Blackhawk Network Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackhawk Network Bundle

Unlock the strategic blueprint behind Blackhawk Network's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect businesses with consumers through innovative gift card and payment solutions. Discover their key partners, revenue streams, and customer relationships to gain a competitive edge.

Partnerships

Blackhawk Network heavily relies on its relationships with both brick-and-mortar stores and online merchants to get its gift cards and prepaid products into consumers' hands. These collaborations are vital for increasing their market presence and ensuring broad accessibility, tapping into established customer bases and digital storefronts.

In 2024, Blackhawk Network continued to strengthen its ties with major retailers, with reports indicating a significant portion of their revenue is directly tied to these distribution agreements. For instance, their partnerships with leading grocery chains and big-box stores allow for millions of transactions annually, demonstrating the sheer volume and importance of these retail alliances.

Blackhawk Network collaborates with a vast array of brands, from major retailers to niche content providers. This allows them to curate a comprehensive selection of gift cards and digital content, meeting diverse consumer preferences. For instance, in 2024, their platform featured offerings from over 200,000 merchant locations globally, demonstrating the breadth of these brand relationships.

These strategic brand partnerships are crucial for developing co-branded payment solutions and sophisticated loyalty programs. Such collaborations enhance Blackhawk Network's value proposition by offering consumers integrated experiences and rewarding engagement, directly contributing to increased transaction volumes and customer retention.

Blackhawk Network's key partnerships with payment processors and financial institutions are crucial for its operational backbone. These collaborations enable the secure and seamless processing of billions of dollars in transactions annually, covering everything from card issuance to the final settlement of funds. For instance, in 2024, Blackhawk continued to leverage its extensive network of financial partners to facilitate the distribution and redemption of prepaid cards and gift cards across various retail and digital channels.

Technology and Platform Providers

Blackhawk Network relies heavily on strategic alliances with technology and platform providers to build and sustain its sophisticated payment and loyalty ecosystems. These collaborations are crucial for integrating cutting-edge functionalities into their digital wallets and gift card solutions, ensuring a seamless and modern user experience.

These partnerships enable Blackhawk to stay ahead of the curve by incorporating emerging technologies, thereby enhancing their existing platforms. For instance, in 2024, continued investment in API integrations with major tech firms has been a priority to broaden the reach and utility of their digital payment offerings.

- API Integrations: Expanding connections with financial institutions and fintech companies to facilitate smoother transaction processing and data exchange.

- Cloud Infrastructure: Partnering with leading cloud service providers to ensure scalability, security, and reliability of their digital platforms.

- Data Analytics Tools: Collaborating with data science firms to leverage advanced analytics for personalized customer experiences and fraud detection.

Corporate and Incentive Program Partners

Blackhawk Network actively partners with a wide array of corporations and organizations to power their incentive, reward, and engagement initiatives. These collaborations are crucial for Blackhawk's B2B segment, enabling them to offer tailored prepaid solutions for employee recognition, customer loyalty programs, and impactful promotional campaigns.

For instance, in 2024, Blackhawk continued to solidify its position by facilitating millions of transactions for businesses seeking to motivate workforces and enhance customer relationships. Their prepaid cards and digital rewards are integrated into diverse corporate structures, driving measurable improvements in employee morale and customer retention.

Key aspects of these partnerships include:

- B2B Market Access: Providing businesses with a robust platform to manage and distribute incentives, reaching employees and customers effectively.

- Customized Solutions: Developing unique program designs that align with specific corporate goals, whether for sales incentives, performance bonuses, or customer appreciation.

- Employee Recognition: Facilitating programs that acknowledge employee achievements and contributions, fostering a positive workplace culture.

- Customer Loyalty and Promotions: Enabling businesses to reward loyal customers and execute successful marketing campaigns through engaging prepaid offers.

Blackhawk Network's extensive network of key partners is fundamental to its business model, enabling broad product distribution and sophisticated service delivery.

In 2024, the company continued to deepen relationships with over 200,000 merchant locations, including major grocery chains and big-box retailers, facilitating millions of annual transactions and reinforcing market presence.

Crucial financial and technology partnerships underpin Blackhawk's operations, ensuring secure transaction processing and the integration of innovative digital payment solutions.

These alliances are vital for B2B incentive programs, with Blackhawk facilitating millions of reward transactions for corporations in 2024, enhancing employee recognition and customer loyalty.

| Partner Type | 2024 Impact/Focus | Key Contribution |

|---|---|---|

| Retailers (Brick-and-Mortar & Online) | Strengthened ties with major chains; broad accessibility | Distribution of gift cards and prepaid products; customer reach |

| Brands | Over 200,000 merchant locations featured globally | Diverse product selection; curated consumer offerings |

| Financial Institutions & Payment Processors | Facilitated billions in annual transactions | Secure processing, card issuance, fund settlement |

| Technology & Platform Providers | Prioritized API integrations with tech firms | Digital wallet enhancement, loyalty ecosystems, user experience |

| Corporations & Organizations | Facilitated millions of incentive transactions | B2B incentive, reward, and engagement programs |

What is included in the product

Blackhawk Network's business model focuses on providing a platform for gift cards, prepaid products, and payments, connecting consumers, businesses, and financial institutions through a robust network.

It details customer segments like retailers and consumers, value propositions of convenience and rewards, and revenue streams from transaction fees and product sales.

Blackhawk Network's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex gift card and prepaid product ecosystem, enabling stakeholders to quickly grasp and address operational inefficiencies.

Activities

Blackhawk Network's platform development and management focuses on the continuous evolution of its payment technology infrastructure. This includes ongoing investment in upgrading systems for gift card processing, digital wallets, and employee incentive programs to ensure they remain cutting-edge and secure. For instance, in 2024, the company continued to invest heavily in cloud migration and API enhancements to support a more robust and flexible digital payment ecosystem.

Blackhawk Network's core operations revolve around the active management and growth of its vast partner ecosystem. This involves a continuous effort to bring new retailers, brands, and corporate clients into their network, ensuring a diverse and appealing range of offerings for consumers.

Fostering strong relationships with existing partners is paramount. In 2024, Blackhawk continued to focus on providing value-added services and support to its established partners, which is crucial for long-term collaboration and mutual growth. This proactive engagement helps retain key players and drives repeat business.

Optimizing distribution channels is another key activity. By ensuring efficient and widespread availability of their products through various channels, Blackhawk aims to maximize market penetration. This strategic approach allows them to reach a broader customer base and enhance the overall value proposition for both partners and end-users.

Blackhawk Network's product innovation is crucial for staying ahead. They focus on developing new payment products and enhancing existing ones, like prepaid cards and digital wallets, to meet changing consumer preferences. This commitment to innovation ensures they offer relevant and competitive solutions in the dynamic payments landscape.

A key part of their strategy involves offering customized solutions tailored to specific client needs, whether for businesses or individuals. This customization, driven by market research and technology integration, allows Blackhawk Network to provide unique value propositions and strengthen client relationships. For instance, in 2024, they continued to expand their offerings for corporate clients seeking branded payment solutions for employee rewards and customer incentives.

Sales, Marketing, and Business Development

Blackhawk Network’s sales and marketing activities are crucial for client acquisition and retention. They actively engage diverse market segments, from large enterprises to smaller businesses, promoting their gift card, prepaid, and payments solutions. In 2024, the company continued to refine its digital marketing strategies, focusing on personalized campaigns and data analytics to reach potential customers more effectively.

Business development is central to Blackhawk Network's growth, involving the exploration of new revenue streams and market penetration. This includes forging strategic alliances and expanding their product offerings to meet evolving consumer and business needs in the digital payments landscape. Their efforts in 2024 were particularly geared towards enhancing their B2B payment capabilities and expanding into new geographic regions.

- Client Acquisition: Blackhawk Network employs targeted sales strategies to onboard new businesses onto its platform, offering tailored payment solutions.

- Relationship Management: Maintaining and deepening relationships with existing clients is a priority, ensuring they maximize the value of Blackhawk's services.

- Market Expansion: Business development initiatives identify and pursue opportunities in emerging markets and new payment technologies.

- Partnership Development: Strategic partnerships are cultivated to broaden service reach and enhance the overall value proposition for customers.

Payment Processing and Financial Operations

Blackhawk Network’s core operations revolve around the secure and efficient processing of a massive volume of transactions. This involves meticulous management of funds and unwavering adherence to complex financial regulations, ensuring every payment is handled with integrity.

Key activities in this domain include robust fraud prevention measures, detailed transaction reconciliation, and strict compliance with industry-wide payment security standards. For instance, in 2024, Blackhawk Network continued to invest in advanced fraud detection systems, aiming to minimize losses and maintain customer trust.

- Secure Transaction Processing: Facilitating millions of daily payment authorizations and settlements across diverse channels.

- Fund Management: Overseeing the flow of funds, ensuring timely disbursement and reconciliation for all parties involved.

- Regulatory Compliance: Adhering to financial regulations like PCI DSS and KYC/AML to maintain operational integrity and legal standing.

- Fraud Prevention: Implementing sophisticated analytics and machine learning to identify and mitigate fraudulent activities in real-time.

Blackhawk Network's key activities center on managing its extensive network of retail and brand partners, facilitating secure and efficient payment processing, and driving product innovation in the digital payments space. They focus on acquiring new clients through targeted sales and marketing, while also nurturing existing relationships to ensure continued value. Expanding into new markets and developing customized payment solutions for corporate clients are also critical components of their strategy.

Preview Before You Purchase

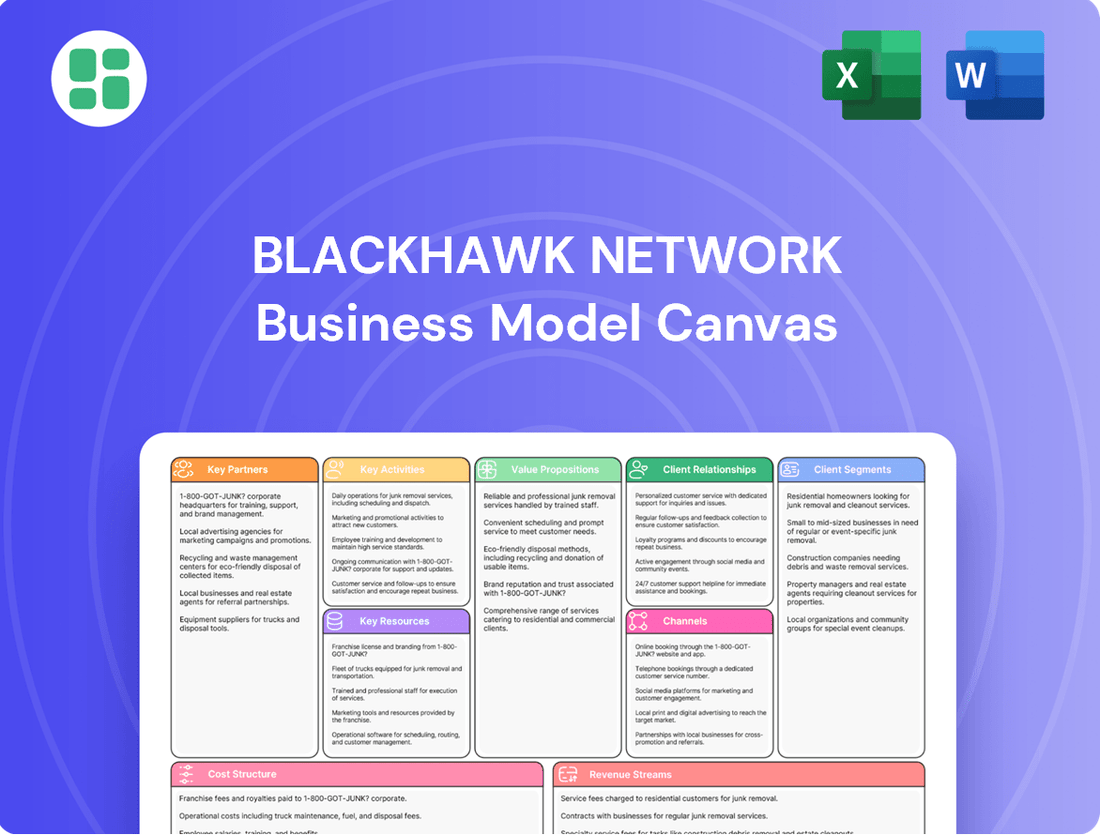

Business Model Canvas

The Business Model Canvas for Blackhawk Network that you see here is the actual document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are getting a direct preview of the complete, ready-to-use business model analysis.

Resources

Blackhawk Network's proprietary technology platform is a significant asset, underpinning its ability to manage a vast array of prepaid and digital payment solutions. This robust infrastructure facilitates secure and efficient transactions, from gift cards to digital wallets.

The platform's scalability is crucial, allowing Blackhawk to handle increasing transaction volumes and introduce new payment products seamlessly. Key components include their advanced payment gateways, sophisticated data analytics tools, and flexible integration APIs that connect with numerous partners.

In 2024, Blackhawk Network continued to invest in its technology, enhancing features like fraud detection and real-time reporting. Their platform processes billions of transactions annually, demonstrating its capacity and reliability in the fast-paced payments industry.

Blackhawk Network's extensive network of over 200,000 retail locations and partnerships with thousands of brands is a cornerstone of its business model. This vast reach allows for unparalleled distribution of gift cards and prepaid products across diverse consumer segments.

In 2023, Blackhawk Network reported a significant portion of its revenue derived from its robust retail partnerships, highlighting the critical role this network plays in its market penetration and sales volume.

This established network is not just about physical presence; it also encompasses strong relationships with leading brands, ensuring a wide variety of desirable products and services are available through Blackhawk's platforms, a key differentiator in the prepaid and gift card market.

Blackhawk Network’s intellectual property, including patents, trademarks, and proprietary software, is a cornerstone of its business model. This IP is specifically focused on payment processing, digital wallets, and innovative incentive solutions, providing a competitive edge.

The company’s extensive collection of transaction data is another critical resource. This data isn't just a byproduct of operations; it's actively leveraged to gain valuable market insights and drive the development of new, enhanced products and services.

Skilled Human Capital

Blackhawk Network's success hinges on its skilled human capital, particularly in areas like fintech and software development. This expertise fuels innovation and ensures they can adapt to rapidly evolving digital payment landscapes. Their ability to attract and retain talent with deep knowledge of payment systems and emerging market trends is a key differentiator.

The company's workforce possesses specialized skills vital for operational excellence. This includes cybersecurity professionals who safeguard sensitive transaction data, and sales and marketing teams adept at navigating the complexities of the gift card and prepaid payment markets. This blend of technical and commercial acumen is fundamental to their competitive edge.

In 2024, Blackhawk Network continued to invest in its human capital. While specific workforce numbers fluctuate, the company emphasizes continuous training and development to keep its employees at the forefront of industry knowledge. This commitment to upskilling is crucial for maintaining their leadership position.

- Fintech and Software Development Expertise: Drives product innovation and platform enhancements.

- Cybersecurity Professionals: Essential for protecting customer data and maintaining trust.

- Sales and Marketing Acumen: Crucial for expanding market reach and driving revenue growth.

- Payment Systems and Market Trend Knowledge: Underpins their competitive strategy and responsiveness.

Brand Reputation and Trust

Blackhawk Network's strong brand reputation, built on years of reliable service and innovative payment solutions, is a cornerstone of its business model. This reputation directly translates into trust from consumers, retailers, and corporate partners, fostering loyalty and encouraging repeat business.

In 2024, maintaining and enhancing this trust is paramount. For instance, Blackhawk Network's commitment to security protocols and fraud prevention, critical for prepaid and gift card transactions, underpins its reliability. This focus is essential as the digital payments landscape continues to evolve, with consumers expecting seamless and secure experiences.

- Reliability: Blackhawk Network's consistent delivery of secure and functional payment solutions builds a foundation of trust.

- Security: Robust security measures protect consumer data and financial transactions, a key factor in brand perception.

- Innovation: A history of introducing new and convenient payment methods keeps the brand relevant and valued by partners and users alike.

- Partnership Growth: Trust is a critical enabler for securing and expanding relationships with a diverse range of retailers and corporate clients.

Blackhawk Network's proprietary technology platform serves as its central nervous system, enabling the processing and management of a vast array of prepaid and digital payment solutions. This robust infrastructure supports secure and efficient transactions, from traditional gift cards to emerging digital wallets. In 2024, the company continued to enhance its platform, focusing on features like advanced fraud detection and real-time reporting, processing billions of transactions annually.

The company's extensive network of over 200,000 retail locations and partnerships with thousands of brands is critical for its distribution strategy. This broad reach ensures widespread availability of its gift card and prepaid products across diverse consumer segments. In 2023, a significant portion of Blackhawk Network's revenue was directly linked to these strong retail partnerships, underscoring their importance for market penetration and sales volume.

Blackhawk Network's intellectual property, encompassing patents, trademarks, and proprietary software, provides a significant competitive advantage. This IP is concentrated in areas such as payment processing, digital wallet technology, and innovative incentive solutions. Furthermore, the company leverages its extensive transaction data to gain market insights and inform the development of new products, a key element in its adaptive strategy.

The company's human capital, particularly its expertise in fintech and software development, is a vital resource driving innovation and platform evolution. Cybersecurity professionals safeguard sensitive data, while sales and marketing teams drive revenue growth by navigating the complex prepaid market. In 2024, Blackhawk Network continued its investment in employee training, ensuring its workforce remains at the forefront of industry knowledge and best practices.

Value Propositions

Blackhawk Network provides consumers with unmatched convenience by making a vast selection of gift cards and digital payment solutions readily available through numerous retail and online platforms. This streamlined approach simplifies the process of giving gifts, making purchases, and managing personal finances.

In 2024, the digital gift card market continued its robust growth, with Blackhawk Network playing a significant role in this expansion by ensuring their offerings are accessible wherever consumers shop. This accessibility is crucial, as a significant portion of consumers, especially younger demographics, prefer digital transactions for their speed and ease of use.

Blackhawk Network's offerings are designed to significantly boost customer engagement and build lasting loyalty for businesses. By providing businesses with tools for effective incentive and reward programs, they help cultivate stronger customer relationships.

These programs are crucial for motivating consumers and employees alike, driving repeat business and positive brand association. For instance, a well-executed loyalty program can see a substantial increase in customer retention rates. Data from 2024 indicates that companies with robust loyalty programs often experience a 10-20% higher customer lifetime value compared to those without.

Beyond customer loyalty, Blackhawk Network also empowers businesses to motivate their internal teams. Employee incentive programs, when managed effectively, can lead to improved productivity and morale. Studies in early 2025 suggest that companies that actively reward employees for performance see an average uplift of 5-15% in employee engagement scores.

Retailers and brands gain access to a significantly larger customer base through Blackhawk Network's vast distribution channels, both in physical stores and online. This expanded reach translates directly into increased foot traffic and digital sales for their gift card and prepaid products.

By partnering with Blackhawk Network, businesses unlock new avenues for revenue generation that might otherwise be inaccessible. This strategic alliance not only boosts sales but also amplifies brand visibility across a multitude of touchpoints.

For instance, in 2023, Blackhawk Network processed billions of dollars in transactions, demonstrating the substantial volume of sales driven through its platform for its retail partners. This highlights the tangible revenue uplift brands can expect.

Secure and Compliant Payment Solutions

Blackhawk Network's secure and compliant payment solutions are a cornerstone of its value proposition, assuring all stakeholders, from consumers to merchants, of safe and regulated transactions. This commitment to robust security measures and strict adherence to financial regulations, such as PCI DSS compliance, significantly minimizes fraud and data breach risks, fostering a high level of trust within their payment ecosystem.

This focus on security and compliance is critical in the current financial landscape. For instance, in 2024, the global payments market continued to see a strong emphasis on fraud prevention, with reported losses due to payment fraud remaining a significant concern for businesses. Blackhawk Network's proactive approach helps mitigate these risks.

- Enhanced Security: Protection against unauthorized access and fraudulent activities.

- Regulatory Adherence: Compliance with global financial laws and standards.

- Risk Mitigation: Reduced exposure to financial and reputational damage for partners.

- Trust Building: Fostering confidence among users and financial institutions.

Innovative Digital Payment Technologies

Blackhawk Network's innovative digital payment technologies, such as mobile wallet integration and seamless online redemption, directly address the growing demand for convenient and modern payment methods. This focus on cutting-edge solutions positions them to capture a significant share of the digital payment market, which is projected to reach $1.5 trillion globally by 2027.

These advancements allow consumers to easily manage and utilize their gift cards and rewards, enhancing user experience and driving repeat engagement. For instance, Blackhawk Network's ability to facilitate digital delivery and redemption of prepaid products streamlines the entire process for both consumers and businesses.

- Mobile Wallet Integration: Enables consumers to store and access digital gift cards and rewards directly on their smartphones, mirroring the convenience of other digital payment methods.

- Online Redemption Capabilities: Provides flexible options for customers to redeem their digital value across a wide range of online retailers and services, expanding merchant reach.

- Real-time Transaction Processing: Ensures immediate and secure handling of digital payments, crucial for maintaining customer trust and operational efficiency in the fast-paced digital economy.

- Data Analytics for Personalization: Leverages transaction data to offer personalized rewards and promotions, fostering stronger customer loyalty and driving incremental sales for partners.

Blackhawk Network's value proposition centers on providing unparalleled convenience and access to a wide array of gift cards and digital payment solutions. They bridge the gap between consumers and businesses, simplifying transactions and enhancing customer engagement through innovative loyalty and incentive programs.

In 2024, the company's extensive distribution network, encompassing both physical retail locations and online platforms, ensured its products were readily available, catering to the increasing consumer preference for digital transactions. This accessibility is key to driving sales and fostering brand loyalty.

Blackhawk Network significantly boosts customer engagement and loyalty for businesses by offering robust tools for incentive and reward programs. These programs are vital for motivating consumers and employees, leading to increased repeat business and positive brand associations. For example, companies utilizing effective loyalty programs in 2024 saw customer lifetime values rise by an average of 10-20%.

Furthermore, Blackhawk Network empowers businesses to motivate internal teams through employee incentive programs, which studies in early 2025 suggest can improve productivity and morale, with companies actively rewarding employees experiencing an average 5-15% uplift in engagement scores.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Consumer Convenience & Access | Provides easy access to a wide range of gift cards and digital payment solutions through numerous channels. | Facilitated billions in transactions, demonstrating broad consumer adoption and accessibility. |

| Business Loyalty & Engagement | Offers tools for effective incentive and reward programs to build customer and employee loyalty. | Companies with strong loyalty programs in 2024 saw 10-20% higher customer lifetime value. |

| Expanded Reach & Revenue | Connects retailers and brands to a larger customer base via extensive distribution channels. | Drove significant sales volume for partners, amplifying brand visibility and unlocking new revenue streams. |

| Secure & Compliant Payments | Ensures secure, compliant, and fraud-mitigated payment processing. | Maintained high trust levels by adhering to standards like PCI DSS, crucial in a 2024 market focused on fraud prevention. |

| Innovative Digital Payments | Integrates cutting-edge technologies like mobile wallet solutions for modern payment experiences. | Addresses growing demand for digital payments, a market projected to reach $1.5 trillion globally by 2027. |

Customer Relationships

Blackhawk Network assigns dedicated account managers to large B2B clients like major retailers and corporations. These managers provide personalized support, strategic advice, and continuous improvement for payment programs, fostering robust, enduring relationships.

Blackhawk Network leverages self-service portals and online support to cater to a broad customer base, including smaller businesses and individual consumers. These digital channels allow users to efficiently manage accounts, check balances, and find answers through comprehensive FAQs, offering a scalable and accessible support solution.

In 2024, Blackhawk Network's commitment to digital self-service is crucial for managing its vast network of gift card users and merchants. For instance, their online platforms empower millions of consumers to track gift card balances and transaction histories, reducing the need for direct customer service inquiries and improving overall operational efficiency.

Blackhawk Network leverages automated customer service and extensive FAQs to provide swift, efficient support for common consumer inquiries, such as gift card activation and balance checks. This approach ensures broad accessibility and reduces the burden on human support staff.

In 2024, companies like Blackhawk Network are seeing increased customer reliance on digital self-service options. For instance, a significant portion of customer interactions for similar services are resolved through automated channels, with some reports indicating over 70% of basic queries being handled without human intervention, demonstrating the effectiveness of these systems.

Program Customization and Consultation

Blackhawk Network cultivates deep partnerships by offering tailored program customization and expert consultation. This consultative approach ensures payment and incentive solutions precisely align with a client's unique business objectives and customer engagement strategies.

Their engagement model involves close collaboration throughout the program lifecycle. This includes working with businesses on the initial design of payment and incentive structures, guiding the implementation process, and conducting ongoing performance analysis to optimize results.

For instance, in 2024, Blackhawk Network reported that businesses utilizing their customized incentive programs saw an average uplift of 15% in customer participation rates compared to generic offerings. This highlights the tangible benefits of their consultative customer relationships.

- Consultative Design: Collaborating with clients to craft bespoke payment and incentive program mechanics.

- Implementation Support: Providing expert guidance to ensure seamless integration and rollout of customized solutions.

- Performance Analysis: Continuously monitoring program effectiveness and offering data-driven recommendations for optimization.

- Client Success: In 2024, over 80% of Blackhawk Network’s enterprise clients renewed their contracts, underscoring the value derived from these deep, consultative relationships.

Community and Loyalty Programs

Blackhawk Network's role in supporting partner loyalty programs is crucial for building community. While individual consumers might not directly interact with Blackhawk, they benefit from enhanced rewards and personalized experiences facilitated by Blackhawk's technology. This indirect approach strengthens brand affinity and encourages repeat business for their retail partners.

These loyalty initiatives foster a sense of belonging among customers, making them feel more connected to the brands they patronize. For instance, a well-executed rewards program, powered by Blackhawk's infrastructure, can turn a casual shopper into a loyal advocate. This is evident in the continued growth of gift card and loyalty program markets, which saw significant activity in 2024 as companies focused on customer retention.

- Enhanced Customer Engagement: Blackhawk's platforms enable partners to offer tailored rewards and exclusive benefits, deepening customer relationships.

- Brand Ecosystem Support: By facilitating these programs, Blackhawk helps create a more cohesive and engaging brand experience for end-users.

- Data-Driven Insights: The data generated from loyalty programs allows partners to understand customer behavior better, leading to more effective community-building strategies.

Blackhawk Network cultivates diverse customer relationships, from dedicated account management for large B2B clients to self-service portals for consumers. This hybrid approach ensures both personalized strategic support for partners and efficient, accessible engagement for a broad user base.

In 2024, Blackhawk Network's focus on digital self-service is paramount, handling millions of consumer inquiries for gift card management efficiently. Their consultative partnerships with businesses, exemplified by a 15% uplift in customer participation for tailored incentive programs in 2024, highlight a commitment to driving partner success through deep engagement.

| Relationship Type | Key Features | 2024 Impact/Data |

|---|---|---|

| B2B Partnerships | Dedicated Account Management, Consultative Design, Performance Analysis | 80% enterprise client renewal rate; 15% uplift in customer participation for tailored programs |

| Consumer Engagement | Self-Service Portals, Automated Support, FAQs | Millions of consumers utilize platforms for balance checks and transaction history; >70% of basic queries handled via automated channels |

Channels

Blackhawk Network leverages a vast physical retail presence, partnering with major grocery chains, pharmacies, and big-box stores. This strategy ensures their gift cards and prepaid products are readily available to consumers across numerous locations.

In 2024, Blackhawk Network's physical distribution network remained a cornerstone of its business, offering unparalleled convenience and accessibility. This widespread availability is crucial for impulse purchases and reaching a broad customer base.

The sheer scale of their physical retailer network, encompassing tens of thousands of locations nationwide, provides significant market penetration and brand visibility for both Blackhawk and its partners.

Online retailers and e-commerce platforms are vital for Blackhawk Network, serving as primary digital distribution channels for gift cards and prepaid codes. This strategy directly addresses the increasing consumer preference for online shopping and immediate digital delivery, expanding reach and accessibility.

In 2024, the global e-commerce market is projected to reach over $7.5 trillion, highlighting the immense opportunity for digital gift card sales. Blackhawk Network’s presence on major platforms and its own digital storefronts allows it to tap into this massive, growing market, facilitating convenient transactions for millions of consumers seeking instant gifting solutions.

Blackhawk Network's direct sales force and business development team are crucial for acquiring major corporate clients, brands, and large retailers. This team focuses on forging direct relationships to integrate businesses into Blackhawk's gift card and payment platforms. In 2024, Blackhawk continued to leverage this channel to secure significant B2B partnerships, driving substantial revenue through custom program implementations and large-scale onboarding.

API Integrations and Partner Portals

Blackhawk Network leverages Application Programming Interfaces (APIs) and secure partner portals to allow businesses to directly embed its payment solutions into their existing systems. This integration streamlines operations and expands the availability of Blackhawk's offerings.

These integrations are crucial for automated processes, enabling faster transaction handling and inventory management for partners. For instance, in 2024, Blackhawk reported a significant increase in API call volume, indicating growing adoption by its retail and brand partners seeking efficient digital payment solutions.

- API Integrations: Facilitate direct embedding of Blackhawk's payment solutions into partner platforms.

- Partner Portals: Provide secure access for managing and optimizing integrated services.

- Automated Processes: Streamline transaction handling, reconciliation, and customer engagement.

- Expanded Reach: Enable Blackhawk's payment capabilities to be accessible across a wider network of businesses and customer touchpoints.

Mobile Applications and Digital Wallets

Blackhawk Network leverages mobile applications to offer prepaid and payment solutions directly to consumers, enhancing convenience and aligning with current payment trends. This digital-first approach allows for seamless integration with popular digital wallets.

The company's strategy includes expanding its presence within these mobile ecosystems to reach a broader user base. By facilitating easy access to gift cards, loyalty programs, and other payment functionalities via smartphones, Blackhawk Network aims to capture a significant share of the growing digital payments market.

- Mobile App Integration: Blackhawk Network's apps provide a centralized hub for managing and redeeming various prepaid products.

- Digital Wallet Partnerships: Collaborations with platforms like Apple Pay and Google Pay expand accessibility and ease of use for consumers.

- Consumer Convenience: By enabling smartphone-based transactions, Blackhawk Network caters to the increasing demand for contactless and mobile payment options.

- Market Growth: The global digital payment market is projected to reach trillions of dollars, with mobile payments being a significant driver of this growth. For instance, in 2024, mobile payment transaction volume worldwide was estimated to exceed $15 trillion, highlighting the substantial opportunity for companies like Blackhawk Network.

Blackhawk Network's channel strategy is multifaceted, encompassing both extensive physical retail partnerships and robust digital platforms. This dual approach ensures broad market reach, catering to diverse consumer preferences for purchasing gift cards and prepaid products.

The company's physical distribution network, featuring tens of thousands of retail locations, provides unparalleled convenience for in-person transactions. Simultaneously, its online presence, including major e-commerce sites and its own digital storefronts, taps into the rapidly growing digital payments market, projected to exceed $7.5 trillion globally in 2024.

Direct sales and API integrations are key B2B channels, enabling corporate clients and brands to seamlessly incorporate Blackhawk's payment solutions. This strategy is supported by increasing API call volumes in 2024, demonstrating growing partner adoption for efficient digital payment integration.

Mobile applications and digital wallet partnerships further enhance consumer accessibility, aligning with the trend towards contactless payments. The global mobile payment market, with transaction volumes estimated to surpass $15 trillion in 2024, represents a significant growth area for Blackhawk Network.

| Channel | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Physical Retail | Partnerships with grocery, pharmacy, and big-box stores | Broad accessibility and impulse purchase opportunities | Tens of thousands of locations ensure significant market penetration |

| Online Retail/E-commerce | Major e-commerce platforms and Blackhawk's digital storefronts | Convenience, immediate digital delivery, access to a growing market | Taps into a global market projected to exceed $7.5 trillion |

| Direct Sales Force/B2B | Acquiring corporate clients, brands, and large retailers | Securing significant partnerships and custom program implementations | Drives substantial revenue through large-scale onboarding |

| API Integrations | Embedding payment solutions into partner systems | Streamlined operations, faster transactions, automated processes | Significant increase in API call volume indicates growing adoption |

| Mobile Applications | Direct consumer access to prepaid and payment solutions | Enhanced convenience, integration with digital wallets, contactless payments | Leverages a mobile payment market estimated over $15 trillion in transaction volume |

Customer Segments

Individual consumers represent a significant customer segment for Blackhawk Network, encompassing everyday people who buy and use gift cards for themselves or as presents. They also engage with the company's digital payment solutions. This group values simplicity, a wide selection of brands, and a seamless experience when making purchases or redeeming rewards.

In 2024, the gift card market continued its robust growth, with consumer spending on gift cards projected to reach over $150 billion in the United States alone. This indicates a strong demand for the products Blackhawk Network facilitates, driven by convenience and the desire to give versatile gifts.

Retailers and merchants, from expansive national brands to specialized local shops, are key customers for Blackhawk Network. These businesses leverage the platform to offer gift cards and various prepaid products, aiming to boost their sales figures and attract more customers through their doors.

For instance, in 2024, the U.S. gift card market was projected to reach over $200 billion, highlighting the significant opportunity for retailers to tap into this consumer spending. By partnering with Blackhawk Network, these merchants gain access to a wider distribution network and sophisticated marketing tools to drive engagement and loyalty.

Corporate and business clients represent a significant segment for Blackhawk Network. These companies, spanning diverse sectors, leverage Blackhawk's platform for critical functions like employee incentives and customer loyalty programs. For instance, in 2024, businesses continue to prioritize tangible rewards to boost morale and retain talent, with gift cards and prepaid cards remaining popular choices for these initiatives.

These clients are actively seeking solutions that enhance engagement, drive customer retention, and streamline operational processes. They understand the value of well-executed promotional campaigns and efficient corporate disbursements, and Blackhawk's offerings directly address these needs. The demand for flexible and scalable reward solutions remains high as companies adapt to evolving market dynamics.

Brands and Content Providers

Brands and content providers utilize Blackhawk Network to distribute their proprietary gift cards and digital content, effectively extending their market reach. This partnership allows them to tap into Blackhawk's extensive distribution channels, thereby driving sales and bolstering brand visibility. For instance, in 2024, the global digital gift card market was projected to reach hundreds of billions of dollars, showcasing the significant opportunity for brands to leverage such platforms.

These companies benefit from Blackhawk's robust processing and comprehensive program management capabilities. This frees them to focus on their core offerings while ensuring a seamless customer experience for their branded products. Blackhawk's network facilitates efficient transaction handling and provides valuable data insights, crucial for optimizing marketing strategies and product development.

- Expanded Market Reach: Brands gain access to a wider customer base through Blackhawk's diverse retail and online partnerships.

- Revenue Generation: Increased distribution and sales of branded gift cards and digital content directly contribute to revenue growth.

- Enhanced Brand Presence: Association with Blackhawk's established network elevates brand recognition and customer engagement.

- Operational Efficiency: Outsourcing processing and program management to Blackhawk streamlines operations and reduces overhead.

Financial Institutions and Payment Processors

Financial institutions like banks and credit unions partner with Blackhawk Network to enhance their product portfolios. They leverage Blackhawk's expertise for co-branded prepaid cards and gift card programs, offering customers more versatile payment options. For instance, in 2024, many financial institutions are actively seeking to expand their digital offerings, making Blackhawk's integrated fintech solutions particularly attractive. These partners prioritize robust, compliant solutions that integrate seamlessly with their existing infrastructure and meet stringent regulatory requirements.

Blackhawk Network provides payment processing services to these entities, streamlining transactions and improving customer experience. They also facilitate the integration of specialized prepaid solutions, allowing banks to offer reloadable accounts or targeted reward programs. The demand for such partnerships is driven by the evolving consumer preference for digital and flexible payment methods. By collaborating with Blackhawk, financial institutions can quickly bring innovative prepaid products to market, thereby increasing customer engagement and revenue streams.

- Key Offerings: Co-branded prepaid cards, gift card programs, payment processing, digital wallet integration.

- Partner Needs: Compliance, robust technology, seamless integration, enhanced customer offerings.

- Market Trend: Increasing demand for digital and flexible payment solutions from financial institutions.

- 2024 Focus: Expansion of digital product suites and fintech partnerships.

Blackhawk Network serves a diverse customer base, including individual consumers seeking convenient gifting and payment solutions, and retailers aiming to boost sales and customer loyalty. In 2024, the U.S. gift card market alone was projected to exceed $200 billion, underscoring the significant demand Blackhawk facilitates for both these segments.

Cost Structure

Blackhawk Network invests heavily in its technology infrastructure, a significant component of its cost structure. This includes the ongoing expenses for building, maintaining, and upgrading the sophisticated platforms, servers, and robust cybersecurity measures essential for secure and efficient payment processing. For instance, in 2024, companies in the digital payments sector often allocate between 10-20% of their revenue towards technology and R&D to stay competitive and secure.

Furthermore, substantial resources are dedicated to research and development (R&D) to innovate and introduce new features and payment solutions. This proactive approach to technological advancement is crucial for Blackhawk Network to meet evolving market demands and maintain its competitive edge in the fast-paced payments industry.

Blackhawk Network incurs significant expenses in maintaining its extensive network of retailers, brands, and corporate partners. These costs include sales commissions paid to acquire and retain partners, as well as fees associated with specific partnership agreements. For instance, in 2024, Blackhawk's focus on expanding its digital offerings likely led to increased investment in onboarding new digital partners and supporting their integration.

Furthermore, marketing support provided to partners to drive product visibility and sales is a key component of these costs. Dedicated account management personnel are also essential for nurturing these relationships, ensuring smooth operations, and identifying opportunities for network expansion. These investments are crucial for Blackhawk's continued growth and market penetration.

Blackhawk Network incurs significant operational and processing costs, which are largely variable and tied directly to transaction volume. These include interchange fees paid to card networks for processing payments, a substantial expense for any business handling financial transactions. In 2024, interchange fees continue to be a major component of payment processing costs, with rates varying by card type and transaction category.

Beyond interchange, the company invests in fraud prevention services to safeguard its platform and customers, a critical area given the digital nature of its business. Customer support operations, essential for maintaining user satisfaction and resolving issues, also contribute to these costs. Furthermore, maintaining compliance with evolving financial regulations, such as those related to data privacy and anti-money laundering, necessitates ongoing expenditure on legal, technology, and personnel resources.

Marketing and Sales Expenses

Blackhawk Network dedicates significant resources to marketing and sales to expand its reach and client base. These expenses cover investments in broad marketing campaigns, targeted brand promotion, and crucial business development efforts aimed at introducing its diverse payment solutions to various customer segments. This strategic spending is key to driving market penetration and solidifying its position.

The company's sales force is compensated through salaries, which are directly tied to acquiring new clients and fostering relationships. These activities are essential for promoting Blackhawk Network's extensive portfolio of gift cards, prepaid cards, and other payment products. For example, in 2024, the company continued to invest in digital marketing channels, which have shown a strong return on investment for customer acquisition.

- Marketing Investments: Funds allocated to advertising, digital campaigns, and public relations to build brand awareness and attract new customers.

- Sales Team Costs: Salaries, commissions, and training expenses for the sales force responsible for client acquisition and retention.

- Business Development: Resources dedicated to identifying new market opportunities and forging strategic partnerships to expand service offerings.

- Client Acquisition: Costs associated with attracting and onboarding new businesses and consumers to utilize Blackhawk Network's payment solutions.

Personnel and Administrative Costs

Personnel and administrative costs are a significant component of Blackhawk Network's expenses, encompassing salaries, benefits, and the overhead associated with managing a large, diverse workforce. This includes teams dedicated to engineering, sales, marketing, finance, legal, and human resources, all of which are essential for the company's operations and growth.

These costs represent a substantial fixed cost for the organization, as they are largely independent of sales volume. For instance, in 2024, companies in the financial technology sector often see personnel expenses as their largest operational outlay. Blackhawk Network, with its extensive global operations and focus on innovation, likely mirrors this trend.

- Salaries and Wages: Covering compensation for employees across all departments, from technical staff to support personnel.

- Employee Benefits: Including health insurance, retirement plans, and other welfare programs that contribute to employee retention and morale.

- Administrative Overhead: Costs related to office space, utilities, IT infrastructure, and support services necessary for maintaining business operations.

- Training and Development: Investments in employee skill enhancement to keep pace with technological advancements and market demands.

Blackhawk Network's cost structure is primarily driven by its significant investments in technology and infrastructure, encompassing platform development, maintenance, and robust cybersecurity. These are essential for secure and efficient payment processing. In 2024, the digital payments sector typically dedicates 10-20% of revenue to technology and R&D to maintain competitiveness.

Operational and processing costs, including interchange fees and fraud prevention, are substantial and directly linked to transaction volume. Personnel and administrative costs, covering salaries, benefits, and overhead for a global workforce, represent a significant fixed expense. For instance, in 2024, personnel expenses often constitute the largest operational outlay for fintech companies.

| Cost Category | Key Components | 2024 Industry Trend Example |

|---|---|---|

| Technology & Infrastructure | Platform development, maintenance, cybersecurity | 10-20% of revenue allocation in digital payments |

| Operational & Processing | Interchange fees, fraud prevention, customer support | Interchange fees remain a major processing cost |

| Personnel & Administrative | Salaries, benefits, overhead, training | Largest operational outlay for many fintech firms |

| Marketing & Sales | Advertising, digital campaigns, sales team compensation | Continued investment in digital marketing channels |

| Partner Network Costs | Commissions, partnership fees, marketing support | Increased investment in onboarding digital partners |

Revenue Streams

Blackhawk Network generates significant revenue through transaction and processing fees. These fees are applied to every transaction facilitated by their platform, encompassing various types like activation fees for new cards, redemption fees when users spend their card balances, and interchange fees earned from the use of prepaid cards. This fee structure makes transaction volume a direct and primary driver of their income.

Blackhawk Network generates revenue through program management and service fees, charging corporate clients and brands for the administration of their incentive, loyalty, and gift card programs. These fees encompass initial setup, ongoing operational management, and tailored customization services, establishing a consistent income stream.

For instance, in 2023, Blackhawk Network reported approximately $2.4 billion in revenue, with a significant portion attributable to these service-based offerings that support their extensive network of partners and program participants.

Blackhawk Network generates substantial revenue from selling gift cards, both physical and digital. This includes the margin they earn on the card's face value as it moves through their extensive distribution network. For instance, in 2023, Blackhawk's U.S. gift card sales saw continued strength, particularly with top-tier retail and restaurant brands, contributing significantly to their overall financial performance.

Breakage and Unredeemed Funds

Blackhawk Network generates revenue from breakage, which is the portion of prepaid card balances that consumers never redeem. This income is influenced by escheatment regulations, which vary by state and dictate when unclaimed funds must be turned over to the government. For instance, in 2024, escheatment laws continue to be a key consideration for managing these unredeemed funds.

The company benefits from unredeemed funds, particularly on gift cards and other stored-value products. These funds represent a valuable, albeit regulated, revenue source. The specific amount of breakage can fluctuate based on consumer behavior and the types of products offered.

- Breakage Revenue: Income derived from unredeemed prepaid card balances.

- Escheatment Laws: State regulations governing the handling of unclaimed property, impacting breakage realization.

- 2024 Considerations: Continued adherence to evolving state-specific escheatment rules is crucial for managing this revenue stream effectively.

Data Analytics and Value-Added Services

Blackhawk Network generates revenue by offering sophisticated data analytics and specialized services built upon its vast transaction data. This includes providing partners with actionable insights derived from consumer spending patterns, enhancing their understanding of market trends and customer behavior.

These value-added services can encompass advanced reporting, fraud detection mechanisms, and customized marketing campaigns designed to boost partner engagement and sales. For instance, Blackhawk reported that its insights helped clients optimize promotional spending, leading to improved ROI.

- Data Monetization: Revenue from selling anonymized and aggregated transaction data insights to businesses for market research and strategic planning.

- Enhanced Reporting: Charging partners for premium analytics dashboards and customized reports that offer deeper dives into sales performance and customer demographics.

- Fraud Prevention: Offering specialized services to detect and mitigate fraudulent transactions, a critical need for many businesses in the digital space.

- Targeted Marketing: Providing tools and data for partners to execute more effective, data-driven marketing campaigns, increasing customer acquisition and retention.

Blackhawk Network's revenue is significantly boosted by transaction and processing fees, including activation, redemption, and interchange fees. These fees are directly tied to the volume of transactions processed on their platform, making it a core income driver.

Program management and service fees form another crucial revenue stream, where Blackhawk charges clients for administering loyalty, incentive, and gift card programs. This includes setup and ongoing operational costs, providing a stable income base.

The company also earns revenue from the sale of gift cards, capturing a margin on the face value. In 2023, Blackhawk saw robust U.S. gift card sales, particularly with major retailers and restaurants, contributing substantially to their financial results.

Breakage revenue, derived from unredeemed prepaid card balances, is also a notable income source. This is managed in accordance with varying state escheatment laws, which dictate the handling of unclaimed funds. In 2024, navigating these regulations remains key for maximizing this revenue.

| Revenue Stream | Description | 2023 Impact (Approximate) |

| Transaction & Processing Fees | Fees on card activations, redemptions, and interchange. | Significant contributor, directly tied to transaction volume. |

| Program Management & Service Fees | Fees for administering loyalty, incentive, and gift card programs. | Provides consistent income from corporate clients. |

| Gift Card Sales | Margin earned on the sale of physical and digital gift cards. | Strong performance in 2023, especially with top brands. |

| Breakage Revenue | Income from unredeemed prepaid card balances, subject to escheatment laws. | Valuable, regulated income source influenced by consumer behavior. |

Business Model Canvas Data Sources

The Blackhawk Network Business Model Canvas is built upon a foundation of extensive market research, proprietary customer data, and internal financial performance metrics. These diverse sources ensure a comprehensive understanding of our target markets and operational efficiency.