Builders FirstSource Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Builders FirstSource Bundle

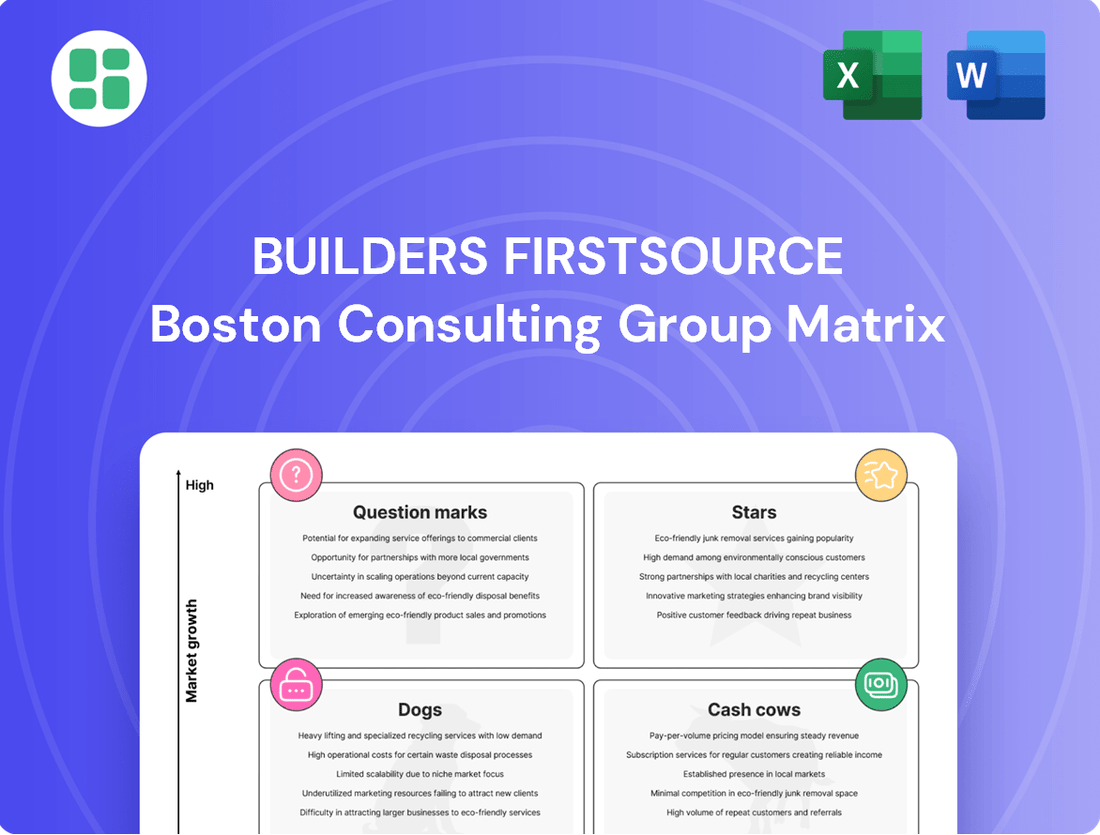

Builders FirstSource's BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. This snapshot reveals which segments are driving growth and which might require a strategic re-evaluation.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Builders FirstSource is significantly expanding its value-added product lines, including manufactured components like trusses and wall panels. These offerings are designed to tackle key industry challenges such as labor scarcity and the need for greater construction speed.

This strategic focus on value-added products addresses critical customer needs, driving growth in a segment that is rapidly expanding within the overall construction sector. The company's investment in these areas positions them for sustained success.

As of the latest reporting, these value-added products now constitute roughly 47% of Builders FirstSource's total sales. This substantial market share underscores their leadership in this dynamic and increasingly important part of the construction supply chain.

Builders FirstSource's proprietary myBLDR.com e-commerce platform is a clear Star in their BCG Matrix. This digital sales platform has seen impressive growth, processing billions in orders and quotes since its launch in early 2024. This rapid customer adoption highlights its strong market position and future potential.

The company's strategic focus on digital transformation is evident in myBLDR.com's performance. With a target of achieving $1 billion in digital sales by 2026, this platform is not just a sales channel but a key driver of customer engagement and operational efficiency. Its success positions it as a high-growth, high-market-share asset.

Builders FirstSource strategically targets acquisitions to bolster its presence in burgeoning markets and expand its service offerings. For instance, the acquisition of Truckee Tahoe Lumber in 2023, a company operating in a high-growth region, exemplifies this approach to capture new customer bases and market share. These strategic bolt-on acquisitions are crucial for driving overall sales growth and reinforcing BFS's dominant position in the building materials sector. In 2023, Builders FirstSource completed 16 acquisitions, adding approximately $1.2 billion in annualized revenue.

Automation in Manufacturing

Builders FirstSource is heavily investing in automation, especially in offsite fabrication. This strategy is key to boosting efficiency and tackling labor shortages prevalent in the construction sector. By automating processes, BFS aims to optimize how much they can produce and enhance the quality of their manufactured components. For instance, in 2024, the company continued to expand its automated manufacturing capabilities, which are crucial for meeting growing demand and improving operational throughput.

This commitment to advanced robotics and automated systems is positioning Builders FirstSource as a frontrunner in a rapidly evolving construction landscape. The company's focus on these high-growth areas allows for better capacity utilization and a more consistent service level for their clients. Their strategic deployment of automation in 2024 is a direct response to industry trends demanding faster, more reliable, and higher-quality building materials.

- Increased Efficiency: Automation in offsite fabrication allows for faster production cycles and reduced waste, contributing to better project timelines.

- Labor Challenge Mitigation: By automating tasks, Builders FirstSource can offset the impact of skilled labor shortages in traditional construction roles.

- Capacity Utilization: Enhanced automation directly translates to maximizing the output from their manufacturing facilities, meeting higher market demand.

- Service Quality Improvement: Consistent, automated processes lead to a higher standard of quality for manufactured building components.

Turnkey Solutions for Homebuilders

Builders FirstSource (BFS) is expanding its turnkey solutions, blending material provision with installation and project oversight. This strategy directly targets builder demand for streamlined construction and faster project completion.

By offering these integrated services, BFS is meeting a critical need in the market, positioning itself as a leader in a high-growth segment. For example, in 2024, BFS reported significant growth in its value-added services, which include these turnkey offerings, contributing to an overall revenue increase.

- Integrated Supply and Installation: BFS now provides a more complete package, reducing the need for builders to manage multiple vendors.

- Project Management Support: This includes coordination of material delivery and installation schedules, optimizing on-site efficiency.

- Addressing Builder Pain Points: The focus is on simplifying the construction process and shortening build cycles, a key priority for many homebuilders in the current market.

- Market Position: BFS's investment in these comprehensive services reinforces its standing in the industry, particularly as demand for such solutions escalates.

Builders FirstSource's digital sales platform, myBLDR.com, is a prime example of a Star in the BCG Matrix. Launched in early 2024, it has rapidly processed billions in orders and quotes, demonstrating strong market adoption and high growth potential.

The company's ambitious target of achieving $1 billion in digital sales by 2026 further solidifies myBLDR.com's status as a Star. This platform is not merely a sales channel but a crucial driver for customer engagement and operational efficiency, indicating its significant market share and future growth prospects.

Builders FirstSource's strategic investment in automation, particularly in offsite fabrication, positions these capabilities as Stars. In 2024, the company actively expanded its automated manufacturing, a move vital for meeting increasing demand and enhancing production efficiency, thereby securing a high-growth, high-market-share segment.

| Category | BCG Matrix Status | Key Drivers | 2024 Data/Projections |

| Digital Sales Platform (myBLDR.com) | Star | Rapid customer adoption, high transaction volume, significant growth targets | Billions in orders/quotes processed since early 2024; target $1 billion in digital sales by 2026 |

| Automation in Offsite Fabrication | Star | Addressing labor shortages, increasing efficiency, meeting demand for manufactured components | Continued expansion of automated capabilities in 2024 to boost operational throughput |

What is included in the product

Builders FirstSource's BCG Matrix offers a strategic view of its diverse product lines, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest based on market share and growth potential.

A clear BCG Matrix visualizes Builders FirstSource's portfolio, easing the pain of understanding which segments need investment and which are cash cows.

Cash Cows

Builders FirstSource's traditional lumber and commodity distribution segment functions as a classic Cash Cow. As the leading U.S. supplier, the company commands a significant market share in this established industry. This dominance, even with commodity price volatility, translates into robust and reliable cash generation due to the sheer volume of sales.

In 2023, Builders FirstSource reported net sales of $16.9 billion, with a substantial portion stemming from its foundational lumber and building materials offerings. This consistent cash flow from its core operations in 2024 provides the financial muscle to fund strategic investments in higher-growth areas of the business.

Builders FirstSource's extensive national distribution network, encompassing roughly 590 locations across 43 states, positions it as a formidable player in the industry. This vast infrastructure is key to its status as a cash cow, facilitating efficient delivery and a strong market presence that underpins consistent revenue from its loyal customer base.

The maturity of this distribution network means that while it generates substantial revenue, the need for significant ongoing investment to maintain or expand it is relatively low. This operational efficiency further solidifies its cash cow status within the Builders FirstSource BCG Matrix, allowing for strong cash flow generation.

Builders FirstSource's operational excellence initiatives are a prime example of a Cash Cow within its BCG Matrix. In 2024, these efforts yielded an impressive $117 million in productivity savings. This focus on optimizing existing operations and controlling costs directly translates into enhanced profit margins and robust free cash flow generation.

The company is projecting further success, targeting up to $90 million in savings from these initiatives in 2025. This consistent generation of strong free cash flow from mature, efficient processes solidifies its position as a reliable cash generator for the business.

Repair and Remodel (R&R) Segment

The Repair and Remodel (R&R) segment for Builders FirstSource (BFS) functions as a Cash Cow within its business portfolio. This segment, contributing approximately 14% to BFS's FY24 revenues, demonstrates a stable yet modest growth trajectory or has remained relatively flat in recent periods. Its resilience is particularly notable, often weathering market downturns with greater stability compared to the new construction sector.

- Stable Revenue Stream: The R&R segment provides a consistent and reliable source of income for Builders FirstSource.

- Market Resilience: It is less susceptible to the cyclical swings that often impact new home construction.

- Established Market Position: BFS's strong presence and significant market share in R&R ensure continued cash flow generation.

Strong Liquidity and Capital Discipline

Builders FirstSource demonstrates robust financial health, characterized by significant liquidity and a commitment to capital discipline. This financial prudence is evident in their strategic share repurchase programs, which directly return value to shareholders.

The company consistently generates substantial free cash flow, a testament to the efficiency of its core operations. This strong cash-generating ability, coupled with effective debt management, provides the financial flexibility needed to support ongoing business activities and shareholder returns.

- Strong Liquidity: Builders FirstSource maintains a healthy liquidity position, enabling operational stability and strategic flexibility.

- Capital Discipline: The company employs a disciplined approach to capital allocation, including share buybacks, to enhance shareholder value.

- Free Cash Flow Generation: Consistent generation of significant free cash flow highlights the underlying strength and profitability of its business segments.

- Effective Debt Management: Prudent management of its debt obligations further solidifies its financial stability and capacity for investment.

The traditional lumber and commodity distribution segment of Builders FirstSource is a prime example of a Cash Cow. This segment benefits from a leading U.S. market share, ensuring consistent, high-volume sales that translate into reliable cash generation despite commodity price fluctuations.

In 2023, Builders FirstSource achieved net sales of $16.9 billion, with a significant portion derived from these foundational building materials. This segment's mature distribution network, spanning approximately 590 locations, supports efficient operations and a strong customer base, underpinning its cash cow status.

The company's focus on operational excellence, which yielded $117 million in productivity savings in 2024 and targets up to $90 million in 2025, further enhances its cash cow characteristics by boosting profit margins and free cash flow.

The Repair and Remodel (R&R) segment, contributing around 14% to FY24 revenues, also acts as a Cash Cow due to its stable revenue stream and resilience against new construction market cycles.

| Segment | BCG Category | Key Characteristics | 2023 Net Sales Contribution (Approx.) |

| Lumber & Commodity Distribution | Cash Cow | Leading Market Share, High Volume, Established Network | ~86% |

| Repair & Remodel (R&R) | Cash Cow | Stable Revenue, Market Resilience, Strong Presence | ~14% |

Full Transparency, Always

Builders FirstSource BCG Matrix

The Builders FirstSource BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning.

Dogs

Builders FirstSource's multi-family construction sales have seen a considerable downturn. In the first two quarters of 2025, sales in this segment dropped by a significant 23% to 33%.

This contraction mirrors wider industry trends, with forecasts indicating a mid-teens percentage decrease in multi-family housing starts for the entirety of 2025.

Considering these low growth expectations and Builders FirstSource's own diminished performance, the multi-family construction segment is currently classified as a low-performing area within the company's portfolio.

Builders FirstSource's underperforming regional operations represent its 'Dogs' in the BCG Matrix. Despite a strong national footprint, specific local markets or distribution centers might be struggling with low market share and minimal growth, possibly due to localized economic downturns or fierce competition. The company's strategy to right-size its network indicates a proactive approach to identifying and rectifying these underperforming areas.

Commodity-dependent, low-margin products, like certain lumber segments where Builders FirstSource (BFS) operates, can become question marks if they consistently show low gross margins, especially during deflationary periods. In 2024, the volatility in lumber prices, which can swing significantly, directly impacts the profitability of these less differentiated offerings.

For BFS, areas where they don't possess a substantial cost advantage and face fierce price competition are particularly vulnerable. If these segments consistently generate minimal returns, they risk becoming cash traps, draining resources without contributing meaningfully to overall growth or profitability.

Legacy Systems and Inefficient Processes

Legacy systems and inefficient processes represent internal operational challenges for Builders FirstSource. These older, fragmented systems, or outdated internal workflows that haven't been modernized, can drain resources and hinder productivity. For instance, in 2023, companies across various sectors reported significant costs associated with maintaining legacy IT infrastructure, often exceeding 70% of their IT budget, according to industry analyses.

These internal 'units' consume capital and personnel time without directly contributing to market share expansion or revenue growth. The company's ongoing enterprise resource planning (ERP) implementation and broader digital transformation initiatives are designed to address these inefficiencies, signaling a strategic shift towards more streamlined and effective operations.

- Resource Drain: Older systems and processes consume capital and operational resources without generating proportional value.

- Hindrance to Growth: Inefficiencies can slow down innovation and market responsiveness, impacting competitive positioning.

- Digital Transformation Focus: Efforts like the ERP implementation aim to replace or integrate these legacy components, improving overall efficiency and agility.

Declining Niche Product Lines

Within Builders FirstSource's broad product offerings, certain specialized building material lines might be experiencing a downturn due to shifting construction preferences or obsolescence. These niche segments likely hold a small portion of the market and face declining customer interest.

For instance, if a particular type of historic architectural molding or a specialized insulation material is no longer in high demand, it would fall into this category. Builders FirstSource, like many large distributors, manages a vast inventory, and some items naturally become less relevant over time. In 2023, Builders FirstSource reported net sales of $17.9 billion, a slight decrease from $18.7 billion in 2022, indicating a dynamic market where product line performance can vary.

These declining niche product lines, characterized by low growth and low market share, are often referred to as Dogs in the BCG Matrix framework.

- Low Market Share: These products appeal to a shrinking customer base.

- Low Market Growth: The overall demand for these specific materials is decreasing.

- Resource Allocation: Management may decide to divest or minimize investment in these areas to focus on more profitable product categories.

- Potential Divestiture: Companies often prune their portfolios, selling off or discontinuing lines that no longer align with strategic goals or market trends.

Builders FirstSource's multi-family construction segment is a prime example of a 'Dog' within its portfolio. Sales in this area experienced a significant decline, dropping between 23% and 33% in the first half of 2025. This performance aligns with broader industry forecasts predicting a mid-teens percentage decrease in multi-family housing starts for the full year 2025, indicating a challenging market with limited growth prospects for this segment.

The company's underperforming regional operations also fit the 'Dog' profile. These are specific markets or distribution centers that struggle with low market share and minimal growth, potentially due to localized economic issues or intense competition. Builders FirstSource's strategy to right-size its network underscores its commitment to addressing these less productive areas.

Certain specialized building material lines, particularly those with declining demand due to shifting construction trends, also represent 'Dogs'. These niche products typically have low market share and face a shrinking customer base. For instance, while Builders FirstSource reported net sales of $17.9 billion in 2023, a slight dip from $18.7 billion in 2022, this overall trend highlights how some product lines may naturally become less relevant over time, requiring careful portfolio management.

| Segment | Market Share | Market Growth | Profitability | Strategic Implication |

| Multi-family Construction | Low (declining) | Low (negative) | Low | Divestiture or turnaround |

| Underperforming Regions | Low | Low | Low | Restructuring or exit |

| Declining Niche Products | Low | Low (declining) | Low | Discontinue or minimize |

Question Marks

Builders FirstSource's recent acquisitions, such as the acquisition of BMC Stock Holdings in 2021, represent a strategic push into new geographic territories. While these expansions offer high growth potential, the initial market share in these newly integrated areas may be modest as BFS works to consolidate operations and establish its presence. For instance, post-acquisition integration requires substantial investment to achieve market penetration and operational synergy.

The integration process for these new geographic markets is crucial for transforming them from question marks into stars within the BCG framework. Builders FirstSource is investing heavily in operational alignment and market development to leverage the growth potential of these acquired regions. This strategic focus aims to increase market share and solidify its competitive position, turning these areas into future growth engines.

Builders FirstSource is actively investing in advanced AI and data analytics tools, a strategic move positioning these initiatives as potential stars in its BCG Matrix. These technologies, including AI-driven insights and real-time tracking, aim to revolutionize operations and customer interactions. For instance, the company's focus on enhancing supply chain visibility through advanced analytics could lead to significant efficiency gains, a key indicator of future growth potential.

Despite their high potential, these cutting-edge tools are currently in the early stages of development and adoption within Builders FirstSource. This means they represent high-growth prospects with low market penetration for the company. As of early 2024, the full impact and market share capture of these nascent technological solutions are yet to be realized, placing them in a category that requires further investment and strategic rollout to move towards maturity.

The U.S. market for green building materials is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond. This surge is fueled by heightened consumer demand for energy-efficient homes and evolving environmental regulations. Builders FirstSource (BFS) is likely observing this trend, potentially looking to enter or expand its offerings in this high-potential sector.

While the overall market for sustainable construction is booming, BFS's current market share in specialized green building materials and advanced technologies is likely nascent. This positions these offerings as potential Stars or Question Marks within a BCG matrix framework, representing a significant growth opportunity but requiring strategic investment to capture market share.

Expansion into Complex Turnkey Shell Construction

Builders FirstSource (BFS) could significantly bolster its market position by expanding into complex turnkey shell construction. This involves offering end-to-end solutions, from foundation to finished shell, rather than just supplying materials. Such an expansion represents a strategic move into a high-growth segment, potentially capturing a larger share of the construction value chain.

This strategic pivot requires substantial investment in specialized labor, advanced project management, and potentially new equipment. For instance, the U.S. construction industry faced a deficit of approximately 540,000 skilled workers in 2023, according to Associated Builders and Contractors. By developing these capabilities, BFS could directly address this persistent labor shortage for its clients.

- Market Opportunity: Transitioning to turnkey shell construction taps into a market segment seeking integrated solutions, potentially commanding higher margins than component supply alone.

- Capability Development: This move necessitates building expertise in areas like concrete work, structural framing, and exterior envelope systems, requiring significant training and recruitment.

- Addressing Labor Shortages: BFS's expansion could offer a solution for builders struggling to find skilled trades, providing a more reliable and streamlined construction process.

- Competitive Advantage: Offering comprehensive shell construction would differentiate BFS from competitors focused solely on material provision, creating a stronger value proposition.

New Service Offerings for Small Production Builders

Builders FirstSource (BFS) is exploring new service offerings to better cater to small production builders, a segment that represents a significant growth opportunity. While BFS traditionally focuses on larger professional homebuilders, developing specialized digital services for smaller builders could unlock substantial incremental sales. This strategic move aims to tap into a less saturated market, provided the right services are created and effectively marketed.

This initiative aligns with BFS's broader strategy to expand its digital footprint and customer base. For instance, in 2024, the company has been investing in digital platforms designed to streamline the quoting and ordering process. Small production builders, often operating with tighter margins and less dedicated administrative staff, could greatly benefit from such digital tools. These services might include customized material package solutions, online project management integration, or even simplified financing options, all accessible through a user-friendly digital interface.

- Targeted Digital Solutions: Develop online platforms for streamlined quoting, ordering, and project management specifically for small production builders.

- Material Package Customization: Offer flexible, pre-packaged material solutions tailored to the scale and needs of smaller construction projects.

- Financial and Logistical Support: Explore integrated financing options and optimized delivery scheduling to address the unique challenges faced by this segment.

- Incremental Digital Sales: Aim to capture a larger share of the small production builder market, driving measurable growth in digital channel revenue.

Builders FirstSource's strategic acquisitions and investments in new technologies, alongside efforts to cater to niche markets like small production builders, position several initiatives as potential question marks in their BCG matrix. These ventures represent high-growth opportunities but currently hold a relatively low market share, necessitating further investment and strategic development to mature into stars.

The company's expansion into new geographic territories through acquisitions, such as BMC Stock Holdings, and its focus on developing advanced digital services for small production builders are prime examples of question marks. These areas show significant market potential, but BFS is still in the process of consolidating operations and building market penetration, requiring substantial capital and strategic focus to realize their full growth capabilities.

Furthermore, BFS's exploration of complex turnkey shell construction and its investments in AI and data analytics also fall into the question mark category. While these represent significant future growth avenues, they require considerable upfront investment in capabilities and market development before they can achieve substantial market share and become established stars within the company's portfolio.

Builders FirstSource is actively working to transform these question mark initiatives into stars by dedicating resources to market penetration, operational synergy, and technological integration. The company's strategic investments are aimed at capturing market share in these high-potential areas, ensuring they contribute significantly to future growth and profitability.

BCG Matrix Data Sources

Our Builders FirstSource BCG Matrix is constructed using comprehensive financial statements, detailed market share data, and industry growth projections.