Robert Bosch GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robert Bosch GmbH Bundle

Robert Bosch GmbH, a global powerhouse in technology and services, boasts robust strengths in its diversified portfolio and commitment to innovation, but faces significant opportunities in emerging markets and sustainability trends.

Want the full story behind Bosch's market position, including its key weaknesses and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Robert Bosch GmbH's strength lies in its highly diversified business portfolio, spanning Mobility Solutions, Industrial Technology, Consumer Goods, and Energy and Building Technology. This broad operational spread significantly enhances its resilience against sector-specific downturns, ensuring more stable and predictable revenue streams. For instance, in 2023, despite challenges in some areas, the company reported a robust total sales of €91.6 billion, demonstrating the stabilizing effect of its varied business segments.

Bosch's strong innovation and R&D capabilities are a significant competitive advantage. In 2024, the company invested a substantial €7.8 billion in research and development, which equated to 8.6% of its sales. This commitment fuels its ability to stay at the forefront of technological advancements.

The company's dedication to innovation is further demonstrated by its consistent filing of patents, exceeding 6,700 in 2024. These patents are concentrated in high-growth areas such as artificial intelligence, the Internet of Things (IoT), semiconductors, electromobility, and hydrogen technology, ensuring Bosch remains a leader in emerging markets.

This continuous investment in a robust R&D pipeline is fundamental to Bosch's future growth strategy. It not only allows the company to develop new products and solutions but also solidifies its technological leadership across its diverse business sectors.

Robert Bosch GmbH demonstrates a significant commitment to sustainability, actively championing the electrification of its diverse product lines, from mobility solutions to home appliances. This strategic focus positions the company to capitalize on the growing global demand for environmentally conscious technologies.

The company views hydrogen as a pivotal element in achieving climate-neutral energy systems, indicating a forward-thinking approach to the energy transition. Bosch has established ambitious environmental targets, including a 30% reduction in Scope 3 carbon emissions by 2030, underscoring its dedication to tangible climate action.

Global Market Presence and Strategic Acquisitions

Robert Bosch GmbH maintains a robust global market presence, continually fortifying its position through strategic investments and key acquisitions. This expansion is crucial for leveraging growth opportunities across diverse economies. The company's strategy involves targeting high-growth sectors and geographical areas to broaden its market penetration and competitive advantage.

Bosch's proactive approach to market expansion is evident in recent strategic moves. For instance, the planned acquisition of Johnson Controls' HVAC business and the completed acquisition of TSI Semiconductors are designed to significantly bolster its market share, particularly in rapidly expanding regions like North America and Asia. These acquisitions are expected to enhance its portfolio and operational capabilities.

- Global Reach: Bosch operates in over 60 countries, demonstrating a vast international footprint.

- Strategic Acquisitions: Recent acquisitions, like TSI Semiconductors, aim to bolster technological capabilities and market access.

- Market Share Growth: The planned acquisition of Johnson Controls' HVAC business is poised to increase Bosch's presence in key North American and Asian markets.

- Diversified Operations: This global presence and strategic expansion contribute to a diversified revenue stream and reduced reliance on single markets.

Unique Ownership Structure for Long-Term Vision

Robert Bosch GmbH's unique ownership structure, with 94% of its share capital held by the charitable Robert Bosch Stiftung GmbH, provides a significant advantage. This foundation ownership, coupled with voting rights managed by Robert Bosch Industrietreuhand KG, shields the company from the short-term pressures often faced by publicly traded firms. This allows for a consistent, long-term strategic vision and the capacity to make substantial upfront investments in research and development, ensuring sustained innovation and future growth.

Bosch's extensive global presence is a core strength, allowing it to tap into diverse markets and customer bases. This international reach is supported by a strategic approach to expansion, including key acquisitions aimed at strengthening its position in high-growth regions.

| Metric | 2023 Value (€ billion) | 2024 Projection/Target |

| Total Sales | 91.6 | Expected growth |

| R&D Investment | 7.8 | 8.6% of sales |

| Patents Filed | 6,700+ | Continued focus on AI, IoT, semiconductors |

What is included in the product

Delivers a strategic overview of Robert Bosch GmbH’s internal and external business factors, highlighting its strong market position and technological innovation while also acknowledging potential challenges in emerging markets and evolving industry trends.

Identifies critical market vulnerabilities and competitive threats for proactive risk mitigation.

Highlights internal strengths and opportunities to leverage for competitive advantage and growth.

Weaknesses

Bosch's financial results for 2024 reflected the impact of a global economic slowdown, with sales revenue experiencing a nominal decrease. The company's earnings before interest and taxes (EBIT) margin also saw a reduction, underscoring the pressure from this challenging economic climate.

Demand in key European markets and within the industrial technology sector was particularly subdued. This sluggishness indicates Bosch's sensitivity to broader macroeconomic trends and their direct effect on its core business areas.

Robert Bosch GmbH faces a significant challenge with the slower-than-expected adoption of electromobility. Despite substantial investments in this sector, the market's growth hasn't met Bosch's initial projections, leading to underutilized production capacity.

This slower pace means that the significant upfront investments made in electromobility are taking longer to generate the anticipated returns, directly impacting the profitability of Bosch's crucial Mobility Solutions segment. For instance, while the global EV market is projected for strong growth, the pace of consumer and infrastructure development has been uneven, creating a mismatch with Bosch's production ramp-up plans.

Bosch's commitment to pioneering future technologies like AI, IoT, and hydrogen necessitates substantial upfront capital and research expenditures. For instance, in 2023, Bosch invested €7.3 billion in R&D, a significant portion allocated to these forward-looking areas. This heavy investment, while crucial for long-term market leadership, can temporarily depress short-term profitability and strain current financial margins.

Job Reductions and Structural Adjustments

Bosch is undertaking significant structural adjustments, including job reductions, particularly in its European and German operations, to boost competitiveness and agility. This strategy, while aimed at improving efficiency, carries the risk of negatively impacting employee morale and creating workforce instability. For example, in late 2023 and early 2024, reports indicated thousands of planned job cuts across various divisions, including IT and administration, as the company streamlines operations.

These workforce adjustments can strain industrial relations and potentially lead to a loss of institutional knowledge. The company's commitment to efficiency through these measures might also face scrutiny regarding its social responsibility. The ongoing transformation within Bosch highlights the delicate balance between operational necessity and the human element of business strategy.

The impact of these job reductions is a key consideration for stakeholders, as it directly affects the company's internal culture and external reputation. Bosch's approach to managing these changes will be crucial in navigating the current economic climate and maintaining its long-term workforce stability.

Intense Competition, Particularly from Asia

Bosch is navigating an intensely competitive global market, with a significant challenge stemming from agile and cost-effective competitors, particularly those based in Asia. This dynamic puts considerable pressure on Bosch's pricing strategies and market share across its diverse product lines, from automotive components to smart home devices.

The pressure from Asian manufacturers is not just about price; many have demonstrated rapid innovation and adaptability. For instance, in the automotive sector, Chinese battery manufacturers are rapidly gaining ground, impacting Bosch's traditional dominance in powertrain technology. This competition directly challenges Bosch's ability to maintain its target profit margins in a market where cost efficiency is paramount.

- Intensified Rivalry: Bosch faces growing competition from Asian manufacturers known for their speed and cost-effectiveness in sectors like automotive parts and electronics.

- Pricing Pressure: The influx of lower-cost alternatives from Asia directly impacts Bosch's ability to command premium pricing and maintain its profitability targets.

- Market Share Erosion: Agile competitors are increasingly capturing market share, forcing Bosch to constantly innovate and optimize its operations to stay ahead.

- Margin Squeeze: Achieving ambitious margin targets becomes more difficult in a crowded market where competitors can often offer similar products at a lower cost.

Bosch's significant investments in future technologies like AI, IoT, and hydrogen, while strategically vital, place a considerable strain on its short-term profitability. For example, the company allocated €7.3 billion to research and development in 2023, a substantial portion dedicated to these forward-looking areas, which can impact current financial margins.

The slower-than-anticipated market adoption of electromobility presents a challenge, leading to underutilized production capacity despite substantial investment. This mismatch between investment and market growth directly affects the profitability of its crucial Mobility Solutions segment.

Intense competition, particularly from agile and cost-effective Asian manufacturers in sectors like automotive components, exerts significant pricing pressure on Bosch. This rivalry challenges the company's ability to maintain market share and achieve its target profit margins.

Structural adjustments, including job reductions in Europe, while aimed at boosting competitiveness, carry the risk of negatively impacting employee morale and workforce stability. Reports in late 2023 and early 2024 indicated thousands of planned job cuts across various divisions.

Preview Before You Purchase

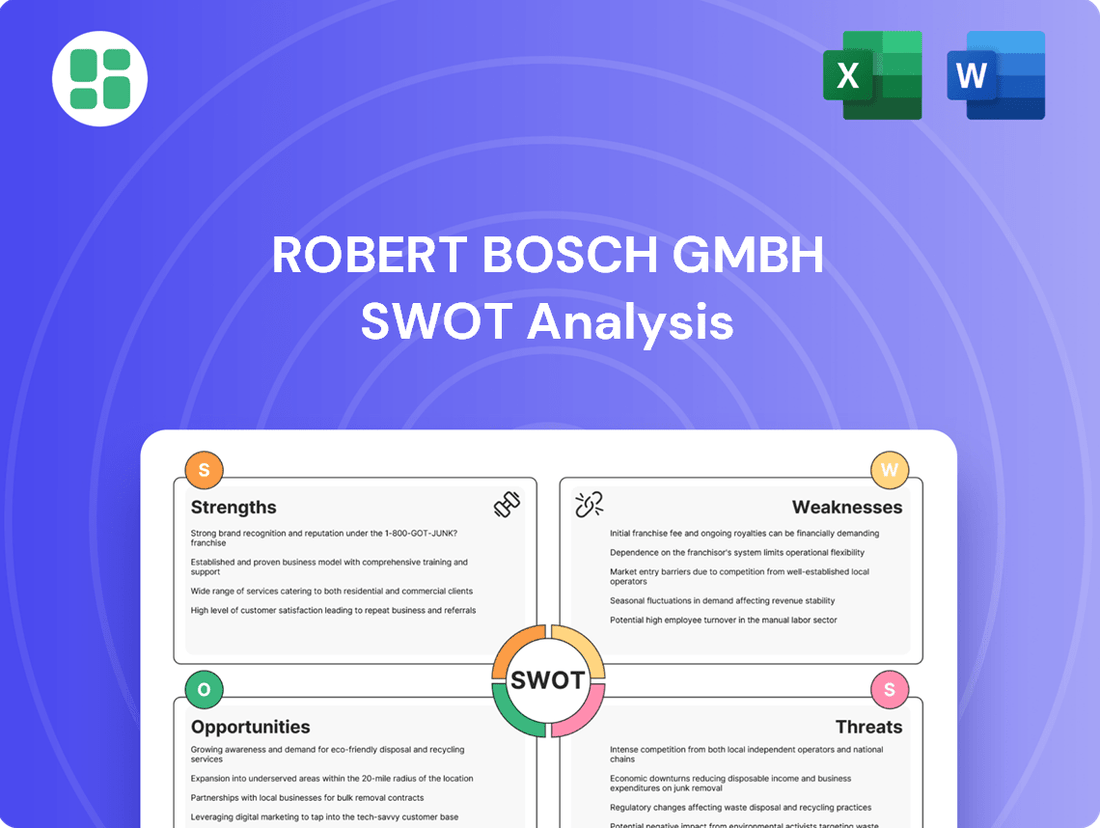

Robert Bosch GmbH SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Robert Bosch GmbH's Strengths, Weaknesses, Opportunities, and Threats comprehensively.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a strategic overview of Bosch's competitive landscape.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, enabling you to tailor the insights to your specific needs.

Opportunities

The global transition to electric vehicles and the growing interest in hydrogen technology represent significant growth avenues for Bosch. Despite some current market challenges, the long-term outlook for these clean energy solutions remains robust.

Bosch is actively investing in both electromobility and hydrogen solutions, including the development of fuel cell systems for vehicles and supporting EV production. These strategic investments are designed to position the company to benefit from the expanding decarbonization market.

For instance, Bosch's mobility solutions segment, which includes electrification, saw sales grow by over 10% in 2023, reaching approximately €22.7 billion. This demonstrates the company's strong performance in the burgeoning EV market.

Bosch is heavily investing in AI and IoT, with significant capital allocated to develop AI-powered solutions. These investments are strategically targeted towards high-growth areas like assisted driving, industrial automation, and smart home technology, creating substantial new revenue opportunities. For instance, Bosch's AI for assisted driving is a key driver in the automotive sector's digital transformation.

These advanced technologies are not just about new products; they are also designed to boost internal efficiencies and foster innovation across Bosch's diverse business units. By integrating AI and IoT, Bosch aims to create smarter products and optimize its manufacturing processes, leading to improved competitiveness in the market.

Bosch is strategically positioned to capitalize on the expanding HVAC and smart home markets. The planned acquisition of Johnson Controls' HVAC business, a significant move, is expected to bolster its presence in this sector. Furthermore, Bosch's commitment to smart home solutions, including integration with the Matter protocol, aligns perfectly with the growing consumer demand for energy-efficient and connected living spaces.

Strengthening Regional Presence, Especially North America and Asia

Bosch is strategically increasing its footprint in North America and Asia, particularly in China and India, to capture growth in these key markets. This expansion aims to create a more balanced regional sales distribution, reducing reliance on mature markets.

By investing in these high-growth areas, Bosch can tap into burgeoning demand for its diverse product portfolio, from mobility solutions to smart home technology. For instance, Bosch's investment in India's automotive sector is significant, with the company aiming to expand its local manufacturing capabilities.

- Regional Growth Focus: Bosch prioritizes North America, China, and India for market expansion and investment.

- Mitigating Market Risk: Balancing regional contributions helps offset slower growth in traditional markets.

- Tapping New Demand: High-growth regions offer substantial opportunities for Bosch's product lines.

- Investment in India: Bosch is actively increasing its presence and investments in the Indian market, particularly in the automotive sector.

Leveraging Semiconductor Manufacturing Capabilities

Bosch's strategic investments in semiconductor manufacturing, especially in silicon carbide (SiC) power semiconductors, are a significant opportunity. These investments are bolstered by government programs like the U.S. CHIPS Act, which aims to onshore semiconductor production. This positions Bosch as a vital supplier for the booming electric vehicle (EV) market.

By expanding its in-house SiC production, Bosch can reduce its dependence on external chip suppliers, mitigating supply chain risks. This move also enhances its technological autonomy, allowing for greater control over innovation and product development in a critical sector.

- Strategic Investment: Bosch is investing heavily in semiconductor manufacturing, with a particular focus on SiC technology, crucial for EV power electronics.

- Government Support: Initiatives like the U.S. CHIPS Act provide financial incentives and support for domestic semiconductor production, benefiting Bosch's expansion plans.

- Market Dominance: Strengthening its semiconductor capabilities allows Bosch to solidify its role as a key component supplier for the rapidly growing EV sector.

- Supply Chain Resilience: In-house manufacturing reduces reliance on external foundries, improving supply chain stability and control.

Bosch is well-positioned to capitalize on the global shift towards electrification and hydrogen technologies, with significant investments in electromobility and fuel cell systems. The company's mobility solutions segment, which includes electrification, demonstrated strong growth, with sales increasing by over 10% to approximately €22.7 billion in 2023.

The company's strategic focus on AI and IoT is creating substantial new revenue streams, particularly in areas like assisted driving, industrial automation, and smart home technology, where AI integration is a key driver of digital transformation.

Bosch's expansion into HVAC and smart home markets, bolstered by strategic acquisitions and adherence to protocols like Matter, aligns with increasing consumer demand for energy-efficient connected living spaces.

Furthermore, Bosch's targeted investments in key growth regions like North America, China, and India, alongside its expansion in the Indian automotive sector, aim to balance regional sales and tap into burgeoning market demand.

| Opportunity Area | Key Developments | 2023 Impact (Approx.) |

|---|---|---|

| Electromobility & Hydrogen | Investment in fuel cell systems, EV production support | Mobility Solutions Sales: >10% growth (€22.7 billion) |

| AI & IoT Integration | Development of AI-powered solutions for assisted driving, automation, smart home | Driving digital transformation in automotive and other sectors |

| HVAC & Smart Home | Acquisition of Johnson Controls' HVAC business, Matter protocol integration | Meeting growing demand for energy-efficient connected homes |

| Regional Expansion | Increased footprint in North America, China, India; expanded Indian automotive presence | Balancing regional sales, capturing growth in key markets |

Threats

The ongoing global economic uncertainty, with moderate growth forecasts for 2024 and 2025, coupled with persistent geopolitical tensions, presents a significant threat to Bosch's business stability. These factors can lead to fluctuating demand for its diverse product portfolio, from automotive components to consumer goods.

Trade policies and the potential for new tariffs, particularly between major economic blocs, can disrupt Bosch's intricate global supply chains and negatively impact its international sales performance. For instance, increased protectionism could raise the cost of raw materials and components, squeezing profit margins.

A slower-than-anticipated uptake of electric vehicles (EVs) presents a significant threat to Robert Bosch GmbH. This directly impacts the profitability and return on investment for their considerable investments in electromobility technology. For instance, in 2024, some European markets experienced a slowdown in EV sales growth compared to initial projections, which could lead to underutilized production capacity for Bosch's EV components.

Abrupt shifts in government incentives and regulations, such as those observed in Germany's revised EV subsidy programs, create market volatility. These policy changes can drastically alter consumer demand for EVs, forcing Bosch to constantly adapt its production and R&D strategies. This unpredictability makes long-term financial planning for the electromobility sector more challenging.

Robert Bosch GmbH faces significant threats from escalating competition, particularly from nimble new players emerging from Asia within the automotive and technology industries. This influx of competitors challenges Bosch's established market positions and necessitates continuous innovation to maintain its edge.

The intense rivalry can lead to market share erosion and pressure on pricing, directly impacting Bosch's profitability across its wide array of products and services. For instance, in the electric vehicle component market, Chinese suppliers have rapidly gained ground, often offering competitive pricing that forces established players like Bosch to re-evaluate their cost structures.

This competitive landscape demands strategic agility and a keen focus on cost efficiency. Bosch's ability to adapt to evolving market dynamics, embrace new technologies, and potentially leverage strategic partnerships will be crucial in navigating these intensifying competitive pressures and safeguarding its long-term growth prospects.

High Energy Costs and Regulatory Hurdles

High energy costs, especially in Europe where Bosch has a significant manufacturing presence, present a considerable challenge. For instance, in 2023, industrial electricity prices in Germany, a key market for Bosch, remained among the highest in the EU, impacting production expenses. This directly affects Bosch's cost of goods sold and can squeeze profit margins, particularly for energy-intensive manufacturing processes.

Navigating a complex web of evolving regulations, such as stringent emissions standards for automotive components and stricter environmental rules for industrial operations, adds another layer of difficulty. Compliance with these regulations often necessitates significant investment in new technologies and process adjustments. For example, the automotive sector's push towards Euro 7 emissions standards in Europe, while driving innovation, also requires substantial R&D and manufacturing retooling, increasing operational costs for suppliers like Bosch.

- Increased Production Expenses: Elevated energy prices directly inflate manufacturing costs, potentially reducing profitability.

- Regulatory Compliance Costs: Adhering to new environmental and emissions standards requires substantial investment in technology and process adaptation.

- Operational Constraints: Evolving regulations can limit manufacturing flexibility and necessitate costly operational changes.

Workforce Reductions and Employee Morale

Bosch’s ongoing structural adjustments and workforce reductions, especially within its European operations, present a significant threat to employee morale. These measures, while intended to boost competitiveness, could lead to decreased job security and a less engaged workforce. For instance, reports from late 2023 indicated plans for thousands of job cuts across various divisions, impacting core areas.

A decline in employee morale can directly hinder innovation and operational efficiency, which are vital for Bosch's long-term success. The company's ability to retain its top talent is at risk if employees feel undervalued or uncertain about their future. This situation could slow down the development of new technologies and impact the quality of existing products and services.

- Impact on Innovation: Reduced morale can stifle creativity and the willingness of employees to go the extra mile, potentially slowing down new product development.

- Talent Retention Challenges: A demotivated workforce is more likely to seek opportunities elsewhere, leading to a loss of valuable skills and institutional knowledge.

- Operational Disruptions: Uncertainty and low morale can result in decreased productivity and increased errors, affecting overall business performance.

Intensifying competition, particularly from agile Asian players in automotive and technology sectors, poses a significant threat to Bosch's market share and pricing power. This necessitates continuous innovation and cost-efficiency measures to maintain its competitive edge, especially in the rapidly evolving EV component market where Chinese suppliers are gaining traction.

The global economic slowdown and geopolitical instability create market volatility, impacting demand for Bosch's diverse product range and potentially disrupting its intricate supply chains. For instance, moderate global growth forecasts for 2024-2025, coupled with trade policy uncertainties, could lead to fluctuating sales and increased costs for raw materials.

| Threat Category | Specific Threat | Impact |

| Competition | Rise of Asian competitors in EV and tech sectors | Market share erosion, pricing pressure |

| Economic/Geopolitical | Global economic uncertainty, trade policy changes | Fluctuating demand, supply chain disruption |

| Regulatory | Stringent environmental and emissions standards | Increased R&D and compliance costs |

| Operational | High energy costs in Europe | Increased production expenses, reduced profitability |

SWOT Analysis Data Sources

This Robert Bosch GmbH SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial reports, comprehensive market research, and insights from industry experts and reputable news outlets.