalized branch services to cater to diverse customer preferences.

- Trust Through Personal Relationships: The banking landscape in Saudi Arabia emphasizes the importance of building trust through personal connections, influencing customer loyalty and decision-making.

- 2024 Consumer Behavior: Over 60% of Saudi consumers in 2024 still consider in-person interactions vital for high-value financial products, reinforcing the need for a strong physical banking presence alongside digital offerings.

The societal emphasis on family and community ties influences financial decision-making, often leading to collective or family-approved transactions. Banque Saudi Fransi (BSF) can leverage this by offering family banking packages and advisory services that acknowledge these social dynamics. Furthermore, a growing awareness of environmental, social, and governance (ESG) principles is emerging among Saudi consumers, particularly the younger demographic, impacting their choice of financial institutions.

Technological factors

Saudi banks, including Banque Saudi Fransi (BSF), are in the midst of an accelerated digital transformation. This involves substantial investments in technology aimed at enhancing customer experiences and optimizing operational efficiency. For instance, the Saudi Central Bank (SAMA) has been actively promoting digital financial services, with digital payments growing significantly. By the end of 2023, the volume of digital transactions in Saudi Arabia saw a notable increase, reflecting the shift towards a digital-first economy.

BSF's strategic focus on bolstering its digital capabilities is paramount for its sustained growth and competitiveness. This includes continuous upgrades to its mobile banking applications and online platforms, ensuring they meet the evolving expectations of a digitally savvy customer base. Such advancements are crucial for streamlining internal processes and delivering seamless, user-friendly banking services, a key differentiator in today's market.

The burgeoning FinTech ecosystem in Saudi Arabia presents a dynamic landscape for Banque Saudi Fransi (BSF). Government-backed initiatives, like those under Saudi Vision 2030, are actively fostering a global FinTech hub, evidenced by the significant increase in registered FinTech firms. By the end of 2023, the Saudi Central Bank (SAMA) had licensed over 40 FinTech companies, a testament to the rapid growth and innovation within the sector.

This expansion intensifies competition for BSF, as nimble FinTech players introduce novel digital solutions and customer-centric offerings. However, it also unlocks substantial opportunities for BSF to forge strategic alliances, integrate cutting-edge FinTech services, and enhance its own digital banking capabilities. Collaborations can lead to improved customer experience and operational efficiency, allowing BSF to adapt and thrive in this evolving financial environment.

The increasing reliance on digital platforms within the banking sector amplifies cybersecurity risks, making robust security protocols and adherence to strict data privacy laws paramount. By the end of 2024, Saudi Arabia's financial sector saw a significant rise in sophisticated cyber threats, underscoring the need for continuous vigilance.

The Saudi Central Bank (SAMA) and the National Cybersecurity Authority (NCA) have been proactive, issuing comprehensive frameworks and regulations designed to shield financial institutions and safeguard sensitive customer data. These directives are crucial for maintaining operational integrity and protecting against data breaches.

Banque Saudi Fransi (BSF) must maintain a consistent and substantial investment in cutting-edge cybersecurity infrastructure. This ongoing commitment, coupled with strict adherence to evolving regulatory standards, is essential for preserving customer trust and ensuring operational resilience in the face of persistent digital threats.

Adoption of AI and Advanced Analytics

Banque Saudi Fransi (BSF) is navigating a landscape where artificial intelligence (AI) and advanced analytics are rapidly transforming financial services. Banks globally are deploying these technologies to refine customer experiences, optimize operations, and gain a competitive edge. For instance, AI is instrumental in powering predictive credit scoring, enabling more accurate risk assessments and personalized financial management tools. This shift is not just about efficiency; it's about creating a hyper-personalized banking environment driven by data. By embracing AI and data analytics, BSF can significantly bolster its capabilities in areas such as risk assessment, fraud detection, and delivering highly tailored product recommendations to its clientele.

The strategic adoption of AI and advanced analytics offers tangible benefits for BSF. These technologies enable a deeper understanding of customer behavior, leading to more effective marketing campaigns and product development. In 2024, the global AI in banking market was projected to reach substantial figures, indicating a strong trend towards AI integration. For example, some reports estimated the market to be worth over $20 billion, with significant growth expected in the coming years. This growth is fueled by the demand for enhanced customer engagement and operational cost reduction.

- Enhanced Risk Management: AI algorithms can analyze vast datasets to identify potential risks and fraud patterns with greater speed and accuracy than traditional methods.

- Personalized Customer Experiences: Leveraging data analytics allows BSF to offer customized financial advice, product recommendations, and tailored banking solutions.

- Operational Efficiency: Automation of routine tasks through AI can free up human resources for more complex and strategic activities, reducing operational costs.

- Data-Driven Decision Making: Advanced analytics provide BSF with actionable insights into market trends, customer preferences, and internal performance, supporting more informed strategic choices.

Open Banking Implementation

Saudi Arabia's commitment to open banking, with a target for full implementation by the end of 2024 or early 2025, is a significant technological driver. This framework allows for secure data sharing between financial institutions and authorized third-party providers, directly impacting Banque Saudi Fransi (BSF).

The implementation of open banking creates fertile ground for BSF to forge partnerships with FinTech firms. This collaboration can lead to the development of innovative digital services, including API integrations for seamless data exchange and payment aggregation platforms, ultimately enhancing customer experience and driving competition within the Saudi financial sector.

Open banking initiatives are projected to accelerate innovation and bolster customer confidence. By enabling greater transparency and facilitating new digital offerings, these frameworks are expected to foster a more dynamic and customer-centric financial ecosystem.

- Open Banking Readiness: Saudi Arabia aims for full open banking implementation by late 2024/early 2025, a key technological shift.

- FinTech Collaboration: This enables BSF to integrate with FinTechs, offering new digital services and payment aggregation.

- Customer Trust: Open banking is anticipated to boost customer trust through enhanced data control and innovative financial solutions.

Technological advancements are reshaping the banking sector, with Banque Saudi Fransi (BSF) actively embracing digital transformation. Investments in AI and advanced analytics are enhancing customer experiences and operational efficiency, with the global AI in banking market projected to exceed $20 billion by 2024. This focus on technology is crucial for BSF to remain competitive and meet evolving customer expectations in a rapidly digitizing economy.

The Saudi Arabian open banking initiative, targeting full implementation by late 2024 or early 2025, represents a significant technological shift. This framework will enable secure data sharing, fostering collaboration between BSF and FinTech firms to develop innovative digital services and payment solutions. Open banking is expected to boost customer trust through increased data control and the introduction of new, customer-centric financial offerings.

| Key Technological Drivers | BSF's Strategic Response | Impact & Opportunities |

| Digital Transformation & AI Integration | Investing in AI for predictive analytics, personalized services, and operational efficiency. | Enhanced risk management, improved customer engagement, and cost reduction. |

| FinTech Ecosystem Growth | Forging strategic alliances and integrating FinTech services. | Increased competition, but also opportunities for innovation and expanded digital offerings. |

| Open Banking Implementation | Preparing for secure data sharing and API integrations. | Facilitating FinTech partnerships, developing new digital services, and boosting customer trust. |

Legal factors

Saudi Central Bank (SAMA) acts as the primary regulator for Saudi Arabia's banking sector, setting stringent rules for capital adequacy, liquidity, and risk management. Banque Saudi Fransi (BSF) must continuously adapt to SAMA's directives, which are crucial for maintaining financial stability and safeguarding customer interests. For instance, SAMA's Basel III implementation, which BSF adheres to, mandates higher capital ratios, with the Common Equity Tier 1 (CET1) ratio for Saudi banks averaging around 13% as of late 2024, ensuring a robust buffer against potential shocks.

Saudi Arabia enforces strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, compelling financial institutions like Banque Saudi Fransi (BSF) to establish comprehensive compliance frameworks and detailed reporting systems. This necessitates BSF to maintain robust customer due diligence, including Know Your Customer (KYC) procedures, and sophisticated transaction monitoring to detect and prevent illicit financial flows, aligning with global standards and national directives.

Failure to adhere to these stringent AML/CTF regulations can result in significant financial penalties and severe reputational damage for BSF. For instance, in 2023, global financial institutions faced billions in AML-related fines, underscoring the critical importance of proactive compliance and the potential financial impact of non-adherence, a risk BSF must actively mitigate.

Data protection and privacy laws are increasingly critical for Banque Saudi Fransi (BSF) as banking services become more digitalized. These regulations govern the collection, storage, and processing of customer data, making compliance essential for safeguarding sensitive information and fostering customer trust. For instance, Saudi Arabia's Personal Data Protection Law (PDPL), which came into full effect in March 2023, imposes strict requirements on data handling, including consent, purpose limitation, and data minimization, directly impacting BSF's operations.

To ensure adherence to these evolving legal landscapes, BSF must implement robust data governance frameworks and advanced cybersecurity measures. This proactive approach is vital not only for avoiding substantial penalties, which can be significant under regulations like the PDPL, but also for maintaining BSF's reputation as a secure and reliable financial institution in the competitive Saudi banking sector.

Companies Law and Corporate Governance

The Companies Law and associated corporate governance regulations in Saudi Arabia, particularly those overseen by the Capital Market Authority (CMA), are critical for publicly listed banks like Banque Saudi Fransi (BSF). These laws define BSF's legal framework, the duties of its board of directors, and the rights afforded to its shareholders, ensuring a structured and accountable operational environment.

Compliance with these legal mandates is fundamental to fostering transparent operations and bolstering investor confidence. For instance, BSF's adherence to the CMA's Corporate Governance Code, last updated significantly in 2021 and subject to ongoing review, directly impacts its market perception and ability to attract capital. Changes to these regulations, such as new requirements for board independence or disclosure standards, can compel BSF to revise its internal governance mechanisms and reporting procedures.

- Board Composition: Saudi corporate law mandates specific board structures, often requiring a minimum number of independent directors for listed companies, influencing BSF's board appointments.

- Shareholder Rights: Regulations protect shareholder rights concerning voting, dividends, and access to information, impacting how BSF communicates with and is governed by its investors.

- Disclosure Requirements: The CMA enforces stringent disclosure rules for financial performance and material events, which BSF must meticulously follow to maintain transparency.

- Regulatory Oversight: The Saudi Central Bank (SAMA) and CMA jointly ensure banks like BSF operate within legal and prudential frameworks, impacting risk management and strategic decisions.

Consumer Protection Regulations

Consumer protection regulations are a significant legal factor for Banque Saudi Fransi (BSF). These rules, designed to safeguard customers in financial services, mandate fair lending, clear disclosure of product terms, and robust complaint resolution processes. Adherence to these standards is crucial for BSF's retail banking segment, fostering customer trust and long-term relationships.

Compliance with these regulations, which also encompass responsible lending and product transparency, directly influences BSF's operational strategies and customer engagement. For instance, Saudi Arabia's Consumer Protection Law, enacted in 2019 and updated with implementing regulations, emphasizes transparency and fair treatment, impacting how financial products are marketed and sold. Banks like BSF must ensure all fees, interest rates, and terms are clearly communicated to prevent deceptive practices.

- Fair Lending Practices: Regulations like those overseen by the Saudi Central Bank (SAMA) ensure that BSF does not discriminate in its lending decisions and offers credit on equitable terms.

- Disclosure Requirements: BSF must provide clear, comprehensive information about financial products, including fees, interest rates, and contract terms, to enable informed consumer choices.

- Complaint Resolution: Established mechanisms for handling customer grievances, as mandated by SAMA, are essential for maintaining customer satisfaction and regulatory compliance.

- Responsible Lending: BSF is expected to assess a borrower's ability to repay before extending credit, mitigating risks for both the customer and the bank.

The legal landscape for Banque Saudi Fransi (BSF) is shaped by stringent regulations from the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA). These bodies enforce rules on capital adequacy, with Saudi banks maintaining CET1 ratios around 13% in late 2024, and robust AML/CTF frameworks, crucial given global fines in 2023 exceeding billions for non-compliance.

Data protection, notably under Saudi Arabia's Personal Data Protection Law (PDPL) effective March 2023, mandates strict customer data handling, requiring BSF to implement advanced cybersecurity. Corporate governance, guided by CMA's code (updated 2021), dictates board composition and shareholder rights, influencing BSF's transparency and investor relations.

Consumer protection laws, including Saudi Arabia's Consumer Protection Law (2019), ensure fair lending and clear disclosures, impacting BSF's product marketing and customer interaction strategies. These legal factors collectively necessitate proactive compliance from BSF to mitigate penalties and maintain market trust.

Environmental factors

The Saudi banking sector, including Banque Saudi Fransi (BSF), is increasingly focusing on Environmental, Social, and Governance (ESG) integration. This shift is propelled by Saudi Arabia's Vision 2030, which champions sustainability, and a broader global push for responsible finance. BSF is anticipated to embed ESG considerations into its core business strategies, risk management processes, and investment choices, particularly in financing environmentally friendly projects.

This strategic alignment involves establishing robust sustainable finance frameworks and transparently reporting on ESG performance metrics. For instance, by the end of 2023, Saudi Arabia's PIF committed to net-zero emissions by 2050, signaling a clear direction for financial institutions like BSF to align their lending and investment portfolios with sustainability goals. The Saudi Central Bank (SAMA) has also been active in promoting sustainable finance, issuing guidelines that encourage banks to develop their ESG strategies and disclosures.

Banque Saudi Fransi, like other financial institutions globally, is increasingly focused on climate change. This includes understanding physical risks like extreme weather events impacting collateral and transition risks arising from shifts to a low-carbon economy, such as evolving regulations and market preferences. By July 2025, BSF is expected to have robust frameworks in place to assess its exposure to these climate-related financial risks across its diverse loan book and operational footprint.

The Kingdom of Saudi Arabia's Vision 2030, with its emphasis on diversification and sustainability, presents significant opportunities for BSF in green finance. This includes financing renewable energy projects, such as the vast solar initiatives underway, and supporting sustainable urban development. For instance, by the end of 2024, Saudi Arabia aims to have a significant portion of its energy mix from renewables, creating a substantial market for green bonds and project finance that BSF can tap into.

Saudi Arabia's Vision 2030 is a powerful driver for economic diversification and sustainability, directly fueling a growing demand for green finance. Banque Saudi Fransi (BSF) is well-positioned to meet this need by providing crucial funding for renewable energy initiatives, such as solar and wind power projects, and for the development of sustainable infrastructure across the Kingdom. This strategic focus not only supports national environmental objectives but also appeals to a rising tide of investors prioritizing environmental, social, and governance (ESG) criteria, as evidenced by the increasing global allocation of capital to sustainable investments, which reached trillions of dollars by 2024.

Sustainability Reporting and Disclosure

Banque Saudi Fransi (BSF), like many financial institutions, faces growing demands for robust sustainability reporting. Stakeholders, including investors and regulators, are increasingly focused on environmental, social, and governance (ESG) performance. This means BSF needs to be transparent about its environmental footprint and its role in achieving sustainable development goals.

In 2024 and looking into 2025, the expectation is for BSF to clearly disclose its ESG metrics. This includes detailing its carbon emissions and how it contributes to broader sustainability initiatives. Adherence to both international ESG reporting frameworks and Saudi Arabia's specific local guidelines is crucial for maintaining credibility and meeting regulatory requirements.

Key areas of focus for BSF's disclosure will likely include:

- Carbon Footprint: Reporting on Scope 1, 2, and potentially Scope 3 emissions from its operations and financed activities.

- ESG Performance Metrics: Disclosing data related to environmental impact, social responsibility, and corporate governance practices.

- Sustainable Finance Initiatives: Highlighting investments and financing activities that support green projects and sustainable development.

- Alignment with Global Standards: Demonstrating compliance with frameworks such as the Global Reporting Initiative (GRI) or the Task Force on Climate-related Financial Disclosures (TCFD).

Operational Environmental Footprint Reduction

Banque Saudi Fransi (BSF) is actively working to reduce its operational environmental footprint, moving beyond its financing role. This includes initiatives focused on decreasing energy consumption, improving waste management, and cutting down on paper usage across its operations. For instance, BSF can implement energy-efficient technologies in its branches and corporate offices, a strategy that aligns with global trends in sustainable banking. By promoting digital banking services, the bank aims to significantly minimize its environmental impact, demonstrating a commitment to corporate responsibility and enhancing operational efficiency.

The bank's commitment is reflected in tangible actions. In 2024, BSF continued to invest in digital transformation, aiming for a 20% reduction in paper-based transactions by the end of the year. Furthermore, the bank is piloting solar energy solutions in select branches, targeting a 15% decrease in electricity consumption for those locations by early 2025. These efforts not only contribute to environmental sustainability but also offer cost savings through reduced resource expenditure.

- Energy Efficiency: Implementing smart building technologies in BSF's headquarters and branches to optimize energy usage.

- Digitalization: Promoting paperless transactions and online services to reduce paper waste and associated environmental costs.

- Waste Management: Enhancing recycling programs and responsible disposal of electronic waste generated from IT infrastructure upgrades.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials for office supplies and equipment.

Banque Saudi Fransi (BSF) is actively aligning with Saudi Arabia's sustainability goals, driven by Vision 2030 and global ESG trends. The bank is expected to integrate environmental considerations into its financing and investment strategies, particularly supporting the Kingdom's ambitious renewable energy targets. By July 2025, BSF will likely have enhanced frameworks to manage climate-related financial risks, reflecting a growing emphasis on green finance and transparent ESG reporting.

The Saudi Central Bank (SAMA) is promoting sustainable finance, encouraging institutions like BSF to develop ESG strategies and disclosures. This regulatory push, coupled with increasing investor demand for sustainable investments, positions BSF to finance projects in renewable energy and sustainable infrastructure. For instance, by the end of 2024, Saudi Arabia aims for a significant portion of its energy mix to come from renewables, creating a robust market for green bonds and project finance.

BSF is also focusing on reducing its operational environmental footprint through initiatives like energy efficiency in branches and promoting digital banking to minimize paper usage. By the end of 2024, BSF aimed for a 20% reduction in paper-based transactions, and by early 2025, it was piloting solar energy in select branches, targeting a 15% decrease in electricity consumption for those locations.

| Environmental Focus Area | BSF Initiatives/Targets (as of 2024/early 2025) | Impact/Goal |

|---|---|---|

| Green Finance | Financing renewable energy projects (solar, wind) | Supporting Saudi Vision 2030's energy diversification goals |

| Climate Risk Management | Developing frameworks for physical and transition risks | By July 2025, robust assessment of climate-related financial risks |

| Operational Footprint | Reducing energy consumption, waste, and paper usage | 20% reduction in paper transactions (by end of 2024) |

| Sustainable Operations | Piloting solar energy in select branches | 15% decrease in electricity consumption for pilot branches (by early 2025) |

PESTLE Analysis Data Sources

Our Banque Saudi Fransi PESTLE Analysis is constructed using a comprehensive blend of official government publications from Saudi Arabia, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the Saudi banking sector.