Builders FirstSource Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Builders FirstSource Bundle

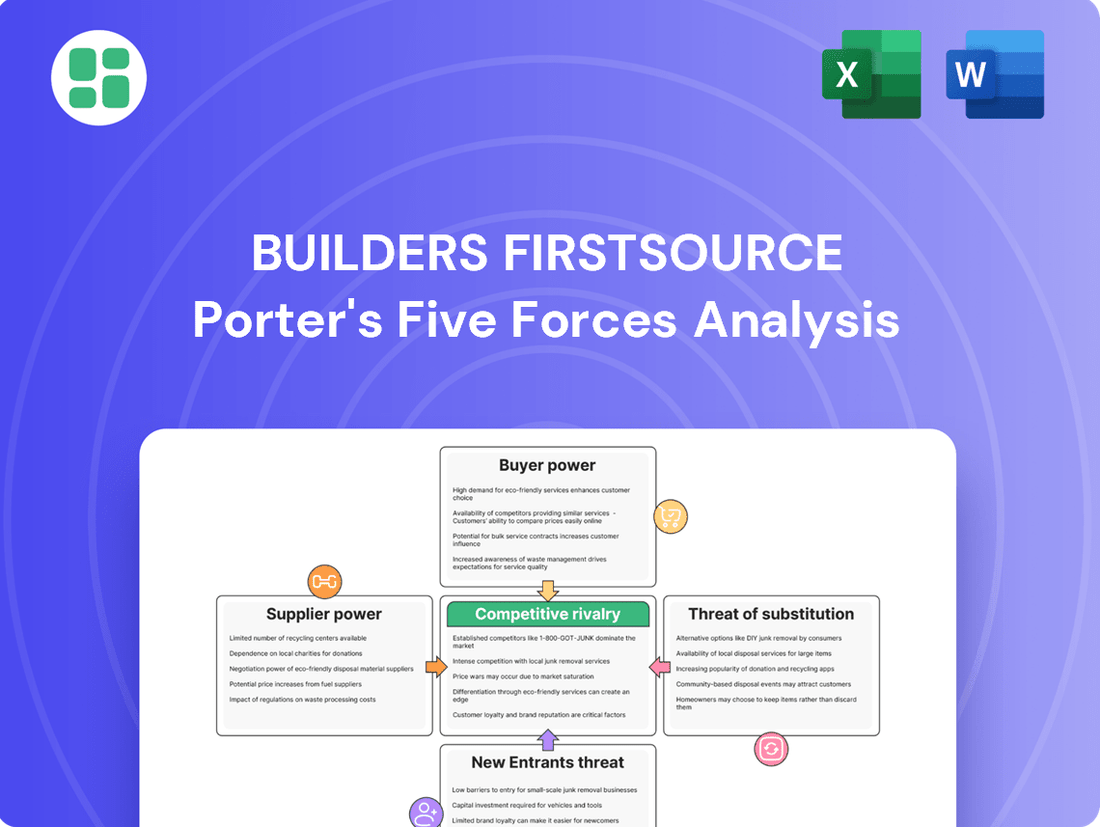

Builders FirstSource operates within a dynamic construction supply industry where buyer power can be significant due to the fragmented nature of many customer segments. Understanding the intensity of this force, alongside the threat of new entrants and the bargaining power of suppliers, is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Builders FirstSource’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration can significantly influence pricing power. In the building materials sector, while basic commodities might have many suppliers, specialized or engineered wood products often originate from a smaller number of manufacturers. This limited pool can give these suppliers more leverage when negotiating prices with distributors like Builders FirstSource.

Market shifts, such as mill closures or the imposition of trade duties on imported materials, can further consolidate the supplier base. For instance, in 2024, ongoing supply chain adjustments and the impact of tariffs on certain wood products continued to shape the availability and cost of key materials, potentially strengthening the bargaining position of remaining domestic or less-affected suppliers.

Commodity price volatility, particularly for key materials like lumber, directly amplifies the bargaining power of suppliers. When prices for these essential inputs surge or become unpredictable, suppliers are in a stronger position to dictate terms and demand higher prices from companies like Builders FirstSource. This can squeeze profit margins, as the cost of goods sold increases without a commensurate ability to immediately pass those costs onto customers.

For instance, in 2024, lumber prices experienced significant fluctuations. While specific figures vary, periods of sharp increases can directly impact Builders FirstSource's cost structure. The company's efforts in strategic procurement and inventory management are crucial for buffering these shocks, but sudden, steep price hikes can still grant suppliers leverage, forcing the company to absorb higher costs or risk supply disruptions.

Builders FirstSource's core operations are fundamentally dependent on a steady supply of diverse building materials and components. Key inputs such as lumber, plywood, windows, and doors are absolutely vital for their day-to-day business, underscoring the necessity of dependable suppliers.

The bargaining power of suppliers is a significant factor for Builders FirstSource. In 2023, the company's cost of goods sold was approximately $16.5 billion, highlighting the substantial volume of materials procured. Any fluctuations in the pricing or availability of these essential inputs, driven by supplier power, can directly affect Builders FirstSource's profitability and its capacity to meet customer demands.

Cost of Switching Suppliers

The cost of switching suppliers for Builders FirstSource, especially for high-volume or specialized building materials, can be substantial. This involves not only the direct costs of finding and vetting new suppliers but also the indirect expenses associated with retooling, retraining, and integrating new supply chains. In 2023, the construction industry, which Builders FirstSource serves, faced ongoing supply chain disruptions, making the risk and cost of switching even more pronounced.

These switching costs can significantly enhance the bargaining power of existing suppliers. Builders FirstSource might incur expenses related to:

- Supplier Qualification and Auditing: Ensuring new suppliers meet quality and reliability standards.

- Logistical Adjustments: Modifying transportation, warehousing, and inventory management systems.

- Product Integration and Testing: Verifying that new materials perform as expected in various construction applications.

- Potential for Production Delays: The time lag in establishing new supplier relationships can disrupt project timelines.

Supplier's Ability to Forward Integrate

Suppliers in the building materials industry, particularly those creating manufactured components, possess the theoretical ability to integrate forward. This means they could potentially bypass distributors like Builders FirstSource and sell directly to builders or even end consumers.

However, the significant barriers to entry for such a move are substantial. Builders FirstSource boasts an extensive distribution network and deep logistical expertise, coupled with crucial value-added services. These capabilities make it difficult for most raw material suppliers to effectively compete on a direct-to-customer basis, thereby limiting their bargaining power in this regard.

- Suppliers' Forward Integration Threat: Building material manufacturers could theoretically distribute directly to builders or consumers.

- Builders FirstSource's Defense: The company's vast distribution network and logistical expertise create a significant barrier for suppliers.

- Value-Added Services: Builders FirstSource offers services that raw material suppliers often cannot replicate, further reducing the threat.

The bargaining power of suppliers for Builders FirstSource is influenced by factors like supplier concentration and the cost of switching. In 2023, Builders FirstSource's cost of goods sold was approximately $16.5 billion, demonstrating the significant volume of materials procured.

Specialized building materials often come from fewer manufacturers, giving them more pricing leverage. For instance, market shifts in 2024, like tariffs on certain wood products, continued to consolidate the supplier base, potentially strengthening the position of remaining suppliers.

The cost and complexity of switching suppliers for essential materials are substantial, including qualification, logistics, and integration. This makes it challenging for Builders FirstSource to easily change suppliers, thus enhancing the bargaining power of current ones.

| Factor | Impact on Builders FirstSource | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | Higher concentration leads to greater supplier leverage. | Specialized engineered wood products often have fewer manufacturers. |

| Switching Costs | High switching costs increase supplier bargaining power. | Costs include qualification, logistics, and integration for new suppliers. |

| Cost of Goods Sold (2023) | Reflects the scale of material procurement. | Approximately $16.5 billion, indicating significant reliance on suppliers. |

What is included in the product

This analysis dissects the competitive forces impacting Builders FirstSource, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the building materials industry.

Instantly understand competitive pressures with a clear, one-sheet summary of Builders FirstSource's Porter's Five Forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Builders FirstSource's core customers, including professional homebuilders, subcontractors, and remodelers, are acutely aware of material costs. These costs directly influence their project profitability and the final price for homeowners, making them highly sensitive to price fluctuations.

In the current economic climate, marked by elevated interest rates and widespread affordability concerns for new homes, these customers are increasingly inclined to negotiate for more competitive pricing. This behavior significantly amplifies their bargaining power.

Builders FirstSource's financial performance in Q2 2025 reflects this reality, with revenue declines partly attributed to falling core organic sales. This suggests that customers are indeed pushing back on prices, impacting the company's top line.

The volume of purchases by large professional homebuilders and contractors significantly impacts their bargaining power with suppliers like Builders FirstSource. These major buyers acquire materials in substantial quantities, which naturally gives them leverage to negotiate more favorable pricing and payment terms. Builders FirstSource's business model heavily relies on serving this professional segment, meaning a considerable portion of their income originates from these high-volume customers who can effectively apply pressure on pricing.

For instance, in 2023, Builders FirstSource reported net sales of $17.0 billion, with a substantial portion attributable to their professional customer base. The capacity of these large customers to consolidate their procurement or readily shift their bulk orders to alternative suppliers further amplifies their influence, making them a formidable force in price negotiations.

Customers today wield significant bargaining power, largely due to readily available pricing information and a wider array of product choices, amplified by digital platforms. This increased transparency empowers buyers to compare offerings and negotiate more effectively, reducing the traditional information gap with sellers.

Builders FirstSource's own digital initiatives, designed to streamline operations and enhance customer experience, inadvertently contribute to this heightened customer awareness and their ability to compare options. For instance, in 2024, the construction materials sector saw a notable increase in online marketplaces where pricing and product specifications are openly displayed, making it easier for builders to shop around.

Availability of Alternative Suppliers

The building materials distribution market, despite ongoing consolidation, presents customers with a robust selection of suppliers. Builders and contractors have the flexibility to source materials from a diverse range of local, regional, and national distributors, alongside major home improvement retailers for specific product categories. This broad accessibility to alternatives significantly enhances customer bargaining power, enabling them to readily switch suppliers if pricing or service levels from Builders FirstSource are perceived as uncompetitive.

For instance, in 2024, the U.S. construction industry continued to see a mix of large national players and numerous regional and local suppliers. This competitive landscape means that a contractor needing lumber, drywall, or roofing materials can often compare quotes from several sources. Builders FirstSource's ability to retain business is therefore directly tied to its competitive pricing and service delivery compared to these readily available alternatives. The market dynamics underscore the importance of maintaining strong customer relationships and efficient operations to counter the inherent power customers wield due to supplier choice.

- Supplier Diversity: Customers can choose from national distributors, regional suppliers, and big-box retailers.

- Competitive Pricing: The availability of alternatives allows customers to negotiate or switch based on price.

- Service Differentiation: Beyond price, service quality and delivery reliability are key factors in customer retention.

- Market Pressure: Builders FirstSource faces pressure to offer competitive terms to prevent customer defection to other suppliers.

Low Switching Costs for Customers

The bargaining power of customers for Builders FirstSource is significantly influenced by low switching costs for many standard building materials. This means that if a customer finds a better price or delivery schedule elsewhere, they can often move to a new supplier without much difficulty or expense.

For instance, a contractor purchasing common lumber or drywall can readily compare prices across multiple distributors. Builders FirstSource's ability to retain these customers hinges on competitive pricing and reliable service, as the cost to switch suppliers for these basic items is minimal. In 2023, the U.S. construction industry saw fluctuating material costs, making price sensitivity a key factor for buyers.

- Low Switching Costs: For commodity building products, customers face minimal financial or operational hurdles when changing suppliers.

- Price Sensitivity: Customers often prioritize cost-effectiveness, readily exploring alternatives if Builders FirstSource's pricing is not competitive.

- Availability of Alternatives: The presence of numerous suppliers offering similar standard materials empowers customers to negotiate or seek better deals.

Builders FirstSource's customers, particularly large professional builders, possess considerable bargaining power due to their substantial purchase volumes and the availability of numerous alternative suppliers. This leverage allows them to negotiate favorable pricing and terms, a trend amplified by increased market transparency and low switching costs for many standard building materials. Builders FirstSource's Q2 2025 revenue declines, partly due to falling core organic sales, suggest customers are actively pushing back on prices, impacting the company's financial performance.

| Customer Segment | Purchase Volume Impact | Supplier Alternatives | Price Sensitivity |

|---|---|---|---|

| Professional Homebuilders & Contractors | High (Bulk orders grant leverage) | High (Numerous national, regional, and local distributors) | Very High (Directly impacts project profitability) |

| Subcontractors & Remodelers | Moderate (Smaller volumes, but still significant collectively) | Moderate to High (Access to various suppliers and big-box retailers) | High (Sensitive to material costs affecting bids) |

Same Document Delivered

Builders FirstSource Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Builders FirstSource's competitive landscape through Porter's Five Forces, offering a comprehensive analysis of industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. This in-depth report is ready for immediate use, providing actionable insights into the strategic positioning of Builders FirstSource within the building materials sector.

Rivalry Among Competitors

Builders FirstSource operates within a building materials supply industry that features a broad array of competitors. This includes major national companies, numerous regional distributors, and a multitude of smaller, local supply yards. Additionally, large home improvement retailers also vie for market share, creating a complex and often aggressive competitive environment.

The rivalry is particularly fierce in the local markets where Builders FirstSource has a significant presence with its distribution and manufacturing facilities. This dense network of competitors, even those with smaller operations, contributes to a highly fragmented market across many geographic areas, intensifying the pressure on pricing and service.

The construction industry, especially residential building, sees its growth ebb and flow with the economy, interest rates, and how many new homes are being built. For 2025, a slight uptick in single-family housing is anticipated, but multifamily construction is expected to shrink. This creates a tougher market where companies battle harder for fewer opportunities.

When the market grows slowly, competition naturally heats up. Builders FirstSource and its rivals have to fight more intensely for the same pool of customers instead of expanding into new markets. This dynamic directly fuels competitive rivalry as companies scramble to capture market share in a less expansive landscape.

Builders FirstSource actively seeks to stand out by offering a broad product selection, manufactured components, and complementary services. This strategy, including prefabricated elements and digital platforms, aims to lessen reliance on competing solely on the price of basic building materials.

The company's focus on integrated solutions and digital tools helps it move beyond simple commodity sales, fostering a competitive advantage. For instance, their investment in digital platforms is designed to streamline customer interactions and project management, a key differentiator in the industry.

However, the competitive landscape is dynamic, with rivals also enhancing their value-added services and operational effectiveness. Builders FirstSource must consistently innovate to preserve its market position, as evidenced by the industry's ongoing trend towards more sophisticated, service-oriented offerings.

High Fixed Costs and Capacity

Builders FirstSource operates a substantial network of distribution centers and manufacturing facilities, inherently leading to high fixed costs. These substantial overheads necessitate consistent high sales volumes to achieve profitability, often compelling companies to engage in aggressive pricing tactics when demand falters.

This pressure to keep facilities running at optimal capacity directly fuels competitive rivalry. When market demand softens, the need to cover those fixed costs intensifies, leading to price wars and a heightened struggle for market share among industry players.

- High Fixed Costs: Builders FirstSource's extensive infrastructure, including numerous distribution centers and manufacturing plants, represents a significant capital investment with ongoing fixed operating expenses.

- Capacity Utilization Pressure: To offset these high fixed costs and maintain profitability, there's a constant drive to maximize sales volume and keep production and distribution capacity utilized.

- Aggressive Pricing: During periods of lower demand or economic slowdown, this pressure can lead to competitive price reductions to secure sales and cover operational expenses, intensifying rivalry.

- Impact on Rivalry: The need to utilize capacity effectively exacerbates competitive pressures, particularly in a market where demand can be cyclical, forcing companies to compete more fiercely on price and service.

Strategic Acquisitions and Consolidation

The building materials supply sector has been a hotbed for mergers and acquisitions, with Builders FirstSource itself actively acquiring companies. For instance, in 2023, Builders FirstSource completed several strategic acquisitions, bolstering its market presence.

While these deals trim the number of smaller competitors, they simultaneously forge larger, more powerful entities. These consolidated giants possess greater economies of scale and broader geographic footprints, intensifying competition among the remaining major players.

This ongoing consolidation fundamentally alters the competitive arena. The industry is moving towards a scenario with fewer, but significantly stronger, rivals, each vying for market share with enhanced capabilities.

- Increased Market Concentration: Acquisitions lead to fewer, but larger, competitors.

- Enhanced Scale and Reach: Consolidated firms benefit from greater operational efficiency and wider distribution networks.

- Intensified Rivalry: Larger players with more resources create a more challenging competitive environment.

- Strategic M&A Activity: Builders FirstSource's consistent acquisition strategy highlights this trend.

Builders FirstSource faces intense rivalry from a broad spectrum of competitors, including national firms, regional distributors, local yards, and large home improvement retailers. This fragmented market, especially in areas where Builders FirstSource has a strong presence, drives aggressive pricing and service competition.

The industry's cyclical nature, tied to housing starts and economic conditions, amplifies rivalry during downturns. For 2024, a projected slowdown in new residential construction, particularly multifamily, means companies must fight harder for market share, increasing price pressures.

Builders FirstSource differentiates itself through value-added services like manufactured components and digital platforms, aiming to reduce reliance on price competition alone. However, rivals are also enhancing their service offerings, necessitating continuous innovation to maintain a competitive edge.

The company's extensive infrastructure leads to high fixed costs, pushing for consistent sales volumes and potentially aggressive pricing when demand is low. This capacity utilization pressure fuels rivalry, as firms strive to cover overheads, particularly during market slowdowns.

| Competitor Type | Market Presence | Impact on Rivalry |

|---|---|---|

| National Companies | Broad geographic reach, significant market share | High price and service competition |

| Regional Distributors | Strong local/regional presence, established customer base | Intense localized competition |

| Local Supply Yards | Niche markets, personalized service | Price sensitivity, service differentiation |

| Home Improvement Retailers | Consumer focus, broad product range | Competition for DIY and smaller professional projects |

SSubstitutes Threaten

The threat of substitutes for Builders FirstSource is evolving, primarily stemming from advancements in construction technology and materials. While the company largely serves the traditional residential construction market, newer methods like modular building and 3D-printed homes are gaining traction. For instance, the global 3D printed construction market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a shift in consumer and builder preferences towards more efficient and potentially cost-effective solutions.

Innovative materials also present a substitution risk. Composites like Fiber Reinforced Polymer (FRP) rebars are increasingly being explored as alternatives to traditional steel reinforcement in concrete structures due to their corrosion resistance and lighter weight. While these advanced methods and materials currently represent a smaller portion of the overall construction landscape, their potential for faster build times, reduced labor costs, and enhanced sustainability could lead to greater adoption, impacting demand for Builders FirstSource's core product offerings.

For smaller remodeling jobs and specific components, consumers and even some smaller contractors might bypass traditional suppliers and source materials directly from big-box home improvement stores or online retailers. This trend is fueled by the increasing popularity of DIY projects, with abundant online tutorials and readily available materials. For instance, the home improvement retail sector, a key channel for DIYers, saw significant growth, with companies like Home Depot reporting net sales of $152.7 billion in fiscal year 2023, indicating substantial consumer spending outside of professional channels.

Builders FirstSource faces a growing threat from substitutes in the form of recycled and sustainable building materials. Increased environmental consciousness and stricter regulations are boosting demand for eco-friendly options. For instance, the global green building materials market was valued at over $250 billion in 2023 and is projected to grow significantly.

While Builders FirstSource does offer some sustainable products, a substantial pivot towards these materials could benefit specialized suppliers whose primary focus is on green alternatives. This trend might compel Builders FirstSource to adjust its product range to stay competitive, potentially losing ground to competitors exclusively offering eco-friendly solutions.

Changes in Construction Design and Building Codes

Changes in construction design and evolving building codes present a significant threat of substitutes for Builders FirstSource. As new regulations emerge, for example, those mandating higher energy efficiency or specific fire-resistance ratings, they can drive demand towards alternative materials or construction methods. For instance, a shift towards advanced composite materials or pre-fabricated modular construction could lessen reliance on traditional lumber and building components that form a core part of Builders FirstSource's product portfolio.

Design trends also play a crucial role. A growing consumer preference for minimalist aesthetics or specific architectural styles might favor materials or systems that Builders FirstSource does not currently specialize in. For example, the increasing popularity of cross-laminated timber (CLT) in certain high-rise applications, while still wood-based, represents a different product category than the dimensional lumber typically supplied. This necessitates continuous market intelligence to anticipate and adapt to these shifts.

- Evolving Building Codes: New codes can favor alternative materials, impacting demand for traditional products.

- Design Trends: Shifts in architectural preferences may increase demand for non-traditional building components.

- Consumer Preferences: Growing interest in sustainable or innovative building methods can lead to substitute material adoption.

Customer's Ability to Self-Manufacture Components

The threat of customers self-manufacturing components, while generally low for individual builders, could emerge from very large homebuilding companies. These giants might explore vertical integration, setting up their own facilities for items like trusses or wall panels, directly substituting Builders FirstSource's offerings.

For instance, a major builder could potentially achieve economies of scale in component production, making it a viable alternative. However, Builders FirstSource's established manufacturing efficiency and scale often present a cost disadvantage for customers attempting to self-manufacture.

- Vertical Integration Potential: Large homebuilders may consider in-house production of components like trusses and wall panels.

- Cost-Effectiveness Barrier: Builders FirstSource's scale and manufacturing efficiency typically make self-production less economical for most customers.

- Market Share Impact: If a few large players vertically integrate, it could reduce demand for Builders FirstSource's manufactured components.

The threat of substitutes for Builders FirstSource is multifaceted, encompassing technological advancements, material innovations, and shifting consumer preferences. While traditional construction methods remain dominant, emerging alternatives like modular building and 3D-printed homes are gaining traction, with the global 3D printed construction market valued around $1.5 billion in 2023. Furthermore, the rise of DIY culture and online retail channels means consumers can bypass traditional suppliers for smaller projects, as evidenced by Home Depot's $152.7 billion in net sales for fiscal year 2023.

| Substitute Category | Examples | Market Trend/Value (2023/2024) | Impact on Builders FirstSource |

|---|---|---|---|

| New Construction Technologies | Modular building, 3D-printed homes | 3D Printed Construction Market: ~$1.5 billion (2023), growing | Potential shift in demand away from traditional materials and on-site labor. |

| Innovative Materials | Composites (FRP rebars), advanced insulation | Green Building Materials Market: >$250 billion (2023), growing | Could reduce reliance on lumber and traditional components if cost-effective and widely adopted. |

| Alternative Sales Channels | Big-box retailers, online marketplaces | Home Improvement Retail: Home Depot FY23 Net Sales: $152.7 billion | Direct competition for smaller projects and DIY segments, impacting volume for certain products. |

| Sustainable/Recycled Materials | Recycled lumber, bamboo, reclaimed materials | Green Building Materials Market: >$250 billion (2023), growing | Increased demand may favor specialized suppliers, requiring Builders FirstSource to adapt its offerings. |

Entrants Threaten

The building materials distribution and manufacturing sector demands substantial capital. Newcomers must invest heavily in real estate, operational facilities, machinery, and maintaining significant inventory levels to compete effectively.

Builders FirstSource's extensive footprint, comprising around 590 locations spread across 43 states as of early 2024, exemplifies this capital intensity. Such a widespread presence requires immense upfront investment in infrastructure and logistics.

This high barrier to entry, driven by the need for considerable financial resources, effectively discourages many potential competitors from entering the market at a scale that could pose a significant threat to established companies like Builders FirstSource.

Building an effective distribution network for bulky construction materials across vast regions presents a substantial hurdle for newcomers. Builders FirstSource's existing infrastructure, encompassing manufacturing, warehousing, and delivery, creates a formidable entry barrier.

The complexity of managing logistics for diverse building products, from lumber to windows, requires significant capital investment and operational expertise. Builders FirstSource's established scale in 2024, serving numerous professional builders, means new entrants would face immense difficulty in matching its reach and efficiency, impacting their ability to compete on delivery speed and cost.

Builders FirstSource cultivates deep loyalty with professional builders and contractors, built on consistent reliability, tailored service, and comprehensive solutions. This strong brand preference means new competitors face a significant hurdle in displacing established supplier relationships.

In 2024, the construction supply sector continues to see a high percentage of builders sticking with their preferred vendors, underscoring the difficulty new entrants face in gaining traction. Disrupting these entrenched partnerships requires substantial investment in service and product offerings.

Regulatory Hurdles and Permitting

The construction sector faces significant regulatory barriers that deter new entrants. Navigating a complex web of building codes, zoning laws, and permitting processes, which differ greatly by location, demands substantial time and financial investment. For instance, a new builder aiming for operations across several states would need to master distinct regulatory frameworks in each, a process that can easily extend timelines and inflate initial capital requirements.

Compliance with environmental regulations and stringent safety standards further elevates the cost and complexity for newcomers. In 2024, the average time to obtain building permits in major US cities often exceeded 60 days, with some projects facing delays of over six months due to regulatory reviews. This lengthy and often unpredictable process acts as a substantial deterrent, favoring established players with existing relationships and expertise in managing these requirements.

- Complex Permitting: New entrants must contend with varying building codes and zoning laws across different jurisdictions.

- Time and Cost: Navigating these regulations can be time-consuming and expensive, especially for multi-state operations.

- Environmental and Safety Compliance: Adhering to environmental protection and worker safety standards adds further complexity and cost.

- Regional Variations: The patchwork of regulations means that what is permissible in one area may not be in another, increasing the learning curve for new businesses.

Access to Raw Materials and Supplier Relationships

Securing consistent access to raw materials is a significant hurdle for new entrants in the building materials sector. Builders FirstSource, for instance, benefits from its established, long-term relationships with key suppliers. These relationships often translate into preferential pricing and guaranteed supply, especially crucial during times of high demand or when global supply chains face disruptions, as seen in various periods throughout 2023 and early 2024.

New companies entering the market may find it challenging to secure competitive sourcing for essential materials like lumber, steel, and concrete. This difficulty can directly impact their cost structure, making it harder to match the pricing of established players. For example, lumber prices, which can fluctuate significantly, might be more manageable for a company with existing contracts compared to a newcomer needing to establish new supply lines.

- Supplier Leverage: Builders FirstSource's scale allows for bulk purchasing, often securing better terms than new entrants.

- Material Volatility: New entrants face greater risk from price swings in key commodities like lumber and steel, impacting their initial cost competitiveness.

- Supply Chain Resilience: Established relationships provide a buffer against supply chain disruptions, a critical advantage in the volatile construction market.

The threat of new entrants for Builders FirstSource is generally low due to significant capital requirements and established economies of scale. New companies need substantial investment for facilities, inventory, and distribution networks, making market entry challenging. For example, in 2024, the cost of establishing a single, well-equipped distribution center can easily run into millions of dollars, a figure that deters many smaller players.

Builders FirstSource's extensive operational footprint, with approximately 590 locations across 43 states by early 2024, represents a massive capital investment that new entrants would struggle to replicate. This scale provides significant cost advantages in purchasing and logistics. Furthermore, the company's established brand loyalty among professional builders, cultivated over years of reliable service, creates a strong barrier to customer acquisition for any new competitor attempting to gain market share.

Regulatory hurdles, including complex permitting processes that can take months and vary significantly by region, add further complexity and cost for potential new entrants. In 2024, average permit approval times in many US metropolitan areas exceeded 60 days, with some projects facing delays of over six months, increasing the financial burden and risk for newcomers. This environment favors established players like Builders FirstSource who have the experience and resources to navigate these complexities efficiently.

| Factor | Impact on New Entrants | Builders FirstSource Advantage |

|---|---|---|

| Capital Requirements | Very High (facilities, inventory, distribution) | Economies of scale, established infrastructure |

| Brand Loyalty & Relationships | Difficult to build | Strong existing customer base, trusted supplier status |

| Regulatory Compliance | Time-consuming and costly (permits, codes) | Established expertise, existing compliance processes |

| Distribution Network | Expensive to establish and scale | Extensive national footprint, efficient logistics |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Builders FirstSource leverages data from industry-specific market research reports, company annual filings, and trade publications to understand competitive dynamics.