Builders FirstSource PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Builders FirstSource Bundle

Builders FirstSource operates within a dynamic external environment, shaped by political shifts, economic fluctuations, and evolving social trends. Understanding these forces is crucial for strategic planning and identifying potential opportunities or threats. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable insights.

Gain a competitive edge by understanding the technological advancements and environmental regulations impacting the building materials sector. Our expertly crafted PESTLE analysis for Builders FirstSource provides a clear roadmap to navigate these complexities. Download the full version to unlock strategic intelligence and make informed decisions.

Political factors

The Bipartisan Infrastructure Investment and Jobs Act (IIJA) is a significant driver for Builders FirstSource, channeling substantial federal funds into U.S. infrastructure. This legislation is funding critical projects like roads, bridges, and broadband expansion, directly increasing the need for building materials.

These infrastructure investments are expected to fuel construction sector growth, with projections indicating that over half of new jobs created by the end of 2025 will be within construction. This sustained demand for labor and materials benefits companies like Builders FirstSource.

Changes in U.S. trade policies, particularly the imposition of tariffs on key building materials like steel, aluminum, and Canadian softwood lumber, directly affect Builders FirstSource's cost structure. For instance, tariffs implemented in recent years have demonstrably increased the price of these essential inputs, impacting both the company's procurement expenses and the final cost for its customer base.

These protectionist measures, while intended to encourage domestic manufacturing, often lead to inflationary pressures within the construction sector. This can necessitate a reevaluation of supply chain strategies as companies seek to mitigate the financial impact of these evolving trade dynamics, potentially seeking alternative sourcing or absorbing increased costs.

Government policies aimed at boosting housing affordability, such as potential first-time homebuyer credits or incentives for affordable housing development, could significantly increase demand for construction materials in 2024 and 2025. Conversely, stricter zoning laws or lengthy permitting processes can slow down new construction, impacting Builders FirstSource's sales volumes. For instance, in early 2024, several metropolitan areas reported average permit approval times exceeding 6 months, creating bottlenecks.

Streamlining permitting processes at the federal or state level is a key consideration. Initiatives to expedite permits for large-scale residential projects, particularly those addressing housing shortages, could enhance the viability of substantial construction contracts for Builders FirstSource. The U.S. Department of Housing and Urban Development (HUD) has been exploring ways to reduce regulatory burdens on housing development throughout 2024.

Environmental Regulations and Green Building Mandates

Governments worldwide are intensifying their focus on sustainability, leading to more stringent environmental regulations and green building mandates. These policies directly impact the construction industry by dictating material sourcing and construction techniques, pushing for greater energy efficiency. Builders FirstSource needs to proactively integrate eco-friendly product lines and adapt its supply chain to align with these evolving standards.

The push for greener construction is accelerating. For instance, by 2025, many regions are implementing stricter building codes requiring higher levels of insulation and reduced carbon emissions. This trend is not just about compliance; it's also driven by consumer demand for sustainable homes. Builders FirstSource's ability to offer certified green building materials and solutions will be a key differentiator.

- Stricter Energy Efficiency Standards: Many jurisdictions are updating building codes to mandate higher R-values for insulation and more efficient HVAC systems, impacting material specifications.

- Growth in Green Building Certifications: Programs like LEED and BREEAM continue to gain traction, encouraging the use of sustainable materials and construction practices, with LEED-certified projects increasing year-over-year.

- Focus on Embodied Carbon: Regulations are beginning to address the carbon footprint of building materials themselves, influencing demand for lower-carbon alternatives.

- Incentives for Sustainable Construction: Government tax credits and subsidies for energy-efficient upgrades and new green builds are becoming more common, driving market adoption.

Labor and Employment Policies

Government policies directly impacting labor availability, such as those concerning training programs and immigration, continue to shape the construction sector. These regulations can exacerbate or alleviate the ongoing shortage of skilled labor, a persistent challenge for the industry. For instance, the Biden administration's focus on workforce development, including apprenticeships, aims to address these gaps, though the impact on the skilled trades remains a developing narrative through 2025.

While Builders FirstSource doesn't directly manage its clients' workforces, these labor policies significantly influence the operational capacity of its professional homebuilder and subcontractor customers. A tighter labor market, driven by restrictive immigration policies or insufficient training initiatives, can limit the ability of these clients to take on new projects. This, in turn, affects overall market demand for Builders FirstSource's products and services, impacting their sales volumes and operational efficiency.

- Skilled Labor Gap: The U.S. construction industry faced a significant skilled labor shortage, with projections indicating millions of needed workers in the coming years. For example, a 2023 Associated General Contractors of America survey found that 70% of construction firms reported difficulty finding skilled workers.

- Immigration Policy Impact: Changes in immigration policies can directly affect the availability of labor in construction, a sector that has historically relied on immigrant workers.

- Workforce Development Initiatives: Government and industry partnerships focused on apprenticeship programs and vocational training are crucial for building a sustainable talent pipeline.

Government infrastructure spending, particularly through the Bipartisan Infrastructure Law, is a major tailwind for Builders FirstSource, driving demand for materials in 2024-2025. Conversely, trade policies like tariffs on steel and lumber directly increase input costs, impacting profitability. Policies affecting housing affordability and permitting processes also play a crucial role in shaping market demand.

What is included in the product

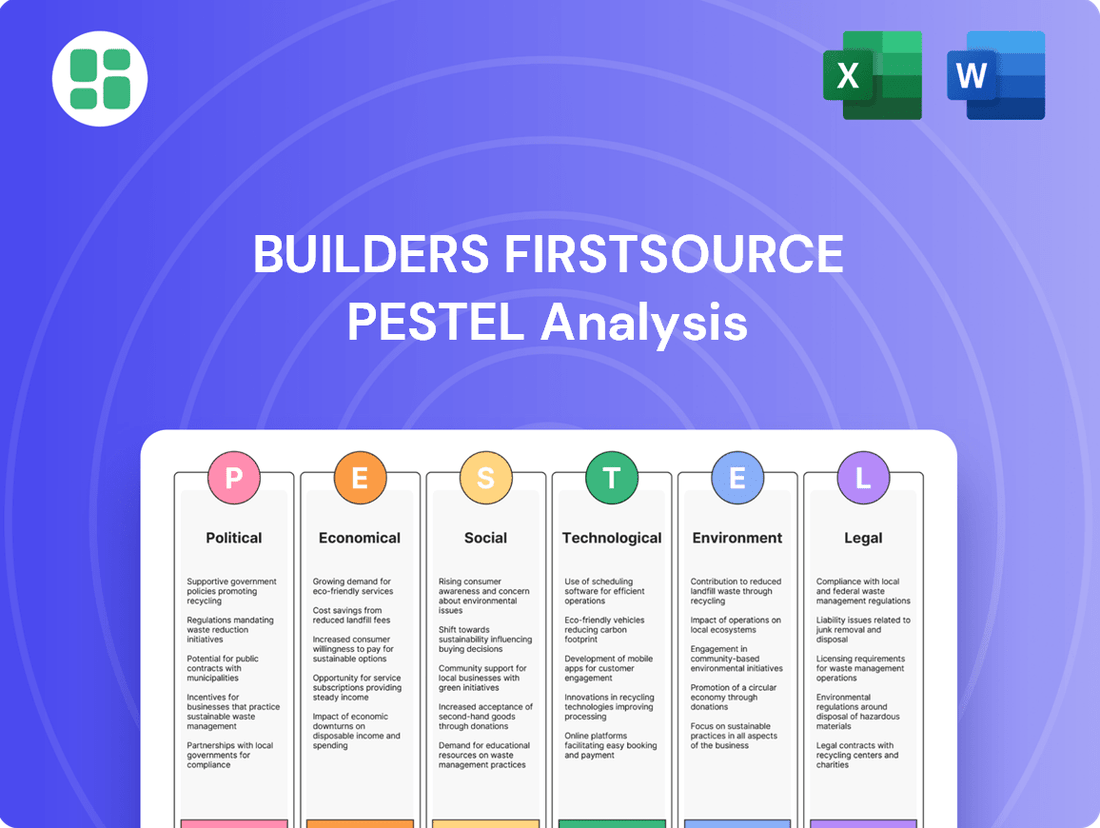

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Builders FirstSource, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights by detailing how these forces create both threats and opportunities, enabling strategic decision-making for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for Builders FirstSource.

Economic factors

The U.S. housing market's vitality, especially single-family home construction, directly impacts Builders FirstSource. Despite interest rate headwinds that previously slowed starts, forecasts for 2024 and 2025 suggest a more favorable environment. Economists anticipate gradual growth in single-family housing starts, bolstered by potential Federal Reserve rate adjustments that could lower mortgage costs and reignite new home building.

Builders FirstSource navigates significant headwinds from material cost volatility and inflation. Fluctuations in lumber, steel, and concrete prices directly affect their cost of goods sold and ultimately, profitability. For instance, while lumber prices saw some moderation towards the end of 2024, the broader inflationary environment and persistent supply chain disruptions continue to demand robust cost management strategies and a focus on diversifying material sourcing to mitigate these impacts.

The overall health of the U.S. economy, as indicated by Gross Domestic Product (GDP) growth, is a critical driver for Builders FirstSource. Strong GDP performance typically translates to higher consumer spending and business investment, both of which fuel demand for construction materials and services. For instance, the U.S. economy expanded at a 2.1% annualized rate in the first quarter of 2024, according to the Bureau of Economic Analysis.

However, projections suggest a moderation in economic expansion. While 2024 demonstrated resilience, forecasts for 2025 anticipate a slowdown in GDP growth. This deceleration could lead to reduced spending across various construction sectors, including commercial, industrial, and residential, potentially impacting Builders FirstSource's sales volumes and revenue.

Consumer Spending and Home Renovation Trends

Consumer spending on home improvement and remodeling remains a crucial revenue driver for Builders FirstSource, often offsetting slower new construction activity. This trend is bolstered by an aging housing stock, with many homes requiring upgrades, and a persistent shortage of existing homes for sale, pushing more homeowners towards renovation rather than moving. For instance, the U.S. Census Bureau reported that homeowner expenditures on improvements and repairs reached an estimated $485 billion in 2023, a figure expected to see continued strength into 2024 and 2025.

Several factors are fueling this sustained demand for renovations:

- Aging Infrastructure: A significant portion of U.S. homes were built before 1980, necessitating repairs and upgrades.

- Low Housing Inventory: Limited availability of existing homes encourages owners to invest in their current properties.

- DIY and Professional Projects: Both do-it-yourself enthusiasts and professional contractors contribute to the remodeling market, driving sales of building materials.

- Interest Rate Environment: While higher rates can impact new construction, they can also incentivize homeowners to stay put and renovate, especially if they have favorable existing mortgage rates.

Access to Capital and Lending Conditions

Tight credit conditions and elevated interest rates for development loans can significantly impede new construction, especially in the multifamily residential market. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, remained elevated throughout much of 2024, impacting the affordability of construction financing. Builders FirstSource's customer base, which includes homebuilders and contractors, directly experiences this as their ability to secure project funding is paramount to material demand.

Favorable lending environments are crucial for Builders FirstSource's clients. When credit is readily available and interest rates are manageable, developers are more likely to initiate and expand projects, thereby increasing the demand for lumber, windows, doors, and other building materials that Builders FirstSource supplies. Conversely, a contraction in lending or a sharp rise in borrowing costs can lead to project delays or cancellations, directly impacting sales volumes for the company.

The economic landscape in 2024 and early 2025 has presented a mixed picture for capital access:

- Federal Reserve Rate Hikes: The Fed's aggressive rate hikes through 2023 continued to influence borrowing costs in 2024, making development loans more expensive.

- Regional Bank Stability Concerns: Lingering concerns about regional bank stability in 2024 could have led to more cautious lending practices by financial institutions.

- Inflationary Pressures: Persistent inflation, while showing signs of moderation, continued to put upward pressure on material costs and labor, further complicating project financing.

The U.S. housing market's trajectory, particularly single-family home construction, remains a primary economic indicator for Builders FirstSource. While interest rates presented challenges, forecasts for 2024 and 2025 point to a more supportive environment, with anticipated gradual growth in housing starts as potential Federal Reserve rate adjustments could ease mortgage burdens.

Builders FirstSource is significantly influenced by material cost volatility and broader inflationary trends. Fluctuations in key commodities like lumber, steel, and concrete directly impact the company's cost of goods sold and profit margins. For instance, while lumber prices saw some moderation by late 2024, ongoing inflationary pressures and supply chain issues necessitate diligent cost management and diversified sourcing.

The overall health of the U.S. economy, measured by GDP growth, is a critical factor for Builders FirstSource. A robust economy generally translates to increased consumer and business spending, which in turn fuels demand for construction materials. The U.S. economy grew at a 2.1% annualized rate in Q1 2024, demonstrating resilience, though forecasts for 2025 suggest a slowdown, potentially impacting construction sector demand.

Consumer spending on home improvements and renovations is a vital revenue stream for Builders FirstSource, often counterbalancing weaker new construction activity. This segment is supported by an aging housing stock and a persistent shortage of existing homes for sale, encouraging more homeowners to invest in upgrades. Homeowner expenditures on improvements and repairs were estimated at $485 billion in 2023, with continued strength anticipated through 2024 and 2025.

| Economic Factor | 2024 Outlook | 2025 Outlook | Impact on Builders FirstSource |

|---|---|---|---|

| Housing Starts (Single-Family) | Moderate growth expected | Continued gradual increase | Directly boosts demand for building materials |

| Inflation/Material Costs | Persistent but moderating | Expected to continue moderating | Affects cost of goods sold; necessitates pricing strategies |

| GDP Growth | Resilient growth (e.g., 2.1% in Q1) | Slight slowdown anticipated | Influences overall construction demand |

| Home Improvement Spending | Strong and sustained | Continued strength | Provides a stable revenue base |

What You See Is What You Get

Builders FirstSource PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Builders FirstSource PESTLE analysis covers all critical external factors impacting the company's operations and strategic planning. You'll gain deep insights into the political, economic, social, technological, legal, and environmental landscape affecting Builders FirstSource.

Sociological factors

Demographic shifts are significantly impacting housing demand. For instance, the large Baby Boomer generation, many of whom were still actively participating in the housing market in 2023, continues to influence purchasing trends. Concurrently, evolving household formation patterns are reshaping the types of housing needed.

The nation faces a substantial housing deficit, estimated at 1.5 million homes, a direct result of a decade of insufficient new construction. This persistent shortfall creates a strong, long-term demand for new housing stock, a trend expected to continue shaping the market for Builders FirstSource.

Consumers increasingly prioritize sustainable, energy-efficient, and healthy living spaces. This trend directly impacts building material selection and construction methods, pushing for eco-friendly options. For instance, a 2024 survey indicated that over 60% of homebuyers consider energy efficiency a top priority when purchasing a new home.

Builders FirstSource needs to adapt by offering and promoting materials that meet these evolving homeowner values. This includes non-toxic components, biophilic design elements that connect occupants with nature, and robust disaster-resistant features, crucial in an era of increasing climate variability.

The construction sector is grappling with a persistent shortage of skilled workers, a trend that directly impacts professional homebuilders and subcontractors by delaying projects and escalating costs. This societal issue is forcing companies like Builders FirstSource to consider greater investment in training initiatives and educational programs to bolster their workforce.

As of early 2024, the U.S. Bureau of Labor Statistics reported that the construction industry needed to hire approximately 546,000 additional workers over the next two years to meet demand. This ongoing labor gap necessitates strategic responses, potentially including the adoption of automation technologies to supplement human labor and improve efficiency.

Urbanization and Adaptive Reuse Trends

Urbanization continues to concentrate populations in city centers, driving demand for housing and renovation. This trend is particularly beneficial for Builders FirstSource as it fuels the need for construction materials in urban development projects. For instance, the U.S. Census Bureau reported that by 2023, over 83% of the U.S. population resided in urban areas, a figure expected to grow.

The growing popularity of adaptive reuse, where existing structures are repurposed, presents a significant opportunity. Builders FirstSource can capitalize on this by supplying materials for converting underutilized commercial spaces, such as offices and retail centers, into residential units. This aligns with sustainability goals and addresses urban housing shortages. In 2024, the market for adaptive reuse projects saw a notable increase, with a significant portion focused on converting commercial buildings to multifamily housing.

- Urban Population Growth: Over 83% of the U.S. population lived in urban areas by 2023, a trend showing continued growth.

- Adaptive Reuse Demand: The conversion of commercial properties to residential use is a key driver for material supply.

- Environmental Alignment: Repurposing existing buildings supports environmentally responsible redevelopment initiatives.

- Market Opportunity: Increased adaptive reuse projects in 2024 highlight a growing demand for renovation and conversion materials.

Changing Lifestyle and Work Patterns

The shift towards remote and hybrid work models continues to reshape housing demand. A 2024 survey indicated that 35% of employees prefer a hybrid work arrangement, influencing preferences for larger homes with dedicated office spaces and improved outdoor living areas. This trend directly impacts Builders FirstSource by potentially increasing demand for renovation materials and specific product categories like lumber for decks and windows for home offices.

Lifestyle changes, including a greater emphasis on health and wellness, also play a role. Homeowners are investing more in features that support these preferences, such as improved air quality systems, home gyms, and sustainable building materials. Builders FirstSource can capitalize on this by offering a wider range of eco-friendly and health-focused building products, aligning with consumer values and market trends observed through 2025.

- Remote Work Impact: 35% of employees favored hybrid work in 2024, driving demand for home offices and flexible living spaces.

- Renovation Demand: Increased preference for outdoor living and home office upgrades fuels renovation projects, benefiting material suppliers.

- Lifestyle Preferences: Growing interest in health, wellness, and sustainability influences the demand for specific building materials and features.

- Product Specification: Material choices are increasingly influenced by the need for functional home offices, enhanced outdoor spaces, and healthier indoor environments.

Societal values are increasingly centered on sustainability and health, influencing consumer choices in home construction and renovation. Builders FirstSource is well-positioned to meet this demand by offering eco-friendly materials and products that promote healthier indoor environments, a trend amplified by growing climate awareness through 2025.

The persistent shortage of skilled labor in construction, with the industry needing an estimated 546,000 additional workers by 2025 according to the U.S. Bureau of Labor Statistics, presents both a challenge and an opportunity for companies like Builders FirstSource to invest in training and explore automation.

Urbanization, with over 83% of the U.S. population residing in urban areas by 2023, continues to drive demand for construction materials, especially with the rise of adaptive reuse projects converting commercial spaces to residential units, a market segment showing significant growth in 2024.

Shifting work-life balances, particularly the 35% of employees favoring hybrid work in 2024, are reshaping housing preferences, leading to increased demand for larger homes with dedicated office spaces and enhanced outdoor living areas, thereby influencing material needs for renovations and new builds.

Technological factors

Building Information Modeling (BIM) is rapidly transforming construction, moving beyond simple 3D design to become a central hub for efficiency and data. This evolution means it's now a critical tool for collaboration and making smarter decisions throughout a project's lifecycle.

Builders FirstSource can harness these BIM advancements to refine material estimates, significantly cutting down on waste. Furthermore, it allows for smoother coordination with clients in the supply chain, leading to more accurate project planning and cost projections.

The construction industry's adoption of BIM is growing; for instance, a 2024 report indicated that over 70% of construction firms are now utilizing BIM on at least some projects, highlighting its increasing importance for operational improvement.

The construction industry is rapidly embracing automation, robotics, and prefabrication. This shift is driven by the need for greater efficiency and reduced costs. For instance, the global construction robotics market was valued at approximately $1.7 billion in 2023 and is projected to reach $4.4 billion by 2030, according to some market analyses.

Builders FirstSource, with its focus on component manufacturing, is strategically positioned to capitalize on these advancements. Prefabricated and modular building techniques allow for faster project completion, a significant advantage in today's fast-paced development environment. This trend also directly addresses labor shortages by shifting work from often challenging on-site conditions to controlled factory settings.

The adoption of these technologies leads to tangible benefits such as reduced material waste, with prefabrication often cutting waste by up to 30% compared to traditional methods. Furthermore, the controlled environment of factory production enhances quality control, leading to more consistent and durable building components. This aligns perfectly with Builders FirstSource's operational model.

Artificial intelligence is revolutionizing construction, enhancing everything from initial project planning and design to predicting risks and streamlining operations. For Builders FirstSource, this means opportunities to leverage AI for more accurate demand forecasting and optimizing their complex supply chains, potentially reducing waste and delivery times.

By implementing AI-powered predictive analytics, Builders FirstSource could anticipate material needs with greater precision, a significant advantage given that construction material costs can fluctuate. For instance, in 2024, the construction industry is increasingly adopting AI for tasks like identifying potential project delays, which could translate to substantial cost avoidance for a large supplier.

Development of Smart and Sustainable Materials

Innovations in building materials are rapidly advancing, with technologies like graphene-enhanced concrete, phase-change materials for thermal regulation, and bio-based insulation solutions becoming increasingly prominent. Self-healing concrete is also emerging, promising extended structural lifespans and reduced maintenance costs. These developments directly impact the construction industry's pursuit of sustainability and performance.

Builders FirstSource must actively monitor and integrate these cutting-edge materials into its product offerings. For instance, the global smart building materials market is projected to reach $12.5 billion by 2027, indicating significant growth potential. Offering materials that enhance energy efficiency, such as advanced insulation or phase-change materials, aligns with increasing demand for green building practices, which saw a 10% increase in new green building construction in the US during 2023.

- Graphene-enhanced concrete: Offers superior strength and durability, potentially reducing material usage by up to 30%.

- Phase-change materials (PCMs): Can store and release thermal energy, improving building energy efficiency by an estimated 15-20%.

- Bio-based insulation: Derived from sustainable sources like hemp or wood fiber, offering a lower embodied carbon footprint compared to traditional options.

- Self-healing concrete: Incorporates bacteria or microcapsules to repair cracks autonomously, extending structural integrity and reducing lifecycle costs.

Digitalization of Supply Chain and Logistics

The ongoing digitalization of supply chains, encompassing connected construction sites and real-time asset tracking, is a significant technological factor. Builders FirstSource can leverage these advancements to boost efficiency and minimize mistakes throughout its operations. For example, adopting advanced inventory management systems, which saw a global market value of approximately $3.5 billion in 2023 and is projected to grow, can streamline stock levels.

Implementing these technologies allows Builders FirstSource to refine its distribution network and delivery services. This leads to more effective inventory control and shorter lead times for customers. The adoption of IoT devices for asset tracking, a market expected to reach $1.5 trillion by 2025, can provide granular visibility into the movement of materials and equipment, further optimizing logistics.

- Enhanced Efficiency: Digital tools reduce manual processes, cutting down on labor costs and improving workflow speed.

- Improved Inventory Management: Real-time data analytics enable precise tracking of stock, minimizing overstocking and stockouts.

- Reduced Lead Times: Optimized logistics and better visibility into the supply chain allow for faster delivery of materials.

- Error Reduction: Automation and data-driven insights decrease the likelihood of human error in order fulfillment and delivery.

The construction sector's increasing reliance on digital platforms, from Building Information Modeling (BIM) to cloud-based project management, is a key technological driver. Builders FirstSource can leverage these tools for enhanced collaboration and data accuracy. For example, the global BIM market was valued at over $7 billion in 2023 and is projected to grow significantly, indicating widespread adoption.

Automation and robotics are transforming construction sites, boosting efficiency and safety. Builders FirstSource can benefit from prefabrication and modular construction, which are gaining traction. The global construction robotics market is expected to reach $4.4 billion by 2030, highlighting this trend.

Innovations in materials science, such as self-healing concrete and advanced insulation, offer improved performance and sustainability. Builders FirstSource should consider integrating these into its product lines, especially as the green building sector continues its upward trajectory, with new green building construction seeing a notable increase in 2023.

| Technology Area | Impact on Construction | Builders FirstSource Opportunity | Market Data/Projection |

|---|---|---|---|

| Building Information Modeling (BIM) | Enhanced collaboration, improved estimates, reduced waste | Streamlined project planning, better client coordination | Global BIM market > $7 billion (2023) |

| Automation & Robotics | Increased efficiency, reduced labor costs, improved safety | Capitalize on prefabrication and modular construction | Construction robotics market projected to reach $4.4 billion (2030) |

| Advanced Materials | Improved durability, energy efficiency, sustainability | Integrate innovative materials into product offerings | Green building construction saw increased activity in 2023 |

Legal factors

Builders FirstSource must navigate a complex web of building codes and safety standards, which are constantly being updated. For instance, in 2024, many municipalities are implementing stricter energy efficiency requirements for new construction, impacting material choices and design. This necessitates continuous adaptation in their product lines to ensure compliance and provide customers with approved solutions.

Adherence to zoning laws also plays a critical role, influencing where and how construction can occur. Changes in these regulations can affect project timelines and feasibility for Builders FirstSource's clientele. The company's ability to stay ahead of these legal shifts, particularly in areas like fire safety and structural integrity, is key to maintaining its market position and supporting its customers' projects effectively.

Builders FirstSource operates under increasingly strict environmental regulations covering emissions, waste, and sustainable sourcing. The company must ensure its manufacturing and product lines comply with these laws, including its commitment to setting reduction targets for Scope 1 and Scope 2 emissions.

In 2023, Builders FirstSource reported progress in its sustainability initiatives, aiming to align with evolving legal frameworks. For instance, their efforts in waste management and responsible material sourcing are critical for maintaining compliance and avoiding potential penalties.

Builders FirstSource, as a significant employer, navigates a web of labor laws. This includes adhering to federal and state wage and hour rules, ensuring workplace safety under OSHA, and complying with anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, critical for a company with a large hourly workforce.

Attracting and retaining skilled labor is paramount, especially in the current economic climate. In 2024, the construction sector faced persistent labor shortages, with the U.S. Bureau of Labor Statistics reporting millions of job openings. Builders FirstSource's ability to offer competitive wages and comprehensive benefits, such as health insurance and retirement plans, directly impacts its capacity to secure and keep essential talent.

Trade Regulations and Import/Export Laws

Trade regulations and import/export laws significantly influence Builders FirstSource's operations. For instance, the U.S. has various trade agreements, like the USMCA, which impact the flow of construction materials. Tariffs on imported goods, such as steel or lumber, directly affect sourcing costs. In 2024, lumber prices experienced volatility, partly due to trade dynamics and supply chain issues, impacting Builders FirstSource's cost of goods sold.

Changes in these regulations can necessitate strategic shifts in procurement and distribution. Builders FirstSource must navigate complex import/export laws to ensure compliance and manage supply chain risks effectively. For example, evolving environmental regulations related to imported wood products could require sourcing adjustments or additional compliance measures.

- Impact of Tariffs: Increased tariffs on key building materials like lumber or steel can directly raise Builders FirstSource's procurement costs, potentially affecting product pricing and margins.

- Supply Chain Adjustments: Fluctuations in international trade agreements or the imposition of new import/export restrictions may force the company to diversify its supplier base or explore alternative domestic sourcing options.

- Compliance Costs: Adhering to varying international trade regulations, including those related to product standards and customs procedures, incurs administrative and operational costs for Builders FirstSource.

Contract Law and Liability

The legal landscape surrounding Builders FirstSource is heavily influenced by contract law, dictating agreements with homebuilders, subcontractors, and suppliers. Navigating these contracts effectively is key to managing risk and ensuring operational stability. For instance, in 2024, the construction industry continued to see an emphasis on clear contractual terms to mitigate disputes, a trend expected to persist into 2025.

Product liability laws also present a significant legal consideration. Builders FirstSource must ensure the quality and safety of its materials to avoid potential claims arising from defects. This includes adherence to building codes and standards, with regulatory bodies actively enforcing compliance to protect consumers and maintain industry integrity.

- Contractual Risk Management: Ensuring all agreements with partners clearly define responsibilities and liabilities to prevent future disputes.

- Product Quality Assurance: Implementing rigorous quality control measures for materials to comply with safety regulations and minimize product liability exposure.

- Subcontractor Agreements: Scrutinizing contracts with subcontractors to ensure they meet legal requirements and align with Builders FirstSource's operational standards.

- Supplier Compliance: Verifying that suppliers adhere to all relevant legal and safety mandates for the products they provide.

Builders FirstSource must adhere to evolving building codes and safety regulations, with stricter energy efficiency mandates becoming common in 2024, impacting material choices and construction methods. Compliance with zoning laws is also crucial, as changes can affect project feasibility and timelines for their customers, highlighting the need for proactive legal monitoring.

The company faces stringent environmental laws regarding emissions and waste management, requiring ongoing efforts to meet reduction targets, such as those for Scope 1 and Scope 2 emissions. In 2023, Builders FirstSource reported progress in sustainability, aligning with these evolving legal frameworks through improved waste management and responsible sourcing practices.

Labor laws, including wage and hour regulations and workplace safety standards like OSHA, are critical for Builders FirstSource, especially given the persistent labor shortages in the construction sector in 2024. The U.S. Bureau of Labor Statistics reported millions of job openings, underscoring the importance of competitive compensation and benefits to attract and retain skilled workers.

Trade regulations and tariffs significantly influence material costs, with lumber prices experiencing volatility in 2024 due to trade dynamics, impacting the company's cost of goods sold. Builders FirstSource must navigate complex import/export laws and potential tariffs to manage supply chain risks and ensure compliance with international trade agreements.

Environmental factors

The construction industry is increasingly prioritizing sustainability, with green building certifications like LEED gaining significant traction. This trend directly impacts material suppliers. Builders FirstSource is responding by sourcing over 95% of its wood from certified vendors, demonstrating a commitment to environmentally responsible practices.

This focus on sustainability isn't just about sourcing; it extends to the products and solutions offered. Builders FirstSource is developing and promoting innovative materials and building methods designed to reduce the carbon footprint of construction projects. This proactive approach positions them to meet the growing demand for eco-friendly building.

Growing concerns about resource depletion, especially for critical construction materials like timber, are pushing companies like Builders FirstSource towards sustainable sourcing and more efficient material usage. This environmental pressure is becoming a significant factor in operational strategy.

Builders FirstSource itself acknowledges this trend, reporting that its sales of more efficient manufactured products have contributed to saving millions of trees. This demonstrates a proactive approach to optimizing resource utilization within their business model.

The escalating frequency of extreme weather events, such as hurricanes and wildfires, directly impacts the construction industry. Builders FirstSource is increasingly seeing demand for materials and methods that improve a home's resilience to these conditions, a trend expected to grow. For instance, in 2024, the National Oceanic and Atmospheric Administration (NOAA) reported a significant increase in billion-dollar weather disasters compared to the previous decade, highlighting the urgency for disaster-resistant building solutions.

Waste Reduction and Circular Economy Principles

The construction sector faces increasing demands to curb waste and adopt circular economy models. Builders FirstSource can play a pivotal role by advocating for recycled and upcycled materials and by refining its production to cut down on waste, thereby bolstering its environmental commitment.

This shift is driven by growing regulatory pressure and consumer preference for sustainable practices. For instance, the U.S. Environmental Protection Agency (EPA) reported that construction and demolition (C&D) debris accounted for approximately 600 million tons of waste in the United States in 2018, with only about 35% being recycled. Builders FirstSource's focus on optimizing material usage and promoting salvaged components directly addresses this significant environmental challenge.

- Waste Reduction Initiatives: Builders FirstSource can implement advanced inventory management and prefabrication techniques to minimize on-site waste.

- Circular Economy Integration: The company can expand its offerings of products made from recycled content, such as reclaimed lumber or recycled steel.

- Supply Chain Collaboration: Partnering with suppliers who prioritize sustainable sourcing and waste reduction further strengthens the company's environmental footprint.

- Material Innovation: Investing in or promoting the use of innovative building materials that are designed for disassembly and reuse aligns with circular economy principles.

Energy Efficiency and Carbon Footprint Reduction

The construction industry faces increasing pressure to minimize its environmental impact, particularly concerning energy efficiency and the carbon footprint of materials. This trend is driving demand for sustainable building solutions and necessitates a focus on reducing embodied carbon in construction processes. Builders FirstSource is responding to this by emphasizing energy-efficient product offerings and advanced insulation materials.

The company has set ambitious goals, aiming to achieve a reduction in its Scope 1 and Scope 2 emissions by 2025. This proactive approach aligns with broader market shifts and regulatory landscapes that prioritize decarbonization within the building sector.

- Builders FirstSource's commitment to reducing Scope 1 and Scope 2 emissions by 2025.

- Growing market demand for energy-efficient building products and advanced insulation.

- Industry-wide focus on lowering the embodied carbon of construction materials.

- The regulatory push towards greater sustainability in the built environment.

Environmental factors are increasingly shaping the construction landscape, pushing companies like Builders FirstSource to adopt more sustainable practices. The demand for green building solutions, driven by consumer preference and regulatory shifts, is a significant trend. Builders FirstSource is actively responding by focusing on certified wood sourcing and developing eco-friendly product lines.

The impact of climate change is also a growing concern, with extreme weather events driving demand for resilient building materials. Builders FirstSource is addressing this by offering solutions that enhance home durability. Furthermore, the industry faces pressure to reduce waste, with efforts to incorporate circular economy principles and optimize material usage becoming critical for long-term success.

Builders FirstSource's commitment to sustainability is evident in its operational goals, including a target for Scope 1 and Scope 2 emissions reduction by 2025. This aligns with the broader industry movement towards decarbonization and energy efficiency in construction.

| Environmental Factor | Impact on Construction | Builders FirstSource Response | Supporting Data/Trend |

|---|---|---|---|

| Sustainability Demand | Increased need for eco-friendly materials and building methods. | Sourcing over 95% of wood from certified vendors; developing green product lines. | Growing traction of green building certifications like LEED. |

| Climate Change & Extreme Weather | Demand for disaster-resistant and resilient building solutions. | Offering materials and methods to improve home resilience. | NOAA reported significant increase in billion-dollar weather disasters in 2024. |

| Waste Reduction & Circular Economy | Pressure to minimize construction waste and adopt recycling. | Optimizing material usage, promoting salvaged components, aiming for waste reduction. | C&D debris accounted for ~600 million tons of US waste in 2018, with only ~35% recycled (EPA). |

| Energy Efficiency & Carbon Footprint | Focus on reducing embodied carbon and improving building energy performance. | Emphasizing energy-efficient products and advanced insulation; aiming for Scope 1 & 2 emissions reduction by 2025. | Industry-wide focus on lowering embodied carbon. |

PESTLE Analysis Data Sources

Our Builders FirstSource PESTLE Analysis is meticulously crafted using data from reputable sources including government economic reports, industry-specific market research, and regulatory updates. This comprehensive approach ensures that each factor, from political stability to technological advancements, is grounded in accurate and current information.