Banque Saudi Fransi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banque Saudi Fransi Bundle

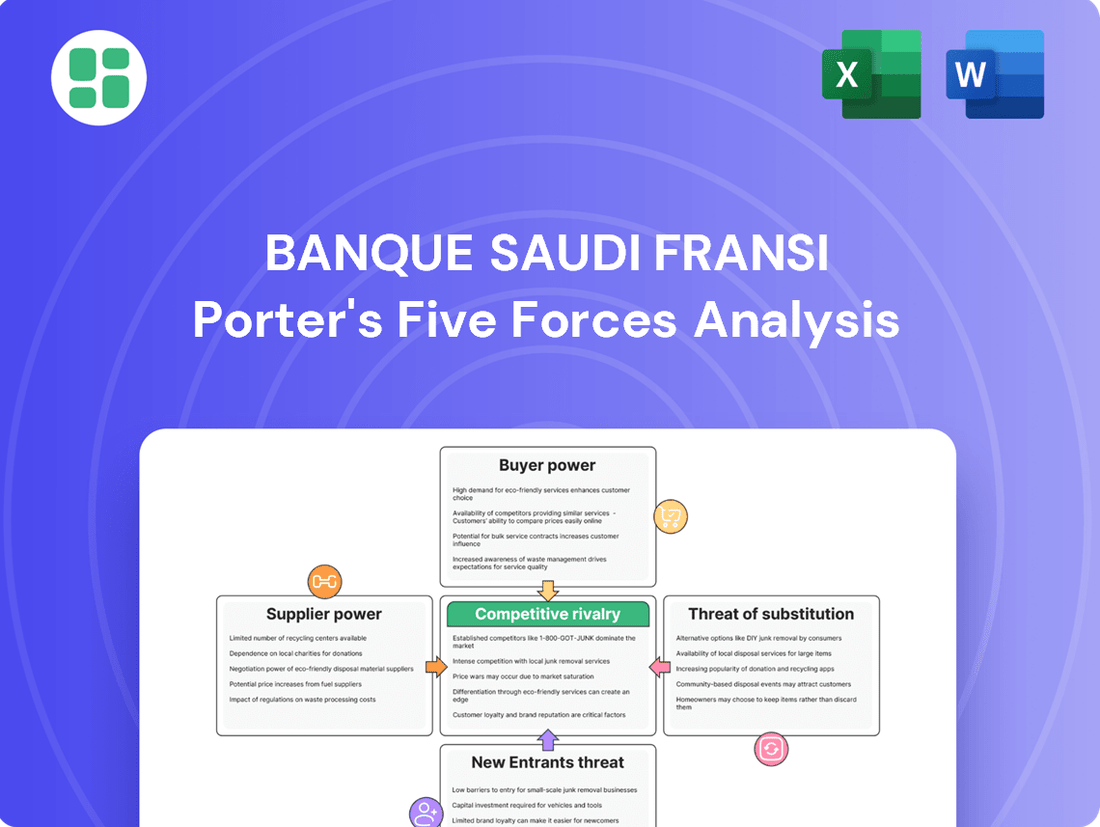

Banque Saudi Fransi operates in a dynamic banking sector where understanding competitive forces is paramount. While initial analysis suggests moderate threat from new entrants due to high capital requirements, the bargaining power of buyers, particularly large corporations, can significantly impact pricing and service offerings. The intensity of rivalry among established Saudi banks also plays a crucial role in shaping market dynamics.

The complete report reveals the real forces shaping Banque Saudi Fransi’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Banque Saudi Fransi's reliance on technology and digital infrastructure providers for its digital transformation, including AI and open banking, means these suppliers hold significant sway. The growing demand for sophisticated digital solutions within the Saudi banking sector, estimated to see continued growth in digital banking adoption throughout 2024 and beyond, could further amplify the bargaining power of specialized tech suppliers.

However, the presence of numerous global and local tech firms competing for business with BSF can act as a counterbalancing force, potentially moderating the suppliers' ability to dictate terms. For instance, in 2023, the Saudi government's Vision 2030 initiatives spurred significant investment in digital infrastructure, attracting a wider array of technology partners and increasing competition among them.

The banking sector, including Banque Saudi Fransi (BSF), critically depends on a highly skilled workforce, especially in burgeoning fields like digital transformation, cybersecurity, and financial product innovation. The availability of such specialized human capital directly impacts a bank's ability to compete and adapt.

A noticeable scarcity of top-tier talent in these niche areas within Saudi Arabia can significantly amplify the bargaining power of employees and specialized consultants. This dynamic can translate into increased recruitment expenses and higher salary demands for BSF, directly affecting operational costs and profitability.

For instance, in 2024, the demand for cybersecurity professionals in the GCC region saw a substantial increase, with reports indicating a potential shortage of up to 30% for highly skilled individuals. This trend underscores the growing influence of specialized labor on the operational expenditures of financial institutions like BSF.

Banque Saudi Fransi, like other banks, relies on a mix of funding: customer deposits, the interbank market, and international capital markets. While Saudi banks generally enjoy steady deposit growth, the significant funding needs for Vision 2030 initiatives mean an increased reliance on external sources. This shift can empower large institutional investors and international lenders, giving them more leverage.

S&P Global anticipates Saudi banks will continue to tap international capital markets to fuel their expansion. For instance, in 2024, Saudi banks have actively raised capital through various debt instruments, reflecting this trend. This reliance on external funding directly impacts the bargaining power of those providing the capital, potentially increasing borrowing costs for the banks.

Influence of Payment Network and Data Providers

Payment network providers and data analytics firms are increasingly vital suppliers for banks like Banque Saudi Fransi (BSF). As digital transactions and data-driven personalization grow, these entities can leverage their critical role to potentially increase fees or dictate terms, impacting BSF's expenses and service capabilities. For instance, the global digital payments market was projected to reach over $2.4 trillion by 2025, highlighting the growing reliance on these networks.

The bargaining power of these suppliers is further amplified by the increasing demand for sophisticated data analytics. Banks need these insights for everything from risk management to customer segmentation. In 2023, Saudi Arabia's fintech sector saw significant growth, with a particular emphasis on data analytics and payment solutions, indicating a robust market for these specialized services.

Furthermore, regulatory shifts, such as the Saudi Central Bank's (SAMA) initiatives like Open Banking, could reshape the landscape of data sharing. While this may foster competition, it also necessitates reliance on the infrastructure and expertise of data providers, potentially maintaining or even increasing their leverage in negotiations with BSF.

- Growing Digital Payments: The global digital payments market is expanding rapidly, increasing reliance on payment network providers.

- Data Analytics Demand: Banks require advanced data analytics for competitive advantage, empowering data providers.

- Open Banking Influence: Regulatory frameworks like Open Banking could alter data sharing dynamics, impacting supplier leverage.

- Fintech Growth in Saudi Arabia: The burgeoning fintech sector in Saudi Arabia, focusing on payments and data, underscores the importance of these suppliers.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers wield considerable influence over Banque Saudi Fransi (BSF). The dynamic nature of financial regulations, particularly concerning Anti-Money Laundering/Counter-Financing of Terrorism (AML/CFT) and cybersecurity, necessitates specialized legal and advisory expertise. For instance, Saudi Central Bank (SAMA) continuously updates its directives, requiring banks like BSF to adapt their compliance frameworks. This ongoing need for specialized knowledge and adherence to stringent SAMA guidelines, which saw significant updates in 2024 regarding data privacy and digital banking security, can lead to increased costs for BSF in securing these essential services.

The bargaining power of these providers is amplified by the critical nature of their services. Failure to comply with evolving regulations can result in substantial penalties and reputational damage for BSF.

- Increased regulatory scrutiny: SAMA's proactive approach to financial sector oversight in 2024, including enhanced cybersecurity mandates, directly impacts compliance service demand.

- Specialized expertise required: The niche knowledge of compliance and legal professionals is not easily replicated, granting them leverage.

- Cost implications: BSF's investment in robust compliance infrastructure, including external legal and consulting fees, can be a significant operational expense.

- Risk of non-compliance: The potential for heavy fines and reputational damage if regulations are not met strengthens the negotiating position of service providers.

Banque Saudi Fransi's reliance on technology providers for digital transformation, including AI and open banking, grants these suppliers significant leverage. The growing demand for sophisticated digital solutions in Saudi Arabia's banking sector, with digital banking adoption expected to continue its upward trend through 2024, further strengthens the bargaining power of specialized tech firms.

However, the competitive landscape, bolstered by Saudi Vision 2030 initiatives attracting diverse technology partners, helps moderate supplier influence. The increasing need for specialized talent, particularly in cybersecurity, creates a tight labor market, empowering employees and consultants with higher salary demands and impacting BSF's operational costs.

BSF's funding mix, increasingly relying on external sources for Vision 2030 initiatives, enhances the bargaining power of institutional investors and international lenders. This trend is reflected in Saudi banks actively raising capital through debt instruments in 2024, potentially increasing borrowing costs for the bank.

Payment network providers and data analytics firms hold considerable sway due to the critical nature of their services in an increasingly digital transaction environment. The global digital payments market's projected growth to over $2.4 trillion by 2025 underscores this reliance, while Saudi Arabia's robust fintech growth in 2023, focusing on payments and data, highlights the value of these specialized services.

| Supplier Type | Key Drivers of Bargaining Power | Impact on BSF | 2024/2025 Data/Trends |

| Technology Providers | Digital transformation needs, AI, Open Banking | Increased costs for specialized solutions | Continued growth in digital banking adoption |

| Specialized Labor | Scarcity of top-tier talent (e.g., cybersecurity) | Higher recruitment costs, increased salary demands | GCC cybersecurity talent shortage estimated at 30% |

| Capital Providers | Increased reliance on external funding for Vision 2030 | Potentially higher borrowing costs | Active capital raising by Saudi banks via debt instruments |

| Payment & Data Providers | Growth in digital payments and data analytics demand | Potential for increased fees, impact on service capabilities | Global digital payments market projected >$2.4 trillion by 2025 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Banque Saudi Fransi's operating environment in Saudi Arabia.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Banque Saudi Fransi.

Customers Bargaining Power

Saudi banking customers demonstrate a significant inclination towards digital channels, with online banking and digital payments experiencing robust growth. In 2024, the Kingdom saw a substantial increase in mobile banking usage, with many transactions migrating from traditional branches to digital platforms.

This high digital adoption empowers customers, allowing them to readily compare offerings and switch banks based on superior digital experiences. Consequently, Banque Saudi Fransi must maintain a competitive edge by continually enhancing its digital platforms to ensure a seamless and user-friendly customer journey.

The evolving digital landscape necessitates that customers expect sophisticated tools and highly personalized financial services. This puts pressure on BSF to innovate and deliver advanced digital solutions that meet these growing expectations.

The digital wave sweeping through Saudi Arabia's financial landscape has dramatically increased transparency, making it simpler for customers to compare banking products and services. This ease of access to information empowers them to make more informed choices, directly impacting a bank's ability to command premium pricing.

Furthermore, the advent of digital onboarding and a proliferation of competitive offerings from both traditional banks and nimble fintech companies have significantly lowered switching costs. For instance, in 2024, the average time to open a new bank account digitally in Saudi Arabia has fallen to under 15 minutes, a stark contrast to previous manual processes. This ease of migration means customers can readily move to a competitor offering better terms or services, thereby amplifying their bargaining power.

To counter this, Banque Saudi Fransi must prioritize customer retention strategies. This involves not just competitive pricing but also delivering exceptional service and developing highly personalized banking solutions. By understanding and catering to individual customer needs, BSF can build loyalty that transcends minor price differences, effectively mitigating the increased bargaining power of its customer base.

Customers in Saudi Arabia benefit from a broad spectrum of banking products, encompassing commercial, investment, and retail services. This extensive selection is provided by a multitude of local and international financial institutions, giving consumers significant choice.

The availability of numerous banking options empowers customers to compare offerings and negotiate favorable terms, especially for substantial corporate clients involved in financing major projects aligned with Saudi Vision 2030. For instance, in 2024, the Saudi banking sector saw continued growth, with total assets reaching over SAR 3.7 trillion, indicating a competitive landscape where customer leverage is amplified by the sheer volume of choices.

Growing Financial Literacy and Demand for Tailored Solutions

As Saudi Arabia's Vision 2030 propels economic diversification and financial literacy grows, customers are increasingly sophisticated. They now demand personalized financial advice and bespoke products, shifting power towards them. This means banks like Banque Saudi Fransi must innovate beyond standard offerings to meet these evolving needs, as customers are less inclined to accept generic solutions.

The heightened awareness among consumers translates into a stronger ability to negotiate terms and seek out the best value. For instance, in 2024, the Saudi Central Bank (SAMA) continued to emphasize consumer protection and financial inclusion, indirectly empowering customers to demand more transparency and tailored services from financial institutions.

- Increased Demand for Personalization: Customers are actively seeking financial products and services that cater to their specific life stages and financial goals, moving away from standardized packages.

- Negotiating Power: With greater access to information and comparison tools, customers can more effectively negotiate fees, interest rates, and service levels.

- Innovation Driver: The demand for tailored solutions pushes banks to invest in technology and develop innovative products, such as specialized investment funds or flexible financing options, to retain and attract customers.

- Focus on Value: Customers are scrutinizing the overall value proposition, including service quality, digital accessibility, and responsiveness, in addition to pricing.

Significant Corporate Lending Needs for Vision 2030 Projects

Corporate clients, especially those undertaking massive Vision 2030 initiatives, possess considerable leverage when seeking financing from banks like Banque Saudi Fransi. These substantial funding requirements mean that BSF, alongside other major financial institutions, actively competes for these high-value corporate loans, which are crucial for driving credit expansion in the banking sector.

The ability of these large corporate entities to negotiate more favorable terms and interest rates directly impacts BSF's profitability on such deals. For instance, in 2024, Saudi Arabia's commitment to Vision 2030 continued to fuel demand for corporate lending, with major infrastructure and development projects requiring billions in capital. Banks that can offer competitive pricing and flexible structures are better positioned to win this business.

- Large Project Financing: Vision 2030 projects, such as NEOM and Red Sea Global, necessitate enormous capital injections, often in the tens of billions of dollars.

- Competitive Lending Environment: BSF competes with other Saudi banks like Riyad Bank and National Commercial Bank (NCB) for these substantial corporate mandates.

- Negotiating Power: Borrowers with strong credit profiles and significant funding needs can negotiate lower interest rates and fees, reducing the bank's net interest margin on these loans.

The bargaining power of customers for Banque Saudi Fransi (BSF) is significant, driven by high digital adoption and increasing customer sophistication. In 2024, the ease of comparing financial products and switching providers, amplified by digital channels and lower switching costs, means customers can readily demand better terms.

Corporate clients, particularly those involved in large Vision 2030 projects, hold substantial leverage due to their significant financing needs. This enables them to negotiate more favorable interest rates and flexible structures, impacting BSF's profitability on these crucial deals.

The Saudi banking sector's growth, with total assets exceeding SAR 3.7 trillion in 2024, underscores a competitive environment where customers benefit from a wide array of choices, further enhancing their negotiating power.

Customers are increasingly seeking personalized financial advice and bespoke products, pushing banks like BSF to innovate and offer tailored solutions to retain their business.

| Factor | Impact on BSF | 2024 Data/Example |

|---|---|---|

| Digital Channel Adoption | Increased customer ability to compare and switch | High mobile banking usage, many transactions migrated from branches |

| Lower Switching Costs | Amplified customer bargaining power | Digital account opening under 15 minutes |

| Corporate Client Needs (Vision 2030) | Significant leverage for large borrowers | Billions in capital required for projects like NEOM |

| Market Competition | Customers have broad choices, enhancing negotiation | Total banking assets over SAR 3.7 trillion |

Same Document Delivered

Banque Saudi Fransi Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Banque Saudi Fransi, detailing the competitive landscape and strategic positioning of the bank. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing valuable insights into industry rivalry, buyer and supplier power, threat of new entrants, and threat of substitutes.

Rivalry Among Competitors

The Saudi banking landscape is dominated by several substantial, well-funded local institutions, such as Saudi National Bank, Al Rajhi Bank, Riyad Bank, and Saudi Awwal Bank, all of whom are significant rivals to Banque Saudi Fransi. This concentration of strong players intensifies the competition for market share across various banking services, from retail to corporate and investment banking.

These major banks actively compete for customer deposits and loan opportunities, driving down margins and requiring continuous innovation to maintain a competitive edge. For instance, as of Q1 2024, Saudi National Bank reported total assets of SAR 974 billion, Al Rajhi Bank SAR 777 billion, and Riyad Bank SAR 372 billion, highlighting the scale of the competition BSF faces.

The competitive landscape for Banque Saudi Fransi (BSF) is significantly shaped by the rise of digital-only banks and fintech companies. New entrants such as D360 Bank and STC Bank, alongside a burgeoning ecosystem of licensed fintechs, are directly challenging established institutions. This is particularly evident in fast-growing areas like digital payments and retail banking services.

These agile, digitally native competitors often boast more streamlined operations and a focus on innovative, user-friendly digital experiences. They are adept at leveraging technology to attract customers, offering services that can be more convenient and cost-effective than traditional banking models. This puts pressure on BSF to continuously enhance its own digital offerings to remain competitive.

The Saudi Arabian government's strategic push towards a cashless economy further amplifies this digital rivalry. Initiatives aimed at increasing digital transaction volumes create a fertile ground for fintech innovation and digital banking adoption. For instance, by the end of 2023, Saudi Arabia saw a notable increase in e-commerce, with digital payments forming a substantial portion of these transactions, highlighting the growing importance of digital channels.

The ambitious Vision 2030 projects in Saudi Arabia are a significant catalyst for credit growth, particularly within the corporate lending sector. This surge in demand for financing large-scale developments naturally fuels intense competition among banks. Banks are actively vying for these lucrative financing mandates, often by offering competitive terms, attractive pricing, and enhanced service offerings to secure corporate clients.

Focus on Digital Transformation and Customer Experience

Banque Saudi Fransi (BSF) faces intense rivalry driven by the industry-wide push for digital transformation and superior customer experience. Banks are pouring resources into AI, open banking, and advanced mobile platforms to personalize services and improve operational efficiency. This focus on digital innovation intensifies competition, compelling BSF to consistently enhance its digital offerings and customer journeys to remain competitive.

- Digital Investment: Saudi banks collectively invested billions in digital transformation initiatives in 2023, aiming to capture market share through enhanced customer interfaces.

- Customer Experience Focus: A 2024 report indicated that over 70% of banking customers in the region prioritize seamless digital experiences when choosing a financial provider.

- AI Adoption: Leading financial institutions are integrating AI for personalized financial advice and fraud detection, creating a benchmark that BSF must meet or exceed.

- Open Banking Impact: The ongoing implementation of open banking frameworks is fostering greater collaboration and competition, allowing fintechs and other banks to offer integrated services, thereby raising customer expectations for connectivity and convenience.

Market Concentration and Strategic Positioning

The Saudi banking sector, while dominated by a few large institutions, is experiencing increased competition. Banque Saudi Fransi (BSF) operates within this environment where established giants coexist with emerging digital challengers. In 2024, the top five Saudi banks, including BSF, controlled a substantial share of the market, but the rise of fintech solutions and neobanks is reshaping customer expectations and competitive dynamics.

BSF's strategic positioning is crucial for navigating this evolving landscape. Leveraging its extensive branch network, established client base, and a broad spectrum of financial products remains a core strength. However, to counter disruption, BSF must continue to invest in digital transformation, enhancing its online and mobile banking platforms to compete with agile new entrants. This dual approach of fortifying traditional advantages while embracing digital innovation is key to maintaining market share.

- Market Share Dynamics: In early 2024, the largest Saudi banks collectively held over 70% of the total banking assets in the Kingdom, highlighting significant market concentration.

- Digital Disruption: The emergence of digital-only banks and payment providers in Saudi Arabia is creating new competitive pressures, particularly for services traditionally offered through physical branches.

- Strategic Adaptation: BSF's strategy involves balancing its robust physical presence with significant investments in digital capabilities to meet diverse customer needs and fend off new competitors.

The competitive rivalry for Banque Saudi Fransi (BSF) is intense, driven by both established banking giants and agile digital disruptors. Major players like Saudi National Bank and Al Rajhi Bank, with substantial asset bases in early 2024, exert significant pressure on market share and margins. This rivalry necessitates continuous innovation and investment in digital capabilities to remain competitive.

| Competitor | Total Assets (Q1 2024, SAR billions) | Key Competitive Focus |

|---|---|---|

| Saudi National Bank | 974 | Digital transformation, retail and corporate banking |

| Al Rajhi Bank | 777 | Digital services, Islamic banking, retail expansion |

| Riyad Bank | 372 | Corporate finance, digital channels, wealth management |

| Saudi Awwal Bank | 345 | Digital offerings, corporate banking, international services |

SSubstitutes Threaten

The rapid proliferation of fintech solutions in Saudi Arabia presents a significant threat of substitution for traditional banks like Banque Saudi Fransi. Driven by government support and increasing tech adoption, these digital alternatives are capturing market share. By mid-2024, the Saudi Central Bank had licensed over 40 fintech companies, offering services ranging from digital payments and peer-to-peer lending to robo-advisory and micro-financing, directly challenging established banking models.

Large corporations are increasingly bypassing traditional bank loans by directly accessing capital markets. In 2024, Saudi Arabia's Tadawul All Share Index (TASI) saw significant activity, with companies raising substantial capital through equity and debt issuances, reflecting this growing trend.

This direct access to capital, facilitated by the deepening of Saudi capital markets, presents a potent substitute for commercial bank lending. For Banque Saudi Fransi (BSF), this signifies a direct threat to a core segment of its corporate banking revenue streams as clients seek alternative, potentially more cost-effective, financing solutions.

The rise of alternative investment and wealth management platforms presents a significant threat of substitutes for Banque Saudi Fransi. Customers now have access to a wider array of options beyond traditional banks, including fintech platforms, robo-advisors, and specialized asset managers.

These substitutes often provide more competitive fee structures and a broader range of investment products, including Shariah-compliant options, which can attract customers away from BSF's traditional offerings. For instance, the global robo-advisory market was projected to reach over $2.4 trillion in assets under management by 2024, highlighting the growing appeal of these digital alternatives.

Non-Bank Financial Institutions

Specialized non-bank financial institutions, like financing companies and remittance providers, present a threat by offering focused alternatives to traditional banking services. These entities can attract specific customer segments seeking niche solutions, potentially diverting business from Banque Saudi Fransi (BSF).

For instance, the growth of fintech companies offering digital payment and lending solutions highlights this trend. In 2023, the global fintech market was valued at approximately $1.1 trillion, with significant expansion expected in areas directly competing with bank services.

- Financing Companies: Offer specialized loans (e.g., auto, consumer) that can bypass traditional bank lending processes, potentially at more competitive rates for specific customer profiles.

- Remittance Service Providers: Companies like Western Union and MoneyGram provide efficient international money transfer services, posing a direct substitute for bank-based remittances, often with lower fees and faster processing times.

- Digital Payment Platforms: Services enabling peer-to-peer payments and online transactions offer convenience that can reduce reliance on bank accounts for everyday financial activities.

Potential Impact of Central Bank Digital Currencies (CBDCs)

The Saudi Central Bank (SAMA) is actively exploring the potential of a central bank digital currency (CBDC). This initiative could significantly reshape how payments are made, creating a new digital alternative to existing financial services.

A successful CBDC implementation could offer a direct digital substitute for commercial bank deposits and payment services. This might lead to disintermediation for traditional banks such as Banque Saudi Fransi in specific operational areas.

- CBDC Exploration: SAMA is actively researching the feasibility of a CBDC, a digital form of the national currency.

- Payment Landscape Shift: A widely adopted CBDC could offer a direct digital alternative to commercial bank deposits and payment services.

- Potential Disintermediation: This could lead to traditional banks like BSF being bypassed in certain payment functions.

- Early Stages: The development and potential adoption of a CBDC are still in their early phases.

The threat of substitutes for Banque Saudi Fransi (BSF) is multifaceted, stemming from evolving financial technologies and alternative capital access. Fintech solutions, offering digital payments, peer-to-peer lending, and robo-advisory, are directly challenging traditional banking services. By mid-2024, Saudi Arabia's fintech sector had seen over 40 licensed companies, indicating a robust competitive landscape.

Furthermore, corporations increasingly bypass traditional lending by tapping directly into capital markets. In 2024, Saudi companies actively raised significant funds through the Tadawul All Share Index (TASI), demonstrating a clear substitute for commercial bank financing, impacting BSF's corporate revenue streams.

Alternative investment platforms and specialized financial institutions also present substitutes. These entities often provide more competitive fees and a wider product range, attracting customers seeking tailored solutions. The global robo-advisory market, projected to exceed $2.4 trillion in assets under management by 2024, underscores this shift.

The potential introduction of a central bank digital currency (CBDC) by the Saudi Central Bank (SAMA) could further disintermediate banks by offering a direct digital alternative for deposits and payments.

| Substitute Category | Examples | Impact on BSF | 2024 Market Data/Projections |

|---|---|---|---|

| Fintech Solutions | Digital Payments, P2P Lending, Robo-Advisors | Challenges traditional banking services, potential revenue loss | Over 40 licensed fintechs in Saudi Arabia by mid-2024 |

| Capital Markets | Equity & Debt Issuances | Direct financing alternative for corporations, reducing reliance on bank loans | Significant capital raised by Saudi companies on TASI in 2024 |

| Alternative Investment Platforms | Robo-Advisors, Specialized Asset Managers | Attracts customers with competitive fees and diverse products | Global robo-advisory market projected over $2.4 trillion AUM by 2024 |

| Central Bank Digital Currency (CBDC) | Digital form of national currency | Potential disintermediation in payments and deposits | SAMA actively exploring CBDC feasibility |

Entrants Threaten

High regulatory hurdles and licensing requirements act as a significant barrier to entry in the Saudi banking sector. The Saudi Central Bank (SAMA) mandates comprehensive licenses and strict capital adequacy ratios, making it a costly and complex process for new entrants. For instance, in 2024, SAMA continued to emphasize robust risk management frameworks and digital operational resilience, adding layers of compliance for any aspiring financial institution.

Establishing a competitive bank in Saudi Arabia requires immense capital. This includes building cutting-edge technological infrastructure, ensuring secure digital platforms, and potentially a physical branch network, even for digital-only banks. These substantial upfront costs act as a major deterrent for newcomers.

In 2024, the Saudi banking sector continued to see significant investment. For instance, the total assets of Saudi banks reached SAR 3.7 trillion by the end of Q1 2024, indicating the scale of capital required to operate within this market. Such high capital demands naturally limit the number of new players that can realistically enter and compete effectively.

Established brand loyalty and customer trust represent a significant barrier to new entrants in the Saudi banking sector. Major incumbent banks like Banque Saudi Fransi (BSF) leverage decades of operation to cultivate deep-rooted customer relationships and a strong reputation for reliability. For instance, BSF reported a net profit of SAR 3,257 million in 2023, underscoring its stable financial footing and continued customer engagement.

Newcomer banks must invest heavily in marketing and customer acquisition to even begin to chip away at this ingrained loyalty. Building credibility and trust from the ground up is a lengthy and resource-intensive process, often requiring substantial incentives and superior service offerings to attract customers away from established providers. The high levels of customer satisfaction reported by many existing banks further amplify this challenge.

Need for Extensive Distribution Networks and Talent Acquisition

The need for extensive distribution networks, encompassing both physical branches and sophisticated digital platforms, presents a significant barrier for new entrants aiming to serve Saudi Arabia's diverse population. This is particularly true in banking, where trust and accessibility remain paramount. For instance, in 2024, traditional banking still held a strong presence, with many customers preferring in-person interactions for complex transactions or advice, making it costly for newcomers to replicate an established physical footprint.

Furthermore, attracting and retaining top talent is a formidable hurdle. The Saudi banking sector, like many globally, requires specialized expertise in areas such as digital transformation, cybersecurity, and regulatory compliance. In 2024, competition for these skilled professionals was intense, with established institutions like Banque Saudi Fransi investing heavily in employee development and competitive compensation packages, making it difficult for new players to build a comparable talent pool quickly.

- Distribution Network Costs: Establishing and maintaining a widespread network of branches or a robust digital infrastructure requires substantial capital investment, a significant barrier for new entrants.

- Talent Acquisition Challenges: The demand for skilled financial professionals, particularly in technology and compliance, drives up recruitment costs and intensifies competition for talent.

- Brand Recognition and Trust: New entrants must overcome the established trust and brand recognition of incumbent banks, which often rely on extensive customer relationships built over years through their distribution channels.

- Regulatory Compliance Expertise: Navigating complex financial regulations in Saudi Arabia necessitates specialized legal and compliance talent, which is often scarce and expensive to acquire.

Government Support for Fintech Startups and Regulatory Sandboxes

The Saudi government's commitment to fostering fintech innovation, exemplified by initiatives like Fintech Saudi and the establishment of regulatory sandboxes, significantly lowers entry barriers. These controlled environments allow new players to test and refine their offerings, potentially disrupting established financial services.

The Saudi Central Bank (SAMA) has been actively promoting fintech development, with regulatory sandboxes providing a crucial testing ground. For instance, by the end of 2023, SAMA had onboarded numerous fintech companies into its regulatory sandbox, facilitating the introduction of novel financial products and services.

- Government-backed initiatives like Fintech Saudi actively encourage new entrants.

- Regulatory sandboxes reduce the risk for startups testing innovative financial solutions.

- This supportive environment can lead to specialized fintech players gaining market share.

The threat of new entrants in the Saudi banking sector, while generally moderate, is influenced by significant capital requirements and stringent regulatory oversight. Established players like Banque Saudi Fransi benefit from strong brand loyalty and extensive distribution networks, making it challenging for newcomers to gain traction. However, government support for fintech innovation and regulatory sandboxes are lowering some entry barriers, potentially introducing specialized competitors.

The Saudi Central Bank (SAMA) continues to enforce robust capital adequacy ratios, requiring substantial financial backing for any new banking institution. For example, in 2024, SAMA's focus on digital operational resilience adds another layer of investment for aspiring entrants. The total assets of Saudi banks reached approximately SAR 3.7 trillion by the end of Q1 2024, illustrating the immense scale of capital involved.

| Factor | Impact on New Entrants | Example/Data Point (2023-2024) |

|---|---|---|

| Regulatory Hurdles | High | SAMA mandates strict licensing and capital requirements. |

| Capital Requirements | High | Total Saudi bank assets ~SAR 3.7 trillion (Q1 2024). |

| Brand Loyalty | Significant | Banque Saudi Fransi's 2023 net profit of SAR 3,257 million indicates strong customer engagement. |

| Fintech Support | Moderate Reduction | SAMA's regulatory sandbox onboarded numerous fintechs by end of 2023. |

Porter's Five Forces Analysis Data Sources

Our analysis of Banque Saudi Fransi's competitive landscape is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the Saudi Central Bank and Tadawul. We also incorporate insights from reputable industry research reports and economic data from sources like the World Bank to provide a comprehensive view.