Blackhawk Network Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackhawk Network Bundle

Blackhawk Network operates within a dynamic landscape shaped by intense rivalry and the significant bargaining power of both buyers and suppliers. Understanding these forces is crucial for navigating its competitive environment.

The threat of new entrants and the availability of substitutes also present considerable challenges, impacting Blackhawk Network's pricing power and market share.

Ready to move beyond the basics? Get a full strategic breakdown of Blackhawk Network’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration is a major factor in Blackhawk Network's bargaining power. Key suppliers, like Visa and Mastercard, represent a significant portion of the payment processing landscape. The limited number of dominant players in this space inherently grants them considerable leverage.

Technology providers essential for payment processing and the brands that supply gift cards also contribute to this concentration. When a few entities control crucial inputs, their ability to dictate terms and pricing intensifies, directly impacting Blackhawk's operational costs and profit margins.

The costs and complexities Blackhawk Network faces when switching suppliers significantly influence supplier power. If Blackhawk needs to re-integrate payment systems or renegotiate extensive brand partnerships, existing suppliers gain leverage due to these high switching costs.

For instance, a major shift in their gift card processing infrastructure could involve substantial IT investment and potential disruptions to customer service, making a change costly and time-consuming. This complexity directly empowers suppliers who offer specialized or deeply integrated services.

Blackhawk's strategic acquisitions, such as Tango Card in 2020 for $230 million, play a role in mitigating this. By bringing certain capabilities in-house, Blackhawk can reduce its dependence on external providers for services like digital gift card fulfillment, thereby lessening the bargaining power of those specific suppliers.

The uniqueness of supplier offerings significantly impacts their bargaining power with Blackhawk Network. If a supplier provides proprietary technology or exclusive access to popular gift card brands, their leverage increases. For instance, a supplier holding exclusive rights to a widely recognized and in-demand retail gift card program can command better terms.

Blackhawk Network's ability to maintain a diverse and attractive product catalog is directly tied to the unique value proposition of its suppliers. In 2024, the gift card market continued to see strong demand, with U.S. gift card sales projected to reach over $200 billion, underscoring the importance of securing exclusive or highly desirable brand partnerships.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Blackhawk Network's business operations significantly influences supplier bargaining power. If key payment networks or major gift card issuers were to establish their own direct distribution channels and incentive management systems, it could diminish Blackhawk's role and market presence.

However, the intricate nature of managing a vast and varied distribution network often acts as a deterrent for suppliers considering such a move. For example, in 2024, the global gift card market was valued at over $350 billion, a complex ecosystem with numerous touchpoints that suppliers would need to replicate. The significant investment and operational expertise required to directly manage such a scale, including customer service, fraud prevention, and diverse redemption options, generally makes forward integration a less attractive strategy for many suppliers.

This complexity means that while the potential exists, the practical execution often limits the actual threat, thereby moderating the bargaining power suppliers might otherwise wield through this avenue.

- Supplier Forward Integration Threat: Major payment networks or large gift card brands could bypass Blackhawk by directly managing their own distribution and incentive programs.

- Market Impact: Such a move would directly compete with Blackhawk, potentially reducing its market share and revenue streams.

- Deterrents to Integration: The high complexity and significant investment required to manage a diverse distribution network often discourage suppliers from integrating forward.

- Market Size Context: The global gift card market's substantial size and intricate operational demands (over $350 billion in 2024) highlight the challenges suppliers would face in replicating Blackhawk's infrastructure.

Importance of Blackhawk to Suppliers

The significance of Blackhawk Network as a customer directly impacts its suppliers' bargaining power. When Blackhawk constitutes a substantial part of a supplier's revenue stream, that supplier may be more amenable to negotiating favorable terms and pricing. This is particularly true for smaller or specialized suppliers who rely heavily on consistent business from large partners.

Blackhawk Network's extensive global presence and considerable transaction volumes position it as a major client for numerous brands and payment processing entities. This scale means that suppliers, especially those in the gift card and prepaid services sector, often view Blackhawk as a critical channel for reaching a broad consumer base. For example, in 2024, Blackhawk reported facilitating billions of dollars in transactions across its various platforms, underscoring its importance to its network of partners.

- Blackhawk's substantial transaction volume in 2024 highlights its critical role for many suppliers.

- A significant portion of a supplier's revenue often comes from their relationship with Blackhawk, increasing Blackhawk's leverage.

- The global reach of Blackhawk makes it an attractive and important partner for brands seeking wider distribution.

The bargaining power of suppliers for Blackhawk Network is influenced by several factors, including supplier concentration, switching costs, and the uniqueness of their offerings. Key players like Visa and Mastercard, along with essential technology providers and popular gift card brands, hold significant leverage due to market concentration and the complexities involved in switching. Blackhawk's strategic acquisitions aim to reduce this dependence, but the inherent value of exclusive brand partnerships remains a strong point for suppliers.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (2024 Context) |

|---|---|---|

| Supplier Concentration | High | Dominant payment networks (Visa, Mastercard) and key gift card brands limit alternatives. |

| Switching Costs | High | Re-integrating payment systems or renegotiating brand partnerships involves significant IT investment and potential disruption. |

| Uniqueness of Offerings | High | Exclusive access to popular brands or proprietary technology increases supplier leverage. |

| Forward Integration Threat | Moderate | While possible, the complexity of managing Blackhawk's vast network (global gift card market over $350 billion in 2024) deters many suppliers. |

| Customer Significance | Low to Moderate | Blackhawk's substantial transaction volumes (billions facilitated in 2024) make it a critical customer for many suppliers, increasing Blackhawk's leverage. |

What is included in the product

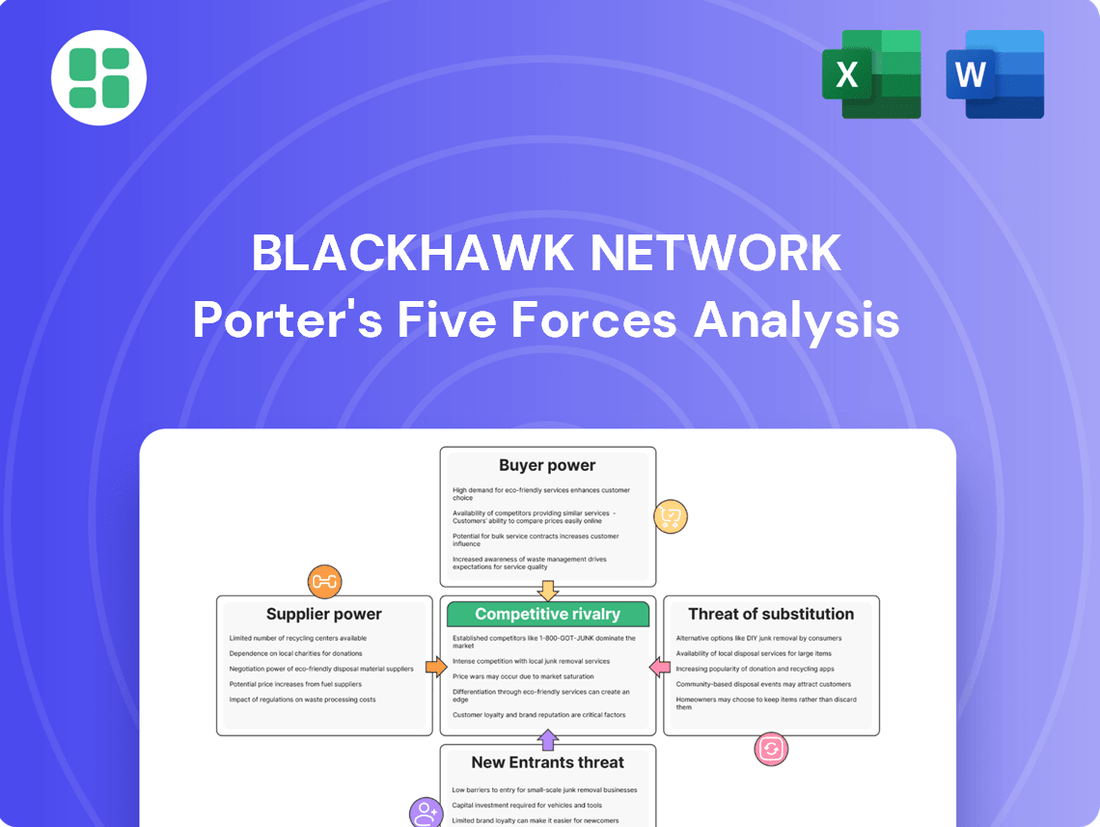

Analyzes the competitive intensity and profitability potential for Blackhawk Network by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and existing industry rivalry.

Effortlessly visualize the competitive landscape and identify strategic vulnerabilities with Blackhawk Network's Porter's Five Forces analysis, providing immediate clarity on market pressures.

Customers Bargaining Power

Blackhawk Network's customer base is largely concentrated among major retailers, corporations utilizing their incentive and engagement programs, and prominent brands. This concentration means that significant clients, by virtue of their substantial transaction volumes, possess considerable leverage to negotiate more favorable pricing and bespoke service arrangements, directly impacting Blackhawk's margins.

For instance, a single large retail partner might account for a notable percentage of Blackhawk's gift card distribution. If this partner were to demand a reduction in Blackhawk's commission rates or more sophisticated integration services, their substantial business volume would lend significant weight to these demands, potentially forcing Blackhawk to concede to maintain the relationship.

However, Blackhawk Network’s strategy of serving a broad spectrum of sectors, from general retail to specialized corporate rewards, helps to diffuse the bargaining power of any single customer. This diversification means that the loss or unfavorable renegotiation with one major client is less likely to cripple the company, as other customer segments can absorb or offset the impact.

Customer switching costs significantly influence the bargaining power of Blackhawk Network's clients, primarily retailers and businesses. If a customer finds it difficult or expensive to transition away from Blackhawk's payment and loyalty solutions, their ability to negotiate better terms is diminished.

High switching costs can arise from substantial investments in IT infrastructure, employee training on new systems, or the potential loss of customer data and established loyalty program benefits. For instance, if a retailer has deeply integrated Blackhawk's platform into their point-of-sale systems, the effort and expense to migrate to a competitor could be considerable, thereby limiting their leverage.

Blackhawk Network actively works to increase customer stickiness by providing seamless integration and value-added services, aiming to make the cost and complexity of switching prohibitively high for their clients. This strategy directly counters the bargaining power of customers by making it less attractive to explore alternative providers.

Customers' sensitivity to pricing significantly impacts their bargaining power with Blackhawk Network. For services perceived as commodities, such as basic prepaid cards or straightforward payment processing, customers are highly attuned to cost. This price sensitivity intensifies in competitive markets, driving customers to seek the most economical options and consequently pressuring Blackhawk's profit margins.

Blackhawk Network actively works to mitigate this by focusing on differentiation through value-added services. These offerings, including advanced analytics, robust fraud prevention, and loyalty program management, aim to provide benefits beyond mere transaction processing. By demonstrating unique value, Blackhawk seeks to reduce the perception of its services as interchangeable commodities, thereby lessening direct price-based competition.

Threat of Backward Integration by Customers

The threat of backward integration by customers is a key factor in Blackhawk Network's bargaining power. Large clients, such as major retailers or corporations, could potentially develop their own in-house payment or incentive solutions if Blackhawk's offerings become prohibitively expensive or lack the necessary flexibility. This is a significant consideration, as it directly impacts the stickiness of Blackhawk's customer relationships.

For instance, if a large enterprise finds Blackhawk's transaction fees or customization options to be a bottleneck, they might explore building a proprietary system. This is particularly relevant in the loyalty and rewards space, where companies are increasingly looking to control the customer experience. While the technical expertise required for such an undertaking is substantial, the potential cost savings and greater control can be a strong motivator for larger players.

However, the specialized nature of payment technology and the complexities of regulatory compliance often make backward integration impractical for many customers. Developing and maintaining secure, efficient, and compliant payment platforms requires significant investment in technology and skilled personnel. This complexity acts as a natural barrier, limiting the number of customers who can realistically pursue this strategy.

- Customer Integration Costs: The significant upfront investment and ongoing maintenance costs associated with building proprietary payment solutions often outweigh the perceived benefits for most of Blackhawk Network's customer base.

- Specialized Expertise Required: Developing and managing secure, compliant, and scalable payment and incentive platforms demands specialized technical talent that many companies may not possess in-house.

- Market Dynamics: The rapid evolution of payment technology and evolving consumer expectations necessitate continuous innovation, making it challenging for individual companies to keep pace without dedicated resources.

- Focus on Core Competencies: Most businesses prefer to concentrate on their primary operations rather than diverting resources to complex payment infrastructure, thus relying on specialized providers like Blackhawk Network.

Information Availability to Customers

Customers' access to information significantly impacts their bargaining power. In the fintech sector, increased transparency allows consumers to readily compare services and pricing from various providers. For instance, a 2024 report indicated that over 70% of consumers research financial products online before making a decision, directly empowering them to seek better deals.

This heightened information availability puts pressure on companies like Blackhawk Network to clearly articulate their distinct advantages. Customers can easily compare loyalty program benefits, payment processing fees, and digital wallet features across different platforms. This ease of comparison can lead to greater price sensitivity.

- Information Access: Over 70% of consumers in 2024 utilized online resources to research financial products, enhancing their ability to compare offerings.

- Market Transparency: The fintech landscape's growing transparency facilitates easier comparison of services and pricing, potentially driving down costs for consumers.

- Value Proposition: Blackhawk Network must continuously emphasize its unique network, security features, and customer experience to counter the commoditization driven by information availability.

The bargaining power of Blackhawk Network's customers is a significant factor, driven by their concentration, switching costs, and price sensitivity. Large clients, such as major retailers or corporations, wield considerable leverage due to their substantial transaction volumes, enabling them to negotiate favorable pricing and customized services. While Blackhawk's diversified customer base mitigates the impact of any single client's demands, the potential for large customers to seek alternatives or even develop in-house solutions remains a key consideration.

Customer switching costs are a crucial element, as high integration expenses, training requirements, and potential data loss make it difficult for clients to move away from Blackhawk's established platforms. This stickiness, actively fostered by Blackhawk through seamless integration and value-added services, directly reduces customer leverage. Furthermore, customers' access to readily available market information in 2024, with over 70% researching financial products online, increases price sensitivity and compels Blackhawk to highlight its unique value proposition beyond basic transaction processing.

| Factor | Impact on Blackhawk Network | Mitigation Strategies |

| Customer Concentration | High leverage for large clients, impacting margins | Diversification across sectors |

| Switching Costs | Lowers customer bargaining power if high | Value-added services, seamless integration |

| Price Sensitivity | Intensifies pressure on profit margins | Focus on differentiation, unique benefits |

| Backward Integration Threat | Potential for large clients to build in-house solutions | Complexity of specialized platforms, regulatory hurdles |

Preview Before You Purchase

Blackhawk Network Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Blackhawk Network, detailing the competitive landscape and strategic positioning within the prepaid and loyalty solutions market. The document you see here is the exact, fully formatted analysis you'll receive immediately upon purchase, offering actionable insights without any placeholders or surprises. This professional assessment will equip you with a thorough understanding of the industry's dynamics, enabling informed strategic decision-making for Blackhawk Network.

Rivalry Among Competitors

Blackhawk Network operates in a crowded prepaid and digital payments landscape, facing a multitude of competitors. This includes established financial institutions, specialized prepaid providers like InComm Payments and CardCash, and dynamic fintech companies offering digital wallet solutions.

The sheer number and diversity of these players, such as Edenred Group which serves over 50 million users globally, contribute to a highly competitive environment. This intensity means companies must constantly innovate and offer compelling value propositions to capture and retain market share.

The robust expansion within the digital payments, prepaid card, and gift card sectors significantly fuels competitive rivalry. As these markets grow, numerous companies are actively seeking to capture a larger share of the increasing demand, leading to a more intense battle for customers and market dominance.

The global payment processing solutions market is a prime example, with projections indicating a compound annual growth rate of 16.3% between 2024 and 2025. Similarly, the gift card market is experiencing substantial growth, further intensifying competition as more players enter and existing ones expand their offerings to capitalize on these expanding opportunities.

The intensity of competition within the gift card and payments sector is significantly shaped by how effectively companies can differentiate their products and services. This differentiation often hinges on innovation, the inclusion of unique features, and the delivery of exceptional customer service. For instance, while many providers offer standard gift card functionalities, leading players distinguish themselves through advanced data analytics capabilities, the creation of customized incentive programs tailored to specific business needs, and the seamless integration of digital payment solutions.

Blackhawk Network's strategic acquisition of Tango Card in late 2023 is a prime example of this differentiation strategy in action. This move bolstered Blackhawk's capacity to deliver a more sophisticated, digital-first reward experience for its clients and their customers. Such enhancements are crucial in a market where consumers increasingly expect intuitive and versatile digital payment options, making it harder for competitors to simply offer basic, undifferentiated services.

Switching Costs for Customers

The payment solutions industry, including Blackhawk Network's sector, generally exhibits low switching costs for customers. This means businesses can readily shift their payment processing or incentive program needs to another provider without significant financial or operational hurdles. This ease of transition directly fuels intense competitive rivalry.

For Blackhawk Network, this translates into a constant need to differentiate and provide exceptional value. Competitors such as TruCentive and Online Rewards offer comparable incentive solutions, making it crucial for Blackhawk to leverage its network effects and service quality to maintain customer loyalty. In 2024, the market continues to see new entrants, further intensifying this dynamic.

- Low Switching Costs: Customers can easily move between payment and incentive providers, increasing competitive pressure.

- Competitive Landscape: Blackhawk Network faces rivals like TruCentive and Online Rewards, offering similar solutions.

- Customer Retention Strategy: Demonstrating superior value and strong network effects is critical for retaining clients in 2024.

Strategic Stakes and Exit Barriers

The payments industry, including players like Blackhawk Network, is characterized by high strategic stakes. Companies invest heavily in technology, infrastructure, and network expansion, making it difficult to disengage. For instance, the global digital payments market was valued at approximately $7.7 trillion in 2023 and is projected to reach over $15 trillion by 2029, highlighting the immense capital commitment required to compete.

High exit barriers further intensify competitive rivalry. These barriers can include specialized, non-transferable assets and entrenched long-term contracts with partners and merchants. When companies cannot easily exit, they often engage in more aggressive strategies to maintain or improve their market position, even if it means lower short-term profitability.

Blackhawk Network's ownership by private equity firms, such as Silver Lake, suggests a long-term strategic perspective. Private equity typically aims to optimize operations and market position over several years, often involving significant reinvestment rather than a quick exit. This can translate into sustained, aggressive competition as Blackhawk seeks to solidify its market share and enhance its value proposition.

- High Investment: The payments sector demands substantial upfront and ongoing investment in technology and network development.

- Entrenched Players: Significant investments create high barriers to entry and make exiting the market costly.

- Aggressive Competition: Companies are incentivized to fight for market share due to the difficulty of leaving.

- Private Equity Influence: Blackhawk's PE backing implies a long-term strategy, potentially leading to continued aggressive market engagement.

The competitive rivalry within Blackhawk Network's operating space is intense due to numerous players and the rapid growth of digital payments and prepaid services. Companies like InComm Payments and Edenred Group, which serves over 50 million users, are significant rivals. The market is further heated by new entrants and existing players expanding their offerings to capture a larger share of a market projected to see the global digital payments market reach over $15 trillion by 2029.

Differentiation through innovation, unique features, and superior customer service is key, as evidenced by Blackhawk's acquisition of Tango Card to enhance its digital reward capabilities. Low switching costs for customers mean providers must constantly offer compelling value to retain business, with companies like TruCentive and Online Rewards presenting direct competition in 2024.

High strategic stakes and significant investments in technology and infrastructure create high exit barriers, encouraging aggressive competition. Blackhawk Network's private equity ownership suggests a long-term strategy focused on market position, further contributing to sustained rivalry as companies fight for market share in a sector demanding substantial capital commitment.

| Competitor Type | Key Players | Market Growth Driver | Competitive Tactic Example |

|---|---|---|---|

| Specialized Prepaid Providers | InComm Payments, CardCash | Expanding gift card market | Offering advanced data analytics |

| Fintech Digital Wallets | Various emerging companies | Increasing demand for digital payments | Seamless integration of payment solutions |

| Global Payment Processors | Edenred Group | Growth in global payment processing solutions (CAGR 16.3% 2024-2025) | Acquisitions to bolster digital offerings (e.g., Tango Card) |

| Incentive Program Providers | TruCentive, Online Rewards | Need for customized business solutions | Leveraging network effects and service quality |

SSubstitutes Threaten

The threat of traditional payment methods like cash and physical checks continues to exist as substitutes for Blackhawk Network's digital and prepaid offerings, especially among demographics less comfortable with digital technologies. Despite the significant growth in digital payments, cash still accounts for a portion of consumer transactions, representing a persistent substitute.

Large corporations and major retailers possess the resources to develop their own in-house solutions for managing rewards, incentives, and closed-loop payment systems. This presents a direct substitute for Blackhawk Network's enterprise services. For instance, a large retail chain could invest in building its proprietary loyalty program infrastructure, potentially reducing reliance on third-party providers.

However, the significant investment in technology, ongoing maintenance, and specialized expertise required to create and operate these internal systems often outweighs the benefits. Building a robust and secure platform from scratch can be prohibitively expensive and time-consuming. In 2024, the average cost for a large enterprise to develop and maintain a custom loyalty program platform can range from several million to tens of millions of dollars annually, making outsourcing to established players like Blackhawk a more pragmatic choice for many.

The proliferation of direct-to-consumer digital gifting platforms and peer-to-peer payment applications like Venmo and Zelle poses a significant threat of substitution for traditional gift cards and incentive programs managed by companies like Blackhawk Network. These digital alternatives provide consumers with instant and often more personalized ways to send money or gifts, bypassing the need for pre-purchased gift cards. For instance, by mid-2024, Venmo reported over 90 million users, highlighting the widespread adoption of these convenient payment methods for personal transactions, including gifting.

Alternative Loyalty and Reward Mechanisms

Businesses can bypass traditional gift card and prepaid card loyalty programs by offering direct discounts, branded merchandise, or unique experiential rewards. This diversifies how customer loyalty is cultivated, moving beyond stored value products.

Software providers like incentX and Preferred Patron Loyalty offer robust platforms for managing a wide array of loyalty initiatives. These systems enable businesses to implement points-based rewards, tiered membership benefits, and personalized offers, directly substituting the need for third-party gift card solutions.

The market for customer loyalty solutions is substantial. For instance, the global loyalty management market was valued at approximately $3.3 billion in 2023 and is projected to grow significantly, indicating a strong demand for alternative loyalty mechanisms.

- Direct Discounts: Offering immediate price reductions on products or services.

- Merchandise Rewards: Providing branded goods or relevant items as incentives.

- Experiential Rewards: Creating unique opportunities like event access or special services.

- Loyalty Software Platforms: Utilizing technology to manage points, tiers, and personalized engagement.

Emerging Fintech Innovations

Emerging fintech innovations present a significant threat of substitutes for Blackhawk Network. The rapid growth of blockchain-enabled payments, embedded finance, and buy-now-pay-later (BNPL) services offers consumers and businesses alternative, often more convenient or cost-effective, methods for transactions and financial management. For instance, the global BNPL market was projected to reach over $3.6 trillion by 2024, highlighting the accelerating adoption of these substitute solutions.

Blackhawk must actively innovate to counter these evolving alternatives. The increasing integration of financial services directly into non-financial platforms through embedded finance, for example, allows users to complete transactions without needing separate payment providers, directly impacting traditional payment facilitators. This trend is seeing substantial investment, with the embedded finance market expected to grow significantly in the coming years.

- Blockchain Payments: Offering faster, cheaper cross-border transactions, bypassing traditional banking infrastructure.

- Embedded Finance: Seamlessly integrating financial services into non-financial applications, reducing reliance on dedicated payment platforms.

- Buy-Now-Pay-Later (BNPL): Providing flexible payment options at the point of sale, appealing to consumer demand for deferred payments.

While Blackhawk Network's digital and prepaid solutions are strong, traditional methods like cash and checks remain substitutes, particularly for less digitally-inclined consumers. Despite the digital shift, cash still holds a transaction share, representing a persistent alternative. Furthermore, large corporations can develop proprietary loyalty and payment systems, directly substituting Blackhawk's enterprise services, though the substantial investment required often makes outsourcing more practical. For example, building a custom loyalty platform can cost millions annually.

The rise of direct-to-consumer digital gifting and peer-to-peer payment apps like Venmo, which boasts over 90 million users by mid-2024, directly challenges traditional gift cards and incentive programs. Businesses are also increasingly offering direct discounts, merchandise, or experiential rewards as alternatives to stored-value products. Loyalty software platforms from providers like incentX also offer comprehensive solutions, substituting the need for third-party gift card management. The global loyalty management market, valued at approximately $3.3 billion in 2023, highlights the demand for diverse loyalty mechanisms.

| Substitute Category | Examples | Impact on Blackhawk Network | Market Trend/Data Point (2024) |

|---|---|---|---|

| Traditional Payment Methods | Cash, Checks | Persistent, especially with certain demographics | Cash still accounts for a portion of consumer transactions. |

| In-House Corporate Solutions | Proprietary loyalty programs, closed-loop systems | Direct substitute for enterprise services | Development and maintenance costs can be millions annually. |

| Digital P2P & Gifting Platforms | Venmo, Zelle, digital gift cards | Challenging traditional gift cards and incentives | Venmo had over 90 million users by mid-2024. |

| Alternative Loyalty Rewards | Direct discounts, merchandise, experiences | Diversifies customer engagement beyond stored value | Global loyalty management market valued at ~$3.3 billion in 2023. |

| Emerging Fintech | Blockchain payments, BNPL, embedded finance | Offers alternative transaction and financial management methods | BNPL market projected to exceed $3.6 trillion by 2024. |

Entrants Threaten

The substantial capital outlay needed to establish a global payment network, encompassing infrastructure, advanced technology, and rigorous compliance, presents a formidable barrier for potential new entrants aiming to compete with Blackhawk Network. This includes the costs associated with building out secure transaction processing capabilities and data management systems.

Furthermore, cultivating the extensive relationships required with a diverse array of brands, retailers, and financial partners demands significant investment in business development and ongoing operational support. For instance, onboarding new merchants often involves complex integration processes and dedicated account management resources.

The financial services and payments sector, where Blackhawk Network operates, is heavily regulated. New companies must contend with stringent rules like anti-money laundering (AML) and know-your-customer (KYC) requirements, alongside robust data security mandates. These compliance demands create a significant barrier to entry, requiring substantial investment in legal and operational infrastructure.

Blackhawk Network thrives on powerful network effects; the more brands, retailers, and consumers join its platform, the more valuable it becomes for everyone. This creates a significant barrier to entry, as new competitors would need substantial resources and time to replicate the established trust and reach Blackhawk possesses.

In 2024, Blackhawk's extensive network of over 40,000 retail locations and partnerships with thousands of brands underscores this advantage. This deep integration and widespread adoption make it incredibly challenging for newcomers to gain comparable market penetration and consumer recognition quickly.

Access to Distribution Channels

New companies looking to enter the gift card and prepaid payments market face significant hurdles in securing access to established distribution channels. Blackhawk Network, for instance, has cultivated deep relationships with a wide array of retailers, from major grocery chains to electronics stores, and maintains a strong presence on prominent online marketplaces. This extensive network, built over years of operation, is not easily replicated by newcomers.

These established partnerships mean that new entrants struggle to get their products onto the shelves or digital storefronts where consumers actively purchase gift cards and prepaid solutions. Blackhawk's existing infrastructure and agreements provide them with a substantial competitive moat, making it difficult for emerging players to gain comparable visibility and sales volume. For example, as of early 2024, Blackhawk Network's distribution network spans tens of thousands of retail locations globally, a testament to the scale of their established channel access.

- Limited Retail Placement: New entrants find it difficult to secure shelf space in major retail chains, a key sales channel for gift cards.

- Online Platform Barriers: Gaining prominent placement on popular e-commerce sites is challenging due to existing partnerships and platform requirements.

- Established Brand Trust: Consumers often gravitate towards familiar brands like those distributed by Blackhawk, making it harder for new entrants to build credibility.

- High Setup Costs: The investment required to build a comparable distribution network, including technology integration and marketing, is substantial.

Proprietary Technology and Patents

Blackhawk Network's substantial investment in proprietary payment technologies and data analytics, protected by patents, acts as a significant deterrent to new entrants. This focus on innovation, evident in their ongoing R&D efforts, creates a high barrier. For instance, in 2024, Blackhawk continued to emphasize the development of secure and advanced digital payment solutions, a costly endeavor for any newcomer.

Developing comparable, sophisticated, and secure payment systems requires considerable research and development expenditure and a significant time investment. This technological moat makes it challenging for new players to compete effectively on innovation and security alone.

- Proprietary Technology: Blackhawk Network invests heavily in unique payment processing and data analytics platforms.

- Patents and IP: These technologies are often protected by patents, creating a legal barrier.

- R&D Investment: Continuous investment in research and development is crucial to maintain this advantage.

- Time and Cost: Replicating Blackhawk's technological sophistication requires substantial time and financial resources for new entrants.

The threat of new entrants in Blackhawk Network's market is significantly mitigated by the immense capital required for infrastructure, technology, and regulatory compliance. Building a global payment network demands substantial upfront investment, creating a high barrier for potential competitors. Furthermore, Blackhawk's established relationships with thousands of brands and retailers, coupled with strong network effects, make it exceedingly difficult for newcomers to gain comparable market penetration and consumer trust. In 2024, Blackhawk's extensive distribution network, reaching tens of thousands of retail locations globally, highlights the difficulty new entrants face in securing vital sales channels and achieving similar visibility.

| Barrier Category | Description | Impact on New Entrants | Example (2024) |

|---|---|---|---|

| Capital Requirements | Establishing global payment infrastructure, technology, and compliance. | Very High - Requires significant upfront investment. | Costs for secure transaction processing and data management systems. |

| Brand & Retailer Relationships | Cultivating extensive partnerships with brands and retailers. | High - Takes considerable time and effort to build trust and integration. | Onboarding new merchants involves complex integration and dedicated support. |

| Regulatory Compliance | Adhering to stringent financial regulations (AML, KYC, data security). | High - Demands substantial investment in legal and operational infrastructure. | Meeting anti-money laundering and data privacy mandates. |

| Network Effects | Value increases with more users (brands, retailers, consumers). | High - New entrants struggle to match established reach and trust. | Blackhawk's widespread adoption makes it difficult for newcomers to replicate value. |

| Distribution Channels | Securing access to established retail and online sales platforms. | Very High - Existing partnerships limit shelf space and prominent placement for newcomers. | Blackhawk's presence in tens of thousands of retail locations globally. |

| Proprietary Technology | Investment in patented payment technologies and data analytics. | High - Replicating sophisticated and secure systems is costly and time-consuming. | Blackhawk's ongoing R&D in advanced digital payment solutions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Blackhawk Network leverages data from financial filings, investor presentations, and industry-specific market research reports to assess competitive intensity and strategic positioning.