BNP Paribas PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNP Paribas Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping BNP Paribas's trajectory. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate challenges and seize opportunities. Download the full version now to gain a decisive market advantage.

Political factors

The stability of government policies and the regulatory environment are crucial for BNP Paribas. Shifts in political leadership or policy priorities, like changes in fiscal or monetary strategies, directly affect the banking sector's profitability and growth potential. For instance, during 2024, the European Central Bank's monetary policy decisions, including interest rate adjustments, significantly influenced lending volumes and net interest margins across major European banks, including BNP Paribas.

BNP Paribas actively monitors these political and regulatory shifts to adapt its business strategies and maintain compliance. Evolving national and international frameworks, such as those related to capital requirements (e.g., Basel IV implementation progress) or environmental, social, and governance (ESG) regulations, necessitate continuous strategic adjustments. In 2025, the ongoing focus on digital asset regulation and cybersecurity frameworks will likely present both challenges and opportunities for financial institutions like BNP Paribas.

Global geopolitical tensions, including ongoing trade disputes and regional conflicts, significantly impact international banking groups like BNP Paribas. These events introduce market volatility and economic uncertainties, affecting everything from investment strategies to client confidence. For instance, the ongoing trade friction between major economic blocs can disrupt global supply chains and alter investment flows, directly influencing the demand for banking services.

The imposition of tariffs, embargoes, and sanctions by governments creates direct challenges. These measures can disrupt international trade, affecting BNP Paribas' clients across various sectors. In 2024, the global trade landscape continues to be shaped by these policies, requiring banks to meticulously adjust their risk management frameworks and financing activities to navigate these complexities and support their clients effectively.

BNP Paribas, like other global financial institutions, faces significant operational hurdles due to the evolving landscape of international sanctions. The bank must meticulously adhere to a growing number of sanctions regimes, such as those imposed by the US Treasury Department's Office of Foreign Assets Control (OFAC) and the European Union. Failure to comply can result in substantial fines; for instance, in 2023, several major banks collectively paid billions in penalties for sanctions violations, highlighting the financial and reputational stakes.

Financial diplomacy, the use of financial tools and agreements to achieve foreign policy objectives, further complicates matters. BNP Paribas must remain agile, adapting its compliance strategies to shifts in geopolitical alliances and trade policies. The bank's commitment to robust anti-money laundering (AML) and counter-terrorism financing (CTF) frameworks, reinforced by ongoing training and technological investments, is crucial for mitigating these risks across its extensive international network.

Government Support and Intervention in the Financial Sector

Government attitudes toward the financial sector significantly shape BNP Paribas' operational landscape. In 2024 and 2025, European governments are likely to continue their focus on financial stability and economic growth, potentially leading to supportive measures for key institutions like BNP Paribas. This support could manifest through initiatives aimed at bolstering lending to strategic industries or managing sovereign debt exposures.

BNP Paribas' role as a major European bank means its activities are often intertwined with national and supranational policy objectives. For instance, initiatives like the European Central Bank's Targeted Longer-Term Refinancing Operations (TLTROs) or national programs to support small and medium-sized enterprises (SMEs) directly influence the bank's cost of funding and lending opportunities. As of early 2025, the ongoing efforts to deepen the Banking Union and Capital Markets Union could introduce new regulatory frameworks that impact capital requirements and business models.

- Government Intervention in Financial Stability: Following the banking stresses of 2023, European governments and regulators are prioritizing robust oversight. This includes potential capital buffer adjustments or enhanced stress testing requirements for systemically important financial institutions (SIFIs) like BNP Paribas, aiming to prevent future crises.

- Support for Strategic Sectors: Policies designed to accelerate the green transition or digital transformation in Europe are likely to see continued government backing. BNP Paribas, as a significant lender, will be positioned to benefit from and contribute to these initiatives, potentially through preferential financing or investment programs.

- Regulatory Harmonization: Ongoing efforts to harmonize financial regulations across the EU, particularly in areas like digital finance and sustainable finance, will continue to shape BNP Paribas' compliance and strategic planning. The implementation of new directives or regulations in 2024-2025 could present both challenges and opportunities for the bank.

Political Stability in Key Operating Markets

Political stability in BNP Paribas' key operating markets is a cornerstone for sustained business operations and investor trust. For instance, the bank has a significant presence in France and Italy, both of which have experienced varying degrees of political shifts. In 2024, France's political climate, particularly leading up to potential elections, is a key consideration, as it can influence regulatory frameworks and economic policies impacting the financial sector.

Instability, whether through social unrest, geopolitical tensions, or abrupt changes in government policy, poses direct threats. These can manifest as economic downturns, volatile currency exchange rates affecting international transactions, and a general increase in operational risks. For example, in 2023, certain emerging markets where BNP Paribas has exposure saw increased political uncertainty, leading to heightened risk premiums on investments.

BNP Paribas actively monitors the political and regulatory landscapes across its global footprint to mitigate potential disruptions. This involves detailed risk assessments of countries like Germany, Belgium, and the United States, evaluating factors such as election outcomes, legislative changes, and trade policy developments. Such diligence informs strategic decisions on market entry, capital allocation, and client service delivery, ensuring resilience against political volatility.

- France's political outlook in 2024 is closely watched due to its impact on EU economic policy and banking regulations.

- BNP Paribas' exposure to Italy means it must navigate the nation's evolving political stability, which can affect sovereign debt and market sentiment.

- In 2023, geopolitical events in Eastern Europe underscored the importance of assessing country-specific political risks for financial institutions.

- The bank's proactive political risk analysis helps anticipate and adapt to potential policy shifts that could affect its profitability and operational efficiency.

Government policies on financial stability and economic growth are key for BNP Paribas, with European governments focusing on robust oversight and potential capital adjustments for institutions like BNP Paribas. Support for green and digital transitions offers financing opportunities.

Regulatory harmonization across the EU, especially concerning digital and sustainable finance, will continue to shape the bank's strategies through 2024-2025. Political stability in France and Italy remains a critical factor influencing market sentiment and regulatory frameworks.

Geopolitical events in 2023 highlighted the importance of assessing country-specific political risks, prompting BNP Paribas to conduct detailed risk analyses in its key operating markets like Germany and the United States to ensure resilience.

| Political Factor | Impact on BNP Paribas | 2024/2025 Relevance |

|---|---|---|

| Government Support for Green Transition | Potential for increased lending and investment in sustainable projects. | Continued government initiatives in the EU to accelerate green finance. |

| EU Regulatory Harmonization (Digital Finance) | Challenges in compliance, but opportunities for innovation in digital services. | Ongoing implementation of new digital asset and cybersecurity regulations. |

| Political Stability in France | Influences regulatory environment and economic policies affecting the banking sector. | Key consideration due to France's role in EU economic policy. |

| Sanctions Regimes (e.g., OFAC, EU) | Operational hurdles and significant compliance risks, with potential for large fines. | Increasing complexity of sanctions necessitates robust AML/CTF frameworks. |

What is included in the product

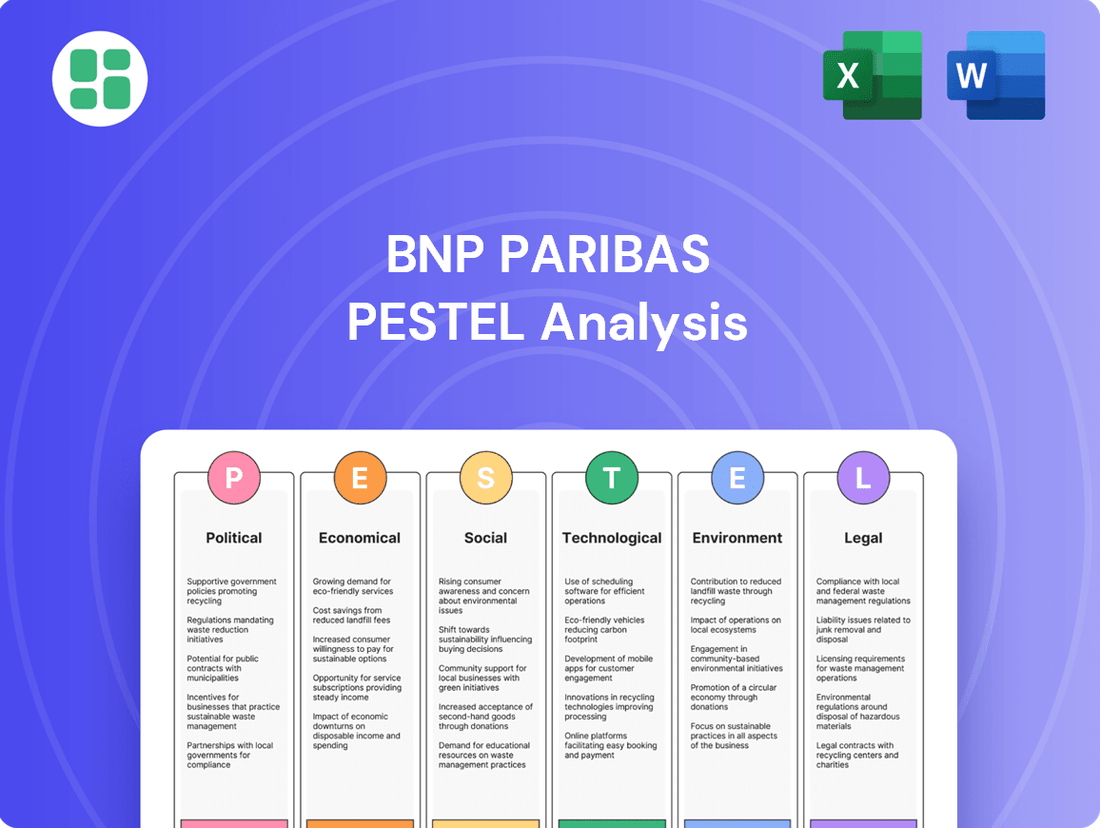

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing BNP Paribas, providing a comprehensive overview of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting BNP Paribas.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences on BNP Paribas.

Economic factors

The global interest rate environment significantly shapes BNP Paribas' financial performance, particularly its net interest margin and overall lending profitability. Central bank policies are the primary drivers of these rates, and their decisions directly impact how much the bank earns from its lending activities.

Anticipated interest rate cuts by major central banks, with projections pointing towards late 2025, could provide a tailwind for leveraged asset classes. This shift in monetary policy may also influence BNP Paribas' investment strategies, potentially encouraging a more risk-on approach.

BNP Paribas actively monitors these evolving rate movements to strategically optimize its balance sheet and refine its product offerings. For instance, in early 2024, the European Central Bank maintained its key interest rates, reflecting ongoing efforts to manage inflation while signaling potential future adjustments.

Inflationary pressures and economic growth are crucial for BNP Paribas. Stronger growth typically boosts demand for banking services and improves borrower repayment capacity. However, persistent inflation can erode purchasing power and increase operating costs for the bank.

Global economic growth demonstrated resilience through 2024, with many economies outperforming initial expectations. For instance, the IMF projected global growth at 3.2% for both 2024 and 2025. Despite this overall strength, significant regional variations exist, and a general deceleration is anticipated heading into 2025, requiring strategic adjustments from BNP Paribas.

Fluctuations in currency exchange rates directly affect BNP Paribas' international revenues, the valuation of its global assets, and the cost of its cross-border transactions. For instance, a stronger Euro could reduce the value of earnings generated in US dollars when translated back into Euros, impacting reported profits.

As a major global banking group with operations spanning numerous countries, effectively managing foreign exchange risk is paramount to maintaining financial stability and ensuring consistent profitability. BNP Paribas reported €1.3 billion in net banking income from its international retail and international financial services segments in Q1 2024, highlighting the significant impact currency swings can have.

The bank's global markets division is instrumental in this regard, offering sophisticated solutions for hedging and financing across a diverse array of currencies and geographies. This includes providing clients with tools to mitigate the impact of adverse currency movements on their own international business activities.

Credit Market Conditions and Liquidity

Global credit market conditions significantly impact BNP Paribas' core operations, particularly its lending and investment banking arms. The availability and cost of credit, alongside overall market liquidity, directly influence the bank's ability to originate loans and underwrite deals. For instance, widening credit spreads can signal increased risk aversion among investors, potentially making it more expensive for BNP Paribas to secure funding or for its clients to borrow.

BNP Paribas actively manages its exposure to these conditions by closely monitoring key indicators like credit spreads and the looming maturity walls for corporate debt. By understanding these dynamics, the bank can proactively adjust its financing strategies, ensuring it maintains adequate liquidity to meet its obligations and capitalize on market opportunities. This adaptability is crucial in navigating the inherent volatility of financial markets.

Recent trends suggest an improving risk outlook for many companies, as evidenced by the progress made in addressing debt maturities scheduled for 2025 and 2026. This positive development in the credit markets generally translates to a more favorable operating environment for banks like BNP Paribas, potentially leading to lower funding costs and increased demand for credit products.

Key indicators to watch for BNP Paribas include:

- Credit Spreads: Observing the difference in yield between corporate bonds and government bonds provides insight into perceived credit risk. For example, the average investment-grade corporate bond spread over Treasuries in early 2024 has shown some tightening compared to previous periods, indicating improved credit sentiment.

- Liquidity Levels: Monitoring measures like the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) showcases the bank's ability to meet short-term and long-term obligations. BNP Paribas consistently reports strong LCR figures, often exceeding regulatory minimums, demonstrating robust liquidity.

- Maturity Walls: Analyzing the concentration of debt maturities in upcoming years helps assess potential refinancing risks for clients and the market. The reduction in the size of the 2025 and 2026 maturity walls for many sectors reflects successful deleveraging or refinancing activities by corporations.

- Central Bank Policies: Interest rate decisions and quantitative easing/tightening programs by major central banks like the ECB and Federal Reserve directly influence credit availability and cost, impacting BNP Paribas' profitability and risk management.

Consumer Spending and Corporate Investment Trends

Consumer spending remains a crucial driver for BNP Paribas, impacting demand across its retail and corporate banking arms. For instance, in Q1 2024, retail sales in the Eurozone saw a modest increase of 0.5% year-on-year, indicating continued consumer activity that supports lending and transaction volumes for the bank. Corporate investment trends are equally vital; as businesses expand or invest in new projects, they engage BNP Paribas for financing and advisory services. A notable trend is the increasing allocation of capital towards environmental, social, and governance (ESG) initiatives, with corporate investment in green technologies projected to grow significantly in the coming years.

BNP Paribas is actively adapting to these shifts. The bank's commitment to sustainable finance is evident in its growing portfolio of green bonds and loans, supporting clients' transition to low-carbon economies. In 2023, BNP Paribas facilitated over €30 billion in sustainable finance, demonstrating its role in shaping corporate investment towards ESG goals. This strategic focus allows the bank to offer tailored solutions that align with both market opportunities and evolving client priorities in areas like renewable energy and circular economy projects.

- Consumer spending growth in the Eurozone averaged 0.4% quarter-on-quarter in the first half of 2024, boosting transaction volumes for retail banking services.

- Corporate investment in sustainable infrastructure is projected to reach $2 trillion globally by 2025, creating significant opportunities for BNP Paribas' corporate and investment banking divisions.

- BNP Paribas reported a 15% increase in its sustainable finance activities in 2023 compared to 2022, reflecting growing client demand for ESG-aligned financial products.

- The bank's advisory services for clients undertaking digital transformation projects saw a 10% rise in demand during 2024, highlighting the impact of technological investment trends.

Economic growth trends and inflation levels directly influence BNP Paribas' revenue streams and operational costs. While global growth showed resilience in 2024, a projected slowdown into 2025 necessitates strategic adaptation. Higher inflation can compress margins, whereas strong economic activity generally boosts demand for banking services.

Interest rate policies by central banks, such as the ECB's stance in early 2024, are pivotal for BNP Paribas' net interest margin. Anticipated rate cuts later in 2025 could encourage more risk-taking, impacting investment strategies and potentially boosting asset classes.

Currency fluctuations significantly affect BNP Paribas' international earnings and asset valuations. The bank's global markets division actively manages this exposure, as seen in its Q1 2024 international retail and financial services income of €1.3 billion.

Credit market conditions dictate the cost and availability of funding for BNP Paribas and its clients. Improving credit sentiment, with reduced corporate debt maturity walls for 2025-2026, generally creates a more favorable operating environment.

| Economic Factor | 2024/2025 Data/Trend | Impact on BNP Paribas |

|---|---|---|

| Global Economic Growth | Resilient in 2024 (IMF projecting 3.2%), but decelerating into 2025. | Influences demand for loans, transaction volumes, and corporate investment. |

| Inflation | Persistent pressures noted, impacting purchasing power and operating costs. | Can erode margins if not passed on; influences interest rate expectations. |

| Interest Rates | ECB maintained rates in early 2024; cuts anticipated late 2025. | Directly impacts net interest margin and profitability of lending. |

| Currency Exchange Rates | Fluctuations impact international revenues and asset valuations. | Requires active management of foreign exchange risk to stabilize earnings. |

| Credit Spreads | Tightening observed for investment-grade corporate bonds in early 2024. | Lower spreads suggest reduced borrowing costs and improved credit sentiment. |

Preview the Actual Deliverable

BNP Paribas PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of BNP Paribas provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping BNP Paribas's strategic landscape.

Sociological factors

Customer demographics are shifting, with younger, digitally native generations increasingly expecting intuitive, mobile-first banking. BNP Paribas is responding by investing heavily in its digital platforms and forging alliances with innovative fintech companies to meet these evolving demands and stay ahead in the competitive landscape.

The demand for personalized banking solutions, powered by artificial intelligence, is a significant trend. BNP Paribas's focus on AI-driven services aims to create tailored experiences, which are crucial for attracting and keeping customers in today's market. For instance, in 2024, many banks reported a significant increase in mobile banking usage, with some seeing over 70% of transactions conducted via app.

Societal emphasis on financial literacy and inclusion directly influences BNP Paribas' approach to responsible banking and product innovation. The bank actively strives to make financial services both accessible and comprehensible, backing programs designed to enhance financial well-being for a broad range of customers.

BNP Paribas' dedication to this area was recognized when Euromoney awarded them the title of 'World's Best Bank for Financial Inclusion' in 2024, highlighting their significant efforts in this domain.

The banking sector, including BNP Paribas, is navigating significant shifts in workforce dynamics. Remote and hybrid work models are now standard, impacting how talent is managed and developed. Employees increasingly seek purpose-driven roles, pushing financial institutions to emphasize their commitment to sustainability and social responsibility.

BNP Paribas is actively responding to these changes by investing in its workforce. For instance, its Sustainability Academy aims to equip employees with the necessary skills in areas like ESG (Environmental, Social, and Governance) and sustainable finance, reflecting the growing demand for expertise in these fields. This focus is vital for aligning employee capabilities with the bank's strategic objectives.

Attracting and retaining top talent remains a key challenge, particularly in specialized areas such as artificial intelligence (AI) and green finance. In 2024, the demand for AI specialists in finance saw a significant surge, with some reports indicating a 30% increase in job postings for AI-related roles within the financial services industry compared to the previous year. BNP Paribas' ability to secure these critical skill sets will be instrumental in its future success and innovation.

Ethical Consumerism and Responsible Banking

The rise of ethical consumerism and increasing investor demand for responsible banking are significant sociological forces shaping BNP Paribas. These trends compel the bank to embed Environmental, Social, and Governance (ESG) criteria deeply into its operations and product development.

BNP Paribas demonstrates a strong commitment to sustainable finance, actively working to align its credit portfolio with net-zero pathways and facilitate the shift towards a low-carbon economy. This dedication is evident in its robust performance in the sustainable bonds and loans markets.

- ESG Integration: Growing consumer and investor preference for ethical practices is driving BNP Paribas to prioritize ESG factors in its decision-making.

- Sustainable Finance Growth: In 2023, BNP Paribas issued €30 billion in green and sustainable bonds, reflecting market demand and the bank's commitment.

- Net-Zero Ambitions: The bank aims to have 100% of its energy sector financing aligned with net-zero trajectories by 2030, a key response to societal expectations.

Public Trust in Financial Institutions

Public trust in financial institutions is a cornerstone of a stable economy, and its erosion can have significant repercussions. Factors like past financial crises, the ethical behavior of institutions, and their perceived contribution to society all play a role in shaping this trust. For instance, a 2023 survey indicated that while trust in banks has seen some recovery, it remains a key concern for consumers globally, with transparency and ethical practices being paramount.

BNP Paribas actively works to bolster this trust by strengthening its compliance systems and prioritizing transparency in all its dealings. The bank understands that maintaining client confidence, employee loyalty, and public goodwill is essential for long-term success. This commitment is evident in its integrated reporting, which details the bank's efforts to generate economic and social value.

BNP Paribas's focus on responsible business practices aims to rebuild and sustain public confidence. For example, in 2024, the bank announced enhanced ESG (Environmental, Social, and Governance) reporting standards, providing greater clarity on its social impact and ethical frameworks. This proactive approach is crucial in an era where stakeholders increasingly scrutinize corporate behavior beyond financial performance.

- 2024 ESG Reporting: BNP Paribas committed to improving its ESG disclosures, aiming for greater transparency on social impact and ethical governance.

- Client Confidence: The bank's emphasis on compliance and transparency is designed to foster and maintain trust among its diverse client base.

- Societal Contribution: BNP Paribas highlights its role in creating economic value and contributing positively to society through its operations and initiatives.

- Past Crisis Impact: Acknowledging the lingering effects of past financial downturns, the bank prioritizes ethical conduct to rebuild public faith.

Societal expectations are increasingly pushing financial institutions towards greater social responsibility and ethical conduct. BNP Paribas is responding by embedding Environmental, Social, and Governance (ESG) principles into its core strategy, recognizing that long-term value creation is tied to societal well-being.

The bank's commitment to financial inclusion and literacy is a direct response to societal demands for more accessible and understandable financial services. BNP Paribas actively supports initiatives aimed at empowering individuals with the knowledge and tools to manage their finances effectively.

Workforce dynamics are also a key sociological factor, with employees seeking purpose-driven careers and flexible work arrangements. BNP Paribas is adapting by investing in employee development, particularly in areas like sustainable finance, to meet these evolving expectations and attract top talent.

| Sociological Factor | BNP Paribas' Response | Supporting Data/Initiative |

|---|---|---|

| Ethical Consumerism & Investor Demand | Prioritizing ESG integration in operations and product development. | Issued €30 billion in green and sustainable bonds in 2023. |

| Financial Inclusion & Literacy | Making financial services accessible and comprehensible; supporting financial well-being programs. | Recognized as 'World's Best Bank for Financial Inclusion' by Euromoney in 2024. |

| Workforce Expectations (Purpose & Flexibility) | Investing in employee development (e.g., Sustainability Academy) and adapting to hybrid work models. | Focus on ESG skills development for employees. |

| Public Trust in Financial Institutions | Strengthening compliance, prioritizing transparency, and enhancing ESG reporting. | Committed to improving ESG disclosures in 2024 for greater transparency. |

Technological factors

BNP Paribas is heavily invested in the digitalization of its banking services, viewing it as a crucial strategic driver. This focus translates into developing user-friendly mobile platforms and robust digital identity solutions to streamline customer interactions and enhance security. The bank's objective is to provide seamless, integrated digital experiences that cater to the evolving digital habits of its clientele.

In 2023, BNP Paribas reported a significant increase in its digital customer base, with over 80% of its retail clients actively using its digital channels. This trend is expected to continue, driven by ongoing investments in AI and data analytics to personalize services and improve operational efficiency. For instance, the group aims to further automate customer onboarding processes, reducing processing times by up to 30% by the end of 2024.

BNP Paribas faces escalating cybersecurity threats, making robust data protection a critical operational focus. The bank is committed to significant investments in security infrastructure and risk management protocols to counter evolving digital dangers.

New regulations like the Digital Operational Resilience Act (DORA) are reshaping the financial sector's approach to operational resilience, compelling institutions like BNP Paribas to enhance their defenses and compliance frameworks. This regulatory push underscores the growing importance of safeguarding sensitive customer information and maintaining system integrity.

Artificial intelligence plays a vital role in BNP Paribas's strategy to combat fraud and monitor transactions in real-time. AI-powered solutions are instrumental in detecting and preventing illicit activities, thereby protecting both the bank and its clients from financial losses and data breaches.

BNP Paribas is strategically embedding advanced technologies like AI, blockchain, and cloud computing to boost operational efficiency, customer engagement, and risk mitigation. The bank is actively investigating AI's potential for delivering tailored financial guidance, streamlining professional tasks, and improving natural resource oversight. For instance, in 2024, BNP Paribas announced a significant investment in AI-driven fraud detection systems, aiming to reduce false positives by an estimated 15%.

Fintech Competition and Collaboration

The financial technology (fintech) landscape is rapidly evolving, presenting both significant competitive pressures and avenues for strategic collaboration for established institutions like BNP Paribas. Fintech firms are increasingly offering specialized, often more agile, digital solutions that challenge traditional banking services. For instance, by the end of 2023, global fintech investment reached over $150 billion, highlighting the sector's dynamism and its potential to disrupt established players.

BNP Paribas is actively embracing an open innovation approach to navigate this competitive environment. This strategy involves actively seeking out and co-creating new digital solutions with fintech partners. The aim is to leverage the innovative capabilities of startups to accelerate the bank's own digital transformation and meet the escalating customer demand for seamless, digitized financial experiences. By working with fintechs, BNP Paribas can develop cutting-edge payment solutions and other digital services more efficiently.

This collaborative model extends to actively supporting the fintech ecosystem. BNP Paribas participates in accelerator programs designed to nurture and scale promising startups. These initiatives not only provide financial and mentorship support to emerging companies but also offer BNP Paribas early access to groundbreaking technologies and potential acquisition targets. For example, in 2024, the bank announced partnerships with several fintechs focused on areas like sustainable finance and AI-driven customer service, aiming to integrate their innovations into its core offerings.

- Fintech Investment Growth: Global fintech investment exceeded $150 billion in 2023, underscoring the competitive threat and innovation potential.

- Open Innovation Strategy: BNP Paribas actively co-creates digital solutions with fintechs to enhance its service offerings and maintain competitiveness.

- Digitalization Demand: The collaboration aims to address the growing customer need for digitized banking services, improving user experience.

- Startup Ecosystem Support: BNP Paribas supports fintech startups through accelerator programs, fostering innovation and identifying future partners.

Data Analytics and Personalized Services

BNP Paribas is heavily investing in data analytics and artificial intelligence to offer highly personalized banking experiences. This technology allows them to understand individual client behaviors, from spending habits to investment preferences, enabling tailored advice and product recommendations.

By leveraging AI, the bank aims to anticipate customer needs, proactively suggesting solutions before clients even realize they need them. For instance, analyzing transaction data can trigger alerts for potential savings opportunities or identify suitable investment products based on risk appetite.

This focus on data-driven personalization is a key differentiator. In 2024, BNP Paribas reported significant growth in its digital banking services, with a substantial portion of customer interactions occurring through their advanced mobile app, which heavily relies on data analytics for personalized insights.

- Personalized Product Recommendations: AI algorithms analyze client data to suggest relevant banking products, such as loans or investment funds, increasing cross-selling opportunities.

- Proactive Financial Advice: By monitoring spending patterns, the bank can offer timely tips on budgeting or saving, enhancing customer financial well-being.

- Enhanced Customer Experience: Data analytics helps streamline processes and provide quicker, more relevant responses to customer inquiries, boosting satisfaction.

- Predictive Customer Needs: Advanced analytics allows BNP Paribas to forecast future client requirements, enabling them to prepare and offer solutions in advance.

BNP Paribas is actively integrating artificial intelligence and machine learning to enhance operational efficiency and customer service. These technologies are being deployed for tasks ranging from fraud detection to personalized financial advice, aiming to streamline processes and improve client engagement.

The bank's commitment to digitalization is evident in its substantial investments in AI-driven solutions. For example, in 2024, BNP Paribas announced a significant push to implement AI for automating customer onboarding, targeting a 30% reduction in processing times by year-end. This strategic adoption of AI is crucial for maintaining a competitive edge in the rapidly evolving digital banking landscape.

The increasing sophistication of cybersecurity threats necessitates continuous investment in advanced security technologies. BNP Paribas is prioritizing robust data protection measures and sophisticated AI-powered systems to combat fraud and safeguard sensitive client information, a critical aspect of its technological strategy.

BNP Paribas is also exploring the potential of blockchain technology for improving transaction security and efficiency, particularly in areas like cross-border payments and trade finance. The bank's forward-looking approach includes piloting blockchain solutions to streamline complex financial operations.

Legal factors

BNP Paribas is heavily regulated by Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws worldwide. These regulations necessitate sophisticated compliance frameworks and ongoing vigilance to detect and prevent illicit financial activities. Failure to comply can result in substantial fines and reputational damage.

The bank's Compliance department acts as a critical second line of defense, working to safeguard financial integrity and enforce international sanctions. In 2023, global financial institutions faced increased scrutiny, with regulatory bodies levying significant penalties for AML/CTF breaches, underscoring the importance of robust internal controls for entities like BNP Paribas.

BNP Paribas faces significant legal obligations due to data privacy regulations like the GDPR. Compliance demands transparency, fair data handling, and strong security for the extensive client information the bank manages. Failure to adhere can lead to substantial fines; for instance, the GDPR allows for penalties up to 4% of global annual turnover or €20 million, whichever is higher, impacting trust and operational continuity.

Consumer protection laws are a significant legal factor for BNP Paribas, demanding increased transparency and fairness in all its offerings and customer dealings. By 2025, the global regulatory landscape will likely intensify scrutiny on data security and ethical banking practices, pushing institutions like BNP Paribas to proactively build and maintain customer trust. The bank's commitment to enhancing autonomy, control, flexibility, and transparency in payment transactions directly addresses these evolving legal expectations.

Banking Capital Requirements (e.g., Basel IV, CRR III)

BNP Paribas operates under increasingly stringent capital requirements, notably influenced by the finalization of Basel III, often referred to as Basel IV, and the EU's Capital Requirements Regulation III (CRR III), which became effective in January 2025. These regulations mandate higher levels of capital adequacy, demanding banks maintain a larger buffer against potential losses. For instance, CRR III introduces revised approaches to calculating risk-weighted assets, potentially increasing them for certain portfolios.

These evolving legal frameworks directly impact BNP Paribas's capital structure and strategic planning. The bank must ensure it holds sufficient capital to meet these elevated standards, which could affect its profitability and ability to lend. For example, the output floor introduced by Basel IV aims to prevent excessive variability in risk-weighted assets across different banks, ensuring a more standardized approach to capital calculation.

- Capital Adequacy Ratios: BNP Paribas must maintain robust Common Equity Tier 1 (CET1) ratios, which are critical for absorbing unexpected losses.

- Risk Management Enhancements: CRR III places a greater emphasis on sophisticated risk management practices, requiring more granular data and advanced modeling.

- Impact on Profitability: Higher capital requirements can lead to a reduced return on equity if not offset by increased efficiency or revenue generation.

- Operational Adjustments: The bank may need to adjust its business models or asset allocations to comply with new risk weightings and capital constraints.

Competition Law and Antitrust Regulations

Competition law and antitrust regulations are critical for BNP Paribas, shaping its ability to engage in mergers, acquisitions, and overall market conduct. These rules, particularly within the EU Single Market, are designed to foster fair competition and prevent any single entity from dominating the financial landscape. For instance, the European Commission actively scrutinizes large banking mergers to ensure they do not stifle competition, impacting BNP Paribas' strategic growth avenues.

BNP Paribas must navigate a complex web of antitrust provisions that influence its pricing strategies, distribution channels, and potential collaborations. Adherence to these regulations is paramount to avoid significant fines and reputational damage. The ongoing enforcement of these laws by bodies like the European Commission in 2024 and 2025 will continue to define the boundaries of permissible market activities for major financial institutions.

- EU Merger Control Thresholds: BNP Paribas must assess if proposed acquisitions exceed notification thresholds set by competition authorities, such as those in France or the EU, to ensure compliance.

- Market Dominance Scrutiny: Regulators closely monitor financial institutions for practices that could indicate an abuse of a dominant market position, impacting product offerings and customer access.

- State Aid Rules: While less direct for operational conduct, state aid regulations can influence the competitive landscape if governments provide support to specific financial entities, indirectly affecting BNP Paribas.

- Digital Market Regulation: Emerging regulations focused on digital platforms and data usage in finance will increasingly impact how BNP Paribas competes and partners in the evolving digital economy.

BNP Paribas is subject to stringent legal frameworks governing financial stability and consumer protection. The implementation of Basel IV (CRR III) from January 2025 mandates enhanced capital adequacy, with a focus on risk-weighted assets, impacting how banks like BNP Paribas manage their capital buffers. This regulatory shift requires significant adjustments to risk management and potentially affects profitability metrics, such as return on equity.

Environmental factors

BNP Paribas is actively responding to evolving climate change regulations, which are a significant environmental factor influencing its operations. The bank is committed to aligning its credit portfolio with net-zero trajectories and substantially reducing financed emissions, particularly in high-carbon sectors. This strategic shift is driven by increasing global and national mandates for environmental responsibility.

The bank has established concrete decarbonization targets for key sectors by 2030, including air transport, maritime transport, and commercial property. Furthermore, BNP Paribas has accelerated its low-carbon financing goals for energy production, demonstrating a proactive approach to the green transition. For instance, by the end of 2023, the bank reported a substantial increase in its green finance activities, exceeding €20 billion for the year, with a focus on renewable energy projects.

BNP Paribas views ESG integration as a core strategic element, impacting its investment choices, product innovation, and how it manages risks. This focus is driven by a growing demand from institutional investors who are prioritizing sustainable approaches to achieve both financial returns and positive societal impact.

The trend towards sustainable investing is accelerating, with a significant portion of institutional assets now managed under ESG principles. For instance, in 2024, global sustainable investment assets were projected to reach over $50 trillion, underscoring the market's commitment.

Reflecting this shift, BNP Paribas Securities Services is enhancing its offerings by introducing new ESG criteria for portfolio monitoring. These new criteria are designed to be adaptable and flexible, allowing clients to tailor their oversight to specific sustainable themes and performance metrics.

BNP Paribas is actively working to shrink its own operational carbon footprint, alongside assisting clients in their own decarbonization journeys. The bank has set ambitious goals to finance a carbon-neutral economy by 2050, a key part of its commitment to fostering a sustainable and inclusive economy across all operating regions.

These efforts include implementing robust energy efficiency plans and championing sustainable mobility solutions. For instance, in 2023, BNP Paribas reported a 15% reduction in its financed emissions intensity for the energy sector compared to its 2019 baseline, demonstrating tangible progress towards its climate objectives.

Sustainable Finance Product Development

BNP Paribas is a significant player in developing and promoting sustainable finance products, crucial for the ecological transition. The bank actively offers green bonds, social bonds, and sustainability-linked loans, reflecting a commitment to financing projects with positive environmental and social impacts.

The bank's leadership in this area is substantial. For instance, in 2023, BNP Paribas ranked as a top global bookrunner for green and social bonds, facilitating over $50 billion in issuance. This leadership extends to sustainability-linked loans, where they have been a leading arranger, demonstrating a strong market presence.

BNP Paribas's sustainable finance offerings are designed to support key transition areas. This includes providing financing solutions for energy renovation projects, contributing to building efficiency, and supporting clean mobility solutions, such as electric vehicle infrastructure and public transportation initiatives.

- Global Leadership: BNP Paribas consistently ranks among the top global bookrunners for sustainable bonds, a testament to its extensive involvement in financing the ecological transition.

- Product Diversification: The bank offers a comprehensive suite of sustainable finance products, including green bonds, social bonds, and sustainability-linked loans, catering to diverse client needs.

- Impact Financing: BNP Paribas actively finances projects aimed at positive environmental and social impact, such as energy renovation and clean mobility solutions.

- Market Commitment: By leading in the arrangement of sustainability-linked loans, the bank signals a strong commitment to integrating sustainability performance into corporate financing structures.

Reputational Risks Related to Environmental Impact

BNP Paribas grapples with reputational risks stemming from its environmental footprint, particularly its financing of industries with significant carbon emissions. Public scrutiny intensifies as stakeholders demand greater accountability for climate change impacts. This exposure can affect customer loyalty and investor confidence.

To counter these challenges, BNP Paribas emphasizes transparent reporting on its climate commitments and the progress made towards achieving them. The bank actively engages with its clients, aiming to support their transition to more sustainable, low-carbon business models. This proactive approach is central to its corporate social responsibility (CSR) strategy.

The bank’s integrated reports offer comprehensive details on its environmental initiatives and performance. For instance, in its 2023 integrated report, BNP Paribas detailed its efforts to reduce financed emissions and its targets for increasing green financing. These reports are crucial for demonstrating the bank's commitment to environmental stewardship to a wide audience.

- Reputational Impact: Negative perceptions regarding environmental financing can deter customers and investors.

- Client Engagement: BNP Paribas actively supports clients in their transition to sustainable practices.

- Transparency: Detailed reporting on climate commitments and progress is a key mitigation strategy.

- CSR Strategy: Environmental responsibility is integrated into the bank's core business operations and reporting.

BNP Paribas is actively navigating a landscape shaped by increasing environmental regulations and a global push towards sustainability. The bank is committed to aligning its credit portfolio with net-zero goals, significantly reducing financed emissions, particularly in high-carbon sectors, and has set concrete decarbonization targets for key industries by 2030.

The bank's strategic integration of ESG principles is a direct response to growing demand from institutional investors prioritizing sustainable approaches, with global sustainable investment assets projected to exceed $50 trillion in 2024. BNP Paribas is also focused on shrinking its operational carbon footprint and has set ambitious goals to finance a carbon-neutral economy by 2050.

BNP Paribas is a leading provider of sustainable finance products, including green bonds and sustainability-linked loans, crucial for the ecological transition. In 2023, the bank facilitated over $50 billion in green and social bond issuance, underscoring its significant market presence and commitment to financing environmentally positive projects.

Reputational risks associated with financing carbon-intensive industries are a key concern, prompting BNP Paribas to emphasize transparent reporting on its climate commitments and actively support clients in their transition to low-carbon business models. The bank's 2023 integrated report detailed progress on reducing financed emissions and increasing green financing.

| Environmental Factor | BNP Paribas's Action/Commitment | Data/Target |

|---|---|---|

| Climate Change Regulations | Aligning credit portfolio with net-zero, reducing financed emissions | Decarbonization targets for air transport, maritime transport, commercial property by 2030 |

| Sustainable Investing Trend | Integrating ESG into investment choices, product innovation | Global sustainable investment assets projected to exceed $50 trillion in 2024 |

| Sustainable Finance Products | Offering green bonds, social bonds, sustainability-linked loans | Facilitated over $50 billion in green/social bond issuance in 2023 |

| Operational Footprint | Reducing own carbon footprint, supporting client decarbonization | Target to finance a carbon-neutral economy by 2050 |

PESTLE Analysis Data Sources

Our PESTLE analysis for BNP Paribas is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside reports from reputable economic and market research firms. We also incorporate official government publications and regulatory updates relevant to the banking sector globally.