Box Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Box Bundle

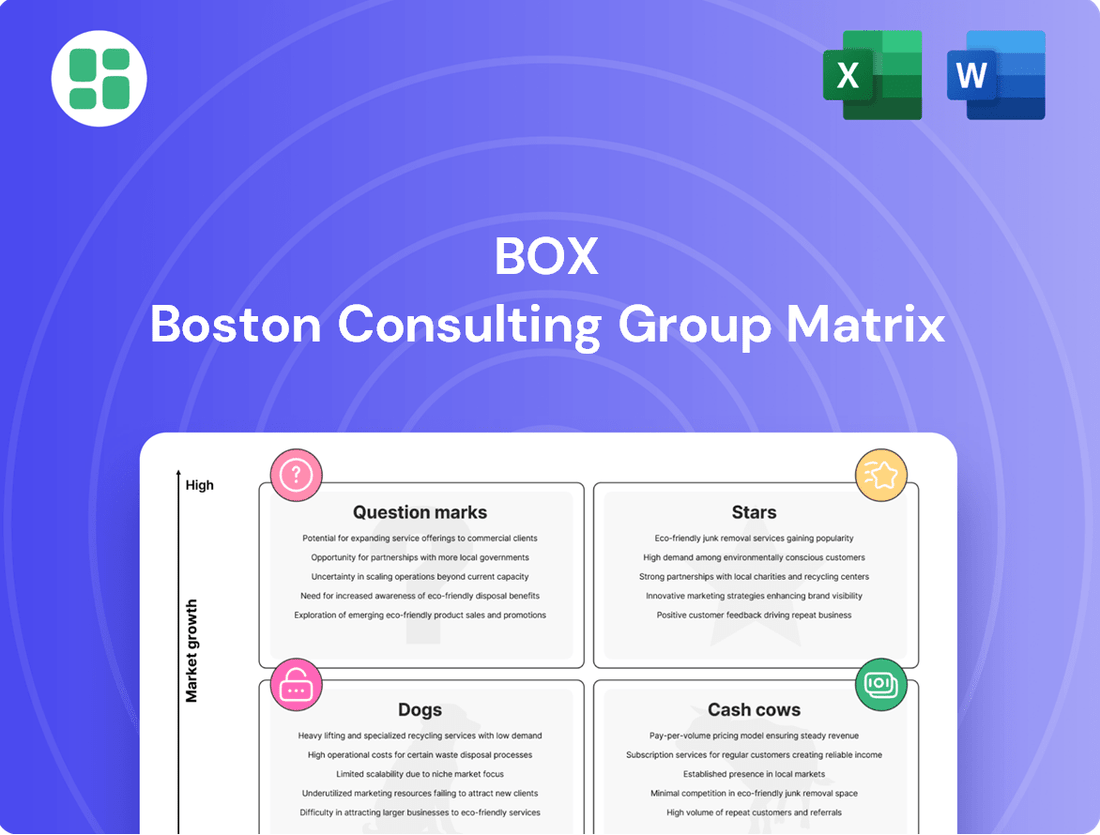

Understand your product portfolio's potential with the BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, guiding strategic decisions. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investments and drive growth.

Stars

Box's AI offerings, including Box AI Studio and its new AI Agents, are positioned as Stars in the BCG Matrix due to their high growth potential. These tools are designed for in-depth research and efficient data extraction, tapping into a burgeoning market for enterprise AI solutions.

The company's significant investment in these AI capabilities is a clear indicator of their strategic focus. Recent financial disclosures from Box in 2024 have underscored robust customer adoption and a notable increase in upgrades to their AI-enhanced services, reflecting strong market traction.

This aggressive development and market penetration solidify Box's standing as a frontrunner in the rapidly expanding enterprise AI adoption landscape. The demand for sophisticated AI tools that can streamline complex data tasks is a key driver for this classification.

Box's strategic pivot to an Intelligent Content Management (ICM) platform, heavily infused with AI, positions it squarely in a high-growth segment. This evolution leverages AI to unlock value from unstructured data, a critical need for businesses today.

Major analyst firms like Gartner and Forrester recognized Box as a leader in content management and collaboration in 2024, highlighting the platform's advanced AI capabilities. This market is experiencing rapid expansion, driven by the increasing demand for AI-powered solutions that enhance productivity and data utilization.

The integration of AI into Box's ICM platform signifies a strong market position and future growth potential. This focus on intelligent automation and data insights places Box in a category of offerings that are both innovative and highly sought after by enterprises looking to gain a competitive edge through advanced content management.

The Enterprise Advanced Plan, launched in January 2025, represents Box's strategic push into premium, integrated solutions. This offering combines Box AI Studio for AI-driven workflows, Box Hubs for enhanced collaboration, and advanced security features, directly addressing the increasing enterprise need for sophisticated content management and protection.

This plan is positioned as a significant growth engine for Box, capitalizing on the demand for AI-powered productivity tools and stringent security. Early adoption trends observed in the first half of 2025 indicate strong market reception, with initial uptake exceeding internal projections, suggesting its potential to become a key revenue driver.

AI-Powered Workflow Automation

AI-powered workflow automation is a rapidly expanding sector, with market forecasts showing significant compound annual growth rates (CAGRs) extending through 2034. Box is strategically positioned within this high-growth area through its AI-enhanced offerings like Box Relay and Box Sign. These solutions automate content processing and facilitate intelligent decision-making, leveraging Box's integrated platform for a competitive edge.

Box's investment in AI for workflow automation directly addresses a key market trend. For instance, the global market for Robotic Process Automation (RPA), a core component of workflow automation, was valued at approximately $3.05 billion in 2023 and is projected to reach $12.73 billion by 2028, demonstrating a robust CAGR of 33.5% during that period. This highlights the immense potential for solutions like Box Relay and Box Sign.

- Market Growth: The workflow automation market is experiencing substantial growth, with projections indicating high CAGRs through 2034.

- AI Integration: Box's AI integration in Box Relay and Box Sign enables automated content processing and intelligent decision-making.

- Competitive Advantage: Box's integrated platform provides a strong competitive advantage in the high-growth AI-powered workflow automation segment.

- RPA Market Data: The RPA market, a key driver of workflow automation, was valued at $3.05 billion in 2023 and is expected to reach $12.73 billion by 2028, with a 33.5% CAGR.

Box Hubs for Content Publishing

Box Hubs, especially with its integrated Box AI, is emerging as a significant new capability for enterprise content publishing. This offering is strategically positioned to help businesses unlock valuable insights from their content, targeting a segment with substantial growth potential.

The recent general availability of Box Hubs underscores its importance in the evolving content management landscape. By leveraging AI, Box aims to establish a leadership position in this high-growth area, providing advanced solutions for content organization and analysis.

- Box Hubs for Content Publishing: A key innovation for enterprises seeking efficient content management.

- Box AI Integration: Enhances content publishing by enabling insight extraction.

- Strategic Market Positioning: Targets a high-growth segment within the enterprise content market.

- Goal: To achieve a leading market position with its AI-powered content solutions.

Box's AI Studio and AI Agents are classified as Stars due to their high growth potential in the enterprise AI solutions market.

The company's substantial investments and strong customer adoption of AI-enhanced services in 2024 highlight their strategic focus and market traction.

Box's position as a leader in content management, recognized by Gartner and Forrester in 2024, further solidifies its Star status in the AI-driven content management sector.

The Enterprise Advanced Plan, launched in January 2025, is a key growth driver, showing strong initial adoption that exceeded projections, indicating its potential as a significant revenue contributor.

| Offering | BCG Category | Growth Potential | Market Traction |

|---|---|---|---|

| Box AI Studio & AI Agents | Star | High | Strong customer adoption (2024) |

| Intelligent Content Management (ICM) | Star | High | Market leadership (Gartner/Forrester 2024) |

| Enterprise Advanced Plan | Star | High | Exceeded initial adoption projections (H1 2025) |

| AI-powered Workflow Automation (Relay, Sign) | Star | High | Leveraging robust RPA market growth |

What is included in the product

Strategic guidance on resource allocation by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

Instantly visualize portfolio health, relieving the pain of unclear strategic direction.

Cash Cows

Box's core enterprise cloud content management, encompassing secure cloud storage and file sharing, stands as a mature offering with a commanding market share. This foundational service, while operating in a market with more moderate growth compared to emerging segments, consistently delivers robust revenue streams and boasts impressive gross margins for the company.

The stability and profitability of this segment are crucial, as it reliably generates substantial cash flow. This consistent financial inflow is instrumental in funding Box's investments in new strategic initiatives and product development, allowing the company to innovate and expand its market presence.

Box's enterprise-grade security and compliance features, including Box Shield and Box Governance, are key drivers of its status as a cash cow. These robust offerings, such as the recently introduced Box Archive and Content Recovery, cater to the persistent, high-demand need for stringent data protection and regulatory adherence among its large enterprise clients. This focus on security ensures strong customer loyalty and significantly boosts profit margins in a well-established market.

Box Sign, as an integrated e-signature solution, benefits from a mature market with substantial existing adoption. Its seamless integration with the broader Box content management platform offers existing users enhanced efficiency, reducing the need for separate e-signature applications.

This synergy within the Box ecosystem translates into consistent, high-margin revenue streams. The strong attach rate of Box Sign to the core Box offering underscores its value proposition, making it a reliable revenue generator for the company.

Strategic Integrations with Major Business Applications

Box's strategic integrations with major business applications like Microsoft 365 and Google Workspace are key to its position as a Cash Cow. These deep ties ensure Box becomes embedded in daily workflows, making it difficult for users to switch. For instance, Box's seamless integration with Microsoft Teams allows for direct file sharing and collaboration within the chat interface, enhancing productivity.

By leveraging the vast user bases of these partner platforms, Box solidifies its value proposition and creates significant platform stickiness. This strategy directly contributes to securing recurring revenue streams from its existing customer base, as the utility of Box increases with each integrated application. In 2023, Box reported that over 60% of its customers used at least one of its key integrations, highlighting the success of this approach.

- Platform Stickiness: Integrations with Microsoft 365, Google Workspace, and Salesforce make Box essential to daily business operations.

- Leveraging Market Share: Box benefits from the widespread adoption of its integration partners, enhancing its own indispensability.

- Revenue Security: These integrations lock in existing customers, ensuring continued subscription revenue and reducing churn.

- Workflow Enhancement: By embedding Box into common enterprise tools, productivity and collaboration are directly improved, reinforcing its value.

Large Enterprise Customer Base

Box's substantial base of over 100,000 paying organizations, including a significant number of Fortune 500 companies, positions it as a dominant player in the enterprise cloud content management sector. This extensive customer adoption translates into a robust and predictable revenue stream, a hallmark of a cash cow.

The company's high net retention rates within this large enterprise segment underscore the sticky nature of its services. These long-term contracts and the ability to expand services within existing accounts are critical drivers of consistent cash generation, providing a stable financial foundation.

- Market Dominance: Serves over 100,000 paying organizations, including a large portion of the Fortune 500.

- Stable Revenue: High net retention rates ensure a predictable and recurring revenue stream.

- Consistent Cash Flow: Long-term contracts and account expansion guarantee steady cash generation.

Cash cows in the BCG matrix represent established products or services with high market share in a low-growth market. For Box, its core cloud content management offering fits this description perfectly. This segment generates significant, stable cash flow, which is vital for funding other areas of the business.

Box's enterprise-grade security features, like Box Shield and Box Governance, are key to its cash cow status. These robust offerings address critical customer needs for data protection and compliance, ensuring strong customer loyalty and high profit margins in a mature market. The consistent demand for these services fuels predictable revenue.

The company's strategic integrations with major platforms such as Microsoft 365 and Google Workspace further solidify its cash cow position. By embedding itself into daily workflows, Box achieves high platform stickiness, leading to secure, recurring revenue streams from its extensive customer base. This strategy is a testament to its ability to maintain a strong hold in established markets.

| Business Unit | Market Share | Market Growth | Cash Flow Generation | Strategic Importance |

|---|---|---|---|---|

| Core Cloud Content Management | High | Low | High | Primary revenue driver, funds innovation |

| Box Sign | Moderate to High | Moderate | Moderate to High | Enhances core offering, sticky revenue |

| Security & Governance (Shield, Governance) | High | Low to Moderate | High | Differentiator, drives retention and margins |

Full Transparency, Always

Box BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This ensures you get precisely what you see—a comprehensive strategic tool ready for immediate application without any watermarks or placeholder content. You can confidently expect the same professional design and analytical depth in the final version, enabling you to effectively analyze your product portfolio and make informed strategic decisions.

Dogs

If Box were to offer only undifferentiated basic cloud storage, it would likely fall into the Dogs quadrant of the BCG Matrix. This segment would face low market share and low growth due to intense competition from numerous providers. For instance, the global cloud storage market, while growing, is largely dominated by players focusing on scale and basic functionality, making it difficult for a company without unique offerings to gain traction.

Competing solely on price for commodity storage, without leveraging its advanced security, collaboration, or AI features, would yield minimal returns for Box. This strategy would likely result in low profitability and could become a cash trap, draining resources without significant upside. The market for basic storage is highly saturated, with companies like Amazon S3 and Microsoft Azure Blob Storage offering competitive pricing and vast infrastructure.

Box's strategic direction, however, is firmly set on its Intelligent Content Cloud, which integrates advanced capabilities beyond simple storage. This focus positions Box away from the commoditized market and towards higher-value solutions. In 2024, Box reported strong growth in its cloud content management business, highlighting the success of its strategy to move beyond basic storage offerings.

Box's legacy file sync and share offerings for non-enterprise users, while foundational, now reside in a mature and highly competitive market. These products, not deeply integrated into the enterprise ecosystem, face significant challenges.

The market for individual and small business file sharing is saturated with free or low-cost alternatives, leading to low market share for Box's standalone legacy solutions. Growth potential is further hampered by the commoditization of this segment, making it difficult to differentiate and capture new users.

Box's Intelligent Content Management strategy aims to streamline workflows and leverage AI. Features that haven't kept pace, such as certain legacy integrations or older collaboration tools, might fall into the Outdated or Underutilized Niche Features category within a BCG-like analysis. These could represent a drag on resources.

For instance, if a specific integration, like an older version of a document annotation tool, sees less than 5% of active Box users engaging with it monthly, it could be a prime candidate for this classification. Such features might still require maintenance, consuming engineering cycles without driving significant new customer acquisition or upsell opportunities for Box in 2024.

Manual Content Processing Tools

Prior to the widespread integration of Box AI, manual content processing tools within the platform, now largely superseded by AI-driven automation, could be seen as Question Marks in the BCG Matrix. These older methods, if still maintained as standalone options, offer low efficiency and lack the growth potential of AI-powered alternatives, likely experiencing a diminishing market share.

These manual tools, such as basic keyword searching or manual tagging, are significantly less efficient compared to AI-powered solutions. For instance, a study on document management systems in 2023 indicated that manual data extraction can be up to 80% slower than automated processes. This stark difference in speed and accuracy positions them as candidates for divestment or significant strategic review.

- Low Efficiency: Manual processing is time-consuming and prone to human error, impacting productivity.

- Limited Scalability: These tools struggle to handle growing volumes of content, hindering business expansion.

- Diminishing Market Relevance: As AI capabilities advance, the demand for manual processing tools is expected to decline significantly.

- High Operational Costs: The labor-intensive nature of manual processing leads to higher operational expenses.

Direct Competition in Pure Consumer Cloud Storage

Box's strategic focus is firmly on enterprise solutions, not direct competition in the consumer cloud storage market. Competing head-to-head with giants like Google Drive or Dropbox for individual users, without leveraging its core strengths in enterprise security and compliance, would likely result in low market share and limited growth for Box.

This segment of the market, while large, doesn't align with Box's established value proposition. For instance, in 2024, the global cloud storage market was valued at approximately $100 billion, but the consumer segment is highly saturated with established players offering freemium models.

Box's competitive advantage lies in its advanced security, granular access controls, and regulatory compliance features tailored for businesses. Attempting to replicate the consumer-focused offerings of companies that have already captured significant individual user bases would be a diversion of resources.

- Box's Enterprise Focus: Box is designed for business collaboration and content management, not individual consumer use.

- Market Saturation: The pure consumer cloud storage market is dominated by established players like Google Drive and Dropbox.

- Strategic Misalignment: Competing in the consumer space without enterprise differentiators would be a low-growth, low-market-share endeavor for Box.

- Resource Allocation: Box's resources are better utilized in strengthening its enterprise offerings where it holds a competitive edge.

If Box were to focus solely on basic file sync and share for individual consumers, it would likely be categorized as a Dog in the BCG Matrix. This segment is characterized by low growth and low market share due to intense competition and commoditization.

The consumer cloud storage market, valued in the tens of billions globally, is dominated by established players offering robust free tiers and extensive ecosystems. For Box to compete here without leveraging its enterprise-grade security and workflow automation would result in minimal market penetration and profitability.

Box's strategic pivot towards its Intelligent Content Cloud, emphasizing AI and workflow automation for enterprises, positions it away from this commoditized Dog quadrant. This strategic focus is crucial for Box to maintain a competitive edge and drive future growth.

Question Marks

Newly launched niche AI agents and APIs, while potentially innovative, often fall into the Question Mark category of the BCG Matrix. These specialized tools target emerging, high-growth markets, such as industry-specific predictive analytics or hyper-personalized content generation. However, their current market share is typically low as they are in the early stages of customer adoption and market validation.

For instance, a new AI API focused on optimizing supply chain logistics for the semiconductor industry in 2024 might have a vast potential market but only a handful of early adopters. The challenge lies in demonstrating tangible ROI and building widespread trust. Companies like OpenAI, while a Star overall with products like GPT-4, also launch specialized APIs that initially require significant marketing and development to gain traction.

Expanding into untapped vertical markets is akin to placing a company's resources into the question mark category of the BCG Matrix. This strategy involves venturing into new, high-growth sectors where the company's existing brand recognition and specific product offerings are not yet prominent. For instance, a software company known for its accounting solutions might explore the burgeoning market for specialized AI-driven diagnostic tools in healthcare, a sector with projected growth rates exceeding 20% annually in the coming years.

These aggressive expansion efforts are inherently high-risk, high-reward propositions. They demand significant capital investment to establish market presence and compete effectively against established players. Consider the substantial R&D and marketing budgets required for a consumer electronics firm to enter the competitive electric vehicle market, where initial investments can easily run into billions of dollars, as seen with many new automotive startups in 2024.

Geographic expansion into nascent markets, where cloud content management adoption is still developing and Box's current market share is minimal, would indeed place such initiatives in the Question Marks quadrant of the BCG Matrix. These regions represent opportunities for substantial growth, but they also come with inherent risks and demand considerable upfront investment.

Early-Stage Beta Offerings within New Suites

Early-stage beta offerings within new suites, such as certain Box Apps or Forms, are prime examples of Question Marks in the BCG Matrix. These components are part of a high-growth strategy but are in the nascent stages of market acceptance. Their future trajectory hinges on successful market validation and significant investment for scaling.

- Early Market Traction: These new offerings are still building their user base and proving their value proposition in the market.

- High Growth Potential: They are aligned with strategic initiatives aimed at capturing emerging market opportunities and expanding the product ecosystem.

- Investment Needs: Significant capital is required for further development, marketing, and sales efforts to drive adoption and achieve market leadership.

- Uncertain Future Success: The ultimate success of these beta offerings is contingent on their ability to gain widespread market acceptance and generate substantial revenue in the future.

Partnerships Targeting Emerging Technologies

Box's strategic alliances in emerging technologies, such as advanced blockchain for ensuring content provenance, position it in high-growth sectors. These partnerships, while promising for future market penetration, currently represent areas where Box's immediate market share and revenue generation may be modest. Significant investment and development are still needed to fully capitalize on these ventures.

These collaborations are crucial for Box to stay ahead in rapidly evolving tech landscapes. For instance, in 2024, the global blockchain market was projected to reach over $15 billion, indicating substantial growth potential for applications beyond cryptocurrencies. Box's involvement in such areas, even with initial lower revenue streams, is a strategic play for long-term competitive advantage.

- Advanced Blockchain for Content Provenance: Enhancing trust and traceability of digital assets.

- Quantum Computing Collaborations: Exploring potential for enhanced data security and processing.

- Edge Computing Integrations: Optimizing data handling for distributed systems.

Question Marks represent new ventures with low market share in high-growth industries, demanding significant investment to capture potential. Their success hinges on converting them into Stars through strategic resource allocation and market development.

These initiatives are characterized by their nascent market position and the substantial capital required to foster growth and achieve competitive standing.

Failure to effectively manage and invest in Question Marks can lead to them becoming Dogs, draining resources without generating returns.

The primary objective is to analyze their potential and strategically decide whether to invest for growth or divest if prospects dim.

| Initiative | Market Growth Rate | Current Market Share | Investment Required (Estimated) | Strategic Outlook |

|---|---|---|---|---|

| Niche AI Agents/APIs | High (e.g., 25-40% CAGR for specialized AI) | Low (<5%) | Significant (R&D, Marketing) | Potential Star if successful |

| Expansion into Untapped Verticals | High (e.g., Healthcare AI: 20%+ CAGR) | Low (<10%) | Very High (Billions for new markets) | High Risk, High Reward |

| Geographic Expansion (Nascent Markets) | High (Emerging market growth varies) | Minimal | Substantial (Infrastructure, Sales) | Long-term growth play |

| Early-Stage Beta Offerings | High (Depends on suite's market) | Low (Pre-commercialization) | Moderate to High (Scaling) | Dependent on market validation |

| Strategic Alliances (Emerging Tech) | High (e.g., Blockchain: $15B+ market in 2024) | Low (Early stage of integration) | Moderate (Partnership costs, R&D) | Future competitive advantage |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.