BOE Technology Group Co Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOE Technology Group Co Bundle

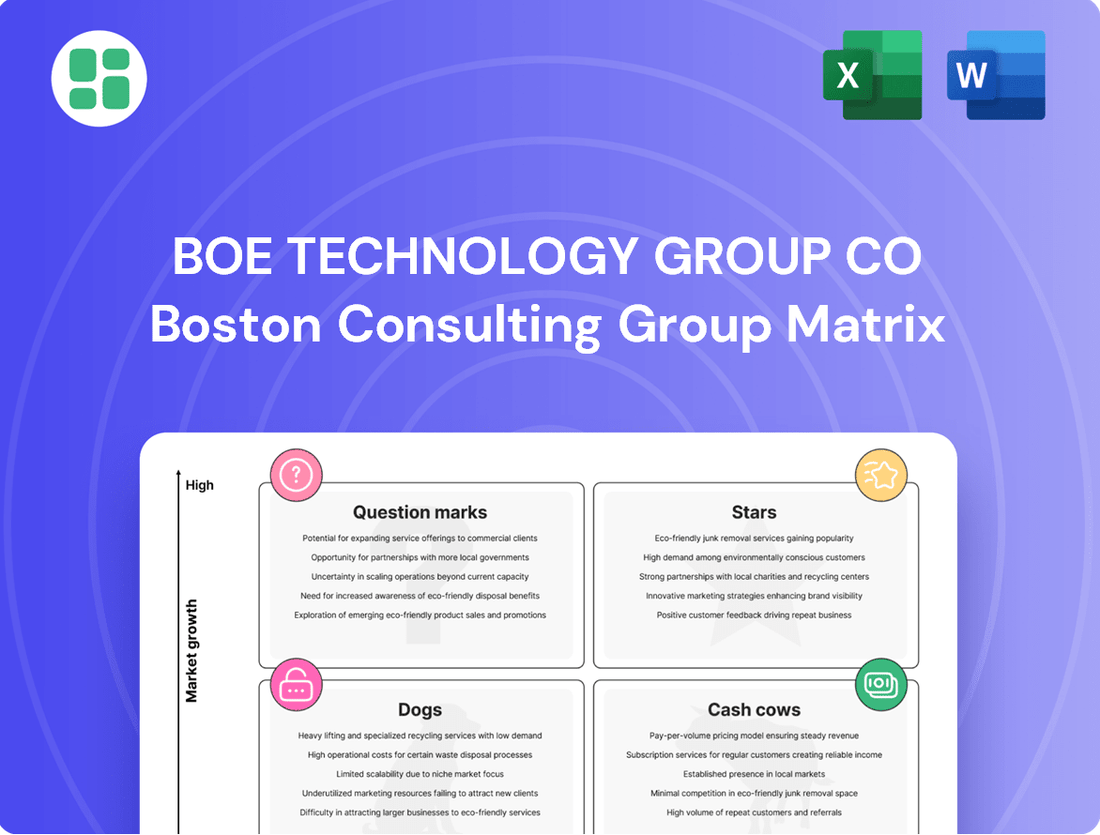

Curious about BOE Technology Group's strategic positioning? Our BCG Matrix preview reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear path to optimizing your investments.

Stars

BOE Technology's flexible OLED displays for high-end smartphones and foldables are a significant growth driver. In the first quarter of 2024, BOE captured a commanding 48% of the flexible AMOLED market, largely propelled by its supply to Huawei's popular foldable devices. This strong performance highlights BOE's crucial role in the burgeoning foldable phone market.

Looking ahead, BOE projects robust expansion in this sector, targeting shipments of 170 million flexible AMOLED displays in 2025. This represents a substantial 21% increase compared to their 2024 shipments, underscoring the immense demand for these advanced display technologies. The segment is defined by its need for cutting-edge visual quality and the unique adaptability offered by flexible screens.

BOE Technology Group is heavily investing in Mini/Micro LED technologies, a strategic move that places them in a strong position within the BCG matrix. Their commitment is underscored by the establishment of a Micro LED wafer manufacturing and packaging test base in November 2024, specifically geared towards mass production.

These advanced display technologies are highly sought after for premium applications due to their superior brightness, contrast ratios, and color accuracy. This makes them ideal for demanding sectors such as high-performance gaming, automotive dashboards, and professional design monitors. The market for these cutting-edge displays is expanding rapidly, signaling significant growth potential.

BOE's aggressive push into Mini/Micro LED manufacturing and their focus on high-value applications suggest a strong "Star" positioning for this business segment. The company is not just participating but actively shaping the future of display technology, aiming for market leadership in this burgeoning field.

BOE Technology Group is a significant player in the high-resolution and high-refresh-rate gaming display market. Their collaborations with industry leaders like Dell, ASUS, and Lenovo are evident in cutting-edge products. For instance, at CES 2025, BOE showcased displays boasting 4K resolution and an impressive 300Hz refresh rate, directly catering to the demanding needs of gamers.

The market for these advanced gaming displays is experiencing robust growth, driven by consumers seeking more immersive and responsive gaming experiences. This demand fuels BOE's investment in and development of proprietary technologies such as ADS Pro and α-MLED, which are crucial for maintaining their competitive edge in this high-performance segment.

Automotive Displays with Advanced Features

BOE Technology Group is a dominant force in automotive displays, securing the number one global position in both shipments and shipment area for the first three quarters of 2024. This leadership is driven by continuous innovation, exemplified by their 'HERO smart cockpit' concept. This advanced solution integrates features like biometric steering wheels, sophisticated haptic feedback systems, and immersive glasses-free 3D displays, catering to the evolving demands of the automotive industry.

The automotive market is rapidly shifting towards digital integration, with a strong emphasis on advanced digital dashboards and comprehensive infotainment systems. This transformation creates a fertile ground for BOE's cutting-edge display technologies, positioning them for substantial growth. Their ability to deliver these sophisticated features directly addresses the industry's push for more connected and interactive vehicle experiences.

- Global Leadership: BOE held the top global spot in automotive display shipments and shipment area in Q1-Q3 2024.

- Innovation Showcase: The 'HERO smart cockpit' features biometric steering wheels, haptic systems, and glasses-free 3D displays.

- Market Transformation: The automotive sector's move towards digital dashboards and infotainment systems fuels demand for BOE's advanced solutions.

- Growth Opportunity: BOE is well-positioned to capitalize on the high-growth potential of advanced automotive display markets.

AI-Powered Display Solutions

BOE's AI-Powered Display Solutions are a key component of its strategic growth. In 2024, the company launched its 'AI+' strategy, specifically targeting the integration of artificial intelligence across its manufacturing, product development, and operational processes. This initiative aims to significantly improve display performance and unlock new smart application possibilities.

The company is actively developing AI-enhanced displays for a range of consumer electronics. These include AI-powered televisions, personal computers, smartphones, and increasingly, in-vehicle display systems. By employing intelligent algorithms, BOE is enhancing real-time image processing capabilities and optimizing power efficiency in these devices.

BOE's proactive approach to AI integration places its display solutions in a market with substantial growth potential. As AI becomes an indispensable feature in consumer electronics, BOE's early and aggressive adoption strategy is designed to capture a significant share of this high-potential market segment.

- AI+ Strategy Launch: BOE initiated its 'AI+' strategy in 2024, emphasizing AI integration in manufacturing, products, and operations.

- Product Applications: AI-powered displays are being developed for TVs, PCs, smartphones, and automotive applications.

- Performance Enhancements: Intelligent algorithms are used for real-time image processing and improved power efficiency.

- Market Position: Early and aggressive AI adoption positions BOE favorably in the high-growth consumer electronics market.

BOE's flexible OLED displays for high-end smartphones and foldables are a significant growth driver, capturing 48% of the flexible AMOLED market in Q1 2024. With projected shipments of 170 million flexible AMOLED displays in 2025, a 21% increase from 2024, this segment is a clear Star due to its high demand and BOE's strong market position.

BOE's investment in Mini/Micro LED technologies, including a dedicated manufacturing base established in November 2024, positions them for leadership in premium applications like gaming and automotive displays. The high demand for superior visual quality in these sectors, coupled with BOE's aggressive development, marks this as a Star.

BOE's dominance in automotive displays, holding the number one global position in shipments and area for the first three quarters of 2024, underscores its Star status. Innovations like the 'HERO smart cockpit' and the industry's shift towards digital integration ensure continued strong performance and growth in this segment.

The AI-Powered Display Solutions, driven by BOE's 2024 'AI+' strategy, represent a high-potential market. By integrating AI across its operations and developing AI-enhanced displays for various devices, BOE is poised to capture significant share in this rapidly growing segment, solidifying its Star classification.

What is included in the product

The BOE Technology Group BCG Matrix analyzes its product portfolio by market share and growth rate, identifying Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, actionable visual of your portfolio's strategic positioning, easing the pain of resource allocation debates.

Cash Cows

BOE Technology Group's traditional large-area LCD panels, particularly for televisions, are a clear cash cow. The company has maintained its position as the world's top manufacturer of these panels for seven consecutive years, demonstrating exceptional market dominance. By March 2024, BOE held a substantial 33.1% share of the large-area display market, underscoring its leadership.

Despite a low unit-based demand growth in the broader LCD market, revenue-based demand remains steady. Furthermore, panel prices are projected to experience a rebound in 2025, which will further bolster profitability. This segment consistently generates stable cash flow, driven by BOE's commanding market position and an improving profit outlook for panel manufacturers.

BOE Technology Group holds a dominant position in the LCD panel market for monitors and laptops, a mature yet crucial sector of the display industry. The company benefits from its extensive manufacturing capabilities and advanced ADS Pro technology, ensuring a steady presence in this stable market.

These LCD panels, while not exhibiting rapid growth, consistently generate significant revenue and maintain a high market share, effectively functioning as cash cows for BOE. In 2024, BOE continued to be a leading supplier, with its LCD panel shipments for IT devices remaining a cornerstone of its business.

Mainstream Smartphone LCD Displays represent a significant cash cow for BOE Technology Group. Despite the increasing adoption of OLED technology, LCDs still command a substantial share of the global smartphone display market, with BOE being a dominant player. In 2024, BOE maintained its position as a leading supplier of smartphone displays, including a robust offering of LCD panels.

While the growth rate for smartphone LCDs is moderating, BOE's deep-rooted partnerships with major global smartphone manufacturers guarantee a consistent and predictable demand for these displays. This sustained demand, coupled with BOE's highly efficient, large-scale manufacturing capabilities, translates into reliable and substantial cash flow generation for the company.

Standard Commercial Displays (e.g., Digital Signage, Whiteboards)

BOE Technology Group's standard commercial displays, such as digital signage and interactive whiteboards, represent a significant cash cow. These products are essential for businesses and educational institutions, meeting a consistent demand for reliable and cost-effective display solutions.

BOE's strong market position and diverse product offerings in this segment generate a predictable and stable revenue stream. For instance, in 2024, the digital signage market was projected to reach over $30 billion globally, with commercial displays forming a substantial portion of this. BOE's established manufacturing capabilities and distribution networks allow it to capitalize on this ongoing demand.

- Stable Revenue Generation: These products contribute a consistent and reliable income for BOE, underpinning its financial stability.

- Market Penetration: BOE's wide range of standard commercial displays ensures broad adoption across various business and educational sectors.

- Cost-Effectiveness: The focus on reliability and affordability makes these displays a preferred choice for many organizations, driving sustained sales.

- Market Share: BOE holds a notable share in the commercial display market, leveraging its scale to maintain profitability in this segment.

Display Module Manufacturing Services

BOE Technology Group's Display Module Manufacturing Services are a prime example of a Cash Cow within the BCG Matrix. This segment capitalizes on BOE's established leadership in panel production, extending its offerings to encompass the complete integration of display modules. These services provide a reliable and consistent revenue stream, drawing from a broad client base that values BOE's end-to-end capabilities.

This mature business line benefits from high market share, directly supporting and enhancing the value proposition of BOE's core display products. For instance, in 2023, BOE continued its dominance in the large-size display market, holding a significant share that underpins the demand for its module manufacturing services across various consumer electronics and automotive applications.

- Steady Revenue: The integration and manufacturing of display modules offer a predictable income source, leveraging existing production infrastructure.

- Market Dominance: BOE's strong position in the display panel market translates to high demand for its module assembly services.

- Value Extension: This service enhances the overall value of BOE's display products by providing ready-to-deploy solutions for clients.

- Client Diversification: Services cater to a wide array of industries, including smartphones, televisions, automotive displays, and IT devices.

BOE's large-area LCD panels for televisions are a definitive cash cow, consistently holding the top global market share for seven years. By March 2024, BOE commanded 33.1% of the large-area display market, a testament to its enduring strength. Despite modest unit growth, revenue remains stable, with panel prices anticipated to rise in 2025, further boosting profits.

The company's dominance in LCD panels for monitors and laptops, a mature but vital segment, also functions as a cash cow. BOE's extensive manufacturing capacity and advanced ADS Pro technology secure its steady market presence. These panels, while not experiencing rapid expansion, generate substantial and consistent revenue, solidifying their cash cow status.

Mainstream smartphone LCD displays are another key cash cow for BOE. Even with OLED's rise, LCDs retain a significant market share, and BOE leads in supplying them. Their deep relationships with major smartphone makers ensure consistent demand, amplified by BOE's efficient, large-scale production, which translates into reliable cash flow.

Standard commercial displays, including digital signage and interactive whiteboards, are also significant cash cows for BOE. These products cater to a steady demand from businesses and educational institutions for dependable, cost-effective solutions. BOE's strong market position and diverse offerings in this area create a predictable revenue stream, capitalizing on a market projected to exceed $30 billion globally in 2024.

| Product Segment | Market Position | Cash Flow Contribution | Key Differentiator | 2024 Data Point |

| Large-Area LCD TV Panels | Global Leader (7 consecutive years) | High & Stable | Market Dominance, Scale | 33.1% Large-Area Display Market Share (March 2024) |

| Monitor & Laptop LCD Panels | Dominant Player | High & Stable | Advanced ADS Pro Tech, Manufacturing Capacity | Cornerstone of IT Device Display Shipments |

| Mainstream Smartphone LCD Displays | Leading Supplier | High & Stable | Deep Client Partnerships, Efficient Production | Continued leadership in smartphone display supply |

| Standard Commercial Displays | Strong Market Position | High & Stable | Reliability, Cost-Effectiveness, Diverse Offerings | Digital Signage Market > $30 Billion (Projected 2024) |

Delivered as Shown

BOE Technology Group Co BCG Matrix

The preview you're seeing is the identical, fully-formatted BOE Technology Group Co BCG Matrix report you'll receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready document designed for strategic decision-making.

Rest assured, the BOE Technology Group Co BCG Matrix displayed here is the exact final version you will download upon completing your purchase. It's meticulously crafted to provide a clear, actionable overview of BOE's product portfolio, ready for immediate integration into your business strategy or presentations.

Dogs

BOE's legacy or niche display technologies, such as older LCD panel types or specialized monochrome displays, likely fall into the 'Dogs' category of the BCG matrix. These are technologies where BOE might still possess manufacturing capabilities but faces a market where demand is consistently shrinking, having been overtaken by newer, more advanced alternatives like OLED or Mini-LED. For instance, while BOE is a leader in OLED, their older generation LCD lines for certain applications might be experiencing this decline.

These products typically exhibit very low growth prospects and a diminishing market share. They often contend with intense price competition from other manufacturers still operating in these shrinking markets. In 2024, the overall market for traditional CCFL-backlit LCDs, a segment BOE might still serve in some capacity, continued its downward trend as LED-backlit and other advanced technologies became standard.

Consequently, these legacy products are likely to generate minimal returns for BOE. They can also tie up valuable resources, including manufacturing capacity and capital, that could be more effectively allocated to high-growth areas like advanced foldable displays or micro-LED technologies, where BOE is actively investing and innovating.

Within the display industry, BOE Technology Group likely faces challenges in highly commoditized segments where differentiation is minimal. These low-margin display components, characterized by intense price competition, probably contribute little to the company's overall profitability despite potentially high sales volumes. For instance, in 2024, the global market for basic LCD panels saw significant price erosion, with average selling prices dropping by an estimated 5-10% year-over-year for certain standard sizes, impacting margins for all major suppliers including BOE.

BOE Technology Group's ventures into areas like IoT and healthcare, while strategic long-term, may include smaller, non-core initiatives that aren't performing well. These could be pilot projects or early-stage explorations that haven't yet shown significant market traction or a clear path to profitability. For instance, a small-scale smart home device pilot that failed to gain consumer adoption would fit here.

These underperforming ventures, lacking strategic synergy with BOE's core display technology business, risk becoming resource drains. If these initiatives, such as a niche healthcare monitoring system that didn't secure regulatory approval or market share, continue to consume capital without demonstrating clear growth potential, they represent a drag on overall performance.

Outdated Production Lines or Technologies Not Adaptable to New Demands

Outdated production lines or technologies not adaptable to new demands represent a significant challenge for companies like BOE Technology Group. These are essentially the Dogs in the BCG Matrix. Think of older manufacturing setups that are inefficient and expensive to run. They also struggle to keep up with the fast-paced evolution of display technology, like the demand for higher refresh rates or new panel types.

BOE, a leader in the display industry, must constantly assess its manufacturing capabilities. In 2024, the pressure to adopt advanced manufacturing processes for OLED and Mini-LED displays is immense. Companies with legacy equipment that cannot be retrofitted for these cutting-edge technologies would fall into this category. This can lead to a situation where operational costs are high, but the products generated have limited market appeal and a weak competitive edge.

- Cash Drain: Maintaining these older facilities often becomes a significant cash drain, as they require ongoing investment for operation and maintenance without yielding substantial returns or demonstrating future growth potential.

- Market Obsolescence: Products manufactured using outdated technologies face a high risk of market obsolescence, especially in a rapidly evolving sector like consumer electronics.

- Limited Adaptability: The inability to pivot production to meet emerging market demands, such as flexible displays or micro-LED, severely restricts a company's ability to capitalize on new opportunities.

Certain Regional Market Segments with Limited Penetration and Growth

BOE Technology Group, despite its broad global reach, may encounter specific regional market segments characterized by limited penetration and sluggish growth. These are areas where BOE's market share is minimal, and the prospects for expansion are either stagnant or in decline. This situation often arises due to the dominance of strong local competitors or market conditions that do not align with BOE's existing product portfolio and strategic focus.

For instance, consider the market for specialized industrial displays in a particular emerging economy where established local manufacturers hold a significant advantage due to long-standing relationships and tailored product offerings. If BOE's current display solutions are not competitive in terms of price, features, or local support within this niche, it would fall into the 'Dog' category of the BCG Matrix. Continued investment in such segments without a clear strategy to overcome these barriers or pivot to more promising areas would tie up valuable resources.

- Limited Market Share: In certain niche regional markets, BOE's share could be less than 10%, indicating a weak competitive position.

- Low Growth Prospects: These markets might exhibit an annual growth rate below 3%, suggesting little potential for future gains.

- Resource Drain: Continued focus on these 'Dog' segments without a viable turnaround strategy can detract from investments in high-growth areas.

- Strategic Re-evaluation: BOE needs to assess whether to divest from these segments or develop a targeted strategy to improve market position and profitability.

BOE's legacy display technologies, such as older LCD panel types, represent 'Dogs' in the BCG matrix. These products face shrinking demand and intense price competition, generating minimal returns. For example, the market for traditional CCFL-backlit LCDs, which BOE might still serve, continued its decline in 2024 as advanced technologies became standard, with average selling prices for basic LCD panels dropping by an estimated 5-10% year-over-year for certain standard sizes.

These 'Dog' segments tie up valuable resources, including manufacturing capacity and capital, that could be better allocated to high-growth areas like foldable displays or micro-LED. Companies with legacy equipment that cannot be retrofitted for cutting-edge technologies would fall into this category, leading to high operational costs and limited market appeal.

BOE must assess underperforming ventures, such as niche IoT or healthcare initiatives that haven't gained traction. These resource drains, lacking strategic synergy with core display businesses, risk hindering overall performance if they continue to consume capital without clear growth potential.

In certain niche regional markets, BOE's limited penetration and sluggish growth, potentially with market share below 10% and annual growth rates below 3%, also classify as 'Dogs'. Continued focus without a viable turnaround strategy detracts from investments in high-growth areas, necessitating strategic re-evaluation or divestment.

| BCG Category | BOE Technology Group Example | Market Characteristics | Financial Implications |

|---|---|---|---|

| Dogs | Legacy LCD panel types (e.g., CCFL-backlit) | Low market growth, declining demand, high competition | Low profitability, potential cash drain, resource allocation inefficiency |

| Dogs | Underperforming niche IoT/healthcare pilots | Lack of market traction, unproven profitability | Resource drain, distraction from core business |

| Dogs | Niche regional markets with minimal penetration | Stagnant or declining growth, strong local competitors | Limited return on investment, opportunity cost |

Question Marks

BOE Technology Group is strategically positioning itself in the burgeoning smart healthcare sector, evidenced by its significant investment in Beijing BOE Hospital, scheduled for opening in 2026. This initiative, alongside the development of a health IoT ecosystem, targets a high-growth market fueled by the increasing integration of technology in medical services.

While BOE's commitment to smart healthcare signifies substantial future potential, its current market share within the broader industry is likely still developing, especially when compared to established medical technology giants. This places BOE's smart healthcare solutions and digital hospitals in a category that offers high growth prospects but currently holds a relatively low market share, characteristic of a question mark in the BCG matrix.

BOE Technology Group's advanced sensor technologies, encompassing bio-detection and industrial sensors, align with the high-growth potential of the global IoT market. This segment is a key area for BOE, leveraging their expertise in photoelectric sensing to penetrate critical sectors like medical imaging.

The broader IoT market, where sensors are integral, is experiencing robust expansion, with projections indicating continued strong growth through 2024 and beyond. For instance, the global IoT market was valued at approximately $1.57 trillion in 2023 and is expected to reach over $2.5 trillion by 2027, showcasing significant upward momentum.

While BOE possesses strong technological foundations in these advanced sensor areas, their current market share in specific, niche sensor verticals may not yet reflect their full potential. Capturing a more dominant position in these rapidly evolving and high-growth markets will necessitate considerable strategic investment and focused development efforts to capitalize on emerging opportunities.

BOE is making significant strides in the VR/AR microdisplay arena, focusing on advanced technologies like OLEDoS and LEDoS. Their strategic plan includes establishing a dedicated microdisplay base in Beijing, signaling a strong commitment to this sector.

The VR/AR market is experiencing robust growth, fueled by the increasing demand for immersive experiences and the burgeoning metaverse trend. This sector is projected to see substantial expansion in the coming years, creating a fertile ground for innovation.

Despite the market's potential, it remains relatively nascent, with BOE facing competition from established, specialized players. This competitive landscape means BOE's current market share in VR/AR microdisplays is likely modest, underscoring the need for substantial investment to secure a leading position.

Integrated IoT Solutions (Beyond Core Displays)

BOE Technology Group is actively transitioning from a display-centric company to a comprehensive innovation-oriented Internet of Things (IoT) solutions provider. This strategic pivot involves extending its offerings beyond core display technologies to encompass end-to-end IoT solutions.

The global market for end-to-end IoT solutions is experiencing robust expansion. In 2024, this market is valued at an estimated $1518 million and is projected to grow significantly, reaching $2771 million by 2031, highlighting a substantial growth opportunity.

While BOE benefits from its established display expertise, its position within the broader and highly fragmented IoT solutions market is still evolving. To achieve significant market share and leadership, strategic investments will be crucial for BOE to solidify its presence and offerings in this dynamic sector.

- Market Growth: The global IoT end-to-end solutions market is projected to grow from $1518 million in 2024 to $2771 million by 2031.

- Strategic Shift: BOE is moving beyond displays to become an innovation-oriented IoT firm.

- Market Position: BOE's share in the broad IoT solutions market is developing, necessitating strategic investments.

- Leveraging Strengths: BOE aims to utilize its display technology expertise to enhance its IoT solution offerings.

New Applications of Flexible Displays (e.g., Rollable, Transparent, Automotive)

BOE is actively demonstrating its prowess in flexible display technology with groundbreaking applications like a 31.6-inch rollable screen and advanced OLED intelligent cockpits. These innovations are poised to tap into burgeoning high-growth market segments, signaling a significant push beyond traditional display uses.

While BOE holds a strong leadership position in the flexible OLED panel manufacturing space, the commercial success and widespread adoption of these novel applications, such as transparent automotive displays, are still in their nascent stages. This necessitates considerable investment in market development and consumer education to fully realize their potential.

- Rollable Displays: BOE's 31.6-inch rollable screen represents a significant leap in display form factors, offering unprecedented flexibility for future consumer electronics and commercial signage.

- Automotive Integration: The development of OLED intelligent cockpits and transparent sunroofs showcases BOE's strategic focus on the automotive sector, a key growth area for advanced display technologies.

- Market Evolution: Despite BOE's established strength in OLED panel production, the market penetration for these highly innovative, flexible display applications is still developing, requiring ongoing R&D and market cultivation.

- Growth Potential: These new applications are designed to address emerging market needs, potentially creating substantial new revenue streams for BOE as adoption rates increase in the coming years.

BOE's ventures into smart healthcare and advanced sensors, while promising high growth, currently represent nascent market positions. Similarly, their VR/AR microdisplays and broader IoT solutions are in developing stages, requiring substantial investment to capture significant market share.

These areas are classified as question marks in the BCG matrix due to their high market growth potential coupled with BOE's relatively low current market share. Success hinges on strategic investment and market development to convert these opportunities into strong market positions.

For instance, the global IoT market, where BOE's sensors operate, is projected to grow significantly, with market values expected to rise from approximately $1.57 trillion in 2023 to over $2.5 trillion by 2027. BOE's smart healthcare, targeting a high-growth market, also presents a similar question mark profile.

The VR/AR market is also expanding rapidly, yet BOE's share in this still-developing sector is modest. The company's transition to an IoT solutions provider positions it within a market valued at an estimated $1518 million in 2024, with strong projected growth, but its current market penetration is still evolving.

BCG Matrix Data Sources

Our BOE Technology Group Co BCG Matrix is built on a robust foundation of market data, incorporating financial disclosures, industry growth forecasts, and competitive landscape analyses to provide strategic clarity.