Brinker International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brinker International Bundle

Explore Brinker International's strategic positioning with a glimpse into its BCG Matrix. Understand which of their brands are market leaders and which require careful consideration for future investment.

This preview offers a foundational understanding, but for a comprehensive view of Brinker's portfolio—including detailed quadrant placements and actionable insights—purchase the full BCG Matrix report.

Unlock the full potential of this analysis and gain a clear roadmap for optimizing Brinker International's brand strategy and resource allocation. Get the complete report today for decisive market advantage.

Stars

Chili's '3 For Me' value menu, starting at an appealing $10.99, has been a powerful engine for customer engagement and revenue growth. This offering, which bundles bottomless chips and salsa, a drink, and an entree, directly taps into the widespread consumer desire for budget-friendly options in casual dining.

The '3 For Me' initiative has been instrumental in Chili's ability to attract and retain customers, contributing to its strong performance amidst a competitive restaurant landscape. This strategic pricing and bundled offering have demonstrably boosted traffic and sales, solidifying its position as a key differentiator for the brand.

The Big Smasher and Big QP burgers, key components of Chili's '3 For Me' value menu, have been instrumental in driving customer traffic and increasing market share for Brinker International. These innovations directly address the fast-casual market's demand for affordable yet appealing options, successfully drawing in consumers, particularly younger demographics.

Chili's saw a notable increase in comparable store sales in the first quarter of fiscal year 2024, partly attributed to the positive reception of these new burger offerings. This strategic menu expansion into value-driven propositions has allowed Chili's to effectively compete with traditional fast-food players, enhancing its brand perception and customer loyalty in a competitive landscape.

Chili's has masterfully employed social media, especially TikTok, to generate buzz for items like the Triple Dipper, creating viral marketing moments.

This digital strategy has proven effective in drawing in younger demographics and encouraging more frequent visits from their existing customer base.

In 2024, Chili's reported a notable increase in digital engagement, with social media campaigns contributing to a significant uplift in brand visibility and customer acquisition.

The brand's adeptness at using digital platforms for marketing underscores its strong potential for continued growth by capturing the attention of today's diners.

Chili's Overall Traffic Growth

Chili's has demonstrated impressive traffic growth, with a notable 21% increase in guest visits during Q3 Fiscal 2025. This surge is particularly significant in the current casual dining landscape, where many competitors are experiencing visitor declines.

This substantial rise in customer traffic underscores Chili's strong appeal and effective market strategies. It suggests a growing customer base and a strengthening market position within its segment.

- Chili's Q3 Fiscal 2025 Traffic Growth: 21% increase in guest visits.

- Industry Context: Outperforming many casual dining rivals who are seeing declines.

- Market Position: Indicative of strong market acceptance and potential market share gains.

- Future Outlook: Sustained momentum suggests a positive trajectory for continued expansion.

Operational Improvements at Chili's

Chili's has focused on operational improvements to solidify its Star status. These include kitchen workflow enhancements and a streamlined menu, boosting efficiency and profitability.

These strategic moves have directly impacted the bottom line. For instance, Brinker International reported that Chili's comparable restaurant sales increased by 5.7% in the first quarter of fiscal year 2024, a testament to these efforts.

- Kitchen Efficiency: Upgrades to kitchen technology and processes have reduced order times.

- Menu Simplification: A more focused menu allows for faster preparation and reduced waste.

- Improved Margins: These efficiencies contributed to a 15.1% restaurant-level operating margin for Chili's in Q1 FY24.

- Traffic Handling: The brand is now better equipped to manage higher customer volumes without compromising service quality.

Chili's "3 For Me" value menu, featuring items like the Big Smasher and Big QP burgers, has been a significant driver of customer traffic and market share growth for Brinker International. This strategy directly addresses the demand for affordable, appealing options, particularly among younger consumers.

The brand's digital marketing, especially on platforms like TikTok for promotions such as the Triple Dipper, has successfully engaged younger demographics and boosted brand visibility. In 2024, Chili's saw increased digital engagement, contributing to customer acquisition and brand awareness.

Chili's experienced a substantial 21% surge in guest visits during Q3 Fiscal 2025, outperforming many casual dining competitors. This traffic growth, coupled with operational enhancements like kitchen workflow improvements and menu streamlining, has bolstered efficiency and profitability, evidenced by a 5.7% increase in comparable restaurant sales in Q1 FY24.

These combined efforts, including operational efficiencies that contributed to a 15.1% restaurant-level operating margin for Chili's in Q1 FY24, position Chili's as a strong performer, effectively handling increased customer volumes and solidifying its Star status within the Brinker International portfolio.

| Metric | Chili's Performance | Brinker International Context |

|---|---|---|

| Q3 FY25 Guest Traffic Growth | 21% increase | Outperforming many casual dining competitors |

| Q1 FY24 Comparable Sales Growth | 5.7% increase | Driven by value menu and operational improvements |

| Q1 FY24 Restaurant-Level Operating Margin | 15.1% | Reflects improved efficiency and profitability |

| Key Growth Drivers | '3 For Me' value menu, digital marketing, operational enhancements | Strengthening market position and customer loyalty |

What is included in the product

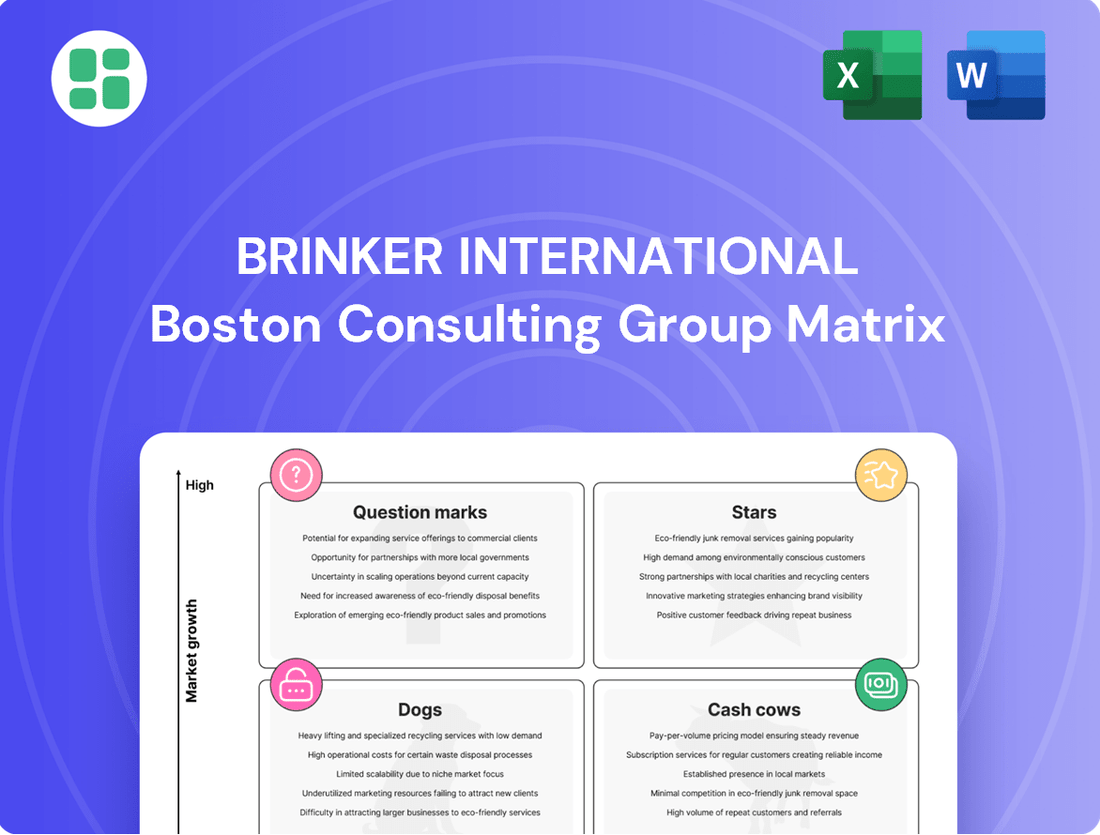

Brinker International's BCG Matrix offers a tailored analysis of its restaurant brands across Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest for strategic portfolio management.

A clear BCG Matrix visualizes Brinker International's portfolio, highlighting areas needing investment or divestment to alleviate strategic uncertainty.

Cash Cows

Chili's Grill & Bar, Brinker International's primary brand, is a classic cash cow. It holds a dominant market share in the casual dining sector, consistently bringing in significant profits. As of the first quarter of fiscal year 2024, Chili's reported a 3.1% increase in comparable restaurant sales, demonstrating its continued strength.

With over 1,600 locations worldwide, Chili's benefits from a vast and loyal customer base. This extensive reach and established brand recognition translate into a predictable and robust revenue stream, making it a reliable engine for Brinker International's financial success.

Maggiano's Little Italy, a key player in the upscale casual Italian dining scene, demonstrated a 0.4% comparable sales increase in Q3 FY25, largely driven by strategic pricing. This growth, though modest, underscores its strong market position.

Despite facing slight traffic headwinds, Maggiano's maintains a substantial market share. Its established brand equity and a dedicated customer following, coupled with an average check size that surpasses Chili's, solidify its role as a consistent profit generator for Brinker International.

The brand's commitment to premium ingredients and an enhanced dining experience translates into reliable, albeit not rapid, cash flow. This consistent generation of funds allows Brinker to allocate resources to other ventures within its portfolio.

Franchised Chili's locations act as Brinker International's cash cows, generating consistent royalty and franchise fees with minimal direct operational involvement. These established units leverage the brand's strong market presence and effective marketing, offering a predictable, high-profit, low-growth revenue source for the company. For instance, in fiscal year 2024, Brinker International reported that its franchise segment, which includes a significant portion of Chili's restaurants, contributed substantially to overall profitability, demonstrating the enduring strength of this model.

Established Menu Staples at Chili's

Chili's established menu staples, like its iconic fajitas and ribs, act as consistent revenue generators for Brinker International. These enduring favorites, complemented by classic margaritas, have cultivated decades of customer loyalty and demand minimal marketing spend. They are the bedrock of Chili's consistent cash flow, representing high-volume, dependable offerings.

These core menu items are the brand's "Cash Cows" in the BCG Matrix. For instance, in fiscal year 2023, Brinker International reported total revenue of $3.9 billion, with Chili's being a significant contributor. The predictable demand for these staples ensures a steady stream of income, allowing Brinker to invest in other areas of its business.

- Fajitas: Consistently high sales volume due to widespread popularity.

- Ribs: A signature item with a loyal customer base.

- Classic Margaritas: A beverage staple driving significant drink sales.

- Brand Loyalty: Decades of consistent quality foster repeat business with low marketing costs.

Brinker's Supply Chain and Operational Efficiencies

Brinker International's strategic focus on its consolidated supply chain and operational efficiencies is a key driver for its Cash Cows. By simplifying menus across its portfolio, the company effectively optimizes cost structures, directly leading to improved restaurant operating margins. This streamlined approach allows Brinker to leverage its considerable scale.

This disciplined strategy ensures that the substantial revenue generated by its high-market-share brands, like Chili's and Maggiano's, is converted into robust cash flow. For instance, in fiscal year 2023, Brinker reported a consolidated operating margin of 9.2%, a testament to these ongoing efficiencies. The company’s ability to maximize profitability from established brands is crucial for funding growth initiatives and returning value to shareholders.

- Menu Simplification: Reduced complexity in offerings leads to lower food costs and improved kitchen efficiency.

- Supply Chain Optimization: Leveraging scale for better purchasing power and reduced logistics expenses.

- Improved Operating Margins: Direct impact on profitability, with fiscal year 2023 operating margin at 9.2%.

- Strong Cash Flow Generation: Maximizing revenue from established brands translates into reliable cash for reinvestment.

Chili's Grill & Bar and Maggiano's Little Italy are Brinker International's primary cash cows, holding strong market positions with consistent revenue generation. Chili's, in particular, saw a 3.1% increase in comparable restaurant sales in Q1 FY24, showcasing its enduring appeal and dominance in the casual dining sector. Maggiano's, while experiencing more modest growth with a 0.4% comparable sales increase in Q3 FY25, maintains a substantial market share and benefits from a higher average check size.

These established brands, supported by loyal customer bases and iconic menu items like fajitas and ribs, provide a stable and predictable cash flow for Brinker International. This financial stability is further bolstered by the company's focus on operational efficiencies and supply chain optimization, leading to improved operating margins. For instance, Brinker reported a consolidated operating margin of 9.2% in fiscal year 2023, highlighting the profitability derived from these mature brands.

The franchised Chili's locations are particularly valuable as cash cows, generating consistent royalty and franchise fees with limited direct operational oversight. This model leverages the brand's established presence and marketing power to deliver high-profit, low-growth revenue. Brinker International's overall revenue in fiscal year 2023 reached $3.9 billion, with these cash cows forming a significant portion of that total.

| Brand | Market Share | Comparable Sales Growth (Recent) | Contribution to Cash Flow | Key Drivers |

| Chili's Grill & Bar | Dominant (Casual Dining) | 3.1% (Q1 FY24) | High | Iconic Menu, Brand Loyalty, Franchise Model |

| Maggiano's Little Italy | Substantial (Upscale Casual Italian) | 0.4% (Q3 FY25) | Consistent | Premium Experience, Higher Average Check, Dedicated Following |

What You’re Viewing Is Included

Brinker International BCG Matrix

The Brinker International BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. Unlock immediate access to this market-backed analysis, perfect for editing, printing, or presenting to stakeholders.

Dogs

Maggiano's Italian Classics, a virtual brand launched by Brinker International, has been largely discontinued. The company stated in their 2023 annual report that these virtual brands were de-emphasized due to their detrimental effect on profit margins.

The initiative proved to be a cash trap, as it led customers to opt for lower-priced virtual entrees instead of higher-margin dine-in options. This shift negatively impacted overall profitability, consuming resources without delivering the expected incremental value.

Brinker International has dialed back promotional efforts for its virtual brand, It's Just Wings. This strategic pivot acknowledges that aggressive marketing for this concept sometimes cannibalized sales from its primary Chili's brand, rather than generating truly new business.

The company's experience suggests that the substantial investment in promoting It's Just Wings wasn't translating into the expected incremental revenue. This positions It's Just Wings within the BCG Matrix as a question mark or potentially a dog, characterized by low market share and low growth potential, especially when promotional spending is reduced.

Brinker International, like many large restaurant chains, faces the challenge of underperforming or outdated menu items within both its Chili's and Maggiano's brands. These items, failing to align with current consumer tastes or exhibiting low profit margins, can become a drag on overall sales performance and operational efficiency.

For instance, Maggiano's Little Italy made a strategic move in 2024 by streamlining its menu, removing eight items and reducing 17 prep steps. This initiative directly addresses the issue of menu complexity and the inefficiency of supporting items that do not contribute significantly to revenue or customer satisfaction, freeing up valuable kitchen resources and inventory.

Geographically Underperforming Company-Owned Restaurants

Brinker International's portfolio includes company-owned restaurants that may not be performing as well as others. These underperforming locations, often older or in less-than-ideal spots, struggle with customer traffic and sales compared to the average for the brand. They can drain resources without contributing much to overall profitability.

These specific units can be categorized as 'Dogs' in a BCG Matrix context. They operate in markets with limited growth potential or face intense local competition, making it difficult to boost sales and profits. For instance, a specific Chili's location in a declining suburban area might exhibit these characteristics.

- Underperforming Locations: Some company-owned restaurants, particularly those established years ago or situated in areas with reduced economic activity, consistently fall below average sales benchmarks.

- Resource Drain: These units require ongoing investment in staffing, maintenance, and marketing, yet their low revenue generation makes them a net drain on company resources.

- Market Challenges: Factors such as increased local competition, changing consumer preferences in a specific neighborhood, or a general slowdown in the local economy contribute to their poor performance.

- Strategic Consideration: While Brinker International has not announced specific divestitures of these types of units in recent reports, their persistent low performance aligns with the 'Dog' quadrant, suggesting a need for strategic review, such as renovation, repositioning, or potential closure.

Previous Take-Home Pasta Deals at Maggiano's

Maggiano's Little Italy, a casual Italian dining chain, has strategically removed its popular $6 take-home pasta deals. This move is part of a broader turnaround effort aimed at revitalizing the brand's financial performance.

These deeply discounted pasta offers, while popular with customers, were likely detrimental to the company's bottom line. Such promotions often cannibalize sales of higher-margin items and may not attract the kind of customer base that contributes significantly to overall profitability.

The decision to eliminate these deals indicates that they were not an effective growth driver and were hindering the brand's ability to achieve sustainable, profitable growth.

- Maggiano's $6 Take-Home Pasta Deal Elimination

- Rationale: Turnaround strategy, focus on profitability

- Impact: Potential increase in average check size, reduced cannibalization

- Classification: Considered a 'Dog' in the BCG Matrix due to low profitability and lack of strategic growth contribution

Certain company-owned restaurant locations within Brinker International's portfolio exhibit characteristics of 'Dogs' in the BCG Matrix. These are units that have low market share and low growth potential, often struggling with customer traffic and sales compared to brand averages.

These underperforming units, potentially older or situated in less economically vibrant areas, can consume resources without generating substantial returns. For example, a specific Chili's location in a declining neighborhood might fit this profile, facing limited growth prospects due to local market conditions.

The strategic streamlining of Maggiano's menu in 2024, removing underperforming items, directly addresses the inefficiency of supporting low-revenue contributors. This focus on core, profitable offerings is a common strategy for managing 'Dog' assets within a larger portfolio.

While specific divestiture plans for these individual units haven't been publicly detailed by Brinker International, their persistent low performance aligns with the 'Dog' quadrant, suggesting a need for strategic review, which could include repositioning, renovation, or eventual closure.

Question Marks

Maggiano's Little Italy is currently implementing a strategic turnaround, drawing parallels to the successful revitalization of Chili's. This involves streamlining operations, refining the core menu, and curbing excessive discounting to address declining customer traffic and foster renewed growth.

This strategy positions Maggiano's as a 'Question Mark' within Brinker International's portfolio. While the turnaround holds the potential for significant future growth, its current modest market share in terms of traffic growth necessitates considerable strategic investment and close observation.

Brinker International is actively experimenting with off-premise-only kitchens, such as those for Chili's and It's Just Wings, particularly in dense urban markets like New York City and near college campuses. This strategic move taps into the booming demand for delivery and takeout, a significant growth area within the restaurant sector.

These smaller, more agile kitchen units are designed to capitalize on the evolving consumer preference for convenience. While the restaurant industry saw delivery sales grow by an estimated 12.5% in 2024, reaching $76.7 billion, Brinker's ghost kitchen ventures are still in their nascent stages. Their contribution to Brinker's overall revenue and profitability is currently moderate, positioning them as a star with high growth potential but requiring substantial investment to solidify their long-term market position and prove consistent returns.

Chili's new premium frozen margaritas featuring Patrón tequila and monthly 'Marg of the Month' specials are positioned as potential growth drivers. These additions are designed to attract a higher-spending customer and increase overall beverage revenue, a category that saw significant growth in the casual dining sector throughout 2024.

While the premiumization of the beverage menu aligns with broader market trends favoring craft cocktails and premium spirits, the success of these specific offerings within Chili's established value proposition remains to be fully determined. Brinker International (EAT) reported that beverage sales contributed a notable portion to their overall revenue in recent quarters, but the long-term impact of these premium margaritas on market share and profitability is still under evaluation, placing them in the 'Question Mark' category.

Targeted Technology Initiatives

Brinker International's targeted technology initiatives, such as the implementation of a new Enterprise Resource Planning (ERP) system, are designed to streamline operations and elevate the customer experience. These significant investments are pivotal for maintaining competitiveness in an increasingly digital restaurant landscape.

While the full impact on market share and revenue is still unfolding, these projects represent Brinker's commitment to future growth. For instance, in fiscal year 2023, the company reported capital expenditures of $375.3 million, a portion of which is allocated to these critical technology upgrades aimed at long-term efficiency and customer engagement.

- ERP System Implementation: Aimed at enhancing back-end processes, supply chain management, and financial reporting for greater operational agility.

- Digital Customer Engagement Tools: Investments in loyalty programs, online ordering platforms, and mobile app enhancements to capture a larger share of digital sales, which represented a significant portion of the industry's growth in 2024.

- Data Analytics Capabilities: Building robust data infrastructure to better understand consumer behavior, personalize marketing efforts, and optimize menu offerings.

Exploration of New Dining Formats/Concepts

Brinker International, beyond its core brands like Chili's and Maggiano's, actively investigates novel dining formats. These emerging concepts, characterized by high growth potential but currently low market penetration, reside in the Question Mark quadrant of the BCG matrix. They represent strategic bets on future market demands.

For instance, in early 2024, the company was reportedly experimenting with smaller, more digitally-focused service models for certain brands, aiming to tap into the growing ghost kitchen and delivery-only market. Such initiatives require substantial capital for development and marketing to establish a foothold.

- Nascent Concepts: Brinker's exploration of new dining formats, such as curated virtual brands or enhanced quick-service options, fits the Question Mark profile.

- High Growth Potential: These ventures are designed to capture evolving consumer preferences for convenience and diverse culinary experiences.

- Low Market Share: As unproven concepts, they currently hold minimal market share.

- Investment Needs: Significant investment is necessary to test, refine, and scale these new formats, with uncertain outcomes.

Brinker International's strategic investments in technology, such as their new ERP system, and experimental dining formats, like off-premise-only kitchens, are classified as Question Marks. These initiatives show promise for future growth, evidenced by the industry's 12.5% delivery sales growth in 2024, but currently have low market share and require significant capital to prove their long-term viability.

The premiumization of Chili's beverage menu, including new Patrón margaritas, also falls into this category. While beverage sales are a strong contributor to revenue, the ultimate impact of these specific premium offerings on market share and profitability is still under evaluation, making them a strategic gamble with uncertain returns.

Maggiano's Little Italy's turnaround strategy, aiming to revitalize its operations and menu, positions it as a Question Mark. Despite the potential for significant future growth, its current modest market share necessitates ongoing investment and close monitoring to ensure success.

These Question Mark initiatives, including nascent concepts and technology upgrades that saw Brinker allocate $375.3 million in capital expenditures in fiscal year 2023, are crucial for staying competitive and capturing evolving consumer trends.

| Brinker International BCG Matrix: Question Marks | Current Market Share | Market Growth Rate | Strategic Outlook |

|---|---|---|---|

| Maggiano's Turnaround | Low (relative to potential) | Moderate to High (potential) | Requires significant investment and close monitoring for revitalization. |

| Off-Premise Kitchens/Ghost Kitchens | Low (nascent stage) | High (industry trend) | High investment needed to scale and prove profitability in the growing delivery sector. |

| Premium Beverage Offerings (e.g., Chili's Margaritas) | Low (specific product impact) | Moderate to High (beverage category growth) | Uncertain long-term impact on market share and profitability, dependent on customer adoption. |

| Technology Investments (ERP, Digital Engagement) | Low (direct market share impact) | High (industry necessity) | Essential for operational efficiency and future competitiveness, with long-term ROI yet to be fully realized. |

BCG Matrix Data Sources

Our Brinker International BCG Matrix is informed by comprehensive data, including company financial filings, industry growth reports, and competitive market analysis.