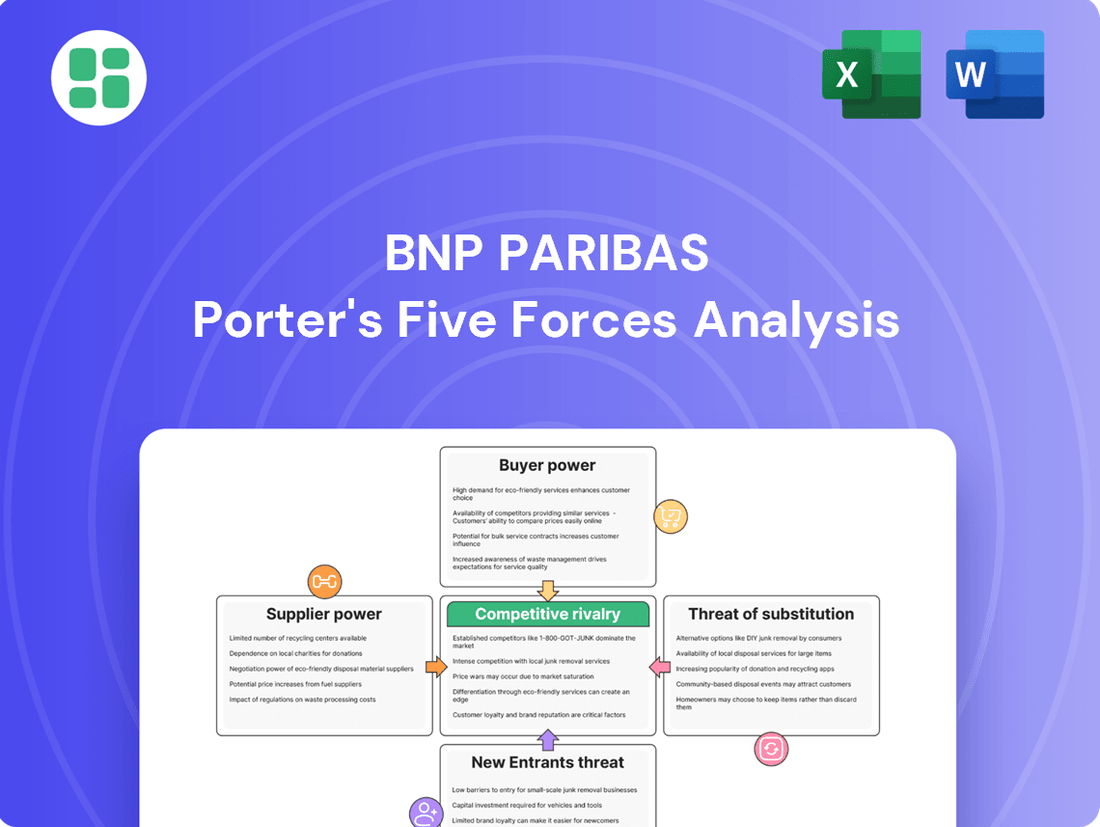

BNP Paribas Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNP Paribas Bundle

BNP Paribas operates within a highly competitive banking landscape, where understanding the intensity of each force is crucial for strategic success. Our analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors. This snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore BNP Paribas’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

BNP Paribas, a global banking leader, depends on a select group of technology suppliers for essential services like cloud computing, data analytics, and cybersecurity. The concentration of these key suppliers means they hold considerable sway. For instance, in 2024, the global cloud computing market saw a significant portion dominated by a few major players, giving them leverage over large clients like BNP Paribas.

BNP Paribas faces significant supplier bargaining power when switching costs for embedded technologies or long-term service contracts are high. For instance, the integration of core banking systems or specialized financial data platforms often involves substantial upfront investment and complex implementation processes. In 2024, major banks like BNP Paribas continue to rely on established IT vendors for critical infrastructure, with migration projects for such systems frequently costing tens of millions of euros and taking years to complete.

The complexity and expense associated with changing vendors for essential IT infrastructure or crucial financial data services directly empower existing suppliers. When a vendor's solution is deeply embedded within BNP Paribas' operational framework, from customer relationship management to risk assessment, the bank encounters considerable technical and financial hurdles in seeking alternative providers. This deep integration means that even minor disruptions during a transition could have a material impact on service delivery and regulatory compliance.

Suppliers providing highly unique or proprietary technologies, like advanced AI for fraud detection or specialized financial software, wield significant bargaining power. When these offerings grant a distinct competitive edge and are challenging to duplicate, BNP Paribas's negotiation leverage diminishes. The financial sector's growing tech spending, expected to exceed $700 billion by 2025, underscores the sway of these specialized providers.

Threat of Forward Integration by Suppliers

While direct forward integration by suppliers into core banking services is rare due to heavy regulation and capital needs, some technology or data providers could theoretically offer niche financial products. For instance, a fintech firm supplying advanced analytics to BNP Paribas might later launch its own wealth management platform. This scenario, however, remains a low probability threat for a diversified financial institution like BNP Paribas, as established banks possess significant advantages in customer trust and regulatory compliance. In 2024, the financial services sector continued to see innovation from tech companies, but the barriers to entry for full-scale banking remain substantial.

The bargaining power of suppliers for a large bank like BNP Paribas is generally limited, particularly concerning core financial services. This is due to the highly regulated nature of the banking industry and the substantial capital required to operate. For example, while a technology vendor might provide crucial software, their ability to integrate forward and compete directly is severely constrained. This dynamic significantly reduces the overall leverage most suppliers hold against major financial institutions.

- Limited Forward Integration Threat: Suppliers in the financial sector, especially technology providers, face significant regulatory hurdles and high capital requirements to offer full banking services, making direct competition with established players like BNP Paribas unlikely.

- Regulatory Barriers: The stringent regulatory environment in banking acts as a strong deterrent against suppliers attempting to integrate forward and become direct competitors.

- Reduced Supplier Leverage: The high barriers to entry and regulatory oversight minimize the bargaining power of most suppliers against large, diversified financial institutions.

Importance of Supplier's Input to BNP Paribas' Operations

The importance of a supplier's input to BNP Paribas' core operations directly correlates with their bargaining power. For instance, providers of critical liquidity, interbank networks, or essential human capital, such as highly skilled financial professionals, possess significant leverage. Disruptions or increased costs from these fundamental suppliers can directly impact the bank's operational efficiency and profitability.

In 2024, the cost of capital, a key supplier input for banks like BNP Paribas, remained a significant factor. While interest rates began to stabilize after earlier increases, the cost of wholesale funding and securing liquidity still presented a challenge. For example, the average cost of funds for major European banks in early 2024 hovered around 3-4%, a notable increase from previous years, directly impacting net interest margins.

- Critical Infrastructure Providers: Companies offering essential IT systems, payment processing networks, and data management solutions hold considerable sway due to the mission-critical nature of their services for a global bank.

- Talent Acquisition and Retention: The market for experienced financial professionals, particularly in areas like risk management, digital banking, and quantitative analysis, remains competitive, giving skilled individuals and specialized recruitment firms bargaining power.

- Regulatory Compliance Services: Firms providing specialized legal and consulting services to navigate complex and evolving financial regulations are vital, and their expertise can command premium pricing.

Suppliers of critical technology and specialized financial data hold significant bargaining power over BNP Paribas due to high switching costs and deep integration into the bank's operations. For example, in 2024, the concentration in cloud computing markets allowed major providers to exert leverage, while the multi-year, multi-million euro cost of migrating core banking systems further cemented vendor influence.

The bargaining power of suppliers for BNP Paribas is influenced by the uniqueness of their offerings and the difficulty in finding alternatives. For instance, proprietary AI for fraud detection provides a competitive edge, and with the financial sector's tech spending projected to exceed $700 billion by 2025, such specialized providers are well-positioned.

While direct forward integration by suppliers into core banking is unlikely due to regulatory and capital barriers, some fintechs offering advanced analytics could potentially enter niche financial product markets. However, established banks like BNP Paribas retain advantages in customer trust and compliance in 2024.

The cost of capital and liquidity, essential supplier inputs for banks, remained a key consideration in 2024, with average funding costs for major European banks around 3-4%. This directly impacts profitability and highlights the leverage of providers in these essential financial markets.

| Supplier Type | Bargaining Power Factor | Example for BNP Paribas (2024) |

| Technology Providers (Cloud, Data) | High Switching Costs, Deep Integration | Concentrated cloud market, complex core system migrations |

| Specialized Software/AI Vendors | Unique/Proprietary Offerings, Competitive Edge | AI for fraud detection, advanced analytics platforms |

| Capital & Liquidity Providers | Essential Input, Cost of Funds | Wholesale funding costs impacting net interest margins |

| Skilled Financial Professionals | Talent Scarcity, Specialized Expertise | Demand for risk management and digital banking talent |

What is included in the product

Analyzes the competitive intensity within the banking sector, focusing on how the bargaining power of customers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players impact BNP Paribas.

Effortlessly assess competitive intensity and identify strategic vulnerabilities with a visual breakdown of each force.

Customers Bargaining Power

BNP Paribas caters to a vast array of clients, ranging from everyday individuals to major corporations and global institutions. This broad reach means customer power isn't uniform across the board.

For instance, individual retail customers, while numerous, generally hold less sway due to their smaller transaction sizes. However, large corporate and institutional clients, by virtue of the substantial business volumes they represent, can wield considerable bargaining power, potentially influencing pricing and service terms.

In 2024, the retail banking segment likely continued to represent the largest customer base by sheer numbers, but the profitability and influence often stemmed from the larger, more concentrated corporate and investment banking clients. This inherent diversity in customer size and transaction volume creates a nuanced landscape for customer bargaining power within BNP Paribas.

For everyday banking, the ease of digital onboarding and competitive promotions from rival banks and fintechs mean that switching costs for retail customers are often quite low. This can give them a bit more leverage.

However, when it comes to more involved financial services like mortgages, wealth management, or specialized corporate banking, the situation changes. The integration of services and the strength of existing relationships mean that switching becomes much more difficult and costly for these customers, thereby limiting their immediate bargaining power.

Retail customers exhibit significant price sensitivity for everyday banking services, such as transaction fees and savings account interest rates. The proliferation of digital-only banks, which often boast lower overheads and thus offer more competitive pricing, intensifies this pressure. For instance, in 2024, many neobanks continued to attract customers with zero-fee current accounts and higher interest rates on savings compared to traditional institutions.

While corporate and institutional clients also consider pricing, their decision-making is more nuanced. These clients place a premium on service quality, operational reliability, and the availability of customized financial solutions. This focus on value beyond just price means that while competitive rates are important, they are not always the sole determinant for these larger customers, providing a degree of insulation for banks that can deliver superior service offerings.

Availability of Substitute Financial Services

The growing availability of alternative financial services significantly boosts customer bargaining power against traditional institutions like BNP Paribas. Fintech startups, challenger banks, and even large technology firms are offering specialized services that often compete directly with traditional banking products.

Customers can now easily access services such as peer-to-peer lending platforms, digital payment solutions like Apple Pay or Google Pay, and direct investment apps, all of which provide alternatives to traditional banking. This ease of switching or utilizing these alternatives directly strengthens the customer's position.

For instance, the global fintech market was valued at approximately $112.5 billion in 2023 and is projected to grow substantially. This expansion means more options for consumers, from digital wallets processing billions in transactions to robo-advisors managing significant assets, all of which can divert business from established players.

- Increased Competition: Fintechs and challenger banks offer specialized, often lower-cost, services, forcing traditional banks to compete on price and innovation.

- Digital Accessibility: Platforms like Revolut or N26 provide seamless digital experiences, attracting customers who prioritize convenience over traditional branch networks.

- Diversified Investment Options: Apps like Robinhood or eToro democratize investing, offering alternatives to traditional brokerage services.

- Payment Alternatives: Digital payment systems and buy-now-pay-later services provide alternatives to credit cards and traditional payment processing.

Customer Information Asymmetry

Customers today possess significantly more financial information than in the past. This is largely due to the proliferation of comparison websites and readily available online reviews, which effectively bridge the gap in knowledge between customers and banks. For instance, in 2024, a significant portion of consumers actively used online tools to research financial products, with studies indicating over 60% comparing multiple options before making a decision.

This increased transparency empowers customers, allowing them to scrutinize product features, fees, and interest rates with greater ease. Consequently, they are better equipped to negotiate for more favorable terms and conditions. This shift directly translates into heightened bargaining power for customers when dealing with financial institutions like BNP Paribas.

- Informed Decisions: Customers leverage readily available data to make comparisons, reducing information asymmetry.

- Negotiation Leverage: Greater transparency enables customers to negotiate better terms and pricing from banks.

- Market Influence: Informed customers can drive competition by choosing providers offering superior value and service.

The bargaining power of customers for BNP Paribas is a mixed bag, heavily influenced by customer segment and service type. While individual retail customers can exert some pressure due to low switching costs for basic services, the real power lies with large corporate and institutional clients who represent significant business volumes.

In 2024, the digital landscape continued to empower retail customers, with numerous fintechs offering competitive rates and fee structures for everyday banking. This ease of access to alternatives means customers can readily switch, forcing banks to remain competitive on price.

However, for complex services like mortgages or wealth management, the higher switching costs and established relationships limit customer leverage. This dynamic ensures that while price is a factor, service quality and integration become more critical for retaining these valuable client segments.

| Customer Segment | Bargaining Power Factor | Impact on BNP Paribas |

|---|---|---|

| Retail Customers (Basic Services) | Low Switching Costs, Price Sensitivity | Pressure on fees and interest rates; need for competitive digital offerings. |

| Retail Customers (Complex Services) | Higher Switching Costs, Relationship Integration | Moderate power; focus on service quality and tailored solutions. |

| Corporate & Institutional Clients | High Transaction Volumes, Customization Needs | Significant power; ability to negotiate pricing and service terms for substantial business. |

Full Version Awaits

BNP Paribas Porter's Five Forces Analysis

This preview showcases the complete BNP Paribas Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the banking sector. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain instant access to this professionally formatted and ready-to-use strategic tool.

Rivalry Among Competitors

BNP Paribas operates in a fiercely competitive global banking arena, contending with a multitude of large, established international institutions. This includes other universal banks, prominent investment banks, and specialized financial service providers, all vying for market share.

The competitive landscape is particularly intense in Europe, where BNP Paribas faces significant rivalry from major banking players. Globally, it must also contend with other financial giants, creating a highly dynamic and challenging environment for growth and profitability.

For instance, as of early 2024, the global banking sector is characterized by significant consolidation, yet still boasts numerous entities with assets exceeding $1 trillion. This sheer number and the substantial financial muscle of these competitors underscore the intensity of the rivalry BNP Paribas navigates daily.

The traditional banking sector generally sees moderate growth, particularly in well-established markets. This subdued overall expansion means banks must intensely compete for existing customers and market share, rather than benefiting from a rapidly expanding pie. For instance, in 2023, the global banking industry’s revenue growth was around 3-5%, a modest figure that underscores the competitive pressure.

Many core banking products offered by institutions like BNP Paribas are becoming increasingly commoditized. This makes it tough to truly differentiate, often pushing competition towards price wars. For instance, basic savings accounts or standard loans might not offer much to set one bank apart from another.

BNP Paribas focuses on offering integrated solutions and specialized services to combat this. Think of their wealth management or corporate banking divisions, which offer tailored advice and complex financial products. However, staying ahead requires constant innovation, especially in digital banking and creating personalized customer experiences to capture and retain clients in a highly competitive landscape.

Exit Barriers

BNP Paribas, like many large financial institutions, faces significant exit barriers. These are the costs and difficulties a company encounters when trying to leave a market or industry. For banks, these barriers are particularly high, which can keep even struggling players in the game longer than might otherwise be expected.

High exit barriers mean that banks are often reluctant to shut down operations or drastically reduce their presence. This is due to several factors. For instance, banks have substantial investments in fixed assets like branches, IT infrastructure, and specialized equipment. Divesting these assets can be challenging and often results in significant losses. In 2023, the global banking sector saw considerable investment in digital transformation, further increasing the sunk costs associated with technology infrastructure.

Regulatory obligations also play a crucial role. Banks operate under strict oversight from central banks and financial authorities. Winding down operations requires extensive approvals and adherence to complex liquidation procedures, which can be time-consuming and costly. Furthermore, there are often social costs associated with layoffs, including severance packages and potential reputational damage, which add to the difficulty of exiting the market.

- Significant Fixed Asset Investments: Banks have large, often specialized, physical and technological assets that are difficult to sell quickly or at their book value.

- Regulatory Hurdles: Strict government regulations and compliance requirements make it complex and expensive for banks to exit the market.

- Social and Reputational Costs: Layoffs and the closure of branches can lead to negative public perception and significant severance expenses.

- Persistent Overcapacity: These barriers can contribute to prolonged periods of intense competition, as banks remain operational even when market conditions are unfavorable, potentially leading to overcapacity in services.

Strategic Commitments and Aggressiveness of Rivals

Competitive rivalry in the banking sector is intense, with institutions frequently engaging in aggressive strategies to capture market share. This often translates to substantial investments in areas like digital transformation and artificial intelligence, as seen in the broader industry trend. For instance, many European banks, including those competing with BNP Paribas, are channeling significant capital into upgrading their technological infrastructure to enhance customer experience and operational efficiency.

BNP Paribas's own strategic roadmap for 2024-2026 underscores this dynamic. The plan prioritizes growth, technology adoption, and sustainability, mirroring the strategic commitments being made by its rivals. This indicates a landscape where competitors are not only vying for customers but are also making substantial, long-term commitments to innovation and market positioning.

Key areas of aggressive competition include:

- Digital Transformation: Banks are investing heavily to offer seamless online and mobile banking experiences. In 2024, many European banks reported double-digit percentage increases in their IT budgets dedicated to digital initiatives.

- AI and Data Analytics: Rivals are leveraging AI for personalized customer service, fraud detection, and risk management, aiming to gain a competitive edge through data-driven insights.

- Strategic Partnerships and Acquisitions: To expand services or reach new customer segments, competitors are actively pursuing partnerships and M&A activities, further intensifying the competitive environment.

- Product Innovation: The continuous launch of new financial products and services, often with a focus on sustainability and digital accessibility, is a hallmark of aggressive rivalry.

The competitive rivalry for BNP Paribas is exceptionally high, characterized by numerous global and regional players vying for market share. This intense competition is fueled by the commoditization of many banking products, pushing firms to differentiate through digital innovation and customer experience. For instance, in 2023, European banks collectively invested billions in technology upgrades to stay competitive.

Competitors are actively engaged in aggressive strategies, including significant investments in digital transformation and AI, as evidenced by reported double-digit increases in IT budgets for digital initiatives in 2024. This arms race for technological superiority and personalized services intensifies the pressure on all market participants, including BNP Paribas.

The banking sector’s moderate growth, around 3-5% revenue growth globally in 2023, further exacerbates this rivalry, as institutions must fight harder for existing customers. High exit barriers, such as substantial fixed asset investments and stringent regulatory requirements, also mean that even struggling competitors remain in the market, maintaining a crowded and competitive landscape.

| Competitor Type | Key Competitive Actions | Example Data Point (2023-2024) |

|---|---|---|

| Global Universal Banks | Digital transformation, AI integration, strategic acquisitions | IT budget increases averaging 10-15% for digital initiatives |

| Investment Banks | Product innovation, advisory services, market share gains | Increased M&A advisory fees by 8% |

| Specialized Financial Providers | Niche market focus, customer service excellence, fintech partnerships | Growth in wealth management assets by 7% |

| Regional Banks | Customer retention, localized offerings, competitive pricing | Focus on increasing digital customer onboarding by 12% |

SSubstitutes Threaten

Fintech companies and digital-only banks present a significant threat of substitutes to traditional banking services. These agile players, like Revolut and N26, offer streamlined mobile payments, online lending, and often commission-free trading, directly competing with BNP Paribas' offerings. Their ability to innovate rapidly and provide superior digital experiences at lower costs erodes customer loyalty to established institutions.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat by offering alternative funding and investment channels that bypass traditional banking structures. These platforms can attract both borrowers seeking capital and investors looking for potentially higher yields, directly competing with BNP Paribas’s core lending and deposit-taking businesses.

In 2023, the global P2P lending market was valued at approximately $100 billion, with projections indicating continued growth. Similarly, crowdfunding platforms facilitated billions of dollars in fundraising for businesses and projects. This demonstrates a substantial and growing segment of the financial market that operates outside of conventional banking, offering more flexible terms or attractive returns that can draw customers away from established institutions like BNP Paribas.

The burgeoning world of cryptocurrencies and Decentralized Finance (DeFi) presents a significant threat of substitutes for traditional banking services. These digital ecosystems enable peer-to-peer transactions, lending, and investment opportunities, bypassing established financial institutions. As of early 2024, the total value locked in DeFi protocols surpassed $100 billion, indicating substantial user adoption and a growing alternative to conventional finance.

While still navigating regulatory uncertainties and inherent volatility, DeFi's ability to offer potentially higher yields and more accessible financial tools poses a long-term challenge to incumbent banks. The increasing sophistication and adoption of blockchain technology suggest these decentralized alternatives will continue to mature, drawing users and capital away from traditional financial channels.

Big Tech Companies Entering Financial Services

Big Tech's foray into financial services presents a significant threat of substitutes for traditional banks like BNP Paribas. Companies such as Apple, Google, and Amazon are leveraging their massive customer bases and advanced data analytics to offer integrated financial products, including payment processing, lending, and digital wallets. For instance, Apple Pay, launched in 2014, has seen widespread adoption, with reports indicating over 500 million users globally by early 2024, demonstrating a clear shift in consumer behavior towards these convenient, embedded solutions.

These tech giants possess distinct advantages that make their offerings compelling substitutes. Their established brand loyalty and seamless user interfaces, honed through years of consumer technology development, can easily entice customers away from incumbent financial institutions for routine transactions. In 2023, global mobile payment transaction volume was estimated to exceed $10 trillion, a figure largely driven by the user-friendly platforms provided by these technology companies.

- Customer Acquisition: Big Tech companies can acquire financial service customers at a fraction of the cost of traditional banks due to their existing user ecosystems.

- Data Advantage: Access to vast amounts of customer data allows for personalized financial product offerings and more efficient risk assessment.

- Regulatory Arbitrage: In some instances, tech firms may operate under less stringent financial regulations compared to established banks, enabling faster innovation and lower compliance costs.

- Ecosystem Integration: Financial services are often embedded within broader digital ecosystems, making them a natural and convenient choice for users already engaged with these platforms.

Internal Corporate Finance Departments and Capital Markets

For large corporate clients, sophisticated internal finance departments and direct access to capital markets can significantly substitute for traditional bank financing. This means companies can bypass banks for large funding needs by issuing their own debt, like bonds or commercial paper. For instance, in 2024, corporate bond issuance globally remained robust, with major corporations leveraging this channel to secure substantial capital, thereby reducing their dependence on bank loans.

This direct access to capital markets offers a compelling alternative, especially for investment banking services like mergers and acquisitions advisory or underwriting. Companies can manage these activities internally or through specialized advisors, diminishing the need for a full suite of banking services. The cost-effectiveness and flexibility of these substitutes are key drivers for their adoption by financially adept corporations.

- Direct Capital Access: In 2023, the total value of global corporate bond issuance reached trillions of dollars, showcasing a significant alternative to bank lending for large corporations.

- Internal Finance Expertise: Many Fortune 500 companies employ dedicated treasury and finance teams that are highly capable of managing complex financial operations and capital raising independently.

- Reduced Reliance: This trend allows large corporations to negotiate more favorable terms with banks, or even opt-out of certain banking services altogether when capital markets offer a more attractive solution.

- Market Efficiency: The efficiency and depth of capital markets in 2024 continue to provide viable substitutes, particularly for companies with strong credit ratings and predictable cash flows.

The rise of alternative financial service providers, from fintech startups to Big Tech, significantly challenges traditional banks like BNP Paribas. These new entrants offer streamlined digital experiences, often at lower costs, directly competing for customer business. For instance, in 2023, the global fintech market size was valued at over $110 billion, highlighting the scale of this disruptive force.

Cryptocurrencies and DeFi protocols represent a growing substitute, enabling transactions and investments outside traditional banking. As of early 2024, DeFi's total value locked exceeded $100 billion, demonstrating substantial user adoption and a clear alternative for financial activities.

Large corporations increasingly bypass banks by accessing capital markets directly, issuing bonds or commercial paper. Global corporate bond issuance in 2024 remained strong, with major companies securing trillions in funding this way, reducing their reliance on bank loans and services.

| Substitute Type | Key Characteristics | Impact on Traditional Banks | 2023/2024 Data Point |

|---|---|---|---|

| Fintech & Digital Banks | Agile, low-cost, superior digital experience | Customer attrition, fee compression | Global Fintech Market: >$110 billion (2023) |

| P2P Lending & Crowdfunding | Alternative funding and investment channels | Loss of lending and deposit business | P2P Lending Market: ~$100 billion (2023) |

| Cryptocurrencies & DeFi | Decentralized transactions, higher yields | Potential disintermediation of core banking functions | DeFi Total Value Locked: >$100 billion (early 2024) |

| Big Tech Financial Services | Integrated, convenient, data-driven | Competition for payments, lending, and customer loyalty | Apple Pay Users: >500 million (early 2024) |

| Direct Capital Markets Access | Bypassing banks for corporate funding | Reduced demand for corporate lending and advisory | Global Corporate Bond Issuance: Trillions (2024) |

Entrants Threaten

The banking sector, particularly for a large universal bank like BNP Paribas, presents a formidable threat of new entrants due to exceptionally high capital requirements. Establishing a bank necessitates significant upfront investment for obtaining licenses, adhering to stringent regulatory compliance, and building a comprehensive operational framework. For instance, in 2024, minimum capital requirements for new banks in major European jurisdictions often run into hundreds of millions of euros, creating a substantial financial barrier.

BNP Paribas operates within a banking sector characterized by a stringent regulatory environment, which acts as a significant barrier to new entrants. These regulations include rigorous licensing procedures, demanding capital adequacy ratios like those mandated by Basel III and its upcoming iterations (Basel IV), and comprehensive compliance requirements covering Anti-Money Laundering (AML), Know Your Customer (KYC) protocols, and data privacy. For instance, in 2024, the European Union continued to refine its banking regulations, with ongoing discussions around the implementation of Basel IV, which will further increase capital requirements for banks, making it more costly for new players to establish themselves. The sheer complexity and ongoing evolution of these rules necessitate substantial investment in legal, compliance, and operational infrastructure, deterring many potential competitors.

Established banks like BNP Paribas benefit from strong brand recognition and deep-seated customer trust, built over decades. For instance, in 2023, BNP Paribas reported a customer base of over 30 million individuals across its retail banking operations, a testament to its long-standing presence and reliability.

New entrants face the significant challenge of overcoming this ingrained loyalty and building credibility in a sector where security and reliability are paramount concerns for customers. The cost and time required to cultivate such trust can be a substantial barrier, making it difficult for newcomers to quickly gain market share.

Economies of Scale and Scope

Economies of scale are a significant barrier for new entrants looking to compete with established players like BNP Paribas. Large incumbent banks leverage massive operational volumes, shared technology platforms, and sophisticated risk management systems to drive down per-unit costs across a wide array of financial products and services. For instance, in 2024, major European banks continued to invest billions in digital transformation, a cost that new, smaller entities would find prohibitive to match at scale.

Achieving comparable cost efficiencies is exceedingly difficult for newcomers without an established, large customer base and diversified revenue streams. This scale advantage allows BNP Paribas to offer competitive pricing and absorb market fluctuations more effectively than a startup could. The sheer breadth of services, from retail banking to complex investment banking, also creates economies of scope, further entrenching incumbents.

- Economies of Scale: Large banks like BNP Paribas benefit from lower per-unit costs due to high-volume operations.

- Technology Investment: Billions are spent by established banks on technology, creating a high entry cost for new players.

- Diversified Revenue: A broad product and service offering allows incumbents to spread costs and risks.

- Customer Base: Existing large customer bases enable incumbents to achieve greater operational leverage.

Access to Distribution Channels and Networks

Newcomers face significant hurdles in securing access to established distribution channels and networks. For traditional banking services, this means replicating the extensive branch networks that incumbents have built over decades, a costly endeavor. Even for digital-first players, integrating with existing payment systems and forging partnerships to reach a broad customer base requires substantial investment and time. For instance, in 2024, the cost of establishing a new physical bank branch can range from $2 million to $5 million, excluding ongoing operational expenses.

Fintechs, while adept at leveraging digital platforms, still grapple with the need for robust infrastructure and strategic alliances to compete effectively. Building out the necessary technological backbone and securing agreements with payment processors and other financial institutions is a resource-intensive undertaking. By the end of 2023, the average cost for a fintech to acquire a new customer through digital channels was approximately $50, highlighting the ongoing expense of market penetration.

- Distribution Channel Barrier: New entrants must overcome the significant challenge of accessing and building out extensive distribution networks, whether physical or digital.

- Infrastructure Costs: Establishing the required technological infrastructure and payment system integrations is a major capital outlay for new players.

- Partnership Necessity: Gaining traction often necessitates forming strategic partnerships, which can be difficult to secure against established players with deep relationships.

- Competitive Landscape: The entrenched nature of existing distribution channels and networks, often built over many years, presents a formidable barrier to entry.

The threat of new entrants for BNP Paribas is generally low due to substantial capital requirements and stringent regulatory hurdles, particularly in 2024. New banks face immense costs for licensing, compliance, and operational setup, often requiring hundreds of millions of euros in initial investment in major European markets. This high barrier, coupled with the need to build customer trust and leverage economies of scale, makes it challenging for newcomers to compete effectively.

| Barrier Type | Description | 2024 Impact Example |

| Capital Requirements | Significant upfront investment needed for licenses and operations. | Hundreds of millions of euros for European banking licenses. |

| Regulatory Compliance | Complex rules (Basel IV, AML, KYC) demand substantial infrastructure. | Ongoing refinement of EU banking regulations increases compliance costs. |

| Brand Loyalty & Trust | Established banks like BNP Paribas benefit from decades of customer relationships. | BNP Paribas served over 30 million retail customers in 2023. |

| Economies of Scale | Incumbents leverage high-volume operations for lower per-unit costs. | Billions invested by major banks in digital transformation are prohibitive for startups. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BNP Paribas is built upon a robust foundation of data, including the bank's annual reports, investor presentations, and regulatory filings. We also leverage industry-specific research from financial data providers and market analysis firms to capture competitive dynamics and emerging trends.