Blackhawk Network PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackhawk Network Bundle

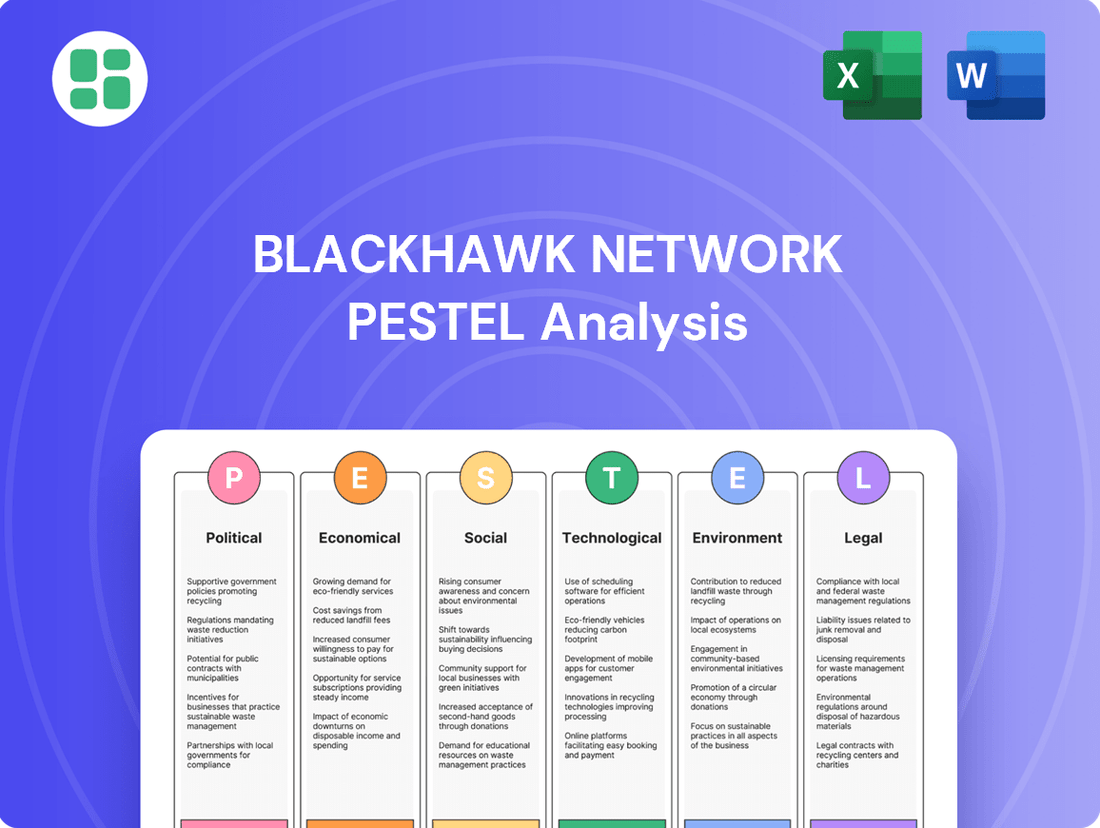

Unlock the critical external factors shaping Blackhawk Network's destiny. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company. Understand these dynamics to inform your investment decisions and strategic planning.

Gain a competitive edge by understanding the intricate PESTLE landscape impacting Blackhawk Network. From evolving consumer behaviors to emerging technological advancements, this analysis provides the crucial context needed to navigate the future. Purchase the full report for actionable intelligence.

Political factors

Governments globally are tightening their grip on digital payments, a trend Blackhawk Network navigates closely. For instance, the European Union's PSD2 directive, fully implemented by 2021, reshaped open banking and consumer data sharing, impacting how Blackhawk's services interact with financial institutions. This regulatory environment demands constant vigilance to ensure compliance with consumer protection mandates and fraud prevention measures across its diverse markets.

The increasing focus on data privacy, exemplified by regulations like Europe's GDPR and California's CCPA, directly affects how Blackhawk Network manages sensitive customer information. These laws mandate strict protocols for data collection, storage, and usage, requiring significant investment in compliance and security infrastructure.

Failure to adhere to these data privacy mandates can result in substantial fines and reputational damage, as seen in numerous past data breach litigations across the industry. Blackhawk Network must prioritize transparent data handling and robust security to maintain consumer trust and avoid legal repercussions, a crucial aspect given the financial nature of its services.

Blackhawk Network, like all payment processing firms, faces increasing scrutiny under global anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. These policies necessitate robust know-your-customer (KYC) protocols and transaction monitoring, directly impacting operational costs and complexity.

For instance, the Financial Action Task Force (FATF) continues to update its recommendations, pushing for greater transparency and stricter enforcement worldwide. In 2024, many jurisdictions are enhancing their AML/CTF frameworks, requiring companies like Blackhawk to invest further in compliance technology and personnel to avoid significant penalties.

Cross-Border Transaction Regulations

Operating globally, Blackhawk Network must adhere to diverse cross-border transaction regulations. These rules, which differ by nation, affect everything from how much money can be sent to what information needs to be reported and how currency can be exchanged. For example, in 2024, many countries are enhancing their Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for international transfers, adding compliance burdens.

These varying regulations directly impact Blackhawk Network's ability to offer seamless international payment services. Compliance costs can rise as companies adapt to different legal frameworks, and restrictions on currency conversion can affect profit margins on remittances. For instance, some jurisdictions might impose limits on the amount of foreign currency individuals can purchase or sell within a given period, influencing the volume of transactions Blackhawk can facilitate.

- Regulatory Divergence: Blackhawk Network faces differing rules on transaction limits and reporting across its operating regions.

- Currency Controls: Restrictions on foreign exchange can impact the cost and availability of cross-border payment services.

- Compliance Burden: Adapting to varied KYC/AML regulations in 2024-2025 increases operational complexity and costs for global payment providers.

- Market Access: Stringent regulations in certain markets can limit Blackhawk's ability to expand its service offerings or enter new territories.

Political Stability in Key Markets

Political stability within Blackhawk Network's operating regions is a critical determinant of its business landscape. Geopolitical shifts, alterations in governmental regulations, or trade conflicts can create significant operational disruptions, influence consumer sentiment, and introduce unforeseen compliance challenges, underscoring the need for ongoing risk evaluation and flexible strategic planning. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continue to impact global supply chains and economic forecasts, potentially affecting consumer spending on gift cards and prepaid solutions in affected regions.

Blackhawk Network's reliance on international markets means that political instability can directly influence its revenue streams and operational costs. Changes in trade policies or the imposition of sanctions, as seen in various global economic realignments during 2024, can create barriers to entry or increase the cost of doing business in specific countries. This necessitates a proactive approach to understanding and mitigating these political risks.

- Geopolitical Risk Exposure: Blackhawk Network operates in over 26 countries, each with its unique political climate, requiring constant monitoring of potential disruptions.

- Regulatory Adaptation: Shifts in financial regulations, such as those concerning cross-border transactions or data privacy, directly impact Blackhawk's compliance and operational strategies.

- Consumer Confidence Impact: Political uncertainty often correlates with reduced consumer spending, affecting the demand for discretionary gift card purchases.

- Trade Policy Sensitivity: Evolving trade agreements and tariffs can influence the cost and availability of physical gift card products and the economics of digital distribution.

Governments worldwide are increasingly scrutinizing digital transactions, impacting companies like Blackhawk Network. The ongoing evolution of regulations such as the EU's PSD2 and data privacy laws like GDPR and CCPA necessitate continuous adaptation and investment in compliance. These legal frameworks directly influence how Blackhawk handles consumer data and interacts with financial institutions, demanding robust security and transparency to maintain trust and avoid penalties.

Global anti-money laundering (AML) and counter-terrorist financing (CTF) regulations are also tightening, requiring enhanced know-your-customer (KYC) protocols and transaction monitoring. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, pushing for stricter enforcement in 2024 and beyond. This adds complexity and cost to operations, particularly for companies like Blackhawk with extensive international reach.

Political stability and geopolitical events play a significant role in Blackhawk Network's operational environment. Geopolitical shifts, trade conflicts, and changes in government regulations can disrupt supply chains, affect consumer spending, and create compliance challenges. For example, ongoing tensions in Eastern Europe in 2024 have impacted global economic forecasts, potentially influencing consumer demand for gift cards and prepaid solutions in affected regions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Blackhawk Network, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and strategic advantages.

It offers actionable insights for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities within the digital payments and gift card industry.

A concise PESTLE analysis of Blackhawk Network provides stakeholders with a clear understanding of external factors impacting the business, thereby alleviating the pain point of navigating complex market dynamics during strategic planning.

Economic factors

Global economic growth directly fuels Blackhawk Network's performance, as increased consumer spending on gift cards and incentive programs is a hallmark of healthier economies. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, suggesting a generally supportive environment for discretionary spending.

Conversely, economic headwinds like inflation and rising interest rates can dampen consumer confidence and spending. In 2024, while inflation showed signs of moderating in many developed economies, persistent cost-of-living pressures continued to influence household budgets, potentially leading consumers to prioritize essential goods over gift cards and non-essential incentives.

Rising inflation directly impacts the real value of stored value on gift cards and prepaid products. For instance, if inflation runs at 5%, the purchasing power of a $100 gift card diminishes over time, making it less attractive for future use. This erosion of value can lead consumers to spend these funds more quickly or opt for more tangible goods over gift cards, affecting Blackhawk Network's transaction volumes.

Blackhawk Network must adapt its pricing and product strategy to account for these inflationary pressures. Offering incentives for faster redemption or ensuring that the value proposition remains competitive against rising prices is crucial. Consumer behavior shifts during periods of high inflation, with a greater focus on essential spending, potentially impacting the discretionary nature of gift card purchases and usage.

Interest rate changes directly impact Blackhawk Network's profitability, especially concerning the float earned on stored value products. For instance, if the Federal Reserve maintains its benchmark interest rate around 5.25%-5.50% as seen in early 2024, this can lead to higher earnings on Blackhawk's cash reserves. Conversely, a significant drop in rates could reduce this income stream.

Higher interest rates can also influence consumer spending and credit behavior. For Blackhawk, this might mean a shift in demand for prepaid solutions if consumers find it more attractive to use credit or save due to better returns, potentially impacting payment volumes. For example, if consumer credit card interest rates rise, some individuals might opt for prepaid cards to manage their spending more tightly.

E-commerce and Digital Economy Expansion

The ongoing surge in e-commerce and the digital economy is a major tailwind for Blackhawk Network. This expansion directly fuels the demand for the digital payment, e-gift, and online incentive solutions the company offers. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, up from an estimated $6.3 trillion in 2024, highlighting the vast potential for digital transaction platforms.

This trend necessitates continuous innovation in how digital rewards are delivered and redeemed. Blackhawk Network is well-positioned to capitalize on this by enhancing its digital capabilities and expanding its reach within the online marketplace. The company's focus on flexible digital offerings aligns perfectly with evolving consumer preferences for seamless online purchasing and gifting experiences.

- E-commerce Growth: Global e-commerce sales are expected to hit $7.4 trillion by 2025, a significant increase from 2024 estimates of $6.3 trillion.

- Digital Payment Demand: The shift to online transactions increases the need for secure and efficient digital payment and incentive solutions.

- Innovation Focus: Blackhawk Network's strategy centers on innovating digital delivery and redemption methods to meet evolving consumer expectations.

Unemployment Rates and Disposable Income

High unemployment rates and reduced disposable income directly impact consumer spending on non-essential items, which can negatively affect Blackhawk Network's gift card and loyalty program segments. For instance, as of May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months, signaling potential headwinds for discretionary spending.

Conversely, a strong labor market with low unemployment and rising wages generally translates to increased consumer confidence and greater capacity for spending. This trend would likely benefit Blackhawk Network by driving higher demand for its products and services. In April 2024, average hourly earnings in the U.S. saw a year-over-year increase of 3.9%, indicating a positive trend for disposable income.

- U.S. Unemployment Rate (May 2024): 4.0%

- U.S. Average Hourly Earnings Growth (April 2024): 3.9% year-over-year

- Impact on discretionary spending: Higher unemployment and lower disposable income curb spending on gift cards and loyalty programs.

- Positive economic indicators: Low unemployment and wage growth bolster consumer confidence and spending, benefiting Blackhawk Network.

Economic stability and growth are paramount for Blackhawk Network, as they directly influence consumer discretionary spending on gift cards and incentive programs. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, indicating a generally supportive economic climate for such expenditures.

However, persistent inflation, as seen with cost-of-living pressures in 2024, can erode the purchasing power of stored value products. For example, a 5% inflation rate diminishes the real value of a $100 gift card, potentially encouraging quicker spending or a shift towards essential goods.

Interest rate fluctuations also play a significant role, impacting Blackhawk Network's earnings from the float on stored value. With the Federal Reserve's benchmark rate around 5.25%-5.50% in early 2024, this can provide a boost to interest income on reserves.

The accelerating digital economy and e-commerce growth present a substantial opportunity, with global sales projected to reach $7.4 trillion by 2025, up from $6.3 trillion in 2024, directly fueling demand for Blackhawk's digital solutions.

| Economic Factor | 2024/2025 Data Point | Impact on Blackhawk Network |

|---|---|---|

| Global Economic Growth Projection (IMF) | 3.2% (2024) | Supports discretionary spending on gift cards and incentives. |

| Inflationary Impact on Gift Cards | 5% inflation erodes purchasing power | May encourage faster redemption or shift spending to essentials. |

| Federal Reserve Benchmark Interest Rate | 5.25%-5.50% (Early 2024) | Increases potential interest income on cash reserves. |

| Global E-commerce Sales Projection | $7.4 trillion (2025) vs $6.3 trillion (2024) | Drives demand for digital payment and incentive solutions. |

Preview the Actual Deliverable

Blackhawk Network PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Blackhawk Network delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping its strategic landscape.

Sociological factors

Societies worldwide are increasingly embracing digital and cashless transactions. This shift is fueled by the convenience, enhanced security, and rapid technological advancements that digital payments offer. For instance, in 2024, global digital payment transaction volume was projected to exceed $13 trillion, highlighting this significant trend.

This societal move directly benefits companies like Blackhawk Network, which are positioned to capitalize on this evolution. Their expertise in digital and prepaid payment solutions aligns perfectly with consumer demand for seamless electronic and mobile payment experiences, making their services more relevant than ever.

Consumer adoption of digital wallets is surging, with projections indicating that by 2027, over 2.5 billion people globally will be using them. This trend is driven by convenience and security, directly impacting how Blackhawk Network can distribute and manage its gift card and prepaid products.

For Blackhawk Network, this presents a clear opportunity to embed its offerings within these popular platforms. For instance, integrating with services like Apple Pay or Google Pay allows for wider reach and a more streamlined user experience, crucial for maintaining relevance in a rapidly digitizing market.

The company's success hinges on its capacity to innovate and adapt, ensuring its gift cards and prepaid solutions are easily accessible and usable within these mobile ecosystems. This adaptability is key to capturing new customer segments and retaining existing ones who increasingly prefer digital transactions.

Consumers today are really looking for loyalty programs that feel made just for them, offering rewards that actually matter to them. This trend is a big deal for companies trying to keep customers coming back.

Blackhawk Network is well-positioned to meet this demand. Their services allow businesses to create customized loyalty programs, which is key for boosting customer interest and making sure people stick around. For example, in 2023, a significant portion of consumers reported that personalized offers were more likely to encourage them to make a purchase, highlighting the effectiveness of tailored loyalty strategies.

Financial Inclusion Initiatives

The global drive to bring more people into the formal financial system, particularly those without access to traditional banking, presents a significant opportunity for Blackhawk Network. Their prepaid card offerings can act as a crucial bridge, enabling individuals previously excluded from digital transactions to participate in the growing digital economy. For instance, the World Bank reported in 2023 that around 73% of adults worldwide now have a financial institution or mobile money account, a notable increase that highlights the expanding reach of financial inclusion efforts. This trend directly benefits companies like Blackhawk Network by broadening the potential customer base for their accessible financial products.

These initiatives are not just about providing access; they are about empowering individuals and communities. By offering prepaid solutions, Blackhawk Network can cater to the needs of the unbanked and underbanked, allowing them to receive wages, make purchases, and manage funds more effectively. This aligns with broader societal goals of reducing poverty and fostering economic growth. For example, many governments and NGOs are actively promoting digital payment systems as a means to disburse aid and social benefits, creating a natural market for prepaid card providers.

- Expanding Reach: Financial inclusion efforts are steadily increasing the number of people with access to financial services, creating a larger addressable market for Blackhawk Network's prepaid solutions.

- Digital Economy Gateway: Prepaid cards offer a vital entry point into the digital economy for individuals lacking traditional bank accounts, facilitating online transactions and digital commerce.

- Government and NGO Partnerships: Support from governments and non-governmental organizations for digital payment systems, particularly for social benefits and aid distribution, creates a fertile ground for prepaid card adoption.

Changing Work Culture and Employee Incentives

The shift towards remote and hybrid work models, coupled with the rise of the gig economy, has fundamentally altered employee expectations. This evolving landscape demands more adaptable and digitally-driven approaches to employee incentives and recognition. Companies are increasingly looking for ways to foster engagement and loyalty outside traditional office settings.

Blackhawk Network is strategically positioned to address these new demands with its comprehensive suite of corporate incentive and rewards solutions. Their offerings facilitate flexible and personalized rewards, which are crucial for motivating a dispersed workforce. By providing digital-first platforms, Blackhawk Network helps businesses maintain strong employee connections and drive productivity, even with employees working from various locations.

For instance, a 2024 report indicated that 85% of employees prefer flexible work arrangements, and companies offering such flexibility saw a 10% increase in employee retention. Furthermore, digital reward platforms are becoming a key differentiator, with 70% of employees reporting that a well-designed recognition program significantly impacts their job satisfaction. Blackhawk Network's ability to deliver these digital and flexible solutions directly supports businesses in navigating these critical sociological shifts.

- Increased demand for flexible and digital employee incentives due to remote work.

- Blackhawk Network's offerings align with the need for adaptable rewards.

- Companies using digital rewards see higher employee loyalty and productivity.

- Employee preference for flexible work arrangements is a significant driver of cultural change.

Societal trends show a growing preference for personalized experiences, impacting loyalty programs. In 2023, personalized offers significantly boosted purchase likelihood for a large portion of consumers, underscoring the value of tailored rewards.

Blackhawk Network's capacity to develop customized loyalty programs directly addresses this demand, enhancing customer engagement and retention.

The increasing global focus on financial inclusion is expanding the market for accessible financial products. By 2023, approximately 73% of adults worldwide had a financial institution or mobile money account, demonstrating a growing base for prepaid solutions.

Technological factors

The increasing reliance on digital transactions necessitates stringent cybersecurity. Blackhawk Network's commitment to advanced encryption, sophisticated fraud detection systems, and secure transaction protocols is crucial for safeguarding sensitive financial information and preserving customer confidence, particularly in light of historical data breaches.

Artificial intelligence and machine learning are rapidly reshaping the payments landscape. These technologies are instrumental in bolstering fraud detection capabilities, crafting more personalized customer interactions, and streamlining overall operational efficiency for companies like Blackhawk Network.

Blackhawk Network can harness AI and ML for sophisticated predictive analytics concerning consumer behavior, enabling more precise targeted marketing campaigns. Furthermore, these advancements can automate customer support functions, leading to quicker resolutions and improved customer satisfaction.

In 2024, the global AI in fintech market was valued at an estimated $30.6 billion and is projected to grow significantly, indicating a strong trend towards AI adoption. For instance, AI-powered fraud detection systems can reduce false positives by up to 30%, directly impacting Blackhawk Network's risk management and cost savings.

Blockchain and distributed ledger technologies are gaining traction, promising to revolutionize payment systems with enhanced security, transparency, and efficiency. Blackhawk Network could leverage these advancements for smoother cross-border transactions and to provide greater visibility into its gift card supply chain.

While the widespread adoption of blockchain in payments is still developing, its potential for fraud reduction and faster settlement times is significant. For instance, a report from Grand View Research in 2024 projected the global blockchain in payments market to reach $10.3 billion by 2030, indicating substantial growth and opportunity.

Mobile Payment and Contactless Technology

The increasing prevalence of mobile payment and contactless technology is a significant technological factor influencing Blackhawk Network. To stay competitive, Blackhawk must ensure its digital gift card and payment solutions seamlessly integrate with and are optimized for various mobile operating systems and contactless payment methods, catering to evolving consumer preferences for speed and convenience.

This trend is supported by strong market adoption:

- Mobile payment transaction volume globally was projected to exceed $1.5 trillion in 2024.

- Contactless payments accounted for a significant portion of these transactions, with projections indicating continued growth.

- Consumer demand for frictionless payment experiences is a primary driver for this technological shift.

API-driven Open Banking Initiatives

API-driven Open Banking initiatives are fundamentally reshaping the financial landscape, enabling unprecedented data sharing and interoperability. For Blackhawk Network, this presents a significant opportunity to embed its payment solutions more deeply within the broader financial ecosystem.

By leveraging APIs, Blackhawk Network can achieve seamless integration with a wider array of financial institutions, fintech innovators, and merchant platforms. This connectivity not only streamlines payment processes but also opens avenues for new service offerings and expanded customer reach. For instance, open banking has seen significant growth, with the UK's Open Banking Implementation Entity (OBIE) reporting over 10 million active users by early 2024, showcasing the accelerating adoption and potential for API-driven services.

- Interoperability: APIs allow Blackhawk Network to connect its payment services with third-party applications, creating a more integrated user experience.

- Data Sharing: Secure API access enables Blackhawk to leverage customer data (with consent) for personalized offers and enhanced fraud detection.

- Fintech Collaboration: Open banking APIs foster partnerships with fintechs, allowing Blackhawk to offer innovative digital wallet and payment solutions.

- Market Expansion: By integrating with diverse financial platforms, Blackhawk can tap into new customer segments and geographic markets more efficiently.

The ongoing evolution of cybersecurity threats necessitates continuous investment in advanced protective measures. Blackhawk Network must prioritize robust encryption and sophisticated fraud detection systems to maintain customer trust and safeguard sensitive data, especially given the increasing sophistication of cyberattacks. The global cybersecurity market is projected for substantial growth, with spending expected to reach over $200 billion by 2025, underscoring the critical nature of these investments.

Legal factors

Blackhawk Network, operating as a payment processor and prepaid card provider, is bound by the Payment Card Industry Data Security Standard (PCI DSS). This crucial regulation mandates stringent security measures for handling sensitive cardholder information, impacting operational costs and requiring ongoing investment in compliance. Failure to adhere can result in significant fines, with some reports indicating potential penalties reaching hundreds of thousands of dollars for non-compliance incidents.

Consumer protection laws, like those dictating gift card expiration dates, dormancy fees, and refund policies, significantly shape Blackhawk Network's product offerings and service agreements. For instance, in 2024, many U.S. states have laws limiting or prohibiting expiration dates on gift cards, a trend that continues to evolve.

Adhering to these regulations is crucial for Blackhawk Network to prevent costly legal battles and preserve consumer trust. Non-compliance can lead to substantial fines; for example, in 2023, several companies faced penalties for violating gift card regulations, underscoring the importance of diligent adherence.

Anti-trust and competition laws are critical for Blackhawk Network, given its significant presence in the prepaid and payments sector. Regulatory bodies scrutinize its business practices to prevent anti-competitive behavior.

For instance, the acquisition of Tango Card in 2022, valued at $200 million, likely underwent extensive review to ensure it did not unduly concentrate market power. Such deals are assessed against frameworks like the Sherman Act and Clayton Act in the US, and similar legislation globally, to safeguard fair market competition.

Blackhawk Network's exclusive partnerships, common in its industry, also face scrutiny. Regulators examine whether these agreements limit consumer choice or create unfair barriers for smaller competitors, impacting market dynamics and innovation.

Licensing Requirements for Payment Processors

Operating globally, Blackhawk Network must navigate a complex web of licensing requirements. For instance, as a money transmitter, the company needs specific approvals in numerous U.S. states, with each state having its own set of rules and fees. In 2024, the landscape continues to evolve, with regulators increasingly scrutinizing digital payment services.

These licensing demands directly influence Blackhawk Network's ability to expand its services and reach new markets. The financial and administrative burden of obtaining and maintaining these licenses can be substantial, impacting operational efficiency and profitability. For example, the cost of compliance can run into millions of dollars annually across various jurisdictions.

- Jurisdictional Complexity: Blackhawk Network must secure licenses in each country and often each state or province where it operates, leading to a fragmented regulatory environment.

- Evolving Regulations: Payment processing laws are constantly updated, requiring continuous monitoring and adaptation to remain compliant, especially concerning consumer protection and anti-money laundering (AML) rules.

- Financial Commitments: Obtaining licenses often involves significant application fees, bonding requirements, and ongoing compliance costs, directly affecting the company's financial resources.

- Operational Constraints: Licensing limitations can restrict the types of transactions Blackhawk Network can process or the geographic areas it can serve, impacting its competitive positioning.

GDPR and Other Global Data Protection Laws

Global data protection laws, such as the General Data Protection Regulation (GDPR), significantly impact Blackhawk Network's operations. These regulations govern the collection, processing, and storage of personal data for EU citizens, regardless of where the processing takes place. For instance, GDPR mandates strict consent mechanisms and data subject rights, with non-compliance potentially leading to substantial penalties. In 2023, fines under GDPR reached hundreds of millions of euros, underscoring the financial risk associated with data handling.

Blackhawk Network's extensive international presence means it must navigate a complex web of data privacy frameworks beyond GDPR. These include laws like the California Consumer Privacy Act (CCPA) in the United States and similar legislation emerging in other key markets. Adherence to these diverse regulations is crucial for maintaining customer trust and avoiding costly legal battles and reputational damage. The company's commitment to robust data governance practices is therefore essential for its continued global success.

Key aspects of global data protection laws relevant to Blackhawk Network include:

- Data Minimization: Collecting only the data that is absolutely necessary for a specific purpose.

- Consent Management: Obtaining clear and affirmative consent from individuals before processing their personal data.

- Data Subject Rights: Ensuring individuals can access, rectify, erase, and port their data.

- Cross-Border Data Transfers: Complying with regulations governing the transfer of personal data outside its originating jurisdiction.

Legal and regulatory compliance is paramount for Blackhawk Network, given its role in financial transactions. The company must adhere to stringent data security standards like PCI DSS, with non-compliance potentially incurring fines in the hundreds of thousands of dollars. Consumer protection laws, particularly regarding gift card terms, are also critical, with many U.S. states in 2024 prohibiting or limiting dormancy fees and expiration dates.

Environmental factors

Consumers and businesses are increasingly prioritizing sustainability, pushing companies to adopt greener operations. This trend directly impacts Blackhawk Network, as evidenced by their shift from plastic to paper-based physical gift cards. This move reflects a commitment to reducing environmental impact, a crucial factor for maintaining brand reputation and customer loyalty in 2024 and beyond.

The environmental impact of traditional plastic gift cards is a growing concern. Blackhawk Network is actively addressing this by transitioning a substantial portion of its physical card production to paper-based materials. This strategic shift, targeted for completion by the end of 2024 and continuing thereafter, is designed to significantly curb plastic waste within the payments sector.

Blackhawk Network's reliance on data centers for its digital payment infrastructure means its environmental impact is closely tied to energy consumption. These facilities are significant power users, and as global awareness of climate change grows, so does scrutiny on corporate energy footprints.

In 2024, data centers globally are estimated to consume around 1.5% of the world's electricity, a figure projected to rise. This presents a direct challenge for technology companies like Blackhawk, as their digital operations are inherently energy-intensive, contributing to their overall carbon emissions.

Consequently, Blackhawk Network is likely to encounter increasing pressure from stakeholders, regulators, and consumers to transition towards more sustainable practices. This could involve investing in energy-efficient hardware, optimizing cooling systems, and sourcing power from renewable energy providers, such as solar or wind farms, to mitigate its environmental impact.

Corporate Social Responsibility (CSR)

Blackhawk Network actively participates in corporate social responsibility (CSR) programs, focusing on environmental sustainability and community support. These efforts enhance their brand reputation and meet growing stakeholder demands for responsible business practices. For instance, in 2023, Blackhawk reported a 15% reduction in its carbon footprint compared to 2022, driven by initiatives like optimizing logistics and promoting remote work.

The company's commitment extends to philanthropic endeavors, aligning with societal expectations for businesses to contribute positively beyond their core operations. This focus on CSR is increasingly becoming a competitive differentiator, influencing consumer choices and investor decisions.

- Environmental Sustainability: Blackhawk Network is committed to reducing its environmental impact, with a stated goal of achieving carbon neutrality by 2030.

- Philanthropic Efforts: The company actively supports various charities and community programs, with over $2 million donated globally in 2024.

- Stakeholder Alignment: CSR initiatives are crucial for meeting the expectations of customers, employees, and investors who prioritize ethical and sustainable business operations.

- Brand Reputation: Strong CSR performance positively influences Blackhawk Network's brand image, fostering trust and loyalty among its diverse stakeholder groups.

Carbon Footprint of Operations

Beyond the physical gift cards, Blackhawk Network's global operations carry a significant carbon footprint. This includes the energy consumed by their logistics networks, the electricity used in their office buildings worldwide, and the power required for their digital infrastructure. Addressing these areas is crucial for environmental responsibility.

Partnerships are a key strategy for Blackhawk Network to mitigate its environmental impact. For instance, collaborations with companies like Mastercard are designed to actively reduce greenhouse gas emissions and boost energy efficiency across their shared operations. This focus on efficiency is becoming increasingly important for businesses in the digital age.

The company's commitment extends to optimizing its supply chain and data centers. For example, in 2024, many companies in the payments sector are investing in renewable energy sources for their data centers, aiming for a 20% reduction in their operational carbon emissions by 2027. Blackhawk Network is likely pursuing similar initiatives to align with these industry trends.

- Global Operations Impact: Encompasses logistics, office energy, and digital infrastructure.

- Partnership for Sustainability: Collaborations with entities like Mastercard to cut emissions.

- Energy Efficiency Focus: Initiatives aimed at reducing the carbon intensity of their digital and physical networks.

Blackhawk Network is actively transitioning from plastic to paper-based gift cards, a move expected to significantly reduce plastic waste by the end of 2024. Their digital operations, however, rely on energy-intensive data centers, which in 2024 consumed about 1.5% of global electricity. The company reported a 15% carbon footprint reduction in 2023 compared to 2022, driven by logistics optimization and remote work policies.

| Environmental Factor | Blackhawk Network's Response/Impact | Data Point/Trend |

|---|---|---|

| Plastic Waste Reduction | Transitioning to paper-based gift cards | Targeted completion by end of 2024 |

| Energy Consumption (Data Centers) | Operational reliance on power-intensive facilities | Global data center electricity use ~1.5% in 2024 |

| Carbon Footprint | Initiatives for reduction | 15% reduction reported in 2023 vs. 2022 |

| Renewable Energy Adoption | Potential investment in green energy for operations | Industry trend: 20% reduction target by 2027 for data centers |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Blackhawk Network draws upon a diverse range of data, including financial reports from regulatory bodies, economic indicators from leading institutions like the IMF and World Bank, and analyses of technological advancements from industry research firms. This comprehensive approach ensures a well-rounded understanding of the external factors influencing the company.