Brinker International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brinker International Bundle

Brinker International, a titan in the casual dining sector, possesses strong brand recognition and a diverse portfolio of popular restaurant concepts, but faces challenges in adapting to evolving consumer preferences and a competitive landscape. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Brinker International boasts a robust portfolio anchored by its well-known brands, Chili's Grill & Bar and Maggiano's Little Italy. These brands enjoy significant customer loyalty and a substantial market footprint, extending across 29 countries and two territories, a testament to their enduring appeal and effective market penetration.

Chili's, specifically, has shown remarkable performance, with notable increases in both sales and customer traffic. This growth is largely attributed to strategic marketing initiatives and appealing value propositions, such as the popular '3 for Me' meal deals and the 'Big Smasher' burger, which resonate well with consumers seeking affordability and satisfaction.

Brinker International is demonstrating impressive financial strength. In the third quarter of fiscal year 2025, consolidated comparable restaurant sales surged by a notable 28.2%. Chili's brand was a key driver, with its comparable sales jumping 31.6%, largely due to increased customer traffic.

This robust sales performance translated directly to the top line. Brinker International reported total revenues of $1.43 billion for Q3 fiscal 2025, a significant increase from $1.12 billion in the same period last year. Looking ahead, the company anticipates full-year fiscal 2025 total revenues to fall within the $5.33 billion to $5.35 billion range, underscoring continued positive momentum.

Brinker International's commitment to refining its operational and marketing strategies is a significant strength. For instance, Chili's focused on menu simplification and enhancing the guest experience, leading to a notable 4.9% increase in comparable restaurant sales in Q1 2024. This strategic approach directly translates to improved customer satisfaction and encourages repeat business.

Improved Profitability and Margin Expansion

Brinker International has demonstrated a strong ability to enhance profitability. A key indicator of this is the significant improvement in restaurant operating margins, with non-GAAP figures reaching 18.9% in the third quarter of fiscal year 2025. This represents a substantial year-over-year increase of 470 basis points.

This margin expansion is a direct result of several strategic initiatives. The company has benefited from strong top-line growth, which creates sales leverage. Simultaneously, effective cost management strategies are in place, even while the company continues to invest in crucial areas like staffing and technology upgrades.

- Improved Restaurant Operating Margins: Non-GAAP restaurant operating margin reached 18.9% in Q3 fiscal 2025.

- Year-over-Year Growth: This marks a 470 basis point increase compared to the previous year.

- Drivers of Improvement: Sales leverage from strong revenue growth and efficient cost controls are key factors.

- Strategic Investments: Margin gains were achieved despite ongoing investments in staffing and technology.

Commitment to Debt Reduction and Financial Stability

Brinker International's commitment to strengthening its balance sheet is a significant advantage. The company actively managed its debt, successfully repaying an additional $125 million in funded debt during the third quarter of fiscal year 2025. This strategic move not only reduces the company's leverage but also enhances its overall financial stability.

This disciplined approach to debt reduction provides a more robust financial foundation, enabling Brinker to pursue growth opportunities and navigate economic fluctuations with greater resilience. The reduction in long-term debt is a clear indicator of sound financial management.

- Debt Reduction: Repaid $125 million in funded debt in Q3 FY2025.

- Financial Stability: Improved balance sheet health and reduced leverage.

- Foundation for Growth: Enhanced capacity for future investments and strategic initiatives.

- Capital Management: Demonstrates a disciplined approach to financial stewardship.

Brinker International's strengths are evident in its powerful brand portfolio, particularly Chili's Grill & Bar and Maggiano's Little Italy, which have cultivated significant customer loyalty and a broad market presence. Chili's has experienced a remarkable resurgence, driven by effective value-driven marketing like the '3 for Me' program and strong comparable sales growth of 31.6% in Q3 FY2025.

The company's financial performance in Q3 FY2025 was robust, with consolidated comparable restaurant sales up 28.2% and total revenues reaching $1.43 billion. This growth is supported by improved restaurant operating margins, which hit 18.9% (non-GAAP) in Q3 FY2025, a 470 basis point increase year-over-year, attributed to sales leverage and cost management.

Furthermore, Brinker International is actively strengthening its financial foundation by reducing debt, having repaid $125 million in funded debt in Q3 FY2025, enhancing its financial stability and capacity for future growth.

| Metric | Q3 FY2025 | Year-over-Year Change |

|---|---|---|

| Consolidated Comparable Restaurant Sales | +28.2% | N/A |

| Chili's Comparable Restaurant Sales | +31.6% | N/A |

| Total Revenues | $1.43 billion | +27.7% (vs. $1.12 billion in Q3 FY2024) |

| Restaurant Operating Margin (Non-GAAP) | 18.9% | +470 basis points |

| Funded Debt Repaid | $125 million | N/A |

What is included in the product

Delivers a strategic overview of Brinker International’s internal and external business factors, highlighting its brand portfolio and market position.

Identifies key internal strengths and weaknesses to address operational challenges.

Highlights external opportunities and threats to proactively mitigate risks.

Weaknesses

Brinker International's significant reliance on the casual dining segment presents a notable weakness. This sector, though experiencing some recovery, remains susceptible to economic downturns and evolving consumer tastes, which increasingly favor quick-service or unique experiential dining.

While Chili's, a key brand, demonstrates resilience, the broader casual dining industry has seen inconsistent performance, with several brands encountering difficulties. This concentration exposes Brinker to sector-specific headwinds.

Maggiano's Little Italy is lagging behind its sister brand, Chili's, in terms of growth. While Chili's has shown strong comparable restaurant sales, Maggiano's reported a modest 0.4% increase in Q3 fiscal 2025, with some periods even seeing a dip in customer traffic. This performance suggests that Maggiano's isn't a significant growth driver for Brinker International and might need a more focused strategy to improve its standing.

Brinker International, like many in the casual dining sector, continues to grapple with escalating operating expenses. Rising labor costs, a persistent challenge throughout 2024, coupled with inflationary pressures on key commodities such as beef and poultry, put a strain on margins. For instance, the average hourly wage for restaurant workers saw an increase, and commodity costs for many ingredients were up by 5-10% year-over-year in early 2025, impacting the cost of goods sold.

While Brinker has demonstrated resilience by leveraging sales growth and implementing operational efficiencies to offset these increases, the underlying pressure remains. These rising costs can still erode profitability if not consistently managed through strategic pricing adjustments and ongoing cost control measures. The company's ability to maintain its competitive pricing while absorbing these higher expenses is a critical factor for its financial health.

Intense Competitive Environment

Brinker International operates within a fiercely competitive restaurant landscape, especially in the casual and fast-casual dining sectors. This intense rivalry means Brinker must constantly innovate and provide attractive value propositions to stand out. Competitors range from established fast-food giants to other full-service dining establishments, all vying for consumer attention and spending.

The pressure to differentiate is significant. For instance, in 2023, the U.S. restaurant industry saw continued growth, but also increased price sensitivity among consumers, making value a critical factor. Brinker's ability to adapt its menus, pricing, and customer experience is paramount to maintaining its market position against a multitude of dining options.

- High Saturation: The casual dining segment, where brands like Chili's operate, faces numerous established and emerging competitors.

- Price Sensitivity: Consumers are increasingly seeking value, putting pressure on pricing strategies.

- Innovation Lag: Failure to introduce new menu items or dining experiences can lead to customer attrition.

- Operational Costs: Rising labor and food costs can impact profitability, making it harder to compete on price.

Potential for Consumer Price Sensitivity

Despite successful value campaigns, consumers remain highly price-sensitive in the current economic climate. Brinker's value offerings, such as the '3 for Me' deal, have shown resilience, but the broader market conditions present a challenge. For instance, in Q3 2024, while same-store sales at Chili's grew by 3.7%, overall consumer spending on dining out is closely watched for signs of pullback due to inflation.

Aggressive promotional environments from competitors and the increasing affordability of grocery options could challenge Brinker's pricing power and long-term traffic. This dynamic means that while value is appreciated, the continuous need to offer compelling price points might squeeze margins or require careful menu engineering to maintain profitability.

- Price Sensitivity: Consumers are actively seeking value, making pricing a critical factor in dining decisions.

- Promotional Environment: Competitors' aggressive discounting can pressure Brinker's market share and pricing strategy.

- Grocery Affordability: The rising appeal of home-cooked meals due to grocery price stability poses a threat to restaurant traffic.

- Margin Pressure: Balancing attractive pricing with operational costs is a key challenge for sustained profitability.

Brinker's reliance on the casual dining segment, while a core strength, also represents a vulnerability. This sector is highly sensitive to economic fluctuations and shifts in consumer preferences, which are increasingly leaning towards faster service or more unique dining experiences. The consistent performance of Chili's is a positive, but the overall casual dining market has seen uneven results, with some brands struggling.

Maggiano's Little Italy, while part of the Brinker portfolio, has not kept pace with Chili's growth trajectory. In Q3 fiscal 2025, Maggiano's reported a modest 0.4% increase in comparable sales, with certain periods even experiencing a decline in customer traffic. This indicates it's not a primary growth engine and may require a more targeted revitalization strategy.

Escalating operating expenses remain a persistent weakness. Brinker, like many in the industry, faces rising labor costs and increased commodity prices, with key ingredients like beef and poultry seeing year-over-year increases of 5-10% in early 2025. While the company has implemented efficiencies, these cost pressures continue to challenge profit margins.

The competitive intensity within the casual and fast-casual dining sectors is a significant hurdle. Brinker must continually innovate its menu, pricing, and overall customer experience to maintain its market share against a broad range of competitors. The industry's continued growth in 2023 was accompanied by heightened consumer price sensitivity, making value a critical differentiator.

What You See Is What You Get

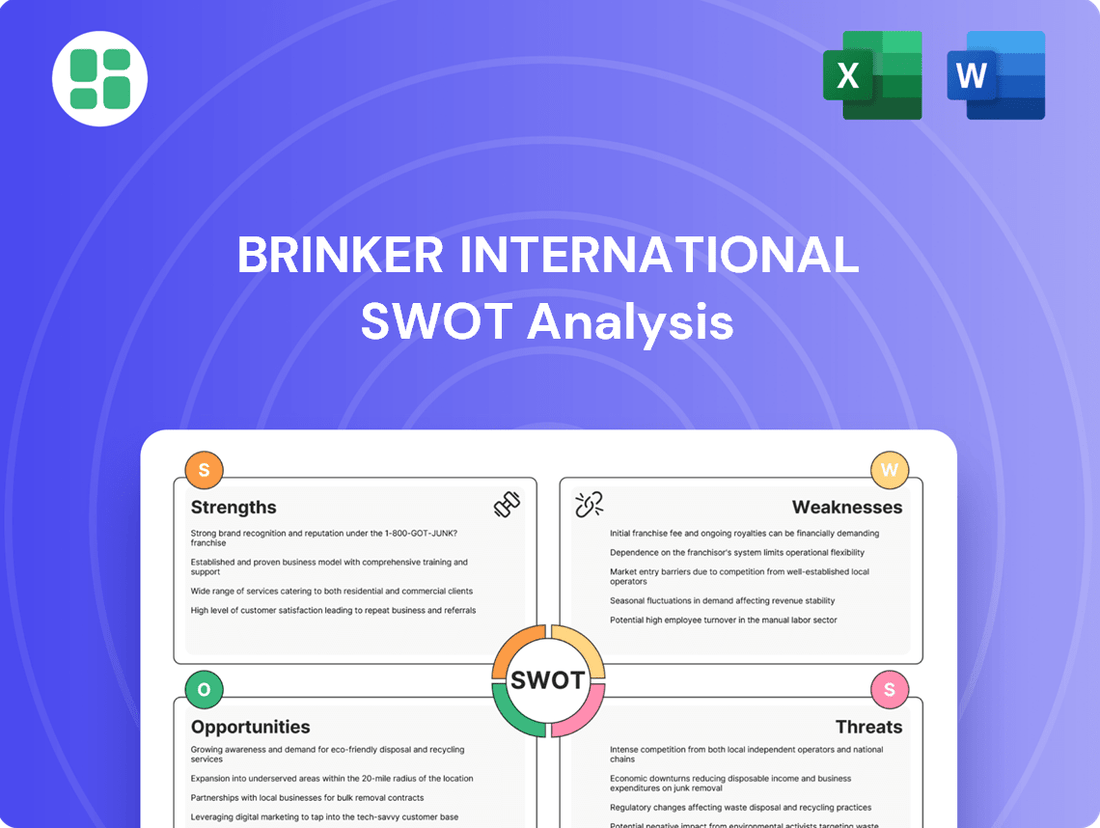

Brinker International SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Brinker International. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout. This ensures you receive the full, detailed report you expect.

Opportunities

The increasing consumer demand for digital ordering and delivery services offers a prime avenue for Brinker International to broaden its customer base and boost sales. By enhancing its online ordering capabilities and delivery infrastructure, the company can effectively tap into the growing preference for convenient, off-premise dining options.

Brinker International has a significant opportunity to boost sales and customer engagement through ongoing menu innovation. Expanding into popular segments like plant-based alternatives and exploring diverse global cuisines can attract a wider demographic, including younger consumers and those seeking healthier or more adventurous dining experiences.

Chili's, a key brand for Brinker, has demonstrated this potential with recent successful introductions. For instance, their 'Big Smasher' burger, launched in late 2023, resonated well with customers, showcasing a clear demand for novel and appealing menu items. This suggests a strong foundation for further experimentation and the introduction of new, trending dishes that align with evolving consumer tastes.

Brinker International is strategically investing in technology to boost efficiency and guest satisfaction. Their capital expenditure plans for 2024-2025 include significant upgrades and renovations, signaling a commitment to leveraging tech like AI and automation. This focus aims to optimize operations, refine staffing, and create more personalized dining experiences for customers.

Strategic International Expansion

Brinker International's established global footprint, boasting over 1,600 restaurants across 29 countries as of late 2024, presents a significant opportunity for strategic international expansion. This extensive network provides a robust platform for entering untapped markets or deepening penetration in existing international territories, thereby diversifying revenue and mitigating dependence on the U.S. market.

This expansion strategy could unlock substantial growth by capitalizing on the global appeal of brands like Chili's and Maggiano's. For instance, emerging economies often show a strong appetite for established casual dining concepts, offering Brinker a chance to replicate its domestic success. However, this path is not without its challenges, including navigating diverse regulatory environments and adapting to local consumer preferences.

Key opportunities within this strategic pillar include:

- Market Penetration: Increasing restaurant density in countries where Brinker already operates, leveraging brand recognition and established supply chains.

- New Market Entry: Targeting regions with favorable demographics and growing disposable incomes, such as parts of Southeast Asia or Eastern Europe, where casual dining is gaining traction.

- Franchise Development: Collaborating with local partners to accelerate expansion, sharing investment burdens and benefiting from local market expertise.

Applying Chili's Turnaround Playbook to Maggiano's

Brinker International has clearly signaled its intent to leverage the successful turnaround playbook from Chili's, including operational streamlining and menu enhancements, for Maggiano's Little Italy. This strategic move represents a prime opportunity to inject new life into the Maggiano's brand, aiming to boost its sales figures and customer traffic.

The company's focus on simplifying operations and refreshing the menu at Maggiano's is a direct response to the brand's recent performance challenges. For instance, Brinker reported that Maggiano's comparable restaurant sales decreased by 1.8% in the second quarter of fiscal year 2024, highlighting the need for such strategic interventions.

- Operational Simplification: Implementing efficiencies learned from Chili's to reduce complexity and improve service speed at Maggiano's.

- Menu Revitalization: Introducing updated dishes and potentially more appealing price points to attract a broader customer base.

- Brand Rejuvenation: Capitalizing on the established Maggiano's brand equity while addressing current market demands.

- Traffic Growth: The ultimate goal is to reverse the negative traffic trends observed in recent periods.

Brinker International can leverage its digital capabilities to enhance customer reach and sales, particularly through improved online ordering and delivery services. The company's investment in technology, including AI and automation, for 2024-2025 is poised to optimize operations and personalize guest experiences.

Menu innovation presents a significant opportunity, with recent successes like Chili's 'Big Smasher' burger in late 2023 demonstrating consumer appetite for new offerings. Expanding into plant-based and global cuisines can attract a wider demographic.

International expansion offers substantial growth potential, building on Brinker's existing global footprint of over 1,600 restaurants in 29 countries as of late 2024. This includes market penetration, new market entry, and franchise development.

Revitalizing the Maggiano's brand through operational simplification and menu enhancements, following its Q2 FY24 comparable sales decline of 1.8%, is a key strategic opportunity to drive traffic and sales.

Threats

Economic downturns and persistent inflation pose a significant threat to Brinker International. A potential recession could curb consumer discretionary spending, directly impacting dining out. For example, during periods of economic contraction, consumers often cut back on non-essential expenses like restaurant meals.

Ongoing inflationary pressures, particularly on food costs, squeeze restaurant margins and can force price increases that alienate price-sensitive customers. In 2023, the Consumer Price Index (CPI) for food away from home saw an increase, a trend that continued into early 2024, potentially reducing traffic for casual dining chains like Chili's and Maggiano's Little Italy.

This environment may drive consumers towards more affordable options, such as home cooking or fast-food establishments, thereby decreasing customer traffic and sales volumes for Brinker's brands.

Brinker International faces a significant threat from the growing fast-casual dining sector, which offers a blend of convenience and perceived higher quality compared to traditional casual dining. This trend is reshaping consumer preferences, drawing customers away from established casual dining brands.

Furthermore, quick-service restaurants (QSRs) are aggressively deploying value-driven promotions and deals. This intensifies price competition, forcing casual dining establishments like Brinker to contend with a more aggressive 'value war' for consumer spending.

The restaurant sector, including Brinker International, grapples with persistent labor shortages and escalating wage expectations. This trend directly inflates operating expenses, a critical concern for the company's bottom line.

Despite Brinker's efforts to bolster its workforce, ongoing hikes in labor expenditure pose a significant threat to profit margins. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for all employees in the Leisure and Hospitality sector increased by 4.5% year-over-year as of April 2024, highlighting the industry-wide pressure.

Evolving Consumer Preferences and Health Consciousness

Brinker International faces a significant threat from shifting consumer tastes towards healthier, more sustainable, and personalized food choices. A failure to innovate its menu and dining experience to meet these evolving demands could lead to a decline in market share as competitors better cater to current health-conscious trends.

This evolving preference landscape is a critical challenge. For instance, data from 2024 indicates a continued rise in demand for plant-based options and transparency regarding ingredient sourcing. Brinker's ability to adapt its core brands, like Chili's and Maggiano's, to these preferences will be key.

- Increased demand for plant-based and sustainable ingredients.

- Consumer desire for greater menu customization and transparency.

- Risk of losing market share to agile competitors.

Supply Chain Disruptions and Commodity Volatility

Brinker International, like many in the restaurant industry, faces ongoing risks from supply chain disruptions and fluctuating commodity prices. These factors can directly impact the cost of goods sold, affecting profitability. For instance, while Brinker primarily sources domestically, global events such as geopolitical tensions or extreme weather patterns can still disrupt the availability and increase the price of key ingredients like beef, poultry, and produce.

The company's exposure to commodity volatility was evident in recent financial reporting. For example, in fiscal year 2024, Brinker noted that higher commodity costs, particularly for beef and chicken, put pressure on their margins. This sensitivity underscores the need for robust procurement strategies and potential menu price adjustments to offset these external pressures.

- Supply Chain Vulnerability: Despite a largely domestic supply chain, Brinker remains susceptible to disruptions caused by global events, impacting ingredient availability.

- Commodity Price Swings: Volatility in the cost of key food and beverage inputs, such as beef and poultry, directly affects operational expenses and profitability.

- Impact on Food Costs: Fluctuations in commodity prices can lead to increased food and beverage expenses, requiring careful management and potential price adjustments.

Intensifying competition from fast-casual and QSR segments poses a threat, as these formats often appeal to value-conscious consumers. Additionally, evolving consumer preferences towards healthier, plant-based, and transparently sourced food require continuous menu innovation, a challenge for established casual dining brands.

Economic headwinds, including inflation and potential recessions, directly impact discretionary spending on dining out, squeezing Brinker's sales volumes and margins. Rising labor costs, with average hourly earnings in hospitality up around 4.5% year-over-year by April 2024, further strain profitability.

Supply chain disruptions and volatile commodity prices, such as beef and chicken, also present significant risks. For instance, Brinker noted higher commodity costs impacting margins in fiscal year 2024, necessitating careful procurement and pricing strategies.

SWOT Analysis Data Sources

This Brinker International SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary, ensuring a robust and data-driven assessment.