Blink Charging Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blink Charging Bundle

Curious about Blink Charging's product portfolio? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture!

Unlock the complete Blink Charging BCG Matrix to understand exactly where each product fits and how to leverage their market position. Purchase the full report for actionable insights and a clear path to optimizing your investments.

Stars

Blink Charging's service revenues, encompassing charging services, network fees, and car-sharing, are a significant growth engine. These revenues saw a substantial 29.2% increase in the first quarter of 2025 when compared to the same period in 2024, highlighting their importance to Blink's strategy of building a recurring revenue base.

The Owner-Operator DC Fast Charging Network is a shining star for Blink Charging. In Q1 2025, this segment saw a remarkable 341% year-over-year revenue increase, showcasing its immense growth potential.

This rapid expansion is a direct response to the market's increasing demand for faster charging solutions. Blink's strategic investments in its DC fast charging infrastructure solidify its position as a key player in this evolving electric vehicle landscape.

Blink Charging is actively growing its footprint through strategic alliances. In the first quarter of 2025 alone, the company added 319 Blink-owned chargers, building on a substantial 19,771 chargers deployed globally throughout 2024.

These expansions are often driven by key collaborations, such as the agreement with Power Design to outfit multifamily apartments with charging infrastructure. Furthermore, Blink is strategically placing DC fast chargers in vital transportation corridors, exemplified by installations near the U.S.-Mexico border.

These partnerships are crucial for increasing market penetration and ensuring higher utilization rates for their charging network.

Vertical Integration and Domestic Manufacturing

Blink Charging's strategy of vertical integration, including its manufacturing operations in Bowie, Maryland, and India, offers a significant competitive edge. This approach directly addresses supply chain vulnerabilities and positions the company to benefit from initiatives like Buy American policies.

By bringing charger manufacturing in-house, Blink Charging gains greater control over product quality and can adapt more quickly to evolving market needs. This is particularly important in the rapidly expanding electric vehicle charging sector.

- Manufacturing Expansion: Blink announced plans to expand its US manufacturing capabilities, aiming to produce thousands of EV chargers annually at its Maryland facility.

- Supply Chain Resilience: Domestic manufacturing helps reduce reliance on overseas suppliers, mitigating potential disruptions and lead time issues.

- Policy Alignment: Producing chargers in the United States allows Blink to directly capitalize on government incentives and procurement opportunities favoring domestic production.

- Cost Control: In-house manufacturing can lead to better cost management and potentially higher profit margins as the company scales its operations.

Focus on Enterprise and Fleet Solutions

Blink Charging's focus on enterprise and fleet solutions positions it strongly within the electric vehicle market. The partnership with dfYOUNG, for instance, offers a comprehensive turnkey EV fleet management and home charger installation service tailored for corporate sales teams. This strategic initiative is designed to streamline the adoption of electric vehicles for businesses, covering everything from installation and logistics to ongoing support.

This move directly addresses a high-growth niche by simplifying the complexities of EV adoption for corporate clients. By providing a complete package, Blink Charging aims to remove barriers for companies looking to electrify their fleets. This is particularly relevant as fleet electrification represents a significant and rapidly expanding segment of the overall EV market.

- Targeting corporate fleets simplifies EV adoption by offering integrated solutions.

- Partnerships enhance service offerings for enterprise clients.

- Fleet electrification is a key growth driver in the EV sector.

- Blink Charging is strategically positioned to capture this expanding market.

Blink Charging's Owner-Operator DC Fast Charging Network is a clear star in its BCG matrix. This segment experienced a remarkable 341% year-over-year revenue increase in Q1 2025, demonstrating its high growth and market leadership potential. This rapid expansion is driven by the increasing demand for faster EV charging solutions, a trend Blink is actively capitalizing on through strategic infrastructure investments.

| Segment | Growth Rate (Q1 2025 YoY) | Key Driver | Strategic Importance |

|---|---|---|---|

| Owner-Operator DC Fast Charging Network | 341% | Demand for faster charging | Market leadership, high growth potential |

What is included in the product

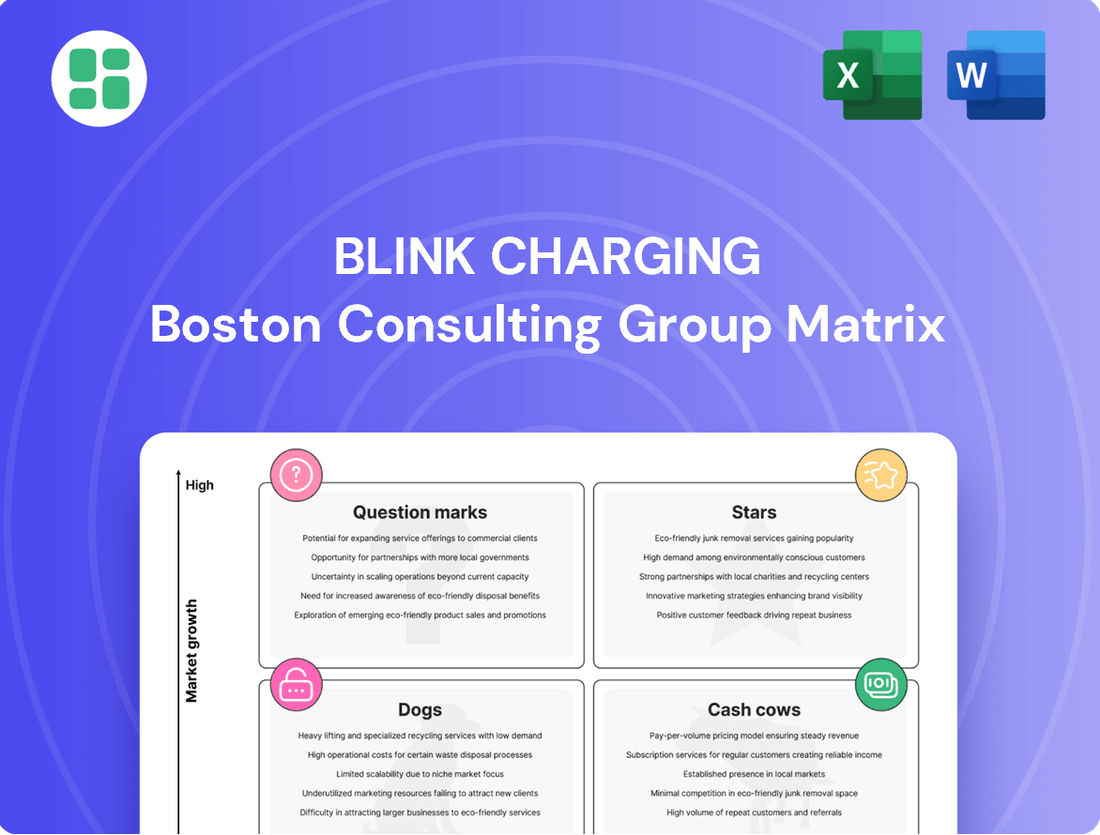

The Blink Charging BCG Matrix analyzes its charging stations as Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment strategies.

A clear BCG Matrix visualizes Blink Charging's portfolio, easing strategic decision-making.

Cash Cows

While Blink Charging is still in a growth phase and not yet profitable, its recurring network and service fees are the closest thing to a cash cow right now. These fees are growing steadily, showing a 29.2% increase in Q1 2025. This indicates a move towards a more stable income stream, less dependent on selling hardware.

Blink Charging's established AC Level 2 charging network is a significant asset, boasting over 24,000 charging ports across the U.S. as of early 2024. While currently facing profitability hurdles, this extensive infrastructure forms a solid base for future growth and potential cash generation.

The existing installations, especially those with consistent usage and lower deployment costs, are poised to become stable, lower-growth cash cows as the EV charging market matures. This transition will be supported by anticipated improvements in operational efficiencies and market stabilization.

Blink Charging's owner-operator model focuses on owning and managing a segment of its charging stations. This strategy is designed to create a steady stream of income from charging fees and network services over the long haul. While it demands substantial upfront capital, the goal is to build a portfolio of assets that, once established, can deliver reliable cash flow with reduced promotional expenses.

This approach prioritizes consistent revenue generation over rapid product sales. For instance, as of the first quarter of 2024, Blink Charging reported a significant increase in its owned and operated station count, contributing to a growing base for recurring revenue. The company’s 2023 annual report highlighted the increasing contribution of charging revenue from its owned network to its overall financial performance.

Maintenance and Warranty Services

Maintenance and warranty services for Blink Charging represent a stable, low-growth revenue segment. In Q1 2025, these services generated $1.8 million, a figure consistent with previous periods, and saw an increase for the entirety of 2024. This stability is a hallmark of a cash cow, providing predictable income.

As Blink Charging's network of installed chargers expands, the demand for essential maintenance and ongoing support services is projected to rise in tandem. This growing installed base directly translates into a larger customer pool for these recurring revenue streams.

These service offerings typically boast higher profit margins compared to the initial sale of charging hardware. Crucially, once the infrastructure for these services is in place, they require minimal additional capital investment, thereby enhancing operational stability and cash flow generation for Blink Charging.

- Revenue Stability: Q1 2025 saw $1.8 million from warranty and maintenance, indicating consistent income.

- Growth Driver: An increasing installed base of chargers directly fuels demand for these services.

- Profitability: Higher margins and lower capital expenditure requirements contribute to strong cash flow.

- Operational Support: These services provide a foundational element of financial predictability for the company.

Leveraging Existing Infrastructure for Efficiency

Blink Charging's strategy to boost charger utilization across its existing network is a key move to get more from its deployed assets. This focus on efficiency is vital for turning current infrastructure into reliable revenue streams.

The company reported a significant 66% increase in energy disbursed on its network during Q1 2025. This surge in usage directly translates to higher revenue generation from its installed base, demonstrating a clear path to improved operational efficiency.

- Increased Energy Disbursed: 66% growth in Q1 2025 highlights better network utilization.

- Revenue from Existing Assets: Focus on maximizing returns from deployed charging stations.

- Operational Efficiency: Driving more revenue without proportional capital expenditure increases.

- Cash Cow Potential: Transforming current infrastructure into future cash-generating units.

Blink Charging's recurring network and service fees represent its closest approximation to cash cows, showing a 29.2% increase in Q1 2025. The company's extensive network of over 24,000 U.S. charging ports as of early 2024, particularly its owned and operated segment, is designed for steady income from charging fees. Maintenance and warranty services, which generated $1.8 million in Q1 2025, offer a stable, low-growth revenue stream with higher profit margins and minimal capital reinvestment.

| Revenue Stream | Q1 2025 Data | Significance |

|---|---|---|

| Network & Service Fees | 29.2% Growth | Indicates growing recurring revenue |

| Owned & Operated Network | Expanding base | Foundation for steady charging fee income |

| Maintenance & Warranty | $1.8 million | Stable, predictable income with high margins |

Preview = Final Product

Blink Charging BCG Matrix

The Blink Charging BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis is ready for immediate strategic application, offering deep insights into Blink Charging's product portfolio without any watermarks or demo content. You can confidently use this exact file for your business planning, presentations, or competitive analysis upon completion of your purchase.

Dogs

Blink Charging's product sales segment is currently facing significant headwinds, as evidenced by a sharp decline in revenue. In the first quarter of 2025, product revenues plummeted by 69.5% when compared to the same period in 2024. This substantial drop, from $27.5 million down to $8.4 million, signals a serious challenge in meeting market demand or fending off competitive pressures.

This downward trend isn't isolated to the first quarter of 2025; it also reflects a broader pattern observed throughout the full year of 2024 for product revenue. Consequently, the outright sale of charging equipment is categorized as a 'Dog' within the BCG Matrix. This classification stems from its combination of a low market share and a clear pattern of declining growth, indicating it’s a segment that requires careful consideration for future investment or divestment strategies.

Blink Charging has acknowledged a gap in its product lineup, specifically in the value segment. This admission, coupled with the accelerated development of its Gen-3 charger, suggests that some of its current charger models might be lagging behind in terms of competitiveness.

Older or less advanced charger models that don't align with current customer needs or competitive pricing could be categorized as question marks or even dogs in the BCG matrix. These units likely hold a small market share and contribute very little to Blink's overall growth trajectory. For instance, if older models represent less than 5% of Blink's total charging station deployments in 2024, they would fit this description.

Blink Charging's legacy AC installations, while extensive, are currently struggling to generate sufficient revenue to offset their operational costs. This situation suggests that some of these older charging stations may be underperforming financially, potentially acting as cash drains.

The company's focus on expanding its owner-operator model highlights a potential shift away from these legacy assets. Older, less frequently used AC chargers might incur higher maintenance and operational expenses than the revenue they bring in, especially if they are not integrated into the company's active growth strategies.

Non-Strategic or Underperforming Geographic Markets

Blink Charging's international expansion, while promising, may include geographic markets where its presence is minimal or growth is slow. These areas, characterized by low EV adoption rates or intense competition, might not justify continued significant investment if they don't demonstrate potential for future gains.

While specific financial breakdowns for underperforming regions aren't publicly detailed, these markets would represent Blink's Non-Strategic or Underperforming Geographic Markets in a BCG analysis.

- Low Market Share: Regions where Blink has minimal penetration despite its global rollout efforts.

- Stagnant EV Adoption: Markets with slow or no significant growth in electric vehicle uptake, hindering charger demand.

- Resource Reallocation: Potential for shifting capital and resources from these markets to more promising areas.

- Strategic Review: Necessity to reassess the long-term viability and strategic importance of operations in these geographies.

High Operating Expenses Relative to Product Revenue

Blink Charging's product sales segment is characterized by high operating expenses that significantly outweigh its revenue. This imbalance is a primary reason for its classification as a 'Dog' in the BCG Matrix. For instance, in Q1 2024, Blink reported operating expenses of $54.9 million, while product revenue was only $10.2 million, highlighting a substantial operational cost relative to the income generated from selling charging equipment.

Despite ongoing efforts by Blink to reduce costs, the persistent and substantial losses from product sales demonstrate an inherent inefficiency. The current operational model for this segment is not yielding positive returns, instead acting as a drain on the company's financial resources.

- High Operating Expenses: In Q1 2024, operating expenses were $54.9 million.

- Low Product Revenue: Product revenue for Q1 2024 was $10.2 million.

- Inefficiency: The significant gap indicates an inefficient operational structure for product sales.

- Resource Drain: This segment is not generating positive returns and consumes valuable resources.

Blink Charging's product sales segment, characterized by a low market share and declining growth, firmly places it in the 'Dog' category of the BCG Matrix. This segment is currently a significant drain on resources, with operating expenses vastly exceeding the revenue generated from equipment sales. For instance, in Q1 2024, operating expenses hit $54.9 million against product revenue of just $10.2 million, underscoring its inefficiency.

The company's product revenue saw a dramatic 69.5% decrease in Q1 2025 compared to Q1 2024, dropping from $27.5 million to $8.4 million. This sharp decline, coupled with the acknowledgment of a gap in its value segment offerings and the accelerated development of its Gen-3 charger, suggests that older or less competitive charger models are contributing to this 'Dog' classification.

Legacy AC installations, while extensive, are also underperforming financially, potentially failing to cover their operational costs. This situation, along with potential underperforming international markets with low EV adoption, further solidifies the 'Dog' status for certain assets and geographic segments that require strategic reassessment.

| BCG Category | Blink Charging Segment | Key Characteristics | Financial Data (Q1 2024) | Strategic Implication |

|---|---|---|---|---|

| Dog | Product Sales (Older Models) | Low market share, declining revenue, high operating costs relative to revenue, gap in value segment. | Product Revenue: $10.2 million; Operating Expenses: $54.9 million. | Divestment or significant restructuring may be necessary to stop resource drain. |

| Dog | Legacy AC Installations | Low utilization, potentially high maintenance costs compared to revenue generation. | Specific financial data not publicly detailed, but implied underperformance. | Consider phasing out or repurposing to reduce operational burden. |

| Dog | Underperforming Geographic Markets | Minimal market penetration, slow EV adoption, intense competition. | Specific financial data not publicly detailed for individual regions. | Reallocate resources to more promising markets; reassess long-term viability. |

Question Marks

Blink Charging's next-generation DC fast chargers, or Gen-3, represent a strategic move into the rapidly expanding DC fast charging market. This new product line signifies Blink's commitment to innovation and meeting evolving customer needs in the electric vehicle (EV) infrastructure space.

While the Gen-3 charger is positioned in a high-growth segment, its market share is currently minimal due to its recent introduction. This places it in the "Question Mark" category of the BCG matrix, requiring substantial investment to gain traction and achieve significant market penetration.

Blink Charging's strategic alliance with Create Energy to provide integrated energy management solutions, particularly for grid resiliency, positions them to capture a growing market. This partnership combines electric vehicle (EV) charging infrastructure with energy storage capabilities, creating a comprehensive offering for customers. The company is actively investing in this area, recognizing the increasing demand for such combined solutions.

This 'one-stop-shop' approach is designed to meet the evolving needs within the EV ecosystem, offering a more complete energy management package. While the market adoption for these integrated solutions is still in its early phases, Blink Charging sees significant potential for growth. The company's focus on this segment is a strategic move to differentiate itself and capitalize on emerging trends in energy management and EV infrastructure.

Blink Charging's EV Totem concept, blending electric vehicle charging with digital advertising, is a bold move into the high-potential smart city and retail sectors. This innovative approach aims to generate revenue streams beyond just charging fees, leveraging prime locations for advertising visibility.

While promising, the EV Totem is a nascent product with limited market penetration as of early 2024. Blink's investment in marketing and deployment is crucial to establishing its scalability and gauging consumer and advertiser adoption. The success hinges on demonstrating a strong return on investment for advertisers and a seamless user experience for EV drivers.

International Market Expansions

Blink Charging's international market expansions, such as its initiatives in Belgium and Mexico, position it within the question mark category of the BCG matrix. These regions are characterized by high potential for electric vehicle (EV) adoption, presenting significant growth opportunities for charging infrastructure providers. However, Blink's current market share in these emerging international operations remains relatively low, reflecting the early stage of their penetration.

The company's strategic investments in these markets, including the deployment of charging infrastructure in Belgium and fast chargers in Mexico, demand substantial capital outlay and focused strategic execution. The goal is to capture a meaningful market share and establish a leadership position in these developing EV ecosystems. For instance, Blink announced in early 2024 its plans to install 200 Level 2 charging ports in Mexico through a partnership, aiming to capitalize on the country's growing EV market.

- High Growth Potential: Emerging international markets like Belgium and Mexico show strong upward trends in EV adoption.

- Low Market Share: Blink is still establishing its presence and market share in these new territories.

- Capital Intensive: Expansion requires significant financial investment and strategic planning to gain traction.

- Uncertain Future Success: While promising, the long-term success and market leadership in these regions are yet to be fully realized.

Corporate Fleet Home Charging Solutions

Blink Charging's partnership with dfYOUNG to offer home charging for corporate sales teams represents a niche but rapidly expanding area within the electric vehicle (EV) fleet market. This specialized service targets a growing demand for convenient charging solutions for employees working remotely or on the road.

As a newer offering for Blink, its current market share within this specific segment of corporate fleet home charging is likely modest. Capturing a significant position will necessitate substantial investment in areas like installation logistics, customer support, and dedicated sales efforts to cater to the unique needs of corporate clients.

- Market Niche: Corporate fleet home charging is a specialized, high-growth segment within EV adoption.

- Market Share: Blink's current market share in this specific niche is likely low due to its relatively new service offering.

- Investment Needs: Scaling requires focused investment in installation, logistics, and customer support.

- Growth Potential: This segment presents a promising opportunity for Blink to establish a strong foothold.

Blink Charging’s Gen-3 DC fast chargers, EV Totem, and international expansions in markets like Belgium and Mexico are all classified as Question Marks in the BCG matrix. These ventures are in high-growth sectors but currently hold a small market share, necessitating significant investment to achieve market leadership.

The company's strategic alliances, such as the one with Create Energy for integrated energy management, and its niche offerings like corporate fleet home charging through dfYOUNG, also fall into this category. These initiatives target emerging trends and specific market segments with substantial growth potential, but their current market penetration is limited, requiring focused capital and strategic execution to succeed.

Blink's approach to these Question Marks involves substantial investment in product development, marketing, and deployment to capture market share in these promising but unproven areas. The success of these ventures will determine their future classification within the BCG matrix, potentially moving them to Stars or Dogs.

For instance, Blink announced in early 2024 its plans to install 200 Level 2 charging ports in Mexico through a partnership, aiming to capitalize on the country's growing EV market. This is a prime example of investing in a high-potential, low-share market.

BCG Matrix Data Sources

Our BCG Matrix for Blink Charging is constructed using a blend of financial disclosures, market growth data, and industry-specific research to accurately position its product portfolio.