Brambles Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brambles Bundle

Brambles operates in an industry characterized by moderate bargaining power of buyers, influenced by the availability of alternative solutions and the cost of switching. The threat of new entrants is somewhat contained due to capital intensity and established distribution networks, but potential disruptors always loom.

The complete report reveals the real forces shaping Brambles’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Brambles' reliance on key inputs like timber and plastic for its extensive pallet and container operations means that fluctuations in raw material costs directly affect its production expenses. For instance, the price of lumber, a critical component, experienced significant volatility in 2023 and early 2024 due to various supply chain disruptions and demand shifts, directly impacting Brambles' cost of goods sold.

The availability and pricing of these essential materials can be further influenced by the concentration of Brambles' supplier base. If a few key suppliers control a significant portion of the timber or plastic market, their bargaining power increases, potentially allowing them to dictate terms and prices, which can squeeze Brambles' profit margins.

Suppliers of specialized manufacturing equipment for pallet and container production, or advanced IT solutions for tracking and logistics, can hold significant bargaining power. For instance, a provider of proprietary RFID technology crucial for Brambles' pooled asset tracking might have few alternatives, allowing them to command higher prices or more favorable terms. This is especially true if the technology is deeply integrated and difficult to replace.

The limited number of suppliers offering unique capabilities, such as specialized machinery for automated container cleaning or advanced data analytics platforms for optimizing supply chain efficiency, can amplify their leverage. If Brambles relies on a single or a very small group of vendors for these critical components, these suppliers can influence pricing and contract conditions. In 2024, the global market for industrial automation equipment, including specialized machinery, continued to see consolidation, potentially reducing the number of independent suppliers.

While Brambles manages a significant portion of its logistics internally, it relies on third-party logistics (3PL) providers for specific routes and to manage fluctuating demand. The bargaining power of these transport service suppliers is influenced by the availability and cost of reliable carriers, particularly in geographically diverse operating regions. For instance, in 2024, global shipping rates saw considerable volatility, impacting companies like Brambles that utilize external transport. This reliance can grant suppliers leverage, especially when supply chain disruptions, such as port congestion or driver shortages, become prevalent, further concentrating power in the hands of available service providers.

Labor Supply and Costs

The availability of skilled labor for Brambles' manufacturing, maintenance, and logistics operations is a significant factor in supplier bargaining power. A tight labor market, particularly for specialized roles, can empower workers to demand higher wages and better benefits.

Labor unions, where present, can amplify this power by collectively negotiating terms. For instance, in 2024, many sectors experienced labor shortages, leading to increased wage pressures. This directly impacts Brambles' operational costs and can influence profitability.

- Skilled Labor Availability: Shortages in manufacturing and logistics expertise can drive up labor costs.

- Union Influence: Collective bargaining by unions can lead to increased wage demands and improved working conditions.

- Regional Shortages: Specific geographic areas with high demand for labor can see wage inflation, impacting Brambles' operational expenses.

- Wage Inflation: General economic trends, like the 3.5% average wage growth observed in developed economies in early 2024, can increase Brambles' labor expenditure.

Maintenance and Repair Services

Brambles' extensive network of reusable assets, like pallets and containers, necessitates consistent maintenance and repair. This ongoing need means suppliers of specialized parts and skilled labor hold a degree of bargaining power, particularly if their services are critical to Brambles' operational continuity and few alternative providers exist. For instance, in 2024, the global industrial maintenance market was valued at approximately $250 billion, indicating a substantial ecosystem of service providers.

The criticality of these maintenance and repair services to Brambles' asset uptime means that suppliers who can offer specialized expertise or unique parts can command higher prices or more favorable terms. The availability of qualified technicians and specialized components for Brambles' proprietary asset designs directly influences supplier leverage. A report from late 2024 highlighted that specialized industrial repair services can see profit margins ranging from 15-25%, underscoring the potential for suppliers to exert pricing power.

To mitigate this supplier power, Brambles must cultivate a diversified and robust network of repair partners. This strategy not only fosters competition among service providers but also ensures operational resilience by reducing reliance on any single supplier. By establishing strong relationships and potentially investing in training programs for repair technicians, Brambles can secure more predictable service costs and availability. In 2024, companies focused on supply chain resilience reported a 10% reduction in operational disruptions by diversifying their service provider base.

- Criticality of Services: Brambles' operational efficiency hinges on well-maintained reusable assets, making repair services indispensable.

- Supplier Leverage: Suppliers with specialized parts or labor for Brambles' unique asset designs can exert significant bargaining power.

- Market Size: The global industrial maintenance market, valued around $250 billion in 2024, indicates a large pool of potential suppliers.

- Mitigation Strategy: Developing a broad network of repair partners is crucial for Brambles to reduce dependency and manage supplier influence.

Brambles faces moderate bargaining power from its suppliers, particularly for specialized inputs and services. The company's reliance on timber and plastic, while diversified, can still be influenced by market concentration among a few large producers. For instance, the price of lumber, a key material, saw notable fluctuations in 2023 and early 2024 due to global supply chain dynamics.

Suppliers of proprietary technology, such as RFID tracking systems essential for Brambles' asset management, can wield significant influence due to limited alternatives. Similarly, specialized machinery providers for manufacturing and maintenance operations can command higher prices if their offerings are critical and difficult to substitute. The global industrial automation equipment market, experiencing consolidation in 2024, might further concentrate power among fewer suppliers.

The bargaining power of third-party logistics providers is also a consideration, especially during periods of high demand or supply chain disruptions. Volatility in global shipping rates in 2024 underscored this leverage. Furthermore, shortages in skilled labor for manufacturing and maintenance can empower workers and unions, potentially increasing Brambles' operational costs, with average wage growth in developed economies around 3.5% in early 2024.

| Supplier Category | Bargaining Power Factors | Impact on Brambles | 2024 Data/Trend |

|---|---|---|---|

| Raw Materials (Timber, Plastic) | Supplier concentration, commodity price volatility | Increased cost of goods sold | Lumber price fluctuations in 2023-2024 |

| Specialized Technology (RFID, IT) | Proprietary nature, few alternatives | Higher procurement costs, integration challenges | Limited supplier options for advanced tracking |

| Industrial Machinery | Market consolidation, specialized capabilities | Potential for increased capital expenditure | Consolidation in industrial automation market |

| Logistics Services (3PL) | Carrier availability, shipping rate volatility | Fluctuating transportation costs | Global shipping rate volatility in 2024 |

| Skilled Labor/Maintenance Services | Labor market tightness, specialized repair needs | Higher operational and maintenance expenses | Wage inflation; 3.5% average wage growth (early 2024) |

What is included in the product

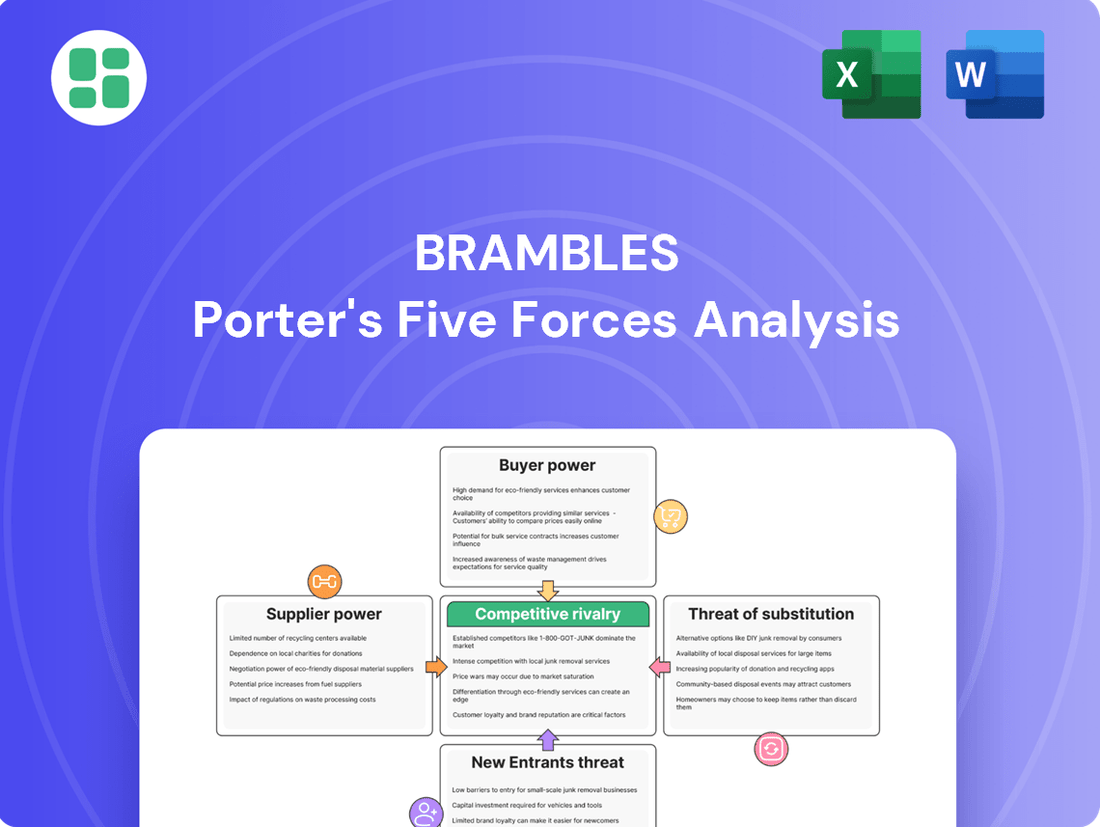

This Brambles Porter's Five Forces analysis evaluates the intensity of competition, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes for Brambles' operations.

Instantly identify and mitigate competitive threats with a visual breakdown of supplier power, buyer bargaining, and substitute product risks.

Customers Bargaining Power

Brambles' extensive customer base, which includes major global corporations in sectors like consumer goods and automotive, grants these clients substantial bargaining power. These large entities often procure Brambles' services in significant volumes, enabling them to negotiate more favorable pricing and service agreements. Their sheer scale allows them to exert considerable pressure on Brambles, influencing both cost structures and operational standards.

While Brambles' pooling system generally locks customers in, a segment of very large customers might find the logistical hurdles and costs of switching to a competitor or their own fleet manageable, thus retaining some bargaining power. For instance, if a major retailer in a key market like North America, where Brambles holds a significant share, experiences dissatisfaction with pricing or service, they might explore alternatives.

In sectors where Brambles serves a limited number of very large clients, the bargaining power of these customers can be substantial. For instance, if a few major retailers or manufacturers represent a significant portion of Brambles' revenue, these key accounts can leverage their volume to negotiate more favorable terms, including lower pricing or customized service packages. This concentration necessitates careful management to ensure profitability is not unduly eroded by the demands of these powerful customers.

Availability of Alternative Pooling Providers

The bargaining power of customers is significantly influenced by the availability of alternative pooling providers. Customers can choose from other pallet pooling companies or opt to manage their own pallet fleets entirely.

This competitive landscape, where alternatives exist, empowers customers to negotiate more favorable terms with Brambles. For instance, in 2024, the global pallet rental market saw increased competition, with several regional players expanding their service offerings, putting pressure on established providers like Brambles to maintain competitive pricing and service levels.

- Customer Choice: Pallet users can select from multiple pooling providers or consider in-house fleet management.

- Competitive Pressure: The presence of alternatives forces pooling companies to offer attractive pricing and service packages.

- Negotiating Leverage: Customers with viable options can more effectively bargain for better rates and contract conditions.

Customer Focus on Cost Efficiency and Sustainability

Customers are increasingly scrutinizing their supply chains for efficiency and cost savings, with sustainability also becoming a major driver. Brambles' circular economy model inherently supports these customer objectives. For instance, in 2024, many businesses are setting ambitious ESG targets, making reusable packaging solutions like Brambles' pallets and containers more attractive.

However, this focus means customers will continuously assess Brambles' value proposition against alternatives. If Brambles cannot consistently prove superior cost efficiencies or demonstrable environmental benefits, such as reduced carbon emissions per use compared to single-use options, their bargaining power could increase. This could lead to pressure on pricing or demands for more tailored solutions.

- Customer Focus on Cost Efficiency: Businesses are actively seeking ways to reduce operational expenses, with supply chain logistics being a key area of review.

- Sustainability as a Driver: Growing environmental regulations and corporate social responsibility initiatives are pushing customers towards greener supply chain practices.

- Brambles' Value Proposition: Brambles' reusable asset model offers inherent advantages in cost and sustainability, but requires ongoing demonstration of superiority.

- Potential for Increased Customer Power: Failure to consistently deliver superior cost savings or environmental benefits could empower customers to negotiate more aggressively.

Brambles' customers, particularly large corporations, wield significant bargaining power due to their substantial order volumes and the availability of alternatives. In 2024, many businesses intensified their scrutiny of supply chain costs and sustainability, creating opportunities for customers to negotiate better terms. This means Brambles must continually demonstrate its value proposition to retain these crucial relationships.

| Customer Segment | Bargaining Power Factors | 2024 Market Trend Impact |

|---|---|---|

| Major Retailers/Manufacturers | High volume procurement, potential for in-house fleet management | Increased negotiation leverage due to cost and sustainability focus |

| SME Customers | Lower individual volume, but collective impact can be significant | Less direct power, more influenced by overall market pricing |

| Global Corporations | Ability to switch providers or internalize services, strong ESG demands | Can demand tailored solutions and transparent environmental reporting |

Full Version Awaits

Brambles Porter's Five Forces Analysis

This preview showcases the complete Brambles Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the exact file you will receive immediately after purchase, ensuring no surprises or missing information. It is professionally formatted and ready for your immediate use, providing actionable insights into Brambles' competitive landscape.

Rivalry Among Competitors

Brambles faces strong competition from established global players in the pallet pooling sector. Companies such as LPR (Euro Pool System) and PECO Pallet are significant rivals, particularly in specific geographic markets and for certain types of pooling solutions. This intense rivalry among major global participants directly impacts pricing power and market share dynamics for Brambles.

Beyond the major global players, the competitive landscape for Brambles is shaped by a multitude of regional and niche market participants. These smaller entities often focus on specific countries or specialize in particular types of containers, offering tailored solutions that can be highly attractive to local customers.

This fragmentation, particularly evident in certain segments of the market, intensifies competitive pressure. For instance, in 2024, the reusable packaging market saw a rise in regional providers offering specialized pallet or crate solutions, often with more flexible service agreements than larger, more standardized operators.

These localized competitors can leverage their understanding of specific market needs and regulatory environments to gain an edge, forcing larger companies like Brambles to remain agile and responsive to diverse customer demands across different geographies.

Competitive rivalry in the asset pooling industry is intensified by the critical importance of asset utilization and network density. Companies that can maximize the use of their pooled assets and maintain a dense, efficient distribution network gain a significant advantage. This allows them to offer more attractive pricing and superior service levels to customers.

For instance, Brambles, a leader in the reusable pallet and container sector, consistently focuses on optimizing its global network. In fiscal year 2023, Brambles reported a significant increase in its return on capital employed, partly driven by improved asset utilization across its extensive network. This efficiency directly translates into a competitive edge against rivals who may struggle with less optimized operations or lower asset turnover rates.

The drive for higher asset utilization and denser networks means competitors are perpetually investing in technology and logistics to streamline operations. This ongoing investment cycle fuels the rivalry, as companies strive to outmaneuver each other through superior network reach and operational efficiency, ultimately impacting pricing power and market share.

Service Quality and Innovation

Brambles faces intense rivalry where differentiating through superior service quality and cutting-edge innovation is paramount. Competitors are actively vying to provide enhanced logistics support, richer data analytics, and more sustainable operational practices. For instance, the increasing adoption of Internet of Things (IoT) tracking solutions by competitors allows for real-time visibility of assets, directly impacting efficiency and customer satisfaction.

The ability to consistently innovate and adapt to evolving market demands is a critical determinant of market share. Companies are investing heavily in developing new solutions, such as advanced pooling systems and integrated digital platforms, to gain a competitive edge. This focus on innovation isn't just about technology; it also encompasses developing more efficient and environmentally friendly operational models.

- Technological Advancement: Competitors are integrating IoT sensors into their pallets and containers, enabling real-time tracking and condition monitoring. This technology allows for better inventory management and reduces loss or damage.

- Service Enhancement: Beyond basic rental, companies are offering value-added services like supply chain optimization consulting and on-demand delivery solutions to differentiate themselves.

- Sustainability Focus: Innovation in sustainable materials and circular economy models is becoming a key battleground, appealing to environmentally conscious customers.

- Data-Driven Insights: Competitors are leveraging data analytics from asset usage to provide customers with insights into their supply chain performance, aiming to improve efficiency and reduce costs.

Pricing Strategies and Cost Leadership

In the pallet and container pooling sector, price competitiveness is paramount, as the service is often viewed as a utility. This intense price pressure means rivals frequently employ aggressive pricing tactics to secure or maintain substantial contracts. For instance, major players often compete on a per-trip or per-unit basis, with pricing structures designed to attract high-volume clients.

Cost leadership, achieved through superior operational efficiency, represents a significant competitive advantage. Companies that can optimize their logistics, maintenance, and asset utilization can offer more attractive pricing while maintaining healthy margins. Brambles, a key player, has historically focused on streamlining its supply chain and leveraging technology to reduce per-unit costs.

- Price Sensitivity: The commoditized nature of pooling services makes price a primary decision factor for many customers, especially large enterprises.

- Aggressive Pricing Tactics: Competitors may offer discounts or tailored pricing models to capture market share, particularly in bids for major client accounts.

- Operational Efficiency as a Differentiator: Companies like Brambles leverage scale and process optimization to drive down costs, enabling competitive pricing and profitability.

- Impact of Fuel Costs: Fluctuations in fuel prices directly affect transportation costs, influencing the overall pricing strategies of all market participants.

Brambles operates in a highly competitive environment where differentiation through service quality and innovation is crucial. Rivals are actively enhancing logistics support, offering advanced data analytics, and adopting more sustainable practices. For example, the increasing use of IoT tracking by competitors provides real-time asset visibility, directly boosting efficiency and customer satisfaction.

The ability to innovate and adapt to changing market needs is a key factor in securing market share. Companies are investing in new solutions like advanced pooling systems and integrated digital platforms. This innovation extends to developing more efficient and environmentally friendly operational models, with a growing emphasis on sustainability and circular economy principles.

Price competitiveness is a major factor in the pallet and container pooling sector, as the service is often perceived as a utility. This intense price pressure leads competitors to use aggressive pricing strategies to win or retain significant contracts. For instance, major players frequently compete on a per-trip or per-unit basis, with pricing structures designed to attract high-volume clients.

Cost leadership, achieved through superior operational efficiency, provides a substantial competitive advantage. Companies that optimize logistics, maintenance, and asset utilization can offer more attractive pricing while maintaining healthy margins. Brambles, a leading player, consistently focuses on streamlining its supply chain and leveraging technology to reduce per-unit costs.

| Competitor | Key Offerings | 2024 Market Focus |

|---|---|---|

| LPR (Euro Pool System) | Pallet pooling, container pooling | European expansion, sustainability initiatives |

| PECO Pallet | Pallet pooling, specialized pallet solutions | North American market, customer-specific designs |

| CHEP (a Brambles brand) | Pallet pooling, container pooling, supply chain solutions | Global network optimization, digital integration |

| Regional Players | Niche pallet/container solutions, flexible contracts | Localized service, specific industry needs |

SSubstitutes Threaten

The most direct substitutes for Brambles' reusable packaging solutions are single-use alternatives like cardboard boxes, wooden pallets, and plastic shrink wrap. While these may appear cheaper upfront, their environmental impact and long-term costs are often higher.

For less complex supply chains, businesses might opt for these disposable materials due to a perceived simplicity in handling. However, the growing emphasis on sustainability and circular economy principles is increasingly mitigating this threat, as companies recognize the total cost of ownership for single-use packaging.

Large customers, particularly those with substantial volume requirements, can opt to develop and manage their own pallet or container fleets. This direct control over assets bypasses the per-use fees associated with pooling services. For instance, major retailers or manufacturers might find it economically feasible to invest in their own reusable packaging solutions if their operational scale justifies the initial outlay and ongoing management responsibilities.

The threat of substitutes for traditional pallets and containers is growing as logistics and manufacturing processes evolve. Innovations like specialized racking systems, automated guided vehicles (AGVs) that bypass traditional handling, and direct-to-shelf delivery models offer indirect alternatives. For instance, the adoption of AGVs in warehouses, which saw a significant increase in deployment throughout 2024, can reduce the reliance on forklifts and, consequently, the need for standard pallet configurations.

Emerging Technologies in Supply Chain

Future technologies like advanced robotics in warehouses or drone delivery systems could significantly alter how goods are transported, potentially reducing the reliance on traditional palletized systems. While not direct substitutes for the physical pallet itself, these innovations might change the fundamental requirements for efficient goods movement, impacting Brambles' core business. For instance, autonomous mobile robots (AMRs) are increasingly being adopted in logistics, with the global AMR market projected to reach USD 11.7 billion by 2027, indicating a growing trend towards automated handling solutions that could bypass traditional pallet infrastructure.

New forms of packaging or unitization, perhaps integrated with smart technology, could also emerge as disruptive forces. These might offer enhanced protection, tracking, or direct shelf-ready capabilities, diminishing the need for intermediate handling solutions like pallets. The ongoing development in sustainable packaging solutions, driven by environmental concerns and regulatory pressures, could also lead to novel approaches that compete with current logistics standards. For example, the global sustainable packaging market was valued at USD 269.7 billion in 2023 and is expected to grow substantially, potentially fostering innovation in alternative unitization methods.

Brambles must actively monitor these long-term technological threats. The potential for these emerging technologies to reshape supply chain dynamics means that adaptation and innovation will be crucial for maintaining market leadership. Companies are already investing heavily in these areas; for example, Amazon's continued investment in robotics and automation within its fulfillment centers, which surpassed USD 60 billion in 2023, highlights the scale of the shift towards technologically advanced logistics.

- Advanced Robotics: Increased automation in warehouses could reduce the need for manual handling and traditional pallet movements.

- Drone Delivery: For certain types of goods, drone delivery might bypass the need for palletized transport altogether.

- New Packaging Solutions: Innovations in packaging could offer direct shelf-ready or integrated handling capabilities, lessening reliance on pallets.

- Market Investment: Significant global investments in logistics automation and sustainable packaging underscore the evolving threat landscape.

Digitalization and Information Flow

The increasing digitalization of supply chains presents a significant threat of substitutes for Brambles' core business. While Brambles provides digital tracking solutions, the broader trend towards enhanced information flow and supply chain visibility platforms means customers might achieve similar efficiencies through data alone, reducing their reliance on physical asset pooling services.

For example, advancements in real-time data analytics and predictive logistics software could allow companies to optimize their own inventory and transportation without needing to lease pooled assets. This shift could diminish the perceived value proposition of physical asset pooling if customers can gain comparable cost savings and operational improvements through sophisticated data management systems.

Consider the growth in Software-as-a-Service (SaaS) platforms focused on supply chain optimization. These platforms, often leveraging AI and machine learning, offer capabilities such as demand forecasting, route optimization, and inventory management. Companies are increasingly investing in these digital tools, with the global supply chain management market projected to reach approximately $40 billion by 2027, indicating a strong move towards data-driven solutions.

- Digital Tracking Limitations: Brambles' digital tracking, while valuable, may not fully offset the appeal of comprehensive data-driven supply chain management platforms.

- Information Flow as a Substitute: Enhanced information flow and visibility platforms can directly substitute the need for physical asset pooling by enabling better internal resource management.

- Diminishing Value Proposition: If customers achieve similar efficiencies and cost reductions through data analytics alone, Brambles' core offering faces a direct threat.

- Market Trends: The expanding market for supply chain optimization software highlights the growing customer preference for data-centric solutions over traditional asset-based services.

The threat of substitutes for Brambles' reusable packaging solutions remains moderate but is evolving. Direct substitutes include single-use packaging materials like cardboard and plastic, which offer lower upfront costs but higher long-term environmental and operational expenses. Larger customers also have the option to manage their own fleets, bypassing Brambles' pooling services entirely if their scale justifies the investment.

Emerging technological advancements in logistics, such as advanced robotics and drone delivery, present indirect substitutes by potentially altering the fundamental need for traditional palletized systems. For example, the global market for autonomous mobile robots (AMRs) in logistics is projected to grow substantially, indicating a shift towards automated handling that could bypass existing infrastructure. Furthermore, the expanding global sustainable packaging market, valued at over $269 billion in 2023, fuels innovation in alternative unitization methods.

The increasing digitalization of supply chains also poses a threat, as sophisticated data analytics and supply chain management platforms can offer efficiencies comparable to physical asset pooling. Companies are increasingly investing in these data-centric solutions, with the global supply chain management market expected to reach around $40 billion by 2027. This trend suggests that enhanced information flow could directly substitute the need for physical asset pooling.

Entrants Threaten

The significant capital required to establish a competitive reusable pooling service, particularly for acquiring and maintaining a substantial fleet of pallets, crates, or containers, presents a formidable barrier to entry. For instance, Brambles, a leader in this space, operates a massive global network, necessitating ongoing substantial investments in its asset base. In fiscal year 2023, Brambles reported capital expenditure of approximately $1.2 billion, underscoring the scale of investment needed to compete effectively.

The value of Brambles' pooling services, like its CHEP pallets, is directly tied to how large and widespread its network is. A denser network means more efficient recovery and redistribution of assets, which translates to cost savings and better service. For instance, in 2023, Brambles reported that its global pallet pool handled over 300 million movements, highlighting the sheer scale of its operations.

This established network density creates a significant barrier for potential new entrants. Replicating the extensive infrastructure, logistical capabilities, and customer relationships that Brambles has built over decades is incredibly challenging and capital-intensive. This advantage allows Brambles to maintain strong competitive positioning against those looking to enter the market.

Brambles benefits significantly from economies of scale in its operational processes, including manufacturing, logistics, and asset management. This scale allows them to spread fixed costs over a larger volume, driving down per-unit costs.

For instance, Brambles' extensive global network of service centers and its large fleet of reusable pallets and containers mean they can optimize transportation routes and maintenance schedules more effectively than smaller competitors. This cost advantage is a substantial barrier to entry.

New entrants would struggle to achieve similar cost efficiencies without investing heavily to reach a comparable operational scale, making it challenging to compete on price against established players like Brambles.

Customer Relationships and Brand Loyalty

Existing players like Brambles have cultivated deep, long-standing relationships with major global customers, built on a foundation of trust and proven service reliability. These established ties are a significant barrier for newcomers. For instance, in 2024, Brambles continued to serve a vast network of multinational corporations across various sectors, many of whom have relied on their pooling solutions for decades.

New entrants would find it incredibly difficult to displace these entrenched relationships. Building a reputation for dependability and consistent service delivery in a highly competitive, service-oriented industry like pallet pooling takes considerable time and investment. This is particularly true when dealing with large-scale operations that depend on seamless supply chain integration.

- Established Customer Loyalty: Decades of service have fostered deep trust and loyalty among Brambles' key clients.

- Service Reliability: The industry demands unwavering reliability, a trait that new entrants must prove over extended periods.

- High Switching Costs: For major global customers, changing pooling providers involves significant logistical and operational disruption, making them reluctant to switch.

- Brand Reputation: Brambles' strong brand recognition and reputation for quality present a formidable hurdle for any new competitor attempting to gain market share.

Regulatory and Sustainability Compliance

The reusable packaging sector, especially for food and pharmaceuticals, faces stringent regulatory hurdles. New companies must meticulously adhere to hygiene and safety standards, a significant barrier to entry. For instance, compliance with FDA regulations for food-contact materials or specific pharmaceutical packaging guidelines requires substantial investment and expertise, potentially costing millions in validation and testing.

Demonstrating robust sustainability credentials is also becoming a non-negotiable requirement, adding another layer of complexity and cost for potential entrants. Companies are increasingly scrutinized for their environmental impact, including carbon footprint and waste management. In 2024, the global sustainable packaging market was valued at approximately $295 billion, with reusable packaging a key segment, indicating high consumer and regulatory demand for environmentally sound solutions.

- Regulatory Compliance Costs: New entrants face significant upfront costs for certifications and adherence to standards like ISO 22000 for food safety, which can range from tens of thousands to hundreds of thousands of dollars.

- Sustainability Investment: Achieving recognized sustainability certifications (e.g., B Corp, Cradle to Cradle) requires investment in operational changes, material sourcing, and reporting, often adding 5-15% to initial setup costs.

- Market Access Barriers: Established players already possess the necessary accreditations and demonstrated track records, making it difficult for newcomers to gain trust and secure contracts with major clients who prioritize compliance.

- R&D for Compliance: Continuous investment in research and development is needed to keep pace with evolving regulations and sustainability best practices, a burden heavier for new, less capitalized firms.

The substantial capital outlay required to establish a competitive reusable asset pool, coupled with the immense scale of operations needed to achieve cost efficiencies, presents a significant barrier to entry in Brambles' market. New entrants must invest heavily in acquiring and maintaining a large fleet of pallets, crates, or containers, mirroring the extensive infrastructure Brambles already possesses. For example, Brambles' fiscal year 2023 capital expenditure of approximately $1.2 billion highlights the sheer financial commitment necessary to compete effectively in this asset-intensive industry.

Brambles' established network density, where more assets mean more efficient recovery and redistribution, creates a powerful advantage that is difficult for newcomers to replicate. In 2023, Brambles' global pallet pool facilitated over 300 million movements, demonstrating the scale of logistics and operational expertise required. This extensive infrastructure and logistical capability, built over decades, represent a formidable hurdle for any potential competitor seeking to enter the market.

The threat of new entrants is also mitigated by the deep, long-standing relationships Brambles has cultivated with major global customers, often built on decades of proven service reliability. In 2024, Brambles continued to serve a vast network of multinational corporations, many of whom have relied on their pooling solutions for years. These entrenched relationships, combined with high switching costs for clients, make it exceptionally challenging for new competitors to gain traction and market share.

Porter's Five Forces Analysis Data Sources

Our Brambles Porter's Five Forces analysis leverages data from annual reports, industry association publications, and market research firms like IBISWorld to assess competitive intensity and strategic positioning.