Brambles SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brambles Bundle

Brambles' SWOT analysis reveals a strong foundation built on robust operational efficiency and a global distribution network. However, it also highlights potential vulnerabilities in supply chain dependencies and evolving market competition.

Want the full story behind Brambles' competitive edge and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Brambles, largely via its CHEP division, boasts an exceptionally robust global network for its pallet and container pooling operations. This vast infrastructure, spanning numerous countries and catering to a wide array of industries, ensures remarkable efficiency in asset management and deployment, solidifying its leadership in the supply chain solutions sector. For instance, CHEP operates in over 60 countries, managing millions of pallets and containers, a testament to its extensive reach and operational scale.

Brambles' core business revolves around a highly sustainable model, providing reusable pallets, crates, and containers. This inherently reduces waste and optimizes resource utilization within supply chains, a key differentiator in today's market.

This circular economy approach directly addresses the growing global demand for environmentally responsible supply chain solutions. Brambles' commitment to sustainability not only appeals to eco-conscious clients but also positions them favorably against competitors. In FY23, Brambles reported that its customers saved an estimated 1.7 million metric tons of CO2e by using their pooled solutions, underscoring the tangible environmental benefits.

Brambles' innovative pooling model is a significant strength, directly translating into cost efficiency for its customers. By allowing multiple businesses to share and reuse their platforms, Brambles dramatically lowers the individual capital expenditure required for packaging assets. This shared economy approach offers substantial cost savings for clients, fostering strong customer loyalty and making Brambles a highly attractive, economically sound choice in the market.

Diversified Industry Exposure

Brambles' strength lies in its extensive reach across numerous industries, including fast-moving consumer goods, fresh produce, beverages, and automotive. This broad customer base acts as a significant buffer against economic volatility in any single sector. For instance, in fiscal year 2023, Brambles reported that its revenue was derived from a wide array of end markets, demonstrating this inherent diversification.

The company's diversified industry exposure translates into a more stable and predictable revenue stream. When one sector experiences a slowdown, demand from other sectors can help offset the impact, providing a level of resilience that single-industry focused businesses often lack. This broad market penetration ensures consistent demand for its pooling solutions.

Key sectors contributing to Brambles' diversified revenue include:

- Consumer Goods: A consistent driver of demand for pallet and container solutions.

- Fresh Produce: Essential for the efficient transportation and storage of perishable items.

- Beverages: A large and stable market requiring robust logistics.

- Automotive: Critical components require reliable and standardized handling.

Operational Expertise and Scale

Brambles' extensive experience in managing intricate global supply chains, coupled with its substantial asset base, translates into formidable operational expertise and significant economies of scale. This deep understanding allows for optimized asset utilization, maintenance, and distribution networks, ensuring the consistent reliability and efficiency of its pallet and crate pooling solutions. For instance, in fiscal year 2023, Brambles managed over 340 million of its distinctive CHEP pallets and containers across more than 60 countries, demonstrating the sheer scale of its operations.

This operational mastery creates a substantial competitive advantage, acting as a high barrier to entry for potential rivals seeking to replicate Brambles' service model. The company's ability to efficiently manage such a vast and complex pool of assets underpins its value proposition to customers, ensuring a steady and dependable supply of essential logistics equipment.

- Global Reach: Operates in over 60 countries, managing a massive pool of assets.

- Efficiency Gains: Optimized logistics and asset management drive cost efficiencies.

- Competitive Moat: Scale and expertise create a significant barrier for new entrants.

- Reliability: Proven track record in delivering consistent service quality.

Brambles' extensive global network is a cornerstone of its strength, enabling efficient pallet and container pooling across over 60 countries. This vast infrastructure supports millions of assets, ensuring seamless supply chain operations for a diverse clientele. The company’s commitment to sustainability, evident in its reusable pooling solutions, significantly reduces waste and CO2 emissions, with customers saving an estimated 1.7 million metric tons of CO2e in FY23 alone. This circular economy model not only appeals to environmentally conscious businesses but also provides substantial cost efficiencies for clients through shared asset utilization.

What is included in the product

Maps out Brambles’s market strengths, operational gaps, and risks.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Brambles' business model inherently demands significant upfront capital investment. Acquiring and maintaining a massive global pool of reusable pallets, crates, and containers requires substantial ongoing expenditure, impacting cash flow and profitability, particularly during growth phases or when assets need replacement. For instance, in the fiscal year 2023, Brambles reported capital expenditure of approximately $1.1 billion, highlighting the scale of investment needed to sustain its operations and fleet.

Brambles faces a significant weakness in its vulnerability to commodity price fluctuations. The cost of timber and plastics, essential for producing and repairing its reusable pallets and containers, can directly impact operational expenses. For instance, if timber prices surge, as they have seen volatility in recent years due to supply chain disruptions and demand shifts, Brambles' cost of goods sold will rise.

These price swings can compress profit margins if Brambles cannot effectively hedge against them or pass the increased costs onto its customers. For example, a sharp increase in plastic resin prices, a key input for many of its containers, could significantly erode profitability if not managed through strategic sourcing or pricing adjustments. This makes consistent financial performance challenging without robust risk management strategies in place.

Managing Brambles' vast global pool of millions of reusable assets, like CHEP pallets and IFCO crates, presents considerable logistical hurdles. This complexity stems from the need for precise tracking, efficient retrieval, diligent maintenance, and strategic redistribution across varied customer supply chains worldwide.

These intricate operations can lead to increased operational overhead due to potential asset loss or damage, impacting the company's bottom line. For instance, while Brambles aims for high asset utilization, the sheer scale of its operations means even small percentages of loss or damage can translate into significant costs, as seen in their ongoing efforts to optimize asset recovery rates.

Dependence on Economic Stability and Trade Volumes

Brambles' significant reliance on the stability of the global economy and trade volumes presents a key weakness. When economies falter, consumer spending typically declines, directly impacting the movement of goods and consequently reducing the demand for Brambles' essential pooling solutions. This can lead to lower asset utilization rates across their extensive network.

For instance, during periods of economic contraction, such as the slowdown experienced in various regions in late 2023 and early 2024, Brambles would likely see a dip in the volume of pallets and containers required by its customers. This sensitivity means that a significant global recession could materially impact revenue and profitability.

The company's performance is also vulnerable to disruptions in international trade, including tariffs, geopolitical tensions, or shipping bottlenecks. These factors can impede the flow of goods, thereby reducing the need for Brambles' services and potentially increasing the cost of operating its global logistics network.

- Economic Sensitivity: Brambles' revenue is directly correlated with global economic activity and the volume of goods moving through supply chains.

- Trade Disruption Impact: Tariffs, geopolitical events, and shipping issues can hinder trade flows, negatively affecting demand for Brambles' services.

- Asset Utilization Risk: Economic downturns can lead to decreased demand, resulting in lower utilization rates for Brambles' extensive asset base.

Operational Risks and Asset Contamination

The shared nature of Brambles' assets, like pallets and containers, introduces significant operational risks. These include the potential for damage, loss, or contamination, which can occur as these assets move across a wide array of industries and diverse customer operations.

Maintaining consistent asset quality and rigorous hygiene standards across such varied sectors presents an ongoing challenge for Brambles. This complexity directly impacts the reliability of their services and, consequently, customer satisfaction levels.

- Asset Damage: In 2023, Brambles reported a net loss of approximately 40 million pallets, highlighting the ongoing issue of asset damage in circulation.

- Hygiene Concerns: Incidents of contamination, though not always publicly quantified, can lead to significant reputational damage and require costly remediation efforts.

- Operational Complexity: Managing a global pool of over 300 million assets across more than 60 countries inherently creates complex logistical and quality control hurdles.

Brambles' extensive global operations, managing over 300 million assets across more than 60 countries, create significant logistical complexities. This vast network requires meticulous tracking, retrieval, maintenance, and redistribution, leading to higher operational overheads and potential for asset loss or damage, impacting profitability. For instance, in fiscal year 2023, Brambles reported a net loss of approximately 40 million pallets, underscoring the continuous challenge of asset recovery and management.

Preview Before You Purchase

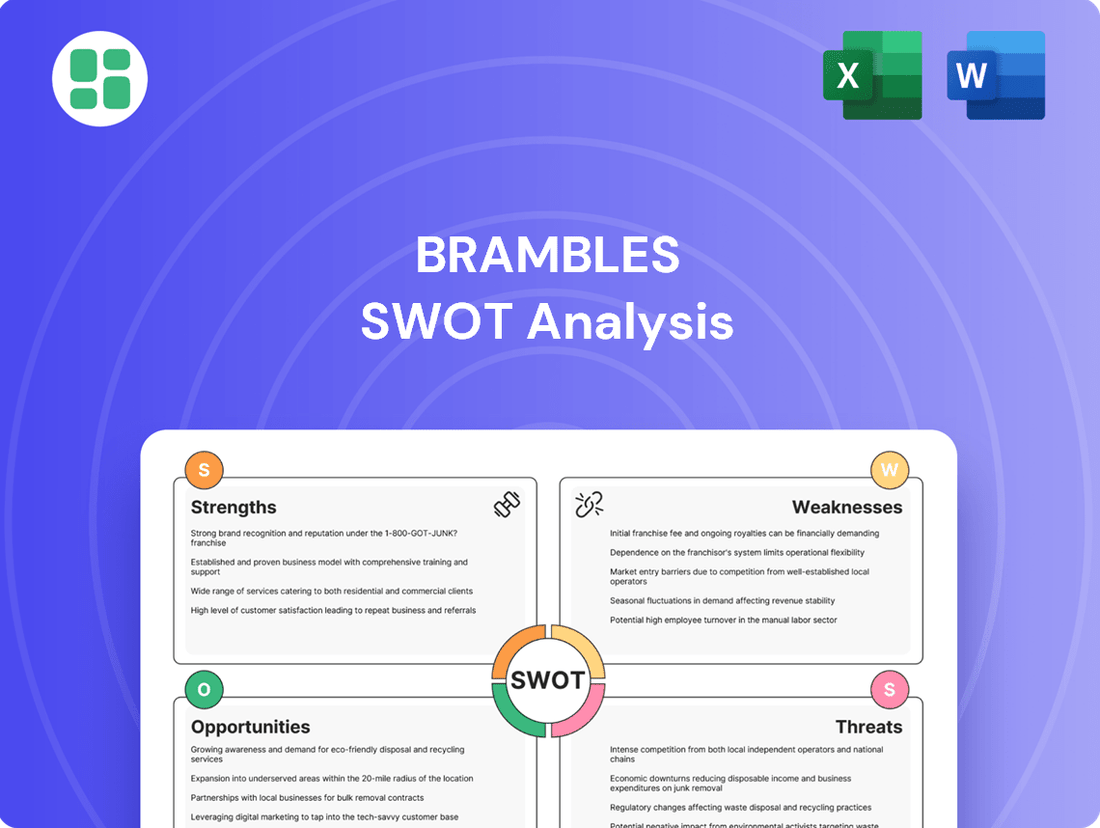

Brambles SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Brambles SWOT analysis, ensuring transparency and quality. Purchase unlocks the complete, in-depth report, so you know exactly what you're getting.

Opportunities

Growing environmental awareness and ambitious corporate sustainability goals are significantly boosting the demand for eco-friendly logistics solutions. This trend directly supports Brambles' business model, as their core reusable pallet and container system inherently offers a reduced environmental footprint compared to single-use alternatives.

Brambles is strategically positioned to benefit from this shift, providing a tangible solution for businesses aiming to lower their carbon emissions and achieve their Environmental, Social, and Governance (ESG) targets. For instance, in fiscal year 2023, Brambles reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions intensity, demonstrating their commitment and capability in this area.

Brambles has a substantial opportunity to grow by offering its pooling solutions in new territories, especially in emerging markets where supply chains are still developing. These regions often provide a chance to become a market leader early on and attract new customers as their economies expand. For instance, the Asia-Pacific region, with its growing e-commerce and manufacturing sectors, presents a fertile ground for Brambles' expansion, building on its existing presence in Australia and Southeast Asia.

Brambles has a significant opportunity to broaden its service portfolio beyond its core pallet and container offerings. This could involve venturing into new categories of reusable packaging solutions designed for specific industries or product types. For instance, in 2024, the demand for sustainable packaging solutions saw a notable increase, with market reports indicating a compound annual growth rate of over 5% for eco-friendly packaging options.

Furthermore, Brambles can leverage its extensive supply chain expertise to offer value-added services. This might include providing supply chain consulting to optimize logistics, offering advanced data analytics to improve inventory management for clients, or developing specialized logistics solutions for niche markets. Such diversification not only creates new revenue streams but also deepens customer loyalty by becoming an indispensable partner in their operational efficiency.

Leveraging Technology for Enhanced Efficiency

Brambles can seize opportunities by integrating cutting-edge technologies. Adopting IoT sensors, AI analytics, and blockchain can revolutionize asset tracking, optimize delivery routes, and boost supply chain transparency. For instance, in 2023, Brambles reported a 10% reduction in transit times through pilot programs utilizing advanced routing software.

These technological investments promise substantial gains in operational efficiency and a decrease in asset loss. By enhancing visibility, Brambles can also unlock avenues for offering innovative new services to its clientele, further solidifying its market position.

- Improved Asset Tracking: IoT sensors provide real-time location data, reducing loss and improving utilization.

- Optimized Logistics: AI-driven route optimization can cut fuel costs and delivery times.

- Enhanced Supply Chain Visibility: Blockchain offers secure and transparent tracking of goods throughout the supply chain.

- New Service Offerings: Data insights from these technologies can be packaged into value-added services for customers.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions present significant opportunities for Brambles. Collaborating with leading logistics providers or innovative technology companies could enhance Brambles' supply chain efficiency and digital capabilities. For instance, a partnership with a company specializing in AI-driven route optimization could reduce transportation costs by an estimated 5-10% in the coming years.

Acquiring smaller, specialized firms offers a direct path to market expansion and service diversification. This could involve integrating advanced tracking technologies or expanding into niche markets like pharmaceutical cold chain logistics. Such moves are crucial for staying ahead in a rapidly evolving industry, as demonstrated by competitors who have successfully integrated new technologies through targeted acquisitions in 2024.

- Expand Market Reach: Forge alliances with global logistics players to access new territories and customer segments.

- Integrate New Technologies: Acquire or partner with tech firms to embed IoT, AI, and blockchain for enhanced asset tracking and predictive maintenance.

- Enter Complementary Services: Diversify offerings by acquiring businesses in related areas like waste management or specialized packaging solutions.

- Accelerate Growth: Strategic M&A activity can provide a faster route to scaling operations and increasing market share compared to organic growth alone.

Brambles can capitalize on the increasing global focus on sustainability by expanding its reusable packaging solutions into new geographical markets, particularly in developing economies with growing e-commerce sectors. The company also has a significant opportunity to diversify its service offerings, moving beyond core pallet pooling to include specialized packaging for various industries and providing value-added services like supply chain consulting and data analytics. For example, the demand for sustainable packaging solutions saw a notable increase in 2024, with market reports indicating a compound annual growth rate of over 5% for eco-friendly packaging options.

Threats

Brambles faces significant threats from a diverse competitive landscape. Beyond traditional pallet pooling rivals, the company contends with single-use packaging providers and innovative logistics firms offering alternative supply chain models. This intense rivalry puts constant pressure on Brambles to remain cost-effective while still providing top-tier service, which could lead to downward pressure on pricing and margins.

Global economic instability, such as the lingering effects of inflation and the potential for recessions in major markets, presents a significant threat. These macroeconomic headwinds can dampen manufacturing activity and consumer spending, directly impacting the volume of goods that need to be transported and, consequently, Brambles' core business of providing reusable pallets and containers.

Escalating trade wars and protectionist policies can further disrupt global supply chains. This disruption leads to reduced cross-border shipping, directly affecting Brambles' asset utilization and revenue streams. For example, increased tariffs could make international trade less attractive, thereby lowering the demand for the efficient logistics solutions Brambles provides.

As a business heavily reliant on moving goods, Brambles is quite sensitive to changes in fuel prices and other transportation expenses. For instance, in early 2024, global oil prices saw fluctuations, impacting the cost of diesel, a key component for Brambles' logistics network. These rising costs directly translate to higher operational expenses for transporting their pallets and containers.

If Brambles cannot efficiently manage these increased costs or pass them on to their customers, it could put pressure on their profit margins. The company's ability to secure favorable contracts and optimize its delivery routes becomes even more critical in such an environment to mitigate these financial impacts.

Disruptions to Global Supply Chains

Disruptions to global supply chains pose a significant threat to Brambles. Events such as the COVID-19 pandemic, ongoing geopolitical tensions, and extreme weather patterns have already demonstrated their capacity to cause factory closures, port delays, and transportation issues. These disruptions directly impact Brambles' ability to move assets efficiently, deliver services on time, and maintain optimal asset utilization, thereby affecting overall operational effectiveness and potentially increasing costs.

For instance, the impact of supply chain disruptions on the logistics sector, which Brambles operates within, was evident in 2021 and 2022. Freight rates saw substantial increases, with the Drewry World Container Index reaching peaks of over $10,000 per 40ft container in late 2021, a stark contrast to pre-pandemic levels. While rates have since moderated, the underlying vulnerabilities remain. Brambles, heavily reliant on the smooth flow of goods and the availability of transportation, is susceptible to these volatility.

- Increased lead times for critical components and raw materials, impacting production schedules.

- Higher transportation and logistics costs due to congestion and scarcity of shipping capacity.

- Potential for reduced asset utilization if empty return flows are significantly delayed or interrupted.

- The risk of customers experiencing service disruptions, leading to dissatisfaction and potential loss of business.

Regulatory Changes and Environmental Compliance

Evolving environmental regulations, especially those targeting packaging, waste, or carbon emissions, present a significant threat. For Brambles, this could translate into increased compliance costs or operational limitations. For instance, stricter mandates on recycled content in plastic packaging, a core area for Brambles, could necessitate substantial investment in new materials or processing technologies to meet 2024 and 2025 targets.

While Brambles is recognized for its sustainability leadership, shifts in specific regulatory frameworks might demand considerable adaptation and capital expenditure. For example, a sudden increase in carbon pricing mechanisms or extended producer responsibility schemes in key markets could impact the cost-effectiveness of their pooled asset model if not proactively managed. The company's 2024 sustainability report highlighted a commitment to reducing its carbon footprint, but future regulatory changes could accelerate the need for such investments beyond current projections.

- Increased Compliance Costs: New regulations on packaging materials or waste disposal could raise operational expenses.

- Operational Restrictions: Stricter environmental standards might limit how Brambles sources, uses, or disposes of its assets.

- Adaptation Investment: Changes in regulations, such as those concerning recycled content mandates for 2025, may require significant capital outlay for new technologies or materials.

Brambles faces intense competition from traditional rivals, single-use packaging, and innovative logistics firms, potentially squeezing margins. Global economic downturns and inflation can reduce demand for logistics services, directly impacting Brambles' core business. Escalating trade wars and protectionist policies disrupt global supply chains, reducing cross-border shipping and asset utilization.

Fluctuations in fuel prices and transportation costs, like those seen in early 2024, directly increase Brambles' operational expenses. Supply chain disruptions, evidenced by volatile freight rates in 2021-2022, can hinder asset movement and service delivery. Evolving environmental regulations, such as recycled content mandates for 2025, may necessitate costly adaptations and investments.

SWOT Analysis Data Sources

This Brambles SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial reports, comprehensive industry market research, and expert analyses of global supply chain trends.