Blink Charging Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blink Charging Bundle

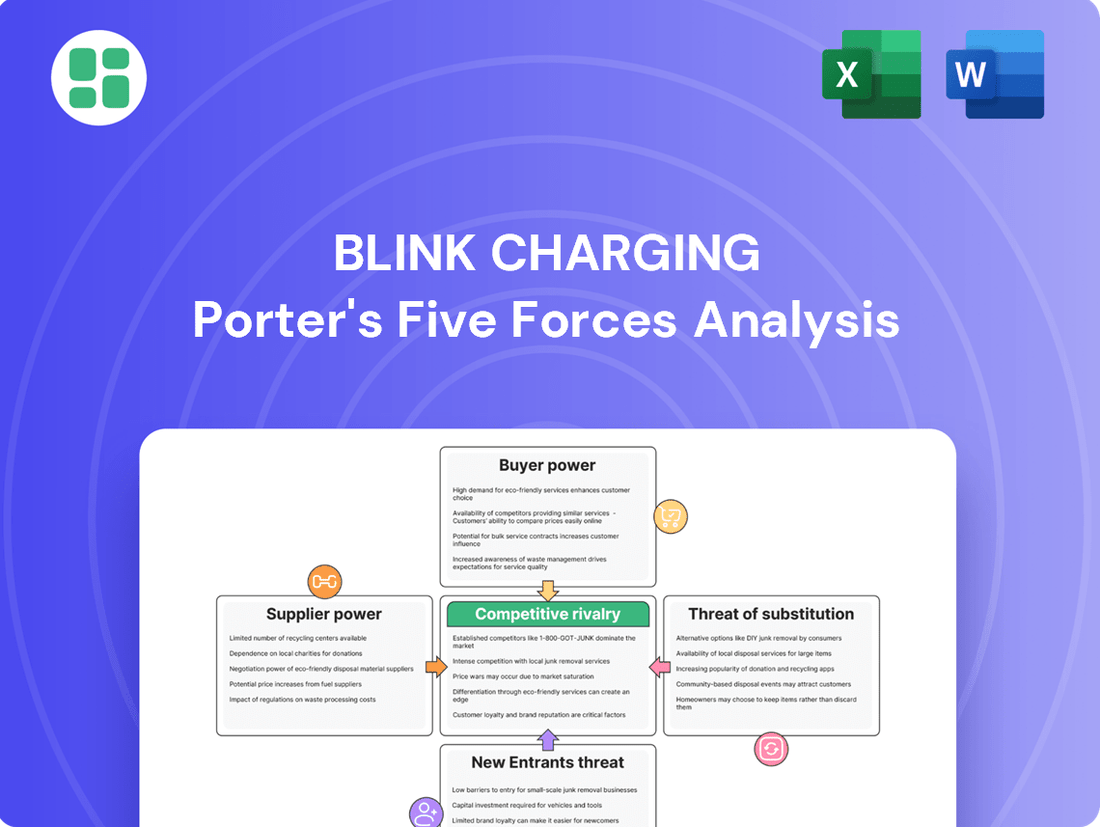

Blink Charging faces significant competitive rivalry and a growing threat of new entrants in the rapidly expanding EV charging market. Understanding the power of buyers and the availability of substitutes is crucial for navigating this dynamic landscape.

The complete report reveals the real forces shaping Blink Charging’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Blink Charging's reliance on specialized hardware, like power modules and connectors, means suppliers of these critical components hold significant sway. A limited number of manufacturers capable of producing advanced electronics for EV charging, particularly for emerging ultra-fast charging and V2G systems, can dictate terms.

While Blink Charging operates its own Blink Network, it might still rely on external software and cloud service providers for specific features or to scale its operations. This dependency can shift power towards these suppliers, especially if Blink requires specialized AI or data analytics for its evolving EV charging solutions. For instance, the market for AI in the automotive sector is projected to grow significantly, potentially increasing the bargaining power of AI software providers.

While Blink Charging focuses on charging infrastructure, the significant demand for raw materials like lithium and cobalt in electric vehicle batteries creates an indirect pressure. Fluctuations in the prices of these essential battery components, driven by global supply and demand, can ripple through the broader EV market, potentially influencing the cost and availability of related technologies for charger manufacturers.

Tariffs imposed on EV components, including batteries and critical minerals, directly impact the EV and battery supply chain. For instance, in 2024, ongoing geopolitical tensions and trade policies continued to shape the sourcing of these materials, potentially increasing component costs and affecting the supply chain's stability for companies like Blink that rely on a robust EV ecosystem.

Limited Number of High-Quality Manufacturers

The market for high-quality EV charging equipment, especially DC fast chargers, often features a limited number of established and reputable manufacturers. This concentration can give these suppliers considerable leverage when negotiating with charging network operators like Blink Charging.

As the demand for dependable and fast charging solutions escalates, this limited supplier base becomes even more critical. Blink Charging, like other players in the industry, must contend with the bargaining power held by these key manufacturers.

The financial health of these suppliers is also a factor. Reports from 2023 and early 2024 indicated that some EV charger manufacturers experienced insolvency, underscoring the inherent supply chain risks and potentially further concentrating the market among financially stable entities.

- Concentrated Market: A few high-quality EV charger manufacturers dominate the market, especially for DC fast chargers.

- Supplier Leverage: This limited number grants suppliers significant bargaining power over buyers like Blink Charging.

- Growing Demand: Increasing demand for efficient charging solutions amplifies supplier influence.

- Supply Chain Risk: Insolvencies among some manufacturers highlight potential disruptions and further market concentration.

Technological Advancements and Proprietary Tech

Blink Charging's reliance on suppliers with proprietary technologies, particularly in advanced energy management and bidirectional charging, significantly influences its bargaining power. Companies holding patents for high-power charging modules or sophisticated grid integration solutions can command premium pricing. For instance, the push for V2G (Vehicle-to-Grid) technology, a key area for future EV infrastructure, is driven by specialized hardware and software, giving these niche suppliers leverage. Blink's need to adopt these innovations to stay competitive means they may face higher procurement costs or become tied to specific technology roadmaps.

- Proprietary Tech: Suppliers with unique energy management systems or V2G capabilities hold significant sway.

- Competitive Necessity: Blink must integrate these advanced technologies to remain relevant in the evolving EV market.

- Cost Implications: Dependence on specialized suppliers can lead to increased component costs for Blink.

- Market Trends: The demand for faster charging and smart grid integration amplifies the power of suppliers offering these solutions.

Blink Charging faces considerable bargaining power from its suppliers due to the specialized nature of EV charging hardware and the limited number of high-quality manufacturers. This concentration, particularly for DC fast chargers, allows these suppliers to dictate terms. For example, the market for advanced electronics for ultra-fast charging and V2G systems is dominated by a few key players, increasing their leverage. The financial instability of some manufacturers, as seen in insolvencies reported in 2023-2024, further consolidates the market, amplifying the power of surviving, financially robust suppliers.

| Supplier Characteristic | Impact on Blink Charging | Supporting Data/Trend (as of mid-2024) |

|---|---|---|

| Concentration of High-Quality Manufacturers | Increased supplier leverage, potentially higher costs | Limited number of established DC fast charger manufacturers |

| Proprietary Technology (V2G, Energy Management) | Suppliers command premium pricing, tie-in risks | Growing demand for V2G solutions, requiring specialized components |

| Supply Chain Volatility (e.g., Tariffs, Material Costs) | Potential for increased component costs and supply disruptions | Ongoing geopolitical factors influencing critical mineral sourcing |

| Financial Health of Suppliers | Market consolidation, increased reliance on stable suppliers | Reported insolvencies of some EV charger manufacturers (2023-2024) |

What is included in the product

This analysis dissects the competitive forces impacting Blink Charging, including the threat of new entrants, buyer and supplier power, and the intensity of rivalry, to understand its market position and strategic vulnerabilities.

Instantly visualize competitive intensity with a dynamic spider chart, simplifying complex market pressures for Blink Charging.

Customers Bargaining Power

Blink Charging's customer base is quite diverse, encompassing multifamily residences, workplaces, public locations, and fleet operators. Each of these segments has distinct requirements and sensitivities to pricing, meaning their collective bargaining power isn't uniform. For instance, in 2024, while individual EV drivers might prioritize ease of use and consistent operation over minor cost variations, larger property owners, especially those deploying numerous charging stations, can exert more influence due to their ability to switch between competing charging providers.

For individual electric vehicle (EV) drivers, the ability to switch between different public charging networks is generally quite straightforward. Most EVs are compatible with various charging networks, although variations in connector types can sometimes be a factor. This ease of transition significantly boosts the bargaining power of EV drivers.

Drivers are increasingly demanding competitive pricing, high reliability in charging station uptime, and a smooth, user-friendly experience. The proliferation of mobile applications that offer real-time data on station availability and pricing further empowers consumers, allowing them to make informed choices and negotiate better terms implicitly through their selection.

The bargaining power of customers is significantly amplified by the increasing availability of charging options. Blink Charging faces this pressure as more charging networks and home solutions emerge, offering consumers greater choice and leverage.

This surge in charging infrastructure, fueled by substantial government and private investment, directly impacts pricing strategies. Customers can now compare options, pushing providers like Blink to offer competitive rates and superior service quality to retain their business. The global stock of public chargers has seen remarkable growth, doubling since 2022, which intensifies this competitive dynamic.

Price Sensitivity and Charging Costs

Customers' bargaining power is influenced by their sensitivity to charging costs. While electric vehicle (EV) adoption is on the rise, the perceived cost of charging, particularly at public stations, can still be a concern for some consumers when compared to gasoline. This price sensitivity means customers closely examine the cost per mile and are wary of fluctuating pricing structures. For instance, in 2024, while home charging remains significantly more economical, the expense of public charging can deter some users, especially those without reliable home charging solutions.

Here's a breakdown of customer price sensitivity:

- Cost Comparison: Consumers often benchmark EV charging costs against traditional gasoline prices, making price a key decision factor.

- Dynamic Pricing Concerns: Customers express unease with variable pricing models, preferring predictable and transparent charging fees.

- Home Charging Advantage: The lower cost of charging at home reduces the immediate need for public charging for many EV owners, lessening their reliance on external providers.

Demand for Interoperability and Standards

Customers, especially large property owners and fleet managers, are increasingly pushing for interoperability and the adoption of industry standards like the Open Charge Point Protocol (OCPP). This is a significant factor in their bargaining power, as they aim to prevent being locked into a single vendor's ecosystem.

This demand for flexibility means customers want charging solutions that can seamlessly connect with a variety of backend systems and hardware. By ensuring compatibility across different providers, they reduce their reliance on any one company's offerings, giving them more leverage in negotiations.

- Demand for OCPP Compliance: As of early 2024, a significant percentage of new EV charging station deployments are expected to support OCPP 1.6 or higher, reflecting a growing customer requirement for open standards.

- Fleet Manager Requirements: Major fleet operators are actively seeking charging infrastructure providers that can integrate with their existing fleet management software, often stipulating open API access as a key requirement.

- Avoiding Vendor Lock-in: Customers are increasingly aware of the costs and complexities associated with proprietary systems, making interoperability a critical factor in their purchasing decisions to maintain long-term flexibility.

Blink Charging's customers, particularly large fleet operators and property managers, wield considerable bargaining power due to their ability to switch providers and their demand for cost-effectiveness and interoperability. This power is amplified by the growing number of charging network options available in 2024, forcing Blink to compete on price and service. The increasing adoption of open standards like OCPP further reduces customer dependence on single vendors, giving them more leverage.

| Customer Segment | Bargaining Power Factors | Impact on Blink Charging |

|---|---|---|

| Individual EV Drivers | Ease of switching networks, price sensitivity | Pressure on per-session pricing, need for user-friendly apps |

| Fleet Operators | Volume purchasing, demand for integration, interoperability needs | Requirement for customized solutions, potential for bulk discounts |

| Property Managers (Multifamily, Workplace) | Ability to choose multiple vendors, negotiation on installation costs | Need for competitive installation and service agreements |

Preview Before You Purchase

Blink Charging Porter's Five Forces Analysis

This preview offers a comprehensive look at the Blink Charging Porter's Five Forces Analysis, showcasing the exact document you will receive immediately after purchase. You'll gain immediate access to this professionally formatted analysis, providing critical insights into the competitive landscape of the electric vehicle charging industry. Rest assured, there are no placeholders or samples here; what you see is precisely what you get, ready for your strategic planning.

Rivalry Among Competitors

The electric vehicle (EV) charging market is a dynamic and rapidly expanding sector, with global investments pouring in to support its growth. This expansion, however, means the market is also quite fragmented, featuring a multitude of companies competing for dominance. Blink Charging operates within this environment, where substantial projected market growth attracts an increasing number of competitors, thereby intensifying the rivalry among existing and new players.

Blink Charging operates in a highly competitive landscape, facing off against numerous established players. Companies like ChargePoint, Tesla Supercharger, Electrify America, EVgo, Shell Recharge, and BP Pulse are significant rivals, often boasting larger charging networks and substantial financial resources.

The sheer scale of some competitors presents a considerable challenge. For example, Tesla's Supercharger network, with over 65,000 connectors globally as of early 2024, has set a high standard for charging speed and network reliability, influencing customer expectations across the industry.

The competitive landscape for electric vehicle charging, especially in the critical DC fast-charging sector, is intensifying. This segment is vital for enabling longer journeys and accelerating EV adoption, making it a key battleground for market share. Companies are aggressively increasing their fast-charging infrastructure and deploying more ultra-fast chargers, creating a dynamic race to build out extensive and speedy networks.

Blink Charging is actively working to expand its own network to keep pace with these rapid deployments by competitors. For instance, in 2023, Blink announced plans to deploy approximately 500 new DC fast chargers across the United States, aiming to bolster its presence in key markets. However, the sheer pace of network expansion by larger players, such as Electrify America and ChargePoint, necessitates continuous investment and strategic site selection for Blink to maintain its competitive edge.

Pricing Strategies and Profitability Challenges

The electric vehicle charging sector is characterized by fierce competition, often forcing companies like Blink Charging to engage in aggressive pricing strategies. This intense rivalry can significantly squeeze profit margins, making it difficult for providers to maintain healthy financial performance.

Despite the industry's growth, achieving consistent profitability remains a hurdle for many players. For instance, Blink Charging reported net losses and a decline in product sales revenue in the first quarter of 2025. This highlights the ongoing challenge of balancing expansion with the need for financial sustainability in a highly competitive market.

- Intense Rivalry: The market is crowded with numerous charging providers, leading to price wars.

- Margin Pressure: Competitive pricing directly impacts the profitability of charging services.

- Profitability Challenges: Many companies, including Blink, are still striving for consistent profitability.

- Q1 2025 Performance: Blink Charging experienced net losses and a revenue dip in product sales during this period.

Technological Innovation as a Differentiator

Competitive rivalry in the electric vehicle charging sector is intensely driven by technological innovation. Companies are pouring resources into developing smart charging capabilities, vehicle-to-grid (V2G) technology, AI-driven solutions for optimized charging, and sophisticated energy management systems. This constant push for advanced features allows companies to stand out in a crowded market.

The capacity to deliver enhanced user experiences, seamless integration with renewable energy sources, and cutting-edge functionalities has become a primary battleground for market share. Blink Charging’s strategic emphasis on these advanced solutions is therefore crucial for its sustained competitiveness in this rapidly evolving technological landscape.

- Smart Charging: Features like scheduled charging to take advantage of lower off-peak electricity rates are becoming standard.

- V2G Technology: This allows EVs to send power back to the grid, offering grid stabilization services and potential revenue streams for users.

- AI Integration: Artificial intelligence is being used to predict charging needs, optimize grid load, and personalize user experiences.

- Energy Management: Advanced systems help users and businesses manage their energy consumption more efficiently, often integrating with solar power or battery storage.

The electric vehicle charging market is experiencing intense rivalry, characterized by rapid network expansion and a constant drive for technological advancement. Companies are fiercely competing to capture market share, leading to pressure on pricing and profitability.

Blink Charging faces significant competition from established players like ChargePoint and Tesla, who possess larger networks and greater financial resources. This dynamic forces Blink to continuously invest in its infrastructure and strategic site selection to remain competitive.

The battleground extends to technological innovation, with companies focusing on smart charging, V2G capabilities, and AI integration to enhance user experience and differentiate themselves. This innovation race is crucial for sustained competitiveness in the evolving EV charging landscape.

Profitability remains a challenge for many in the sector, with Blink Charging reporting net losses and declining product sales revenue in Q1 2025, underscoring the difficulties in balancing growth with financial sustainability amid fierce competition.

| Competitor | Network Size (Approximate Connectors) | Key Differentiators |

| ChargePoint | Over 250,000 | Extensive public and private network, diverse charging solutions |

| Tesla Supercharger | Over 65,000 globally (early 2024) | High-speed charging, seamless integration with Tesla vehicles |

| Electrify America | Thousands of DC fast chargers | Focus on ultra-fast charging, broad geographic coverage |

| EVgo | Thousands of DC fast chargers | Focus on fast charging, strong partnerships |

SSubstitutes Threaten

The most significant substitute for public EV charging stations, like those offered by Blink Charging, is home charging. This is largely due to its unparalleled convenience and typically lower cost per kilowatt-hour for EV owners.

Data indicates that nearly 90% of all EV chargers in operation are private installations, with the vast majority of electric vehicle owners relying on their homes for daily charging needs. This strong preference for home charging directly diminishes the demand for public charging infrastructure.

The availability of workplace and destination charging presents a significant threat of substitutes for Blink Charging's public stations. Many electric vehicle (EV) owners can charge at their offices or at places they frequent, such as hotels and retail centers. This reduces their reliance on public charging infrastructure for everyday needs or during extended stays. For instance, a 2023 survey indicated that over 60% of EV drivers have access to charging at their workplace, a number expected to grow as more companies invest in EV infrastructure.

Improvements in electric vehicle (EV) battery technology, leading to significantly extended driving ranges, act as a substantial threat of substitutes for public charging networks like Blink Charging. As EVs become capable of traveling 200 to 300 miles or more on a single charge, the perceived need for frequent public charging diminishes considerably for many drivers. This enhanced range directly reduces the reliance on public charging infrastructure, as consumers can manage more of their charging needs at home or work.

Alternative Fuel Technologies

While electric vehicles dominate the current landscape, alternative fuel technologies such as hydrogen fuel cells for Fuel Cell Electric Vehicles (FCEVs) represent a potential long-term substitute threat to Blink Charging's core business. If hydrogen infrastructure development accelerates and FCEV adoption gains significant traction, it could siphon demand away from electric charging solutions, impacting Blink's market share.

Several pilot programs and trials for hydrogen-powered vehicles are actively underway in various regions, signaling a growing interest and investment in this alternative. For instance, by early 2024, several countries have announced ambitious targets for hydrogen mobility deployment, with Germany aiming for 1,500 hydrogen refueling stations by 2030.

- Hydrogen Fuel Cell Vehicles (FCEVs): These vehicles use hydrogen gas to generate electricity, emitting only water vapor.

- Infrastructure Development: The expansion of hydrogen refueling stations is crucial for FCEV viability.

- Government Initiatives: Policies and subsidies supporting hydrogen technology can accelerate adoption.

- Technological Advancements: Improvements in fuel cell efficiency and hydrogen production methods impact competitiveness.

Battery Swapping Technology

Battery swapping, a method where depleted EV batteries are swiftly exchanged for fully charged ones, presents a potential substitute, particularly for specific vehicle types or commercial fleets. This technology offers a speed advantage over traditional charging methods and could see increased adoption in particular market niches.

While battery swapping is not yet a mainstream solution, its ability to reduce vehicle downtime makes it an interesting alternative. For instance, companies like Nio have been actively developing and deploying battery swapping stations, aiming to provide a seamless experience for their customers. In 2023, Nio announced plans to significantly expand its battery swapping network, indicating a growing interest in this substitute technology.

- Limited Current Adoption: Battery swapping infrastructure is not yet widely available, restricting its appeal to a niche market.

- Speed Advantage: Swapping a battery can take mere minutes, significantly faster than most EV charging times.

- Fleet Suitability: This model is particularly attractive for commercial fleets where minimizing downtime is crucial for operational efficiency.

- Technological Hurdles: Standardization of battery packs across different EV manufacturers remains a significant challenge for widespread adoption.

The threat of substitutes for Blink Charging's public charging stations is significant, primarily driven by convenient and cost-effective alternatives. Home charging remains the dominant substitute, with approximately 90% of EV chargers being private installations, making it the go-to option for most EV owners. Workplace and destination charging also reduce reliance on public networks, as over 60% of EV drivers in 2023 had access to charging at their offices.

Advancements in EV battery technology, extending driving ranges to 200-300 miles or more, further diminish the perceived need for frequent public charging. Emerging technologies like hydrogen fuel cell vehicles (FCEVs), supported by government initiatives and pilot programs, also pose a long-term substitute threat, with countries like Germany targeting 1,500 hydrogen refueling stations by 2030.

Battery swapping, though currently niche, offers a faster alternative for specific segments, particularly commercial fleets, with companies like Nio expanding their swapping networks. This technology's speed advantage could capture market share if standardization hurdles are overcome.

| Substitute | Key Advantage | Market Penetration/Potential | Impact on Blink Charging |

|---|---|---|---|

| Home Charging | Convenience, Lower Cost | ~90% of EV chargers are private | Reduces demand for public charging |

| Workplace/Destination Charging | Convenience, Integration into daily life | >60% of EV drivers have workplace charging access (2023) | Decreases reliance on public stations |

| Extended EV Range | Reduced charging frequency | Vehicles capable of 200-300+ miles | Lowers perceived need for public charging |

| Hydrogen Fuel Cell Vehicles (FCEVs) | Alternative fueling | Growing pilot programs; Germany targets 1,500 stations by 2030 | Long-term potential to divert demand |

| Battery Swapping | Speed, Reduced downtime | Niche adoption, e.g., Nio expansion | Potential threat in specific market segments |

Entrants Threaten

The significant capital required to build a widespread electric vehicle (EV) charging infrastructure, particularly for fast-charging stations, presents a major hurdle for new companies. This includes the cost of the charging units themselves, securing suitable locations, and ensuring robust grid connectivity.

For instance, the average cost to install a Level 3 (DC fast charger) can range from $30,000 to $100,000 or more, not including installation, permitting, and potential grid upgrades. Blink Charging's own capital expenditures in 2023 reflected this, with significant investments in network expansion and hardware deployment.

Navigating the intricate web of regulatory and permitting processes presents a significant barrier for new entrants in the electric vehicle charging sector. These hurdles include understanding and adhering to diverse zoning laws, obtaining necessary permits for installation, and meeting various safety and operational standards. For instance, in 2024, many municipalities continued to refine their permitting processes for EV charging infrastructure, with some areas experiencing delays of several months due to backlogs and evolving requirements.

Compliance with these complex frameworks, alongside evolving technical standards, escalates the cost and time required for market entry. However, this challenge is being met by government initiatives aimed at streamlining these processes and encouraging EV infrastructure growth. Many jurisdictions are actively implementing mandates and offering incentives, such as tax credits or grants, to accelerate the deployment of charging stations, thereby mitigating some of the entry barriers for new companies.

New entrants into the EV charging market, like Blink Charging, face a significant hurdle in establishing a network dense enough to rival incumbents. For instance, by the end of 2023, ChargePoint reported over 240,000 active charging stations, demonstrating the scale required to offer widespread convenience.

Achieving seamless interoperability across diverse EV models and charging standards is another major challenge. This requires substantial investment in R&D and often necessitates partnerships, as seen with various charging network alliances forming to improve user experience and expand access.

Technological Complexity and Rapid Evolution

The electric vehicle (EV) charging sector is a hotbed of innovation, with technologies like ultra-fast charging, smart grid integration, and AI-powered management systems constantly emerging. For example, the average charging speed for DC fast chargers has been steadily increasing, with many new models offering speeds that can add over 200 miles of range in under 20 minutes.

This rapid pace of technological development presents a significant hurdle for potential new entrants. Establishing a competitive position requires substantial investment in research and development to not only match but also anticipate these advancements. Companies without robust technical capabilities or significant financial backing may find it difficult to enter and thrive in this dynamic market.

- High R&D Investment: New entrants must commit significant capital to stay current with evolving charging speeds, battery management integration, and software platforms.

- Technical Expertise Required: Developing and deploying advanced charging solutions demands specialized engineering talent in areas like power electronics, grid management, and software development.

- Rapid Obsolescence: Without continuous innovation, existing charging infrastructure can quickly become outdated, necessitating ongoing upgrades and further investment.

Brand Recognition and Customer Trust

The threat of new entrants in the EV charging market, particularly concerning brand recognition and customer trust, is significant. Established companies like Blink Charging have cultivated strong relationships and a reputation for reliability. For instance, Blink reported a substantial increase in its charging network in 2024, expanding its reach and reinforcing its brand presence.

Newcomers face the hurdle of building equivalent trust. They must invest heavily in marketing and customer support to assure property owners and EV drivers of their service quality and network dependability. This is crucial as convenience and consistent performance are paramount for users. For example, in 2024, the average uptime for charging stations across the industry remained a key metric for customer satisfaction, highlighting the importance of reliability.

- Brand Equity: Blink's established brand recognition provides a competitive advantage, making it easier to secure prime locations and attract users.

- Customer Loyalty: Trust built through consistent service encourages repeat business, a difficult trait for new entrants to replicate quickly.

- Marketing Investment: New entrants need substantial capital for marketing campaigns to counter the established visibility of players like Blink.

- Partnership Strategies: Forming strategic alliances can help new entrants accelerate brand building and gain initial market access.

The threat of new entrants in the EV charging market is moderate, primarily due to substantial capital requirements for infrastructure development and the need for extensive R&D to keep pace with technological advancements. While government incentives aim to broaden access, the sheer scale of investment needed to build a competitive network, coupled with the complexities of regulatory compliance and brand building, presents significant barriers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for charging hardware, installation, and grid upgrades. | Significant hurdle, requiring substantial funding for market entry. |

| Regulatory Hurdles | Navigating zoning, permits, and safety standards. | Can cause delays and increase operational costs. |

| Technological Pace | Rapid innovation in charging speeds and smart grid integration. | Demands continuous R&D investment to remain competitive. |

| Brand Recognition | Building customer trust and reliability takes time and marketing. | Newcomers must invest heavily to establish credibility against incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Blink Charging is built upon a foundation of comprehensive data, including Blink Charging's own SEC filings, investor relations materials, and annual reports.

We supplement this with insights from reputable industry research firms, market intelligence reports, and publicly available data on the electric vehicle charging infrastructure market to provide a thorough competitive landscape.