Robert Bosch GmbH Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robert Bosch GmbH Bundle

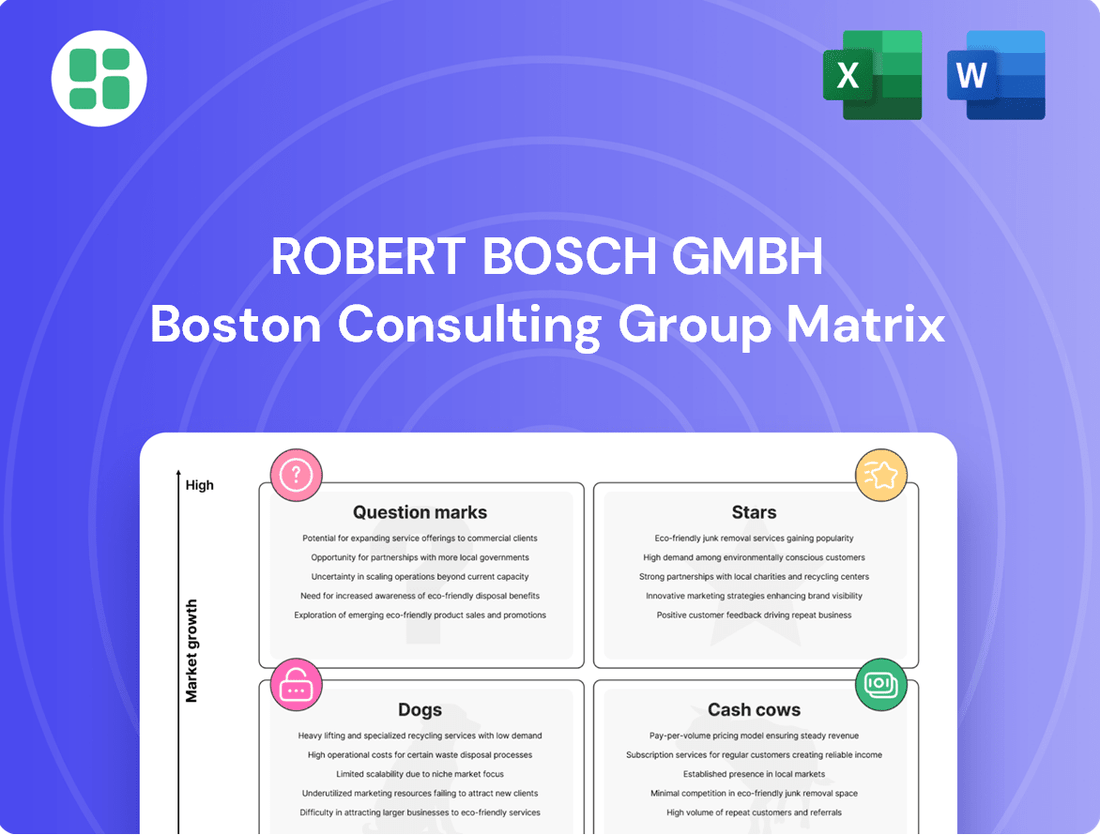

Curious about Robert Bosch GmbH's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't just wonder; know exactly where Bosch's innovations stand. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your own strategic decisions.

Stars

Robert Bosch GmbH is heavily investing in electromobility components, with plans for numerous new production projects in 2024 and 2025 across Europe and China. This strategic push aims to solidify their position in the burgeoning global EV market.

Bosch's ambition is to be a leading supplier in this high-growth sector, targeting significant market share. For instance, in 2023, Bosch's Powertrain Solutions division, which includes e-mobility, saw sales increase by 14%, reaching €24.3 billion, indicating strong current performance and future potential.

Bosch's AI-powered mobility solutions are a significant growth driver, fitting the profile of a Star in the BCG matrix. The company is investing over €2.5 billion in AI by the end of 2027, aiming for more than €10 billion in sales from AI-driven mobility by 2035.

This substantial investment underscores Bosch's commitment to capitalizing on the burgeoning AI market in the automotive sector. Their leading position in AI patents across Europe further solidifies their competitive edge in this rapidly evolving technology landscape.

Bosch's hydrogen technology, encompassing fuel cell power modules and electrolyzers, is positioned as a significant growth area. The company has already begun mass production of fuel cell power modules, signaling a strong commitment to this emerging market.

By 2030, Bosch targets €5 billion in revenue from its hydrogen technology offerings. This ambitious goal is backed by substantial investments, with nearly €2.5 billion allocated between 2021 and 2026 to bolster its capabilities and market presence.

The strategic expansion into electrolyzers further solidifies Bosch's role across the entire hydrogen value chain, from production to utilization, making it a comprehensive player in the burgeoning hydrogen economy.

Advanced Driver-Assistance Systems (ADAS)

Robert Bosch GmbH is strategically positioning itself in the rapidly evolving automotive industry with its Advanced Driver-Assistance Systems (ADAS). The company is actively developing and introducing advanced modular ADAS platforms and AI-powered cockpit computers, capitalizing on the significant opportunities presented by the transforming mobility sector. This focus aligns with the robust growth observed in the ADAS market, driven by an escalating demand for enhanced vehicle safety and automation features.

Bosch's commitment to continuous innovation in ADAS is designed to solidify its leadership in this dynamic segment. The market for ADAS is projected to reach substantial figures, with estimates suggesting a global market size of approximately $55 billion by 2025, and continuing to grow significantly thereafter. Bosch's investment in these technologies underscores its strategy to capture a substantial share of this expanding market.

- ADAS Market Growth: The global ADAS market is experiencing strong expansion, fueled by consumer demand for safety and convenience.

- Bosch's Innovation: Bosch is investing heavily in modular ADAS platforms and AI-driven cockpit solutions to maintain a competitive edge.

- Market Projections: Analysts anticipate continued robust growth in the ADAS sector, with significant market value anticipated in the coming years.

- Strategic Importance: ADAS represents a key growth area for Bosch, aligning with broader trends towards autonomous and connected vehicles.

Smart Home Solutions with Matter Integration

Robert Bosch GmbH is strategically enhancing its smart home offerings by embracing the Matter protocol. This move is designed to ensure seamless interoperability, allowing Bosch devices to connect effortlessly with a wide array of other smart home products. This focus on connectivity is crucial in a rapidly evolving market.

The global smart home market is experiencing significant expansion. Projections indicate a compound annual growth rate of 22.9% leading up to 2032, signaling robust demand for integrated and user-friendly smart home solutions. Bosch's investment in Matter positions them to capitalize on this upward trend.

Bosch's commitment to innovation and user experience within this burgeoning smart home sector places its integrated solutions in a strong position. The company's forward-thinking approach to connectivity, underscored by Matter adoption, suggests these smart home products are poised to become significant growth drivers.

- Matter Integration: Bosch is adopting the Matter protocol for enhanced device interoperability in its smart home solutions.

- Market Growth: The global smart home market is forecasted to grow at a CAGR of 22.9% until 2032.

- Strategic Positioning: Bosch's focus on connectivity and user experience in this expanding market positions its smart home products as potential stars.

Bosch's electromobility components, AI-powered mobility solutions, hydrogen technology, ADAS, and smart home offerings are all strong contenders for Star status in the BCG matrix. These areas represent high-growth markets where Bosch is making significant investments and demonstrating innovative leadership. For example, Bosch's Powertrain Solutions division, including e-mobility, saw a 14% sales increase in 2023, reaching €24.3 billion.

The company's commitment to AI in mobility, with over €2.5 billion invested by 2027, aims for over €10 billion in AI-driven mobility sales by 2035. Hydrogen technology is targeted for €5 billion in revenue by 2030, supported by €2.5 billion in investments between 2021 and 2026. The ADAS market, projected to reach around $55 billion by 2025, is another area of intense focus. Furthermore, the smart home market's projected 22.9% CAGR up to 2032 highlights the potential for Bosch's Matter-integrated solutions.

| Business Area | Market Growth | Bosch's Position/Investment | Key Data Point |

| Electromobility | High | Significant investment in production, targeting leading supplier role | 2023 sales increase of 14% to €24.3 billion for Powertrain Solutions |

| AI-Powered Mobility | High | Over €2.5 billion investment by 2027, aiming for €10 billion sales by 2035 | Leading in AI patents across Europe |

| Hydrogen Technology | High | Targeting €5 billion revenue by 2030, mass production of fuel cell modules | €2.5 billion investment (2021-2026) |

| ADAS | High | Developing modular platforms and AI cockpit computers | Global ADAS market ~ $55 billion by 2025 |

| Smart Home | High | Adopting Matter protocol for interoperability | 22.9% CAGR projected until 2032 |

What is included in the product

This BCG Matrix overview for Robert Bosch GmbH analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on which business units to invest in, hold, or divest for optimal growth.

The Bosch BCG Matrix provides a clear, visual overview of their diverse portfolio, simplifying complex strategic decisions and alleviating the pain of information overload.

Cash Cows

Bosch's traditional internal combustion engine (ICE) automotive components, particularly those for agricultural machinery like tractors, remain a robust cash cow. Despite the industry's pivot to electrification, these established powertrain solutions continue to deliver substantial revenue streams.

As a dominant player in the automotive component market, Bosch commands a significant share in this mature ICE sector. This strong market position translates into a predictable and substantial cash flow, which is crucial for funding Bosch's strategic investments in emerging technologies like electric mobility and autonomous driving.

Bosch's power tools division is a classic Cash Cow, exhibiting robust sales and sustained market interest. This segment benefits from a strong brand reputation and a loyal customer following in a well-established market.

The company's continued investment in new product development, such as advancements in battery technology and cordless tools, underscores its commitment to maintaining a competitive edge. This strategic approach ensures the division remains a steady generator of cash for Robert Bosch GmbH.

In 2024, the global power tools market was valued at approximately $32 billion, with Bosch holding a significant share. The division consistently contributes to Bosch's overall profitability, with its reliable performance underpinning the company's financial stability.

Bosch’s core home appliances, including washing machines, refrigerators, and ovens, represent a significant Cash Cow within its BCG Matrix. This segment benefits from Bosch's strong, established market leadership and the inherent stability of consumer demand for these essential products.

Operating in a mature market, this division consistently delivers high profit margins and generates substantial, predictable cash flows, reinforcing its Cash Cow status. For instance, in 2023, the Home Appliances division of Bosch reported a significant contribution to the group's overall revenue, showcasing the ongoing strength and reliability of these product lines in the market.

Automotive Aftermarket Parts and Services

The Mobility Aftermarket division, encompassing spare parts and services for vehicles, is a significant revenue generator for Robert Bosch GmbH. This includes essential components like diesel engine parts and filters, reflecting the division's role in maintaining the vast existing vehicle fleet.

This segment operates within a mature and stable market. The consistent demand for vehicle maintenance and repairs ensures a reliable and predictable cash flow for Bosch, solidifying its position as a cash cow.

- Mobility Aftermarket Division: Consistent Revenue Contributor

- Key Products: Diesel engine components, filters

- Market Characteristics: Stable and mature

- Financial Impact: Reliable cash flow generation

Braking Systems and Conventional Chassis Components

Bosch's braking systems and conventional chassis components are established cash cows within the automotive industry. These segments benefit from consistent demand due to their critical role in vehicle safety and functionality, a testament to Bosch's significant market share in these mature areas.

The company’s extensive presence in these essential automotive parts translates into robust and predictable cash flow. For instance, the global automotive braking systems market was valued at approximately $30 billion in 2023 and is projected to grow steadily, underscoring the enduring demand for these components.

- Dominant Market Position: Bosch holds a leading share in the global market for braking systems and traditional chassis parts.

- Stable Demand: These components are fundamental to all vehicles, ensuring a consistent customer base.

- Strong Cash Generation: The mature nature of these markets allows for efficient production and significant profit margins, contributing heavily to Bosch's overall financial strength.

- Foundation for Innovation: The cash generated from these units helps fund research and development in newer, high-growth areas for Bosch.

Bosch's established power tools division continues to be a significant cash cow, demonstrating consistent sales and strong brand loyalty in a mature market. The division's reliable performance, bolstered by ongoing product innovation, ensures it remains a steady generator of cash for the company.

In 2024, the global power tools market saw continued demand, with Bosch leveraging its strong brand and distribution network to maintain its market share. This segment's predictable revenue streams are vital for funding Bosch's strategic ventures into new technologies.

Bosch's home appliances segment, including essential items like washing machines and refrigerators, also functions as a robust cash cow. The division benefits from Bosch's established market leadership and the consistent consumer need for these durable goods.

Operating in a mature market, this division consistently delivers healthy profit margins and generates substantial, predictable cash flows, reinforcing its cash cow status. For instance, in 2023, the Home Appliances division of Bosch reported a significant contribution to the group's overall revenue, showcasing the ongoing strength and reliability of these product lines in the market.

| Bosch Cash Cow Segments | Market Status | Key Products/Services | 2023/2024 Relevance | Financial Contribution |

| Power Tools | Mature | Drills, saws, sanders | Continued strong sales globally | Consistent revenue and profit |

| Home Appliances | Mature | Washing machines, refrigerators, ovens | Stable consumer demand, significant revenue contributor | High profit margins, predictable cash flow |

| Mobility Aftermarket | Mature | Diesel engine parts, filters, vehicle maintenance components | Essential for existing vehicle fleet maintenance | Reliable and predictable cash flow |

| Braking Systems & Chassis Components | Mature | Brake pads, discs, suspension parts | Critical for vehicle safety; global market valued ~ $30 billion in 2023 | Robust and predictable cash generation |

Preview = Final Product

Robert Bosch GmbH BCG Matrix

The Robert Bosch GmbH BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, contains no watermarks or demo content, ensuring you get a professional-grade document ready for immediate application in your business planning and decision-making processes.

Dogs

In 2024, Robert Bosch GmbH strategically divested significant parts of its security and communication product business, which was part of its Building Technologies division. This action suggests these product lines likely occupied a low market share within a mature or declining market segment.

This divestment also points to a potential misalignment with Bosch's evolving strategic priorities, which may be increasingly focused on areas like systems integration and digital solutions within the building technology space. By shedding these product lines, Bosch aims to reallocate capital and resources towards more promising growth areas.

While specific financial figures for the divested units are not broadly publicized, such strategic exits are common for companies aiming to streamline operations and enhance overall profitability. For instance, similar divestitures in mature industries often see companies shedding businesses with single-digit growth rates to reinvest in high-growth sectors.

Legacy IT solutions at Robert Bosch GmbH that are not aligned with the company's strong focus on AI and IoT are likely categorized as dogs in the BCG matrix. These older systems may have low market share and limited growth potential in today's rapidly advancing technological environment.

These products often represent cash traps, consuming resources without contributing significantly to Bosch's strategic goals in areas like connected mobility or smart home technology. For instance, while Bosch invested €5.5 billion in R&D in 2023, a portion of this could be tied to maintaining or phasing out these less strategic IT assets.

Within Robert Bosch GmbH's Industrial Technology segment, specific product lines have encountered headwinds. In 2024, certain highly specialized or legacy industrial automation products saw a notable 13% decrease in sales. This decline is attributed to a broader trend of weak global demand impacting these particular offerings.

These challenged segments, characterized by contracting markets or heightened competitive pressures, likely represent areas where Bosch holds a low market share and experiences limited growth potential. While the overall Bosch Rexroth division is actively adapting, these specific product categories may be candidates for strategic re-evaluation within the BCG matrix framework.

Purely Internal Combustion Engine (ICE) Focused R&D Projects

Robert Bosch GmbH's purely internal combustion engine (ICE) focused R&D projects are likely categorized as Dogs in the BCG matrix. These efforts, dedicated to optimizing traditional engines without incorporating hybrid or hydrogen technologies, face a challenging future.

The automotive sector's accelerated pivot towards electrification means that investments in solely ICE technology may experience declining returns. For instance, as of early 2024, global electric vehicle sales continue to surge, with projections indicating a significant market share gain over the next decade.

- Diminishing Market Relevance: Continued focus on ICE technology risks obsolescence as regulatory pressures and consumer demand favor electric and alternative fuel vehicles.

- Reduced Investment Appetite: Investors and automakers are increasingly directing capital towards EV and fuel cell technologies, potentially leaving ICE R&D underfunded.

- Lower Future Profitability: The long-term profitability of purely ICE components is expected to decrease as production volumes for these systems decline.

- Strategic Reallocation Needed: Bosch may need to re-evaluate and potentially reallocate resources from these ICE-centric projects to more future-proof areas like electrification and software development.

Undifferentiated Consumer Electronics (Non-Smart Home)

Within Robert Bosch GmbH's diverse portfolio, certain undifferentiated consumer electronics, excluding their prominent smart home and major appliance categories, might be classified as dogs in the BCG matrix. These are typically products in mature or stagnant markets where Bosch doesn't hold a significant competitive edge.

These segments often grapple with intense competition, leading to low profit margins and minimal growth potential. For instance, if Bosch were to have a line of basic, non-connected audio devices in a market saturated with established brands, these could fall into the dog category. In 2023, the global consumer electronics market, excluding smart home devices, saw moderate growth, but many sub-segments faced intense price competition, impacting profitability for players without strong differentiation.

- Low Market Share: Products in this category likely hold a small percentage of their respective market share, indicating a lack of competitive advantage.

- Low Growth Market: The markets for these undifferentiated electronics are often mature or declining, offering limited opportunities for expansion.

- Low Profitability: Intense competition and lack of unique selling propositions typically result in thin profit margins.

- Potential for Divestment: Companies often consider divesting or minimizing resources allocated to dog products to focus on more promising business areas.

Products or business units categorized as Dogs within Robert Bosch GmbH's BCG matrix are those with low market share in slow-growing or declining industries. These often require significant investment to maintain but yield minimal returns, acting as cash traps. For example, legacy IT solutions not aligned with AI and IoT, or purely internal combustion engine R&D projects, fit this description as the automotive sector shifts towards electrification.

These segments are characterized by limited growth potential and often face intense competition, leading to low profitability. Bosch's divestment of certain security and communication products in 2024, or the decline in sales for specific legacy industrial automation products (down 13% in early 2024), illustrate such scenarios. The company's strategy involves reallocating resources from these areas to more promising growth sectors.

The strategic implications for these Dog categories include potential divestment, phasing out of products, or a significant reduction in investment. This allows Bosch to focus capital and innovation efforts on high-growth areas like connected mobility, smart home technology, and electrification, aligning with market trends and future profitability. For instance, while Bosch invested €5.5 billion in R&D in 2023, a portion of this is strategically directed away from these less viable segments.

Question Marks

Bosch Ventures’ €250 million deep-tech fund signifies a significant commitment to emerging technologies like quantum computing. This investment positions Bosch to explore high-growth, nascent markets, aiming to secure future opportunities in a sector still in its early stages of development.

While the quantum computing market is experiencing rapid expansion, Bosch's direct market share within this specific field is currently minimal. The success of these strategic ventures, though promising, carries inherent uncertainty due to the nascent nature of the technology.

Robert Bosch GmbH is strategically positioning its agentic AI platform for external manufacturing use, a move poised to significantly enhance production efficiency across industries. This initiative, slated for a fall 2025 launch, signifies Bosch's entry into a burgeoning, high-growth market where it aims to establish a strong initial foothold.

The success of this new business model hinges on widespread market acceptance and Bosch's ability to carve out a distinct competitive advantage. As of early 2024, the industrial AI market is experiencing rapid expansion, with projections indicating continued robust growth, providing a fertile ground for Bosch's innovative offering.

Bosch's planned acquisition of Johnson Controls-Hitachi's HVAC business, slated for completion in 2025, positions the company to capitalize on the expanding HVAC market. This move is designed to bolster Bosch's presence in a sector experiencing robust growth, with the global HVAC market projected to reach over $145 billion by 2027, growing at a CAGR of 5.9%.

However, integrating this new venture into Bosch's portfolio presents a classic question mark scenario within the BCG matrix. While the HVAC sector offers significant potential, the substantial investment required for integration and the challenge of carving out a dominant market share for Bosch in this specific segment mean its future performance remains uncertain, demanding careful strategic execution and considerable resource allocation.

New Digital Services and Software Offerings

Bosch's new digital services and software offerings, particularly within its Mobility sector, represent a strategic push into high-growth, competitive markets. The company aims for over €6 billion in sales from these areas by the early 2030s, reflecting significant investment in innovation. These ventures, while promising, are likely to be in the 'Question Mark' category of the BCG matrix due to their newness and the intense competition in the software-defined solutions space.

The market for software-defined vehicles and related digital services is expanding rapidly, offering substantial future potential. However, Bosch, despite its established automotive presence, is entering many of these specific digital service niches with a relatively low current market share. This means these new offerings require substantial investment to gain traction and market position.

- Target: Over €6 billion in sales from software and digital services by early 2030s.

- Focus Area: Primarily within the Mobility business sector.

- Market Characteristic: High-growth, highly competitive digital markets for software-defined solutions.

- BCG Matrix Classification: Likely 'Question Marks' due to low current market share in new, competitive digital service segments.

Emerging Sensor Technologies for New Applications (e.g., Wearables, Hearables)

Robert Bosch GmbH is investing heavily in emerging sensor technologies poised for significant growth in areas like wearables and hearables. These advancements are critical for developing the next generation of smart devices, offering enhanced functionality and user experience.

While these consumer-centric markets are experiencing rapid expansion, Bosch's current market share within these highly specialized segments is likely modest. Established consumer electronics brands often dominate these spaces, necessitating significant strategic investment and market penetration efforts for Bosch to capture substantial market share.

- Bosch's sensor innovation targets the booming wearable and hearable markets.

- The global wearable technology market was valued at approximately $116 billion in 2023 and is projected to grow significantly.

- Bosch's strategy involves leveraging its deep expertise in sensor technology to create differentiated solutions for these consumer segments.

- Gaining significant traction will require substantial investment to compete with entrenched players and build brand recognition in the consumer space.

Bosch's ventures into quantum computing and agentic AI represent significant investments in nascent, high-growth sectors. These initiatives, while holding immense future potential, are classified as Question Marks due to their early stage and the substantial resources required to establish market leadership.

The planned acquisition of Johnson Controls-Hitachi's HVAC business and the expansion of digital services in the Mobility sector also fall into the Question Mark category. Despite strong market growth, Bosch faces the challenge of integrating these new operations and achieving a dominant market share against established competitors.

Similarly, Bosch's advancements in emerging sensor technologies for wearables and hearables are positioned as Question Marks. While the consumer electronics market is booming, Bosch's current market share in these specific niches is likely modest, necessitating significant investment to compete effectively.

These Question Mark initiatives, though requiring substantial investment and facing market uncertainties, are critical for Bosch's long-term growth and diversification strategy, aiming to secure future revenue streams in rapidly evolving technological landscapes.

| Business Area | BCG Classification | Market Growth | Bosch Market Share (Est.) | Investment Need |

|---|---|---|---|---|

| Quantum Computing (Bosch Ventures) | Question Mark | Very High (Nascent) | Minimal | High |

| Agentic AI Platform (External Manufacturing) | Question Mark | High | Low (New Offering) | High |

| HVAC Business (Acquisition) | Question Mark | Moderate to High | Low (New Segment) | High |

| Digital Services & Software (Mobility) | Question Mark | High | Low (New Niches) | High |

| Emerging Sensor Tech (Wearables/Hearables) | Question Mark | High | Modest | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Robert Bosch GmbH's financial reports, internal sales figures, and market share analyses to accurately assess each business unit's position.