BlueCity Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueCity Holdings Bundle

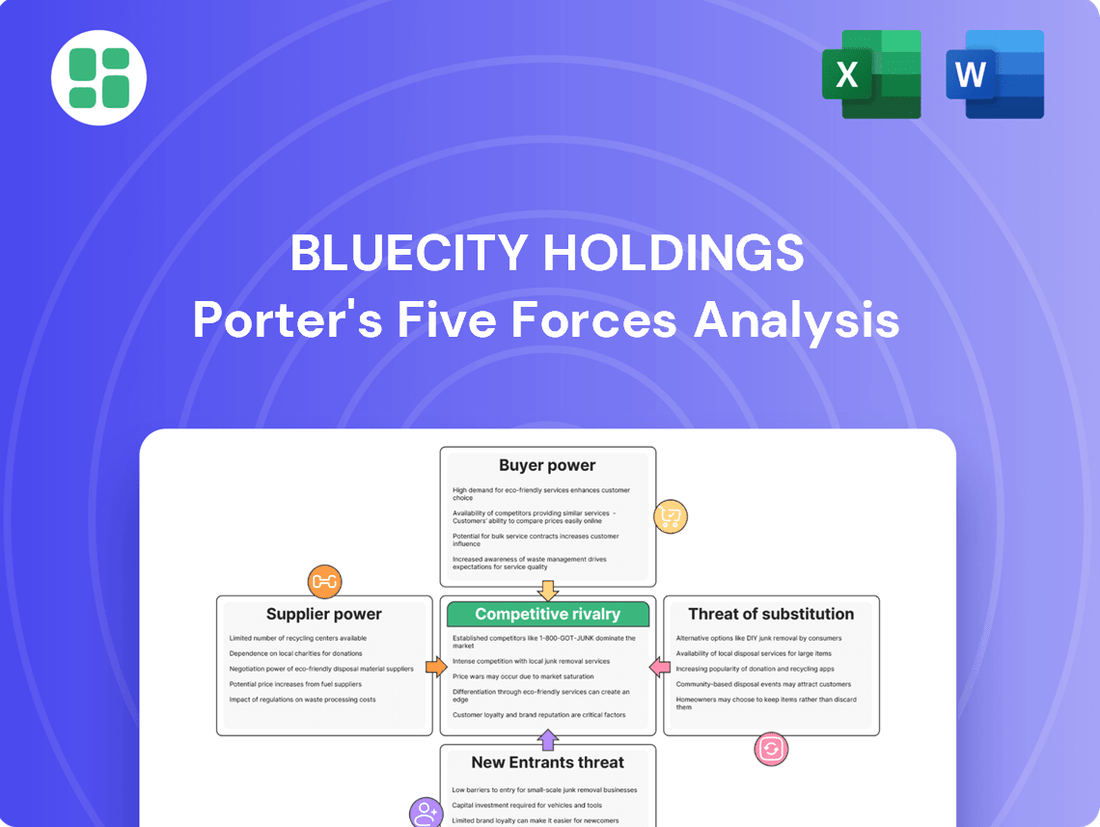

BlueCity Holdings faces a dynamic competitive landscape, with moderate buyer power and a significant threat from substitutes impacting its market position. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping BlueCity Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BlueCity's reliance on a few specialized technology providers for essential services like cloud computing and advanced chips significantly strengthens supplier bargaining power. Companies such as Amazon Web Services, Microsoft Azure, and Google Cloud dominate the market, allowing them to influence pricing and contract terms. This dependence means BlueCity’s operational costs and technological advancement are heavily tied to the decisions of these few key players.

In the vibrant live streaming and social media landscape, content creators and influencers are the lifeblood, driving user engagement and keeping platforms like BlueCity Holdings alive and kicking. Their knack for crafting captivating content and drawing in large followings translates directly into substantial bargaining power. This means platforms are often locked in a fierce competition to woo and keep their star creators, frequently resorting to attractive monetization tools and generous revenue-sharing agreements. This competition can significantly inflate the costs BlueCity incurs to secure and maintain high-quality content.

BlueCity Holdings relies on third-party payment gateways for its revenue streams, primarily from membership subscriptions and value-added services. This dependence means these gateway providers hold a degree of bargaining power, particularly concerning transaction fees and adherence to financial regulations. For instance, in 2023, payment processing fees can range from 1.5% to 3.5% of transaction value, a cost that directly impacts BlueCity's net revenue.

While the market offers several payment gateway options, the critical nature of their service for enabling transactions grants them moderate leverage. Any unfavorable changes in their terms, such as increased fees or stricter compliance requirements, could directly affect BlueCity's profitability and the seamlessness of the user experience. This situation highlights how essential these seemingly simple services are to BlueCity's operational and financial health.

Reliance on Advertising Technology

BlueCity Holdings' reliance on advertising technology providers significantly impacts its bargaining power as a supplier. The company's revenue model is heavily dependent on ad networks and programmatic platforms, meaning changes in these suppliers' capabilities or pricing directly affect BlueCity's advertising effectiveness and revenue streams. For instance, a shift towards more sophisticated programmatic advertising by these suppliers could necessitate increased investment or adaptation from BlueCity to maintain its ad revenue.

The bargaining power of these advertising technology suppliers is amplified by the increasing complexity and consolidation within the ad tech landscape. As of 2024, the digital advertising market is characterized by a few dominant players in areas like demand-side platforms (DSPs) and supply-side platforms (SSPs), giving them considerable leverage. BlueCity's dependence on these platforms for ad delivery and optimization means that supplier-imposed fees or changes in algorithms can directly squeeze BlueCity's profit margins.

- Dependence on Ad Tech: BlueCity's revenue generation is intrinsically linked to the performance and cost structures of third-party advertising technology providers.

- Supplier Leverage: Dominant players in ad tech, particularly in programmatic advertising, hold significant bargaining power due to market concentration.

- Impact on Revenue: Fluctuations in ad tech pricing, policy changes, or technological shifts directly influence BlueCity's advertising revenue and profitability.

- Market Dynamics: The ongoing evolution of digital advertising, including privacy-focused changes and the rise of AI in ad targeting, further empowers sophisticated ad tech suppliers.

Data and Security Service Providers

Data and security service providers hold significant sway over BlueCity Holdings. This is due to the highly sensitive nature of user data, particularly within the LGBTQ+ community that BlueCity serves. These specialized firms are essential for maintaining platform integrity, safeguarding user privacy, and ensuring compliance with stringent data protection laws.

The critical nature of these services, combined with the specialized expertise these providers possess, grants them considerable bargaining power. This power translates into their ability to influence service fees and dictate contract terms. For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is projected to reach $345.4 billion by 2028, indicating strong demand and pricing power for providers.

- Specialized Expertise: Providers offer niche skills in data security and analytics, which are hard for BlueCity to replicate internally.

- Regulatory Compliance: Adherence to data privacy regulations like GDPR or CCPA is paramount, making these providers indispensable.

- High Switching Costs: Migrating sensitive data and security protocols to a new provider can be complex and costly.

- Market Demand: The increasing threat landscape and data volume drive demand for these services, strengthening supplier positions.

BlueCity's reliance on a few specialized technology providers for essential services like cloud computing and advanced chips significantly strengthens supplier bargaining power. Companies such as Amazon Web Services, Microsoft Azure, and Google Cloud dominate the market, allowing them to influence pricing and contract terms. This dependence means BlueCity’s operational costs and technological advancement are heavily tied to the decisions of these few key players.

Content creators and influencers hold considerable sway due to their role in driving user engagement on BlueCity's platforms. This necessitates competitive monetization strategies and revenue-sharing agreements to retain top talent, thereby increasing operational costs.

Third-party payment gateways possess moderate leverage due to their critical function in processing transactions. Any increase in their transaction fees, which can range from 1.5% to 3.5% as seen in 2023, directly impacts BlueCity's net revenue and user experience.

Advertising technology providers, particularly dominant players in programmatic advertising, exert significant bargaining power. As of 2024, market consolidation in ad tech means these suppliers can influence pricing and algorithms, directly affecting BlueCity's advertising revenue and profit margins.

Data and security service providers hold substantial influence due to the sensitive nature of user data and stringent regulatory requirements. The global cybersecurity market's growth, valued at approximately $214.9 billion in 2023, underscores the pricing power of these specialized firms.

What is included in the product

This analysis unpacks the competitive forces impacting BlueCity Holdings, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within its specific market context.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, allowing for rapid identification of key threats and opportunities within the BlueCity Holdings market.

Customers Bargaining Power

Customers in the social networking and live streaming space, like those interacting with BlueCity Holdings' platforms, generally face minimal hurdles when switching. This means a user can hop from one app to another without much effort or expense if they discover a more appealing option. In 2023, the average user spent approximately 2.5 hours per day on social media, highlighting the time commitment users make, but also their willingness to explore alternatives if a platform doesn't meet evolving needs.

Users within the LGBTQ+ community, a core demographic for BlueCity Holdings, exhibit a heightened sensitivity to privacy and safety. This is a critical factor influencing their bargaining power.

The prevalence of hate speech and harassment on social media platforms means that any perceived lack of robust content moderation or inadequate privacy measures can lead to significant user attrition. For instance, a 2024 survey indicated that over 60% of LGBTQ+ individuals have experienced online harassment, making platform safety a non-negotiable aspect of their engagement.

Consequently, BlueCity Holdings' ability to foster a secure and inclusive environment directly impacts user retention. Platforms that demonstrably prioritize user safety and implement effective content moderation policies gain a competitive edge, thereby strengthening the bargaining power of their customers who can easily switch to alternatives perceived as safer.

Customers today demand more than just basic social networking; they expect a rich tapestry of features. This includes live streaming capabilities, integrated health services, and seamless e-commerce options. For BlueCity, which serves the LGBTQ+ community, this translates to a need for highly tailored content and specialized services that cater to unique user needs.

The growing expectation for diverse functionalities directly strengthens customer bargaining power. Users can readily switch to platforms that offer a more comprehensive and personalized experience, making it harder for any single platform to retain them solely on core social features. This is particularly true in the digital space where alternatives are often just a click away.

Preference for Flexible Monetization Models

Customers are increasingly favoring flexible monetization models, which directly impacts companies like BlueCity Holdings. For instance, in 2024, a significant portion of consumers surveyed indicated a preference for ad-supported or freemium tiers for digital services, with some reports suggesting over 60% are willing to tolerate ads for free access to content. This trend empowers consumers by giving them the choice to opt for lower-cost or no-cost alternatives, thereby pressuring platforms to offer more adaptable pricing structures to maintain market share.

This preference for flexibility means that BlueCity Holdings must consider a range of monetization strategies. Consumers can effectively bargain by selecting services that align with their budget and willingness to engage with advertising. For example, the growth of ad-supported tiers in the streaming industry, which saw substantial user adoption in 2023 and continued into 2024, demonstrates this power. Companies that fail to offer such options risk losing customers to competitors who do.

- Consumer preference for ad-supported tiers: Data from 2024 indicates a growing willingness among consumers to accept advertisements in exchange for reduced or no subscription fees for digital content and services.

- Impact on monetization strategies: This trend forces companies to diversify revenue streams beyond traditional subscription models, incorporating advertising or freemium options to cater to a wider customer base.

- Competitive advantage through flexibility: Platforms offering flexible payment options and tiered access are better positioned to attract and retain users in a competitive market, as demonstrated by the success of various streaming services in 2023-2024.

- Bargaining power of customers: The ability to choose between paid and ad-supported services directly enhances the bargaining power of customers, enabling them to dictate terms of engagement based on cost and convenience.

Community-Driven Influence and Feedback

The LGBTQ+ community, known for its strong networking capabilities, can rapidly share feedback, both good and bad, about platforms. This unified voice and capacity to mobilize and shape public opinion grant customers substantial leverage to compel platforms to address their issues, particularly concerning content, features, and community rules.

For instance, in 2024, social media platforms experienced significant shifts in user engagement and content moderation policies often driven by organized community feedback. A study by the Pew Research Center in late 2023 indicated that over 60% of online users felt their feedback had influenced platform changes, a trend likely to continue and intensify.

- Community Network Strength: The highly interconnected nature of the LGBTQ+ community allows for rapid dissemination of information and sentiment regarding digital platforms.

- Collective Bargaining Power: This networked community can collectively influence public perception and exert pressure on companies to adapt their offerings and policies.

- Impact on Platform Policies: Customer feedback, amplified by community organization, can directly lead to changes in content moderation, feature development, and adherence to community guidelines.

Customers in the social networking and live streaming space, like those interacting with BlueCity Holdings' platforms, generally face minimal hurdles when switching, a key factor in their bargaining power. In 2023, the average user spent approximately 2.5 hours per day on social media, highlighting their engagement but also their willingness to explore alternatives if a platform doesn't meet evolving needs. The LGBTQ+ community, a core demographic for BlueCity, exhibits a heightened sensitivity to privacy and safety, making platform security a critical consideration. For instance, a 2024 survey indicated that over 60% of LGBTQ+ individuals have experienced online harassment, underscoring the importance of robust content moderation and privacy measures.

The growing expectation for diverse functionalities, including live streaming and integrated services, directly strengthens customer bargaining power. Users can readily switch to platforms offering a more comprehensive and personalized experience, making it harder for any single platform to retain them solely on core social features. This is particularly true in the digital space where alternatives are often just a click away. Furthermore, consumer preference for flexible monetization models, such as ad-supported or freemium tiers, empowers users to choose services that align with their budget, with over 60% of consumers surveyed in 2024 indicating a willingness to tolerate ads for free access.

The highly interconnected nature of the LGBTQ+ community allows for rapid dissemination of information and sentiment regarding digital platforms, granting them collective bargaining power. This networked community can collectively influence public perception and exert pressure on companies to adapt their offerings and policies. For example, in 2024, social media platforms experienced significant shifts in user engagement and content moderation policies often driven by organized community feedback, with over 60% of online users feeling their feedback had influenced platform changes according to a late 2023 study.

Preview Before You Purchase

BlueCity Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for BlueCity Holdings, detailing the competitive landscape and strategic positioning of the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the bargaining power of substitutes for BlueCity Holdings.

Rivalry Among Competitors

BlueCity Holdings operates in a highly competitive landscape, facing numerous direct rivals within the LGBTQ+ social networking and dating app sector. Platforms such as Grindr, Hornet, ROMEO, and Lex, alongside various other niche applications, offer similar core services. This saturation intensifies the challenge for user acquisition and sustained engagement within this specific demographic.

BlueCity Holdings contends with formidable competition from established social media giants such as TikTok, Instagram, YouTube, and Facebook. These platforms are not merely social networks; they have actively integrated and enhanced live streaming functionalities, a core offering for BlueCity.

Furthermore, these mainstream players are increasingly showcasing LGBTQ+ content and creators, directly siphoning potential users who might otherwise seek out specialized platforms like BlueCity's. For instance, by the end of 2023, TikTok reported over 150 million users in the United States alone, demonstrating the sheer scale of audience these platforms command.

The competition to attract and keep top content creators is fierce, as platforms like Twitch and YouTube are saturated with user-generated material. This intense rivalry means that companies must offer attractive monetization options, favorable revenue splits, and significant promotional support to secure and retain these crucial individuals. In 2024, the average creator on major platforms saw revenue shares fluctuate, with some platforms offering up to 70% of subscription revenue to creators, driving up acquisition costs.

Evolution of Monetization Strategies

Competitive rivalry within the sector is further fueled by the evolving monetization models, including subscriptions, advertising, and the growing trend of live stream e-commerce. Platforms constantly innovate their revenue streams to gain an edge, forcing competitors to adapt quickly or risk losing market share.

In 2024, the digital advertising market continued its robust growth, with projections indicating a global spend exceeding $600 billion, a significant portion of which flows through platforms like those BlueCity Holdings operates within. This intense competition for ad revenue necessitates constant innovation in user engagement and data analytics.

- Subscription Growth: Many platforms are diversifying with subscription tiers, aiming for predictable revenue. For instance, some leading social media platforms reported double-digit percentage increases in their premium subscription user bases throughout 2024.

- Live Stream E-commerce: This dynamic sector saw substantial growth, with global sales projected to reach hundreds of billions in 2024, creating a new battleground for user attention and merchant partnerships.

- Advertising Innovation: Competitors are investing heavily in AI-driven ad targeting and new formats, such as short-form video ads, to capture a larger share of the digital advertising pie.

Brand Safety and Trust as a Differentiator

For platforms targeting the LGBTQ+ community, brand safety and trust are paramount. Ensuring an environment free from hate speech and discrimination is a key differentiator. Companies that actively curate safe spaces, like those that have historically supported Pride events or have robust content moderation policies, attract and retain users more effectively. For instance, a 2024 survey indicated that 78% of LGBTQ+ individuals consider a brand's commitment to inclusivity when making purchasing decisions.

This focus on safety directly impacts competitive rivalry. Platforms that fail to adequately moderate harmful content risk alienating a significant user base, driving them towards competitors. Companies investing in advanced AI for content moderation and human oversight can build stronger brand loyalty. In 2023, social media platforms saw a significant increase in user-generated content, making proactive safety measures crucial for maintaining user trust and engagement within niche communities.

- Brand safety is a crucial battleground for platforms serving the LGBTQ+ community.

- Effective moderation of hate speech fosters trust and user retention.

- In 2024, 78% of LGBTQ+ individuals factor brand inclusivity into purchasing decisions.

- Platforms prioritizing user safety gain a competitive edge over those with lax content policies.

BlueCity Holdings faces intense competition not only from direct LGBTQ+ focused rivals like Grindr and Hornet but also from mainstream social media giants such as TikTok and Instagram. These larger platforms are increasingly incorporating live streaming features, a core offering for BlueCity, and actively showcasing LGBTQ+ content, thereby drawing away potential users. For example, TikTok alone had over 150 million users in the US by the end of 2023.

The battle for content creators is also a significant factor, with platforms offering attractive monetization and revenue splits. In 2024, creator revenue shares on major platforms often reached up to 70% of subscription revenue, driving up acquisition costs. Furthermore, the digital advertising market, projected to exceed $600 billion globally in 2024, intensifies rivalry as platforms compete for ad spend through innovative targeting and new ad formats like short-form video.

| Competitor Type | Key Offerings | 2024 Market Trend/Data Point |

| Direct LGBTQ+ Apps | Social Networking, Dating | Intense user acquisition focus |

| Mainstream Social Media | Live Streaming, Content Discovery | Growing LGBTQ+ content presence, 150M+ US TikTok users (end 2023) |

| Content Creator Platforms | Monetization, Promotion | Up to 70% creator revenue share on subscriptions |

| Digital Advertising Market | Targeted Ads, E-commerce | Global spend > $600 billion |

SSubstitutes Threaten

Mainstream social media and dating apps present a significant threat of substitutes for specialized LGBTQ+ platforms like BlueCity's Blued. These widely adopted platforms, such as Facebook, Instagram, and Tinder, already have massive user bases and integrated features that can satisfy basic social connection and dating desires. For instance, in 2024, Tinder reported over 75 million monthly active users globally, demonstrating the sheer reach and user habituation these mainstream apps command.

For many in the LGBTQ+ community, offline spaces like community centers, local events, and personal networks are strong substitutes for digital platforms. These physical connections offer a depth of intimacy and direct engagement that online interactions often struggle to match, crucial for genuine community building and support.

Generic digital communication tools like messaging apps, video conferencing, and online forums present a significant threat of substitution for BlueCity Holdings. These platforms can fulfill many of the basic communication needs that BlueCity's services might address, often at a lower cost or with broader existing user bases. For instance, a user might opt for WhatsApp for direct messaging instead of a feature within BlueCity's ecosystem.

In the entertainment sphere, dedicated streaming services, particularly those specializing in niche content like LGBTQ+ programming, act as strong substitutes for live streams or content hosted on broader social platforms that BlueCity might offer. This fragmentation of entertainment consumption means users can bypass BlueCity's offerings for more specialized or readily available entertainment options. The global streaming market was valued at over $80 billion in 2023, highlighting the scale of these alternatives.

Traditional and Digital Health Services

The threat of substitutes for BlueCity Holdings' health services is significant, as users have numerous alternatives for health information and care. Traditional healthcare providers, including clinics and hospitals, remain a primary substitute. Furthermore, a growing number of general digital health platforms, some with specific LGBTQ+ focus, offer comparable services, diluting BlueCity's unique positioning.

Users can access health advice, telemedicine, and even mental health support through a vast ecosystem of digital health apps and websites. For instance, in 2024, the global digital health market was valued at over $300 billion, showcasing the breadth of available substitutes. This wide availability means users are not solely reliant on BlueCity for their health needs.

- Traditional Healthcare: Clinics, hospitals, and private practices offer established health services.

- General Digital Health Platforms: Telemedicine providers, wellness apps, and online health information portals.

- Specialized LGBTQ+ Health Services: Other digital platforms or community organizations offering health resources tailored to the LGBTQ+ community.

Other Forms of Digital Content Consumption

Users can easily switch from live streaming on social platforms to other digital content forms. This includes watching pre-recorded videos on platforms like YouTube, engaging with short-form content on TikTok, or subscribing to services like Netflix and Disney+. This wide array of choices means user attention and time are frequently divided, pulling away from direct live social engagement.

The sheer volume of readily available digital entertainment presents a significant threat. In 2024, the global digital media market was valued at over $3.5 trillion, with video streaming alone accounting for a substantial portion. This vast ecosystem offers alternatives that can directly compete for users' leisure time, diminishing the unique appeal of live social streaming.

- Diversion of Attention: Alternative digital content formats directly compete for user attention, fragmenting the audience available for live social streaming.

- Content Variety: Platforms like YouTube and TikTok offer a broad spectrum of content, from educational videos to entertainment, catering to diverse user preferences beyond live interaction.

- Subscription Services: The rise of subscription video-on-demand (SVOD) services provides a curated and often high-quality alternative for entertainment consumption, capturing significant user engagement.

Mainstream social media and dating apps pose a significant threat of substitutes for BlueCity's specialized LGBTQ+ platforms. These dominant platforms boast massive user bases and integrated features that cater to basic social and dating needs. For instance, Tinder reported over 75 million monthly active users globally in 2024, highlighting their extensive reach and user habituation.

Generic digital communication tools like messaging apps and video conferencing can fulfill many of the basic communication needs BlueCity addresses, often at a lower cost or with larger existing user bases. Users may opt for platforms like WhatsApp for direct messaging instead of features within BlueCity's ecosystem.

The entertainment sphere sees streaming services, especially those with niche LGBTQ+ programming, acting as strong substitutes for live streams or content on broader social platforms. This fragmentation means users can easily bypass BlueCity for more specialized or readily available entertainment options. The global streaming market was valued at over $80 billion in 2023.

Entrants Threaten

The threat of new entrants into the social media and app space is significant, largely because the technical hurdles for creating a basic mobile application have dramatically lowered. This accessibility means that with readily available development tools, cloud services, and a wealth of open-source code, new players can emerge with relatively modest initial capital outlays.

While the technical aspects of launching a platform might seem accessible, building genuine trust and a thriving community within a niche, particularly one as sensitive as the LGBTQ+ community, poses a substantial hurdle for new entrants. Simply creating a website or app isn't enough; users expect a safe, inclusive, and reliable space.

Newcomers face significant investment requirements in robust content moderation systems, advanced privacy protections, and dedicated community management to foster user confidence and effectively challenge established players who have already cultivated reputations for safety and inclusivity. For instance, a platform aiming to serve this community would need to demonstrate a commitment to combating hate speech and misinformation, a costly but crucial undertaking.

Newcomers aiming to challenge established players like BlueCity Holdings face a formidable barrier due to the immense capital needed for effective market entry. To gain traction and build a user base, significant investment is essential for aggressive marketing campaigns, user acquisition strategies, and continuous technological innovation. For instance, in 2024, the average cost to acquire a new user in the competitive app market often exceeded $5, making it difficult for underfunded startups to achieve critical mass and establish the network effects that are crucial for success.

Network Effects of Established Platforms

Established social networking platforms, like Meta's Facebook and Instagram, benefit from powerful network effects. The more users on these platforms, the more valuable they become for everyone involved. For instance, Facebook reported over 3 billion monthly active users globally as of the first quarter of 2024, highlighting the immense gravitational pull of its existing user base.

This creates a significant barrier for new entrants. It's challenging for a new platform to attract users when their friends and social circles are already deeply embedded in established networks. A hypothetical new social app would need to offer a compellingly unique value proposition to overcome the inertia of users preferring to stay where their existing social capital resides.

- Network Effects: Value increases with user base, making established platforms sticky.

- User Acquisition Challenge: New entrants struggle to attract users when their social connections are elsewhere.

- Example Data: Meta's 3 billion+ monthly active users in Q1 2024 underscore the scale of existing network effects.

Navigating Regulatory and Safety Compliance

New companies entering the social media and health service arenas, especially those targeting niche communities like LGBTQ+ individuals, are encountering significant hurdles due to rising regulatory demands. These regulations often focus on data privacy, requiring substantial investment in secure infrastructure and compliance protocols.

The need to adhere to evolving safety policies, particularly concerning the moderation of harmful content, hate speech, and disinformation, presents a considerable challenge. For instance, in 2024, major social media platforms continued to grapple with content moderation costs, which can run into billions annually, making it a significant barrier for smaller, new entrants.

- Increased Data Privacy Costs: Compliance with regulations like GDPR and CCPA requires significant upfront and ongoing investment in data security and privacy management systems.

- Content Moderation Expenses: Platforms must invest heavily in technology and human resources to monitor and remove inappropriate content, a cost that disproportionately affects startups.

- Evolving Safety Standards: Keeping pace with rapidly changing definitions of harmful content and the need to protect vulnerable user groups adds complexity and expense to operations.

The threat of new entrants for BlueCity Holdings is moderate, primarily due to high capital requirements for effective market entry and strong network effects enjoyed by incumbents. While technical barriers are low, building trust and a robust community, especially within sensitive niches, demands significant investment in content moderation and privacy, making it difficult for startups to gain traction.

The cost of user acquisition in the competitive app market, often exceeding $5 per user in 2024, presents a substantial financial hurdle. Furthermore, established platforms like Facebook, with over 3 billion monthly active users in Q1 2024, benefit from powerful network effects that make it challenging for newcomers to attract users who are already embedded in existing social networks.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for marketing, user acquisition, and technological innovation. | Significant barrier, especially for startups. |

| Network Effects | Value increases with user base, creating user stickiness. | Makes it difficult for new platforms to attract users already connected elsewhere. |

| Brand Loyalty & Trust | Established platforms have cultivated reputations for safety and inclusivity. | New entrants must invest heavily to build comparable trust, particularly in niche communities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BlueCity Holdings leverages data from company annual reports, industry-specific market research, and government regulatory filings to provide a comprehensive view of the competitive landscape.