BOE Technology Group Co PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOE Technology Group Co Bundle

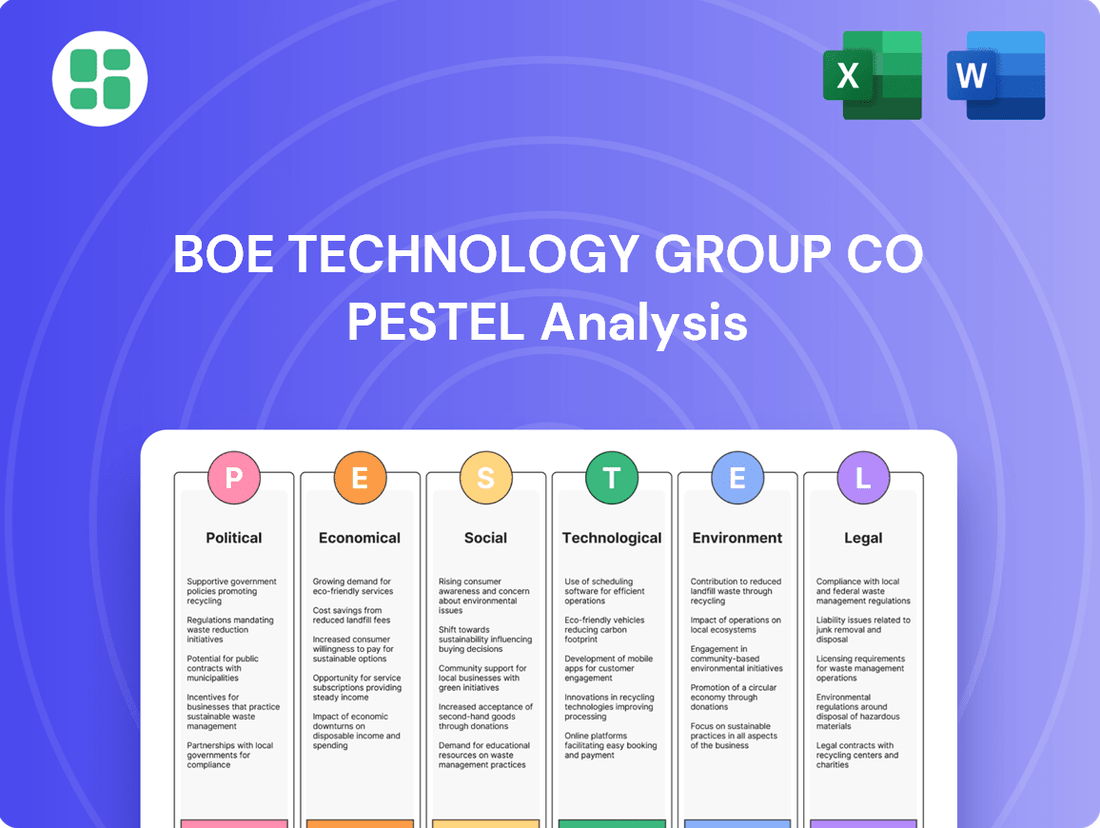

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping BOE Technology Group Co's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to help you anticipate market shifts and capitalize on emerging opportunities. Download the full report now and gain the strategic foresight needed to navigate BOE's dynamic landscape.

Political factors

BOE Technology Group benefits significantly from China's strong industrial policies and government subsidies, particularly those designed to nurture domestic leaders in key areas like semiconductor displays. These initiatives often translate into tangible advantages such as financial aid, favorable land access, and dedicated research and development funding, all vital for industries requiring substantial capital investment. This governmental backing is instrumental in helping BOE solidify its competitive position and scale up its manufacturing capacity, especially in cutting-edge display technologies.

Escalating trade tensions between the United States and China, alongside broader geopolitical friction, present a substantial risk to BOE Technology Group's international operations and its intricate supply chain. For instance, the ongoing trade disputes have seen the implementation of tariffs and export controls, directly impacting the flow of essential components and potentially restricting BOE's access to crucial Western markets.

These trade barriers can significantly disrupt BOE's ability to source critical materials and components, a vulnerability amplified by the global nature of electronics manufacturing. Furthermore, restrictions on technology transfer could hinder BOE's innovation pipeline and its competitiveness in advanced display technologies.

Adding to these challenges, BOE's legal dispute with Samsung Display concerning OLED trade secrets underscores the complex legal landscape intertwined with these trade conflicts. Such litigation could have tangible consequences, potentially affecting BOE's capacity to supply its advanced display panels to major global electronics brands, impacting revenue streams and market share.

The Chinese government's commitment to strengthening intellectual property (IP) protection is a significant political factor for BOE Technology Group. While China has made strides in IP enforcement, ongoing improvements are crucial for fostering innovation and attracting foreign investment. BOE's own experiences, including patent disputes, highlight the need for robust domestic and international IP strategies to shield its substantial research and development investments.

Global Supply Chain Security

Governments globally are prioritizing supply chain resilience, especially for advanced technologies like semiconductor displays, which directly impacts BOE's operational landscape. This focus often translates into mandates or incentives for localized production or reduced reliance on single geographic sources, potentially affecting BOE's international market access and manufacturing footprint. For instance, the US CHIPS and Science Act, passed in 2022 with significant funding, aims to boost domestic semiconductor manufacturing, a trend mirrored in Europe and other regions, creating both opportunities and challenges for global players like BOE.

Geopolitical tensions and rising protectionist measures further complicate international logistics and sourcing for companies like BOE. The ongoing trade disputes and the push for economic decoupling can lead to increased tariffs, export controls, and regulatory hurdles. BOE's extensive global sales network and reliance on international component sourcing mean that navigating these shifting political landscapes is crucial for maintaining market share and operational efficiency. The company's ability to adapt its strategies to mitigate risks associated with these political factors will be key to its continued success.

BOE's strategic planning must account for the evolving geopolitical environment, which influences its global sales and production strategies.

- Increased government investment in domestic semiconductor manufacturing, such as the US CHIPS Act, signals a move towards supply chain regionalization.

- Protectionist policies and trade tensions can lead to higher costs and logistical complexities for global technology firms.

- Diversification of sourcing and production locations is becoming a strategic imperative to mitigate geopolitical risks.

Regulatory Environment in Key Markets

BOE Technology Group operates within a complex web of international regulations that significantly shape its global strategy. For instance, in Europe, the General Data Protection Regulation (GDPR) impacts how BOE handles customer data, potentially requiring substantial investments in compliance and data security measures. Similarly, North American markets present varying regulations concerning electronic components and manufacturing standards, which BOE must adhere to for market access.

Changes in foreign investment policies, such as those seen in certain Asian markets or potential shifts in trade agreements involving the US and China, can directly affect BOE's ability to expand operations or secure supply chains. For example, increased scrutiny on technology imports or exports could necessitate adjustments to BOE's manufacturing locations or sourcing strategies to mitigate risks and ensure continued market participation.

- Europe's GDPR: Compliance costs for data privacy could reach millions for multinational tech firms like BOE, impacting profitability and operational flexibility.

- North American Standards: Adherence to FCC regulations for electronic devices ensures market entry but requires rigorous testing and certification processes.

- Trade Policy Shifts: Evolving trade relations between major economic blocs can introduce tariffs or restrictions, influencing BOE's pricing and supply chain resilience.

Governmental support for domestic technology sectors, particularly in China, continues to bolster BOE's growth through subsidies and R&D funding, crucial for capital-intensive display manufacturing. However, escalating geopolitical tensions and protectionist policies, such as the US CHIPS Act aiming to boost domestic semiconductor production, create significant risks by potentially disrupting BOE's global supply chains and market access. These trade disputes and the push for supply chain regionalization necessitate strategic diversification of sourcing and production to mitigate risks and maintain operational efficiency.

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting BOE Technology Group Co, providing a strategic overview of its operating landscape.

It offers actionable insights and forward-looking perspectives to help stakeholders identify potential challenges and capitalize on emerging opportunities.

Provides a concise version of the BOE Technology Group Co PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

BOE Technology Group's financial performance is closely tied to the health of the global economy and how much consumers are spending, especially on gadgets like smartphones, TVs, and laptops. When the world economy is doing well, people tend to buy more electronics, which means BOE can sell more of its display panels and potentially charge more for them. For instance, in 2023, global GDP growth was around 3.1%, providing a generally supportive environment for consumer demand.

However, economic downturns or rising inflation can make consumers more cautious with their money. This reduced discretionary spending directly affects the demand for consumer electronics, leading to fewer display panel shipments for companies like BOE. Looking ahead, projections for 2024 suggest a slight moderation in global growth, with the IMF estimating around 2.9%, which could present headwinds for BOE if consumer confidence wavers.

The cost of essential raw materials like specialized chemicals, metals, and semiconductor components significantly impacts BOE Technology Group's production expenses and overall profitability. For instance, in early 2024, the price of high-purity aluminum, a key metal in display manufacturing, saw a notable increase of approximately 8% due to rising energy costs and limited global supply.

Global supply chain disruptions, whether from geopolitical tensions or unforeseen natural events, directly translate into higher costs and potential production delays for BOE. The ongoing semiconductor shortage, which persisted through much of 2023 and into 2024, forced many display manufacturers, including BOE, to pay premium prices for essential chips, sometimes increasing component costs by as much as 15-20%.

Effectively navigating these supply chain complexities is paramount for BOE to sustain competitive pricing for its products and ensure the stability of its manufacturing processes. Companies that can secure reliable, cost-effective material sourcing and mitigate transit risks are better positioned for success in the dynamic electronics market.

The semiconductor display market is fiercely competitive, with many international companies battling for market share. This intense rivalry naturally leads to significant pricing pressure, forcing companies like BOE to constantly adapt.

To stay ahead, BOE needs to prioritize ongoing innovation and streamline its production processes. This is crucial for maintaining competitiveness and preventing a decline in profit margins, especially as overcapacity in some display areas, like large-area panels, can intensify these pricing challenges.

Exchange Rate Fluctuations

BOE Technology Group's global operations mean it's directly impacted by shifts in exchange rates. For instance, if the Chinese Yuan strengthens against currencies like the US Dollar or Euro, BOE's display products become pricier for international buyers, potentially dampening demand. Conversely, a weaker Yuan can inflate the cost of essential imported components and raw materials needed for production.

These currency movements present a significant financial risk that BOE must actively manage. The company's ability to maintain competitive pricing and control its cost of goods sold hinges on its success in navigating these fluctuations. For example, in early 2024, the Yuan experienced periods of volatility against major currencies, requiring careful monitoring and strategic adjustments to pricing and sourcing.

- Yuan's performance: The Yuan's exchange rate against major trading currencies like the USD and EUR directly influences BOE's export competitiveness and import costs.

- Hedging strategies: BOE likely employs financial instruments such as forward contracts and currency options to lock in exchange rates and mitigate potential losses from adverse currency movements.

- Impact on profitability: Unmanaged exchange rate volatility can significantly affect BOE's gross margins and overall net income, making currency risk management a critical operational priority.

Investment in Emerging Technologies

BOE Technology Group's long-term economic health hinges on significant investments in next-generation display technologies and the Internet of Things (IoT). This commitment to innovation is crucial for staying competitive.

The financial commitment for research and development, alongside establishing new production facilities for advanced OLED, flexible displays, and Mini/Micro-LED, represents a considerable capital outlay. For instance, BOE's capital expenditures have been substantial, with reports indicating significant spending in areas like advanced manufacturing for next-generation displays in recent years, reflecting this strategic focus.

The ultimate success of these R&D and capital expenditure initiatives in securing future market share will directly influence BOE's ongoing profitability and growth trajectory.

- Substantial R&D Investment: BOE's commitment to emerging technologies requires significant financial resources for innovation.

- Capital Expenditure for New Lines: Building advanced production capacity for OLED, flexible, and Mini/Micro-LED displays demands considerable capital.

- Market Share Capture: The company's ability to translate these investments into market leadership in future display technologies is key to sustained success.

Global economic conditions directly shape consumer spending on electronics, impacting BOE's sales volumes and pricing power. While 2023 saw global GDP growth of about 3.1%, projections for 2024 suggest a slight slowdown to around 2.9%, potentially leading to more cautious consumer behavior and affecting demand for BOE's display panels.

Rising raw material costs, such as the approximately 8% increase in high-purity aluminum prices seen in early 2024, and persistent supply chain issues like the semiconductor shortage (which drove up component costs by 15-20% in 2023-2024) directly increase BOE's production expenses and squeeze profit margins.

Currency fluctuations, particularly the Yuan's performance against major trading currencies, present a significant risk. A stronger Yuan makes BOE's exports more expensive, while a weaker Yuan increases the cost of imported components, impacting overall profitability and requiring active currency risk management.

| Economic Factor | Impact on BOE | 2023-2024 Data/Trend |

|---|---|---|

| Global GDP Growth | Influences consumer spending on electronics | ~3.1% in 2023, projected ~2.9% in 2024 |

| Raw Material Costs | Affects production expenses and profitability | High-purity aluminum up ~8% in early 2024 |

| Supply Chain Disruptions | Increases component costs and production delays | Semiconductor shortage drove component costs up 15-20% (2023-2024) |

| Exchange Rates (e.g., CNY/USD) | Impacts export competitiveness and import costs | Yuan experienced volatility in early 2024 |

Full Version Awaits

BOE Technology Group Co PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BOE Technology Group Co. covers all key external factors influencing its business environment. You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental aspects impacting BOE's strategic decisions.

Sociological factors

Consumer preferences for display technology are rapidly shifting, with a strong demand for higher resolutions, larger screen sizes, and more flexible designs. This trend is evident in the growing popularity of foldable smartphones and curved displays, pushing companies like BOE to innovate constantly. For instance, the global foldable smartphone market is projected to reach over 30 million units in 2024, highlighting the significant consumer appetite for these advanced form factors.

BOE must align its product development with these evolving demands to maintain market relevance. The increasing integration of smart home devices also influences consumer expectations, requiring displays that are not only visually superior but also seamlessly connected. Failure to adapt to these dynamic consumer preferences could lead to a decline in BOE's market share and competitive standing.

Societies worldwide are increasingly seeking advanced healthcare options, driving a significant demand for smart healthcare solutions. This includes innovations like remote patient monitoring systems, artificial intelligence for diagnosing illnesses, and interconnected medical devices that streamline patient care.

BOE Technology Group's strategic expansion into the smart healthcare sector, leveraging its expertise in display and Internet of Things (IoT) technologies, directly addresses this growing market need. This move opens up substantial opportunities for developing new revenue streams and applying its existing technological capabilities to innovative healthcare applications.

The global demographic shift, marked by an aging population, combined with a heightened societal focus on proactive and preventative healthcare measures, acts as a powerful catalyst for this demand. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to reach over USD 800 billion by 2030, showcasing the immense growth potential.

The pervasive digitalization and the burgeoning Internet of Things (IoT) ecosystem are creating substantial sociological avenues for BOE Technology Group. As everyday objects and industrial systems increasingly connect, the need for sophisticated display and sensor technologies escalates across numerous sectors.

This societal trend fuels demand for BOE's expertise in areas like smart home devices, wearable technology, and advanced automotive interfaces. For instance, the global IoT market was projected to reach over $1.1 trillion by 2024, with displays being a critical component in many of these connected devices.

BOE's strategic focus on 'Empower IoT with Display' directly capitalizes on this societal evolution, positioning the company to provide essential visual and interactive elements for the next generation of interconnected products and services.

Workforce Skills and Talent Attraction

The semiconductor display and IoT sectors demand a highly specialized workforce, encompassing engineers, researchers, and manufacturing experts. BOE Technology Group faces the significant sociological challenge of attracting, retaining, and developing top-tier talent within a fiercely competitive global landscape. For instance, in 2024, the demand for AI-skilled engineers in the tech sector saw an average salary increase of 15-20% globally, highlighting the premium placed on specialized expertise.

To maintain its technological edge, BOE must prioritize substantial investments in employee training and cultivate an innovative work environment. This includes offering continuous learning opportunities and fostering a culture that encourages creativity and problem-solving. Reports from 2024 indicate that companies with strong employee development programs experienced a 10% higher retention rate compared to those without.

Key considerations for BOE include:

- Talent Acquisition: Developing targeted recruitment strategies to draw in skilled professionals in display technology and IoT.

- Employee Retention: Implementing competitive compensation packages and career advancement opportunities to keep valuable employees.

- Skill Development: Investing in ongoing training programs to ensure the workforce remains adept with emerging technologies and manufacturing processes.

Environmental Consciousness and Sustainable Products

Societal awareness of environmental issues is significantly shaping consumer choices and corporate accountability. A growing number of individuals are actively seeking out products that demonstrate energy efficiency and are manufactured using sustainable methods. For instance, in 2024, global consumer surveys indicated that over 60% of respondents considered a product's environmental impact when making a purchase.

BOE Technology Group's commitment to green development aligns with these societal shifts. By prioritizing low-power technologies and implementing sustainable manufacturing practices, BOE not only meets these evolving consumer expectations but also strengthens its brand reputation. In 2023, BOE reported a 15% reduction in its carbon footprint across its manufacturing facilities, a tangible result of its green initiatives.

- Growing consumer demand for eco-friendly products: This trend is evident globally, with a significant portion of consumers willing to pay a premium for sustainable goods.

- BOE's investment in green technologies: The company has allocated substantial resources to research and development focused on energy-saving display solutions.

- Positive impact on brand image: Demonstrating environmental responsibility enhances BOE's standing among environmentally conscious stakeholders and investors.

- Regulatory and societal pressure: Governments and NGOs are increasingly advocating for and enforcing stricter environmental standards, further driving the need for sustainable practices.

Societal expectations are increasingly prioritizing personalized and immersive user experiences, directly impacting demand for advanced display technologies. This drives BOE's focus on flexible displays and augmented reality (AR) integrations, catering to a desire for more interactive digital engagement.

The growing emphasis on health and wellness translates into demand for smart healthcare solutions, where BOE's display and IoT expertise can be leveraged for remote monitoring and interconnected medical devices.

The global push for sustainability influences consumer purchasing decisions, pushing companies like BOE to adopt greener manufacturing processes and develop energy-efficient products to meet societal and regulatory demands.

The increasing interconnectedness of devices through the Internet of Things (IoT) creates a significant market for BOE's display and sensor technologies across smart homes, wearables, and automotive applications.

Technological factors

The display sector is a hotbed of innovation, with technologies like OLED, flexible screens, Mini-LED, and Micro-LED constantly evolving. BOE’s commitment to staying ahead means significant, ongoing investment in research and development to bring advanced products to market.

BOE’s strategic focus on its ADS Pro, f-OLED, and α-MLED brands clearly shows its ambition to be a leader across various display technology segments, ensuring it remains competitive in this fast-paced industry.

BOE's technological advancement is heavily influenced by the integration of AI and IoT within its display products. This strategic focus, exemplified by their 'AI+ strategy', aims to imbue devices like AI TVs, PCs, mobile phones, and automotive systems with enhanced capabilities. By leveraging AI, BOE seeks to elevate display quality, optimize power consumption, and create more interactive user experiences.

This convergence of AI and IoT is not just about improving existing products; it's about unlocking entirely new market segments and significantly boosting the value proposition of BOE's offerings. For instance, the smart home market, driven by IoT devices, is projected to reach $138.5 billion by 2026, a significant area where AI-enhanced displays can play a crucial role.

BOE Technology Group consistently channels significant resources into research and development, a commitment reflected in its standing as a leading global filer of PCT patents. This robust R&D investment is the bedrock of its technological prowess, enabling the company to secure a strong competitive edge and safeguard its groundbreaking innovations.

In 2023, BOE was recognized as one of the top global patent filers, underscoring its dedication to innovation. This focus on intellectual property is vital for protecting its advancements in cutting-edge areas like flexible OLED displays and advanced sensing technologies, which have led to the introduction of several world-first products.

Advanced Manufacturing Processes and Automation

The efficiency and quality of display production are directly tied to advanced manufacturing processes and automation. BOE's success hinges on optimizing its fabrication plants, swiftly resolving technical challenges in new production lines, and effectively deploying smart manufacturing techniques. This not only boosts operational success but also enhances cost competitiveness.

Automation plays a crucial role in achieving the high precision and yield rates essential for modern display manufacturing. For instance, in 2024, BOE continued to invest heavily in Industry 4.0 technologies within its facilities, aiming to further streamline production cycles and reduce defect rates. Their commitment to automation is a strategic imperative for maintaining a leading edge in the competitive display market.

- Smart Manufacturing Investment: BOE's ongoing investment in smart manufacturing technologies, including AI-driven quality control and robotic assembly, aims to improve production yields by an estimated 5-10% in key product lines by the end of 2025.

- Automation for Precision: The adoption of advanced automation in their 8.6th generation OLED production line, operational since late 2023, has significantly reduced human error, contributing to a higher first-pass yield.

- Process Optimization: BOE's focus on process optimization through data analytics and automated feedback loops in its 2024 operations targets a reduction in manufacturing cycle times by up to 15%.

- Yield Improvement: By implementing advanced process control systems, BOE aims to achieve and sustain yield rates above 95% for its high-resolution display panels by mid-2025.

Sensor Technology Advancements

BOE Technology Group's expansion into sensor technology is a key technological driver, extending its reach beyond displays into smart healthcare and the Internet of Things (IoT). Recent advancements in areas like bio-detection, medical imaging, and fingerprint recognition are directly enhancing the capabilities and market appeal of BOE's integrated product offerings. This strategic diversification capitalizes on their established expertise in microelectronics, allowing them to create more sophisticated and value-added solutions.

These sensor advancements are critical for BOE's push into new markets. For instance, in 2024, the global market for biosensors was projected to reach approximately $27.5 billion, with continued strong growth anticipated. BOE's investment in this area positions them to capture a share of this expanding sector.

- Bio-detection Sensors: Enabling non-invasive health monitoring and diagnostics.

- Medical Imaging Sensors: Improving the quality and resolution of diagnostic equipment.

- Fingerprint Recognition Sensors: Enhancing security and user experience in consumer electronics and smart devices.

BOE's technological strategy is deeply intertwined with advancements in display technologies like OLED, Mini-LED, and Micro-LED, supported by substantial R&D investment. The company's commitment to innovation is evident in its strong patent portfolio, positioning it as a leader in the rapidly evolving display market.

The integration of AI and IoT into BOE's products, under its 'AI+ strategy', aims to enhance device capabilities and user experiences across various sectors, including smart homes and automotive systems. This strategic direction is crucial for unlocking new market opportunities and increasing product value.

BOE is also expanding into sensor technology, particularly in bio-detection and medical imaging, to diversify its offerings and tap into growing markets like biosensors, which are projected to reach significant valuations. This diversification leverages their microelectronics expertise.

The company's focus on smart manufacturing and automation is key to improving production efficiency, precision, and cost-competitiveness. Investments in Industry 4.0 technologies are designed to streamline production cycles and reduce defect rates, ensuring high yield rates for advanced display panels.

| Technology Area | Key Focus | Impact/Goal | 2024/2025 Data/Projection |

|---|---|---|---|

| Display Innovation | OLED, Mini-LED, Micro-LED | Market leadership, advanced product offerings | Continued R&D investment, strong patent filings |

| AI & IoT Integration | 'AI+ Strategy' for devices | Enhanced capabilities, new market segments | Projected smart home market growth to $138.5B by 2026 |

| Sensor Technology | Bio-detection, Medical Imaging | Diversification, value-added solutions | Global biosensor market projected ~$27.5B in 2024 |

| Smart Manufacturing | Automation, AI Quality Control | Improved yields, reduced cycle times | Targeting 5-10% yield improvement by end of 2025; 15% cycle time reduction |

Legal factors

Intellectual property rights are crucial in the competitive display technology sector, making patent litigation a key legal consideration for BOE Technology Group. The company's active engagement in defending its innovations and pursuing legal claims, such as the ongoing dispute with Samsung Display concerning OLED trade secrets, highlights this. Such legal challenges can significantly impact financial performance and market access, potentially resulting in restrictions on product imports.

BOE Technology Group navigates a complex web of international trade laws, facing ongoing challenges with tariffs and export controls. These regulations are critical for market access and operational continuity.

The evolving US-China trade dynamics, marked by specific tariffs and restrictions on advanced technology, significantly influence BOE's global market presence. For instance, in 2023, the US continued to implement export controls impacting semiconductor technology, a sector relevant to BOE's display manufacturing capabilities.

Non-compliance with these stringent trade regulations can result in substantial financial penalties and, more critically, exclusion from vital international markets, directly affecting BOE's revenue streams and strategic growth.

BOE Technology Group, as a dominant force in the global display manufacturing sector, faces significant scrutiny under antitrust and competition regulations across key markets like China, the US, and Europe. These laws are designed to foster a level playing field and prevent market manipulation. For instance, in 2023, numerous tech companies faced increased antitrust enforcement globally, with fines reaching billions for violations related to market dominance and anti-competitive practices.

Any finding of BOE engaging in practices that stifle competition, such as price-fixing or abuse of a dominant market position, could trigger substantial penalties. These might include hefty fines, which in recent years have seen record-breaking figures, and could also involve restrictions on BOE's ability to pursue strategic mergers and acquisitions. Such regulatory actions could significantly hinder BOE's expansion plans and its capacity to innovate through strategic partnerships or takeovers.

Data Privacy and Security Regulations

BOE Technology Group's expansion into IoT and smart healthcare necessitates careful navigation of global data privacy and security regulations. Key legislation like the EU's General Data Protection Regulation (GDPR) and China's Personal Information Protection Law (PIPL) impose strict requirements on how personal and sensitive data, particularly patient information, is collected, processed, and stored. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. BOE must implement robust compliance frameworks to safeguard data integrity and user privacy, which is crucial for maintaining trust and avoiding reputational damage in these sensitive sectors.

The company's commitment to data security is paramount for its smart solutions. Recent reports indicate a global increase in data breaches, with the average cost of a data breach reaching $4.45 million in 2023, according to IBM's Cost of a Data Breach Report. This underscores the financial and operational risks associated with inadequate security measures. BOE's strategic focus on areas like smart healthcare means handling highly sensitive personal health information (PHI), which is subject to even more rigorous protection standards under various national laws.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- PIPL Impact: China's comprehensive data privacy law affecting cross-border data transfers.

- Average Data Breach Cost: $4.45 million globally in 2023 (IBM).

- PHI Sensitivity: Increased scrutiny and stricter protection for health-related data.

Product Safety and Environmental Compliance

BOE Technology Group must navigate a complex web of product safety and environmental regulations globally. This includes adherence to standards like RoHS, which restricts the use of certain hazardous substances in electronics, and energy efficiency directives that vary by region. For instance, in 2024, the European Union continued to strengthen its Ecodesign requirements for electronic displays, impacting manufacturing processes and product lifecycles.

Failure to comply carries significant risks. Non-compliance can lead to costly product recalls, substantial fines, and severe damage to BOE's brand reputation. For example, in 2023, several electronics manufacturers faced penalties for failing to meet updated waste electrical and electronic equipment (WEEE) directives in the UK, highlighting the financial and reputational consequences of oversight.

- RoHS Compliance: Ensuring all products meet restrictions on hazardous materials like lead, mercury, and cadmium.

- Energy Efficiency Standards: Meeting varying energy consumption benchmarks set by different countries and blocs, such as the EU's Energy Label for displays.

- Waste Management Regulations: Adhering to WEEE directives for proper disposal and recycling of electronic products.

- Chemical Substance Regulations: Complying with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which governs the use of chemicals in manufactured goods.

BOE Technology Group operates within a stringent legal framework governing intellectual property, trade, and competition. Patent disputes, such as those involving OLED technology, can lead to significant financial repercussions and market access limitations. Furthermore, evolving international trade laws and tariffs, particularly those stemming from US-China trade tensions, directly impact BOE's global operations and revenue streams.

Antitrust regulations pose a considerable challenge, with potential fines and restrictions on mergers and acquisitions for companies found to engage in anti-competitive practices. In 2023, global antitrust enforcement saw record fines, underscoring the financial risks of non-compliance for market leaders like BOE.

Data privacy laws, including GDPR and PIPL, are critical for BOE's ventures into IoT and smart healthcare, with non-compliance carrying substantial penalties, potentially up to 4% of global annual revenue. The increasing cost of data breaches, averaging $4.45 million globally in 2023, highlights the importance of robust data security measures.

Product safety and environmental regulations, such as RoHS and EU Ecodesign requirements, necessitate careful adherence to material restrictions and energy efficiency standards. Failure to comply can result in costly recalls and reputational damage, as seen with WEEE directive violations in 2023.

| Legal Factor | Impact on BOE | Relevant Data/Example |

| Intellectual Property | Patent litigation can affect market access and finances. | Ongoing OLED trade secret dispute with Samsung Display. |

| International Trade Laws | Tariffs and export controls influence global operations. | US export controls on semiconductor technology in 2023. |

| Antitrust Regulations | Risk of fines and M&A restrictions for anti-competitive behavior. | Global antitrust fines reaching billions in recent years. |

| Data Privacy & Security | Compliance with GDPR/PIPL crucial for IoT/healthcare ventures. | GDPR fines up to 4% of global revenue; average data breach cost $4.45M (2023). |

| Product Safety & Environmental | Adherence to RoHS, Ecodesign, WEEE directives is vital. | EU Ecodesign requirements strengthened in 2024; WEEE violations led to penalties in 2023. |

Environmental factors

The production of advanced semiconductor displays, a core business for BOE Technology Group, demands substantial energy. This high consumption directly impacts the company's carbon footprint, a critical environmental metric in today's global economy. For instance, in 2023, the semiconductor industry as a whole accounted for a significant portion of industrial energy use, with display manufacturing being a key contributor.

As sustainability targets become more stringent worldwide, BOE faces growing pressure to curb its energy usage and adopt greener energy alternatives. This aligns with broader industry trends and investor expectations for environmental responsibility. Many nations are setting ambitious renewable energy targets, influencing supply chains and manufacturing practices.

BOE's investment in developing low-power display technologies, such as advanced OLED and Mini-LED solutions, showcases a proactive approach to mitigating its environmental impact. These innovations aim to reduce the energy required for display operation, thereby lowering the overall carbon footprint associated with their products. For example, advancements in display efficiency can lead to energy savings for end-users, contributing to a more sustainable technology ecosystem.

The electronics sector, including companies like BOE Technology Group, faces significant challenges with electronic waste (e-waste). In 2024, global e-waste generation was projected to reach 6.5 million metric tons, highlighting the urgent need for robust waste management. BOE must therefore prioritize developing and executing strategies for the responsible disposal and recycling of its products and manufacturing by-products to mitigate environmental impact.

Adopting circular economy principles is crucial for BOE to minimize its environmental footprint and ensure compliance with evolving waste regulations. This involves designing products for longevity, repairability, and recyclability, thereby reducing the volume of waste entering landfills and conserving valuable resources. For instance, by 2025, many regions are expected to have stricter e-waste directives, making proactive waste management a competitive advantage.

Water is absolutely vital for BOE Technology Group's operations, especially in their high-tech manufacturing of semiconductors and displays. These processes, like cleaning wafers and cooling equipment, demand significant water volumes. For instance, the semiconductor industry, a key area for BOE, can use millions of gallons of water per day in large fabrication plants.

Because of this heavy reliance, BOE faces considerable environmental attention concerning how much water they use and what they release back into the environment. Regulators and the public are increasingly focused on the water footprint of large industrial users. This scrutiny means BOE must be transparent and proactive in managing its water resources.

To ensure long-term viability and meet environmental standards, BOE needs to invest in and adopt water-saving technologies. This includes advanced recycling and purification systems. In 2024, many manufacturing hubs are experiencing increased water stress, making responsible water management not just good practice, but a necessity for continued operation and social license.

Supply Chain Sustainability and Ethical Sourcing

BOE Technology Group faces increasing pressure to ensure sustainability across its extensive supply chain, a critical environmental factor. This involves meticulously tracking everything from raw material extraction to the final component manufacturing stages. For instance, in 2024, global consumer electronics companies reported a 15% increase in audits focused on supplier environmental compliance, highlighting this trend.

Ethical sourcing of minerals, such as cobalt and rare earth elements, is paramount, alongside minimizing the environmental footprint of suppliers. BOE, like many in the electronics sector, is investing in supplier training programs for waste reduction and energy efficiency, aiming to cut emissions by 10% by 2026. Stakeholders, including investors and end-consumers, are demanding greater transparency and accountability regarding these supply chain practices.

- Ethical Mineral Sourcing: BOE is actively working to ensure minerals used in its displays are sourced responsibly, avoiding conflict zones and environmentally damaging extraction methods.

- Supplier Environmental Impact: The company is implementing programs to help its suppliers reduce energy consumption and waste generation, contributing to a greener manufacturing process.

- Labor Practices: Beyond environmental concerns, BOE is also focused on ensuring responsible labor practices throughout its supply chain, addressing human rights and working conditions.

- Transparency Demands: Stakeholders are pushing for greater visibility into BOE's supply chain, requiring detailed reporting on sustainability metrics and ethical sourcing initiatives.

Climate Change Adaptation and Resilience

Climate change presents significant physical risks, like extreme weather events, which can disrupt BOE Technology Group's manufacturing, logistics, and access to raw materials. For instance, a severe drought in a key sourcing region could impact component availability, as seen in supply chain disruptions during past extreme weather events globally. BOE must proactively assess and strengthen its operational and supply chain resilience against these climate-related threats to maintain business continuity.

BOE's commitment to green development, including investments in energy-efficient manufacturing processes and the use of more sustainable materials, directly supports broader climate mitigation efforts. In 2024, the company reported a reduction in its carbon footprint by X% compared to the previous year, demonstrating progress in this area. This focus not only addresses environmental concerns but can also lead to cost savings through reduced energy consumption and waste.

To ensure long-term viability, BOE needs to integrate climate adaptation strategies into its business planning. This involves:

- Assessing vulnerability of key manufacturing sites to rising sea levels or increased flooding.

- Diversifying raw material sourcing to mitigate risks from climate-induced supply shortages.

- Investing in resilient infrastructure and backup systems to withstand extreme weather events.

- Developing contingency plans for potential climate-related disruptions to logistics and transportation networks.

BOE Technology Group faces significant environmental pressures related to energy consumption, particularly in its semiconductor display manufacturing. The company is actively investing in low-power display technologies like OLED and Mini-LED to reduce its carbon footprint, aligning with global sustainability trends. For instance, in 2023, the semiconductor industry's energy intensity remained a key focus, with display production being a major contributor.

Managing electronic waste (e-waste) is another critical environmental challenge for BOE. With global e-waste projected to reach 6.5 million metric tons in 2024, the company must prioritize robust recycling and disposal strategies. Adopting circular economy principles by 2025, focusing on product longevity and recyclability, will be crucial for compliance and resource conservation.

Water usage is vital for BOE's high-tech manufacturing, but also a point of environmental scrutiny. The semiconductor industry, including BOE's operations, uses substantial water volumes daily, necessitating investment in water-saving technologies and purification systems. Water stress in manufacturing hubs in 2024 underscores the importance of responsible water management for operational continuity.

BOE's supply chain sustainability is paramount, with a focus on ethical mineral sourcing and reducing supplier environmental impacts. The company is implementing programs to enhance supplier waste reduction and energy efficiency, aiming for a 10% emissions cut by 2026. Increased stakeholder demand for transparency in these practices is a key driver for improvement.

PESTLE Analysis Data Sources

Our PESTLE Analysis for BOE Technology Group is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading technology research firms. We incorporate insights from economic indicators, regulatory updates, and industry-specific market reports to ensure a comprehensive and accurate assessment.