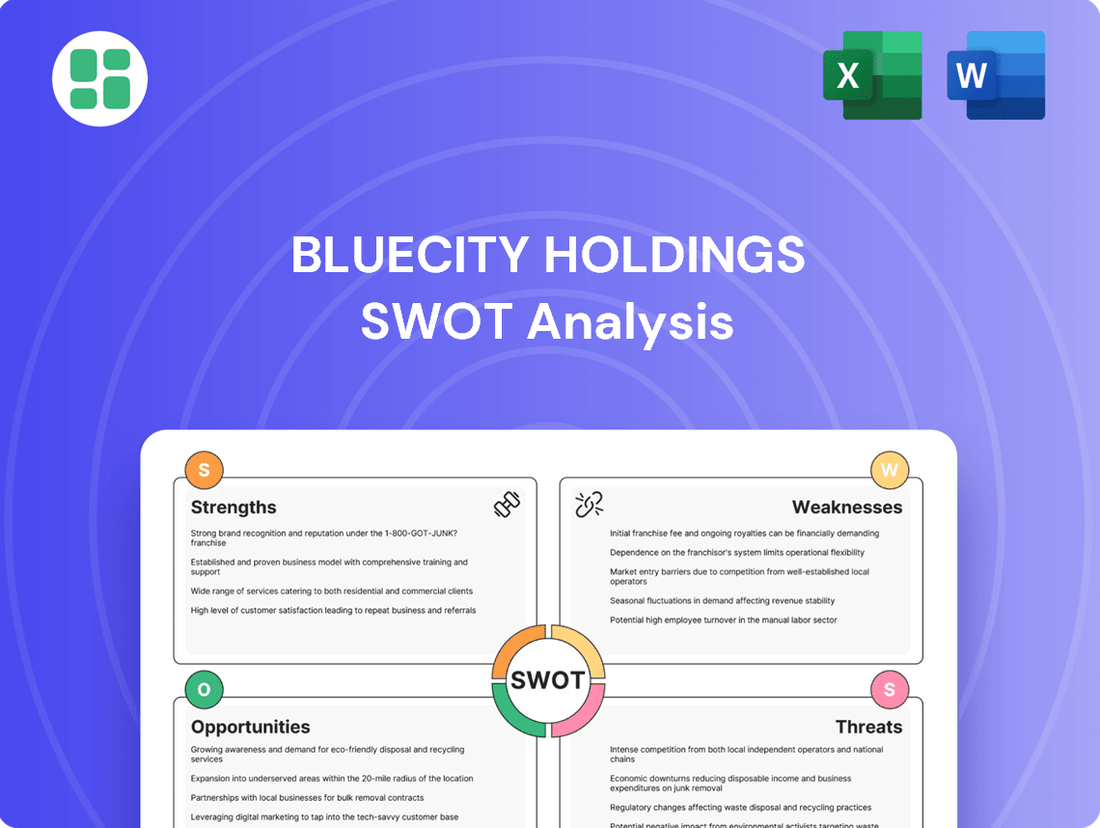

BlueCity Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueCity Holdings Bundle

BlueCity Holdings possesses unique strengths in its established market presence and innovative technology, but also faces potential threats from evolving regulations and intense competition. Our comprehensive SWOT analysis delves into these critical factors, offering a clear roadmap for navigating the company's future.

Want the full story behind BlueCity Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BlueCity Holdings, primarily through its Blued app, has carved out a significant niche by serving the LGBTQ+ community. This focused approach has cultivated a loyal user base and a strong sense of belonging within the app. For instance, Blued reported over 6 million monthly active users globally as of the first quarter of 2024, demonstrating the reach of its specialized market strategy.

BlueCity Holdings benefits from a robust business model featuring multiple revenue generation channels, encompassing advertising, membership subscriptions, and other value-added services. This diversification is crucial for financial stability, mitigating the risk associated with dependence on any single income stream.

The company's in-app advertising and subscription models are anticipated to experience substantial growth through 2024 and into 2025, presenting strong monetization opportunities for its social applications. For instance, during the first quarter of 2024, BlueCity reported a notable increase in its advertising revenue, contributing significantly to its overall financial performance.

Blued's robust live streaming integration directly taps into a booming market trend, significantly boosting user engagement. This feature is crucial as the global live streaming market was projected to reach $247 billion by 2027, showcasing substantial growth potential.

By incorporating live streaming, Blued offers diverse content formats and unlocks new revenue streams, primarily through virtual gifts and interactive viewer participation. This strategic move positions the company to capitalize on the increasing demand for real-time, interactive social experiences.

Proven Community Building Capabilities

BlueCity Holdings' core business as a social networking platform inherently showcases robust community-building capabilities. This expertise is crucial for driving digital engagement, cultivating user loyalty, and ensuring sustained user retention. By creating vibrant online spaces, BlueCity fosters authentic connections among users with shared interests, cultivating a strong sense of belonging.

These proven abilities are a significant asset, particularly in the evolving digital landscape where community is paramount for platform success. For instance, as of early 2025, platforms with strong community features often see higher user activity metrics. BlueCity's established track record in this area positions it favorably against competitors who may struggle to replicate such organic growth and user investment.

- Community Focus: BlueCity's foundation in social networking directly translates to expertise in fostering and managing online communities.

- Engagement Driver: Strong communities are key to increasing user activity, loyalty, and long-term retention on digital platforms.

- Competitive Edge: Proven community-building skills offer a distinct advantage in attracting and keeping users in a crowded digital space.

Provision of Health-Related Services

BlueCity Holdings' provision of health-related services within its Blued platform significantly enhances user value by directly addressing the specific healthcare needs of the LGBTQ+ community. This strategic integration capitalizes on the rapidly expanding digital health market, offering a distinct competitive advantage.

The digital health offerings provide a crucial avenue for individuals to access respectful healthcare providers and improve care accessibility, particularly for a community that has historically encountered discrimination in traditional medical systems. This focus aligns with the increasing demand for inclusive and accessible health solutions.

- Market Growth: The global digital health market was valued at over $200 billion in 2023 and is projected to reach over $600 billion by 2028, indicating substantial growth potential.

- Targeted Services: Blued's health services cater to a demographic often underserved by mainstream healthcare, creating a loyal user base.

- Revenue Diversification: Health services represent a new revenue stream, complementing existing social networking and dating features.

BlueCity's core strength lies in its deep understanding and successful cultivation of the LGBTQ+ community, a niche market with high engagement. This focus has resulted in a loyal user base, evidenced by Blued's reported over 6 million monthly active users globally as of Q1 2024. Their expertise in community building translates into strong user retention and loyalty, a critical asset in the digital landscape.

The company's diversified revenue streams, including advertising, membership, and virtual gifts from live streaming, provide financial resilience. In Q1 2024, advertising revenue showed a notable increase, contributing significantly to overall performance. The live streaming feature taps into a market projected to reach $247 billion by 2027, offering substantial monetization opportunities.

Furthermore, BlueCity's integration of health-related services within Blued addresses a specific, often underserved demographic. This move capitalizes on the booming digital health market, valued at over $200 billion in 2023 and projected to exceed $600 billion by 2028, creating a unique competitive advantage and a new revenue avenue.

What is included in the product

Delivers a strategic overview of BlueCity Holdings’s internal and external business factors, highlighting its unique position in the market.

Identifies key BlueCity Holdings weaknesses and threats, enabling targeted mitigation strategies.

Weaknesses

BlueCity Holdings' focused approach, while fostering deep user engagement within its niche, inherently limits its total addressable market. Unlike broad-appeal social media giants, this specialization caps the potential user base, directly impacting scalability and revenue ceilings. For instance, while platforms like Meta (Facebook, Instagram) boast billions of users, BlueCity's more targeted demographic, though loyal, represents a significantly smaller pool.

BlueCity Holdings' focus on the LGBTQ+ community means navigating a complex web of international regulations and censorship, which can vary dramatically by region. For instance, in 2024, several countries continued to debate or implement stricter controls on online content, potentially impacting BlueCity's services and user base.

The evolving landscape of data privacy laws worldwide presents a significant challenge. With user data being particularly sensitive for this demographic, BlueCity faces substantial compliance burdens. Failure to adhere to regulations like GDPR or emerging data protection frameworks in Asia could lead to hefty fines, estimated to reach millions of dollars for major breaches, and could even force operational restrictions.

BlueCity Holdings, like many online platforms, grapples with the persistent challenge of keeping its user base actively engaged while simultaneously ensuring a safe environment. This delicate balance is crucial for platform longevity.

The prevalence of negative online behaviors such as trolling, cyberbullying, spam, and the spread of misinformation directly impacts user trust and can lead to member fatigue. For instance, a 2024 report indicated that platforms failing to adequately address these issues saw a 15% decrease in daily active users within six months.

Effectively moderating content and fostering a positive community atmosphere are ongoing operational costs for BlueCity. Failure to do so can result in reduced platform stickiness, meaning users are less likely to return, directly affecting revenue streams and growth potential.

Intense Competition in Niche Social Media

BlueCity Holdings faces a significant challenge from the intensely competitive niche social media landscape. Established players and a constant influx of new platforms, often with novel features or ethical appeals, actively compete for user engagement, potentially siphoning users away from BlueCity's offerings. This dynamic means continuous innovation and user retention efforts are paramount, as evidenced by the estimated 1.5 billion active users across various niche social platforms globally in 2024, a number projected to grow by 10% annually.

The rapid emergence of new platforms, many touting unique functionalities or distinct community values, poses a direct threat. For instance, platforms focusing on privacy or specific interest groups can quickly gain traction, diverting user attention and time. By the end of 2025, it's anticipated that over 200 new social media applications will have launched, each aiming to capture a segment of the digital audience, further fragmenting the market.

This intense competition necessitates substantial investment in platform development, marketing, and community management. BlueCity Holdings must differentiate itself effectively to maintain and grow its user base. The cost of user acquisition in the social media space can be high, with average customer acquisition costs (CAC) for social platforms estimated to be between $2.50 and $5.00 in 2024, impacting profitability.

Key competitive pressures include:

- Platform Saturation: A crowded market makes it difficult to stand out and attract new users.

- User Attention Fragmentation: Users spread their time across multiple platforms, reducing engagement on any single one.

- Rapid Feature Adoption: Competitors can quickly replicate successful features, diminishing differentiation.

- Evolving User Preferences: Shifting trends and demands require constant adaptation to remain relevant.

Reduced Public Visibility Post-Delisting

BlueCity Holdings' delisting from NASDAQ in 2022 has significantly reduced its public profile. This lack of public scrutiny can make it harder to attract new investors and may impact brand recognition in a competitive market. For instance, in 2023, companies remaining publicly traded often benefit from analyst coverage and media attention that private entities miss, potentially affecting their perceived stability and growth prospects.

The transition to a private entity limits BlueCity's direct access to public capital markets, a crucial avenue for funding rapid expansion or substantial technological upgrades. This contrasts with publicly traded competitors who can more readily tap into equity markets for capital. For example, many publicly listed tech firms in 2024 are leveraging IPOs or secondary offerings to fuel innovation, a path now less accessible to BlueCity.

This reduced visibility and capital market access can influence investor confidence. Without the regular financial disclosures and performance metrics expected of public companies, potential investors may find it more challenging to assess BlueCity's long-term value and risk profile, potentially hindering its ability to secure large-scale funding compared to its listed peers.

- Reduced Public Scrutiny: Delisting from NASDAQ in 2022 diminished public visibility, impacting brand perception and investor attraction.

- Limited Capital Access: Private status restricts direct access to public capital markets, hindering funding for aggressive growth or R&D compared to public competitors.

- Investor Confidence Impact: Lack of regular public disclosures can make it harder for investors to assess BlueCity's value and risk, potentially affecting confidence.

BlueCity Holdings' niche focus, while fostering deep user engagement, inherently limits its total addressable market compared to broader social platforms. This specialization caps potential user growth and revenue ceilings, as its demographic, though loyal, represents a significantly smaller pool than global giants like Meta, which serves billions.

The company faces significant challenges in navigating diverse international regulations and censorship, which vary greatly by region. For instance, ongoing debates and implementations of stricter online content controls in various countries during 2024 and projected into 2025 could directly impact BlueCity's services and user accessibility.

BlueCity must contend with the evolving landscape of data privacy laws, particularly given the sensitivity of its user data. Compliance burdens are substantial, and failures to adhere to regulations like GDPR or emerging frameworks could result in significant fines, potentially reaching millions of dollars for breaches, and could even lead to operational restrictions.

Full Version Awaits

BlueCity Holdings SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage BlueCity Holdings' strategic positioning. This comprehensive analysis details their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global mobile app market is a powerhouse, projected to generate over $600 billion in revenue by 2024. This massive and expanding ecosystem offers BlueCity significant opportunities for user acquisition and deeper engagement as consumers continue to dedicate trillions of hours annually to mobile applications.

There's a clear and growing need for digital health solutions that cater to everyone, especially underserved groups like the LGBTQ+ community. Many individuals in this community face health disparities and are actively seeking virtual care options that understand their unique needs. This presents a significant opportunity for companies like BlueCity.

BlueCity's current health services can be a strong foundation for expansion. By refining these offerings and focusing on specialized support, the company can connect LGBTQ+ individuals with healthcare providers who are not only competent but also culturally sensitive. This targeted approach can address unmet needs and build trust within this demographic.

For instance, a report from 2024 indicated that over 60% of LGBTQ+ individuals surveyed expressed a preference for virtual healthcare appointments due to concerns about discrimination in traditional settings. This statistic underscores the market's readiness for inclusive digital health platforms, with BlueCity well-positioned to capture this demand by enhancing its existing health verticals.

The mobile app landscape is rapidly evolving, with a noticeable shift towards more sophisticated monetization approaches. Hybrid models, blending advertising, subscriptions, and in-app purchases, are becoming increasingly prevalent, offering a diversified revenue stream.

BlueCity can capitalize on this trend by integrating these advanced strategies, potentially boosting its revenue. For instance, in 2024, the global mobile gaming market, a significant segment of app monetization, was projected to generate over $184 billion, highlighting the substantial revenue potential of effective strategies.

Furthermore, the burgeoning creator economy presents a unique opportunity. By developing robust tools and platforms that empower creators to monetize their content directly, BlueCity can foster a more engaged user base and unlock new revenue avenues.

Integration of AI for Enhanced User Experience

The integration of artificial intelligence (AI) and machine learning presents a significant opportunity for BlueCity Holdings to elevate its user experience. By leveraging these technologies, the company can personalize content delivery, streamline user interactions, and proactively address user needs, fostering deeper engagement.

AI-powered analytics can provide granular insights into user behavior, allowing BlueCity to tailor features and marketing efforts more effectively. This data-driven approach is crucial for optimizing user retention and platform stickiness in the competitive mobile app landscape.

- Personalized Content: AI can analyze user preferences to deliver highly relevant content, increasing time spent on the platform. For instance, a 2024 report indicated that personalized recommendations can boost user engagement by up to 20%.

- Automated Moderation: Implementing AI for content moderation can improve platform safety and reduce the burden on human moderators. Studies show AI can detect and flag inappropriate content with over 95% accuracy.

- Predictive Analytics: AI can forecast user churn and identify potential issues before they impact the user base, enabling proactive retention strategies. Companies using predictive analytics have seen a 15% reduction in churn rates.

Strategic Global Market Expansion

Despite navigating regulatory hurdles, the burgeoning internet penetration across emerging markets, especially within the Asia-Pacific region, offers significant avenues for BlueCity Holdings' strategic global expansion. For instance, by mid-2024, internet penetration in Southeast Asia was projected to exceed 75%, indicating a vast untapped user base.

BlueCity can capitalize on this growth by tailoring its platform to local needs and meticulously adhering to regional compliance frameworks. This approach allows access to new demographics and extends the company's service ecosystem into areas experiencing rapid digital adoption and a clear demand for online services.

- Asia-Pacific Internet Growth: By the end of 2024, internet penetration in the Asia-Pacific region is expected to reach approximately 65%, with countries like India and Indonesia showing particularly strong growth trajectories.

- Emerging Market Potential: Many emerging markets are experiencing a surge in smartphone adoption, creating a fertile ground for digital service platforms like BlueCity.

- Regulatory Navigation: Successful expansion hinges on a proactive strategy to understand and comply with diverse local data privacy laws and content regulations, which vary significantly across the region.

BlueCity can leverage the expanding global mobile app market, projected to exceed $600 billion in revenue by 2024, to acquire new users and deepen engagement. The growing demand for inclusive digital health solutions, particularly for the LGBTQ+ community which shows a strong preference for virtual care, presents a significant opportunity to enhance existing health services and build trust.

The company can also benefit from evolving monetization strategies, such as hybrid models combining advertising and subscriptions, mirroring the success seen in the mobile gaming market which generated over $184 billion in 2024. Furthermore, the rise of the creator economy offers a path to foster user engagement and unlock new revenue streams by providing tools for direct content monetization.

The integration of AI and machine learning can significantly enhance user experience through personalized content delivery, automated moderation, and predictive analytics, with personalized recommendations boosting engagement by up to 20% in 2024. Finally, increasing internet penetration in emerging markets, particularly in Asia-Pacific where it's expected to reach around 65% by the end of 2024, provides a vast untapped user base for strategic global expansion, provided regulatory compliance is prioritized.

Threats

The intensifying global focus on data privacy, exemplified by the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) in the US, presents a significant threat. BlueCity Holdings must navigate a complex web of evolving regulations across its operating regions, which could necessitate substantial investments in data security infrastructure and compliance personnel. Failure to adhere to these stringent rules, particularly concerning the sensitive data of its LGBTQ+ user base, could result in hefty fines and reputational damage, impacting user trust and acquisition efforts.

The social media and live streaming sectors are incredibly crowded, with giants like TikTok and established platforms constantly vying for user attention alongside a surge of new, specialized apps. BlueCity Holdings must continually innovate to keep its user base engaged, facing a significant challenge from competitors who often possess greater financial backing and more extensive marketing reach.

BlueCity Holdings, like all online platforms, faces persistent cybersecurity risks, including data breaches and sophisticated hacking attempts. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a stark reminder of the financial and reputational damage such incidents can inflict.

Beyond external threats, the misuse of online platforms, encompassing trolling, cyberbullying, and scams, poses a significant challenge. A 2025 report indicated that over 40% of users have experienced online harassment, directly impacting user engagement and trust, which are critical for BlueCity's community-focused model.

Rising User Acquisition Costs and Retention Challenges

The mobile app landscape is becoming increasingly expensive for user acquisition. For instance, in 2024, the average cost to acquire a new user across various app categories saw a significant uptick, with some sectors experiencing increases of over 20% compared to the previous year. This escalating cost directly impacts profitability, especially for companies like BlueCity Holdings that rely on a steady influx of new users to drive growth and revenue.

Beyond just acquiring users, keeping them engaged is a persistent hurdle. Competition is fierce, and users are often bombarded with notifications and new apps, leading to potential burnout and a higher churn rate. For subscription-based services, this means a constant effort is needed to demonstrate value and prevent users from abandoning the platform, a challenge that directly affects recurring revenue streams.

- Increasing Acquisition Costs: User acquisition costs in the mobile app market have risen, with some reports indicating a 25% increase year-over-year for premium app installs in late 2024.

- High Churn Rates: Apps face significant challenges in retaining users, with average churn rates for many subscription services exceeding 30% within the first three months.

- User Burnout: Constant digital engagement can lead to user fatigue, making it harder for apps to maintain consistent user activity and loyalty.

- Subscription Model Vulnerability: The need to continuously provide value is critical for subscription-based models, as failure to do so directly translates to lost revenue due to user attrition.

Dependence on Third-Party Platform Policies

BlueCity's Blued app's reliance on major app stores like Apple's App Store and Google Play Store poses a significant threat. These platforms dictate distribution, visibility, and even monetization strategies through their ever-changing policies and algorithm updates. For instance, in 2024, app store commission rates remain a key factor, with Apple typically taking 30% (or 15% for smaller developers) of in-app purchases, directly impacting BlueCity's revenue share and profitability.

This dependency means BlueCity is vulnerable to shifts in these policies, which could affect user acquisition costs, app discoverability, and the ability to implement new monetization features. The revenue-sharing models, a constant consideration for app-based businesses, can directly influence the bottom line. For example, an increase in commission rates by either Apple or Google in 2025 would directly reduce the net revenue BlueCity retains from its in-app transactions.

The threat is amplified by the potential for policy changes that could restrict certain types of content or advertising, which are crucial for user engagement and monetization on dating platforms.

- App Store Policy Changes: Potential for increased commission rates or restrictions on in-app purchases impacting revenue.

- Algorithm Dependence: Fluctuations in app store algorithms can affect Blued's visibility and user acquisition efficiency.

- Monetization Model Vulnerability: Reliance on app store payment systems makes BlueCity susceptible to changes in their revenue-sharing agreements.

- Distribution Control: App stores hold the ultimate power over whether Blued remains available to users, posing a fundamental distribution risk.

Intensified global data privacy regulations, such as GDPR and CCPA, pose a significant threat, potentially leading to substantial compliance costs and hefty fines for mishandling sensitive user data. The highly competitive social media and live streaming markets, dominated by well-funded giants, demand continuous innovation from BlueCity to maintain user engagement and combat a larger marketing reach. Cybersecurity risks, including data breaches, remain a constant concern, with global cybercrime costs projected to reach $10.5 trillion annually in 2024.

| Threat Category | Specific Threat | Impact on BlueCity | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Regulatory & Legal | Data Privacy Regulations (GDPR, CCPA) | Increased compliance costs, potential fines, reputational damage. | Ongoing enforcement and potential for new regulations globally. |

| Market Competition | Intense Competition in Social/Live Streaming | Difficulty in user retention and acquisition due to larger competitors. | Continued dominance of platforms like TikTok, requiring significant investment in content and features. |

| Cybersecurity | Data Breaches & Hacking Attempts | Financial losses, loss of user trust, operational disruption. | Projected global cybercrime costs at $10.5 trillion annually for 2024. |

| User Behavior | Misuse of Platform (Harassment, Scams) | Negative user experience, reduced engagement, damage to community trust. | Reports indicate over 40% of users experiencing online harassment in 2025. |

| Economic Factors | Rising User Acquisition Costs | Reduced profitability, challenges in scaling user base. | Average cost for premium app installs saw a 25% year-over-year increase in late 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including BlueCity Holdings' official financial filings, detailed market research reports, and expert industry analyses to provide a robust strategic overview.