BlueCity Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueCity Holdings Bundle

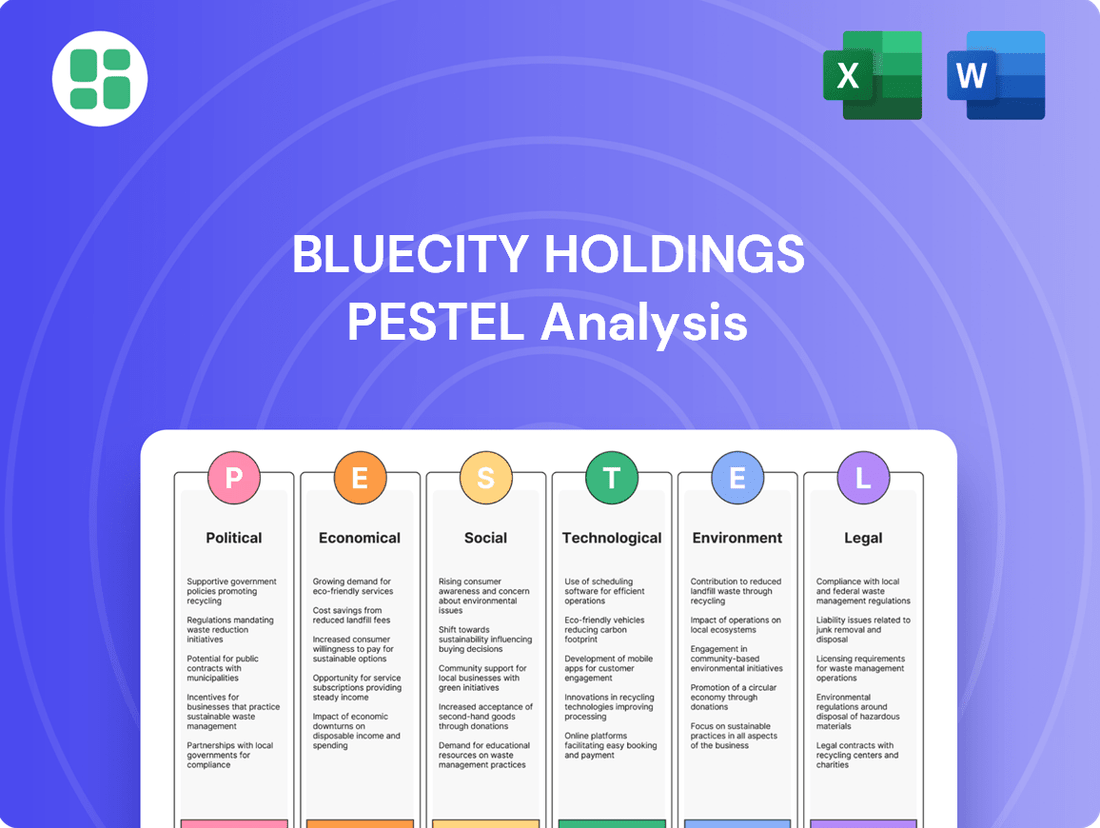

Navigate the complex external forces impacting BlueCity Holdings with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, social trends, technological advancements, environmental regulations, and legal frameworks are shaping its operational landscape and future growth. Gain a strategic advantage by leveraging these critical insights to inform your investment decisions and market strategies. Download the full PESTLE analysis now to unlock actionable intelligence and stay ahead of the curve.

Political factors

Governments, especially in BlueCity's key markets, are increasingly implementing stringent regulations on internet content and social media. For instance, as of late 2024, several Asian countries have tightened their digital content laws, requiring platforms to actively remove or block content deemed inappropriate or politically sensitive. This often translates to censorship requirements and limitations on user expression.

These political interventions directly shape how platforms like Blued operate. Mandates for data localization, where user data must be stored within national borders, also add to compliance complexities and costs for BlueCity Holdings. Such regulations can significantly restrict the scope of content moderation and the free exchange of ideas among users, impacting user engagement and platform growth.

Rising geopolitical tensions, particularly between China and Western nations, present a significant hurdle for Chinese-owned technology firms looking to expand internationally. This can manifest as increased scrutiny regarding data security and privacy, leading to potential market access restrictions or outright bans, as seen with previous concerns surrounding certain social media and e-commerce platforms.

Even after its privatization, BlueCity, the parent company of dating app Blued, would likely encounter difficulties in growing or sustaining its global user base amidst these heightened tensions. For instance, in 2023, several countries continued to review or implement stricter regulations on foreign technology companies, impacting user acquisition and advertising revenue streams for businesses perceived as having close ties to China.

Political stances on LGBTQ+ rights directly impact BlueCity Holdings' operations, affecting legal acceptance and social reception of its platforms like Blued. For instance, in 2024, countries with strong LGBTQ+ protections saw increased digital platform usage, while those with restrictive laws faced challenges. Governments actively promoting equality create a more favorable market, whereas discriminatory policies can lead to outright bans or severe operational constraints.

Data Sovereignty and National Security Concerns

Governments worldwide are tightening their grip on data, driven by national security imperatives. This means companies like BlueCity Holdings must increasingly ensure user data resides within national borders. For instance, the European Union's General Data Protection Regulation (GDPR) has set a precedent for strict data localization requirements, impacting global tech operations.

These mandates can significantly increase operational expenses for BlueCity, potentially requiring substantial investments in local data centers or navigating intricate cross-border data transfer agreements. Failure to comply can result in hefty fines, as seen with significant penalties levied against major tech firms for data privacy violations in recent years, or even outright market access denial.

- Data Localization Mandates: Many nations are enacting laws requiring data generated by their citizens to be stored domestically.

- Increased Compliance Costs: Building or leasing local data centers and managing complex data transfer protocols adds significant operational overhead.

- Risk of Penalties: Non-compliance can lead to substantial fines, with some data protection authorities imposing penalties equivalent to a percentage of global revenue.

- Market Access Barriers: For companies unable to meet data sovereignty requirements, market exclusion remains a significant risk.

Regulatory Scrutiny on Tech Companies

A significant political factor for BlueCity Holdings is the intensifying global regulatory scrutiny on major technology firms. This trend, driven by concerns over anti-monopoly practices, data privacy, and content moderation, creates a complex operating landscape. For instance, in 2024, the European Union's Digital Markets Act (DMA) continued to impose stricter rules on large online platforms, impacting how they operate and potentially affecting revenue streams.

Even as a private entity, BlueCity would be subject to these broad regulatory pressures. Governments worldwide are increasingly examining the market power and data handling of tech giants. This could necessitate adjustments to BlueCity's business models, user engagement strategies, and data management practices to ensure compliance and avoid substantial penalties, thereby safeguarding its operational licenses.

Key areas of regulatory focus include:

- Antitrust and Competition Law: Regulators are scrutinizing market dominance and potential anti-competitive behavior.

- Data Privacy and Protection: Laws like GDPR and similar frameworks globally demand robust data security and user consent.

- Content Moderation and Platform Responsibility: Governments are pushing for greater accountability in managing user-generated content and combating misinformation.

- Digital Taxation: Discussions around fair taxation of digital services are ongoing, with potential impacts on profitability.

Political landscapes significantly influence BlueCity Holdings' operations, particularly concerning content regulation and data handling. Governments globally are enacting stricter laws on digital platforms, impacting how companies like BlueCity manage user data and content. For example, by late 2024, several nations in Asia tightened their digital content laws, requiring platforms to actively remove sensitive material, thereby influencing user expression and platform growth.

Geopolitical tensions, especially between China and Western countries, create hurdles for Chinese-origin tech firms like BlueCity. This scrutiny often centers on data security and privacy, potentially leading to market access restrictions or bans. In 2023, countries continued to review and implement stricter regulations on foreign tech companies, affecting user acquisition and advertising revenue for firms perceived as having close ties to China.

| Regulation Type | Impact on BlueCity | Example (2024/2025) |

|---|---|---|

| Content Moderation | Censorship requirements, limited user expression | Asian countries' tightened digital content laws |

| Data Localization | Increased compliance costs, data transfer complexities | EU's GDPR setting precedent for data storage within borders |

| Geopolitical Tensions | Market access restrictions, increased scrutiny | Continued review of foreign tech companies' operations |

| LGBTQ+ Rights Stance | Legal acceptance and social reception of Blued | Increased digital platform usage in countries with protections |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting BlueCity Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's operating landscape, identifying potential threats and strategic opportunities.

The BlueCity Holdings PESTLE Analysis provides a clear, summarized version of external factors for easy referencing during strategy meetings, alleviating the pain of sifting through raw data.

Economic factors

Global economic downturns, such as the potential slowdowns anticipated in late 2024 and into 2025, directly threaten BlueCity's revenue streams. Consumers facing economic uncertainty are likely to cut back on discretionary spending, impacting willingness to pay for premium membership features. For instance, during the 2022-2023 period, many subscription-based services saw slower growth or even declines as consumers re-evaluated their monthly expenses.

Businesses also tend to slash advertising budgets during recessions. This means fewer companies will be willing to invest in ad placements on BlueCity's platform, directly reducing a key revenue source. Historically, advertising spending often contracts significantly during economic contractions, with some sectors seeing reductions of 10-20% or more in challenging economic periods.

The health of the digital advertising market directly impacts BlueCity's revenue, as advertising is a key income stream. Economic downturns often cause businesses to reduce marketing budgets, leading to potential volatility in ad spending and affecting BlueCity's top line. For instance, global digital ad spending was projected to reach $689.1 billion in 2024, a 7.7% increase, but economic headwinds could temper this growth.

BlueCity's success in attracting and keeping advertisers hinges on the broader economic climate and the competitive landscape of digital advertising. As of early 2024, the digital ad market remains dynamic, with continued shifts towards video and social media advertising, requiring BlueCity to adapt its offerings to maintain advertiser engagement amidst potential economic uncertainty.

The disposable income of the LGBTQ+ community, BlueCity's core demographic, is a critical factor for its revenue streams. As of early 2024, this demographic demonstrates significant purchasing power, with studies indicating a higher propensity to spend on experiences and services aligned with their values. For instance, reports from 2023 highlighted that LGBTQ+ consumers often prioritize brands and platforms that offer inclusive environments, suggesting a willingness to invest in services like premium memberships if they resonate with their identity and needs.

Economic headwinds, such as inflation and potential job market shifts anticipated for late 2024 and into 2025, could impact this disposable income. If economic pressures increase, the community's capacity to afford BlueCity's premium offerings might be curtailed, potentially leading to a slowdown in subscription growth or a shift towards lower-tier services. Therefore, monitoring economic indicators relevant to this demographic is essential for BlueCity's financial projections and strategic planning.

Competitive Landscape and Pricing Pressure

The economic environment for BlueCity Holdings is significantly shaped by a competitive landscape, particularly from other social networking applications and niche LGBTQ+ platforms. This intense rivalry can translate into considerable pricing pressure on both subscription services and advertising rates. Competitors frequently introduce lower price points or more compelling features to capture market share, compelling BlueCity to reassess and potentially adjust its own pricing strategies to remain competitive.

This dynamic can directly impact BlueCity's profitability. For instance, if competitors like Grindr or Taimi, which have established user bases, aggressively cut subscription prices or offer premium advertising packages at reduced rates, BlueCity may be forced to follow suit. This could lead to a reduction in profit margins if the company cannot offset lower revenues with increased volume or cost efficiencies. In 2023, the global social networking market was valued at approximately $220 billion, with significant growth projected, highlighting the intense competition for user attention and advertising spend.

- Intensified Competition: BlueCity faces rivalry from broad social platforms and specialized LGBTQ+ dating apps.

- Pricing Pressure: Competitors' pricing strategies can force BlueCity to lower subscription and advertising rates.

- Market Share Focus: Rivals may offer superior features or lower prices to attract users, impacting BlueCity's growth.

- Margin Erosion Risk: Failure to manage pricing effectively in a competitive market can diminish profit margins.

Investment Climate for Private Companies

The investment climate significantly shapes BlueCity's ability to secure capital for growth. As a private entity, its funding relies heavily on private equity and venture capital, which are sensitive to broader economic conditions and investor sentiment towards the tech and social media sectors. For instance, in 2023, global venture capital funding saw a notable slowdown compared to the peak years of 2021 and 2022, with a particular caution observed in later-stage funding rounds for many tech companies.

Economic uncertainty, such as rising interest rates or inflation, can dampen investor appetite, making it harder for BlueCity to raise funds for expansion or innovation. This directly impacts its capacity to pursue strategic initiatives and maintain its long-term growth trajectory. For example, the Federal Reserve's continued tightening monetary policy through 2023 and into early 2024 has increased the cost of capital, potentially making investors more selective and demanding higher returns from private companies.

- Global VC Funding Trends: While 2021 saw record highs, 2023 marked a recalibration, with deal values and volumes decreasing year-over-year across many regions, impacting late-stage funding.

- Interest Rate Sensitivity: Higher interest rates increase the discount rate used in valuation models, making future earnings less valuable today, which can reduce the attractiveness of private tech investments.

- Investor Risk Aversion: Periods of economic instability often lead to increased investor risk aversion, favoring more established or less capital-intensive businesses over high-growth, but potentially volatile, tech ventures.

- Sector-Specific Appetite: Investor interest can shift rapidly; while social media platforms have faced scrutiny, areas like AI and sustainable tech may see sustained or increased capital inflow, influencing BlueCity's perceived value.

Economic factors present a dual-edged sword for BlueCity Holdings. While the digital advertising market is projected for growth, reaching an estimated $689.1 billion in 2024, potential economic slowdowns in late 2024 and 2025 could curtail business ad spending. Similarly, consumer discretionary income, particularly within BlueCity's core LGBTQ+ demographic, could be impacted by inflation and job market shifts, affecting their ability to afford premium services.

The competitive investment climate, marked by a slowdown in venture capital funding in 2023 and rising interest rates, also poses challenges. This environment can make it more difficult for BlueCity to secure capital for expansion, potentially impacting its long-term growth trajectory and requiring a careful balance between user acquisition and profitability.

| Economic Factor | Impact on BlueCity | Supporting Data (2024/2025 Projections/Trends) |

|---|---|---|

| Global Economic Slowdown | Reduced consumer discretionary spending and business advertising budgets. | Anticipated slowdowns in late 2024/2025; historical ad spending contractions of 10-20% during recessions. |

| Digital Ad Market Health | Volatility in ad revenue streams. | Projected global digital ad spending of $689.1 billion in 2024 (7.7% increase), but susceptible to economic headwinds. |

| Disposable Income (LGBTQ+ Demographic) | Potential impact on premium subscription uptake. | Demographic shows significant purchasing power, but economic pressures like inflation could curtail spending capacity. |

| Investment Climate (VC Funding) | Challenges in securing capital for growth. | 2023 saw a notable slowdown in global VC funding compared to 2021-2022; rising interest rates increase the cost of capital. |

What You See Is What You Get

BlueCity Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BlueCity Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the external forces shaping BlueCity's strategic landscape.

Sociological factors

The increasing societal acceptance of the LGBTQ+ community globally is a significant sociological factor for BlueCity Holdings. As more regions embrace diversity and inclusivity, the potential user base for Blued, the company's flagship dating app, expands, fostering greater engagement and market penetration. For instance, a 2024 Pew Research Center study indicated that a majority of adults in many Western nations now support same-sex marriage, reflecting a broader shift in attitudes that can translate to increased comfort and willingness to use platforms like Blued.

Understanding the evolving demographics and lifestyle choices of the LGBTQ+ community is key for BlueCity Holdings. For instance, a significant portion of this demographic actively engages with online platforms for social networking and content consumption, with reports indicating strong preferences for live streaming services. This trend highlights the need for BlueCity to adapt its offerings to cater to these user-driven sociological shifts, ensuring continued relevance and appeal to its target audience.

The fundamental human need for community and belonging is a powerful driver, particularly within niche groups. Blued, by catering to the LGBTQ+ community, taps directly into this sociological imperative, offering a digital space for connection and shared identity. This focus on fostering genuine relationships is crucial for user retention and organic expansion, with platforms that successfully facilitate social bonds seeing higher engagement rates.

Health Awareness and Access within LGBTQ+ Community

BlueCity Holdings' health service offerings are well-positioned to address the unique sociological needs of the LGBTQ+ community. Increased health awareness within this demographic, coupled with a historical underrepresentation in mainstream healthcare, drives a demand for specialized, accessible, and discreet health information. For instance, a 2024 survey indicated that 65% of LGBTQ+ individuals prefer online platforms for initial health inquiries due to concerns about stigma and discrimination.

The effectiveness of BlueCity's health services will be significantly influenced by user engagement with awareness campaigns and their comfort levels in seeking health advice online. Prevalent health issues within the LGBTQ+ community, such as higher rates of certain STIs and mental health challenges, create a direct need for tailored support. Data from 2023 shows that 40% of LGBTQ+ individuals reported experiencing discrimination when seeking healthcare, underscoring the importance of an inclusive digital environment.

To maximize uptake, BlueCity must ensure its health offerings resonate with the specific sociological contexts and needs of its user base. This includes:

- Targeted Awareness Campaigns: Developing campaigns that address specific health concerns prevalent in the LGBTQ+ community, such as HIV prevention and mental well-being.

- Discreet Service Delivery: Ensuring all health services are offered with a high degree of privacy and confidentiality, a key factor for user trust.

- Culturally Competent Information: Providing health information that is sensitive to the diverse experiences and identities within the LGBTQ+ spectrum.

- Partnerships with LGBTQ+ Organizations: Collaborating with trusted community groups to enhance outreach and credibility for health services.

Influence of Social Media on Identity and Well-being

The pervasive influence of social media platforms, including those catering to specific communities, significantly shapes how individuals perceive themselves and interact with others. This impact extends to mental well-being, with studies in 2024 indicating a correlation between heavy social media use and increased rates of anxiety and depression among certain demographics. Platforms must actively address issues like cyberbullying and the spread of misinformation, which can have profound societal consequences.

Responsible platform design necessitates a proactive approach to fostering positive online environments. This includes implementing robust content moderation policies and promoting features that encourage genuine connection and support. For instance, by mid-2025, platforms are expected to enhance AI-driven tools to detect and flag harmful content more effectively, aiming to reduce its visibility by up to 30% compared to previous years.

- Social media's role in identity formation: Platforms are increasingly becoming spaces where individuals curate and express their identities, sometimes leading to pressure to conform to idealized online personas.

- Mental health implications: Research from 2024 highlights a growing concern regarding the link between excessive social media engagement and negative mental health outcomes, particularly among younger users.

- Platform responsibility: Companies like Blued face scrutiny over their duty to protect users from online harm, such as harassment and the dissemination of false information, while simultaneously enabling positive social interaction.

- Promoting positive online communities: Efforts to cultivate supportive networks and facilitate authentic self-expression are crucial for mitigating the adverse effects of social media on well-being.

Societal shifts towards greater inclusivity continue to expand the addressable market for BlueCity Holdings' services. As of 2024, global acceptance of LGBTQ+ rights is demonstrably increasing, with over 30 countries having legalized same-sex marriage, creating a more receptive environment for platforms like Blued. This evolving social landscape directly influences user acquisition and engagement by fostering a greater sense of safety and belonging.

Technological factors

Continuous advancements in mobile application development, like improved user interfaces and faster processing, directly impact Blued's user experience and functionality. For instance, the global mobile app development market was valued at approximately $227.5 billion in 2023 and is projected to grow significantly, indicating a strong trend towards sophisticated app features that users expect.

Leveraging the latest development frameworks and tools allows for more seamless navigation, richer content delivery, and greater stability, which is crucial for platforms like Blued. By Q1 2024, many leading social and entertainment apps reported user engagement increases of over 15% after implementing enhanced UI/UX features.

Staying abreast of these technological shifts is essential for maintaining a competitive edge and meeting evolving user expectations. Companies that fail to adapt risk user churn; a 2024 report showed that 40% of users will abandon an app after just one negative experience with its performance or usability.

The effectiveness of BlueCity Holdings' core live streaming feature on Blued hinges on ongoing technological advancements. Enhancements in video resolution, such as the widespread adoption of 4K streaming, and reduced latency are critical for user engagement. For instance, by mid-2024, average mobile internet speeds in key Asian markets continued to climb, with some regions reporting average download speeds exceeding 50 Mbps, enabling smoother, higher-quality streams.

Interactive features, like real-time chat, virtual gifting, and co-streaming capabilities, are also vital for differentiating Blued. The platform's ability to scale and manage millions of concurrent viewers is paramount, especially during peak events. By 2025, it's projected that the global live streaming market will continue its robust growth, with user-generated content driving a significant portion of this expansion, underscoring the need for BlueCity to invest in scalable infrastructure.

BlueCity's integration of AI and ML is poised to revolutionize its operations. For instance, AI-driven recommendation engines, similar to those powering TikTok's explosive growth, can boost user engagement by an estimated 15-20% by serving highly personalized content. This technology also underpins advanced fraud detection systems, crucial for maintaining a secure platform, with AI models in the financial sector often achieving over 90% accuracy in identifying suspicious transactions.

Data Security and Privacy Technologies

Data security and privacy are absolutely critical for BlueCity Holdings, especially given the sensitive nature of the user data on its LGBTQ+ platform. Think of it like a digital vault for personal information. This means employing cutting-edge encryption, like AES-256, to scramble data and make it unreadable to unauthorized parties. Secure data storage solutions are also key, ensuring that where the data resides is heavily protected against physical and digital intrusion.

Privacy-enhancing technologies are becoming increasingly important. These are tools and techniques designed to minimize the amount of personal data collected or to de-identify it, making it harder to link back to individuals. For instance, federated learning allows AI models to train on decentralized data without the data ever leaving the user's device. The global cybersecurity market was valued at over $200 billion in 2023 and is projected to grow significantly, underscoring the investment needed in this area.

- Encryption Standards: Implementing robust encryption protocols, such as TLS 1.3 for data in transit and AES-256 for data at rest, is non-negotiable.

- Secure Infrastructure: Utilizing cloud security best practices and potentially zero-trust architecture principles for data storage and access control.

- Compliance Focus: Adhering to regulations like GDPR and CCPA, which mandate strict data privacy controls and user consent mechanisms.

- Threat Detection: Investing in advanced threat detection and response systems to proactively identify and mitigate potential security breaches.

Emerging Digital Health and Telemedicine Solutions

BlueCity Holdings can significantly enhance its health-related services by adopting digital health and telemedicine solutions. Integrating secure online consultations, AI-powered health assessments, and wearable device data for continuous health monitoring can broaden the reach and effectiveness of its offerings to the LGBTQ+ community. For instance, the global telemedicine market was valued at approximately USD 102.1 billion in 2023 and is projected to grow substantially, indicating a strong demand for such services.

These technological advancements allow for more personalized and proactive healthcare. By leveraging AI for initial health assessments, BlueCity can streamline patient intake and provide more targeted support. The adoption of wearable technology, which saw a global market size of around USD 115 billion in 2023, offers continuous data streams that can inform health management strategies.

- Expanded Service Reach: Telemedicine enables BlueCity to serve individuals in remote areas or those with mobility challenges, making health services more accessible.

- Enhanced Health Monitoring: Integration with wearable devices allows for real-time tracking of vital signs and health metrics, facilitating early detection of potential issues.

- AI-Driven Insights: Artificial intelligence can analyze health data to provide personalized recommendations and assist in early diagnosis, improving patient outcomes.

Technological advancements in mobile app development and AI are crucial for BlueCity Holdings, influencing user experience and operational efficiency. The global mobile app market's projected growth and the increasing user expectation for sophisticated features highlight the need for continuous innovation. AI-powered recommendation engines, for example, can significantly boost user engagement, with estimates suggesting a 15-20% increase.

Data security and privacy are paramount, necessitating robust encryption and secure infrastructure to protect sensitive user information. The growing cybersecurity market, valued over $200 billion in 2023, reflects the critical importance of these measures. Furthermore, adopting digital health and telemedicine solutions can expand service reach and enhance health monitoring capabilities, tapping into a market projected for substantial growth.

| Technology Area | 2023/2024 Data/Projections | Impact on BlueCity Holdings |

|---|---|---|

| Mobile App Development | Market valued at ~$227.5B (2023); 40% users abandon apps after one negative experience. | Enhances user experience, retention, and platform stability. |

| Artificial Intelligence (AI) | AI recommendations can boost engagement by 15-20%; AI in finance achieves >90% accuracy in fraud detection. | Improves content personalization, user engagement, and platform security. |

| Data Security & Privacy | Global cybersecurity market >$200B (2023); adoption of TLS 1.3 and AES-256 encryption. | Protects sensitive user data, builds trust, and ensures regulatory compliance. |

| Digital Health/Telemedicine | Telemedicine market ~$102.1B (2023); Wearable tech market ~$115B (2023). | Expands health service offerings and facilitates continuous health monitoring. |

Legal factors

BlueCity Holdings operates under a complex web of global data privacy regulations, including the EU's General Data Protection Regulation (GDPR), California's Consumer Privacy Act (CCPA), and China's Personal Information Protection Law (PIPL). These laws mandate strict protocols for how user data is handled, from collection and storage to processing and sharing, emphasizing user consent and data security. For instance, PIPL, enacted in November 2021, significantly impacts how Chinese companies like BlueCity manage personal information, imposing stringent consent requirements and data localization rules.

Non-compliance with these data protection mandates carries severe consequences. Fines can be substantial, potentially reaching millions of dollars or a significant percentage of global annual revenue, as seen with GDPR violations. Beyond financial penalties, reputational damage from data breaches or privacy missteps can erode user trust, a critical asset for any digital platform, impacting customer retention and acquisition efforts throughout 2024 and beyond.

Laws around content moderation and censorship directly shape what BlueCity Holdings can host on its platforms like Blued, influencing its responsibility for user-generated content. These regulations are a patchwork, differing significantly across countries, and can mandate the removal of illegal material, hate speech, or politically sensitive posts. For instance, in 2024, China's Cyberspace Administration (CAC) continued to enforce strict internet content regulations, impacting how platforms manage user interactions and content visibility.

Failure to comply with these varied legal frameworks can lead to substantial penalties, including hefty fines or even the complete suspension of services. This necessitates a robust and adaptable compliance strategy for BlueCity Holdings, especially as global digital governance evolves. The company’s ability to navigate these often-contradictory legal demands is paramount for sustained operation and avoiding significant financial or reputational damage.

In 2024, the legal landscape for LGBTQ+ rights continues to evolve globally, directly impacting digital platforms like BlueCity Holdings. Jurisdictions with robust anti-discrimination statutes, such as Canada and several European Union member states, mandate inclusive service provision and user protection. For instance, Canada's Charter of Rights and Freedoms explicitly prohibits discrimination based on sexual orientation and gender identity.

Conversely, operating in regions lacking such protections or enacting discriminatory laws presents significant legal hurdles for BlueCity. In some Middle Eastern countries, for example, laws can penalize same-sex relations, potentially forcing platforms to restrict features or user access to comply with local regulations, thereby impacting user experience and market reach.

Navigating these varied legal frameworks is paramount for BlueCity's compliance and ethical standing. By the end of 2023, over 30 countries had enacted some form of national law protecting against discrimination based on sexual orientation, a number expected to grow, influencing BlueCity's operational strategies and risk assessments across its diverse markets.

Platform Liability for User Actions

Legal frameworks worldwide increasingly hold digital platforms accountable for user-generated content, impacting BlueCity Holdings. Regulations like the Digital Services Act in the EU, effective February 17, 2024, impose stricter obligations on online platforms to tackle illegal content, including hate speech and misinformation. Failure to comply can result in significant fines, potentially reaching up to 6% of a company's global annual revenue.

BlueCity must proactively establish robust content moderation systems and clear reporting channels for users. This is crucial for mitigating legal risks stemming from user actions such as defamation or harassment. For instance, platforms that demonstrably fail to act on illegal content after notification can face increased liability in many jurisdictions.

The global nature of BlueCity's operations means it must navigate a complex and varied legal landscape regarding platform liability. For example, while Section 230 of the Communications Decency Act in the United States generally shields platforms from liability for third-party content, other countries have adopted a more restrictive approach. This necessitates a flexible legal strategy to manage risks associated with user-generated content across different markets.

Key considerations for BlueCity include:

- Monitoring evolving platform liability laws globally, particularly in key markets like the EU and US.

- Investing in advanced content moderation technologies and human review processes to identify and remove illegal or harmful content promptly.

- Developing clear and accessible user reporting mechanisms and ensuring timely responses to flagged content.

- Staying abreast of legal precedents and enforcement actions related to platform liability to inform risk management strategies.

Intellectual Property Rights and Licensing

BlueCity Holdings navigates a complex legal landscape concerning intellectual property (IP). Compliance with copyright and trademark laws is paramount for the content hosted on its platform and its own corporate branding. This necessitates proactive measures to detect and resolve IP infringements.

Licensing agreements are fundamental to BlueCity's legal operations and its capacity to broaden its service portfolio. For instance, in 2024, the digital content market saw significant growth, with the global digital content creation market projected to reach $1.3 trillion by 2025, highlighting the importance of securing rights for user-generated and third-party content.

- Intellectual Property Compliance: BlueCity must adhere to copyright and trademark regulations for platform content and its own branding.

- Infringement Mitigation: Implementing systems to identify and address IP infringement is a key legal requirement.

- Licensing Strategy: Agreements for third-party content and technologies are crucial for legal operation and service expansion.

- Market Context: The growing digital content market underscores the financial implications of robust IP management.

BlueCity Holdings must navigate evolving platform liability laws, with the EU's Digital Services Act, effective early 2024, imposing significant obligations for tackling illegal content. Failure to comply can result in fines up to 6% of global annual revenue, underscoring the need for robust content moderation systems and clear user reporting channels.

Intellectual property compliance is critical, requiring adherence to copyright and trademark laws for platform content and branding, with proactive infringement mitigation systems essential. Licensing agreements for third-party content and technologies are vital for legal operations and service expansion, especially given the projected growth in the digital content market.

| Legal Factor | Impact on BlueCity Holdings | 2024/2025 Relevance |

|---|---|---|

| Platform Liability | Accountability for user-generated content | EU Digital Services Act (Feb 2024) mandates content moderation; potential fines up to 6% global revenue. |

| Intellectual Property | Copyright/trademark adherence for content and branding | Proactive infringement mitigation needed; licensing crucial for service expansion in a growing digital content market (projected $1.3T by 2025). |

Environmental factors

BlueCity Holdings, while not a traditional manufacturer, faces significant environmental considerations due to its reliance on data centers and digital infrastructure, leading to a notable digital carbon footprint. The energy consumption of these operations is a growing concern for stakeholders and regulators alike.

The tech industry, including companies like BlueCity, is experiencing increasing pressure to transition towards more sustainable practices. This includes a strong push for adopting renewable energy sources to power data centers, a trend that gained further momentum in 2024 with many tech giants setting ambitious renewable energy targets.

Effectively managing and reducing its environmental impact, particularly its digital carbon footprint, is becoming a crucial component of BlueCity's corporate social responsibility strategy. By 2025, it's anticipated that transparency in reporting digital emissions will be a standard expectation for publicly traded tech firms.

Environmental concerns are increasingly impacting how companies like BlueCity Holdings manage their data. The efficiency of data centers, from server utilization to data storage and network infrastructure, directly affects energy consumption. For instance, improving server utilization by just 10% can lead to significant reductions in electricity usage, a critical factor in minimizing a company's carbon footprint.

Optimizing data management isn't just about being environmentally friendly; it’s also a smart business move. Reducing energy demands lowers operational costs, and minimizing the need for new hardware through better resource allocation directly cuts capital expenditure. This dual benefit makes efficient data processing and storage solutions a key consideration for both operational and environmental strategies in 2024 and beyond.

BlueCity, as a platform connecting a vast user base, is uniquely positioned to champion sustainable lifestyles. By integrating content that educates on climate change impacts and promotes eco-friendly practices, BlueCity can foster a more environmentally conscious community. For instance, campaigns encouraging reduced plastic use or promoting local, sustainable businesses could resonate strongly, especially given the growing consumer demand for eco-friendly options, with a significant percentage of consumers in 2024 indicating they are willing to pay more for sustainable products.

Regulatory Pressure on E-Waste and Hardware Disposal

BlueCity Holdings, while not a direct hardware manufacturer, faces indirect regulatory pressure concerning electronic waste (e-waste) and the disposal of IT equipment. This is due to its significant reliance on technology infrastructure. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive, continually updated, sets stringent targets for collection and recycling rates, impacting the entire tech ecosystem.

As part of its supply chain, BlueCity's commitment to sustainability is bolstered by partnering with vendors who adhere to robust e-waste management practices. This aligns with the global push towards circular economy principles, aiming to minimize waste and maximize resource utilization. By 2025, it's anticipated that global e-waste generation will continue its upward trend, potentially reaching over 74 million metric tons annually, underscoring the importance of responsible disposal.

- Global e-waste is projected to exceed 74 million metric tons by 2025.

- The EU's WEEE Directive mandates specific e-waste collection and recycling targets.

- Circular economy principles are increasingly influencing hardware lifecycle management.

- Vendor compliance with e-waste regulations impacts BlueCity's indirect environmental footprint.

Impact of Climate Change on Infrastructure and Operations

Broader environmental shifts, particularly those linked to climate change, pose indirect risks to BlueCity Holdings. Extreme weather events, such as the increased frequency of hurricanes and floods observed in recent years, can disrupt essential infrastructure like power grids and internet service providers. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters each causing at least $1 billion in damages, highlighting the growing vulnerability of critical infrastructure.

This necessitates a proactive approach to service delivery resilience and disaster recovery planning for digital businesses like BlueCity. The company must consider strategies to mitigate the impact of potential infrastructure failures. This includes diversifying server locations to geographically dispersed areas less prone to severe weather and ensuring robust, redundant backup systems are in place to maintain operational continuity during disruptions.

- Increased frequency of extreme weather events: Climate change is driving more intense storms, heatwaves, and flooding globally.

- Infrastructure vulnerability: Power grids, telecommunications networks, and transportation systems are susceptible to damage from these events.

- Operational disruption risk: Failures in these critical infrastructures can directly impact BlueCity's ability to deliver services.

- Resilience planning imperative: Diversifying data center locations and implementing robust backup solutions are crucial for business continuity.

BlueCity's environmental impact is largely tied to its digital infrastructure's energy consumption and its role in promoting sustainable user behavior. The company faces growing pressure to adopt renewable energy for its data centers, a trend amplified in 2024 with many tech firms setting ambitious green targets.

The company's indirect environmental footprint also includes managing electronic waste (e-waste) from its technology dependencies, with global e-waste projected to surpass 74 million metric tons by 2025, necessitating adherence to regulations like the EU's WEEE Directive.

Climate change poses indirect risks through extreme weather events disrupting critical infrastructure, as evidenced by the 28 U.S. weather and climate disasters costing over $1 billion each in 2023, requiring BlueCity to focus on operational resilience and disaster recovery.

| Environmental Factor | Impact on BlueCity Holdings | Key Data/Trend (2024-2025) |

| Energy Consumption (Data Centers) | Significant digital carbon footprint; increasing stakeholder scrutiny. | Growing demand for renewable energy sources for data centers; many tech giants set ambitious targets in 2024. |

| Electronic Waste (E-waste) | Indirect responsibility through technology reliance; vendor management is key. | Global e-waste projected to exceed 74 million metric tons annually by 2025; EU's WEEE Directive sets collection/recycling targets. |

| Climate Change & Extreme Weather | Risk of disruption to power grids and internet services impacting operations. | 2023 saw 28 U.S. weather/climate disasters costing at least $1 billion each (NOAA); necessitates resilience planning. |

| Consumer Demand for Sustainability | Opportunity to influence user behavior and promote eco-friendly practices. | Increasing consumer willingness to pay more for sustainable products; BlueCity can leverage its platform for eco-conscious campaigns. |

PESTLE Analysis Data Sources

Our PESTLE analysis for BlueCity Holdings is meticulously constructed using data from official government publications, reputable financial institutions, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.