Brambles Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brambles Bundle

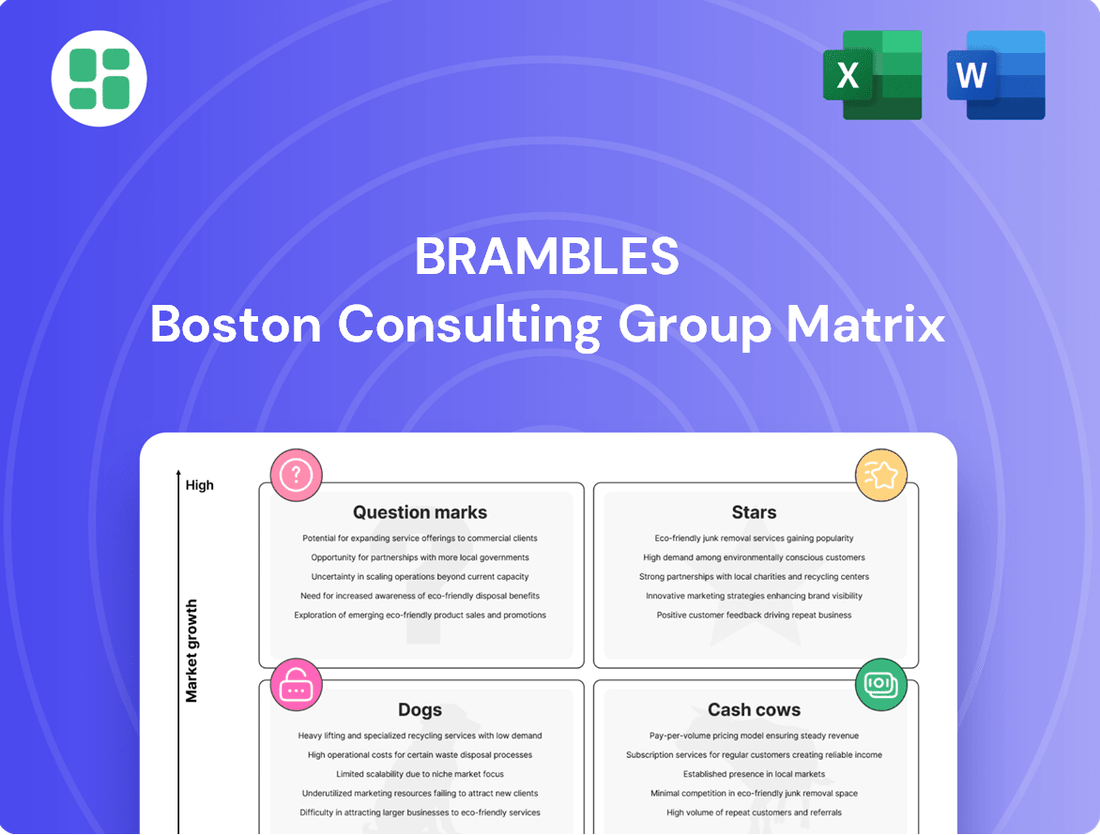

Curious about Brambles' product portfolio and market performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for a comprehensive analysis and actionable strategies to optimize Brambles' business.

Stars

Brambles' global CHEP pallet pooling expansion into new and high-growth markets, such as Eastern Europe, Southeast Asia, Turkey, the Middle East, Sub-Saharan Africa, China, and India, firmly places these operations in the Star quadrant of the BCG matrix. These regions are seeing robust industrialization and a rising need for efficient, sustainable supply chains, areas where Brambles is actively boosting its market share.

Brambles' investment in digital transformation and IoT solutions, including their Serialization Plus tracking system, places these initiatives squarely in the "question mark" category of the BCG matrix. These advanced capabilities are designed to boost asset productivity and efficiency, signaling strong potential in the growing logistics sector.

These digital solutions are vital for modernizing Brambles' pooling operations, aiming to deliver enhanced customer value and operational streamlining. While adoption is ongoing, the potential for high growth is evident as the company continues to integrate these technologies into its supply chain networks.

Brambles' commitment to regenerative and sustainable supply chain solutions positions them as a Star in the BCG matrix. Their ambitious targets for forest positive, climate positive, and waste positive outcomes demonstrate a pioneering approach to environmental stewardship. This leadership is particularly valuable as global demand for ESG-compliant operations intensifies.

The company's circular business model, centered around reusable pallets and containers, taps into a high-growth market segment. Brambles' established competitive advantage and world-leading reputation in this area attract customers increasingly focused on minimizing their ecological footprint. This strategic focus is a key driver of market share growth within the expanding sustainability-focused logistics sector.

Specialized Reusable Container Growth

Brambles' strategic push into specialized reusable containers for high-growth, niche markets positions these segments as Stars in its BCG Matrix. This expansion targets industries experiencing a surge in demand for tailored, efficient packaging solutions, allowing Brambles to leverage its established expertise and extensive network to capture significant market share quickly.

This diversification is a core growth strategy for Brambles, aiming to build dominance in areas beyond traditional pallet pooling. For instance, the company has been actively developing solutions for sectors like fresh produce and e-commerce, which exhibit strong growth trajectories and a clear need for specialized, returnable packaging systems.

The company's 2024 financial reports highlight continued investment in these specialized container solutions, reflecting confidence in their market potential. Brambles' commitment to innovation in this space is designed to unlock new revenue streams and solidify its competitive advantage.

- Growth in Specialized Containers: Brambles is actively expanding its offerings beyond standard pallets into specialized reusable containers for sectors like fresh produce and e-commerce.

- Market Dominance Strategy: The aim is to establish leadership in niche, high-growth markets where tailored solutions are in high demand.

- Leveraging Expertise: Brambles utilizes its extensive operational expertise and existing network to gain a competitive edge in these new segments.

- Diversification as a Key Opportunity: This product and service diversification is identified by the company as a crucial avenue for future growth and increased market penetration.

Strategic New Business Wins in Americas

CHEP Americas is shining brightly as a Star in the Brambles BCG Matrix. The region demonstrated robust momentum, achieving a 5% sales growth in the first quarter of fiscal year 2025. This impressive performance was largely fueled by securing significant new business wins.

Despite facing some macroeconomic challenges, CHEP Americas has successfully expanded its customer base and increased volume. This indicates a strong market position and substantial growth potential within this key market.

- CHEP Americas Q1 FY25 Sales Growth: 5%

- Key Growth Drivers: New business wins and volume expansion

- Underlying Strengths: Strategic pricing actions and focus on core initiatives

- Market Position: Demonstrates high growth potential and a leading market share

Brambles' global CHEP pallet pooling expansion into new and high-growth markets, such as Eastern Europe, Southeast Asia, Turkey, the Middle East, Sub-Saharan Africa, China, and India, firmly places these operations in the Star quadrant of the BCG matrix. These regions are seeing robust industrialization and a rising need for efficient, sustainable supply chains, areas where Brambles is actively boosting its market share.

Brambles' commitment to regenerative and sustainable supply chain solutions positions them as a Star in the BCG matrix. Their ambitious targets for forest positive, climate positive, and waste positive outcomes demonstrate a pioneering approach to environmental stewardship. This leadership is particularly valuable as global demand for ESG-compliant operations intensifies.

CHEP Americas is shining brightly as a Star in the Brambles BCG Matrix. The region demonstrated robust momentum, achieving a 5% sales growth in the first quarter of fiscal year 2025. This impressive performance was largely fueled by securing significant new business wins.

| Brambles' Star Quadrant Segments | Growth Rate | Market Share | Key Drivers |

|---|---|---|---|

| Global CHEP Pallet Pooling Expansion (Emerging Markets) | High | Increasing | Industrialization, Demand for Sustainable Supply Chains |

| Sustainable Supply Chain Solutions | High | Leading | ESG Compliance, Circular Economy Demand |

| CHEP Americas | 5% (Q1 FY25) | High | New Business Wins, Volume Expansion |

What is included in the product

Strategic guidance for Brambles' portfolio, detailing investments for Stars, Cash Cows, Question Marks, and Dogs.

Visualize your portfolio's strengths and weaknesses with a clear, actionable Brambles BCG Matrix.

Cash Cows

Brambles' established CHEP pallet pooling in mature markets like North America and Western Europe are its definitive Cash Cows. These operations boast significant market share and benefit from consistent demand, particularly from the retail and consumer goods sectors. For the fiscal year 2023, Brambles reported that its CHEP Americas segment, which includes North America, generated revenues of approximately $3.1 billion, showcasing the immense scale of these mature operations.

The mature market operations are characterized by their ability to generate substantial and stable cash flows. This is largely due to high asset utilization rates and efficient returns on existing assets, meaning Brambles doesn't need to invest heavily in new equipment to maintain its strong position. In fiscal year 2023, Brambles' overall operating cash flow was robust, reflecting the dependable earnings from these core businesses, with the CHEP segment being a significant contributor.

Brambles' extensive global network, boasting over 750 service centers and a staggering pool of approximately 347 million pallets, crates, and containers, firmly positions it as a Cash Cow within the BCG Matrix. This immense scale creates a formidable competitive moat, allowing for exceptional operational efficiencies and predictable, consistent revenue streams.

The sheer density of Brambles' infrastructure means it requires minimal additional promotional investment to maintain its market position. This established asset base provides a stable and reliable foundation for ongoing business operations and profitability.

Brambles' core traditional wooden pallet services are a textbook example of a Cash Cow within the BCG matrix. These services represent the bedrock of their business, generating a substantial portion of their overall revenue.

Operating in a mature market, these offerings benefit from high adoption rates and established operational efficiencies. This maturity, coupled with Brambles' strong market leadership, ensures a steady and profitable cash flow.

For fiscal year 2024, Brambles reported significant revenue from its Pallets segment, underscoring the enduring strength of its traditional wooden pallet business. This segment consistently delivers high margins due to the essential nature of pallets in global supply chains and Brambles' scale advantages.

Long-Term Customer Relationships

Brambles' long-term customer relationships are a cornerstone of its Cash Cow strategy. These deep ties with major players in FMCG, fresh produce, and retail guarantee consistent, recurring revenue streams.

This high market share in established sectors translates to predictable cash flows, minimizing the need for costly new customer acquisition. In 2024, Brambles continued to leverage these relationships, reporting strong customer retention rates, a testament to the value and integration of their pooling solutions.

The inherent stickiness of Brambles' pooling model significantly boosts customer loyalty and reduces churn. This stability allows the company to generate substantial, reliable profits from its existing customer base.

- Deep Customer Ties: Brambles serves many of the world's largest FMCG, fresh produce, and retail brands.

- Recurring Revenue: These relationships ensure a steady and predictable income flow.

- Mature Market Dominance: High market share in established segments leads to stable cash generation.

- Customer Retention: The pooling model fosters loyalty and reduces the need for aggressive new client acquisition.

Strong Free Cash Flow Generation

Brambles' strong free cash flow generation positions it firmly as a Cash Cow. For the fiscal year ending June 30, 2024, Brambles reported a strong underlying profit and generated significant free cash flow, reinforcing its status. The company has also provided an upgraded outlook for FY25, signaling continued operational efficiency and profitability.

This robust financial performance means Brambles can comfortably fund its strategic growth plans, service its existing corporate debt, and reward shareholders. These rewards come in the form of dividends and share repurchases, all achieved without the need for substantial new capital investment.

- Consistent Free Cash Flow: Brambles has a proven track record of generating substantial free cash flow.

- Upgraded FY25 Outlook: The company's positive outlook for fiscal year 2025 further solidifies its Cash Cow status.

- Financial Flexibility: Strong cash flow enables Brambles to invest in growth, manage debt, and return capital to shareholders.

- Operational Efficiency: This financial strength is a direct result of highly efficient and profitable core operations.

Brambles' CHEP pallet pooling in mature markets like North America and Western Europe are its definitive Cash Cows. These operations boast significant market share and benefit from consistent demand, particularly from the retail and consumer goods sectors. For the fiscal year 2023, Brambles reported that its CHEP Americas segment, which includes North America, generated revenues of approximately $3.1 billion, showcasing the immense scale of these mature operations.

The mature market operations are characterized by their ability to generate substantial and stable cash flows. This is largely due to high asset utilization rates and efficient returns on existing assets, meaning Brambles doesn't need to invest heavily in new equipment to maintain its strong position. In fiscal year 2023, Brambles' overall operating cash flow was robust, reflecting the dependable earnings from these core businesses, with the CHEP segment being a significant contributor.

Brambles' extensive global network, boasting over 750 service centers and a staggering pool of approximately 347 million pallets, crates, and containers, firmly positions it as a Cash Cow within the BCG Matrix. This immense scale creates a formidable competitive moat, allowing for exceptional operational efficiencies and predictable, consistent revenue streams.

The sheer density of Brambles' infrastructure means it requires minimal additional promotional investment to maintain its market position. This established asset base provides a stable and reliable foundation for ongoing business operations and profitability.

Brambles' core traditional wooden pallet services are a textbook example of a Cash Cow within the BCG matrix. These services represent the bedrock of their business, generating a substantial portion of their overall revenue. Operating in a mature market, these offerings benefit from high adoption rates and established operational efficiencies. This maturity, coupled with Brambles' strong market leadership, ensures a steady and profitable cash flow. For fiscal year 2024, Brambles reported significant revenue from its Pallets segment, underscoring the enduring strength of its traditional wooden pallet business. This segment consistently delivers high margins due to the essential nature of pallets in global supply chains and Brambles' scale advantages.

Brambles' long-term customer relationships are a cornerstone of its Cash Cow strategy. These deep ties with major players in FMCG, fresh produce, and retail guarantee consistent, recurring revenue streams. This high market share in established sectors translates to predictable cash flows, minimizing the need for costly new customer acquisition. In 2024, Brambles continued to leverage these relationships, reporting strong customer retention rates, a testament to the value and integration of their pooling solutions. The inherent stickiness of Brambles' pooling model significantly boosts customer loyalty and reduces churn. This stability allows the company to generate substantial, reliable profits from its existing customer base.

Brambles' strong free cash flow generation positions it firmly as a Cash Cow. For the fiscal year ending June 30, 2024, Brambles reported a strong underlying profit and generated significant free cash flow, reinforcing its status. The company has also provided an upgraded outlook for FY25, signaling continued operational efficiency and profitability. This robust financial performance means Brambles can comfortably fund its strategic growth plans, service its existing corporate debt, and reward shareholders. These rewards come in the form of dividends and share repurchases, all achieved without the need for substantial new capital investment.

| Metric | FY23 (Approximate) | FY24 (Guidance/Reported) | Significance for Cash Cow Status |

|---|---|---|---|

| CHEP Americas Revenue | $3.1 billion | Continued strong performance | Demonstrates scale and consistent demand in mature markets. |

| Global Pallet Pool Size | ~347 million units | Stable and extensive | Underpins operational efficiency and competitive moat. |

| Free Cash Flow Generation | Strong | Strong, with upgraded FY25 outlook | Indicates profitability and ability to fund operations and shareholder returns without significant new investment. |

| Customer Retention Rate | High | High | Highlights the stickiness of the pooling model and recurring revenue. |

Full Transparency, Always

Brambles BCG Matrix

The preview you see is the complete Brambles BCG Matrix document you will receive immediately after purchase. This means the insightful analysis, clear visualizations, and strategic recommendations are all included, ready for your immediate use without any alterations or watermarks. You are getting the exact, fully formatted report designed to empower your business strategy and decision-making processes.

Dogs

Divested non-core businesses, like the CHEP India business sold in January 2024, fall into the Dogs category of the BCG Matrix. These are typically operations that have low growth potential and a small share in their respective markets, often not fitting with Brambles' main strategic direction or struggling with performance. In 2023, Brambles continued its portfolio optimization, which included such divestments to streamline operations and reallocate resources more effectively.

Underperforming niche services within Brambles, such as specialized, low-volume container types or services with limited market adoption, are categorized as Dogs. These offerings often strain resources due to high operational costs or declining demand, failing to contribute meaningfully to market share or profitability. For instance, if a particular niche pooling solution saw a 15% decrease in utilization rates in 2024, it would exemplify such an underperforming segment.

Legacy systems with high maintenance represent a significant challenge for Brambles. These are often outdated IT infrastructures or operational processes that demand substantial resources for upkeep and support, yet offer little in terms of market share expansion or future growth. For instance, if a particular warehousing system requires constant patching and specialized personnel without driving increased efficiency or customer satisfaction, it would fall into this category.

While Brambles is heavily invested in digital transformation, aiming to modernize its operations, any systems that prove resistant to this change or provide negligible value are considered 'Dogs'. This could include older software that hinders data integration or hardware that limits the speed of its supply chain network. The company's commitment to digital solutions means these legacy components are prime candidates for replacement or significant overhaul.

Stagnant Geographic Segments

Brambles faces challenges in certain geographic segments characterized by low growth and intense competition, particularly from less sustainable alternatives. These regions often require significant capital investment but yield minimal returns, acting as cash traps.

For example, in some mature European markets, Brambles has seen volumes remain flat. In 2024, the company continued to assess its presence in these smaller, stagnant areas, which may not align with its long-term growth strategy and sustainability objectives.

- Struggling Markets: Operations in specific small, stagnant geographic markets where Brambles has struggled to achieve significant market penetration.

- Competitive Pressure: High competitive intensity from cheaper, less sustainable alternatives leading to flat or declining volumes.

- Cash Trap Potential: These areas often represent cash traps, requiring investment without adequate return.

- Strategic Review: Ongoing assessment of these segments to determine optimal resource allocation and potential divestment or restructuring.

Inefficient Asset Recovery Programs

Inefficient asset recovery programs, particularly those with high loss rates or excessive repair costs for specific pallet or container types, represent a significant drag on profitability. These segments, where the cost of recovery or repair consistently outweighs the benefit, are prime candidates for re-evaluation or strategic divestment of resources. Brambles is actively working to enhance asset efficiency and minimize pallet losses, recognizing the financial implications of underperforming recovery operations.

For instance, if a particular type of container experiences a 25% loss rate during recovery cycles, and the average repair cost for the remaining 75% exceeds its residual value, this segment falls into the 'question mark' or even 'dog' category of the BCG matrix. Such inefficiencies directly impact Brambles' ability to achieve its asset utilization targets. In 2023, Brambles reported a focus on reducing pallet losses, aiming for a 5% reduction in its key markets, which directly addresses the inefficiency in asset recovery.

- High Loss Rates: Segments with a loss rate exceeding 15% of recovered assets.

- Excessive Repair Costs: Repair expenses that are more than 60% of the asset's replacement value.

- Negative ROI: Asset recovery operations that consistently fail to meet their projected return on investment.

- Underutilization: Containers or pallets that spend an extended period in the recovery or repair pipeline, tying up capital.

Dogs in Brambles' portfolio represent business units or services with low market share and low growth prospects, often requiring significant resources without generating substantial returns. These segments, like divested non-core businesses such as CHEP India sold in January 2024, are typically streamlined or divested to improve overall efficiency. For example, underperforming niche services with declining demand, such as specialized low-volume container types, exemplify these 'Dog' segments.

Legacy systems that are costly to maintain and hinder digital transformation efforts are also classified as Dogs. These outdated infrastructures, like older software that impedes data integration, demand resources without contributing to market share growth. Similarly, operations in stagnant geographic markets with intense competition, where Brambles faces flat volumes and limited returns, represent cash traps and are considered Dogs.

Inefficient asset recovery programs, characterized by high loss rates or excessive repair costs, also fall into the Dog category. For instance, if a container type has a 25% loss rate and repair costs exceed its residual value, it's a prime example of an underperforming asset recovery operation. Brambles' focus on reducing pallet losses, aiming for a 5% reduction in key markets in 2023, directly addresses these inefficiencies.

Brambles' strategic review of these underperforming segments, including those with high loss rates exceeding 15% or repair expenses over 60% of replacement value, aims to optimize resource allocation. These 'Dog' segments, which often exhibit negative ROI and underutilization, are prime candidates for restructuring or divestment to enhance overall portfolio performance.

| Segment Example | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Divested Non-Core Business (e.g., CHEP India) | Low | Low | Low/Negative | Divestment |

| Underperforming Niche Service | Low | Low/Declining | Low/Negative | Restructure or Divest |

| Legacy IT Systems | N/A | N/A | Low/Negative (due to maintenance) | Replace or Overhaul |

| Stagnant Geographic Markets | Low | Flat | Low/Negative | Divestment or Restructure |

| Inefficient Asset Recovery | N/A | N/A | Low/Negative | Improve Efficiency or Divest |

Question Marks

Brambles' new digital offerings, like Serialization Plus, aim to boost customer loyalty and streamline operations with sophisticated tracking capabilities. These innovations represent a significant investment in development and deployment, currently in the nascent stages of market acceptance.

While these digital solutions exhibit high growth potential, their market penetration remains low, meaning their long-term market share and profitability are still uncertain. For instance, the global serialization market, which includes solutions like Brambles', was valued at approximately $2.8 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial future opportunity but also the current early-stage nature of adoption.

Brambles' strategic push into untapped emerging markets, where its presence is minimal, signifies a classic 'Question Mark' scenario in the BCG Matrix. These regions, characterized by high growth potential, demand significant upfront investment in logistics and customer education to establish their circular economy model. For instance, Brambles has been actively exploring opportunities in Southeast Asia and parts of Africa, aiming to replicate its success in other regions.

The core challenge lies in converting potential customers to Brambles' 'share and reuse' model, which requires a shift in existing supply chain practices. While these markets offer substantial long-term growth prospects, the initial returns are typically low due to the necessary infrastructure build-out and market development efforts. Brambles' 2024 focus includes pilot programs and partnerships in these nascent markets to gauge adoption rates and refine its go-to-market strategy.

Brambles is actively exploring innovative circular economy pilots that move beyond their established pooling model. These ventures might involve entirely new materials or integrated services, pushing the boundaries of traditional logistics. For instance, Brambles has been investing in pilot programs for reusable packaging solutions for the food industry, aiming to reduce single-use plastics and streamline supply chains. These initiatives are crucial for future market positioning.

These pilot programs represent Brambles' foray into high-risk, high-reward territory, akin to a 'Question Mark' in the BCG matrix. They are characterized by significant upfront investment needed for testing and validation, as their market viability at scale remains unproven. A successful pilot in advanced material recovery or a novel service integration could fundamentally reshape Brambles' operational landscape and revenue streams.

Conversion of Small-to-Medium Enterprises to Pooling

The ongoing push to transition small-to-medium manufacturers from owning whitewood pallets to Brambles' pooling services fits the profile of a Question Mark in the BCG Matrix. This area presents a significant untapped market, often referred to as a 'whitespace' opportunity, with considerable potential for growth.

However, the conversion process for these businesses can be challenging. It's capital-intensive, and the pace of adoption is often slow. This is partly due to the competitive pricing offered by disposable pallet alternatives and a natural customer reluctance to change established practices.

- Market Potential: The global pallet market is substantial, with estimates suggesting it will reach over $80 billion by 2027, indicating a large addressable market for pooling services.

- Conversion Challenges: For instance, in 2024, many SMEs are still hesitant to adopt pooling due to upfront costs and the perceived convenience of existing disposable systems, which can be acquired for as little as $8-$12 per pallet.

- Brambles' Strategy: Brambles aims to overcome these hurdles by highlighting the long-term cost savings and environmental benefits of their pooling model, which can reduce pallet-related expenses by up to 20% for businesses.

Development of New Material Pallets/Containers

Brambles' exploration into new material pallets and containers, like those from upcycled plastic waste, represents a strategic move towards sustainability. While these innovations address growing environmental concerns and anticipate future market needs, their widespread adoption hinges on overcoming challenges in market acceptance, scalability, and cost-competitiveness against established wood or plastic options.

The financial commitment for developing and scaling these novel solutions is substantial. For instance, investing in advanced recycling technologies and new manufacturing processes can run into millions of dollars. Brambles' commitment to sustainability is evident in its 2023 ESG targets, aiming to reduce its carbon footprint by 40% by 2030, which includes exploring alternative materials.

- Sustainability Focus: Development of pallets from upcycled plastic waste aligns with Brambles' ESG strategy and growing market demand for eco-friendly solutions.

- Market Uncertainty: Widespread adoption is contingent on proving market acceptance, achieving economies of scale, and demonstrating cost-effectiveness compared to traditional materials.

- Investment Requirements: Significant capital expenditure is necessary for research, development, and scaling up production of these new material pallets.

- Competitive Landscape: Brambles must innovate to maintain its competitive edge against both existing pallet providers and emerging sustainable material alternatives.

Question Marks in Brambles' portfolio represent business ventures with high growth potential but low market share, requiring careful consideration and investment. These are often new product lines or entries into new geographic markets where Brambles is still establishing its presence and customer base.

The success of these Question Marks hinges on Brambles' ability to convert potential into market dominance, a process that demands significant strategic investment and market development. For instance, Brambles' expansion into emerging markets in Southeast Asia in 2024, while promising high growth, requires substantial upfront capital for logistics and customer education.

These initiatives are critical for Brambles' long-term growth strategy, aiming to capture future market share in areas with evolving customer needs and regulatory landscapes. The company's 2024 focus on pilot programs for new material pallets, like those from upcycled plastic waste, exemplifies this, with significant investment in R&D to prove scalability and cost-effectiveness.

Brambles faces the challenge of transforming these nascent opportunities into profitable ventures, navigating market adoption rates and competitive pressures. The company's strategy involves highlighting long-term cost savings and environmental benefits to encourage adoption of its pooling model, aiming to reduce pallet-related expenses by up to 20% for businesses.

| Brambles' Question Mark Examples | Market Potential | Current Market Share | Investment Focus (2024) | Key Challenges |

|---|---|---|---|---|

| Emerging Markets (e.g., Southeast Asia) | High | Low | Logistics infrastructure, customer education | Market adoption, regulatory hurdles |

| New Material Pallets (e.g., upcycled plastic) | High | Low | R&D, scaling production, cost-competitiveness | Market acceptance, economies of scale |

| SME Conversion to Pooling | High | Low | Highlighting cost savings, environmental benefits | Upfront costs, customer inertia |

BCG Matrix Data Sources

Our Brambles BCG Matrix is informed by comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis to provide strategic clarity.