Brookline Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

Brookline Bank operates within a dynamic financial landscape shaped by intense competition and evolving customer expectations. Understanding the forces of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this market effectively.

The complete report reveals the real forces shaping Brookline Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors hold significant bargaining power over community banks like Brookline Bank, as deposits are a crucial source of capital. In 2024, the banking sector saw continued competition for deposits, with many institutions offering attractive rates to attract and retain customer funds. Depositors can easily compare interest rates across various banks, driving up the cost of capital for institutions that don't offer competitive yields.

Technology providers wield considerable influence over banks like Brookline Bank due to the sector's intense digital transformation. Core banking systems, advanced cybersecurity measures, and AI-driven automation solutions are all heavily reliant on specialized external vendors. This dependency is amplified as banks allocate more resources to improving operational efficiency and customer engagement through technology.

The bargaining power of these tech suppliers is significant, particularly for those offering niche or mission-critical services. For instance, in 2024, the global banking software market was valued at approximately $35 billion, with a substantial portion attributed to core banking solutions, highlighting the critical nature of these partnerships. Banks need these providers for seamless integration and ongoing innovation to maintain their competitive edge and operational stability.

Brookline Bank, like many in the financial services sector, navigates a tight labor market for specialized roles. The demand for tech-savvy professionals, especially in cybersecurity and AI, is particularly acute, driving up recruitment costs and potentially slowing innovation.

In 2024, the financial services industry continued to grapple with a talent deficit in critical areas such as data science and cloud computing. For instance, reports indicated that the average salary for a cybersecurity analyst in banking saw a notable increase, reflecting the intense competition for these essential skills.

This scarcity of qualified human capital grants employees with in-demand expertise significant leverage. Their ability to command higher salaries and better benefits means suppliers of labor can exert considerable bargaining power, impacting Brookline Bank's operational costs and strategic execution.

Regulatory Bodies

Regulatory bodies act as powerful influencers, akin to suppliers, by dictating operational standards and compliance costs for banks like Brookline Bank. In 2024, the financial sector continued to grapple with evolving mandates, particularly concerning cybersecurity and data privacy, which require significant investment in technology and personnel. For instance, the growing emphasis on Environmental, Social, and Governance (ESG) reporting means banks must allocate resources to track and disclose non-financial performance metrics, adding another layer of operational cost.

These regulatory demands translate into a substantial, non-negotiable cost of doing business. Banks must invest in robust compliance frameworks, specialized legal and IT teams, and ongoing training to meet these requirements. Failure to comply can result in hefty fines and reputational damage, making adherence a critical factor in maintaining operational viability and profitability. The increasing complexity and scope of regulations, especially those expected to be further refined by 2025, directly impact a bank's ability to innovate and compete.

- Increased Compliance Costs: Banks face escalating expenses for legal, IT, and staffing to meet regulatory requirements.

- Operational Constraints: Regulations can limit product offerings, operational processes, and strategic flexibility.

- Cybersecurity and Data Privacy Investments: Significant capital is directed towards safeguarding customer data and systems against evolving threats.

- ESG Reporting Demands: Growing pressure for ESG disclosures necessitates investment in data collection and reporting infrastructure.

Wholesale Funding Markets

While Brookline Bank's primary funding comes from customer deposits, wholesale funding markets, including those for capital, play a crucial role. The cost and accessibility of these markets are highly sensitive to broader economic conditions and interest rate shifts. For instance, in early 2024, the Federal Reserve maintained a higher federal funds rate, which generally increased the cost of wholesale borrowing for banks.

Should Brookline Bank experience slower growth in its core deposit base, its reliance on these external markets would naturally increase. This heightened dependence would grant wholesale funding providers greater leverage, potentially driving up borrowing costs and impacting the bank's profitability. In 2023, many regional banks saw increased reliance on wholesale funding as deposit outflows occurred, highlighting this dynamic.

- Increased Reliance: A slowdown in customer deposit growth could force Brookline Bank to lean more heavily on wholesale funding.

- Cost Sensitivity: The cost of wholesale funds is directly tied to macroeconomic factors and prevailing interest rates.

- Market Leverage: As of mid-2024, the cost of Federal Funds remained elevated, influencing the pricing of wholesale borrowing.

- Potential Impact: Greater reliance on wholesale markets can elevate their bargaining power, leading to potentially higher funding costs for the bank.

Brookline Bank, like other financial institutions, faces bargaining power from its suppliers, particularly those providing essential technology and specialized labor. The increasing reliance on digital infrastructure and cybersecurity solutions means that technology vendors hold significant sway, especially those offering niche or critical services. In 2024, the global banking software market, a key segment for these suppliers, was estimated to be around $35 billion, underscoring the critical nature of these partnerships.

| Supplier Type | Bargaining Power Factor | Impact on Brookline Bank (2024/2025 Outlook) |

|---|---|---|

| Technology Providers | High dependency on specialized software, cybersecurity, and AI solutions. | Increased costs for essential services, potential for vendor lock-in, need for continuous investment in tech upgrades. |

| Skilled Labor | Scarcity of talent in cybersecurity, data science, and AI. | Higher recruitment and retention costs, potential delays in innovation due to talent gaps. |

| Wholesale Funding Markets | Sensitivity to interest rates and economic conditions. | Increased borrowing costs if deposit growth slows, impacting profitability. |

What is included in the product

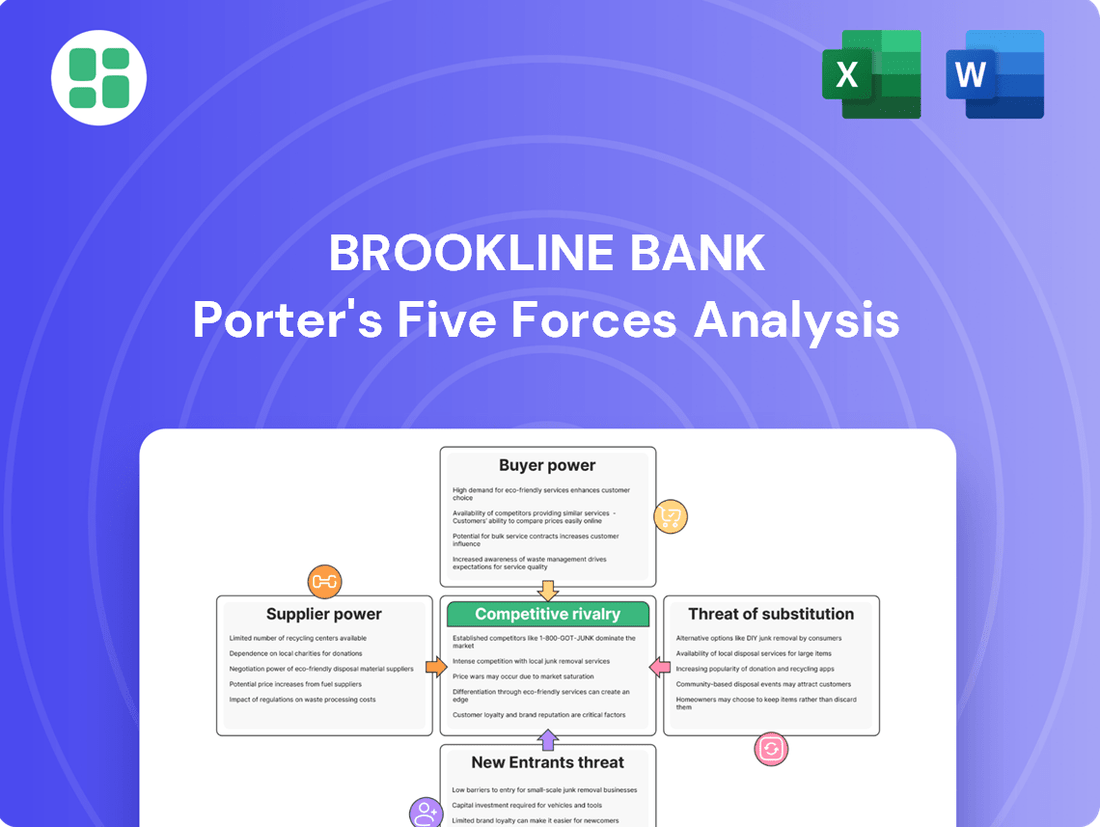

Tailored exclusively for Brookline Bank, analyzing its position within its competitive landscape by examining the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes.

Instantly visualize Brookline Bank's competitive landscape with a clear, actionable summary of each Porter's Five Forces, empowering swift strategic adjustments.

Customers Bargaining Power

Retail depositors at banks like Brookline Bank hold significant bargaining power. This is largely because switching banks is relatively easy and involves low costs. Customers can readily compare interest rates and the quality of services offered by different financial institutions, putting pressure on banks to offer competitive terms.

The expectations of retail customers are also rising. They increasingly seek immediate service, highly personalized banking solutions, and a smooth experience across both digital platforms and physical branches. Failing to meet these demands can lead to customer attrition.

In 2024, the average interest rate on savings accounts across the US saw fluctuations, with some institutions offering rates above 4.5% for high-yield options, illustrating the competitive landscape depositors can leverage. This environment necessitates that banks like Brookline Bank consistently invest in improving their customer experience to retain and attract these valuable retail depositors.

Commercial clients, particularly small to mid-sized businesses in the Greater Boston area, often hold significant bargaining power with Brookline Bank. These businesses typically maintain relationships with several banks, allowing them to compare and secure the most advantageous terms for loans and cash management services.

The commercial lending landscape in 2024 is characterized by substantial loan maturities, creating opportunities for borrowers to renegotiate terms. This dynamic market environment empowers sophisticated commercial clients to negotiate more effectively for better rates and customized financial solutions.

Mortgage and loan applicants possess considerable bargaining power. The widespread availability of online comparison tools and the transparent nature of interest rates empower individuals to shop around among numerous lenders. This competition compels financial institutions like Brookline Bank to offer competitive rates and streamlined application processes to attract and retain borrowers.

Looking ahead to 2025, projections suggest a slight decrease in average mortgage rates, potentially reaching around 6.5% to 7% depending on economic conditions. This anticipated affordability boost will likely intensify competition, giving applicants even more leverage to negotiate favorable terms and potentially forcing banks to further optimize their offerings to secure market share.

Investment Service Clients

Investment service clients at institutions like Brookline Bank possess significant bargaining power due to the abundance of alternative options. These include readily accessible online brokerages and specialized independent wealth management firms, offering clients the flexibility to switch providers with relative ease. This ease of switching directly translates into leverage for clients, compelling service providers to remain competitive.

Clients are increasingly sophisticated, demanding tailored financial advice, robust digital platforms for portfolio tracking, and integrated views of their overall financial well-being. For instance, in 2024, a significant percentage of investors, estimated to be over 70% by various industry surveys, actively utilize digital tools for managing their investments. This necessitates continuous innovation in service offerings from banks.

- High Client Mobility: The availability of numerous alternative investment platforms and advisors allows clients to easily transfer assets, increasing their leverage.

- Demand for Personalization: Clients expect customized financial guidance and advanced digital tools, pushing banks to enhance their service offerings.

- Focus on Digital Tools: In 2024, a majority of investors rely on digital platforms, forcing institutions to invest in user-friendly technology for portfolio management.

Demand for Digital Experience

Customers today demand sophisticated digital banking. This includes intuitive mobile applications, instant payment capabilities, and AI-driven support. Brookline Bank's clientele, particularly in its tech-forward service regions, mirrors this trend.

The expectation for a smooth, convenient, and secure digital platform is paramount. Customers benchmark their banking experience against leading digital services across all sectors, not just financial institutions. In 2024, a significant portion of banking interactions moved to digital channels, with mobile banking adoption continuing its upward trajectory.

- Digital Channel Dominance: By late 2023, over 70% of retail banking transactions for many institutions were conducted through digital channels, a figure expected to grow in 2024.

- Mobile App Expectations: User satisfaction with mobile banking apps is directly linked to retention. A poorly designed app can lead to a 15-20% increase in customer churn for some banks.

- Competitive Benchmarking: Consumers compare banking apps to platforms like Amazon or Netflix, setting high standards for user interface and functionality.

The bargaining power of customers at banks like Brookline Bank is considerable, driven by ease of switching and increasing demands for digital services. In 2024, customers can easily compare rates and services, with many seeking personalized and immediate support across all channels. This necessitates continuous investment in customer experience and technology.

| Customer Segment | Bargaining Power Drivers | 2024/2025 Data/Trends |

|---|---|---|

| Retail Depositors | Low switching costs, rate comparison, demand for personalization | Savings account rates exceeding 4.5% in 2024; high customer expectations for digital and personalized service. |

| Commercial Clients | Multiple banking relationships, loan maturity renegotiation | Sophisticated clients leverage market dynamics to negotiate better loan terms and cash management solutions. |

| Loan Applicants | Availability of online comparison tools, transparent rates | Anticipated slight decrease in mortgage rates by 2025, intensifying competition and applicant leverage. |

| Investment Clients | Abundance of alternative platforms, demand for digital tools | Over 70% of investors utilized digital tools in 2024; easy asset transfer between platforms. |

What You See Is What You Get

Brookline Bank Porter's Five Forces Analysis

This preview displays the complete Brookline Bank Porter's Five Forces Analysis you will receive upon purchase, offering an in-depth examination of competitive forces within the banking sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into Brookline Bank's strategic position. This professionally written analysis is fully formatted and ready to use, ensuring no surprises and immediate applicability for your business needs.

Rivalry Among Competitors

Brookline Bank contends with a crowded marketplace in Greater Boston, where numerous financial institutions vie for customers. This includes major national players, established regional banks, and a significant number of community banks and credit unions, all competing for commercial, retail, and investment business.

The intense competition in the Greater Boston area means customers have a wide array of choices, forcing banks like Brookline to be aggressive. This often translates into competitive pricing, innovative product development, and a strong focus on customer service quality to stand out.

As of early 2024, the Greater Boston area hosts over 100 FDIC-insured institutions, with a substantial portion being community banks and credit unions, highlighting the fragmented and competitive nature of the local banking sector.

Many core banking products, like checking accounts and basic loans, are quite similar across different institutions. This makes it tough for banks, including Brookline Bank, to truly stand out based on product features alone. In 2023, the average interest rate on savings accounts hovered around 0.46%, highlighting how price competition is a major factor.

Because of this lack of unique product offerings, competition often shifts to who offers the best interest rates, the lowest fees, or the most attractive promotions. This can put pressure on Brookline Bank's profit margins, as they might have to lower rates or increase costs to attract customers. For instance, some banks in 2024 are offering promotional APYs on high-yield savings accounts that significantly exceed the national average.

To combat this commoditization, banks like Brookline Bank need to excel in other areas. Focusing on exceptional customer service, offering personalized financial advice, and providing seamless digital banking experiences are crucial differentiators. A bank’s ability to build strong customer relationships and offer tailored solutions can be more impactful than minor differences in product features.

The banking sector is currently navigating an intense digital transformation, with institutions pouring resources into artificial intelligence, automation, and superior digital customer interfaces. This technological race directly impacts competitive rivalry, as banks leveraging these advancements can achieve greater operational efficiency, lower costs, and higher customer satisfaction levels. For instance, in 2024, the global banking sector's IT spending was projected to reach over $200 billion, underscoring the scale of this digital investment.

Strategic Mergers and Acquisitions

The banking industry is seeing a wave of consolidation, with strategic mergers and acquisitions becoming a key driver of competitive intensity. Brookline Bancorp's planned merger with Berkshire Hills Bancorp, announced in 2023, exemplifies this trend, aiming to create a larger entity with enhanced scale and operational efficiencies.

These consolidations result in more powerful competitors possessing wider geographic reach and more comprehensive service portfolios. This forces other institutions to either pursue similar growth strategies or carve out specialized niches to remain competitive.

- Brookline Bancorp's planned merger with Berkshire Hills Bancorp aims to create a combined entity with approximately $11 billion in assets and a significant presence in the Northeast.

- The trend of M&A in banking is driven by the pursuit of economies of scale, technological investment, and expanded market share.

- Institutions that fail to adapt to this consolidation may face increased pressure from larger, more integrated competitors.

Market Growth and Economic Headwinds

The competitive rivalry within the Greater Boston banking market is intensified by economic headwinds. Interest rate volatility and shifts in loan demand significantly impact performance in this mature region. For instance, while commercial lending is expected to see growth in 2025 as loans mature, community banks are grappling with deposit growth challenges due to prevailing interest rate concerns.

These economic factors create a demanding landscape where banks must actively vie for both deposits and attractive loan prospects to maintain profitability. The Federal Reserve's monetary policy, particularly its stance on interest rates, directly influences lending margins and the cost of funding for banks like Brookline Bank.

- Interest Rate Sensitivity: Banks in mature markets are highly susceptible to interest rate changes, affecting net interest margins.

- Deposit Competition: Growing deposits remains a critical challenge, especially when interest rates are high, as customers seek better yields.

- Loan Demand Fluctuations: Economic cycles dictate the demand for commercial and consumer loans, impacting revenue streams.

- 2025 Commercial Lending Outlook: Projections indicate growth in commercial lending due to loan maturities, presenting opportunities amidst competition.

Brookline Bank faces intense competition in Greater Boston from over 100 FDIC-insured institutions, including national banks, regional players, and numerous community banks and credit unions. This crowded market, characterized by similar core banking products, forces banks to compete aggressively on price, customer service, and digital innovation to attract and retain customers.

The ongoing digital transformation sees banks investing heavily in technology, with global banking IT spending projected to exceed $200 billion in 2024, creating a technological arms race. Furthermore, a wave of consolidation, exemplified by Brookline Bancorp's planned 2023 merger with Berkshire Hills Bancorp to form an entity with roughly $11 billion in assets, reshapes the competitive landscape, favoring larger, more efficient institutions.

| Competitor Type | Key Competitive Factors | Example Data/Trend |

|---|---|---|

| National Banks | Brand recognition, extensive branch networks, broad product offerings | Dominant market share in deposits and loans nationally |

| Regional Banks | Strong local presence, tailored business banking solutions | Often have deeper relationships with local businesses |

| Community Banks/Credit Unions | Personalized service, community focus, niche markets | High customer loyalty in specific geographic areas |

| Digital-Only Banks | Low fees, high-yield savings accounts, user-friendly apps | Average savings account APY in 2023 was around 0.46%, but promotional rates can be much higher |

SSubstitutes Threaten

Fintech lenders and payment platforms present a substantial threat by directly competing with traditional banking services. These digital-first companies, like Square or PayPal for payments and numerous online lenders for credit, offer streamlined, often faster, and more accessible alternatives to established bank products. For instance, the global fintech market was valued at over $110 billion in 2023 and is projected for significant growth, indicating a strong demand for these substitute services.

The agility of fintech firms allows them to innovate rapidly and often operate with fewer regulatory burdens than brick-and-mortar banks, enabling them to offer more competitive pricing or user experiences. This can lead to a gradual erosion of market share for traditional banks, particularly in high-volume, lower-margin areas like consumer lending and payment processing, as customers opt for the convenience and cost-effectiveness of digital solutions.

The rise of digital wallets and peer-to-peer payment systems like Zelle and Venmo poses a significant threat by reducing reliance on traditional checking accounts. By 2024, it's estimated that over 80% of consumers in developed markets will utilize mobile payment options for at least some transactions, bypassing conventional banking channels for everyday needs.

Customers increasingly demand instant, secure, and frictionless payment experiences, often preferring app-based solutions over visiting physical branches or using traditional bank interfaces. This shift diminishes the perceived necessity of traditional banking services for routine financial interactions, thereby increasing the substitute threat.

The rise of direct investment platforms and robo-advisors presents a significant threat of substitutes for traditional bank investment services. These digital solutions offer automated portfolio management and direct access to markets, often at a fraction of the cost of human advisors. For instance, by the end of 2023, the assets under management by robo-advisors in the US alone were projected to exceed $2 trillion, demonstrating their substantial market penetration.

This accessibility and cost-effectiveness appeal strongly to a growing segment of investors, particularly younger, tech-savvy individuals who prioritize digital convenience and lower fees. These platforms directly compete with bank-offered investment divisions by providing a streamlined, user-friendly experience. Many robo-advisors charge annual management fees as low as 0.25%, compared to the 1% or more often seen with traditional wealth management services.

Consequently, banks like Brookline Bank must innovate by enhancing their own digital investment tools and personalized advisory services to retain clients and attract new ones. Failure to adapt to this evolving landscape could lead to a loss of market share as investors opt for more agile and cost-efficient alternatives.

Non-Bank Financial Institutions

Non-bank financial institutions present a significant threat of substitutes for Brookline Bank. Credit unions, for instance, are member-owned and often offer competitive rates on loans and deposits, directly challenging traditional banking services. In 2023, credit union assets in the U.S. surpassed $2.3 trillion, indicating their substantial market presence and ability to serve as viable alternatives for consumers and businesses seeking financial products.

Specialized lenders, such as mortgage companies and auto finance providers, also act as substitutes by focusing on specific loan types. These institutions can be more agile and offer tailored products that traditional banks might not prioritize. The private credit market, in particular, has seen considerable growth, providing businesses with alternative financing options outside of conventional bank loans, thereby reducing reliance on institutions like Brookline Bank for capital needs.

- Credit unions hold over $2.3 trillion in assets nationally as of 2023, offering competitive alternatives to bank services.

- Specialized lenders focus on niche markets, providing tailored loan products that can substitute for a bank's broader offerings.

- The growing private credit market offers businesses financing solutions independent of traditional banking channels.

Emerging Technologies and 'Super Apps'

Emerging technologies, such as blockchain, continue to present a long-term threat by offering alternative transaction and value storage methods that could bypass traditional banking. While mainstream adoption is still evolving, the potential for these technologies to disrupt established financial infrastructure remains a key consideration for banks like Brookline. For instance, the global blockchain market size was valued at USD 11.19 billion in 2023 and is projected to grow significantly.

The proliferation of super apps, often developed by non-banking entities, poses a more immediate substitute threat. These platforms consolidate a wide array of services, including financial ones, into a single user interface. This integration draws customer engagement away from traditional banking channels, potentially reducing reliance on established institutions for everyday financial needs.

- Blockchain Potential: Blockchain technology offers decentralized transaction capabilities, potentially reducing the need for intermediaries.

- Super App Integration: Super apps are increasingly embedding financial services, creating a more convenient, all-in-one experience for consumers.

- Market Growth: The global blockchain market is expected to expand, indicating growing interest and investment in alternative financial technologies.

- Customer Loyalty Shift: As users spend more time within super app ecosystems, their loyalty to traditional banks may diminish.

The threat of substitutes for Brookline Bank is significant, driven by agile fintech companies, digital payment platforms, and alternative investment services. These substitutes often offer lower costs and greater convenience, directly challenging traditional banking models.

Fintech lenders and payment platforms provide streamlined alternatives, with the global fintech market exceeding $110 billion in 2023. Digital wallets and peer-to-peer payment systems are also reducing reliance on traditional accounts, with over 80% of consumers in developed markets expected to use mobile payments by 2024.

Robo-advisors, with US assets under management projected to surpass $2 trillion by the end of 2023, offer cost-effective investment solutions. Non-bank financial institutions, like credit unions holding over $2.3 trillion in assets nationally as of 2023, and specialized lenders further diversify the competitive landscape.

| Substitute Type | Key Offering | Market Data Point (2023/2024) |

| Fintech Lenders/Payment Platforms | Streamlined, faster, accessible services | Global Fintech Market > $110 Billion (2023) |

| Digital Wallets/P2P Payments | Convenient, app-based transactions | >80% of developed market consumers using mobile payments (2024 est.) |

| Robo-Advisors | Automated, low-cost investment management | US AUM > $2 Trillion (End of 2023 est.) |

| Credit Unions | Competitive rates, member-owned | US Credit Union Assets > $2.3 Trillion (2023) |

Entrants Threaten

The banking sector, including institutions like Brookline Bank, faces formidable regulatory and capital barriers that significantly deter new entrants. For instance, the implementation of Basel III reforms, including Capital Requirements Regulation III (CRR III), mandates substantial capital reserves, making it incredibly costly for new players to establish a foothold. These requirements, alongside complex licensing and ongoing compliance with directives like the Digital Operational Resilience Act (DORA) and Anti-Money Laundering (AML) regulations, demand immense financial resources and specialized expertise.

Brookline Bank, like other established financial institutions, benefits from significant economies of scale. These scale advantages allow for more efficient operations, lower per-unit costs in marketing, and more robust risk management frameworks, all built upon a substantial existing customer base and infrastructure. For instance, in 2023, the US banking sector saw average operating expenses as a percentage of average assets hover around 1.5%, a figure new entrants would struggle to match initially.

Trust is paramount in banking, and incumbents like Brookline Bank have cultivated decades of brand recognition and customer loyalty. New entrants must overcome the considerable hurdle of building this trust from scratch, a process that is both time-consuming and expensive. Without an established operational footprint or a pre-existing customer base, replicating the competitive cost structures and the implicit trust enjoyed by established banks presents a formidable barrier.

Fintech startups are a significant threat to traditional banks like Brookline Bank, not by aiming to be full-service competitors, but by targeting specific, profitable segments of the financial market. These digital-native companies can operate with much leaner cost structures and often face less stringent regulatory burdens initially, enabling them to rapidly capture market share in areas like digital payments, peer-to-peer lending, or wealth management tools. This strategic unbundling of services means that even if they don't replace a whole bank, they can erode key revenue streams.

Access to Distribution Channels

Traditional banks like Brookline Bank leverage their extensive physical branch networks and advanced digital platforms as critical distribution channels. New entrants must overcome the hurdle of replicating this reach, a process demanding substantial capital for technology, marketing, and customer acquisition.

For instance, the cost of establishing a new bank branch can range from $1 million to $5 million, while building a robust digital infrastructure and acquiring a significant customer base can cost tens of millions. This financial commitment acts as a considerable barrier, limiting the ease with which new competitors can effectively distribute their offerings.

- Established Networks: Brookline Bank benefits from existing physical and digital infrastructure that facilitates customer access to products and services.

- High Entry Costs: New entrants face significant investment requirements in technology, marketing, and customer acquisition to build comparable distribution capabilities.

- Digital Adoption Challenges: Attracting a large user base to digital platforms requires overcoming established customer habits and trust in traditional channels.

- Capital Investment: The sheer scale of investment needed to compete on distribution makes market entry difficult for many potential new players.

Potential Entry of Big Tech Companies

The threat of new entrants, particularly from Big Tech, is a significant concern for traditional banks like Brookline Bank. Companies such as Apple, Google, and Amazon have massive customer bases, substantial financial resources, and cutting-edge technology. For instance, Apple's services revenue alone reached $85.2 billion in 2023, showcasing their financial muscle.

While these tech giants might not seek full bank charters, their capacity to embed financial services within their vast ecosystems presents a potent, long-term disruptive force. They can leverage extensive user data to offer personalized financial products, potentially bypassing traditional banking infrastructure.

- Big Tech's Financial Power: Companies like Apple reported over $383 billion in total revenue for fiscal year 2023, demonstrating significant capital for market entry.

- Customer Ecosystems: Google boasts over 3 billion monthly active users across its services, providing a ready-made customer base for financial offerings.

- Data Monetization: Amazon's extensive customer data allows for highly targeted and potentially disruptive financial product development.

- Technological Advancement: Big Tech firms are at the forefront of AI and data analytics, which are crucial for modernizing financial services.

The threat of new entrants into the banking sector, impacting institutions like Brookline Bank, is generally considered moderate due to substantial barriers. High capital requirements, stringent regulatory compliance, and the need for established trust significantly deter new players. However, the rise of agile fintech firms and the potential entry of Big Tech companies represent evolving challenges that could lower these traditional barriers.

Fintech companies, by focusing on niche services, can bypass some of the extensive regulatory hurdles faced by full-service banks. For example, neobanks often operate with lighter compliance loads initially, allowing for rapid customer acquisition in areas like digital payments. This unbundling strategy erodes traditional revenue streams for established players like Brookline Bank.

Big Tech firms, with their vast customer bases and financial resources, pose a more significant long-term threat. Companies like Apple, with its $85.2 billion services revenue in 2023, can easily integrate financial services into their existing ecosystems, leveraging user data for personalized offerings and potentially disrupting the market without needing traditional banking licenses.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | Mandatory reserves and liquidity ratios | Very High - Requires substantial initial investment | Basel III reforms increase capital adequacy ratios, demanding billions for a new bank charter. |

| Regulation & Compliance | Licensing, AML, KYC, operational resilience | High - Involves complex legal and operational frameworks | DORA implementation adds significant compliance costs for digital operational resilience. |

| Brand Reputation & Trust | Customer loyalty and established credibility | High - Difficult and time-consuming to build | Surveys consistently show trust as a key factor in choosing financial providers, favoring incumbents. |

| Economies of Scale | Lower per-unit costs through large operations | Moderate to High - New entrants start at a cost disadvantage | US banks averaged 1.5% operating expenses to assets in 2023, a benchmark difficult for startups to match. |

| Distribution Networks | Physical branches and digital platforms | High - Requires significant investment to replicate | Establishing a new bank branch can cost $1-5 million; digital infrastructure development is tens of millions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brookline Bank is built upon a foundation of comprehensive data, drawing from publicly available financial statements, investor relations reports, and industry-specific market research. We also incorporate insights from regulatory filings and reputable financial news outlets to provide a robust understanding of the competitive landscape.