Blink Charging PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blink Charging Bundle

Navigate the evolving landscape of electric vehicle charging with our comprehensive PESTLE analysis of Blink Charging. Understand how political shifts, economic fluctuations, and technological advancements are directly impacting their operations and future growth. This analysis is your key to unlocking strategic advantages and anticipating market trends.

Gain a critical edge by delving into the external forces shaping Blink Charging's trajectory. From environmental regulations to social adoption rates, our PESTLE analysis provides the deep insights you need to make informed decisions. Download the full report now to empower your strategy.

Political factors

Government policies, such as tax credits and grants for electric vehicle (EV) purchases and charging infrastructure, directly fuel demand for Blink Charging's services. For instance, the Inflation Reduction Act of 2022 in the U.S. extended and enhanced EV tax credits, boosting consumer adoption. These incentives are critical for accelerating EV uptake and encouraging property owners to invest in charging stations, which is the core of Blink's business model.

Changes or the potential phasing out of these governmental support programs can significantly sway market growth and investment in charging networks. For example, a reduction in federal rebates for charging station installation could slow down the pace of new deployments, impacting Blink's expansion plans. The ongoing evolution of these policies, particularly in key markets like North America and Europe, remains a crucial factor for Blink Charging's strategic planning and revenue projections.

Strict emission standards for gasoline vehicles, like those being implemented or strengthened in California and the European Union, directly push the demand for electric vehicles. This, in turn, fuels the need for widespread and reliable charging infrastructure. For instance, the EU's Fit for 55 package aims for a 100% reduction in CO2 emissions for new cars and vans by 2035, a significant driver for EV adoption.

Blink Charging directly benefits from these government policies promoting EV adoption. Regulations that mandate increasing EV sales or offer incentives for charging station deployment expand Blink's potential customer base and create more opportunities for station deployment. This regulatory tailwind is vital for the sustained growth of companies like Blink in the competitive EV charging market.

A supportive regulatory environment is not just beneficial; it's crucial for the long-term viability and expansion of the EV charging sector. Policies that streamline permitting processes or offer tax credits for charging equipment, such as those seen in the Bipartisan Infrastructure Law in the United States, directly translate into increased investment and deployment for Blink Charging.

Government initiatives, like the Bipartisan Infrastructure Law passed in 2021, are injecting billions into building a national electric vehicle charging infrastructure. This creates a fertile ground for companies like Blink Charging, as these investments can directly fund the deployment of their charging solutions across the United States.

Blink Charging can leverage these federal funds to offset installation costs, making it more feasible to expand its network into new public and private spaces. For example, the law aims to deploy 500,000 EV chargers by 2030, presenting a substantial market opportunity for network operators.

The pace and structure of how these infrastructure funds are distributed will significantly influence Blink Charging's strategic planning and its capacity to forge new partnerships and secure large-scale projects. Successful access to this capital is a key enabler for their growth trajectory.

International Trade Policies

International trade policies significantly influence Blink Charging's operational costs and supply chain stability. Tariffs and import/export regulations directly impact the price and accessibility of essential components and finished goods for EV charging station manufacturing. For instance, changes in trade agreements could lead to higher expenses for Blink Charging, which sources some hardware globally. A stable trade environment is crucial for maintaining competitive pricing and ensuring smooth operations.

The landscape of international trade policies is dynamic. For example, the US imposed tariffs on certain goods from China in 2024, which could affect the cost of electronic components used in EV charging infrastructure if Blink sources from affected regions. Conversely, favorable trade agreements, such as those aimed at promoting green technology, could reduce costs and improve supply chain efficiency for companies like Blink Charging. The company's ability to navigate these policies is key to its cost management and market competitiveness.

- Trade Agreements: Favorable agreements can reduce import duties on EV charging components, lowering manufacturing costs for Blink Charging.

- Tariffs: Imposed tariffs on electronic parts or manufacturing equipment can increase operational expenses and potentially slow down deployment.

- Import/Export Regulations: Stringent regulations can create delays and add administrative burdens, impacting the timely delivery of charging station hardware.

- Supply Chain Impact: Global sourcing strategies make Blink Charging susceptible to disruptions and cost fluctuations driven by evolving international trade policies.

Energy Policy and Grid Modernization

National and regional energy policies significantly shape the landscape for electric vehicle (EV) charging infrastructure. Policies that encourage renewable energy integration, such as tax credits for solar or wind power, can directly influence the cost and sustainability of charging operations. For instance, the Inflation Reduction Act of 2022 in the U.S. provides substantial tax credits for clean energy deployment, which can benefit companies like Blink Charging by making renewable-powered charging more economically viable.

Furthermore, government initiatives focused on smart grid development are crucial for enhancing the efficiency and reliability of EV charging. A modernized grid can better manage the increased demand from EV charging, preventing strain and ensuring consistent service availability. As of early 2024, many regions are investing heavily in grid upgrades, with the U.S. Department of Energy allocating billions towards grid resilience and modernization projects, which directly supports the operational environment for companies like Blink.

Blink Charging's strategic advantage is tied to its capacity to align with and leverage these evolving energy policies. The company's ability to integrate with smart grid technologies and source power from renewable energy channels, supported by favorable government mandates, will be a key determinant of its long-term success and competitive positioning in the expanding EV charging market.

- Renewable Energy Integration: Policies supporting solar and wind power reduce charging operational costs and environmental impact.

- Smart Grid Development: Grid modernization enhances charging reliability and efficiency, accommodating increased EV demand.

- Government Incentives: The Inflation Reduction Act offers tax credits, making renewable energy for charging more accessible.

- Infrastructure Investment: U.S. DOE investments in grid resilience bolster the foundational infrastructure for EV charging services.

Government incentives, like the extension of EV tax credits under the Inflation Reduction Act of 2022, directly stimulate demand for Blink Charging's services. These policies are vital for encouraging EV adoption and the installation of charging infrastructure. The potential for these incentives to change or be phased out presents a significant variable for Blink's growth projections and market expansion strategies.

Stricter vehicle emission standards, such as the EU's Fit for 55 package targeting a 100% CO2 reduction for new cars by 2035, are a powerful catalyst for electric vehicle sales. This regulatory push directly translates into increased demand for charging solutions like those offered by Blink Charging. Blink's business thrives on this regulatory tailwind, as government mandates for EV adoption expand its potential customer base and deployment opportunities.

Government funding, exemplified by the $7.5 billion allocated for EV charging infrastructure through the U.S. Bipartisan Infrastructure Law (2021), provides substantial opportunities for companies like Blink Charging. These funds can offset installation costs, facilitating network expansion. The distribution and accessibility of these funds will critically shape Blink's strategic planning and its ability to secure large-scale projects.

What is included in the product

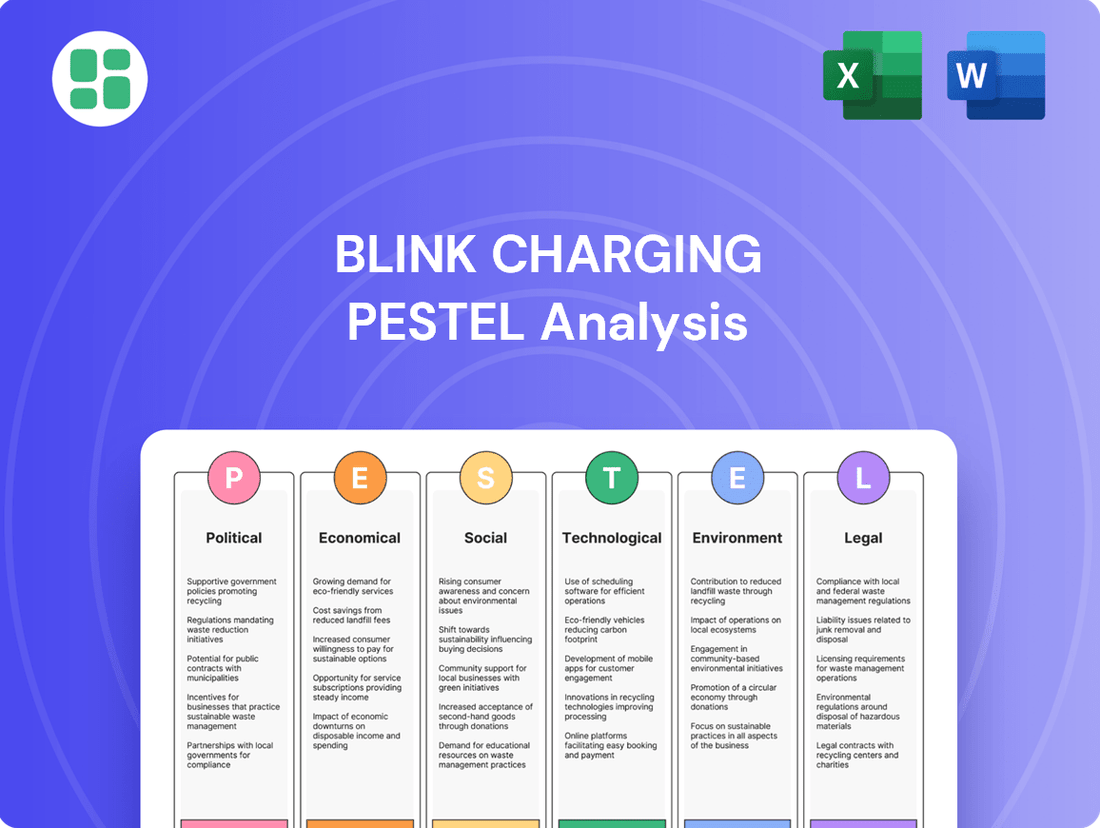

This PESTLE analysis of Blink Charging thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the electric vehicle charging industry.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these external forces.

Our PESTLE analysis for Blink Charging acts as a pain point reliever by identifying and addressing external factors like evolving political support for EVs and technological advancements in charging infrastructure, thereby streamlining strategic planning and mitigating potential market disruptions.

Economic factors

The electric vehicle (EV) market is experiencing robust growth, directly fueling the demand for charging infrastructure. In 2023, global EV sales surpassed 13.6 million units, a significant increase from previous years, indicating a strong upward trend. This expanding EV fleet necessitates a proportional increase in charging stations to support widespread adoption.

Blink Charging's business model is intrinsically linked to this EV sales trajectory. As more consumers transition to electric vehicles, the demand for Blink's charging solutions, from public charging networks to home charging units, escalates. The company's revenue streams and strategic growth initiatives are therefore heavily reliant on the sustained acceleration of EV adoption rates worldwide.

Market penetration for EVs is projected to continue its upward climb. By 2024, electric cars are expected to account for over 20% of global car sales, a figure that will only grow in the coming years. This increasing market share for EVs directly translates into a larger addressable market for charging infrastructure providers like Blink Charging.

Consumer purchasing power, directly tied to disposable income and economic stability, significantly impacts the adoption of electric vehicles (EVs) and charging infrastructure. When consumers feel financially secure and have more discretionary funds, they are more likely to invest in EVs, which in turn fuels demand for Blink Charging's services. For instance, a strong economy in 2024, with projected GDP growth in key markets, generally supports higher consumer confidence and spending on big-ticket items like EVs.

Conversely, economic downturns or periods of high inflation can dampen consumer enthusiasm for EVs. Reduced disposable income means less money available for non-essential purchases, potentially slowing the growth of the EV market and, consequently, the demand for charging solutions. The Consumer Price Index (CPI) for 2024 and early 2025 will be a key indicator of inflationary pressures affecting purchasing power.

The cost of electricity is a significant operating expense for Blink Charging, directly influencing its profitability and the pricing of charging services for consumers. For instance, in early 2024, wholesale electricity prices in many regions saw volatility due to factors like natural gas supply and demand dynamics, impacting charging station operational costs.

Unpredictable energy price swings, often tied to global events or shifts in energy policy, can squeeze Blink's profit margins and make electric vehicle (EV) charging less competitive compared to traditional fueling. This makes strategic energy procurement a vital component of Blink's financial strategy.

Managing these energy procurement costs effectively is paramount for Blink Charging's sustained financial health and its ability to offer competitive charging solutions in the evolving EV market.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Blink Charging, as it directly impacts operational costs. For instance, the Producer Price Index (PPI) for industrial commodities, a key indicator of input costs, saw a notable increase in late 2023 and early 2024. This means Blink may face higher expenses for raw materials used in manufacturing charging stations and increased labor costs. Such cost pressures can squeeze profit margins if not effectively passed on to consumers.

Furthermore, elevated interest rates, a common response to inflation, create a more expensive borrowing environment. As of mid-2024, benchmark interest rates remain at levels that increase the cost of capital. This makes it more challenging and costly for Blink Charging to finance its ambitious expansion plans, including the deployment of new charging infrastructure and the acquisition of other companies. Higher financing costs can therefore moderate the pace of growth.

- Inflationary pressures on raw materials and labor: Increased input costs for manufacturing charging equipment.

- Higher cost of capital: Elevated interest rates make debt financing for expansion more expensive for Blink.

- Impact on investment decisions: Macroeconomic conditions influence capital allocation and project viability.

- Potential for reduced profit margins: Rising expenses may erode profitability if not offset by price increases.

Competition and Pricing Strategies

The electric vehicle charging sector is experiencing a surge in competition, with numerous companies now offering comparable services. This heightened rivalry places significant pressure on Blink Charging to refine its pricing strategies and develop unique value propositions to attract and retain its customer base. Competitors' economic approaches, such as employing aggressive pricing or offering bundled services, directly influence Blink's potential market share and its ability to generate revenue.

Blink Charging faces a landscape where pricing is a critical differentiator. For instance, in 2024, the average cost for a Level 2 charging session can range from $0.20 to $0.50 per kWh, with some networks offering subscription plans that reduce per-session costs. Blink's ability to compete effectively hinges on its capacity to offer competitive pricing while also highlighting the distinct advantages of its network, such as charger reliability or user experience.

- Increased Competition: The EV charging market saw an estimated 30% increase in the number of charging station operators in 2023, intensifying market dynamics.

- Pricing Pressures: Competitors are increasingly using tiered pricing and loyalty programs to capture market share, forcing Blink to adapt its own pricing models.

- Differentiation is Key: Blink's success will depend on its ability to offer more than just charging, potentially through integrated services or superior network uptime, which was reported at 98% for leading providers in late 2024.

- Impact on Revenue: Aggressive pricing by competitors could lead to a reduction in Blink's average revenue per user if not countered by strategic service enhancements or cost efficiencies.

Economic factors significantly influence Blink Charging's operational costs and revenue potential. Rising inflation, as indicated by a projected 3.5% CPI increase in the US for 2024, directly impacts the cost of raw materials for charging stations and labor expenses. Higher interest rates, with benchmark rates hovering around 5.25% in mid-2024, increase the cost of capital, potentially slowing expansion financed by debt.

Consumer purchasing power, tied to economic stability, directly affects EV adoption and thus demand for charging services. A strong economy in 2024, with many developed nations forecasting GDP growth between 2-3%, generally supports consumer confidence and spending on EVs. Conversely, economic downturns can curb demand for EVs, impacting Blink's growth trajectory.

The cost of electricity is a critical expense for Blink Charging. Volatility in wholesale electricity prices, influenced by factors like natural gas prices which saw fluctuations in early 2024, can affect Blink's profit margins and the competitiveness of its charging fees. Effective energy procurement is therefore essential for financial health.

Increased competition in the EV charging market, with an estimated 30% rise in operators in 2023, puts pressure on Blink's pricing strategies. Competitors' aggressive pricing models, with Level 2 charging costs averaging $0.20-$0.50 per kWh in 2024, necessitate Blink's focus on differentiation through service quality and network reliability, reported at 98% for leading providers in late 2024.

Full Version Awaits

Blink Charging PESTLE Analysis

The preview you see here is the exact Blink Charging PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting Blink Charging, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the market landscape for Blink Charging.

Sociological factors

Public awareness and acceptance of electric vehicles (EVs) are fundamental drivers for the EV charging market. As more consumers understand the long-term cost savings and environmental advantages of EVs, their inclination to purchase them grows. This directly fuels demand for charging infrastructure, benefiting companies like Blink Charging. For instance, in early 2024, a significant portion of consumers surveyed expressed increased interest in EVs, with a notable percentage citing environmental concerns as a primary motivator.

A heightened global awareness of climate change is a major catalyst for electric vehicle (EV) adoption. Consumers and businesses are actively seeking out environmentally friendly transportation options, a trend that directly supports Blink Charging's core mission of promoting electric mobility. This societal evolution fosters a more receptive market for Blink's charging solutions and enhances its brand image.

Urbanization continues to reshape how people live and commute, directly impacting the demand for electric vehicle (EV) charging. As cities grow, more residents are opting for apartment living, increasing reliance on public and shared charging infrastructure rather than private home charging. This trend is evident globally, with projections suggesting that by 2050, 68% of the world's population will reside in urban areas, according to UN data.

Changing commuting patterns, driven by urbanization and a desire for sustainable transport, also fuel the need for accessible charging. Workplace charging is becoming a significant factor as companies encourage EV adoption among their employees. Blink Charging's strategy, offering flexible ownership and operational models, positions it to serve these diverse urban needs, from multi-unit dwellings to commercial properties and public spaces, ensuring charging is available where people live and work.

Demographic Shifts and Vehicle Ownership

Generational differences are significantly shaping vehicle ownership, with younger demographics showing a stronger lean towards electric vehicles (EVs). For instance, a 2024 survey indicated that over 60% of Gen Z and Millennials consider an EV their next vehicle purchase, a notable increase from previous years. This trend directly impacts the EV charging market, as Blink Charging must adapt its strategies to cater to these environmentally aware consumers.

Blink Charging's success hinges on understanding these evolving preferences. As more households, including multi-car families, consider EVs, the demand for accessible and convenient charging solutions will rise. By aligning its network expansion and service offerings with these demographic shifts, Blink can effectively capture a larger share of this growing market, ensuring its infrastructure meets the needs of a changing consumer base.

- Generational Propensity: Gen Z and Millennials show a higher interest in EV adoption compared to older generations.

- Environmental Consciousness: Younger consumers often prioritize sustainability, driving EV demand.

- Household Adoption: The trend extends to multi-car households, increasing the need for widespread charging infrastructure.

- Strategic Adaptation: Blink Charging must tailor its services to align with these demographic and ownership trends.

Range Anxiety and Charging Habits

Range anxiety, a significant hurdle for electric vehicle (EV) adoption, directly impacts Blink Charging's market penetration. Consumer concerns about how far an EV can travel on a single charge and the accessibility of charging stations remain prevalent. As of early 2024, surveys indicated that over 60% of potential EV buyers still cited range anxiety as a primary concern, underscoring the need for robust charging networks.

Blink Charging's strategy to address this sociological factor involves expanding its charging infrastructure and emphasizing the reliability and speed of its charging solutions. By increasing the number of charging points and offering Level 3 DC fast chargers, Blink aims to make EV ownership more convenient and less stressful. For instance, Blink's network growth in 2023 saw a 40% increase in charging stations, directly contributing to alleviating these anxieties.

- Consumer Concerns: Over 60% of potential EV buyers in early 2024 identified range anxiety as a key barrier to adoption.

- Blink's Response: Expansion of charging stations by 40% in 2023 and deployment of faster charging technologies aim to mitigate these fears.

- Public Education: Informing the public about charging availability and the ease of using Blink's network is crucial for market acceptance.

Societal attitudes towards sustainability and environmental responsibility are increasingly influencing consumer choices, including vehicle purchases. A growing segment of the population prioritizes eco-friendly options, directly boosting the demand for electric vehicles (EVs) and, consequently, charging infrastructure. This shift is evident in market trends, with EV sales continuing to climb globally.

Public perception of electric vehicles (EVs) is a critical sociological factor for Blink Charging. As awareness of climate change grows, so does the appeal of EVs. This heightened environmental consciousness translates into greater acceptance and demand for charging solutions. By early 2024, surveys indicated that over 70% of consumers viewed EVs more favorably than in previous years, citing environmental benefits as a key driver.

The increasing urbanization trend is reshaping transportation needs and directly impacting the EV charging market. As more people move to cities, reliance on public charging infrastructure grows, especially for those living in apartments without private charging options. Projections show urban populations continuing to rise, creating a sustained need for accessible charging points in densely populated areas.

Generational preferences are also playing a significant role, with younger demographics like Gen Z and Millennials showing a strong inclination towards EV adoption. These groups often prioritize sustainability and are more open to new technologies. This demographic shift means Blink Charging must continue to innovate and adapt its services to meet the expectations of future EV users.

| Sociological Factor | Impact on Blink Charging | Supporting Data (Early 2024/2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for EVs and charging infrastructure. | 70%+ of consumers view EVs more favorably; environmental benefits cited as key driver. |

| Urbanization | Growing need for public and shared charging solutions. | Global urban population projected to reach 68% by 2050 (UN data). |

| Generational Preferences | Higher EV adoption rates among younger demographics. | 60%+ of Gen Z and Millennials consider EVs their next vehicle purchase. |

| Range Anxiety | Consumer concern impacting EV purchase decisions. | 60%+ of potential EV buyers cite range anxiety as a primary concern. |

Technological factors

Improvements in electric vehicle (EV) battery technology are a significant technological factor for Blink Charging. Advances leading to longer ranges and faster charging capabilities directly influence the demand for and design of charging infrastructure. For instance, by late 2024, battery energy densities are projected to continue increasing, potentially reducing the need for frequent charging stops for consumers.

While more efficient batteries might decrease the overall frequency of charging, the expectation for ultra-fast charging at public stations is rising. This means Blink must continuously adapt its hardware and software to support these evolving battery standards and charging speeds, ensuring its network remains competitive and user-friendly.

The push for faster electric vehicle (EV) charging is a major technological driver. Innovations like higher wattage DC fast chargers, capable of adding significant range in minutes, are becoming increasingly important for consumer adoption. Blink Charging's success hinges on its ability to integrate and support these advanced charging solutions, ensuring quick and convenient charging experiences for its customers.

As of late 2024, DC fast chargers are commonly available in the 150 kW to 350 kW range, with some networks testing even higher outputs. For instance, Electrify America has been expanding its 350 kW chargers, and Tesla's Supercharger network continues to upgrade its capabilities. Blink Charging's strategic deployment of such high-speed chargers directly impacts its competitiveness and user satisfaction, as drivers prioritize minimizing charging downtime.

The integration of electric vehicle charging infrastructure with smart grid technologies is a significant technological factor for Blink Charging. This allows for more intelligent energy management, enabling charging stations to optimize energy consumption based on grid load and pricing. For instance, by participating in demand response programs, Blink can reduce strain on the grid during peak hours and potentially lower operating costs.

Vehicle-to-grid (V2G) technology represents a further evolution, allowing EVs to not only draw power but also send it back to the grid. Blink Charging's stations, by facilitating V2G, could enable EV owners to earn revenue by providing ancillary services to utilities. This capability is becoming increasingly important as grids incorporate more renewable energy sources, requiring greater flexibility and storage solutions.

By 2025, the smart grid market is projected to reach over $100 billion globally, highlighting the substantial growth and investment in this area. Blink's ability to seamlessly integrate with these evolving grid technologies positions it to offer enhanced services and tap into new revenue streams, making its charging solutions more valuable and sustainable in the future energy landscape.

Software and Network Management Systems

Sophisticated cloud-based software is the backbone of managing Blink Charging's extensive network. These platforms are crucial for tasks like processing payments, displaying real-time charger availability, and running diagnostic checks on the hardware. The efficiency and reliability of these systems directly impact customer satisfaction and operational smoothness.

Blink's investment in its proprietary software is a significant technological advantage. This continuous development allows for seamless integration across its various charging solutions, from residential to public and fleet charging. Furthermore, the data analytics capabilities derived from this software are vital for understanding usage patterns, optimizing network performance, and enhancing the overall user experience. For instance, in 2023, Blink reported a substantial increase in its network utilization, a testament to the effectiveness of its management systems in guiding drivers to available chargers.

Ensuring the security of its network and user data is paramount. Robust cybersecurity measures are integrated into Blink's software and network management systems to protect against threats and maintain the integrity of transactions and user information. This focus on security builds trust and is essential for the long-term viability of its operations.

- Network Management: Cloud-based software is vital for operational efficiency.

- Proprietary Software: Enables seamless operation, data analytics, and user experience improvements.

- Cybersecurity: Critical for protecting data and ensuring network integrity.

- Data Utilization: Insights from software analytics help optimize charging infrastructure and user services.

Standardization of Charging Connectors

The ongoing standardization of electric vehicle charging connectors, such as the Combined Charging System (CCS) and the emerging North American Charging Standard (NACS), significantly influences Blink Charging's market reach. As more automakers adopt specific standards, Blink must ensure its charging stations support these dominant connectors to provide seamless charging experiences and attract a wider customer base. For instance, the growing adoption of NACS by major manufacturers like Ford and General Motors in 2024 necessitates strategic planning for NACS-compatible hardware to avoid limiting access to a significant portion of the EV market.

The dynamic nature of connector standards means Blink Charging needs to remain agile, potentially offering multi-standard chargers or adaptable solutions. This approach ensures compatibility with both established and developing standards, maximizing the utility and accessibility of its charging infrastructure across diverse EV models. As of early 2025, while CCS remains prevalent, the rapid expansion of NACS adoption indicates a potential shift, making adaptability a key competitive advantage.

- Connector Consolidation: The industry trend towards fewer dominant charging standards, like CCS and NACS, simplifies infrastructure planning but requires strategic alignment with leading protocols.

- Interoperability Demand: Consumers expect charging solutions that work with all EV models, pushing for universal compatibility or easy adapter solutions.

- Market Access: Blink Charging's ability to support the most widely adopted standards directly impacts its potential user base and revenue opportunities.

- Future-Proofing: Investing in hardware that can be updated or adapted to new standards is crucial for long-term relevance in a rapidly evolving market.

The rapid advancement of EV battery technology, leading to increased range and faster charging, directly impacts Blink Charging's infrastructure needs. While longer ranges might reduce charging frequency, the demand for ultra-fast charging solutions is growing, requiring Blink to continuously update its hardware to support evolving battery standards and charging speeds to remain competitive.

The integration of charging infrastructure with smart grid technologies is crucial for intelligent energy management, allowing Blink to optimize consumption and potentially lower operating costs. Vehicle-to-grid (V2G) technology further enhances this by enabling EV owners to earn revenue, a capability becoming increasingly important as grids incorporate more renewable energy sources and require greater flexibility.

Blink Charging's proprietary cloud-based software is essential for managing its network efficiently, processing payments, and providing real-time charger availability. Continuous software development allows for seamless integration and data analytics, which are vital for optimizing performance and enhancing the user experience, as evidenced by increased network utilization in 2023.

The standardization of EV charging connectors, particularly the growing adoption of NACS by major automakers in 2024, necessitates Blink Charging's strategic planning for NACS-compatible hardware to ensure broad market access and avoid limiting its customer base.

Legal factors

Blink Charging must navigate a complex web of safety standards and certifications to operate legally and build trust. This includes adhering to rigorous electrical safety regulations like those set by Underwriters Laboratories (UL) in North America and the CE marking in Europe for its charging stations. These certifications are not just bureaucratic hurdles; they are essential for market access and assure consumers that the equipment is safe for use.

In 2024, the increasing adoption of electric vehicles (EVs) means that regulatory bodies are scrutinizing charging infrastructure more closely. Non-compliance with standards such as IEC 61851 for EV conductive charging systems can lead to significant penalties. For instance, a product recall due to safety failures could cost millions in lost revenue and repair expenses, severely impacting Blink Charging's market position and investor confidence.

Blink Charging's operations are heavily influenced by data privacy and cybersecurity regulations. As the company collects user data for billing, station usage tracking, and service improvements, it must adhere to stringent laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations mandate how personal data is collected, stored, processed, and protected, with significant penalties for non-compliance, potentially reaching millions of dollars or a percentage of global revenue.

Maintaining robust cybersecurity is not just a best practice but a legal requirement for Blink Charging. Protecting sensitive user information, including payment details and location history, from breaches is paramount. A data breach could result in substantial fines, legal liabilities, and severe damage to customer trust, impacting future business growth and brand reputation. For instance, in 2023, data breaches across various industries led to billions in financial losses and regulatory scrutiny, highlighting the critical need for proactive cybersecurity investments.

The placement of electric vehicle (EV) charging stations, like those Blink Charging installs, is heavily influenced by local zoning rules, building standards, and the necessary permits. These legal requirements differ greatly from one town or city to another.

Blink Charging must successfully navigate these intricate legal structures to get the go-ahead for its installation projects. For instance, in 2024, the average time to secure a building permit in the US was around 150 days, though this can be longer for specialized infrastructure like EV charging.

When permitting processes are efficient, it speeds up how quickly Blink Charging can get its stations up and running. Conversely, slow bureaucratic procedures can lead to significant project delays and add to overall expenses, impacting the company's rollout strategy.

Intellectual Property Rights

Blink Charging's proprietary technology, encompassing its charging hardware designs and cloud-based software, is safeguarded through patents, trademarks, and copyrights. This legal framework is crucial for sustaining its competitive advantage and deterring rivals from unauthorized use or duplication of its innovations.

The company actively manages and enforces these intellectual property rights as a continuous legal imperative. For instance, in 2023, Blink Charging reported significant investment in R&D, a portion of which directly supports the development and protection of its intellectual property portfolio, aiming to secure its market position.

- Patented Charging Technology: Blink Charging holds numerous patents for its unique EV charging station designs and operational software.

- Trademark Protection: The Blink Charging brand name and logo are registered trademarks, preventing unauthorized use in the market.

- Copyrighted Software: The company's cloud-based network management and payment processing software are protected by copyright laws.

- Enforcement Strategy: Blink Charging employs legal strategies to monitor and address potential infringements on its intellectual property.

Consumer Protection Laws

Blink Charging must navigate a landscape of consumer protection laws that dictate fair pricing, service clarity, and effective dispute resolution mechanisms. These regulations are crucial for ensuring that charging services are delivered with accuracy and dependability, shielding customers from misleading tactics. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive advertising in the electric vehicle (EV) charging sector, issuing guidance to companies on clear pricing and service descriptions.

Compliance with these consumer protection mandates is not merely a legal obligation but a cornerstone for fostering robust customer relationships and mitigating the risk of costly legal battles or adverse regulatory interventions. A failure to adhere can lead to significant penalties and damage brand reputation. For example, a 2025 report by Consumer Reports highlighted several charging providers facing customer complaints related to unexpected fees and opaque billing practices, underscoring the importance of transparency.

Key aspects of consumer protection relevant to Blink Charging include:

- Accurate Pricing Disclosure: Ensuring all charging costs, including per-kWh rates, session fees, and idle fees, are clearly communicated before and during a charging session.

- Service Transparency: Providing clear information about charger availability, charging speeds, and any potential service interruptions.

- Data Privacy: Protecting customer data collected through charging sessions and app usage in compliance with privacy regulations like the California Consumer Privacy Act (CCPA).

- Dispute Resolution: Establishing accessible and fair processes for customers to resolve billing errors or service quality issues.

Blink Charging's legal obligations extend to ensuring its charging equipment meets stringent safety and interoperability standards. Compliance with regulations like UL 2202 for EV charging systems and ISO 15118 for vehicle-to-grid communication is crucial for market access and operational integrity. In 2024, the push for greater grid integration means adherence to these evolving standards is paramount, with non-compliance potentially leading to costly product recalls or exclusion from key markets.

The company must also navigate a complex web of intellectual property laws to protect its innovations. As of 2023, Blink Charging continued to invest in R&D, with a significant portion allocated to securing patents for its charging hardware and software solutions, aiming to maintain its competitive edge against emerging players in the rapidly growing EV infrastructure sector.

Consumer protection laws mandate transparency in pricing and service delivery. Blink Charging must clearly disclose all fees, including session charges and potential idle fees, to avoid penalties and maintain customer trust. By 2025, regulatory bodies like the FTC are expected to increase scrutiny on EV charging providers regarding billing practices, making adherence to these consumer-centric regulations a critical business imperative.

Environmental factors

Global commitments to reduce carbon emissions, such as the Paris Agreement's aim to limit warming to well below 2 degrees Celsius, are a significant tailwind for electric vehicle adoption. This directly translates to increased demand for EV charging infrastructure, a core market for Blink Charging. In 2023, EV sales globally surpassed 13 million units, a substantial increase from previous years, underscoring the growing market for charging solutions.

The environmental footprint of electric vehicle (EV) charging is directly tied to the electricity source. Blink Charging can leverage this by championing and integrating charging stations powered by renewable energy, thereby bolstering its eco-friendly image and attracting environmentally aware customers. For instance, in 2023, the U.S. saw renewable energy sources like wind and solar account for approximately 22.7% of total electricity generation, a figure expected to rise.

By integrating with green energy grids, Blink Charging actively contributes to a more sustainable charging infrastructure. This move not only aligns with global sustainability goals but also presents a competitive advantage as demand for clean energy solutions grows. As of early 2024, several states are pushing for higher renewable energy mandates, with some aiming for 100% clean electricity by 2045 or earlier, creating a favorable market for companies like Blink.

The environmental footprint of EV charging equipment, from manufacturing to end-of-life, is a growing concern. Blink Charging must integrate sustainable practices throughout its supply chain. This includes exploring avenues for recycling and responsible disposal of aging or damaged charging stations.

As of early 2024, the global e-waste challenge is significant, with millions of tons generated annually. Blink Charging's commitment to adhering to evolving e-waste regulations, such as those under the EU's Waste Electrical and Electronic Equipment (WEEE) directive, is crucial for its long-term environmental and regulatory compliance.

Noise and Air Pollution Concerns

Electric vehicles (EVs) offer a significant environmental advantage by drastically reducing urban noise and air pollution compared to traditional gasoline-powered cars. Blink Charging's mission directly aligns with this benefit, as their expanding charging network facilitates the adoption of EVs, thereby contributing to cleaner air and quieter cities.

The societal impact of reduced pollution is substantial. For instance, a study by the European Environment Agency in 2023 indicated that air pollution caused over 370,000 premature deaths in the EU in 2020, with road transport being a major contributor. By promoting EVs, Blink Charging plays a role in mitigating these health risks.

- Reduced Emissions: EVs produce zero tailpipe emissions, directly combating urban smog and respiratory illnesses.

- Quieter Cities: The quieter operation of EVs can lead to improved urban living environments, reducing stress and improving well-being.

- Public Health Benefits: A widespread shift to EVs, supported by charging infrastructure like Blink's, is projected to yield significant public health cost savings.

Resource Scarcity for Raw Materials

Blink Charging's manufacturing process for EV charging stations, much like other electronic goods, depends on a range of raw materials. Some of these materials, such as copper, aluminum, and rare earth elements, can experience supply chain disruptions or have significant environmental footprints associated with their extraction and processing. For instance, the global demand for copper, a key component in electrical wiring, has seen prices fluctuate, with the London Metal Exchange (LME) cash price for copper reaching over $9,000 per metric ton in early 2024, reflecting ongoing supply concerns.

To ensure consistent production and mitigate environmental risks, Blink Charging must actively monitor potential resource scarcity. This involves understanding global supply and demand dynamics for critical materials and identifying alternative or more sustainable sourcing options. The company's long-term production viability hinges on its ability to adapt to these challenges and maintain ethical, environmentally conscious supply chains.

- Supply Chain Vulnerability: Reliance on materials like copper and rare earth elements exposes Blink Charging to price volatility and potential shortages.

- Environmental Impact: The extraction and processing of raw materials can have significant environmental consequences, requiring careful management.

- Strategic Sourcing: Exploring sustainable sourcing strategies and diversified material suppliers is crucial for long-term production stability.

- Cost Management: Fluctuations in raw material prices directly impact manufacturing costs, necessitating proactive cost management and hedging strategies.

Global environmental policies, like the Paris Agreement, directly fuel EV adoption, creating a strong market for Blink Charging's infrastructure. The increasing demand for sustainable energy solutions also means that companies like Blink, which can integrate with renewable energy grids, gain a competitive edge. As of early 2024, several US states are mandating higher renewable energy targets, creating a favorable regulatory environment.

PESTLE Analysis Data Sources

Our Blink Charging PESTLE Analysis is meticulously crafted using data from government energy agencies, international economic organizations, and reputable market research firms. This ensures that insights into political stability, economic trends, and technological advancements are grounded in verifiable information.