Box Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Box Bundle

Porter's Five Forces offers a powerful lens to dissect Box's competitive landscape, revealing the underlying pressures that shape its market. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Box’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Box's reliance on a few dominant cloud infrastructure providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, significantly concentrates supplier bargaining power. These providers hold a substantial market share, with AWS alone accounting for over 31% of the global cloud infrastructure market in Q1 2024, according to Synergy Research Group. This limited supplier landscape grants them considerable leverage, potentially influencing Box's operational expenses and the terms of its service agreements.

The scarcity of comparable, large-scale cloud infrastructure alternatives means Box has limited options for diversifying its hosting needs. This dependence can lead to increased costs if these major providers decide to raise prices or alter their service offerings, directly impacting Box's profitability and its ability to scale efficiently.

Box's reliance on specialized software components, including AI, e-signature, and workflow automation tools, directly impacts supplier bargaining power. If these components are highly unique or proprietary, the suppliers of these critical elements gain significant leverage, potentially increasing costs for Box. For instance, a vendor providing a cutting-edge AI module with few alternatives could command higher prices, impacting Box's profitability.

The market for cloud and AI talent is extremely competitive, with companies like Box vying for skilled professionals. In 2024, the demand for cloud architects and AI/ML engineers continued to outstrip supply, driving up compensation and making it harder to retain top performers. This scarcity significantly boosts the bargaining power of these specialized workers.

Switching Costs for Box

Box faces significant switching costs when it comes to its core cloud infrastructure providers. The sheer operational complexity and the technical hurdles involved in migrating vast amounts of data, coupled with the risk of service interruptions, make changing suppliers a daunting and expensive undertaking. This inherent difficulty grants considerable leverage to Box's current infrastructure partners.

The integration of new, fundamental software components also presents a substantial barrier. Such processes are typically time-consuming and resource-intensive, further solidifying the position of existing software vendors and limiting Box's agility in adopting alternative solutions.

- High Data Migration Costs: Moving petabytes of customer data between cloud platforms incurs significant expenses related to bandwidth, labor, and potential downtime.

- Integration Complexity: Customizing and integrating new software into Box's existing architecture can take months and require specialized engineering talent, estimated to cost millions in development and testing.

- Operational Disruption Risk: A poorly managed switch could lead to extended service outages, impacting customer trust and revenue, a risk that suppliers of essential services can exploit.

- Loss of Customization Benefits: Box likely benefits from tailored configurations with its current providers, the loss of which upon switching would necessitate costly re-optimization.

Supplier's Importance to Box's Innovation

Suppliers offering advanced AI capabilities and specialized integrations significantly bolster Box's position as an intelligent content management platform. For example, Box's strategic partnerships with major cloud providers like Microsoft Azure OpenAI Service, AWS Bedrock, and Google Cloud's Vertex AI are vital for its innovation pipeline.

The reliance on these suppliers for cutting-edge AI models and unique functionalities directly translates to their increased bargaining power. When a supplier's technology is integral to Box's product differentiation and future strategy, their ability to influence terms and pricing grows substantially.

- Critical AI Integrations: Box's ability to offer advanced features relies heavily on its partners providing state-of-the-art AI models.

- Strategic Partnerships: Collaborations with Microsoft Azure OpenAI, AWS Bedrock, and Google Cloud Vertex AI are key to Box's innovation.

- Supplier Influence: The more essential a supplier's technology is to Box's competitive advantage, the greater their leverage.

Box's bargaining power with its suppliers is significantly influenced by the concentration of the cloud infrastructure market. With giants like AWS, Microsoft Azure, and Google Cloud dominating, holding over 60% of the global cloud infrastructure market in early 2024, Box has fewer options for essential services. This limited choice empowers these providers, allowing them to dictate terms and pricing, thereby increasing Box's operational costs.

The specialized nature of AI and workflow automation tools also amplifies supplier leverage. If Box relies on unique or proprietary components from a single vendor, that supplier gains substantial power. This is evident as companies increasingly integrate advanced AI, with the AI market expected to reach over $200 billion in 2024, making specialized AI providers highly influential.

Switching costs for core cloud infrastructure and complex software integrations are substantial, further strengthening supplier positions. The expense and technical difficulty of migrating data and reconfiguring systems mean Box is often locked into existing relationships, giving suppliers considerable influence over contract renewals and price adjustments.

| Supplier Type | Market Concentration (Early 2024) | Impact on Box | Example Integration |

|---|---|---|---|

| Cloud Infrastructure | AWS, Azure, Google Cloud hold >60% market share | Limited choice, higher costs, supplier leverage | AWS for core data storage |

| AI/ML Services | Highly specialized, few direct competitors for cutting-edge tech | Increased costs for differentiation, supplier influence | Azure OpenAI for advanced features |

| Workflow Automation | Fragmented but critical for unique features | Potential for higher pricing from niche providers | Specific e-signature integration |

What is included in the product

Box's Five Forces analysis dissects the competitive intensity within the cloud content management market, evaluating threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing players.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

For customers focused on basic file storage and sharing, the ability to switch to competitors like Dropbox, Google Drive, or Microsoft OneDrive can be quite straightforward, as switching costs are generally low. This ease of transition is amplified by the increasing commoditization of these fundamental sync-and-share services, allowing users to readily compare and select providers based on price or minor feature variations.

For large enterprises, the bargaining power of customers is significantly reduced when switching costs are high, particularly for integrated solutions like those offered by Box. Box caters to complex needs in content management, collaboration, and workflow automation, meaning businesses have deeply embedded its services into their daily operations.

Customers utilizing advanced features such as Box Sign for digital signatures, Box Shield for advanced security, and Box Relay for workflow automation face substantial hurdles if they consider switching. The sheer volume of data to migrate, the intricate reconfiguration of established business processes, and the necessary retraining of a large workforce represent considerable financial and operational burdens, thereby diminishing their ability to exert strong bargaining power.

Customer bargaining power is a key factor in Box's competitive landscape. While smaller businesses might be more swayed by price, larger enterprises often place a premium on factors like robust security, stringent compliance, seamless integration, and sophisticated workflow automation. These elements can significantly outweigh a slightly higher cost for these clients.

Box's enterprise-grade security and compliance features are particularly valuable for highly regulated industries, such as finance and healthcare. This specialization reduces price sensitivity for these critical value-added services, as the cost of non-compliance or a data breach far exceeds the price of Box's offerings.

For instance, in 2023, cybersecurity breaches cost the global economy an estimated $10.5 trillion annually, highlighting the immense value customers place on security. Box's commitment to meeting these demands, including adherence to standards like HIPAA and GDPR, directly addresses these customer needs, thereby mitigating the impact of price sensitivity.

Customer Size and Concentration

Box's customer base is quite varied, encompassing businesses of all sizes across numerous sectors. This broad distribution of clients generally weakens the bargaining power of any single customer, as the loss of one account, while impactful, doesn't cripple the company. For instance, in fiscal year 2024, Box reported a diverse revenue stream, with no single customer accounting for more than 10% of its total revenue, underscoring this diffusion of customer power.

However, the potential for significant revenue impact exists with the loss of a large enterprise client. While Box aims to serve a wide market, a few very large enterprise customers do represent a substantial portion of its revenue. If this concentration were to increase, the bargaining power of those specific large clients would naturally rise, giving them more leverage in negotiations.

- Diverse Customer Base: Box serves a wide array of industries and business sizes, reducing the influence of any single customer.

- Mitigated Concentration Risk: While large clients are important, Box's broad customer footprint dilutes their individual bargaining leverage.

- Impact of Large Clients: Losing a major enterprise client can still have a notable effect on Box's financial performance.

- Revenue Distribution (FY24): No single customer represented over 10% of Box's total revenue in fiscal year 2024, indicating a healthy spread.

Availability of Alternatives and Bundling

Customers wield significant power when they have many choices. For Box, this means users can opt for competing cloud content management systems, or even simpler cloud storage solutions and productivity suites that already include file-sharing capabilities. Think about the widespread adoption of Microsoft 365 and Google Workspace; these platforms offer integrated file management, often at a price point that feels more attractive to many businesses.

The ease with which customers can switch to these bundled offerings, which can present a lower overall perceived cost, directly enhances their bargaining power. This forces companies like Box to continually innovate and highlight unique, specialized features and integrations that justify their value proposition. For instance, Box’s focus on enterprise-grade security, compliance, and workflow automation becomes crucial differentiators in a market where basic file storage is commoditized.

- Customer Choice: The market offers a variety of cloud content management solutions, alongside broader productivity suites that bundle file sharing.

- Bundled Solutions: Platforms like Microsoft 365 and Google Workspace integrate file sharing, potentially lowering perceived costs for users.

- Increased Bargaining Power: The availability of alternatives empowers customers to demand more value or lower prices.

- Box's Differentiation Strategy: Box must emphasize specialized features and integrations to stand out against bundled, lower-cost options.

Customers' ability to switch providers significantly impacts their bargaining power. For basic cloud storage, switching is easy, but for complex enterprise solutions like Box, high switching costs due to deep integration and workflow embedding diminish customer leverage. For example, in 2023, the global cost of cybersecurity breaches reached an estimated $10.5 trillion annually, underscoring the value customers place on robust security and compliance features offered by providers like Box.

Box's diverse customer base, with no single client exceeding 10% of revenue in fiscal year 2024, generally dilutes individual customer bargaining power. However, the loss of a major enterprise client could still materially affect Box's financial performance, increasing the leverage of those key accounts if their concentration grows.

| Factor | Impact on Box | Supporting Data (FY24) |

|---|---|---|

| Switching Costs (Basic Storage) | High Bargaining Power for Customers | Low for basic sync-and-share. |

| Switching Costs (Enterprise Solutions) | Low Bargaining Power for Customers | High due to integration, workflow, data migration, retraining. |

| Customer Concentration | Lowers Individual Bargaining Power | No single customer > 10% of revenue. |

| Value of Differentiated Features | Mitigates Bargaining Power | Security & compliance critical; breaches cost $10.5T (2023). |

What You See Is What You Get

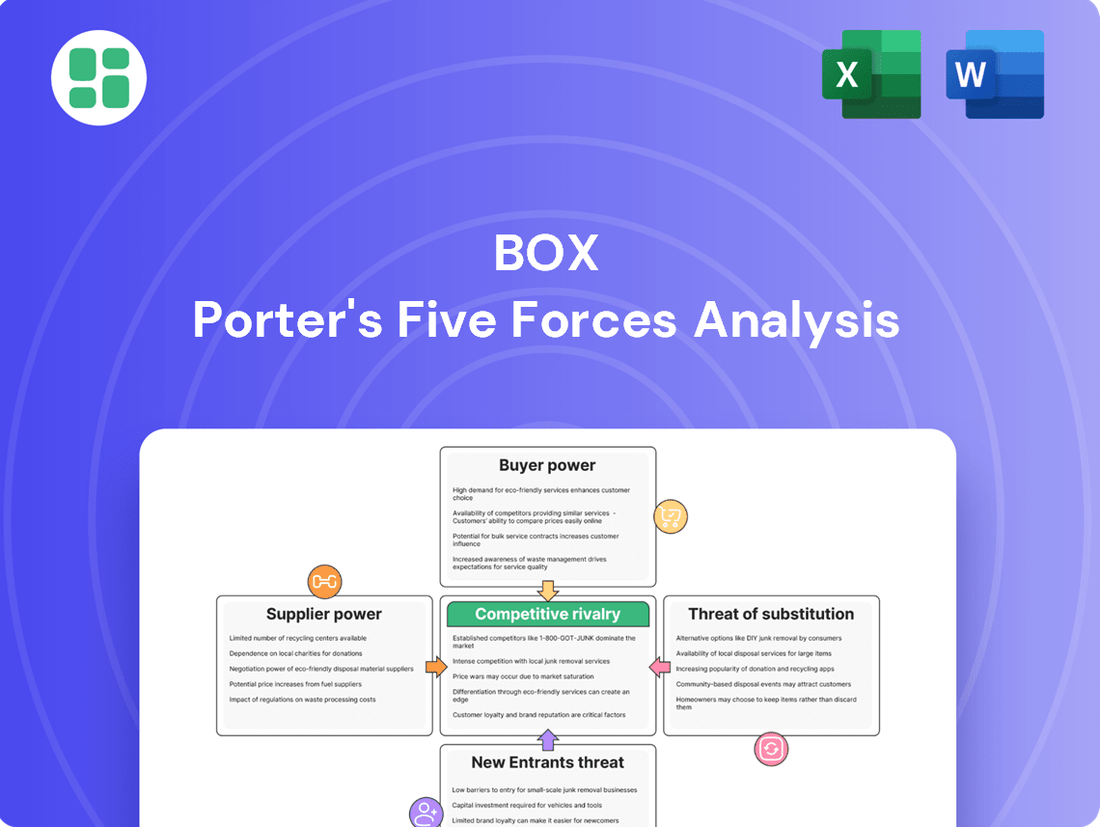

Box Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis, offering a thorough examination of competitive forces within an industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring you get exactly what you need without any surprises.

Rivalry Among Competitors

Box contends with formidable rivals like Microsoft, Google, and Dropbox. These tech behemoths possess substantial financial clout and integrated product suites, enabling them to bundle content management with a wider array of services. For instance, Microsoft's OneDrive and SharePoint are deeply embedded within the Microsoft 365 ecosystem, offering a seamless experience for millions of users.

This deep integration allows competitors to present highly attractive, all-encompassing solutions. In 2024, Microsoft 365 boasts over 380 million paid seats, highlighting the vast reach and customer loyalty these bundled offerings cultivate. This competitive landscape pressures Box to continually innovate and differentiate its specialized content cloud services.

The cloud content management and enterprise file sync and share (EFSS) sectors are experiencing robust growth, yet they are also maturing and becoming intensely competitive. This dynamic is a key factor in understanding competitive rivalry.

While projections indicate the global enterprise content management market could reach hundreds of billions of dollars by 2030, the sheer number of vendors vying for market share fuels aggressive pricing strategies and a constant push for innovative features, intensifying direct competition among established and emerging players.

Box distinguishes itself by centering on Intelligent Content Management (ICM), heavily leveraging AI-driven capabilities, robust security, governance, and streamlined workflow automation.

The company's commitment to ongoing innovation, exemplified by offerings like Box AI Studio and the expansive Box Apps ecosystem, is crucial for maintaining its competitive edge in the evolving market.

However, the competitive landscape is intensifying as rivals are also aggressively incorporating AI and sophisticated features, posing a significant challenge to Box's unique value proposition.

Switching Costs for Competitors' Customers

Box works to lock in its customers by deeply integrating its services and offering unique features. However, this strategy faces a significant hurdle because major competitors like Microsoft and Google also create high switching costs within their own extensive ecosystems.

This deep integration makes it tough for Box to attract customers who are already heavily invested in rival productivity suites. For instance, a business deeply embedded in Microsoft 365, utilizing SharePoint, Teams, and OneDrive, will find it complex and costly to migrate their entire workflow and data to Box. The inertia of established systems and the associated training and support costs create a powerful barrier.

- Deep Integration: Box's strategy relies on embedding its content cloud deeply into customers' existing business processes, making it harder to leave.

- Rival Ecosystems: Microsoft and Google leverage their broad product suites (Office 365, Google Workspace) to create sticky customer relationships.

- Customer Inertia: Businesses are often reluctant to switch due to the significant costs associated with data migration, retraining staff, and reconfiguring workflows.

- Market Share Dominance: Microsoft, for example, held a dominant position in productivity software for years, with a vast installed base that naturally benefits from high switching costs. As of early 2024, Microsoft 365 continues to be a leading productivity suite for businesses globally.

Pricing Strategies and Commoditization

The core file storage and sharing segment of the market has largely transformed into a commodity, creating intense pressure on pricing. This commoditization means that basic storage and sharing features are readily available from numerous providers, often at very low costs, making it difficult for companies like Box to differentiate solely on these fundamental offerings.

Box's strategy to counter this involves shifting focus towards higher-value, integrated content management solutions. These premium offerings, which often include advanced security, workflow automation, and compliance features, are designed to justify a higher price point. By embedding its services into broader enterprise workflows, Box aims to move beyond simple file sharing.

However, the competitive landscape remains challenging due to aggressive pricing strategies from rivals. Many competitors, particularly those offering broader cloud suites, bundle storage and collaboration tools at attractive price points. For instance, Microsoft's OneDrive, often bundled with Microsoft 365 subscriptions, provides a significant cost advantage for many businesses, making it a powerful competitive force.

- Market Commoditization: Basic file storage and sharing is now a commodity, driving down prices.

- Box's Strategy: Moving upmarket to offer premium, integrated content management to justify higher prices.

- Competitive Pricing: Competitors, especially those bundling services like Microsoft 365, exert significant price pressure.

- 2024 Data Insight: While specific 2024 pricing data for all competitors is dynamic, the trend of bundled cloud services, including storage, continues to be a dominant strategy, impacting the standalone value proposition of pure-play storage providers.

The competitive rivalry in the content cloud sector is intense, with Box facing off against tech giants like Microsoft and Google. These competitors leverage their vast financial resources and deeply integrated product ecosystems, such as Microsoft 365 with its over 380 million paid seats in 2024, to offer compelling bundled solutions. This forces Box to continuously innovate and differentiate its specialized content cloud services to maintain its market position.

The market for enterprise content management is growing, but it's also becoming crowded. This means many companies are fighting for a piece of the pie, leading to aggressive pricing and a constant need for new features. Box is focusing on Intelligent Content Management, using AI, security, and workflow automation to stand out, but rivals are also rapidly adopting similar advanced capabilities.

The basic file storage and sharing market has become a commodity, putting pressure on prices. Box is trying to counter this by offering premium, integrated content management solutions with advanced features. However, competitors like Microsoft, which bundles OneDrive with its popular Microsoft 365 subscriptions, offer significant cost advantages that challenge Box's pricing strategy.

| Competitor | Key Offerings | Competitive Advantage | 2024 Market Context |

|---|---|---|---|

| Microsoft | OneDrive, SharePoint, Microsoft 365 | Deep ecosystem integration, vast user base (380M+ paid seats for M365) | Bundled services create high switching costs and perceived value. |

| Google Drive, Google Workspace | Strong collaboration tools, widespread adoption in certain sectors | Offers competitive pricing and seamless integration within its own suite. | |

| Dropbox | Dropbox Business | User-friendly interface, strong brand recognition for file sharing | Faces commoditization pressure in basic storage; focuses on workflow integrations. |

SSubstitutes Threaten

While cloud solutions dominate, on-premise and hybrid content management systems remain viable substitutes for organizations with specific needs. These traditional setups cater to sectors with strict data sovereignty regulations or those heavily invested in existing, complex infrastructure, presenting a less agile but still functional alternative to cloud-native platforms like Box.

For instance, many government agencies and financial institutions, due to compliance and security mandates, continue to utilize on-premise solutions. In 2024, a significant portion of enterprise data, estimated to be around 40%, still resides in on-premise data centers, highlighting the persistent demand for these alternatives.

Businesses can leverage general-purpose cloud storage services like Amazon S3 or Google Cloud Storage, often at a lower price point than specialized platforms. While these solutions may require custom integrations or manual workflows to replicate Box's content management features, they present a viable cost-effective alternative for organizations with less complex content needs or robust internal IT resources. For instance, the global cloud storage market was projected to reach over $100 billion in 2024, indicating significant competition from these broader service providers.

Integrated productivity suites like Microsoft 365 and Google Workspace present a significant threat of substitution for dedicated content management platforms like Box. These bundled offerings often include robust file storage, sharing, and basic collaboration features, making them a compelling alternative for many businesses.

For small to medium-sized businesses, or even specific departments within larger organizations, the all-in-one nature of these suites can eliminate the perceived need for a separate content management system. This is particularly true when the core functionalities provided are sufficient for their operational requirements, potentially reducing the addressable market for specialized solutions.

In 2024, the continued growth of cloud-based productivity suites, with Microsoft 365 reporting over 380 million paid seats and Google Workspace serving millions of businesses, underscores the strength of this substitution threat. The convenience and cost-effectiveness of these integrated platforms can divert potential customers away from standalone content management solutions.

Email and Traditional File Sharing Methods

For basic, ad-hoc file sharing and simple collaboration, traditional methods like email attachments, FTP, and shared network drives persist as rudimentary substitutes. While these lack the robust security, advanced version control, and integrated collaboration features offered by platforms like Box, they remain functional for less demanding content management tasks, especially within smaller businesses or for informal internal communication.

These older methods are often perceived as readily available and cost-effective, particularly when organizations already have the necessary infrastructure in place. For instance, a 2024 survey indicated that over 60% of small businesses still rely on email for the majority of their inter-office file transfers, highlighting the continued prevalence of these substitutes.

- Email Attachments: Widely accessible, but limited by file size restrictions and security concerns.

- FTP (File Transfer Protocol): Offers more direct file transfer but requires technical setup and lacks user-friendly interfaces.

- Shared Network Drives: Convenient for internal networks but can pose security risks and lack granular access controls for external sharing.

Manual Processes and Physical Documents

While digital transformation is widespread, certain sectors and internal operations still lean on paper-based workflows and manual data handling. This persistence of physical documents and manual processes acts as a significant substitute threat, particularly for cloud-based content management solutions like Box. For instance, in 2023, a significant portion of small and medium-sized businesses (SMBs) in sectors like legal and healthcare continued to manage a substantial volume of sensitive documents physically, despite the availability of digital alternatives.

Box directly counters this threat by highlighting the superior efficiency, enhanced security, and automation capabilities offered by its intelligent content management platform. The company emphasizes how moving away from manual processes reduces errors, speeds up workflows, and improves compliance. This is particularly relevant as the cost of manual data entry errors can be substantial; studies in 2024 suggest that data errors can cost businesses an average of 12% of their revenue.

- Persistent reliance on paper documents in specific industries like legal and healthcare.

- Manual processes introduce inefficiencies and a higher risk of errors compared to digital solutions.

- The cost of data errors in 2024 was estimated to impact businesses by up to 12% of their revenue.

- Box's value proposition directly addresses this threat by offering automation, security, and efficiency gains.

The threat of substitutes for Box stems from various alternatives that fulfill similar content management needs. These range from integrated productivity suites to simpler file-sharing methods and even traditional paper-based processes.

Integrated platforms like Microsoft 365 and Google Workspace offer a compelling alternative, bundling storage and collaboration features. In 2024, Microsoft 365 alone served over 380 million paid seats, demonstrating the widespread adoption and potential for these suites to replace dedicated content management systems for many businesses.

Simpler methods like email attachments and shared network drives persist, especially for smaller organizations or less complex tasks. A 2024 survey indicated that over 60% of small businesses still use email for most internal file transfers, highlighting the continued relevance of these basic substitutes.

| Substitute Type | Key Features/Considerations | 2024 Relevance/Data Point |

|---|---|---|

| Integrated Productivity Suites | Bundled storage, sharing, collaboration | Microsoft 365: >380M paid seats; Google Workspace: Millions of businesses |

| General Cloud Storage | Cost-effective, requires custom integration | Global cloud storage market projected >$100B |

| Basic File Sharing (Email, FTP, Network Drives) | Accessible, often free, limited features | >60% of SMBs use email for internal file transfers |

| On-Premise/Hybrid Systems | Data sovereignty, legacy infrastructure | ~40% of enterprise data still resides on-premise |

| Paper-Based/Manual Processes | Industry-specific reliance, inefficiency | Data errors cost businesses up to 12% of revenue |

Entrants Threaten

Establishing a robust cloud content management platform like Box demands immense upfront capital. Think data centers, high-speed networks, and top-tier security systems. In 2024, the global cloud computing market alone was valued at over $600 billion, highlighting the scale of investment needed just for the foundational infrastructure.

This substantial financial hurdle acts as a significant barrier for potential new entrants. Building a secure, scalable, and reliable platform capable of competing with established players requires not just capital, but also specialized expertise and extensive operational experience, making it difficult for smaller companies to enter the market.

Box has cultivated a formidable brand reputation and deep-seated trust with its enterprise clientele, a significant barrier for new entrants. This trust is particularly pronounced in areas critical to businesses, such as data security and regulatory compliance, where Box has demonstrated a consistent track record.

New competitors entering the market would face the substantial challenge of replicating Box's established credibility. This necessitates considerable investment in marketing initiatives and obtaining rigorous security certifications, a lengthy and costly process that can deter potential challengers.

Box benefits significantly from strong network effects; as more users and applications connect to its platform, its value increases for everyone. This is evidenced by its extensive integration capabilities, boasting connections with over 1,500 business applications. For a new entrant, replicating this vast and deeply integrated ecosystem presents a formidable barrier, making it difficult to offer comparable value from the outset.

Regulatory Compliance and Data Governance Complexity

The cloud content management market, particularly for enterprise clients, faces significant hurdles due to rigorous regulatory compliance and data governance demands. Newcomers must grapple with intricate legal frameworks like GDPR and HIPAA, alongside industry-specific mandates, making compliance a substantial and expensive undertaking. For instance, in 2024, companies investing in robust data privacy compliance saw an average increase of 15% in operational costs, directly impacting the capital required for market entry.

Navigating these complex legal and compliance landscapes presents a formidable barrier. Establishing systems that meet these stringent standards requires considerable expertise and financial investment, deterring many potential entrants. The ongoing evolution of data protection laws, with new regulations expected to be introduced in key markets throughout 2025, further amplifies this challenge.

- Regulatory Hurdles: Compliance with GDPR, HIPAA, and sector-specific laws is non-negotiable for enterprise cloud content management.

- Cost of Compliance: Investing in legal counsel, compliance officers, and technology to meet data governance standards can cost millions.

- Time to Market: Achieving full compliance can add months, if not years, to a new entrant's launch timeline.

- Data Governance Complexity: Implementing secure data handling, access controls, and audit trails is a critical, resource-intensive task.

Talent Acquisition and Technological Expertise

The threat of new entrants in the cloud content management platform sector, particularly those incorporating AI, is significantly shaped by the intense competition for specialized talent. Developing and maintaining a sophisticated platform requires deep expertise in cloud engineering, cybersecurity, and artificial intelligence. New players face a substantial hurdle in attracting and retaining this highly sought-after technical workforce, which is already in high demand across various tech industries.

This talent scarcity directly impacts the cost and feasibility for new entrants. For instance, in 2024, the average salary for a senior AI engineer in the US was reported to be around $170,000 annually, with some roles commanding upwards of $200,000. Cloud engineers and cybersecurity specialists command similar premium compensation packages. The need to offer competitive salaries and benefits, alongside cutting-edge research and development opportunities, presents a significant financial barrier.

- High Demand for AI and Cloud Talent: Specialized skills in AI, machine learning, and cloud infrastructure are critical for platform development and innovation.

- Talent Acquisition Costs: New entrants must contend with high salaries and recruitment expenses to attract experienced engineers. In 2024, the tech talent market saw a continued surge in compensation for in-demand roles.

- Retention Challenges: Even after acquiring talent, retaining them against established players offering robust career paths and compensation packages is a persistent threat.

- Impact on Innovation Speed: Limited access to top-tier talent can slow down the pace of product development and feature deployment for new entrants.

The threat of new entrants for platforms like Box is considerably low due to the immense capital required for infrastructure, talent, and regulatory compliance. Building a competitive cloud content management system demands significant upfront investment in data centers, advanced security, and specialized expertise. For example, the global cloud computing market's value exceeding $600 billion in 2024 underscores the scale of foundational investment needed.

Established brands and deep customer trust, particularly in data security, also serve as robust barriers. New entrants must invest heavily in marketing and certifications to build similar credibility, a process that can take years and substantial resources. Box's extensive network of over 1,500 application integrations further solidifies its position, making it difficult for newcomers to offer comparable value from the outset.

Navigating complex regulatory landscapes such as GDPR and HIPAA adds another layer of difficulty, with compliance costs in 2024 increasing operational expenses by an average of 15% for businesses. The intense competition for specialized talent, including AI and cloud engineers, with average senior AI engineer salaries around $170,000 in the US in 2024, presents a significant financial and operational hurdle for any new player attempting to enter the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages publicly available data from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of industry dynamics.