Banque Saudi Fransi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banque Saudi Fransi Bundle

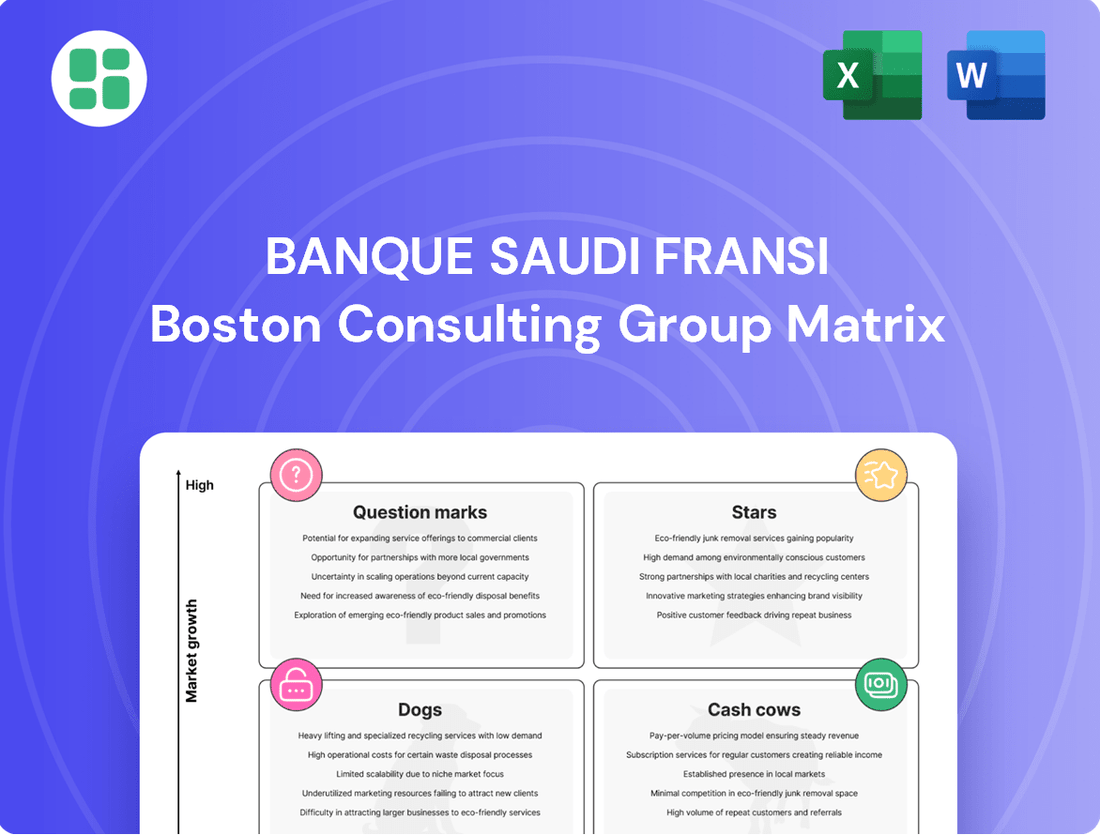

Curious about Banque Saudi Fransi's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. Ready to unlock actionable insights? Purchase the full BCG Matrix to understand precisely which products are Stars, Cash Cows, Dogs, or Question Marks, and gain a clear roadmap for optimizing your investments.

Stars

The Digital Banking Platform for Banque Saudi Fransi (BSF) is a strong contender in the BCG matrix, likely categorized as a Star. BSF's substantial investments in digital transformation, including its omnichannel app and core banking system, are designed for sustained growth. This aligns with the booming fintech market in Saudi Arabia, where digital wallet adoption and mobile app usage are experiencing robust expansion, creating a fertile ground for digital banking innovation.

BSF's commitment to leading the digital space is exemplified by the May 2025 launch of its next-generation digital banking platform, developed in partnership with Backbase. This initiative underscores BSF's strategic focus on capturing a significant share of the rapidly growing digital financial services market, positioning it for future success.

Banque Saudi Fransi's investment portfolio demonstrated robust growth, expanding by 24% in 2024. This surge was significantly fueled by increased gains from non-trading investments, highlighting the effectiveness of the bank's investment strategies.

This performance suggests a strong market reception for specific investment products, likely those strategically aligned with Saudi Vision 2030 objectives. The bank's success in this segment points to a growing demand and expanding market share for these high-growth opportunities.

Banque Saudi Fransi (BSF) is strategically positioned to support Saudi Arabia's Vision 2030 by offering robust corporate banking solutions. The bank's deep understanding of the Saudi market and its commitment to national development align perfectly with the ambitious goals of Vision 2030, enabling it to capture significant market share in key growth areas.

BSF's corporate banking services, particularly project finance and specialized lending for mega-projects, are poised for high market share. For instance, in 2023, Saudi Arabia's non-oil GDP growth reached 4.5%, indicating a strong demand for financing large-scale developments that BSF is well-equipped to provide.

The bank's alignment with Saudi Arabia's economic diversification strategy, a cornerstone of Vision 2030, solidifies its corporate banking offerings as high-growth, high-market share assets. This strategic focus ensures BSF remains a dominant player in financing the Kingdom's transformative projects.

Specialized Treasury Services

Banque Saudi Fransi's (BSF) specialized treasury services, encompassing trading, investment securities, and money market operations, are a substantial contributor to its overall operating income. In 2024, the bank's robust financial performance and the evolving Saudi Arabian financial sector indicate a strong demand for innovative treasury products.

These specialized offerings, designed for corporate clients seeking advanced hedging and liquidity management, are likely positioned for market leadership. BSF's strategic focus on these areas aligns with the growing need for sophisticated financial solutions in the region.

- Trading Activities: BSF's treasury trading desk actively participates in currency and interest rate markets, generating revenue from market movements and client facilitation.

- Investment Securities: The bank manages a diverse portfolio of investment securities, contributing to its net interest income and capital appreciation.

- Money Market Operations: BSF engages in short-term lending and borrowing, ensuring liquidity and optimizing its funding costs.

- Client Solutions: Specialized products like bespoke hedging strategies and tailored liquidity management tools are in high demand among corporate clients navigating market volatility.

Wealth Management for High Net Worth Clients

Banque Saudi Fransi (BSF) strategically targets the high net worth (HNW) segment through its subsidiary, Sur Multi Family Office Limited. This focus aligns with the growing trend of substantial individual investment portfolios within Saudi Arabia.

The increasing sophistication of financial tools available to affluent individuals in 2024 suggests that personalized wealth management solutions for this segment are likely a high-growth, high-market share area for BSF. This positions wealth management for HNW clients as a potential Star within the BCG Matrix.

- Strategic Focus: BSF's dedicated subsidiary for HNW clients underscores a commitment to this lucrative market.

- Market Trends: The rise in individual investment portfolios in Saudi Arabia supports the growth potential of wealth management services.

- Competitive Advantage: Personalized, sophisticated financial solutions can differentiate BSF in the HNW segment.

- Growth Potential: This segment represents a key opportunity for BSF to capture significant market share and revenue.

Stars represent business units with high growth and high market share, demanding significant investment but also generating substantial returns. Banque Saudi Fransi's digital banking platform, its corporate banking solutions supporting Vision 2030, and its wealth management services for high-net-worth individuals are strong candidates for Star status. These areas are characterized by robust market growth and BSF's strategic positioning to capture a leading share.

| Business Unit | Market Growth | Market Share | Rationale |

|---|---|---|---|

| Digital Banking Platform | High | High | Significant investment in next-gen platform, booming fintech market in KSA. |

| Corporate Banking (Vision 2030 aligned) | High | High | Strong demand for project finance, non-oil GDP growth supports financing needs. |

| Wealth Management (HNW Segment) | High | High | Growing HNW segment, increasing sophistication of financial tools, dedicated subsidiary. |

What is included in the product

Highlights which Banque Saudi Fransi units to invest in, hold, or divest based on market share and growth.

The Banque Saudi Fransi BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Traditional retail banking deposits and loans, including current and savings accounts and consumer loans, are Banque Saudi Fransi's (BSF) cash cows. This segment benefits from a substantial existing customer base and typically demands less promotional investment than newer products, ensuring consistent, high-margin cash flow due to its established market position.

Established Corporate Lending represents a significant Cash Cow for Banque Saudi Fransi (BSF) within its BCG Matrix. The bank leverages its long-standing relationships with large, stable corporate clients, securing a high market share in corporate banking through general purpose loans and credit facilities.

These mature lending portfolios are a cornerstone of BSF's profitability, generating predictable interest income with relatively lower growth costs. For instance, in 2024, BSF reported a substantial increase in its net interest income, largely driven by its robust corporate lending segment, underscoring the consistent cash flow these operations provide.

Banque Saudi Fransi's basic payment processing services, encompassing debit and credit card transactions at points of sale, represent a classic cash cow. This segment operates in a mature, low-growth market but generates consistent, substantial revenue through a high volume of daily transactions, a testament to its established market share.

In 2024, the Saudi Arabian payment processing market continued its steady growth, driven by digital transformation initiatives. While specific figures for BSF's market share in this segment are not publicly detailed, the overall increase in digital payments in the Kingdom, with e-commerce transactions alone expected to reach over SAR 70 billion by the end of 2024, underscores the consistent demand for these foundational banking services.

Conventional Trade Finance

Conventional trade finance services are a bedrock offering for Banque Saudi Fransi (BSF), crucial for facilitating import and export operations for its corporate clientele. These services, though in a mature market, command a significant market share for BSF, largely due to deep-rooted client relationships and the persistent demand for secure cross-border transactions.

These mature offerings are known for generating stable fee and commission income, contributing consistently to the bank's overall revenue. For instance, in 2024, trade finance volumes for Saudi banks generally saw robust activity, driven by increased global trade and government initiatives supporting non-oil exports. BSF's established presence in this segment allows it to capitalize on these trends.

- Stable Revenue Stream: Trade finance consistently provides predictable fee and commission income for BSF.

- High Market Share: BSF maintains a strong position due to long-standing corporate relationships.

- Essential Service: These services are fundamental for clients engaged in international trade activities.

- 2024 Market Context: The Saudi trade finance sector experienced healthy growth in 2024, benefiting BSF's established operations.

Basic Shari'ah-Compliant Products

Banque Saudi Fransi's basic Shari'ah-compliant products represent established cash cows. These offerings, including Murabaha and Ijarah, are approved by the bank's Shari'ah Committee and serve a substantial portion of the Saudi market. Their consistent performance, driven by religious adherence and deep-seated customer trust, ensures stable returns for the bank.

These foundational Islamic banking services have a well-entrenched customer base, contributing significantly to BSF's revenue streams. The bank's commitment to Shari'ah principles, verified by its committee, underpins the enduring appeal and reliability of these products. As of the first quarter of 2024, BSF reported a net profit of SAR 3.4 billion, with its Islamic banking segment playing a crucial role in this performance.

- Established Product Suite: Murabaha (cost-plus financing) and Ijarah (leasing) are core offerings with proven demand.

- Stable Customer Base: Religious adherence and long-term trust foster customer loyalty, ensuring consistent revenue.

- Consistent Returns: These products act as reliable income generators, contributing to the bank's overall profitability.

- Market Share Maintenance: BSF's adherence to Shari'ah compliance solidifies its position in the significant Islamic finance market in Saudi Arabia.

Banque Saudi Fransi's (BSF) traditional retail banking, encompassing deposits and consumer loans, stands as a prime example of a cash cow. This segment benefits from a vast, loyal customer base and requires minimal new investment, ensuring steady, high-margin profits. The bank's established market presence in these core services translates into predictable and substantial cash flow, a vital component of its financial strength.

Established corporate lending and basic payment processing services are also key cash cows for BSF. These mature offerings, supported by long-standing client relationships and high transaction volumes, generate consistent fee and commission income. In 2024, BSF's performance, particularly its net interest income and the overall growth in Saudi digital payments, highlights the enduring profitability of these foundational banking activities.

Conventional trade finance and Shari'ah-compliant products like Murabaha and Ijarah further solidify BSF's cash cow portfolio. These services cater to persistent market demand, leveraging deep client trust and religious adherence to ensure stable revenue streams. The bank's solid performance in early 2024, with a net profit of SAR 3.4 billion, underscores the consistent contribution of these mature, reliable offerings.

What You’re Viewing Is Included

Banque Saudi Fransi BCG Matrix

The Banque Saudi Fransi BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase, offering an immediate and comprehensive strategic overview. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready document designed for professional application. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain. Once purchased, this BCG Matrix will be instantly accessible for your business planning, competitive analysis, or presentation needs.

Dogs

Banque Saudi Fransi (BSF) operates a substantial network of 80-87 physical branches across Saudi Arabia. However, certain services within these branches, especially those readily available through digital platforms, might be experiencing low growth and a shrinking market share.

These underutilized physical branch services, if not strategically repositioned towards advisory roles or specialized customer needs, risk becoming costly liabilities. High operational expenses associated with maintaining these services could outweigh the declining customer engagement, potentially turning them into cash traps for the bank.

Outdated legacy banking software and systems at Banque Saudi Fransi (BSF) are likely considered Dogs in the BCG Matrix. These systems, often not integrated with BSF's modern omnichannel digital app or core banking infrastructure, face low growth potential and incur high maintenance expenses. Their inefficiency significantly hampers overall operational performance, making turnaround investments generally unproductive.

Niche, low-demand investment funds often represent the Dogs in a portfolio, characterized by a small market share and little to no growth prospects. These funds might be linked to obsolete market trends or have failed to attract investor interest, leading to underperformance and inefficient capital allocation.

For instance, a hypothetical fund focused on a very specific, declining technology sector from the early 2000s might fit this description. In 2024, such a fund could show a market share of less than 0.1% within its broader asset class, with its net asset value (NAV) stagnating or declining year-over-year.

Inefficient Paper-Based Processes

Inefficient paper-based processes within Banque Saudi Fransi (BSF), particularly in areas like customer onboarding and loan applications, would likely fall into the 'Dogs' quadrant of the BCG Matrix. These represent low growth and low efficiency. For instance, if a significant portion of new account openings still requires manual form filling and physical document submission, this is a clear indicator of such inefficiencies.

In today's rapidly digitizing financial landscape, these manual processes directly translate to higher operational costs due to increased labor and potential for errors. Furthermore, they negatively impact customer satisfaction, as clients expect faster, more streamlined digital experiences. By mid-2024, the Saudi banking sector has seen a significant push towards digital transformation, with many competitors offering fully digital onboarding processes.

- High Operational Costs: Manual processing of paper documents can incur substantial costs related to printing, storage, and administrative labor.

- Low Customer Satisfaction: Customers increasingly prefer swift, digital interactions, making paper-based processes a source of frustration and dissatisfaction.

- Competitive Disadvantage: Banks maintaining heavily paper-based workflows lag behind digitally agile competitors, potentially losing market share.

- Regulatory Compliance Risk: Managing and securely storing physical documents can present greater challenges for regulatory compliance compared to digital systems.

Poorly Adopted Niche Financial Advisory Services

Poorly adopted niche financial advisory services, such as highly specialized wealth management for a very specific demographic or unique alternative investment guidance, can find themselves in the Dogs quadrant of the BCG Matrix. These offerings might possess a low market share due to limited demand or ineffective marketing. For instance, if Banque Saudi Fransi (BSF) launched a service focused on advising on rare art investments, and it only attracted a handful of clients, its market share would be minimal.

Such services often exhibit slow growth because the niche they cater to is either too small or not yet receptive to the offering. If BSF's specialized advisory for expatriate entrepreneurs in Saudi Arabia, for example, has seen very few new clients sign up in 2024, it indicates slow market penetration. These "Dogs" can become resource drains, breaking even or even incurring losses without generating substantial revenue or strategic advantage.

- Low Market Share: Services like advising on emerging market sovereign debt for retail investors might have a minimal client base.

- Slow Growth: A specialized service for managing digital asset portfolios for high-net-worth individuals may not see significant uptake in 2024 if regulatory clarity is lacking.

- Resource Consumption: These offerings can tie up valuable advisor time and marketing budgets without a clear path to profitability.

- Break-Even or Loss: If a niche advisory service generates less revenue than its operational costs, it falls into this category, potentially requiring strategic review.

Dogs within Banque Saudi Fransi's portfolio represent services or products with low market share and low growth potential. These are often characterized by declining relevance or high operational costs that outweigh their revenue generation. For example, legacy systems or inefficient manual processes that haven't kept pace with digital advancements clearly fit this category.

These "Dogs" can drain resources and hinder overall bank performance. Identifying and strategically managing these areas is crucial for optimizing capital allocation and improving efficiency. By mid-2024, many financial institutions are actively divesting or overhauling such underperforming assets to focus on more promising growth areas.

Consider the example of a niche, low-demand investment fund. In 2024, such a fund might hold a market share of less than 0.1% within its asset class, with its Net Asset Value (NAV) stagnating or declining, indicating a classic "Dog" profile.

Similarly, paper-based customer onboarding processes, prevalent in some banking operations, represent significant inefficiencies. If a bank still relies heavily on manual form filling and physical document submission, it faces higher operational costs and lower customer satisfaction compared to competitors offering fully digital solutions, a trend heavily emphasized in the Saudi banking sector by mid-2024.

| Category | BSF Example | Market Share (Illustrative 2024) | Growth Potential | Key Concerns |

| Legacy Systems | Outdated core banking software | Low (Internal) | Very Low | High maintenance, integration issues, operational inefficiency |

| Inefficient Processes | Paper-based loan applications | Low (Customer-facing) | Low | High operational cost, slow processing, poor customer experience |

| Underperforming Products | Niche, low-demand investment funds | < 0.1% | Stagnant/Declining | Low investor interest, capital inefficiency |

| Low-Adoption Services | Specialized wealth management for very specific demographics | Minimal | Slow | Limited client base, resource drain, low ROI |

Question Marks

Banque Saudi Fransi's (BSF) foray into emerging fintech partnerships, likely spearheaded by Saudi Fransi Digital Ventures (SFDV), positions it within a high-growth sector. The Saudi fintech market is experiencing significant expansion; for instance, the number of fintech companies operating in Saudi Arabia grew by approximately 30% in 2023, reaching over 150 entities, according to the Saudi Central Bank. This engagement taps into a dynamic and rapidly evolving landscape.

These new ventures, by their very nature, are likely to have a low current market share in the broader financial services industry. Significant investment will be necessary to nurture these nascent businesses, driving user adoption and scaling their operations. The inherent uncertainty surrounding the success of new market entrants means these initiatives are characteristic of a '?' in the BCG matrix, demanding careful strategic consideration and resource allocation.

Banque Saudi Fransi (BSF) is strategically positioning itself in the burgeoning ESG-linked financial products market, recognizing its alignment with Saudi Vision 2030 and the growing global demand for sustainable finance. These products, such as green loans and sustainable investment funds, represent a significant growth opportunity for BSF.

While the market for ESG-linked products is experiencing rapid expansion, with global sustainable debt issuance reaching an estimated $1.5 trillion in 2024, BSF's current market share in this specific segment is likely modest. This is primarily due to the relative newness of these offerings and the ongoing need for market education and broader investor adoption.

Banque Saudi Fransi's advanced AI-powered banking solutions, such as predictive analytics for wealth management and AI-driven customer service, fall into the question mark category of the BCG matrix. These represent a high-growth frontier in financial services.

While the potential for these AI solutions is immense, Banque Saudi Fransi's current market share in these nascent areas may be low. This necessitates significant investment to establish a leading position and capitalize on future growth opportunities.

For context, the global AI in financial services market was valued at approximately $10.6 billion in 2023 and is projected to grow substantially, with some estimates suggesting it could reach over $26.7 billion by 2028. This rapid expansion highlights the strategic importance of these AI-driven offerings for BSF.

Open Banking-Enabled Services

The burgeoning open banking ecosystem in Saudi Arabia presents a significant opportunity for Banque Saudi Fransi (BSF). Services that effectively utilize open APIs for seamless integration with third-party providers or deliver highly personalized financial insights are poised for substantial growth. These offerings, by enabling innovative customer experiences and potentially new revenue streams, would likely be classified as Stars or Question Marks within the BCG matrix, depending on their current market penetration and growth potential.

BSF's strategic focus on developing and promoting these open banking-enabled services requires considerable investment to secure a strong market position. For instance, the Saudi Central Bank (SAMA) has been actively driving open banking adoption, with initial phases focusing on data sharing and payment initiation. By July 2025, the market is expected to see a significant increase in the number of fintechs and third-party providers actively leveraging these frameworks, creating a competitive yet rewarding landscape for early adopters like BSF.

- Stars: BSF services offering embedded finance solutions through partnerships, allowing customers to access banking functionalities within non-financial apps, demonstrating high market share in a rapidly growing open banking sector.

- Question Marks: Innovative personalized financial management tools powered by open APIs, which have the potential for high growth but currently hold a low market share, necessitating strategic investment to determine their future success.

- Investment Rationale: Capturing market share in the open banking space requires significant upfront investment in technology infrastructure, regulatory compliance, and marketing to build brand awareness and customer trust for these new service offerings.

- Market Growth Drivers: The increasing adoption of digital payments, a growing demand for personalized financial advice, and supportive regulatory initiatives from SAMA are key factors fueling the growth of open banking-enabled services in Saudi Arabia.

Targeted Digital Micro-Lending Platforms

Targeted digital micro-lending platforms represent a burgeoning sector, especially for those serving previously unbanked or niche business communities. As of early 2024, the global fintech lending market, encompassing micro-lending, was projected to reach over $6 trillion by 2030, indicating substantial growth potential. Banque Saudi Fransi (BSF) engaging in or considering these platforms places them in a high-potential, but likely low-market-share, position within the BCG matrix, akin to a 'Question Mark'.

BSF's involvement in digital micro-lending would necessitate significant investment in technology, customer acquisition, and risk management to scale effectively. The Saudi Arabian fintech market itself is experiencing rapid expansion, with the number of licensed fintech companies growing significantly in recent years, signaling a receptive environment for such innovations. To move these initiatives from 'Question Marks' to 'Stars', BSF would need to focus on differentiated offerings and efficient digital onboarding processes.

- Market Growth: The digital lending market, including micro-lending, is experiencing robust expansion, driven by increased digital penetration and demand for accessible credit.

- BSF's Position: BSF's presence in this area is likely nascent, positioning these ventures as 'Question Marks' requiring strategic capital allocation.

- Investment Needs: Significant investment in technology, marketing, and operational efficiency is crucial for these platforms to gain market traction.

- Saudi Fintech Landscape: The supportive regulatory environment and growing fintech ecosystem in Saudi Arabia provide a favorable backdrop for BSF's digital micro-lending initiatives.

Banque Saudi Fransi's (BSF) strategic investments in emerging digital payment solutions, such as innovative mobile wallets and cross-border payment platforms, place them in the 'Question Mark' category of the BCG matrix. These ventures operate in a high-growth market, with the global digital payments market projected to exceed $15 trillion by 2027, according to Statista. However, BSF's current market share in these specific, often rapidly evolving, digital payment niches is likely to be relatively low.

Significant capital infusion is required to build brand recognition, enhance user experience, and achieve widespread adoption for these new payment technologies. The success of these initiatives hinges on BSF's ability to capture a substantial portion of the growing digital payment user base and differentiate its offerings in a competitive landscape. As of early 2024, Saudi Arabia's digital payment transaction volume has seen a significant uptick, underscoring the potential for these 'Question Marks' to mature into 'Stars' with the right strategic execution and investment.

| Category | Description | BSF's Position | Market Growth | Investment Rationale |

| Question Marks | Emerging digital payment solutions | Low current market share, high growth potential | Global digital payments market to exceed $15 trillion by 2027 | Requires significant investment to gain market traction and achieve scale |

BCG Matrix Data Sources

Our Banque Saudi Fransi BCG Matrix leverages official financial disclosures, extensive market research reports, and competitive landscape analysis to provide a comprehensive view of product performance and market share.