BOE Technology Group Co Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BOE Technology Group Co Bundle

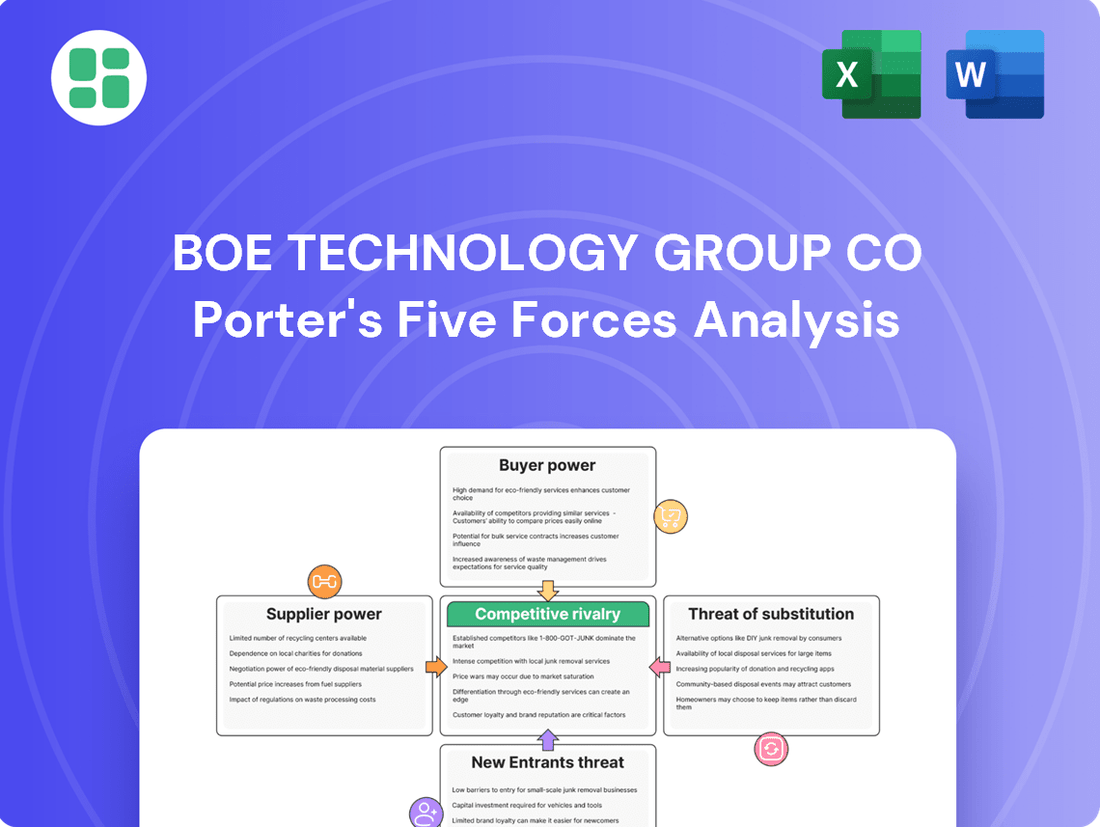

BOE Technology Group Co operates in a dynamic landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating the competitive electronics display market.

The complete report reveals the real forces shaping BOE Technology Group Co’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BOE Technology Group's reliance on a global supply chain for specialized materials like chemicals, glass substrates, and advanced semiconductor components for display manufacturing highlights the potential bargaining power of its suppliers. If a few dominant players control critical, proprietary technologies or high-purity materials essential for cutting-edge displays such as OLEDs and flexible screens, their leverage increases significantly.

The bargaining power of suppliers for BOE Technology Group is significantly influenced by the uniqueness of their inputs and the associated switching costs. When suppliers provide highly specialized components or materials that are critical to BOE's advanced display technologies, their leverage increases.

For instance, the development of cutting-edge flexible and foldable OLED displays relies on unique materials and manufacturing processes. These specialized inputs, often proprietary to a few suppliers, make it difficult and costly for BOE to switch to alternatives. This dependence grants these suppliers greater power in negotiations.

The substantial capital investment required for new production lines, such as BOE's 8.6th generation AMOLED line, further solidifies supplier power. These investments often involve long-term commitments with equipment manufacturers, embedding high switching costs and reinforcing the supplier's advantageous position.

The threat of suppliers integrating forward into display manufacturing, while not a widespread concern, could significantly bolster their bargaining power against companies like BOE Technology Group. Should a critical component supplier decide to enter the display production market, it would not only introduce direct competition but also potentially restrict BOE's access to essential materials, impacting their operational stability.

However, the immense capital investment required for advanced display manufacturing serves as a substantial barrier, deterring most component suppliers from pursuing such a strategic shift. For instance, establishing a new OLED fabrication line can cost billions of dollars, making it a prohibitive undertaking for many. This high entry cost effectively mitigates the immediate risk of widespread forward integration by suppliers in the display industry.

Supplier's Importance to BOE's Cost Structure

The bargaining power of suppliers for BOE Technology Group Co. is significantly influenced by how much their components contribute to BOE's total production costs. For example, if a key component like advanced display materials makes up a substantial percentage of the bill of materials for BOE's high-margin OLED panels, the supplier of these materials would possess considerable leverage. This leverage can translate into higher prices or less favorable terms for BOE.

BOE's strategic diversification across various product segments, including LCD, OLED, Internet of Things (IoT) devices, and healthcare solutions, is a key factor in managing supplier power. By not being overly reliant on any single product category, BOE can potentially spread its purchasing volume and reduce the dependence on any one supplier or group of suppliers. This broadens their sourcing options and provides flexibility in negotiations.

- Component Cost Impact: The proportion of a supplier's component cost within BOE's overall production expenses directly correlates with the supplier's bargaining power. For instance, critical materials for high-resolution displays, representing a significant portion of the cost, grant suppliers more leverage.

- Diversification as a Mitigator: BOE's strategy to diversify its product portfolio across LCD, OLED, IoT, and healthcare solutions helps dilute the impact of price increases from any single supplier segment, thereby reducing overall dependency.

- Supplier Concentration: The number of available suppliers for essential components is crucial; a limited supplier base for specialized materials increases their bargaining power over BOE.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts BOE Technology Group Co's bargaining power with its suppliers. If BOE can easily switch to alternative materials or technologies for its display manufacturing and other products, the power shifts towards BOE. For instance, if there are multiple suppliers offering comparable OLED panel components, BOE can negotiate better terms.

However, in areas requiring highly specialized or proprietary components, such as advanced micro-LED materials or unique sensor technologies, the limited availability of substitutes can empower suppliers. In 2024, the display industry continues to see innovation, but the supply chain for cutting-edge materials often involves a concentrated number of specialized producers, potentially increasing their leverage over companies like BOE.

- Limited Substitutes: In specialized segments of the display market, the scarcity of alternative materials or technologies grants suppliers greater bargaining power over BOE.

- Increased BOE Power: When readily available substitutes exist for a supplier's input, BOE's ability to negotiate favorable terms and prices is enhanced.

- 2024 Market Dynamics: The ongoing development in display technology means that while some components have multiple sourcing options, others remain highly specialized, influencing supplier leverage.

The bargaining power of suppliers for BOE Technology Group is influenced by the concentration of suppliers for critical components. A limited number of suppliers for specialized materials, such as those used in advanced OLED production, grants them significant leverage. For example, in 2024, the supply chain for certain high-purity chemicals essential for OLED manufacturing remains concentrated among a few global players, allowing them to command higher prices and stricter terms from display manufacturers like BOE.

BOE's ability to negotiate with suppliers is also tied to the availability of substitute inputs. While BOE's broad product portfolio, including LCD and IoT devices, offers some flexibility, the cutting-edge nature of its display technologies often means few viable alternatives exist for proprietary materials. This dependence on specialized inputs from a concentrated supplier base can lead to increased costs for BOE.

| Factor | Impact on BOE | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High | Limited suppliers for advanced OLED chemicals and equipment |

| Uniqueness of Inputs | High | Proprietary materials for flexible and foldable displays |

| Switching Costs | High | Significant investment in new production lines tied to specific equipment suppliers |

| Availability of Substitutes | Low for advanced components | Few alternatives for specialized micro-LED materials |

What is included in the product

This analysis unpacks the competitive intensity within the display technology market, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players impacting BOE Technology Group Co.

Effortlessly assess competitive intensity by visualizing the interplay of all five forces, streamlining strategic planning.

Quickly identify and prioritize areas of strategic vulnerability within BOE Technology Group's competitive landscape.

Customers Bargaining Power

BOE Technology Group's customer base is heavily concentrated among major global electronics brands, such as Huawei, Honor, Oppo, Nubia, and OnePlus. This concentration means a few large buyers account for a significant portion of BOE's revenue.

The substantial order volumes from these key smartphone manufacturers grant them considerable bargaining power. They can leverage their importance to negotiate more favorable pricing and contract terms, especially in a highly competitive display market where alternative suppliers exist.

Customers in the consumer electronics sector, including major brands, are acutely price-sensitive regarding display panels. They actively seek competitive pricing to protect their own product profit margins, especially in a market where consumer demand is heavily influenced by price points. For instance, in 2023, the average selling price for OLED panels saw fluctuations, with intense competition driving down costs for buyers.

Switching costs for BOE's customers can be substantial, involving the complex redesign and retesting of electronic devices to integrate new display technologies or suppliers. However, these costs are not insurmountable. If BOE’s competitors offer a significant price reduction or a superior technological advantage, such as higher refresh rates or improved energy efficiency, customers may indeed incur these switching costs to gain a competitive edge in their own product offerings.

Market trends underscore this pressure, with a relentless demand for higher resolutions, enhanced power efficiency, and lighter display designs. In 2024, the push for foldable displays and MicroLED technology is intensifying, requiring manufacturers like BOE to balance cutting-edge innovation with cost-effective production to meet customer expectations and maintain market share.

Large electronics brands, especially those with deep pockets, possess the potential to move into display manufacturing themselves. This threat, though requiring immense capital and specialized knowledge, empowers these customers to negotiate more forcefully with BOE Technology Group. For instance, in 2024, major smartphone manufacturers continued to explore deeper supply chain control, a trend that could intensify if display technology becomes more commoditized.

Availability of Alternative Display Suppliers

BOE Technology Group operates within a fiercely competitive display manufacturing landscape, where customers, primarily large electronics manufacturers, possess significant bargaining power due to the availability of numerous alternative suppliers. Major global players such as Samsung Display, LG Display, TCL Technology Group, and Japan Display are all vying for market share, presenting buyers with a wide array of choices. This intense competition directly translates into increased leverage for customers, allowing them to negotiate more favorable terms and pricing. For instance, in 2024, the global display market saw continued price pressures across various segments, including OLED and LCD panels, directly impacting supplier margins.

The sheer number of capable display manufacturers means that if BOE does not meet customer demands regarding price, quality, or delivery, clients can readily switch to competitors. This dynamic forces BOE to maintain competitive pricing strategies and invest heavily in technological innovation to differentiate its offerings. In 2023, the average selling price for certain LCD panel types experienced a decline, reflecting the intense market rivalry and its effect on profitability for suppliers like BOE.

- High Market Concentration of Competitors: With key players like Samsung Display, LG Display, and TCL Technology Group, customers have multiple high-quality alternatives.

- Price Sensitivity: Intense competition often leads to price wars, empowering customers to demand lower prices for display panels.

- Impact on Profitability: The bargaining power of customers can squeeze profit margins for display manufacturers like BOE, especially during periods of oversupply or slowing demand.

- Customer Loyalty Challenges: Without strong product differentiation or exclusive supply agreements, customer loyalty can be fragile, further enhancing their bargaining power.

Customer Knowledge and Product Differentiation

Customers' deep understanding of display technology and prevailing market prices significantly amplifies their bargaining leverage. This knowledge allows them to effectively negotiate terms and pricing, especially for more standardized products.

While BOE Technology Group Co. has made strides in differentiating its offerings with innovations like flexible and triple-foldable displays, alongside solutions in IoT and smart healthcare, the market for standard LCD panels remains largely commoditized. This commoditization inherently grants customers considerable power in their dealings with suppliers like BOE.

In 2024, the global display market continued to see intense price competition, particularly in the large-size LCD segment. For instance, average selling prices (ASPs) for certain LCD TV panels experienced fluctuations, with some reports indicating year-on-year declines in specific categories, underscoring the price sensitivity and bargaining power of buyers in these segments.

BOE's strategy to counter this includes focusing on high-value, differentiated products. However, the sheer volume and standardization of traditional display panels mean that customer power remains a critical factor in the overall profitability and market positioning of the company.

- Customer Awareness: Buyers possess strong knowledge of display technologies and market pricing, increasing their negotiation strength.

- Product Differentiation: BOE's innovations in flexible and foldable displays offer differentiation, but standard LCDs remain a key area of customer power.

- Market Dynamics: The commoditized nature of standard LCD panels allows customers to exert significant influence on pricing and terms.

- Competitive Landscape: Intense price competition in 2024, especially for LCDs, highlights the ongoing importance of customer bargaining power.

BOE's customers, primarily large electronics manufacturers, wield significant bargaining power due to the availability of numerous alternative suppliers and their own price sensitivity. This allows them to negotiate favorable terms, especially for commoditized products like standard LCD panels.

In 2024, the intense competition in the display market, particularly for large-size LCDs, saw fluctuating average selling prices, underscoring the leverage customers possess. BOE's efforts to differentiate with advanced technologies like foldable displays are crucial for mitigating this power.

The threat of customers vertically integrating into display manufacturing, coupled with their deep understanding of market pricing, further amplifies their negotiation strength. This dynamic necessitates BOE's continuous focus on cost-effectiveness and innovation to maintain its market position.

| Factor | Impact on BOE | Customer Leverage |

|---|---|---|

| Supplier Availability | High competition from Samsung Display, LG Display, etc. | Customers can easily switch to alternatives. |

| Price Sensitivity | Demand for lower prices to protect profit margins. | Customers leverage competition to drive down costs. |

| Switching Costs | Substantial but not insurmountable for customers. | Customers may switch for significant price or tech advantages. |

| Product Commoditization | Standard LCD panels are largely commoditized. | Customers have high power in negotiating terms for these products. |

Preview the Actual Deliverable

BOE Technology Group Co Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, detailing a comprehensive Porter's Five Forces analysis for BOE Technology Group Co. You'll gain insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally written analysis is ready for your immediate use, offering a complete and accurate representation of the market dynamics affecting BOE Technology Group Co.

Rivalry Among Competitors

The semiconductor display industry demands immense capital for fabrication plants and research, with BOE's investment in its 8.6th generation AMOLED line exemplifying this. These substantial fixed costs necessitate high capacity utilization for profitability.

This drive for high utilization often results in intense price competition, especially when the market experiences oversupply. For instance, in 2023, global display panel shipments saw fluctuations, and manufacturers were keen to keep their advanced production lines running at optimal levels, impacting pricing dynamics.

BOE Technology Group operates in highly competitive markets with numerous and diverse rivals. In the crucial display sector, major players like Samsung Display, LG Display, and TCL Technology Group consistently vie for market share, alongside specialists such as Japan Display.

Beyond displays, BOE faces competition in its expanding IoT, smart healthcare, and sensor technology segments. This arena includes a wide array of global tech giants and nimble, specialized companies, all pushing the boundaries of innovation.

This intense rivalry across all its business areas fuels a constant cycle of technological advancement and exerts significant downward pressure on pricing. For instance, the global display market, a key area for BOE, saw significant price fluctuations in 2024 due to oversupply in certain segments, directly impacting profitability for all participants.

BOE Technology Group operates in a market where growth in established areas like Liquid Crystal Displays (LCDs) is moderating. This slower expansion in mature segments intensifies rivalry as companies fight for a larger slice of a less rapidly expanding pie.

While emerging technologies such as OLED and MicroLED are showing robust growth, the overall flat panel display market is projected for a 6.2% compound annual growth rate between 2025 and 2034. This positive but not explosive growth rate fuels aggressive competition among existing players seeking to capture market share.

The sensor market, where BOE also has interests, is expected to grow at a slightly higher rate of 8.7% from 2025 to 2030. Even with this stronger growth, the presence of numerous established manufacturers means competition remains a significant factor.

High Exit Barriers

The display industry, including players like BOE Technology Group, faces extremely high exit barriers. This is primarily due to the massive capital investments required for manufacturing facilities and specialized equipment, often running into billions of dollars. For instance, setting up a state-of-the-art OLED fabrication plant can cost upwards of $10 billion.

These substantial sunk costs make it incredibly difficult and financially unviable for companies to simply shut down or repurpose their operations during market downturns. Consequently, even when facing overcapacity and reduced profitability, firms are compelled to continue operating, intensifying competitive rivalry.

- High Capital Intensity: Display manufacturing fabs represent enormous capital outlays, making closure prohibitively expensive.

- Specialized Assets: Equipment and facilities are highly specialized, limiting alternative uses and resale value.

- Prolonged Competition: Companies remain in the market despite adverse conditions, leading to sustained price competition and potential oversupply.

Product Differentiation and Innovation Pace

Competitive rivalry in the display technology sector, including for BOE Technology Group, is intensely fueled by the relentless pace of innovation. Companies are continuously bringing to market new display types like flexible, foldable, and MicroLED panels, alongside advancements in resolution such as 4K and 8K, and enhanced energy efficiency. For instance, in 2024, the demand for advanced display technologies in smartphones and wearables continued to drive significant R&D investment across the industry.

BOE's strategic approach to differentiation involves not only its core display business but also a strong push into emerging areas. This includes significant investments and product development in the Internet of Things (IoT), smart healthcare solutions, and various sensor technologies. This diversification aims to create unique value propositions and maintain a competitive edge in a rapidly evolving market landscape.

The industry sees a constant stream of new product introductions, making it challenging for any single player to maintain a dominant position without continuous R&D. BOE's commitment to developing next-generation display technologies and expanding into adjacent high-growth sectors is crucial for navigating this competitive environment.

- Innovation as a Differentiator: Companies compete by introducing novel display technologies like foldable screens and MicroLED.

- BOE's Diversification Strategy: BOE expands beyond displays into IoT, smart healthcare, and sensor technology to stand out.

- Market Dynamics: The rapid introduction of new display features and resolutions intensifies competition.

Competitive rivalry within the display industry is exceptionally fierce, driven by a concentrated number of large, global players like Samsung Display, LG Display, and TCL Technology, all vying for market share. BOE Technology Group is a significant participant in this arena, constantly challenged by these established competitors and other specialized firms. This intense competition is further exacerbated by the high capital intensity of the industry, where immense investments in fabrication plants create substantial exit barriers, forcing companies to remain operational even during periods of oversupply.

The drive for high capacity utilization in these capital-intensive operations leads to aggressive pricing strategies, particularly when the market experiences an oversupply of panels. For example, in 2023 and continuing into 2024, fluctuations in global display panel shipments pressured manufacturers to maintain production levels, directly impacting pricing dynamics. BOE's diversification into IoT, smart healthcare, and sensor technologies also places it in highly competitive segments, facing both established tech giants and agile specialists.

Innovation is a critical battleground, with companies like BOE continuously introducing new display technologies such as foldable and MicroLED panels, alongside advancements in resolution and energy efficiency. The global display market, while projected for modest growth, sees intense competition as firms fight for incremental market share increases. For instance, the sensor market, another area of BOE's interest, is expected to grow at approximately 8.7% annually from 2025 to 2030, but this growth still occurs within a competitive landscape populated by numerous manufacturers.

| Key Competitors in Display Technology | Primary Focus | Market Position (General) |

| Samsung Display | OLED, QD-OLED | Market leader in premium displays |

| LG Display | OLED, LCD | Strong presence in OLED TVs and premium LCDs |

| TCL Technology Group | LCD, Mini-LED | Significant player in LCD market, expanding into advanced technologies |

| Japan Display | LCD, OLED (specialty) | Focus on automotive and high-end mobile displays |

SSubstitutes Threaten

While LCD and OLED currently dominate the display market, emerging technologies like MicroLED and quantum dot displays represent a growing threat of substitutes for BOE Technology Group. These advanced displays offer enhanced brightness, superior contrast ratios, and improved energy efficiency, key performance differentiators that could attract consumers and businesses seeking cutting-edge visual experiences.

Although MicroLED and quantum dot technologies are presently priced at a premium, ongoing research and development are steadily driving down production costs. For instance, by 2024, the cost of MicroLED panels, while still high, has seen a noticeable reduction compared to earlier years, making them increasingly viable for premium applications. This trend suggests a future where these substitutes could become more accessible, directly impacting BOE's market share in its core display segments.

Non-display information interfaces present a potential threat of substitution for traditional screens in certain applications. For instance, voice-controlled assistants like Amazon Alexa or Google Assistant can fulfill information retrieval and task execution needs without a visual display. Haptic feedback systems, which provide tactile responses, also offer an alternative way to convey information, particularly in user interaction. Projection technologies, while still niche, could also substitute for screens in specific environments.

The increasing sophistication of these non-display interfaces suggests a growing capability to replace screen-based interactions. While a complete replacement of displays across all applications is improbable, their advancement in specific contexts could indeed diminish the demand for traditional screens. For example, in automotive interiors, voice commands are increasingly handling functions previously requiring screen interaction, reducing driver distraction. The global market for smart speakers, a prime example of voice interface adoption, was projected to reach over $15 billion in 2024, indicating significant consumer acceptance.

Traditional medical devices and manual healthcare processes serve as substitutes for BOE's smart healthcare solutions. For instance, while BOE offers advanced remote patient monitoring systems, a patient might still opt for periodic in-person doctor visits and manual data logging, representing a substitute.

However, the market is increasingly favoring smart healthcare. By 2024, the global digital health market was valued at over $300 billion, with a significant portion driven by telehealth and remote monitoring solutions, indicating a strong shift away from traditional methods.

This trend is further amplified by the demand for AI-powered diagnostics and integrated connected care platforms, which offer enhanced efficiency and patient outcomes, thereby diminishing the threat posed by older, less sophisticated alternatives.

Generic Sensors vs. Advanced Sensor Technology

Generic sensors, while potentially cheaper, often lack the precision and specialized features required by industries like automotive and advanced electronics, making them less viable substitutes for BOE's offerings. The global sensor market, projected to reach approximately $117.7 billion by 2027, highlights a strong demand for sophisticated, high-performance solutions. This trend indicates that while basic sensors exist, they do not adequately replace the advanced capabilities BOE provides, especially as IoT and AI applications proliferate.

The increasing integration of sensors into complex systems like autonomous driving and smart home devices necessitates advanced functionalities such as miniaturization, enhanced accuracy, and robust connectivity. These are areas where generic sensors typically fall short. For instance, the automotive sensor market alone was valued at over $30 billion in 2023, with a significant portion dedicated to advanced sensor types like LiDAR and radar, directly competing with less sophisticated alternatives.

- Limited functionality of generic sensors compared to BOE's advanced solutions.

- Strong market growth in advanced sensor segments, indicating preference for sophisticated technology.

- Key industries like automotive and IoT demand specialized sensor capabilities that generic options cannot meet.

Shift in User Interaction Paradigms

The evolving landscape of human-computer interaction presents a significant threat of substitutes for BOE Technology Group's traditional display products. The rise of augmented reality (AR) and virtual reality (VR) headsets, while still utilizing displays, offers a fundamentally different user experience that could divert demand from conventional flat screens in immersive applications. For instance, by 2024, the global AR/VR market was projected to reach hundreds of billions of dollars, indicating a substantial shift in how users engage with digital content.

These new interaction paradigms, such as AR overlays and fully immersive VR environments, can substitute for the need for traditional displays in gaming, training simulations, and collaborative work. While BOE is actively involved in developing advanced display technologies for these emerging sectors, the shift in user preference towards these more interactive and spatial computing experiences poses a direct challenge to their established market share in traditional display formats.

- AR/VR Headset Market Growth: The global AR/VR market is experiencing rapid expansion, with projections indicating significant growth through 2025, potentially impacting demand for traditional displays.

- User Experience Shift: The immersive and interactive nature of AR/VR offers a compelling alternative to passive viewing on flat screens for specific applications.

- Technological Integration: While AR/VR still require displays, the integration of these displays into head-mounted devices creates a distinct product category and user interaction paradigm.

Emerging display technologies like MicroLED and quantum dot displays are becoming increasingly competitive substitutes for BOE's current offerings. These advanced displays provide superior brightness and contrast, appealing to users seeking enhanced visual experiences. By 2024, the cost of MicroLED panels has seen a notable decrease, making them a more viable alternative in the premium segment.

Non-display interfaces, such as voice assistants and haptic feedback systems, are also substituting for traditional screens in specific applications. For instance, voice commands are reducing the reliance on screens in automotive interiors. The global smart speaker market, a key indicator of voice interface adoption, was projected to exceed $15 billion in 2024.

The threat of substitutes is further amplified by the growth of AR/VR technologies, which offer immersive interaction paradigms that can divert demand from conventional flat screens. The global AR/VR market was projected to reach hundreds of billions of dollars by 2024, highlighting a significant shift in user engagement with digital content.

| Substitute Technology | Key Differentiators | Market Trend/Data (as of 2024) | Impact on BOE |

|---|---|---|---|

| MicroLED Displays | Higher brightness, superior contrast, energy efficiency | Cost reduction making them viable for premium applications | Potential to capture market share in high-end segments |

| Quantum Dot Displays | Enhanced color accuracy, improved brightness | Growing adoption in premium TVs and monitors | Competition in the high-performance display market |

| Voice Assistants | Hands-free operation, reduced visual reliance | Smart speaker market projected over $15 billion | Reduced demand for screens in specific interaction scenarios |

| AR/VR Headsets | Immersive, interactive experiences | Global market projected in hundreds of billions | Shift in user preference away from traditional flat screens for certain applications |

Entrants Threaten

The semiconductor display industry presents a formidable barrier to entry due to its exceptionally high capital intensity. Building a state-of-the-art fabrication plant, or fab, for advanced displays can easily cost upwards of $10 billion, a sum that deters most aspiring newcomers.

This massive financial requirement means that only well-established companies with substantial financial backing can even consider entering the market. For instance, in 2024, companies like Samsung Display and LG Display continue to invest billions in upgrading their OLED and advanced LCD technologies, reinforcing the existing high-cost structure.

The threat of new entrants for BOE Technology Group Co. is significantly mitigated by the immense research and development costs involved in display technology. Developing advanced solutions like flexible OLEDs or MicroLEDs demands substantial, ongoing investment. For instance, the global display industry's R&D spending is in the billions annually, a figure that would be a formidable barrier for any newcomer aiming to compete with established giants like BOE.

BOE Technology Group, a major player in the display industry, benefits immensely from economies of scale. Their massive production volumes allow for lower per-unit costs in manufacturing and raw material procurement, a significant barrier for any newcomer. For instance, in 2024, BOE's extensive supply chain and optimized production lines enable them to achieve cost efficiencies that are difficult for smaller, less established firms to replicate.

Strong Intellectual Property and Patent Portfolios

The display and semiconductor industries are built on a foundation of robust intellectual property (IP). Companies like BOE Technology Group Co. possess extensive patent portfolios that safeguard their manufacturing processes and product innovations. For instance, in 2023, BOE was involved in several patent litigations, underscoring the critical role of IP in this sector.

New entrants into these markets face a significant hurdle in acquiring or developing their own proprietary technology. Alternatively, they must engage in costly and complex licensing agreements with existing IP holders. This intellectual property barrier can be a substantial deterrent, making it difficult for new players to compete effectively against established giants.

- Intellectual Property Dominance: Established players hold vast patent portfolios, creating a high barrier to entry.

- Patent Disputes: Litigation, such as that involving BOE in 2023, highlights the value and contested nature of IP in the industry.

- Licensing Challenges: New entrants must either develop novel technology or secure expensive licenses, both of which are significant deterrents.

- Innovation Costs: The substantial investment required for R&D to create unique IP can be prohibitive for startups.

Established Supply Chains and Distribution Channels

BOE Technology Group Co. benefits significantly from its deeply entrenched supply chains and extensive distribution networks, creating a formidable barrier for potential new entrants. These established relationships with key suppliers and a global logistics infrastructure for its diverse display and IoT products mean that newcomers must invest heavily and spend considerable time replicating these critical operational aspects. For instance, securing the necessary components and ensuring timely delivery to major electronics manufacturers, a core strength for BOE, is a complex undertaking that new players would find challenging to navigate efficiently. This existing infrastructure significantly raises the cost and complexity for any company looking to enter the market and compete effectively.

New entrants face the daunting task of building these vital supplier relationships and distribution channels from the ground up. This process is not only time-consuming but also capital-intensive, requiring substantial upfront investment to gain the trust and secure the capacity of component manufacturers and logistics providers. Consequently, the ability of BOE to leverage its existing, robust supply chain and distribution capabilities acts as a significant deterrent, making it difficult for new competitors to achieve effective market penetration and scale their operations rapidly.

- Established Supplier Relationships: BOE has cultivated long-standing partnerships with key component suppliers, ensuring a stable and cost-effective supply of materials for its extensive product lines.

- Global Distribution Network: The company possesses a well-developed global network for distributing its display and IoT products to a wide array of major electronics brands worldwide.

- High Entry Costs: New entrants would need to invest substantial resources to build similar supplier relationships and distribution channels, increasing the financial barrier to market entry.

- Time-Consuming Setup: Replicating BOE's established operational infrastructure would require a significant amount of time, hindering a new company's ability to quickly gain market traction.

The threat of new entrants for BOE Technology Group Co. is considerably low due to the immense capital required to establish advanced display manufacturing facilities. Building a new, cutting-edge fab can cost upwards of $10 billion, a figure that presents a significant hurdle for potential competitors. For example, in 2024, industry giants like Samsung Display and LG Display continue their multi-billion dollar investments in next-generation display technologies, reinforcing the high entry cost structure.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BOE Technology Group Co. leverages a comprehensive dataset including annual reports, investor presentations, and financial filings from regulatory bodies like the SEC. We also incorporate industry-specific market research reports and analyses from reputable financial news outlets to capture a holistic view of the competitive landscape.