Robert Bosch GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robert Bosch GmbH Bundle

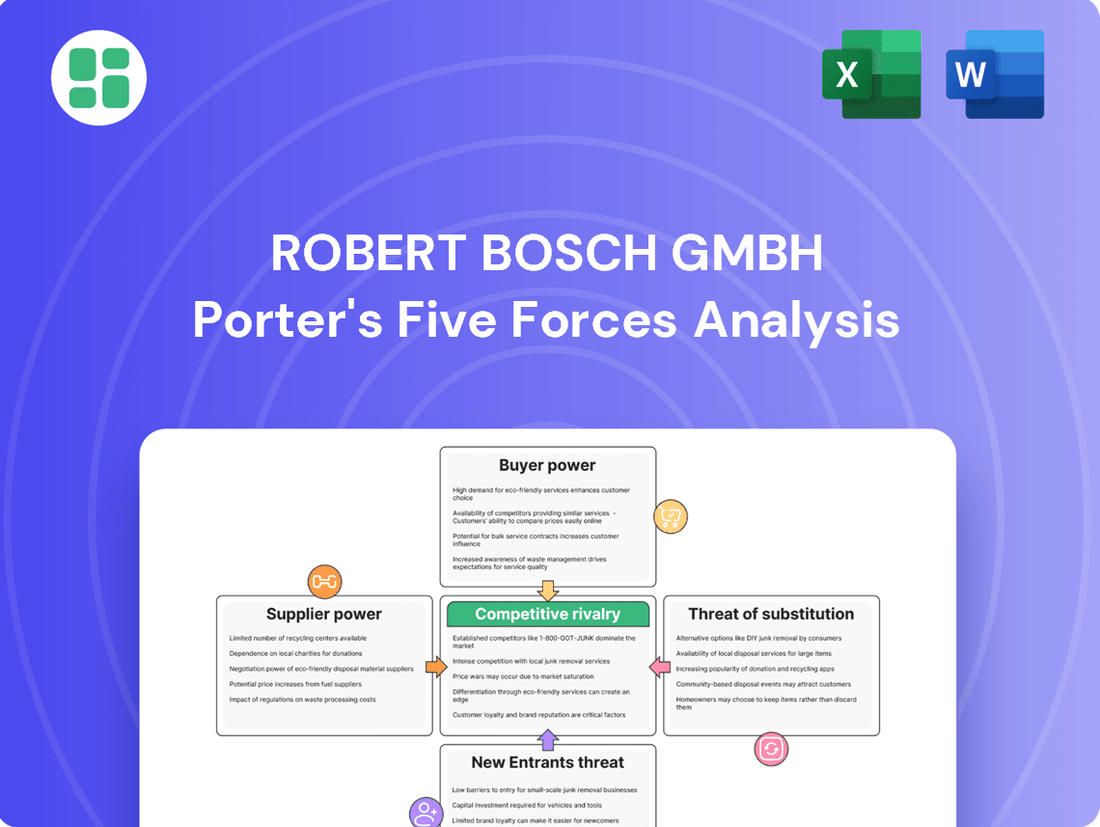

Robert Bosch GmbH operates in a complex landscape where intense rivalry and the threat of substitutes significantly shape its market position. Understanding the nuances of buyer power and supplier leverage is crucial for navigating this environment.

The complete report reveals the real forces shaping Robert Bosch GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Robert Bosch GmbH depends on a vast global supplier base for everything from raw materials to highly specialized technological components. When suppliers offer unique, patented parts with limited substitutes, their bargaining power increases significantly. This is especially true in areas like advanced automotive electronics or specialized industrial machinery, where only a handful of suppliers can meet Bosch's stringent quality and volume demands.

Switching costs for Robert Bosch GmbH can be substantial, especially within its core Mobility Solutions and Industrial Technology segments. For instance, integrating a new supplier for critical automotive components might necessitate significant investments in re-tooling manufacturing lines and conducting rigorous, time-consuming testing to meet stringent quality and safety standards.

These extensive re-design and re-certification processes directly translate into higher costs and potential disruptions to Bosch's production schedules. Consequently, suppliers who have already established deep integration within Bosch's existing supply chain and manufacturing processes hold considerable bargaining power due to the friction and expense involved in replacing them.

Bosch's supplier bargaining power is nuanced; while a significant global entity, its leverage depends on the supplier's size and specialization. For instance, a massive, diversified supplier might see Bosch as just one of many customers, diminishing Bosch's sway.

However, for smaller, niche suppliers, Bosch can represent a substantial portion of their business, granting Bosch considerable bargaining power. This dynamic is further shaped by Bosch's initiative to engage suppliers in decarbonization efforts, fostering a relationship that is both collaborative and strategically influential.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Robert Bosch GmbH's markets is typically low. Bosch's immense scale, established brand, and sophisticated capabilities in integrating complex products across various sectors create significant barriers for suppliers. While a large supplier might theoretically consider direct sales to Bosch's customers in highly commoditized component segments, this is rare for Bosch's core, integrated systems.

Bosch actively works to counter such threats and manage supply chain risks. A key strategy involves strengthening its supply chains through regionalization. This approach aims to reduce dependency on single suppliers or regions and enhance resilience. For instance, in 2024, Bosch continued its efforts to diversify its supplier base, particularly in critical areas like semiconductors, aiming for greater supply chain security.

- Low Forward Integration Threat: Bosch's scale and complexity deter most suppliers from entering its core markets directly.

- Focus on Regionalization: Bosch prioritizes regional supply chains to mitigate risks and enhance resilience.

- Supplier Diversification: Efforts in 2024, particularly in semiconductors, aimed to broaden the supplier base and secure critical components.

Availability of Substitute Inputs

The availability of substitute inputs for Robert Bosch GmbH shows considerable variation across its diverse product lines. For many basic raw materials used in manufacturing, substitute options are generally plentiful, which tends to reduce the bargaining power of those specific suppliers. This means Bosch can often switch between suppliers for common materials without significant disruption or cost increases.

However, the situation changes dramatically when it comes to highly specialized and technically advanced components. For items like cutting-edge semiconductors or intricate, custom-designed sensors, the pool of suppliers offering direct substitutes is much smaller. This scarcity grants these specialized suppliers significant leverage, allowing them to command higher prices and dictate terms more effectively.

In response to this dynamic, particularly within the burgeoning electric vehicle (EV) sector, Bosch is strategically investing in its own production capabilities for critical components. A prime example is their initiative in silicon carbide (SiC) chip manufacturing. By developing in-house SiC production, Bosch aims to decrease its dependence on external suppliers for these vital elements, thereby mitigating supplier power and securing a more stable supply chain for future EV technologies.

Bosch's 2024 financial reports highlight ongoing R&D expenditures, with a significant portion allocated to advanced materials and semiconductor technologies, reflecting this strategic shift to build internal capabilities and reduce reliance on external sources for key innovations.

Robert Bosch GmbH faces varying degrees of supplier bargaining power, largely dependent on the uniqueness and availability of substitute inputs. For standardized materials, Bosch can leverage its scale to negotiate favorable terms. However, for highly specialized components, particularly in areas like advanced automotive electronics and semiconductors, suppliers with proprietary technology and limited competition hold significant sway.

Bosch's strategic response includes investing in its own production capabilities for critical components, such as silicon carbide chips, to reduce reliance on external suppliers. This move aims to bolster supply chain resilience and mitigate the impact of powerful suppliers. The company's 2024 financial reports indicate continued investment in R&D for advanced materials and semiconductor technologies, underscoring this strategy to build internal strengths and secure critical innovations.

| Component Type | Supplier Bargaining Power | Bosch's Mitigation Strategy |

|---|---|---|

| Standard Raw Materials | Low | Leverage scale for negotiation |

| Specialized Automotive Electronics | High | In-house production (e.g., SiC chips), supplier diversification |

| Advanced Sensors | High | Long-term partnerships, R&D investment |

What is included in the product

This analysis delves into the competitive forces shaping Robert Bosch GmbH's operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse markets.

Quickly assess Bosch's competitive landscape and identify strategic vulnerabilities with a clear, actionable breakdown of Porter's Five Forces.

Customers Bargaining Power

Robert Bosch GmbH navigates a complex customer landscape. While serving millions of individual consumers in its home appliance and power tool segments, where individual bargaining power is minimal, the automotive sector presents a different dynamic. Major Original Equipment Manufacturers (OEMs) in the automotive industry, due to their substantial purchase volumes and significant market influence, can exert considerable pressure on Bosch for pricing and terms.

Bosch's automotive division, a significant contributor to its revenue, faces powerful buyers. In 2023, the automotive segment accounted for approximately 60% of Bosch's total sales, reaching €50.4 billion. This concentration of sales within a few large automotive clients means that these customers hold considerable sway in negotiations, potentially impacting Bosch's profit margins.

Customer switching costs significantly impact Robert Bosch GmbH's bargaining power with its clients, varying considerably across its diverse business segments. In the automotive sector, Original Equipment Manufacturers (OEMs) face substantial hurdles when considering a change from Bosch components. These high switching costs stem from the deep integration of Bosch's technology into vehicle platforms, requiring extensive re-engineering, validation, and the fulfillment of stringent safety and regulatory certifications. This integration often represents years of collaborative R&D investment, making a switch a costly and time-consuming endeavor.

Conversely, for Bosch's consumer goods divisions, such as home appliances and power tools, customer switching costs are generally much lower. Consumers can readily opt for competing brands based on price, features, or marketing. While brand loyalty and the perception of quality and reliability do influence purchasing decisions, the ease of access to alternative products means consumers have considerable power to switch if dissatisfied or if better alternatives emerge in the market.

Bosch's robust brand reputation, built on decades of quality, innovation, and reliability, particularly in the automotive sector, significantly reduces its susceptibility to customer price demands. For example, in 2023, Bosch's automotive division, a key revenue driver, continued to see strong demand for its advanced systems, reflecting this brand loyalty.

The company's commitment to developing differentiated products, such as cutting-edge driver-assistance systems (ADAS) and intelligent smart home solutions, creates unique value propositions that customers are often willing to pay a premium for. This focus on innovation, including significant R&D investments, allows Bosch to maintain a competitive edge and mitigate direct price comparisons.

Customer Price Sensitivity

Customer price sensitivity is a key factor influencing Robert Bosch GmbH's bargaining power of customers. This sensitivity varies considerably across Bosch's diverse business segments. For instance, automotive original equipment manufacturers (OEMs) are particularly price-conscious, driven by intense competition within their own industry.

In the consumer goods sector, while a premium segment exists where customers prioritize quality and advanced features, the mass market faces considerable price pressure. This dynamic is further amplified by economic conditions; the headwinds experienced in 2024 and the projected subdued growth for 2025 suggest that price sensitivity will likely remain a significant concern across many of Bosch's operational areas.

- Automotive OEMs: Highly sensitive to price due to intense market competition.

- Consumer Goods: Price sensitivity is high in mass-market segments, though premium segments show less sensitivity.

- Economic Impact (2024-2025): Economic headwinds and slower growth are expected to heighten price sensitivity across industries.

- Bosch's Response: Bosch must balance innovation and cost-efficiency to remain competitive in price-sensitive markets.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Robert Bosch GmbH is generally low, particularly in its core, highly technical segments such as automotive components and industrial automation systems. This is because customers would need to invest heavily in research and development, acquire specialized expertise, and build significant manufacturing capacity to replicate Bosch's sophisticated offerings. For instance, developing the intricate electronics and software for advanced driver-assistance systems (ADAS) requires years of specialized engineering and substantial capital outlay, making it prohibitive for most automotive manufacturers to undertake in-house.

While large automotive original equipment manufacturers (OEMs) might consider producing simpler, less technologically demanding parts internally to gain cost efficiencies or secure supply chains, this is not a widespread trend for the complex systems Bosch provides. The sheer scale and proprietary nature of Bosch's technology, often protected by patents and deep know-how, create a significant barrier to entry for its customers. In 2023, Bosch's sales in the automotive sector reached approximately €50.7 billion, underscoring the breadth and depth of its product portfolio, much of which relies on specialized manufacturing processes and continuous innovation that are difficult for customers to replicate.

- Low Threat in Complex Segments: Customers face high barriers to entry in replicating Bosch's advanced automotive and industrial automation technologies.

- High Investment Required: Replicating Bosch's expertise necessitates substantial investment in R&D, specialized talent, and manufacturing infrastructure.

- Limited In-house Production by OEMs: While some OEMs may produce simpler components, this is not a significant threat for Bosch's core, complex product lines.

- Bosch's Market Dominance: Bosch's €50.7 billion automotive sales in 2023 highlight its scale and technological leadership, making backward integration by customers challenging.

The bargaining power of customers for Robert Bosch GmbH is significant, particularly from large automotive OEMs who represent a substantial portion of its business. These major clients, such as Volkswagen and Stellantis, have considerable leverage due to their purchasing volume and the critical nature of Bosch's components in their vehicle production. In 2023, Bosch's automotive division generated approximately €50.7 billion in revenue, highlighting the concentration of its customer base.

Customer switching costs are high in the automotive sector, as Bosch's technology is deeply integrated into vehicle platforms, requiring extensive re-engineering and validation for any change. However, in consumer segments like home appliances and power tools, switching costs are much lower, giving individual consumers more power. Economic conditions in 2024 and projected for 2025 are increasing price sensitivity across many of Bosch's markets.

| Customer Segment | Bargaining Power Factors | Bosch's Revenue Contribution (2023) |

|---|---|---|

| Automotive OEMs | High volume, critical components, integration costs, price sensitivity | Approx. €50.7 billion |

| Consumer Goods (Home Appliances, Power Tools) | Lower switching costs, brand loyalty, price sensitivity (mass market) | Significant portion of remaining revenue |

What You See Is What You Get

Robert Bosch GmbH Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Robert Bosch GmbH details the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This ready-to-use document provides actionable insights into the strategic landscape of the automotive and technology sectors.

Rivalry Among Competitors

Robert Bosch GmbH operates in markets characterized by a significant number and variety of competitors. This diversity spans across its four main business sectors, creating a complex competitive environment. For instance, in the Mobility Solutions segment, Bosch contends with major global automotive suppliers such as Continental, ZF Friedrichshafen, and Denso. The sheer scale and reach of these players highlight the intensity of competition in this area.

The rivalry extends to other sectors as well. In Consumer Goods, Bosch faces established brands like Siemens, Electrolux, and Dyson, each with their own strengths and market share. This broad spectrum of competitors, ranging from global giants to specialized regional players, naturally fuels a high degree of competitive rivalry, pushing companies to innovate and optimize constantly.

Robert Bosch GmbH operates in a landscape where industry growth rates are quite varied. Sectors like smart home technology and advanced industrial solutions are experiencing significant expansion, reflecting strong demand for innovation. For instance, the global smart home market was projected to grow at a compound annual growth rate (CAGR) of over 10% leading into 2024.

Conversely, some of Bosch's more traditional segments, such as automotive components and certain building technology areas, have seen more modest growth or even contractions in 2024. This divergence in growth creates a dynamic competitive environment where companies must strategically allocate resources to capitalize on burgeoning markets while navigating mature or declining ones.

The overall economic climate in 2024 and continuing into 2025 is characterized by subdued global growth. This economic backdrop naturally intensifies the competition for market share across all of Bosch's operating sectors, as companies fight for a larger piece of a slower-expanding economic pie.

Robert Bosch GmbH actively combats competitive rivalry by prioritizing product differentiation through a relentless focus on innovation, robust research and development (R&D), and unwavering quality standards. This strategy effectively sidesteps direct price wars.

Bosch's commitment to the future is evident in its substantial R&D investments, particularly in cutting-edge areas such as artificial intelligence (AI), the Internet of Things (IoT), hydrogen technology, and software-defined mobility solutions. In 2023, Bosch allocated approximately €7.3 billion to R&D, underscoring its dedication to technological leadership.

This continuous stream of innovation is not merely a competitive tactic; it's fundamental to sustaining Bosch's market advantage and achieving its long-term strategic objectives in a rapidly evolving global landscape.

Exit Barriers

Robert Bosch GmbH faces exceptionally high exit barriers. Its extensive asset base, including highly specialized manufacturing plants for automotive components and industrial technology, represents a massive sunk cost. For instance, Bosch's significant investments in electromobility infrastructure, a key growth area, are not easily transferable or sellable if the company were to consider exiting this segment.

The company’s deep commitment to research and development, with an annual R&D expenditure often exceeding €6 billion (as of 2023), further entrenches it within its various business lines. Divesting from a sector would mean abandoning these R&D efforts and potentially losing valuable intellectual property.

Bosch's diversified structure across mobility solutions, industrial technology, consumer goods, and energy and building technology means that exiting any single sector would necessitate complex strategic realignments. The financial and reputational repercussions of such a move, especially given Bosch's long-standing market presence and brand equity, make outright exits improbable. Instead, the company is more inclined towards internal restructuring or divestment of non-core assets rather than complete sector withdrawal.

- High Capital Intensity: Bosch's manufacturing facilities are designed for specific, often high-volume production, making them difficult and costly to repurpose or sell.

- R&D Investments: Billions invested annually in R&D create specialized knowledge and patents tied to specific product lines, increasing the cost of exit.

- Diversified Portfolio: Exiting one of Bosch's four major business sectors involves significant strategic and operational challenges, impacting the entire organization.

- Reputational Costs: A withdrawal from established markets could damage Bosch's global brand reputation and customer trust.

Strategic Commitments of Competitors

Bosch's competitors are doubling down on strategic commitments, especially in areas like electrification, digitalization, and sustainability. This means companies like Continental, ZF Friedrichshafen, and Denso are pouring significant resources into these future-focused technologies.

Major players are making substantial investments in new technologies and actively expanding their presence in burgeoning markets. For instance, China remains a critical innovation hub for many automotive suppliers, including Bosch, and its rivals are also prioritizing this region. In 2024, for example, many Tier 1 suppliers announced multi-billion dollar investments in EV component production facilities within China.

This intense focus on innovation and market expansion fuels a cycle of continuous competitive pressure. Rivals are constantly striving for leadership in rapidly evolving industries, particularly in the automotive sector where the shift to electric vehicles is accelerating. This dynamic means that staying ahead requires constant adaptation and significant capital deployment.

- Electrification Investments: Competitors are channeling billions into battery technology, electric powertrains, and charging infrastructure. For example, ZF Friedrichshafen announced a significant expansion of its electric drive system production in 2024.

- Digitalization Focus: Companies are investing heavily in software development for autonomous driving, connected car services, and advanced driver-assistance systems (ADAS). Continental, for instance, has been vocal about its software-defined vehicle strategy.

- Sustainability Initiatives: A growing emphasis on sustainable manufacturing processes, circular economy principles, and the use of recycled materials is evident across the industry.

- Emerging Market Expansion: Key competitors are increasing their footprint in growth markets, with China being a primary target for new production facilities and R&D centers.

Robert Bosch GmbH faces intense competitive rivalry due to its presence in diverse, often high-growth sectors populated by numerous global and specialized players. This pressure is amplified by varying industry growth rates, with booming areas like smart homes contrasting with more mature automotive segments, all within a subdued global economic climate in 2024. Bosch counters this by prioritizing product differentiation through significant R&D investments, such as its €7.3 billion allocation in 2023, focusing on innovation in AI, IoT, and sustainable mobility to maintain its market advantage rather than engaging in price wars.

| Competitor | Key Sectors | 2023/2024 Focus Areas |

|---|---|---|

| Continental AG | Mobility Solutions, Industrial Technology | Software-defined vehicles, autonomous driving, electrification |

| ZF Friedrichshafen AG | Mobility Solutions | Electric drives, ADAS, commercial vehicle technology |

| Denso Corporation | Mobility Solutions, Industrial Technology | Electrification, thermal systems, connectivity |

| Siemens AG | Industrial Technology, Consumer Goods, Energy | Digitalization, automation, smart building solutions |

| Electrolux Group | Consumer Goods | Sustainable appliances, smart home integration |

SSubstitutes Threaten

The threat of substitutes for Robert Bosch GmbH is multifaceted due to its broad product portfolio. In the mobility sector, while traditional vehicle components face potential substitution from increased public transportation usage or the rise of ride-sharing services, Bosch is also a key supplier for many of these emerging mobility solutions, including electric vehicle powertrains and connectivity systems.

For Bosch's consumer goods division, the threat comes from a wide array of competing brands and even do-it-yourself alternatives, particularly in areas like home appliances and power tools. For instance, the global home appliance market, where Bosch is a significant player, saw growth in 2024, but intense competition from both established and emerging brands means consumers have many substitute options.

However, in its industrial technology segments, such as automation and powertrain components for commercial vehicles, direct substitutes are considerably rarer. These specialized markets often require deep technological expertise and significant capital investment, creating higher barriers to entry for potential substitutes and thus lowering the threat level for Bosch in these areas.

Substitutes frequently present a distinct price-performance balance. For example, while less sophisticated power tools might be cheaper alternatives to Bosch's high-end products, they often fall short in terms of longevity, accuracy, or advanced capabilities. This means customers must weigh initial cost against expected performance and lifespan.

In the realm of heating and building technology, conventional heating installations can represent a lower initial investment compared to Bosch's energy-efficient or smart systems. However, these older technologies typically do not offer the same long-term operational cost reductions or the convenience and control provided by smart functionalities, impacting the overall value proposition.

Customer propensity to substitute for Robert Bosch GmbH's offerings is influenced by their awareness of alternatives, the perceived value of Bosch products, and how easily they can switch. In markets where Bosch's products are seen as commodities, price becomes a major driver for customers considering alternatives.

However, for critical applications like automotive safety systems, where Bosch holds a strong position, customers exhibit a much lower propensity to substitute. This is due to the high stakes involved; the potential risks associated with performance failures or reliability issues with unproven substitutes far outweigh any potential cost savings. For instance, in the advanced driver-assistance systems (ADAS) market, where Bosch is a key player, the rigorous testing and validation required mean that switching to a less established supplier carries significant reputational and safety liabilities for automakers.

Technological Advancements Creating New Substitutes

Rapid technological progress, especially in software-defined vehicles, renewable energy, and smart home tech, continuously introduces new substitutes. For instance, breakthroughs in battery technology could lessen the need for traditional engine parts. Bosch is investing heavily in areas like hydrogen technology, aiming to transform these potential threats into strategic advantages.

- Technological Disruption: The pace of innovation means new, potentially cheaper or more efficient alternatives can emerge rapidly, impacting Bosch's core product lines.

- Bosch's Response: The company's significant R&D spending, exemplified by its focus on hydrogen fuel cells, demonstrates a proactive approach to developing its own substitutes and staying ahead of market shifts.

- Market Impact: For example, the increasing efficiency and decreasing cost of electric vehicle batteries directly substitute for components historically central to internal combustion engines, a market Bosch has traditionally dominated.

Regulatory and Environmental Shifts Favoring Substitutes

Increasing regulatory pressure and a growing consumer demand for sustainability are significantly boosting the appeal of alternative, eco-friendly substitutes. For example, government policies actively promoting renewable energy sources or the widespread adoption of electric vehicles can accelerate the market penetration of new technologies that directly compete with, or substitute for, traditional fossil fuel-based systems. In 2024, the global electric vehicle market continued its robust growth, with sales projected to reach over 16 million units, a substantial increase from previous years, highlighting the impact of these shifts.

Robert Bosch GmbH is proactively aligning its business strategy with these prevailing sustainability trends. The company is making substantial investments in green technologies, including advancements in hydrogen fuel cell technology and the development of circular economy initiatives. These strategic moves are crucial for Bosch to maintain its competitive edge in markets where environmental consciousness is increasingly a deciding factor for consumers and businesses alike.

The impact of these shifts can be seen in specific sectors. For instance, in the automotive industry, the push towards electrification directly challenges traditional internal combustion engine components, a core area for Bosch historically. The company's commitment to hydrogen, a key component in many future mobility and energy solutions, demonstrates its forward-thinking approach to mitigating the threat of substitutes by becoming a provider of these emerging technologies.

- Regulatory Tailwinds: Policies favoring EVs and renewables create a more favorable environment for substitute technologies.

- Consumer Demand: Growing environmental awareness drives preference for sustainable alternatives.

- Bosch's Adaptation: Investments in hydrogen and circular economy initiatives position Bosch to benefit from these shifts.

- Market Dynamics: The automotive sector's electrification trend exemplifies the direct threat to traditional product lines.

The threat of substitutes for Robert Bosch GmbH is significant across its diverse product lines, particularly where technological shifts or changing consumer preferences enable alternative solutions. In the automotive sector, the accelerating adoption of electric vehicles directly substitutes for components related to internal combustion engines, a traditional strength for Bosch. Similarly, in consumer electronics and appliances, a vast array of brands and even DIY solutions offer alternatives, though often with trade-offs in quality or performance.

Bosch actively counters this threat by investing heavily in research and development, focusing on emerging technologies like hydrogen fuel cells and advanced connectivity solutions. This strategy aims to transform potential substitutes into new market opportunities. For instance, the global push for sustainability in 2024, evidenced by over 16 million electric vehicle sales, highlights the demand for greener alternatives that Bosch is positioning itself to meet.

The company's success hinges on its ability to innovate and offer superior value propositions, whether through enhanced performance, energy efficiency, or integrated smart functionalities, thereby mitigating the appeal of lower-cost or less advanced substitutes. For example, while a basic power tool might be cheaper, its limited lifespan and precision often make Bosch's offering a more economical choice over time.

The threat of substitutes is particularly pronounced in markets where Bosch's products are perceived as commodities, making price a primary consideration for customers. However, in high-stakes sectors like automotive safety systems, where reliability and rigorous testing are paramount, customers exhibit a much lower propensity to switch to unproven substitutes due to the significant safety and reputational risks involved.

Entrants Threaten

The capital requirements to enter Robert Bosch GmbH's core markets are exceptionally high. Establishing advanced R&D facilities, sophisticated manufacturing plants, and extensive global distribution networks demands substantial financial investment, often in the billions of dollars. For instance, building a new semiconductor fabrication plant can easily cost upwards of $10 billion, a figure that deters many potential new entrants.

Robert Bosch GmbH enjoys significant advantages from economies of scale and scope. Its vast global manufacturing footprint and high production volumes in areas like automotive components and power tools allow for substantial cost reductions in production, raw material procurement, and research and development. For instance, in 2023, Bosch reported total sales of €91.6 billion, underscoring the sheer scale of its operations. New entrants would find it incredibly challenging to match these efficiencies, particularly in capital-intensive sectors, making it difficult to compete on price against an established giant like Bosch.

Robert Bosch GmbH benefits from a powerful, enduring brand identity, deeply associated with quality, reliability, and innovation. This established reputation, built over many years, fosters significant customer loyalty, especially in its higher-end product lines. New competitors would face substantial hurdles in replicating this level of trust and recognition, requiring massive marketing expenditure and considerable time to establish a comparable market presence.

Access to Distribution Channels

New entrants face a significant hurdle in replicating Bosch's deeply entrenched distribution network. Accessing established channels, from direct relationships with original equipment manufacturers (OEMs) to extensive retail and specialized industrial distributor partnerships, requires substantial time and capital investment. For instance, in the automotive sector, Bosch's supplier agreements with major car manufacturers are often multi-year commitments, making it difficult for newcomers to secure similar contracts.

Bosch's established sales and service infrastructure further solidifies this barrier. Building out comparable capabilities, including logistics, technical support, and after-sales service, demands considerable resources and expertise. In 2023, Bosch continued to invest heavily in its global sales and service network, further enhancing its reach and customer intimacy across its diverse product portfolios, from automotive components to power tools.

- Challenging OEM Access: New entrants struggle to penetrate the long-term contracts and established relationships Bosch holds with major automotive manufacturers.

- Retail and Industrial Distribution Barriers: Replicating Bosch's extensive retail partnerships and specialized industrial distribution networks requires significant upfront investment and time.

- Logistical and Service Infrastructure: The cost and complexity of building a comparable sales, logistics, and after-sales service network present a formidable entry barrier.

- Leveraging Existing Network: Bosch effectively utilizes its existing distribution channels to introduce and scale new product lines, creating a competitive advantage for established market presence.

Proprietary Technology and Patents

Robert Bosch GmbH benefits significantly from its extensive portfolio of proprietary technologies and patents, especially within automotive electronics, industrial automation, and smart home sectors. This robust intellectual property serves as a substantial barrier to entry, requiring new competitors to undertake considerable investment in research and development to match or surpass Bosch's innovations, while also navigating the risk of patent infringement. For instance, Bosch's advancements in areas like Advanced Driver-Assistance Systems (ADAS) are protected by numerous patents, making it challenging for newcomers to replicate their sophisticated offerings. In 2023, Bosch reported record sales of €91.6 billion, underscoring the market strength derived from its technological leadership.

The threat of new entrants for Robert Bosch GmbH is generally low due to substantial capital requirements, established economies of scale, strong brand loyalty, and extensive distribution networks. These factors create significant hurdles for newcomers aiming to compete in Bosch's core markets, particularly in areas like automotive components and industrial technology. For example, the sheer scale of Bosch's operations, with €91.6 billion in sales in 2023, highlights the cost advantages that are difficult for new players to overcome.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions needed for R&D, manufacturing, and distribution. | Extremely High |

| Economies of Scale | Cost advantages from high production volumes. | Very High |

| Brand Loyalty & Reputation | Established trust in quality and reliability. | High |

| Distribution Networks | Entrenched relationships with OEMs and distributors. | Very High |

| Proprietary Technology | Patented innovations in key sectors. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Robert Bosch GmbH is built upon a robust foundation of data, including their annual reports, investor presentations, and official company press releases. This is supplemented by insights from reputable industry analysis firms and macroeconomic data providers to offer a comprehensive view of the competitive landscape.