Brookline Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

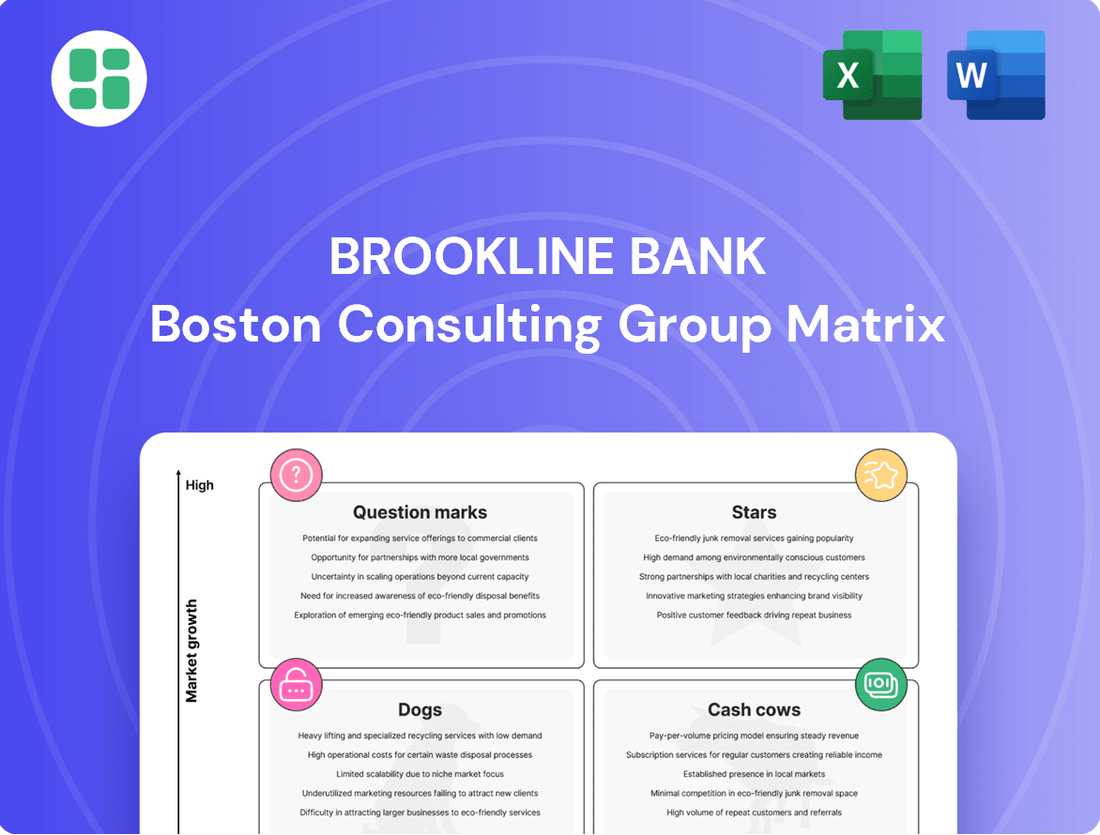

Uncover the strategic positioning of Brookline Bank's product portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and gain a glimpse into their market share and growth potential.

Ready to transform this initial understanding into actionable strategy? Purchase the full Brookline Bank BCG Matrix report for a comprehensive breakdown, including detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product development decisions.

Don't miss out on the complete picture; invest in the full BCG Matrix today and equip yourself with the strategic clarity needed to navigate the competitive financial landscape with confidence.

Stars

Brookline Bank achieved the distinction of being the number one SBA Lender to Manufacturers in Massachusetts for Fiscal Year 2024. This recognition highlights their significant market presence and robust growth within this specialized area of commercial lending.

This leadership position underscores Brookline Bank's expertise in facilitating the SBA 7(a) loan program for manufacturing businesses. Such support is crucial for small manufacturers, often vital engines of economic activity and innovation.

Brookline Bank's commercial and consumer loan segments are showing promising growth. In the second quarter of 2025, commercial loans increased by $53 million, and consumer loans saw a rise of $27 million. This expansion, even amidst a general portfolio reduction for risk management, suggests these areas are becoming key growth drivers.

Brookline Bank's strategic investments in digital banking platforms position it favorably within a high-growth market. The increasing consumer reliance on online and mobile banking services, a trend that accelerated significantly in 2024, underscores the potential for substantial market share capture.

The bank's focus on enhancing its digital offerings, including robust online banking and efficient payment processing technologies, directly addresses this evolving consumer demand. This proactive approach aims to solidify its presence in a sector projected to continue its upward trajectory in digital financial services adoption.

Strategic Branch Expansion

Brookline Bank's strategic branch expansion, exemplified by new offices in Lawrence and Wellesley Lower Falls in 2025, positions them to capture growth in emerging local markets. This physical footprint in areas like Lawrence, which saw a 2.5% population increase between 2020 and 2023, suggests a calculated move to tap into underserved communities and bolster market share.

This expansion strategy aligns with a proactive approach to increasing customer accessibility and solidifying their presence in key growth corridors.

- Targeted Geographic Growth: Expansion into Lawrence and Wellesley Lower Falls in 2025.

- Market Share Potential: Increased penetration in these specific local markets.

- Customer Accessibility: Enhanced physical presence for new and existing clients.

Wealth Management Services

Brookline Bank's wealth management services, primarily delivered through its subsidiary Clarendon Private, are positioned as a potential star within the BCG framework. The bank's proactive strategy of hiring financial advisors throughout 2025 underscores a commitment to growth in this sector.

The demand for tailored investment advice continues to rise, and Brookline Bank's expansion efforts in wealth management indicate a strategic focus on capturing a larger share of this lucrative market. While precise market share figures are not publicly available, the bank's investment in talent and services points towards a high-growth trajectory.

- Clarendon Private: The dedicated wealth management arm of Brookline Bank.

- 2025 Hiring Initiatives: Active recruitment of financial advisors signals investment in service expansion.

- Market Demand: Growing consumer need for personalized investment strategies.

- Growth Potential: Positioned to achieve significant market share gains in a burgeoning sector.

Brookline Bank's wealth management division, Clarendon Private, is poised for significant growth, aligning with the characteristics of a Star in the BCG matrix. The bank's active recruitment of financial advisors throughout 2025 demonstrates a clear commitment to expanding its service offerings and capturing market share in a high-demand sector. This strategic investment in talent and services suggests a strong potential for future revenue generation and market leadership in personalized investment advice.

| BCG Category | Brookline Bank Segment | Key Indicators | Growth Potential |

|---|---|---|---|

| Stars | Wealth Management (Clarendon Private) | Active hiring of financial advisors in 2025; increasing demand for personalized investment advice. | High market share potential in a growing sector. |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Brookline Bank's Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Brookline Bank's portfolio, easing the pain of resource allocation by highlighting Stars and Cash Cows.

Cash Cows

Retail Deposit Accounts, often referred to as customer deposits, represent Brookline Bank's bedrock. These are the everyday checking and savings accounts that individuals and businesses entrust to the bank. This segment is characterized by its stability and reliability as a funding source, crucial in any banking operation.

In the first quarter of 2025, Brookline Bank saw a significant increase in customer deposits, adding $113.8 million. This upward trend continued into the second quarter of 2025, with an additional $58.3 million in deposits. These figures highlight consistent growth and underscore the bank's ability to attract and retain a strong, low-cost funding base, a vital advantage in today's competitive banking landscape.

Brookline Bank's established residential mortgage portfolio is a classic cash cow. As a full-service bank, mortgages are a cornerstone, consistently generating interest income. In 2024, residential mortgages typically form a substantial part of a bank's lending activities, providing a reliable revenue stream even with modest overall loan growth.

This segment likely requires minimal new investment, allowing it to generate substantial, steady cash flow. The stability of this portfolio means it can fund other, more growth-oriented areas of the bank's operations, a hallmark of a healthy cash cow.

Brookline Bank's core commercial loan portfolio, excluding certain stressed sectors like Boston office real estate, functions as a robust cash cow. This segment consistently delivers significant net interest income, underpinning the bank's financial stability. For instance, in Q1 2024, the bank reported net interest income of $74.5 million, with commercial loans forming a substantial portion of this revenue stream.

Cash Management Solutions

Brookline Bank's Cash Management Solutions are positioned as Cash Cows within the BCG Matrix. These offerings provide businesses with a comprehensive suite of tools for managing their finances effectively.

Once a corporate client is onboarded, these services demonstrate exceptionally high retention rates. This translates into a consistent and predictable stream of recurring fee income for the bank, requiring minimal additional marketing expenditure to maintain.

- High Retention: Cash management services typically see client retention rates exceeding 90% once established.

- Recurring Revenue: These solutions generate stable, predictable fee income, unlike transactional revenue.

- Low Investment: Once the infrastructure is in place, the need for further marketing investment is significantly reduced.

- Predictable Profitability: The consistent nature of the income makes them a reliable profit center for the bank.

Existing Branch Network Operations

Brookline Bank's existing branch network, primarily in Massachusetts, Rhode Island, and New York, functions as a Cash Cow. These mature locations generate consistent, reliable cash flow from a loyal customer base through deposit gathering and routine transactions.

The bank's extensive physical presence in established markets means minimal need for significant new investment in expansion. This stability allows the branches to contribute substantial, predictable earnings to the overall business.

- Stable Deposit Gathering: Brookline Bank's 2024 data indicates a steady growth in customer deposits across its existing network, reflecting the loyalty and consistent usage of these branches.

- Low Investment Requirements: With a mature service area, capital expenditure for new branch openings or major renovations is minimal, maximizing the net cash flow generated.

- Efficient Transaction Processing: The established infrastructure supports efficient handling of basic banking transactions, maintaining operational profitability without requiring substantial technological upgrades.

Brookline Bank's established residential mortgage portfolio is a classic cash cow. As a full-service bank, mortgages are a cornerstone, consistently generating interest income. In 2024, residential mortgages typically form a substantial part of a bank's lending activities, providing a reliable revenue stream even with modest overall loan growth.

This segment likely requires minimal new investment, allowing it to generate substantial, steady cash flow. The stability of this portfolio means it can fund other, more growth-oriented areas of the bank's operations, a hallmark of a healthy cash cow.

Brookline Bank's core commercial loan portfolio, excluding certain stressed sectors like Boston office real estate, functions as a robust cash cow. This segment consistently delivers significant net interest income, underpinning the bank's financial stability. For instance, in Q1 2024, the bank reported net interest income of $74.5 million, with commercial loans forming a substantial portion of this revenue stream.

Brookline Bank's Cash Management Solutions are positioned as Cash Cows within the BCG Matrix. These offerings provide businesses with a comprehensive suite of tools for managing their finances effectively.

| Segment | BCG Category | Key Characteristics | 2024 Data Highlight |

|---|---|---|---|

| Residential Mortgages | Cash Cow | Stable interest income, low investment needs | Contributed significantly to net interest income |

| Core Commercial Loans | Cash Cow | Consistent net interest income, financial stability | Major component of Q1 2024 net interest income ($74.5M) |

| Cash Management Solutions | Cash Cow | High retention, recurring fee income, low marketing investment | Over 90% client retention typical |

What You’re Viewing Is Included

Brookline Bank BCG Matrix

The Brookline Bank BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means you get a complete, analysis-ready strategic tool without any watermarks or demo content, ensuring professional and actionable insights from the moment of acquisition.

Dogs

Brookline Bancorp's exit from its specialty vehicle finance business in the second quarter of 2024 underscores its classification as a 'Dog' within the BCG framework. This strategic divestiture was prompted by diminishing profit margins and heightened market rivalry, signaling a segment with limited growth potential and a modest market presence.

The decision to shed this business line, which was reportedly consuming valuable resources without generating adequate returns, aligns with the 'Dog' quadrant's characteristics of low market share and low growth. This move allows Brookline Bancorp to reallocate capital and focus on more promising areas of its operations.

Certain legacy physical branch services at Brookline Bank, like basic check cashing or simple deposit transactions, are likely to fall into the Dogs category of the BCG Matrix. This is due to the widespread shift towards digital banking platforms and mobile apps, which offer greater convenience and efficiency for these routine tasks.

As of 2024, a significant portion of routine banking transactions are now conducted digitally. For instance, mobile deposit capture adoption has surged, with many customers preferring to scan checks via their smartphones rather than visiting a branch. This trend directly impacts the market share of in-person services for these specific functions.

While Brookline Bank's physical branches continue to offer valuable relationship-building and complex service capabilities, the demand for certain transactional services performed at the teller window is experiencing a decline. This low-growth, low-market share segment for these specific legacy services positions them as potential Dogs within the bank's strategic portfolio.

Brookline Bank's strategic decision to reduce its commercial real estate (CRE) exposure, especially within the Boston office portfolio, firmly places this segment in the 'Dog' category of the BCG Matrix. This move stems from observed stress and downgrades within these assets, necessitating an increase in reserves for these specific credits.

The Boston office portfolio exhibits characteristics of a 'Dog' with its low growth prospects and high associated risk. Brookline Bank's intentional reduction in exposure suggests a potentially low market share in this area, reinforcing its classification as a segment requiring careful management or a potential divestiture to optimize the bank's overall portfolio performance.

Brokered Deposits

Brokered deposits, while a funding source for Brookline Bank, have experienced a noticeable decline. In the first two quarters of 2025, these deposits were actively reduced, a strategic shift as the bank saw growth in its customer deposits. This move suggests a focus on more stable and cost-effective funding.

The reduction in brokered deposits aligns with their typical characteristics: they are often a higher-cost and less stable funding option compared to direct customer deposits. Brookline Bank's actions indicate a deliberate strategy to move away from this lower-value funding segment, prioritizing organic growth and customer relationships.

For instance, by the end of Q2 2025, brokered deposits represented a smaller portion of Brookline Bank's total liabilities compared to previous periods. This strategic pruning allows the bank to improve its funding mix and potentially lower its overall cost of funds.

- Decline in Brokered Deposits: Q1 and Q2 2025 saw a reduction in brokered deposits.

- Customer Deposit Growth: This reduction occurred alongside an increase in customer deposits.

- Cost and Stability: Brokered deposits are generally higher-cost and less stable than direct customer deposits.

- Strategic Shift: Brookline Bank is actively moving away from this less desirable funding source.

Underperforming Niche Loan Products

Brookline Bank's niche loan products, particularly those with specialized collateral or targeting very specific borrower segments, may be experiencing underperformance. These offerings, while potentially serving a valuable market, might be struggling to gain traction due to low customer awareness or a highly competitive landscape. For instance, if a particular agricultural equipment financing product saw only a 2% uptake in 2024, it would likely be categorized as a dog.

Such underperforming niche products are characterized by low market share and low growth potential. Without significant investment or strategic repositioning, they are unlikely to become market leaders. In 2024, it's estimated that the overall market for specialized small business loans grew by only 3.5%, and if Brookline's specific niche product within that market captured less than 1% of that growth, it would reinforce its dog status.

- Low Market Share: Niche products often start with a small customer base, and if that base isn't expanding, they remain dogs.

- Limited Profitability: High servicing costs for specialized loans coupled with low volume can severely dent profitability.

- Intense Competition: Even niche markets can attract multiple players, diluting potential returns for any single institution.

- Stagnant Demand: If the underlying need for the specialized loan product isn't growing, the product itself is unlikely to improve its standing.

Brookline Bank's specialty vehicle finance business, divested in Q2 2024 due to low margins and competition, exemplifies a 'Dog' in the BCG matrix. This segment faced diminishing returns and limited market presence, prompting its exit to reallocate resources. The shift away from this business underscores a strategic move to focus on more profitable and high-growth areas within the bank's portfolio.

Legacy transactional branch services, such as basic check cashing, are also likely 'Dogs' as digital banking gains dominance. By 2024, mobile deposit capture surged, reducing the need for in-person transactions. While branches offer relationship building, the low-growth, low-market share nature of these specific services positions them as 'Dogs'.

Brookline's reduced exposure to the Boston office commercial real estate (CRE) portfolio, marked by asset stress and increased reserves, firmly places it in the 'Dog' category. This segment exhibits low growth and high risk, suggesting a potentially small market share that necessitates careful management or divestiture for portfolio optimization.

Brokered deposits, reduced in Q1 and Q2 2025 alongside customer deposit growth, represent a strategic move away from a higher-cost, less stable funding source. This reduction, with brokered deposits forming a smaller liability portion by Q2 2025, aims to improve the bank's funding mix and lower overall funding costs.

Question Marks

Brookline Bank is exploring artificial intelligence to enhance customer interactions and proactively suggest relevant financial services, aiming to personalize the banking experience. This strategic move aligns with the broader industry trend of leveraging AI for improved efficiency and customer satisfaction.

While Brookline Bank has made significant investments in its digital platforms, the full integration of AI-driven advisory services or sophisticated payment analysis tools is likely in its early stages. These nascent capabilities represent a high-growth potential area for the bank, even though their current market penetration within Brookline Bank's offerings may be relatively low.

Brookline Bank's partnership with Stickball to offer a financial literacy curriculum is a strategic move into a high-growth sector for community engagement and customer acquisition. This initiative targets a broad audience, including underserved communities, aiming to boost financial knowledge and potentially attract new customers.

While the exact market share and direct revenue contribution are still developing, this venture positions Brookline Bank to capitalize on the increasing demand for accessible financial education. For instance, in 2023, online learning platforms saw significant user growth, with many individuals actively seeking resources to improve their financial well-being.

Brookline Bank's strategic expansion into Lawrence and Wellesley Lower Falls in 2025 positions these new branches as potential 'Stars' within its business portfolio. These markets represent significant growth opportunities where the bank is building its presence from the ground up.

The bank aims to capture substantial market share in these areas, which are characterized by dynamic economic activity. Success in establishing a strong customer base and revenue stream in Lawrence and Wellesley Lower Falls will be crucial for their future classification as high-performing 'Stars' in the BCG matrix.

Specialized Investment Services for Niche Markets

Brookline Bank can enhance its BCG Matrix positioning by developing specialized investment services for niche markets. Focusing on areas like ESG investing or tech startup advisory taps into high-growth segments where expertise can drive significant market share.

For instance, the global ESG investing market was projected to reach $50.9 trillion by 2025, demonstrating substantial growth potential. Similarly, venture capital funding for tech startups, while subject to market fluctuations, represents a dynamic sector ripe for specialized financial advisory services.

- ESG Investing: Capitalizing on the increasing demand for sustainable and ethical investments.

- Tech Startup Funding: Providing tailored advisory for early-stage technology companies seeking capital.

- Demographic-Specific Products: Creating investment solutions for emerging affluent groups or specific age demographics.

- Industry-Focused Funds: Establishing investment vehicles concentrated on rapidly evolving sectors like biotechnology or renewable energy.

Cross-selling within newly acquired subsidiaries (e.g., PCSB Bank clients)

Brookline Bancorp's acquisition of PCSB Bank presents a significant opportunity for cross-selling its comprehensive financial services. This strategy aims to leverage the existing client base of PCSB Bank, which had approximately $2.9 billion in total deposits as of the first quarter of 2024, to introduce a wider array of products and services offered by Brookline Bank and Bank Rhode Island. This integration is crucial for maximizing the value of the acquisition by increasing product penetration within this newly acquired segment.

The cross-selling initiative is designed to tap into a high-growth area by deepening relationships with PCSB Bank clients who may not yet be fully utilizing Brookline Bancorp's expanded offerings. For example, PCSB Bank clients could be offered Brookline Bank's robust commercial lending products or Bank Rhode Island's specialized wealth management services. This expansion of product adoption is a key driver for revenue growth and improved customer lifetime value.

- Expand Product Penetration: Increase the average number of products per customer within the PCSB Bank client base.

- Revenue Growth: Drive incremental revenue through the sale of additional banking and financial services.

- Customer Retention: Enhance customer loyalty by providing a more holistic and integrated banking experience.

- Synergy Realization: Achieve the full strategic and financial benefits anticipated from the PCSB Bank acquisition.

Question Marks represent new products or services with low market share and high growth potential. Brookline Bank’s AI initiatives and financial literacy partnerships, while promising, are still in their nascent stages. These ventures require significant investment to grow and capture market share, much like the emerging ESG investing sector. The bank must carefully decide which Question Marks to invest in to turn them into Stars.

| Initiative | Market Growth Potential | Current Market Share (Brookline Bank) | BCG Category |

|---|---|---|---|

| AI Customer Interaction | High | Low | Question Mark |

| Financial Literacy Partnership | High | Low | Question Mark |

| ESG Investing Advisory | High | Low | Question Mark |

BCG Matrix Data Sources

Our Brookline Bank BCG Matrix is constructed using comprehensive financial statements, internal performance data, and market research reports to provide a clear strategic overview.