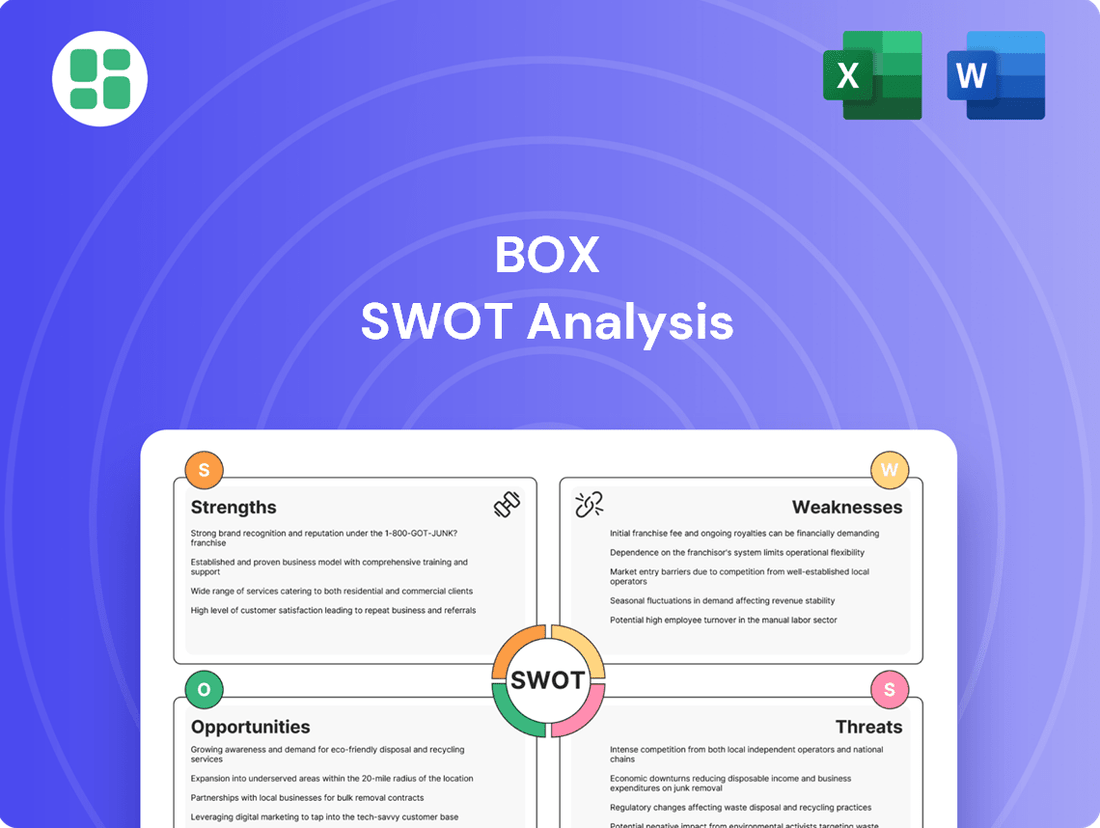

Box SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Box Bundle

This preview offers a glimpse into the company's core competitive advantages and potential challenges. Ready to dive deeper and unlock actionable strategies for growth and risk mitigation?

Our complete SWOT analysis provides a comprehensive, research-backed understanding of the company's market position, internal capabilities, and future opportunities. Equip yourself with the detailed insights and editable tools needed to strategize, plan, and invest with confidence.

Strengths

Box's enterprise-grade security is a significant strength, offering robust protection for sensitive business data. Features like AES 256-bit encryption and granular access controls ensure that only authorized personnel can view and manage content. This focus on security is critical for businesses handling confidential information, making Box a trusted solution for regulated industries.

Compliance with major regulations such as HIPAA, GDPR, and SOC 2 further solidifies Box's appeal to enterprises. By adhering to these stringent standards, Box enables its clients to meet their own regulatory obligations, reducing risk and facilitating smoother operations. This commitment to compliance is a key differentiator in the cloud content management market.

The platform's zero-trust architecture, coupled with advanced offerings like Box Shield for data leak prevention and Box KeySafe for customer-managed encryption keys, demonstrates a proactive approach to data security. These capabilities provide enterprises with enhanced control and visibility over their content, safeguarding against potential breaches and unauthorized access in an increasingly complex threat landscape.

Box's strength lies in its comprehensive Intelligent Content Management (ICM) platform, moving beyond basic file sharing to offer secure storage, robust collaboration, and workflow automation. This integrated approach allows organizations to effectively manage their unstructured data throughout its lifecycle.

The recent Enterprise Advanced plan consolidates these powerful features, streamlining content management for businesses. This unified offering is a significant advantage, especially as unstructured data continues to grow exponentially, with estimates suggesting it will account for 80% of all data by 2025.

Box is aggressively innovating by integrating AI across its platform, aiming to transform content management. Initiatives like Box AI Studio, set to roll out in January 2025, will empower organizations to create custom AI agents for specific use cases.

This commitment extends to supporting a broad range of large language models and offering unlimited AI queries for Enterprise Plus customers, a move designed to unlock substantial value from their existing enterprise content repositories.

Extensive Ecosystem of Third-Party Integrations

Box's strength lies in its extensive ecosystem of third-party integrations, allowing it to connect with over 1,500 popular business applications. This vast network includes major players like Microsoft Office, Google Workspace, Salesforce, and Slack, significantly boosting its utility for businesses. Such broad interoperability ensures Box can seamlessly fit into diverse existing IT infrastructures, making it a highly versatile solution.

This integration capability is a critical differentiator, enhancing productivity and workflow efficiency for users. For instance, by connecting with CRM systems like Salesforce, Box streamlines sales processes and document management. Similarly, integration with collaboration tools such as Slack facilitates smoother communication and file sharing within teams.

- Over 1,500 third-party integrations

- Seamless integration with Microsoft Office, Google Workspace, Salesforce, and Slack

- Enhances utility and productivity across diverse IT infrastructures

Strong Market Recognition and Stable Financial Performance

Box has solidified its market presence, consistently achieving positive revenue growth and enhancing its operating margins, as evidenced by its fiscal year 2025 financial reports. This financial stability is complemented by significant industry accolades.

The company's leadership is further validated by its repeated recognition in prominent industry analyst reports. For instance, Box was named a Leader in The Forrester Wave™: Content Platforms (Q1 2025), and consistently appears in Gartner® Magic Quadrant™ and IDC MarketScape™ reports.

- Consistent Revenue Growth: Fiscal year 2025 saw continued positive revenue trends for Box.

- Improved Operating Margins: The company demonstrated an upward trend in operating profitability.

- Industry Leader Recognition: Positioned as a Leader in Forrester's Q1 2025 Content Platforms report.

- Analyst Endorsements: Frequent inclusion in Gartner and IDC MarketScape evaluations highlights market strength.

Box's robust security framework, featuring AES 256-bit encryption and zero-trust architecture, provides unparalleled data protection. Its commitment to compliance with major regulations like GDPR and HIPAA further cements its position as a secure choice for enterprises. Advanced features like Box Shield and KeySafe offer granular control and proactive defense against data breaches.

The platform's comprehensive Intelligent Content Management capabilities, encompassing secure storage, collaboration, and workflow automation, address the growing need to manage unstructured data. The recent Enterprise Advanced plan simplifies access to these powerful tools, vital as unstructured data is projected to reach 80% of all data by 2025.

Box's extensive ecosystem of over 1,500 third-party integrations, including seamless connections with Microsoft Office, Google Workspace, and Salesforce, greatly enhances its utility and productivity for businesses. This broad interoperability ensures Box fits effortlessly into existing IT infrastructures, streamlining workflows and improving collaboration.

Box demonstrates strong market leadership and financial health, with consistent revenue growth and improving operating margins reported in its fiscal year 2025 financials. Its industry standing is reinforced by its designation as a Leader in The Forrester Wave™: Content Platforms (Q1 2025) and consistent recognition in Gartner and IDC MarketScape reports.

| Metric | Value (FY25) | Significance |

|---|---|---|

| Third-Party Integrations | 1,500+ | Enhances workflow and productivity across diverse systems. |

| Forrester Wave Position | Leader (Q1 2025) | Confirms strong market leadership in content platforms. |

| Revenue Trend | Positive Growth | Indicates sustained business expansion and market demand. |

| Operating Margins | Upward Trend | Demonstrates improving profitability and operational efficiency. |

What is included in the product

Provides a strategic overview of Box’s internal strengths and weaknesses, alongside external opportunities and threats.

Eliminates the struggle of organizing complex SWOT data into a digestible format.

Simplifies the process of identifying and prioritizing strategic actions from raw SWOT findings.

Weaknesses

While Box provides a range of plans, feedback and customer reviews often point to the higher cost of its advanced features and premium add-ons. This pricing structure can make it less accessible for small businesses or those with tighter financial constraints.

Furthermore, reports indicate upcoming mandatory price increases for renewing customers, suggesting that existing users might face higher subscription costs in the near future. For instance, in early 2024, some users reported notifications of upcoming price adjustments for their existing contracts.

Box faces intense competition from tech giants with expansive ecosystems. Microsoft's OneDrive and Google Drive, for instance, are deeply integrated into their respective productivity suites, offering a compelling value proposition for users already invested in those platforms. This broad integration allows them to bundle cloud storage and collaboration tools, often at competitive price points, challenging Box's standalone market position.

Box faces significant customer dissatisfaction, particularly concerning billing and support. Reviews on platforms like the Better Business Bureau frequently cite problems with unexpected auto-renewal charges and challenges in canceling services or connecting with customer assistance.

These negative experiences directly contribute to customer churn, as users become frustrated with the process. For instance, a significant portion of negative feedback in early 2024 revolved around these exact issues, impacting Box's ability to retain its user base and potentially deterring new customers.

Such recurring issues can severely damage Box's reputation. A company known for poor customer service and opaque billing practices will struggle to build trust, making it harder to acquire and keep customers in a competitive cloud storage market.

Slower Revenue Growth Compared to Industry Peers

Box's revenue growth, while steady, lags behind its peers. In the first quarter of 2025, Box reported a 4.23% year-over-year revenue increase. This figure starkly contrasts with the average revenue growth of 52.23% seen among its competitors during the same period, highlighting a slower expansion trajectory in the competitive cloud content management market.

This disparity suggests Box may be struggling to capture market share as effectively as other players. The cloud content management sector is dynamic, and a slower growth rate could impact Box's ability to invest in innovation and maintain its competitive edge.

- Slower Growth: Box's Q1 2025 revenue growth of 4.23% is significantly lower than the industry average of 52.23%.

- Market Share Concerns: This indicates a potential challenge in acquiring new customers or expanding existing relationships at the same pace as competitors.

- Competitive Landscape: The rapid evolution of the cloud content management sector demands aggressive growth to remain competitive.

Forecasted Decline in Future Earnings Per Share

Despite projected revenue increases, some financial analysts anticipate a dip in Box's earnings per share (EPS) for the upcoming three fiscal years. For instance, current consensus estimates suggest a potential EPS contraction from approximately $1.40 in fiscal year 2025 to around $1.25 in fiscal year 2027. This forecast might indicate underlying challenges in maintaining profitability margins or significant reinvestment in expansion strategies that could suppress immediate earnings.

This projected decline in EPS, even amidst revenue growth, could be a point of concern for investors. It may reflect increased operational costs, heightened competition requiring more aggressive pricing, or substantial capital expenditures aimed at future market share gains. For example, if Box invests heavily in new product development or expands its sales force, these costs would directly impact short-term profitability.

- Analyst EPS Projections: Consensus estimates point to a potential decline in EPS from FY2025 to FY2027.

- Profitability Sustainability Concerns: The forecast may signal worries about Box's ability to sustain its current profit margins.

- Impact of Growth Investments: Increased spending on R&D or market expansion could temporarily depress earnings.

- Investor Sentiment: A declining EPS outlook could negatively influence investor perception and stock valuation.

Box faces challenges with its pricing, as advanced features and premium add-ons are often perceived as expensive, limiting accessibility for smaller businesses. Additionally, upcoming mandatory price increases for renewing customers, reported by users in early 2024, signal potential future cost hikes.

The company also grapples with significant customer service issues, particularly concerning billing and support, with frequent complaints about unexpected auto-renewals and difficulties in service cancellation or obtaining assistance. These recurring problems contribute to customer churn and can damage Box's overall reputation.

Box's revenue growth, while stable, lags considerably behind its competitors. In Q1 2025, Box's revenue increased by 4.23% year-over-year, a stark contrast to the average 52.23% growth seen among its peers during the same period. This slower expansion suggests Box may be struggling to gain market share effectively.

Furthermore, financial analysts project a potential dip in Box's earnings per share (EPS) over the next three fiscal years, with estimates suggesting a contraction from approximately $1.40 in FY2025 to around $1.25 in FY2027. This forecast could indicate pressures on profitability margins or significant reinvestment strategies impacting short-term earnings.

| Weakness | Description | Supporting Data/Observation |

|---|---|---|

| Pricing Concerns | Higher cost of advanced features and premium add-ons. | User feedback indicates premium features are expensive; upcoming mandatory price increases reported by users in early 2024. |

| Customer Service Issues | Problems with billing, auto-renewals, and support accessibility. | Frequent complaints on platforms like BBB regarding unexpected charges and difficulties with service cancellation/support. |

| Slower Revenue Growth | Lagging behind industry peers in revenue expansion. | Q1 2025 revenue growth of 4.23% versus industry average of 52.23%. |

| Projected EPS Decline | Anticipated decrease in earnings per share. | Analyst consensus estimates a potential EPS drop from ~$1.40 (FY2025) to ~$1.25 (FY2027). |

Same Document Delivered

Box SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The demand for AI-driven content management is exploding, creating a significant opportunity for Box. Enterprises are actively seeking ways to use AI for extracting insights, automating workflows, and boosting productivity from their vast amounts of unstructured data. This trend is expected to continue its upward trajectory through 2025 and beyond.

Box is well-positioned to seize this opportunity, thanks to its ongoing investments in Box AI Studio and the integration of cutting-edge AI models. These developments allow Box to directly address the growing enterprise need for intelligent content solutions. For instance, by the end of 2024, it's projected that AI in content management could save businesses billions in operational costs.

The ongoing trend of remote and hybrid work models is a significant opportunity for Box. As more companies embrace flexible work, the need for secure cloud content management solutions that facilitate collaboration and efficient workflows becomes even more critical. Box's platform is well-positioned to capitalize on this, as evidenced by the increasing adoption of cloud-based productivity tools globally.

Box's strategic acquisition of Alphamoon in late 2023 for intelligent document processing and Crooze in early 2024 for no-code application building highlights a clear path to platform enhancement. These moves bolster Box's ability to serve a wider range of enterprise needs, moving beyond core content management.

Continuing this acquisition strategy, particularly targeting companies with complementary AI capabilities or strong footholds in underserved verticals, presents a significant opportunity. For instance, acquiring a player in the secure data analytics space could unlock new revenue streams and deepen customer lock-in, further expanding Box's market reach in 2024 and beyond.

Untapped Potential in Vertical Market Penetration

Box's strong security and compliance offerings present a significant opportunity for deeper penetration into highly regulated sectors. Industries such as financial services, healthcare, and government, which are increasingly prioritizing data security and regulatory adherence, represent a fertile ground for Box's specialized solutions.

By customizing its platform to meet the unique compliance mandates and intricate workflows of these sectors, Box can forge deeper customer relationships and create a more defensible competitive advantage. This strategic focus can lead to substantial new revenue streams.

- Financial Services: The global financial services market is projected to reach $34.1 trillion by 2025, with a strong emphasis on secure data management and regulatory compliance like GDPR and CCPA.

- Healthcare: The healthcare cloud computing market is expected to grow to $137.1 billion by 2027, driven by the need for HIPAA-compliant solutions for patient data.

- Government: Government agencies worldwide are investing heavily in secure digital transformation, with a particular focus on cloud adoption for sensitive information management.

Enhanced Value Proposition Through Advanced Analytics and Automation

Box can significantly boost its appeal by integrating advanced analytics and automation into its platform, moving beyond simple file storage. This allows businesses to gain deeper insights from their content and automate intricate workflows, making Box a more attractive solution for enterprises focused on digital transformation.

By offering these sophisticated capabilities, Box can differentiate itself in a crowded market. For instance, by Q1 2025, Box reported a 12% year-over-year increase in revenue, partly driven by its focus on higher-value services and platform enhancements.

- Actionable Insights: Enabling users to extract meaningful data and trends from their stored content.

- Workflow Automation: Streamlining repetitive tasks and complex processes related to content management.

- Competitive Edge: Differentiating Box from competitors by offering advanced, integrated solutions.

- Enterprise Adoption: Attracting larger organizations that require robust digital transformation tools.

The increasing demand for AI-powered content analysis and automation presents a significant growth avenue for Box. Enterprises are actively seeking solutions to leverage AI for extracting valuable insights and streamlining workflows from their data repositories.

Box's strategic expansion into AI, including its AI Studio and acquisitions like Alphamoon, positions it to capitalize on the projected growth of AI in content management, which could yield billions in operational savings for businesses by the end of 2024.

The company's focus on enhancing platform capabilities through targeted acquisitions, such as Crooze for no-code applications, allows Box to offer more comprehensive solutions beyond basic content storage, addressing broader enterprise needs for digital transformation.

Box's robust security and compliance features are a key opportunity to deepen its market penetration in highly regulated industries like financial services and healthcare, sectors prioritizing secure data handling and adherence to stringent regulations.

| Sector | Market Size (Est.) | Key Driver for Box |

|---|---|---|

| Financial Services | $34.1 trillion by 2025 | Secure data management, GDPR/CCPA compliance |

| Healthcare | $137.1 billion (cloud computing) by 2027 | HIPAA-compliant solutions for patient data |

| Government | Increasing cloud adoption for sensitive data | Secure digital transformation initiatives |

Threats

The cloud content management sector is intensely competitive, featuring both established giants and nimble startups. This dynamic environment, marked by rapid technological evolution, demands constant innovation from Box. In Q1 2024, Box reported a 5% year-over-year revenue increase, highlighting the challenge of growth in such a crowded space.

Market fragmentation means Box faces numerous rivals, each vying for market share with specialized offerings. To counter this, Box must consistently differentiate its value proposition, focusing on security and compliance features that appeal to enterprise clients. The ongoing consolidation within the broader cloud market also presents both opportunities and threats as larger players acquire niche competitors.

Despite Box's robust security measures, the persistent threat of data breaches and cybersecurity incidents like ransomware remains a significant concern. For a cloud content management provider, any security lapse can be catastrophic.

A successful breach could result in substantial reputational damage, eroding customer trust which is paramount in the industry. This could translate into significant financial losses and legal liabilities, impacting Box's market position and future growth prospects.

Economic uncertainty is a significant threat, potentially leading businesses to scale back IT expenditures. This could mean less investment in cloud services and software, directly impacting companies like Box that rely on enterprise spending.

For instance, if a recessionary environment takes hold in late 2024 or early 2025, we could see a slowdown in the 10-15% projected growth for enterprise software spending in North America, according to some industry analysts.

This broader economic climate might hinder Box's ability to close large deals with major corporations, as these organizations often become more risk-averse and scrutinize new technology investments more closely during periods of economic instability.

Evolving Regulatory Landscape and Data Sovereignty Concerns

The global regulatory environment for data privacy, including frameworks like GDPR and CCPA, presents a significant challenge for cloud providers like Box. These evolving rules demand constant vigilance and adaptation to ensure compliance, with potential penalties for missteps. For instance, the European Union's GDPR, which came into full effect in 2018, has set a precedent for stringent data protection, impacting how companies handle user data worldwide.

Data sovereignty concerns, where countries mandate that data be stored and processed within their borders, add another layer of complexity. Box must navigate these differing national requirements to maintain its global operations and customer trust. A failure to adapt to these shifting legal and data residency demands could lead to substantial fines, estimated to be up to 4% of annual global turnover under GDPR, and a significant erosion of market share.

- Increasing Compliance Burden: Adapting to diverse global data privacy laws (GDPR, CCPA, etc.) requires ongoing investment in compliance infrastructure and expertise.

- Data Sovereignty Risks: Mandates for local data storage can fragment service delivery and increase operational costs for cloud providers.

- Potential for Penalties: Non-compliance can result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover.

- Reputational Damage: Data breaches or compliance failures can severely damage customer trust and Box's brand reputation.

Customer Perception of Value and Price Sensitivity

Customers might perceive Box's value proposition as insufficient when weighed against its cost, particularly when rivals offer similar functionalities at lower price points or as part of broader software suites. This heightened price sensitivity could directly impact churn rates, as clients re-evaluate their spending on cloud storage and collaboration tools. For instance, in late 2023 and early 2024, many businesses were scrutinizing SaaS expenditures, making value-for-money a paramount consideration.

This ongoing pressure on perceived value can significantly erode customer loyalty, forcing Box to continuously demonstrate its unique benefits. If the premium features or security assurances don't clearly outweigh the cost difference compared to competitors, customers may be more inclined to switch. This dynamic is amplified in a market where alternatives are readily available and often aggressively priced.

- Price Sensitivity: Increased scrutiny of SaaS spending in 2023-2024 means customers are more likely to compare Box's pricing directly against competitors.

- Value Justification: Box must clearly articulate and demonstrate how its features and benefits justify its price point to prevent customer churn.

- Competitive Landscape: Lower-cost alternatives and bundled solutions from competitors pose a significant threat if Box's value proposition isn't compelling enough.

The intense competition within the cloud content management sector necessitates continuous innovation and differentiation for Box. Market fragmentation means Box must consistently highlight its unique value, particularly its robust security and compliance offerings, to attract and retain enterprise clients. The ongoing consolidation within the broader cloud market also presents a dynamic challenge, as larger entities may acquire niche competitors, altering the competitive landscape.

Cybersecurity threats, including ransomware and data breaches, remain a critical concern for Box. A successful breach could lead to severe reputational damage, loss of customer trust, and significant financial and legal repercussions. The increasing sophistication of cyberattacks demands constant investment in advanced security measures.

Economic downturns pose a threat by potentially reducing enterprise IT spending, impacting Box's revenue growth. During periods of economic uncertainty, businesses tend to become more cautious with technology investments, which could slow down deal closures for cloud services. For example, if a recessionary environment emerges in late 2024 or early 2025, projected growth in enterprise software spending might be curtailed.

Navigating the complex and evolving global regulatory landscape for data privacy, such as GDPR and CCPA, presents a significant challenge. Data sovereignty mandates, requiring data to be stored within specific borders, further complicate operations and increase costs. Failure to comply can result in substantial fines, with GDPR penalties potentially reaching up to 4% of annual global turnover.

Customers are increasingly price-sensitive, scrutinizing SaaS expenditures and comparing Box's value proposition against lower-cost or bundled alternatives. This necessitates that Box clearly demonstrates its unique benefits to justify its pricing and prevent customer churn. The market trend observed in late 2023 and early 2024 shows businesses prioritizing value-for-money in their software decisions.

SWOT Analysis Data Sources

This Box SWOT analysis is built on a foundation of robust data, drawing from Box's official financial filings, comprehensive market research reports, and insights from industry analysts and technology experts.