Brookline Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

Navigate the complex external landscape impacting Brookline Bank with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a strategic advantage by uncovering opportunities and mitigating risks. Download the full PESTLE analysis now to empower your decision-making and secure a competitive edge.

Political factors

Brookline Bank, like all financial institutions, navigates a complex web of federal and state government regulations. The Federal Reserve and the Massachusetts Division of Banks, for instance, set critical guidelines for capital adequacy, lending standards, and consumer safeguards. These regulatory frameworks are dynamic; in 2024, for example, banks continued to adapt to evolving cybersecurity mandates and updated fair lending practices, which can influence operational expenses and strategic planning.

Federal Reserve monetary policy shifts, particularly interest rate adjustments, are critical for Brookline Bank, affecting its ability to set competitive lending and deposit rates. These decisions directly shape the bank's profitability through its net interest margin.

Looking ahead to 2025, market forecasts indicate a potential beginning of Federal Reserve rate cuts around September. Such a move could lead to lower borrowing costs for customers, potentially boosting loan demand, but also compressing the bank's interest income on its loan portfolio.

Massachusetts' tax policies significantly shape the operating environment for Brookline Bank and its customers. For fiscal year 2025, a notable change is the repeal of deductions for interest and dividends earned from Massachusetts banks. This alteration could potentially impact how local residents choose to save, making certain investment vehicles less attractive compared to alternatives outside the state.

Political Stability and Business Confidence

Political stability is a cornerstone for business confidence, directly influencing economic activity and the demand for banking services. In 2024, the United States, where Brookline Bank operates, maintained a generally stable political landscape at the federal level, though regional policy shifts can still create ripples. For instance, evolving state-level regulations on lending or financial technology can impact how banks like Brookline operate and serve their clients.

Government policies, both national and state, play a crucial role in shaping the business environment. Federal Reserve interest rate decisions, influenced by political considerations, directly affect borrowing costs and thus demand for loans. In 2024, the Federal Reserve maintained a cautious approach to rate adjustments, aiming to balance inflation control with economic growth, which indirectly affects the lending market Brookline Bank serves.

Trade policies can also have an indirect but significant impact. Changes in tariffs or international trade agreements can affect regional businesses that rely on imports or exports. Such shifts can influence their financial health and their need for commercial loans or international banking services, areas relevant to Brookline Bank's commercial client base.

- Federal Reserve Policy: In 2024, the Federal Reserve's monetary policy, aimed at managing inflation and employment, directly influenced interest rates, impacting loan demand.

- State-Level Regulation: Variations in state-specific financial regulations can create diverse operating environments for banks, affecting compliance costs and service offerings.

- Trade Impact: Evolving trade policies can influence the financial stability of regional businesses, thereby affecting their borrowing needs and the demand for commercial banking services.

Regulatory Compliance Burden

Brookline Bank, like all financial institutions, faces a growing regulatory compliance burden. The sheer volume and intricacy of banking laws, from consumer protection to capital requirements, demand substantial resources for adherence. This includes investing in technology, legal counsel, and skilled compliance personnel to navigate the evolving landscape effectively.

Failure to comply with these regulations can have severe consequences. For instance, in 2023, the U.S. banking sector saw significant penalties for compliance failures, with some institutions facing fines in the tens of millions of dollars. Such penalties not only impact profitability but also damage a bank's reputation, eroding customer trust and potentially affecting market share.

The increasing complexity means Brookline Bank must continually adapt its internal processes and systems. This includes areas such as:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures

- Data privacy regulations (e.g., CCPA, GDPR if applicable to international operations)

- Capital adequacy ratios and stress testing requirements

- Consumer lending and fair lending practices

These ongoing investments in compliance are essential for operational stability and long-term viability, directly impacting the bank's operational costs and strategic decision-making.

Government fiscal policies, including tax rates and government spending, directly influence the economic climate in which Brookline Bank operates. Changes in tax laws, such as those affecting businesses or individuals, can alter disposable income and investment behavior, impacting loan demand and deposit levels. For instance, the Massachusetts fiscal year 2025 budget includes provisions that could affect the tax treatment of certain financial instruments, influencing customer choices.

Political stability and government effectiveness are crucial for fostering a predictable business environment. In 2024, the U.S. political landscape, while experiencing typical partisan debates, maintained a general stability that supported economic activity. However, potential legislative changes, particularly concerning financial sector regulation or economic stimulus, could introduce uncertainty for banks like Brookline.

The Federal Reserve's monetary policy decisions, often influenced by political objectives to manage inflation and employment, are paramount. As of mid-2024, the Fed's stance on interest rates directly impacts borrowing costs and the bank's net interest margin. Projections for late 2024 and into 2025 suggest a cautious approach to rate adjustments, with markets anticipating potential cuts later in 2025, which would reshape the lending landscape.

| Policy Area | 2024/2025 Impact | Brookline Bank Relevance |

|---|---|---|

| Federal Reserve Interest Rates | Anticipated cuts in late 2025, following a period of stability in 2024. | Affects loan origination volume and net interest margin. |

| Massachusetts Tax Law | Repeal of certain deductions for interest/dividends from MA banks (FY25). | May influence customer savings preferences and deposit growth. |

| Financial Regulation | Ongoing adaptation to cybersecurity and fair lending mandates. | Impacts compliance costs and operational strategies. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Brookline Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into emerging trends and potential challenges, equipping stakeholders with the knowledge to navigate the evolving landscape and formulate effective strategies.

A Brookline Bank PESTLE analysis provides a clear, summarized version of external factors for easy referencing during meetings, relieving the pain point of navigating complex market dynamics.

Economic factors

Fluctuations in interest rates, largely driven by the Federal Reserve's monetary policy, significantly influence Brookline Bank's profitability. For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a factor that directly affects the bank's net interest income.

Looking ahead, some economists anticipate potential rate cuts by late 2025. While lower rates could reduce borrowing costs for consumers and businesses, potentially boosting loan demand, they also tend to compress net interest margins for banks like Brookline Bank, as the yield on assets may fall faster than the cost of liabilities.

The economic vitality of Greater Boston is a key driver for Brookline Bank. In early 2025, Massachusetts' GDP growth is projected to trail the national average, but the region's robust technology and life sciences industries offer significant resilience.

These sectors, known for innovation and investment, are expected to continue attracting capital and talent, bolstering commercial lending opportunities for Brookline Bank. Furthermore, the ongoing demand for housing in this desirable metropolitan area supports a healthy residential mortgage market.

The Greater Boston real estate market, a key area for Brookline Bank's mortgage and commercial lending, is projected to maintain its challenging environment in 2025. Expect persistently low inventory levels and elevated property prices to continue, with certain sub-markets anticipating further price appreciation.

For instance, median home prices in the Greater Boston area reached approximately $950,000 in early 2025, a figure that has seen consistent year-over-year increases, reflecting the ongoing demand outpacing supply.

Commercial real estate, particularly in sought-after urban and suburban hubs, also faces similar pressures, with vacancy rates remaining tight in prime locations, driving up rental costs and property values.

Consumer Spending and Debt Levels

Consumer spending habits and household debt levels significantly influence demand for Brookline Bank's retail banking products, such as consumer loans and deposit accounts. In the first quarter of 2024, U.S. consumer spending increased at a 3.4% annualized rate, showing resilience. However, household debt levels, particularly credit card debt, reached a record $1.13 trillion in Q1 2024, according to the Federal Reserve Bank of New York. This trend suggests a potential for increased demand for debt consolidation or refinancing services, but also a heightened risk of defaults if economic conditions worsen.

Economic volatility and uncertainty directly impact consumer confidence and spending patterns, which in turn affect the banking sector. For instance, persistent inflation concerns throughout 2024 have led some consumers to reduce discretionary spending, potentially lowering demand for credit products. Conversely, a strong labor market, with U.S. unemployment rates hovering around 3.9% in mid-2024, provides a cushion for consumer spending, supporting deposit growth and the need for transactional banking services.

- Consumer Spending Growth: U.S. consumer spending rose 3.4% annually in Q1 2024.

- Record Household Debt: U.S. credit card debt hit $1.13 trillion in Q1 2024.

- Unemployment Stability: U.S. unemployment remained around 3.9% in mid-2024.

- Inflationary Impact: Inflationary pressures in 2024 may temper discretionary spending.

Inflation and Purchasing Power

Inflation significantly impacts purchasing power, a key consideration for Brookline Bank. Nationally, the Consumer Price Index (CPI) saw a notable increase, with annual inflation reaching 3.4% as of April 2024. Within the Boston metropolitan area, inflation trends often mirror or slightly exceed national figures, affecting consumer spending habits and business operating expenses. This erosion of purchasing power means consumers may have less discretionary income, potentially influencing loan demand and deposit behavior.

For Brookline Bank, rising inflation presents a dual challenge. While higher inflation can spur demand for loans as businesses and individuals seek to finance purchases before prices rise further, it also poses a risk to deposit values. If interest rates on deposits do not adequately keep pace with inflation, the real return for depositors diminishes, potentially leading to outflows or a shift towards higher-yield, albeit riskier, investments.

- National CPI: 3.4% annual increase as of April 2024.

- Boston Metro Inflation: Generally aligns with or slightly exceeds national trends, impacting local purchasing power.

- Consumer Impact: Reduced discretionary income due to rising costs of goods and services.

- Bank Impact: Potential for increased loan demand versus eroded real value of deposits if interest rates lag inflation.

Interest rate trends, influenced by the Federal Reserve's policy, are crucial for Brookline Bank's earnings. The Fed's decision to hold rates steady at 5.25%-5.50% through early 2024 directly impacts the bank's net interest income, with potential rate cuts anticipated by late 2025.

The economic health of Greater Boston, particularly its strong tech and life sciences sectors, supports commercial lending and mortgage demand for Brookline Bank, despite projected GDP growth trailing the national average in early 2025. The local real estate market, characterized by low inventory and high prices, with median home prices around $950,000 in early 2025, continues to present opportunities and challenges.

Consumer spending, up 3.4% annually in Q1 2024, and record household credit card debt of $1.13 trillion in the same period, influence retail banking demand and risk for Brookline Bank. While a stable labor market, with unemployment near 3.9% in mid-2024, bolsters spending, persistent inflation, at 3.4% nationally in April 2024, erodes purchasing power and impacts deposit values.

| Economic Factor | Key Data Point (Early 2024 - Mid 2025) | Impact on Brookline Bank |

|---|---|---|

| Interest Rates | Federal Reserve Rate: 5.25%-5.50% (early 2024); potential cuts late 2025. | Affects net interest margins and loan demand. |

| Regional Economy (Greater Boston) | Projected GDP growth trails national average; strong tech/life sciences sectors. | Supports commercial lending and mortgage markets; resilience in key industries. |

| Real Estate Market (Greater Boston) | Median Home Price: ~$950,000 (early 2025); low inventory, high prices. | Drives mortgage origination volume; potential for price appreciation. |

| Consumer Spending & Debt | Consumer Spending: +3.4% (Q1 2024); Credit Card Debt: $1.13 trillion (Q1 2024). | Influences demand for retail products; signals potential for debt consolidation services and default risk. |

| Inflation | National CPI: +3.4% (April 2024); Boston metro inflation often higher. | Impacts purchasing power, potentially increasing loan demand but eroding real deposit returns. |

| Unemployment | U.S. Unemployment: ~3.9% (mid-2024). | Provides a cushion for consumer spending, supporting deposit growth. |

Preview Before You Purchase

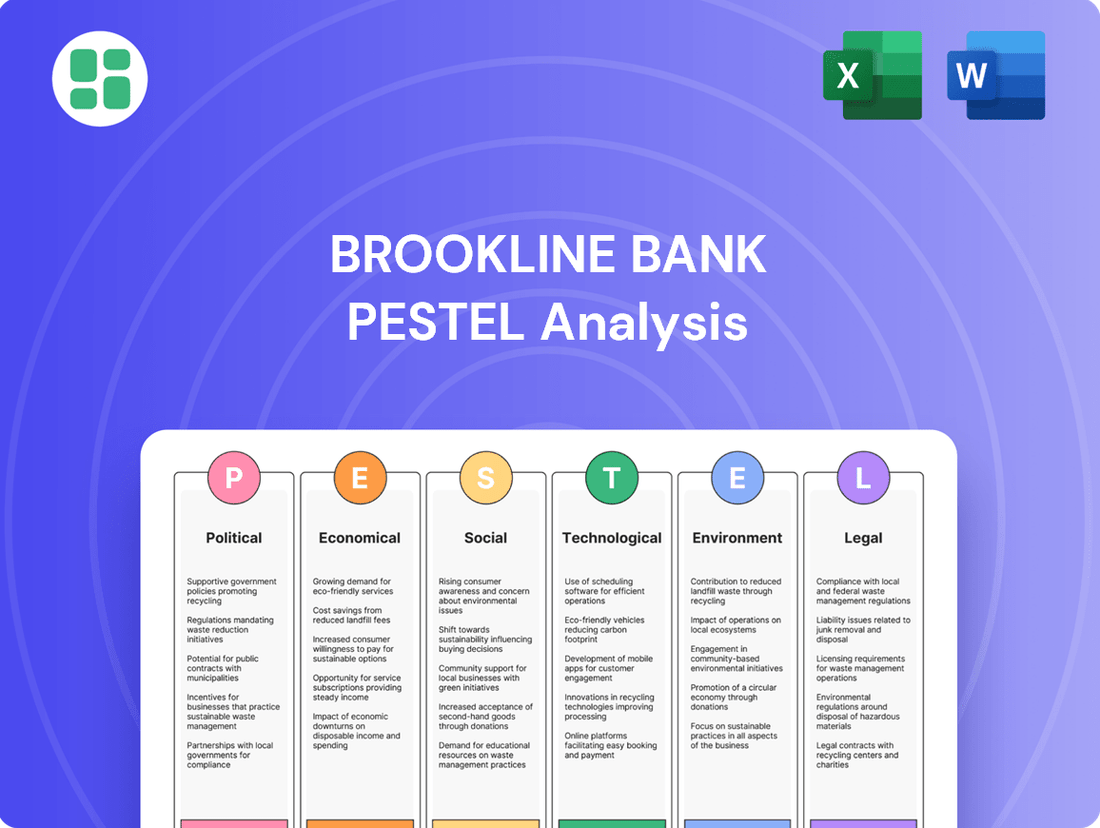

Brookline Bank PESTLE Analysis

The preview shown here is the exact Brookline Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Brookline Bank.

You'll gain valuable insights into the strategic landscape and potential challenges and opportunities facing the institution.

Sociological factors

The Greater Boston area is experiencing significant demographic shifts, with an aging population and increasing cultural diversity. This impacts banking needs, as older adults may seek retirement planning services, while a growing immigrant population might require specialized international banking solutions. For instance, the median age in Massachusetts has been steadily rising, highlighting a growing segment of customers focused on wealth preservation and estate planning.

Consumer banking preferences are rapidly shifting, with a significant surge in demand for digital and mobile-first experiences. Younger demographics, in particular, are driving this trend, expecting seamless online account management and transaction capabilities. For instance, by the end of 2024, it's estimated that over 80% of banking interactions will occur digitally, highlighting the critical need for robust online platforms.

Brookline Bank must therefore prioritize continuous investment in its digital infrastructure and user interface to cater to these evolving expectations. Failing to adapt risks losing market share to agile neobanks and established larger competitors who are already excelling in this digital space. This focus ensures relevance and competitiveness in the modern financial landscape.

The general level of financial literacy significantly influences how people use investment and wealth management services. In 2024, a significant portion of the adult population still struggles with basic financial concepts, creating a strong demand for personalized advice. Brookline Bank addresses this by offering tailored investment services to individuals, families, and businesses looking for expert guidance.

This demand for financial advice is a key sociological factor. For instance, a 2023 survey indicated that over 60% of Americans feel they need more help managing their finances. Brookline Bank's commitment to providing accessible and understandable financial planning helps bridge this knowledge gap, encouraging greater participation in wealth-building opportunities.

Community Engagement and Trust

Public trust is a cornerstone for any financial institution, and for community banks like Brookline Bank, it's even more critical. A strong sense of community engagement can significantly boost this trust, acting as a powerful differentiator in a competitive market.

Brookline Bank's commitment to local initiatives and its reputation for dependable service are key to fostering this trust. For instance, in 2023, the bank reported significant investment in local sponsorships and community development projects, reinforcing its role as a community partner.

- Customer Retention: Banks with high community trust often see better customer loyalty, reducing churn rates.

- Brand Reputation: Positive community involvement enhances brand image, attracting new customers and talent.

- Local Economic Impact: Trust in a local bank can encourage more residents and businesses to bank locally, strengthening the regional economy.

- Regulatory Relationships: Strong community ties can also foster more collaborative relationships with local regulatory bodies.

Workforce Trends and Talent Availability

The availability of skilled talent in finance, especially in tech, cybersecurity, and data analytics, is paramount for Brookline Bank's efficiency and innovation. Massachusetts, like many regions, is experiencing persistent workforce shortages, necessitating proactive talent retention strategies.

The demand for financial professionals with advanced digital skills continues to outpace supply. For instance, a 2024 report indicated a 15% year-over-year increase in job postings for cybersecurity analysts in the Greater Boston area alone, highlighting a critical talent gap.

- Skilled Talent Demand: High demand for tech, cybersecurity, and data analytics professionals in the financial sector.

- Workforce Shortages: Massachusetts faces ongoing challenges in filling these specialized roles.

- Retention Imperative: Strategic efforts are crucial for Brookline Bank to attract and retain top talent amidst competitive pressures.

- Digital Skill Gap: The gap between required digital competencies and available workforce skills is widening.

Sociological factors significantly shape Brookline Bank's operational landscape, influencing customer behavior and service demand. The aging demographic in Greater Boston, with a rising median age in Massachusetts, necessitates a focus on retirement and estate planning services. Simultaneously, the increasing cultural diversity requires specialized international banking solutions to cater to a broader customer base.

Consumer preferences are heavily leaning towards digital and mobile-first banking experiences, a trend driven by younger demographics. By 2024, it's projected that over 80% of banking interactions will occur digitally, underscoring the need for Brookline Bank to enhance its online platforms and user interfaces to remain competitive against digital-native banks.

Financial literacy levels also play a crucial role, with a significant portion of the population seeking guidance on investment and wealth management. A 2023 survey revealed over 60% of Americans feel they need more financial management help, presenting an opportunity for Brookline Bank to offer tailored advice and educational resources.

Public trust, particularly for community banks, is built through strong community engagement and reliable service. Brookline Bank's investments in local sponsorships and development projects in 2023 demonstrate a commitment to fostering this trust, which translates to higher customer retention and a stronger brand reputation.

| Sociological Factor | Impact on Brookline Bank | Supporting Data (2023-2024) |

|---|---|---|

| Demographic Shifts | Demand for retirement planning & international banking | Rising median age in MA; increasing cultural diversity |

| Digital Preferences | Need for robust online & mobile platforms | >80% of banking interactions expected to be digital by end of 2024 |

| Financial Literacy | Opportunity for personalized financial advice | >60% of Americans need more financial management help (2023 survey) |

| Community Trust | Enhanced customer loyalty & brand reputation | Significant investment in local sponsorships (2023) |

Technological factors

The banking sector is experiencing a seismic shift driven by digital transformation, with customers increasingly favoring online and mobile channels for their financial needs. Brookline Bank needs to prioritize investments in user-friendly mobile apps and secure online platforms to meet these evolving expectations. For instance, in 2024, mobile banking transactions are projected to continue their upward trajectory, with many consumers expecting seamless digital onboarding and personalized financial management tools.

Financial institutions like Brookline Bank are increasingly targeted by sophisticated cyber threats. In 2023, the financial services sector experienced a significant rise in ransomware attacks, with reported costs averaging millions of dollars per incident. These threats, including phishing scams and exploits targeting application programming interfaces (APIs), necessitate constant vigilance and investment in advanced security protocols.

Protecting sensitive customer data is not just a regulatory requirement but a cornerstone of trust for any bank. Breaches can lead to substantial financial penalties, as seen with various large financial institutions facing multi-million dollar fines in recent years for data privacy violations. Brookline Bank's commitment to robust cybersecurity measures is therefore critical to safeguarding its reputation and client confidence.

Artificial intelligence and automation are increasingly vital for modern banking, impacting everything from customer interactions via chatbots and sophisticated fraud detection systems to robust risk management and tailored financial guidance. Brookline Bank can harness these advancements to significantly boost operational efficiency, drive down expenses, and elevate the overall customer experience.

For instance, by 2024, the global AI in banking market was projected to reach over $20 billion, with significant growth expected in areas like personalized financial services and automated compliance. Brookline Bank's adoption of AI in areas like credit scoring or personalized investment recommendations could lead to a competitive edge.

Fintech Competition and Collaboration

The financial technology (fintech) landscape is rapidly evolving, presenting Brookline Bank with both competitive pressures and avenues for growth. Fintech firms are increasingly offering specialized, often digital-first, financial services that cater to specific customer needs, from payments and lending to wealth management. This trend necessitates that traditional banks like Brookline Bank remain agile and innovative to retain market share and customer loyalty.

Brookline Bank can navigate this dynamic environment by exploring strategic collaborations with fintech companies. These partnerships can allow the bank to integrate cutting-edge technologies and services more quickly than developing them internally, thereby enhancing its own digital offerings. For instance, a collaboration could streamline loan application processes or introduce new investment platforms, directly addressing customer demand for seamless digital experiences.

The competitive pressure from fintech is significant. By the end of 2024, it's projected that fintech adoption rates will continue to climb across various demographics. For example, a significant percentage of consumers in the US are already using fintech solutions for at least one financial service. This growing reliance on fintech underscores the need for Brookline Bank to adapt.

- Fintech Market Growth: The global fintech market is expected to reach substantial valuations, indicating continued innovation and investment in the sector.

- Digital Service Demand: Consumer preference for digital banking and financial services is a primary driver for fintech adoption, pressuring traditional institutions to enhance their online platforms.

- Partnership Opportunities: Strategic alliances with fintechs can provide Brookline Bank with access to specialized technologies and customer segments, fostering innovation and expanding service portfolios.

- Competitive Imperative: Failure to adapt to fintech advancements could lead to a loss of market share and customer attrition to more digitally adept competitors.

Data Analytics and Personalization

Brookline Bank is increasingly leveraging data analytics to understand its customers better. By analyzing vast datasets, the bank can tailor product offerings and improve customer service, a trend amplified by the 2024-2025 digital transformation push across the financial sector. This allows for more effective risk assessment and the development of personalized financial solutions.

The ability to glean insights from big data is critical for competitive advantage. For instance, by mid-2025, many financial institutions are expected to see a significant uplift in customer retention through hyper-personalized marketing campaigns driven by AI-powered analytics. This data-driven approach also streamlines operations, reducing costs and improving efficiency.

- Customer Behavior Insights: Advanced analytics provide granular understanding of spending habits and financial needs.

- Personalized Services: Tailored product recommendations and communication strategies are becoming standard.

- Enhanced Risk Management: Predictive analytics improve fraud detection and credit scoring accuracy.

- Operational Efficiency: Automation of data processing and customer interaction reduces overhead.

Technological advancements are reshaping how customers interact with banks, with a strong preference emerging for digital channels. Brookline Bank must invest in user-friendly mobile apps and secure online platforms to meet these expectations, as mobile banking transactions continue to grow significantly through 2024 and into 2025. The rise of fintech also presents both challenges and opportunities, necessitating agility and potential collaborations to integrate new technologies and services, especially as fintech adoption rates climb across demographics by the end of 2024.

The increasing sophistication of cyber threats requires constant vigilance and investment in advanced security protocols, given the high costs associated with breaches. Furthermore, leveraging artificial intelligence and automation can significantly boost operational efficiency and customer experience, with the AI in banking market projected for substantial growth. Data analytics is also becoming critical for understanding customers, enabling personalized services and enhanced risk management, with institutions expecting improved customer retention through AI-powered analytics by mid-2025.

| Technology Trend | Impact on Banking | 2024-2025 Data/Projections |

|---|---|---|

| Digital & Mobile Banking | Increased customer preference for online/mobile transactions; need for seamless user experience. | Continued upward trajectory in mobile banking transactions; growing demand for digital onboarding. |

| Cybersecurity | Heightened risk of sophisticated cyber threats (ransomware, phishing); necessity for robust security measures. | Financial services sector experienced significant rise in ransomware attacks in 2023; multi-million dollar fines for data privacy violations. |

| Artificial Intelligence (AI) & Automation | Enhanced customer service (chatbots), fraud detection, risk management, and operational efficiency. | Global AI in banking market projected to exceed $20 billion by 2024; significant growth in personalized services and automated compliance. |

| Fintech Integration | Competitive pressure from specialized digital financial services; opportunities for strategic partnerships. | Continued climbing fintech adoption rates across demographics by end of 2024; growing reliance on fintech solutions. |

| Data Analytics | Deeper customer understanding, personalized product offerings, improved risk assessment, and operational streamlining. | Expected uplift in customer retention by mid-2025 through hyper-personalized marketing driven by AI-powered analytics. |

Legal factors

Brookline Bank navigates a stringent regulatory environment, including Basel III requirements for capital adequacy and the Community Reinvestment Act, which impacts lending practices. Staying abreast of potential legislative shifts, such as those concerning digital banking or data privacy enacted in 2024, is paramount for continued operational integrity and compliance.

Brookline Bank, like all financial institutions, faces significant legal hurdles with data privacy and security. With digital operations expanding, regulations such as the California Consumer Privacy Act (CCPA) and potential federal privacy legislation directly govern how customer data is handled. Failure to comply can result in substantial fines and reputational damage.

The bank must invest heavily in cybersecurity measures to prevent data breaches, a growing concern. In 2023, the financial services sector experienced a notable increase in cyberattacks, with costs averaging over $5 million per incident, underscoring the critical need for robust data protection protocols.

Brookline Bank, like all financial institutions, faces stringent legal mandates regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These are not static requirements but rather dynamic obligations that necessitate ongoing adaptation and robust internal systems. Failure to comply can result in significant penalties and reputational damage.

The bank must implement and continuously refine comprehensive controls and reporting frameworks to actively deter and detect illicit financial activities. This includes thorough customer due diligence, transaction monitoring, and suspicious activity reporting. For instance, in 2023, global AML fines reached billions of dollars, underscoring the high stakes involved for institutions that fall short.

Consumer Protection Laws

Consumer protection laws are a significant factor for Brookline Bank, shaping how it interacts with customers. These regulations ensure fairness in financial dealings, covering aspects like how loans are offered and the information provided to borrowers. For instance, the Community Reinvestment Act (CRA) encourages banks to meet the credit needs of their entire communities, including low- and moderate-income neighborhoods. In 2023, the Federal Reserve reported that banks collectively made significant investments and loans under the CRA, with data showing continued emphasis on community development activities.

Disclosure requirements for loans are particularly important. Banks must clearly outline terms, interest rates, and fees to prevent deceptive practices. This transparency builds trust and helps consumers make informed decisions. Deposit insurance, such as that provided by the FDIC, safeguards customer funds up to a certain limit, reinforcing confidence in the banking system. As of the first quarter of 2024, the FDIC reported that the deposit insurance fund remained robust, exceeding $120 billion, providing a strong safety net for depositors.

- Fair Lending: Laws prohibit discrimination in lending based on race, religion, sex, or other protected characteristics, ensuring equitable access to credit.

- Disclosure Requirements: Regulations mandate clear and accurate information about loan terms, fees, and risks, empowering consumer understanding.

- Deposit Insurance: Federal insurance protects customer deposits, fostering stability and confidence in financial institutions like Brookline Bank.

Cybersecurity Compliance Mandates

Brookline Bank, like all financial institutions, must navigate a complex web of cybersecurity compliance mandates. These go beyond general data privacy, demanding robust security protocols and well-defined incident response plans, often dictated by financial industry standards and regulatory bodies. Failure to adhere can result in significant penalties, impacting financial health and reputation.

The US financial sector faces increasing regulatory scrutiny regarding cybersecurity. For instance, the Gramm-Leach-Bliley Act (GLBA) requires financial institutions to protect customer information, while various state-level data breach notification laws add further layers of complexity. The Federal Financial Institutions Examination Council (FFIEC) also provides guidance on cybersecurity preparedness, which banks are expected to follow.

- GLBA Compliance: Mandates the protection of non-public personal information.

- FFIEC Guidance: Outlines expectations for risk management and cybersecurity controls.

- State Breach Laws: Require timely notification to affected individuals in case of a data breach.

- Potential Penalties: Non-compliance can lead to fines, reputational damage, and operational restrictions.

Brookline Bank operates under a dynamic legal framework, with evolving regulations impacting its operations. Recent legislative trends in 2024 and 2025 are likely to focus on enhancing consumer data protection and cybersecurity standards, requiring continuous adaptation of compliance strategies.

The bank must adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which are critical for preventing financial crime. In 2023, global AML fines exceeded billions of dollars, highlighting the severe consequences of non-compliance for financial institutions.

Consumer protection laws, such as the Community Reinvestment Act (CRA), mandate fair lending practices and community engagement. The Federal Reserve reported in Q1 2024 that the FDIC deposit insurance fund remained robust, exceeding $120 billion, reinforcing depositor confidence.

| Regulation Area | Key Requirement | Example Impact/Data (2023-2024) |

|---|---|---|

| Data Privacy & Cybersecurity | Protecting customer data, incident response | GLBA, FFIEC guidance; State breach laws; Average cyberattack cost in finance >$5M (2023) |

| Financial Crime Prevention | AML/KYC compliance, transaction monitoring | Global AML fines in billions (2023); Robust internal systems needed |

| Consumer Protection | Fair lending, disclosure, deposit insurance | CRA compliance; FDIC fund >$120B (Q1 2024); Clear loan term disclosures |

Environmental factors

Climate change poses evolving financial risks for banks like Brookline Bank, particularly impacting loan portfolios exposed to extreme weather. For instance, commercial real estate and residential mortgages in flood-prone or wildfire-risk zones could face increased default rates. This is why banks are increasingly focusing on climate risk assessment, a trend highlighted by the Federal Reserve's 2023 pilot climate scenario analysis which involved large banks assessing their resilience to climate-related financial risks.

Investors and customers are increasingly factoring Environmental, Social, and Governance (ESG) criteria into their financial choices. This shift is evident in the growing assets under management in ESG-focused funds, which reached over $3.7 trillion globally by the end of 2023, a significant jump from previous years.

Brookline Bank can anticipate heightened demand for sustainable investment products and services. Simultaneously, there will be mounting pressure to embed ESG principles into its core lending activities and day-to-day operations, reflecting a broader market expectation for responsible business practices.

Brookline Bank is facing increasing scrutiny regarding its own operational environmental footprint. This includes evaluating energy consumption across its branches and corporate offices, as well as its waste management practices and overall resource utilization.

In 2023, many financial institutions, including those similar to Brookline Bank, reported significant investments in energy efficiency upgrades. For example, some banks have committed to reducing their Scope 1 and Scope 2 emissions by 30-50% by 2030, often through renewable energy procurement and building retrofits. These initiatives not only address environmental concerns but also offer tangible cost savings through reduced utility bills.

Proactive efforts in energy efficiency and carbon emission reduction can bolster Brookline Bank's reputation among environmentally conscious customers and investors. Furthermore, optimizing resource usage can lead to direct cost reductions, improving the bank's bottom line.

Green Financing and Sustainable Lending

Regulatory and market forces are increasingly steering financial institutions toward green financing and sustainable lending. This trend presents a significant opportunity for Brookline Bank to expand its market reach by supporting initiatives like renewable energy projects and eco-friendly developments. For instance, the global green bond market reached an estimated $1 trillion in 2023, signaling strong investor demand for sustainable investments.

Brookline Bank can leverage this shift by developing specialized loan products and services tailored to environmentally conscious businesses and projects. This strategic alignment with sustainability goals can attract new clients and enhance the bank's reputation as a responsible financial partner.

- Growing Demand: The global sustainable finance market is experiencing robust growth, with assets under management in ESG (Environmental, Social, and Governance) funds projected to reach $33.9 trillion by 2026, up from $12.1 trillion in 2021.

- New Market Avenues: Opportunities exist in financing solar panel installations, energy-efficient building retrofits, and electric vehicle infrastructure.

- Risk Mitigation: Engaging in green finance can also help mitigate long-term risks associated with climate change and evolving environmental regulations.

Reputational Risks from Environmental Impact

Brookline Bank faces reputational risks if it fails to address environmental concerns or engages in activities detrimental to the environment. This can erode customer trust and lead to significant damage. For instance, a 2024 survey by Deloitte found that 65% of consumers consider a company's environmental impact when making purchasing decisions.

Conversely, proactive engagement with environmental sustainability can significantly bolster Brookline Bank's public image. By demonstrating a commitment to green initiatives, the bank can attract environmentally conscious customers and investors. In 2025, reports indicate that financial institutions with strong ESG (Environmental, Social, and Governance) ratings are experiencing an average of 15% higher customer retention rates.

- Reputational Damage: Failure to manage environmental impact can lead to negative media attention and public backlash, impacting customer loyalty.

- Customer Trust: A lack of environmental responsibility can undermine trust, a critical asset for any financial institution.

- Enhanced Public Image: Proactive environmental stewardship, such as investing in renewable energy projects or offering green financing options, can improve brand perception.

- Market Advantage: Aligning with sustainability goals can attract a growing segment of socially responsible investors and customers, providing a competitive edge.

Environmental factors present both risks and opportunities for Brookline Bank, driven by climate change impacts and evolving stakeholder expectations. The bank must navigate increasing demand for sustainable finance products, with global ESG assets projected to exceed $33.9 trillion by 2026.

Addressing its operational footprint, including energy consumption and waste, is crucial, as many financial institutions are investing in efficiency. For instance, some banks aim for 30-50% emission reductions by 2030 through renewable energy and retrofits, yielding cost savings.

Failure to manage environmental impact risks reputational damage, as 65% of consumers consider environmental impact in purchasing decisions as of 2024. Conversely, strong ESG ratings can boost customer retention by an estimated 15% in 2025.

| Environmental Factor | Impact on Brookline Bank | Data/Trend |

|---|---|---|

| Climate Change Risks | Increased loan defaults in vulnerable areas (e.g., flood zones) | Federal Reserve's 2023 climate scenario analysis highlighted resilience needs. |

| ESG Demand | Growing market for sustainable investments | Global ESG assets to reach $33.9T by 2026 (up from $12.1T in 2021). |

| Operational Footprint | Need for energy efficiency and emission reduction | Commitments to 30-50% Scope 1 & 2 emission reduction by 2030 common. |

| Reputational Risk | Customer trust affected by environmental performance | 65% of consumers consider environmental impact (2024 survey). |

| Green Finance Opportunities | Expansion into eco-friendly project financing | Global green bond market reached ~$1T in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brookline Bank is grounded in data from official regulatory bodies, financial market reports, and industry-specific publications. We draw on economic indicators, legislative updates, and technological advancements to provide a comprehensive view.