BNP Paribas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNP Paribas Bundle

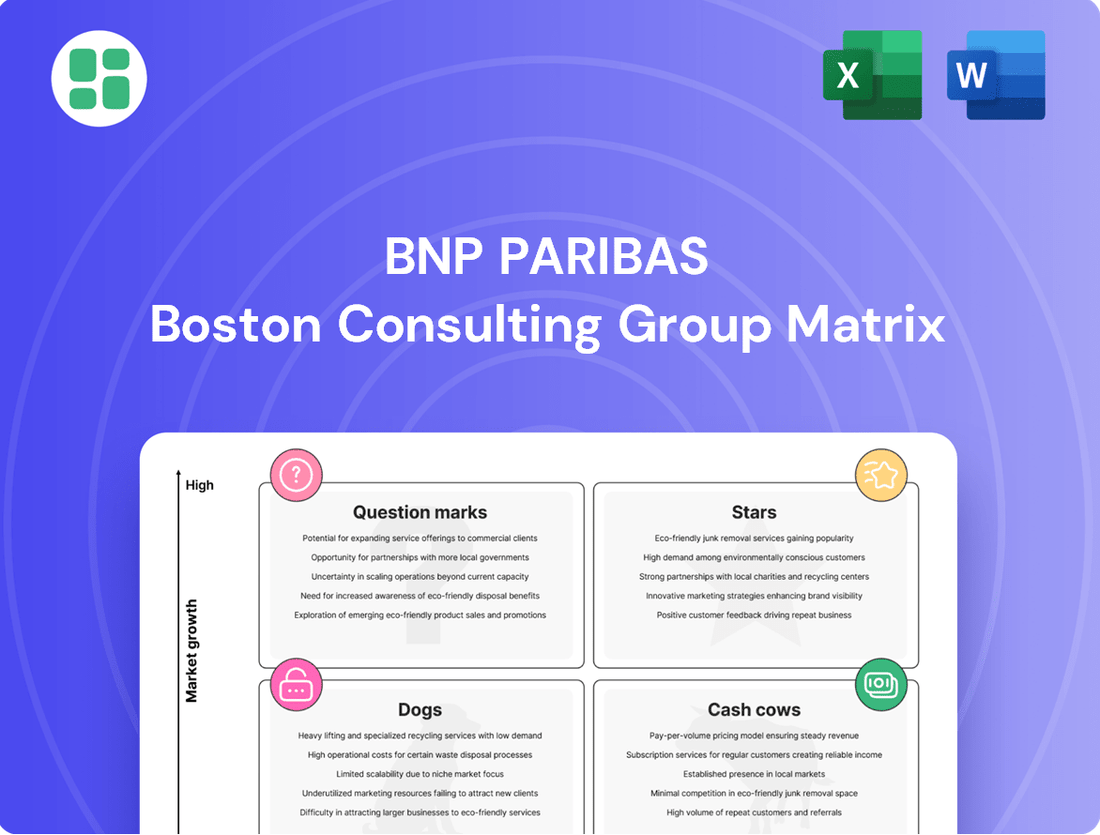

Curious about BNP Paribas's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned in the market, categorizing them as Stars, Cash Cows, Dogs, or Question Marks.

To truly understand their competitive edge and pinpoint future growth opportunities, you need the complete picture. Purchase the full BCG Matrix for a detailed breakdown, data-backed insights, and actionable strategies to guide your own investment and product decisions.

Stars

BNP Paribas stands out as a frontrunner in sustainable finance, boasting a substantial market share and impressive growth in ESG bonds and loans. This commitment is underscored by their active role in helping clients navigate the shift to a low-carbon economy. For instance, in 2023, the bank significantly increased its financing for renewable energy projects, demonstrating a tangible investment in a greener future.

The bank's strategic focus on sustainability, as outlined in its 2025 plan, positions sustainable finance as a key growth engine. BNP Paribas has set ambitious targets for reducing financed emissions, aiming for a substantial decrease by 2030. This proactive approach not only addresses environmental concerns but also taps into a rapidly expanding market segment.

Global Markets within BNP Paribas CIB is a star performer, showcasing robust growth and a significant market presence. This segment's success is particularly evident in Equity & Prime Services, a key driver of CIB's overall strong financial results.

In the first quarter of 2025, CIB achieved a record quarter, with net banking income climbing 12.5%. Global Markets revenues mirrored this strength, surging by over 17%, underscoring its position as a high-growth, high-market-share business line driven by active client engagement and strategic market share expansion.

BNP Paribas Wealth Management's Asian expansion is a clear indicator of its Star status. The region saw substantial net asset inflows, boosting assets under management significantly. For instance, by the end of 2024, Asia represented a growing portion of the wealth management division's global footprint, with reported inflows exceeding €5 billion for the year.

The strategic decision to launch new wealth management units in key Asian markets underscores this focus. This proactive approach taps into a region with immense growth potential, as evidenced by the increasing number of high-net-worth individuals in countries like Singapore and Hong Kong. BNP Paribas' commitment to this high-growth area is further solidified by rising revenues from its Asian operations, which saw a year-on-year increase of over 15% in 2024.

Digital Transformation & Innovation in Financial Services

BNP Paribas is channeling significant resources into technology and digitalization, aiming to elevate client experiences and streamline operations. This includes a keen interest in digital assets and the application of AI for smarter solutions.

The bank's strategic roadmap prioritizes rapid digitalization and actively seeks collaborations with fintech firms, particularly those focused on generative AI startups. This commitment to advanced digital solutions positions BNP Paribas to capture substantial market share in the fast-changing financial sector.

- Investment Focus: BNP Paribas is prioritizing technology investments, with a substantial portion of its capital expenditure directed towards digitalization initiatives.

- AI and Digital Assets: The bank is actively exploring and integrating artificial intelligence-driven solutions and is keenly observing the evolving landscape of digital assets.

- Fintech Partnerships: BNP Paribas has forged strategic partnerships with several fintech companies, including those specializing in generative AI, to foster innovation.

- Market Position: This aggressive push into digital transformation is designed to enhance competitive positioning and drive growth in the evolving financial services market.

Specialized Financing for Energy Transition

BNP Paribas is actively positioning itself as a leader in specialized financing for the energy transition, a move that significantly bolsters its standing in the market. The bank's strategic focus on funding low-carbon energy production, especially renewables, is a primary engine for its growth. This commitment is underscored by ambitious goals to expand its footprint in this critical sector.

The bank has made a clear strategic shift, prioritizing the financing of low-carbon energy solutions. BNP Paribas has set a target to ensure that 90% of its energy production financing is dedicated to low-carbon sources by the year 2030. This specialization in a sector experiencing substantial demand and rapid expansion places BNP Paribas firmly in the Star quadrant of the BCG Matrix.

- Focus on Renewables: BNP Paribas is heavily investing in financing renewable energy projects, a key driver of the global energy transition.

- Ambitious Targets: The bank aims for 90% of its energy production financing to be low-carbon by 2030, demonstrating a strong commitment.

- Market Positioning: This strategic specialization in a high-growth, high-demand sector like low-carbon energy positions BNP Paribas as a Star.

- Growth Potential: The increasing global demand for sustainable energy solutions provides significant growth opportunities for the bank's specialized financing.

BNP Paribas' Global Markets division is a clear Star, demonstrating exceptional growth and market dominance, particularly in Equity & Prime Services. In Q1 2025, Global Markets revenues surged over 17%, contributing significantly to CIB's record quarter. This performance highlights its status as a high-growth, high-market-share business.

The bank's Wealth Management operations in Asia also shine as a Star. Net asset inflows in the region exceeded €5 billion in 2024, driving substantial growth in assets under management. Revenues from Asian operations saw a year-on-year increase of over 15% in 2024, underscoring this segment's strong performance and expansion.

BNP Paribas' strategic focus on technology and digitalization, including AI and digital assets, positions it for future Star status. The bank is actively investing in these areas and forming fintech partnerships to enhance its competitive edge in the evolving financial landscape.

Specialized financing for the energy transition, with a focus on renewables, is another key Star performer. BNP Paribas aims for 90% of its energy production financing to be low-carbon by 2030, tapping into a high-demand, high-growth sector.

| Business Segment | BCG Matrix Quadrant | Key Performance Indicators (2024/Q1 2025 Data) | Strategic Importance |

|---|---|---|---|

| Global Markets | Star | Revenue growth >17% (Q1 2025); Strong market share in Equity & Prime Services | Key driver of CIB's financial results; High growth, high market share |

| Wealth Management (Asia) | Star | Net asset inflows >€5 billion (2024); Revenue growth >15% (YoY 2024) | Expansion into a high-growth region; Increasing AUM |

| Technology & Digitalization | Potential Star | Significant investment in AI, digital assets; Fintech partnerships | Enhancing competitive positioning; Future growth engine |

| Energy Transition Financing | Star | Target: 90% low-carbon financing by 2030; Focus on renewables | Leadership in a critical, high-growth sector; Sustainable finance driver |

What is included in the product

This BCG Matrix analysis offers strategic insights into BNP Paribas' product portfolio, highlighting which units to invest in, hold, or divest.

A clear, visual BNP Paribas BCG Matrix analysis that instantly identifies underperforming units, alleviating the pain of resource misallocation.

Cash Cows

BNP Paribas' French Domestic Markets Retail Banking, a significant player, boasts a substantial customer base and stable deposits. Despite past hurdles, this segment is poised for a strong revenue rebound, anticipated due to a more beneficial interest rate landscape and strategic deployment of non-interest-bearing deposits.

In 2024, this mature market is expected to continue delivering consistent revenue streams, reinforcing its role as a foundational element within BNP Paribas' diversified business model. The bank's commitment to this core market underscores its stability and ongoing revenue generation capabilities.

BNP Paribas’ Corporate & Institutional Banking (CIB) segment, specifically its Global Banking and Securities Services divisions, are clear cash cows. These units consistently generate substantial and stable income, reflecting their mature operational models and dominant market positions.

Global Banking revenues saw an increase, largely fueled by strong performance in Capital Markets and Transaction Banking. In 2024, this segment demonstrated resilience, building on the positive momentum from previous years.

Securities Services also experienced robust growth, with notable upticks in both fees and net interest revenues. This indicates sustained demand for BNP Paribas’ custody, clearing, and fund administration services.

BNP Paribas Wealth Management's European domestic markets, including Belgium, France, Italy, and Luxembourg, are considered cash cows. These mature markets offer a stable foundation for the bank, generating consistent fee income and assets under management.

The established client relationships in these regions contribute significantly to a reliable cash flow, even though growth prospects are more moderate compared to emerging markets. For instance, as of the end of 2023, BNP Paribas reported substantial assets under management in its European wealth management operations, underscoring the steady revenue streams from these core territories.

Insurance Business

BNP Paribas' Insurance business, a key component of its Investment & Protection Services (IPS) division, is a prime example of a Cash Cow. This segment has demonstrated robust and consistent performance, significantly bolstering the division's revenue growth. In the first quarter of 2025, insurance revenues saw a healthy increase of 4.1%, building on strong momentum from 2024 where it was a vital contributor to IPS performance.

The predictable nature of premium income, coupled with an established market footprint, allows the Insurance business to function as a reliable source of cash generation for the group.

- Insurance revenues grew 4.1% in Q1 2025.

- Insurance was a strong driver for IPS throughout 2024.

- Predictable premium income supports stable cash flow.

- Established market presence enhances its Cash Cow status.

Traditional Asset Management Services

BNP Paribas Asset Management, a significant part of the bank's Investment Products & Services (IPS) division, is a prime example of a cash cow. The firm has demonstrated robust performance, particularly in attracting substantial inflows into its money-market funds. This consistent client demand fuels steady fee income, a hallmark of a mature and stable business segment.

While the explosive growth seen in some 'Star' segments might not be replicated here, the sheer size of its established client base and the ongoing revenue generated from managing a wide array of portfolios solidify its cash cow status. For instance, as of the first quarter of 2024, BNP Paribas reported a notable increase in assets under management, reflecting the continued success of its traditional asset management offerings.

- Strong Inflows: BNP Paribas Asset Management has seen significant inflows, especially into its money-market funds, as of early 2024.

- Increased Assets Under Management: This has led to a healthy rise in the total assets managed by the firm.

- Steady Fee Income: The established client base ensures a consistent stream of revenue through management fees.

- Mature Segment: While not experiencing rapid growth, its stability makes it a reliable contributor to the bank's overall financial health.

BNP Paribas’ Corporate & Institutional Banking (CIB) segment, specifically its Global Banking and Securities Services divisions, are clear cash cows. These units consistently generate substantial and stable income, reflecting their mature operational models and dominant market positions.

Global Banking revenues saw an increase, largely fueled by strong performance in Capital Markets and Transaction Banking. In 2024, this segment demonstrated resilience, building on the positive momentum from previous years.

Securities Services also experienced robust growth, with notable upticks in both fees and net interest revenues. This indicates sustained demand for BNP Paribas’ custody, clearing, and fund administration services.

BNP Paribas Wealth Management's European domestic markets, including Belgium, France, Italy, and Luxembourg, are considered cash cows. These mature markets offer a stable foundation for the bank, generating consistent fee income and assets under management.

The established client relationships in these regions contribute significantly to a reliable cash flow, even though growth prospects are more moderate compared to emerging markets. For instance, as of the end of 2023, BNP Paribas reported substantial assets under management in its European wealth management operations, underscoring the steady revenue streams from these core territories.

BNP Paribas' Insurance business, a key component of its Investment & Protection Services (IPS) division, is a prime example of a Cash Cow. This segment has demonstrated robust and consistent performance, significantly bolstering the division's revenue growth. In the first quarter of 2025, insurance revenues saw a healthy increase of 4.1%, building on strong momentum from 2024 where it was a vital contributor to IPS performance.

The predictable nature of premium income, coupled with an established market footprint, allows the Insurance business to function as a reliable source of cash generation for the group.

BNP Paribas Asset Management, a significant part of the bank's Investment Products & Services (IPS) division, is a prime example of a cash cow. The firm has demonstrated robust performance, particularly in attracting substantial inflows into its money-market funds. This consistent client demand fuels steady fee income, a hallmark of a mature and stable business segment.

While the explosive growth seen in some 'Star' segments might not be replicated here, the sheer size of its established client base and the ongoing revenue generated from managing a wide array of portfolios solidify its cash cow status. For instance, as of the first quarter of 2024, BNP Paribas reported a notable increase in assets under management, reflecting the continued success of its traditional asset management offerings.

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Performance Highlight |

|---|---|---|---|

| Corporate & Institutional Banking (Global Banking & Securities Services) | Cash Cow | Mature operations, dominant market positions, stable income generation. | Resilient performance, increased revenues from Capital Markets and Transaction Banking. |

| Wealth Management (European Domestic Markets) | Cash Cow | Established client base, consistent fee income, significant assets under management. | Stable revenue streams from core European territories. |

| Insurance (Investment & Protection Services) | Cash Cow | Predictable premium income, established market presence, consistent revenue growth. | 4.1% revenue increase in Q1 2025, vital contributor to IPS in 2024. |

| Asset Management | Cash Cow | Strong inflows (e.g., money-market funds), steady fee income, large AUM. | Notable increase in assets under management in Q1 2024. |

What You See Is What You Get

BNP Paribas BCG Matrix

The BNP Paribas BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic tool ready for immediate application. You can trust that the insights and analysis presented here accurately represent the comprehensive report you'll download, empowering your strategic decision-making. This is the exact BNP Paribas BCG Matrix, designed for clarity and professional use, ready to be integrated into your business planning and presentations.

Dogs

Legacy IT infrastructure and systems at BNP Paribas, while crucial for ongoing operations, represent a significant challenge. These older platforms often come with substantial maintenance expenses, estimated to be as high as 70-80% of IT budgets in many large financial institutions, leaving less room for innovation.

While these systems are necessary for core banking functions, they offer limited potential for new growth or market expansion. In 2023, many banks reported that a substantial portion of their IT spending was dedicated to maintaining these legacy systems, hindering their ability to invest in cutting-edge digital solutions.

Consequently, these systems can consume considerable resources without contributing proportionally to new revenue streams or market share gains. BNP Paribas, like many of its peers, is likely evaluating these areas for potential optimization or the divestment of related processes as it prioritizes its digital transformation initiatives to remain competitive in the evolving financial landscape.

In the current financial landscape, physical branch networks that are experiencing declining customer visits and are located in areas with high digital banking penetration can be classified as 'Dogs' within the BNP Paribas BCG Matrix. These branches, while historically vital, now often carry significant operational expenses that outweigh their revenue generation capabilities, particularly if they haven't undergone strategic modernization or consolidation efforts.

For instance, in 2024, many traditional banks reported that while their digital channels handled over 70% of customer transactions, their physical branches still incurred substantial costs for staffing, maintenance, and utilities. This disparity highlights the challenge of maintaining an extensive physical footprint in an increasingly digital-first world, where customer preferences and service delivery models have fundamentally shifted.

Certain niche personal finance activities, while part of a broader profitable sector, can struggle with low profitability due to intense competition and limited scalability. These might include highly specialized advisory services or niche lending products that don't achieve economies of scale.

BNP Paribas itself has made strategic decisions reflecting this, such as their 2024 divestment of personal finance activities in Mexico. This move suggests a focus on optimizing their portfolio by exiting markets or segments that are not meeting profitability expectations or strategic growth targets.

Non-Core or Divested Business Units

Non-core or divested business units within BNP Paribas, such as its Personal Finance activities in Mexico, are categorized as Dogs in the BCG Matrix. These segments typically exhibit low market share and low growth potential, often representing a drag on the group's overall resources and profitability. Strategic divestment of such units allows the company to reallocate capital and management focus towards more promising areas.

BNP Paribas' divestment of its Personal Finance operations in Mexico, announced in 2023, exemplifies this strategy. This move aligns with a broader trend of financial institutions streamlining their portfolios to concentrate on core competencies and higher-return activities. Such divestitures are crucial for optimizing the group's strategic positioning and financial performance.

- Divestment Rationale: Focus on core markets and profitable segments.

- Market Position: Low market share and low growth in divested units.

- Financial Impact: Reduces resource drain and improves capital allocation efficiency.

- Strategic Alignment: Enhances overall group competitiveness and profitability.

Outdated Credit Card or Lending Products

Certain traditional credit card or lending products are likely struggling in today's market. Think of older credit card lines or loan offerings that haven't kept up with what people want now, especially with so many new fintech companies popping up. These products often find themselves in a low-growth, low-market-share situation.

When these older products demand substantial marketing investment but don't deliver strong returns, they fit the profile of a Dog in the BCG matrix. For example, a credit card product with declining transaction volumes and high customer acquisition costs, perhaps seeing a 2% year-over-year growth in a market where competitors are growing at 10%, would be a prime candidate.

- Low Market Share: Products with a diminishing slice of the overall credit or lending market.

- Low Market Growth: Industries or segments where these products operate are not expanding significantly.

- High Marketing Costs: Significant resources are spent to maintain or grow these offerings with little success.

- Declining Profitability: The revenue generated doesn't justify the operational and marketing expenses.

Within BNP Paribas' strategic framework, 'Dogs' represent business units or products with low market share and low growth potential. These segments often require significant investment to maintain but generate minimal returns, acting as a drain on resources. Identifying and managing these 'Dogs' is crucial for optimizing the bank's overall portfolio and reallocating capital to more promising ventures.

Examples of 'Dogs' for BNP Paribas could include certain legacy IT systems that are costly to maintain but offer little scope for innovation or expansion. Similarly, physical branches in declining urban areas with low footfall, especially where digital adoption is high, fit this category. In 2024, many financial institutions reported that over 70% of their IT budgets were consumed by maintaining such legacy systems, highlighting the resource drain.

The divestment of non-core or underperforming business units, such as BNP Paribas' Personal Finance activities in Mexico, also exemplifies the management of 'Dogs'. These moves allow the bank to shed low-return assets and focus on areas with higher growth and profitability, enhancing overall financial performance and strategic agility.

Traditional credit card products that have seen declining transaction volumes and high customer acquisition costs, especially when facing intense competition from fintechs, can also be classified as 'Dogs'. For instance, a product with only 2% year-over-year growth in a market where competitors are expanding at 10% would be a clear indicator.

| Category | BNP Paribas Examples | Characteristics | Strategic Action |

|---|---|---|---|

| Legacy IT | Core banking systems requiring extensive maintenance | High cost, low innovation potential | Modernization, phased replacement, or outsourcing |

| Physical Branches | Branches in low-traffic, high digital penetration areas | Declining customer visits, high operational costs | Consolidation, digital-first service models, or divestment |

| Divested Units | Personal Finance in Mexico (divested 2023/2024) | Low market share, low growth, strategic misalignment | Divestment to reallocate capital and focus |

| Underperforming Products | Older credit card or lending lines | Low market share, declining volume, high marketing spend | Revitalization, niche focus, or discontinuation |

Question Marks

BNP Paribas' digital-only venture, Hello bank!, exemplifies a Question Mark in the BCG Matrix. Its ongoing development and customer acquisition highlight a dynamic, high-growth sector within digital banking.

While Hello bank! is expanding, its market share relative to established banking giants likely remains modest in 2024, necessitating strategic investment. This position signifies potential for future growth, but also the risk associated with capturing market share in a competitive digital space.

BNP Paribas is actively engaged in blockchain and Distributed Ledger Technology (DLT) initiatives, notably exploring the tokenization of fund shares and the delivery versus payment (DvP) settlement of digital bonds. These ventures aim to streamline financial processes and unlock new efficiencies.

While the potential for DLT in revolutionizing finance is substantial, with projections for the global blockchain market to reach over $1.5 trillion by 2030, the current adoption and market share remain relatively low. This nascent stage necessitates significant investment in research, development, and infrastructure to establish viability and achieve scalable implementation.

Expanding into new, highly competitive Asian markets beyond core wealth management for BNP Paribas would likely be classified as a Question Mark in the BCG Matrix. While these regions, such as Vietnam or Indonesia, present significant growth opportunities, the intense competition from established local and international players necessitates substantial upfront investment in infrastructure, talent, and marketing to build a meaningful presence and achieve profitability.

For instance, the Asian wealth management market is projected to grow significantly, with some estimates suggesting it could reach over $10 trillion in assets under management by 2025, according to various industry reports. However, entering less developed but rapidly growing economies means facing entrenched competitors and navigating complex regulatory landscapes, demanding a strategic, long-term commitment and considerable capital allocation.

Early-Stage Fintech Investments and Partnerships

BNP Paribas actively engages with early-stage fintech companies, including those leveraging Generative AI, to foster innovation within its operations. These strategic investments and partnerships are positioned within high-potential, emerging markets, mirroring the characteristics of Question Marks in a BCG matrix. While these ventures often represent significant capital outlays and carry inherent risks due to their nascent stages and unproven market traction, they are crucial for building future growth engines.

The bank's commitment to these early-stage fintechs, particularly in rapidly evolving fields like GenAI, underscores a forward-looking strategy. For instance, in 2024, BNP Paribas continued to explore collaborations and investments that could reshape financial services. These early-stage entities, while currently possessing low market share, are targeted for their disruptive potential and ability to capture significant future market share if successful.

- Focus on High-Growth Sectors: BNP Paribas targets fintech startups in transformative areas like Generative AI, recognizing their potential for significant future market impact.

- Capital Intensive and High Risk: Early-stage fintech investments typically require substantial capital and face inherent uncertainty, characteristic of Question Marks.

- Potential for Future Stars: Successful nurturing of these ventures could see them evolve into market leaders, similar to how Stars emerge from Question Marks.

- Strategic Innovation Driver: These partnerships are key to BNP Paribas's strategy for driving innovation and staying competitive in the evolving financial landscape.

Development of AI-driven Advisory and Personalization Tools

BNP Paribas is actively developing AI-driven tools to offer personalized financial advice, a segment showing significant growth potential. This aligns with the broader trend of digital transformation within the banking sector, aiming to enhance customer engagement and tailor services.

While the bank is investing in these advanced technologies, the market penetration and established dominance of specific AI advisory platforms are still in their nascent stages. These initiatives represent high-potential, but currently low-market-share, ventures requiring further refinement and client adoption to achieve widespread success.

- AI in Financial Advisory: The global AI in financial services market was valued at approximately $10.5 billion in 2023 and is projected to reach over $40 billion by 2028, indicating a strong growth trajectory.

- BNP Paribas Digital Investment: BNP Paribas has committed billions of euros to its digital transformation strategy, with a significant portion allocated to enhancing data analytics and AI capabilities for customer-facing applications.

- Adoption Challenges: Despite investment, widespread client trust and seamless integration of AI into daily financial management remain key hurdles for market dominance in this evolving space.

- Personalization Focus: AI enables hyper-personalization, moving beyond generic advice to offer tailored investment recommendations, risk assessments, and financial planning based on individual user data.

BNP Paribas' exploration into new markets, such as expanding its wealth management services into emerging Asian economies, positions these ventures as Question Marks. These regions offer substantial growth potential, as evidenced by the Asian wealth management market's projected growth, but also face intense competition from established players, demanding significant investment to gain traction.

The bank's strategic investments in early-stage fintech companies, particularly those leveraging cutting-edge technologies like Generative AI, also fall into the Question Mark category. These initiatives, while capital-intensive and carrying inherent risks due to their nascent stages, are crucial for fostering future innovation and capturing market share in rapidly evolving financial sectors.

BNP Paribas' development of AI-driven personalized financial advice tools represents another Question Mark. While the AI in financial services market is experiencing rapid growth, with significant projected increases in valuation, the widespread adoption and market dominance of specific AI advisory platforms are still in early stages, requiring further development and client trust.

BNP Paribas' digital-only venture, Hello bank!, is a prime example of a Question Mark. Its expansion into the high-growth digital banking sector necessitates ongoing investment to build market share against established competitors, reflecting the inherent risks and potential rewards of such ventures.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial reports, comprehensive market research, and publicly available industry data to provide an accurate strategic overview.