BlackBerry SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackBerry Bundle

BlackBerry's journey is a fascinating case study in technological evolution, marked by strong brand loyalty and a robust security foundation. However, the company faces significant challenges in adapting to a rapidly changing mobile landscape and intense competition.

Want the full story behind BlackBerry's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BlackBerry's deep expertise in secure communications is a significant strength, built on a long history of providing resilient solutions for mission-critical needs. Their portfolio is extensively certified, offering robust mobile fortification and critical event management capabilities that businesses rely on for operational continuity.

Furthermore, BlackBerry's QNX software is a cornerstone in embedded systems, demonstrating its pervasive influence, especially within the automotive sector. As of early 2024, QNX is powering over 255 million vehicles globally, underscoring its critical role in the safety and functionality of modern automobiles.

BlackBerry's strength lies in its pioneering use of AI and machine learning within the cybersecurity domain. This is clearly demonstrated by its Cylance AI platform, which provides advanced threat detection capabilities. The recent introduction of Cylance Assistant, a generative AI cybersecurity advisor, further solidifies this position by offering proactive attack prevention and faster decision support for security teams.

BlackBerry's strength lies in its deeply embedded position within high-security sectors like automotive, financial services, and government. This signifies a high level of trust and the provision of specialized, robust solutions tailored to these demanding environments.

The company's secure communications portfolio is a stable cornerstone, particularly within regulated institutions and governments. A prime example of this is BlackBerry's cybersecurity solutions contract with the Government of Malaysia, underscoring its reliability in critical national infrastructure.

Growing IoT Business with Significant Royalty Backlog

BlackBerry's Internet of Things (IoT) business, powered by its QNX operating system, is a significant growth engine. This division has shown impressive, steady increases in revenue both sequentially and when compared to the previous year. This consistent performance highlights the increasing adoption and demand for BlackBerry's secure IoT solutions across various industries.

A key strength lies in the substantial royalty backlog within the IoT segment. This backlog represents committed future revenue stemming from design wins in critical sectors like automotive and robotics. For instance, BlackBerry reported in its fiscal year 2025 first-quarter earnings that its IoT revenue grew 11% year-over-year, reaching $66 million. This backlog provides strong revenue visibility and a predictable stream of income for the foreseeable future, underpinning the business's stability and growth potential.

- Consistent Revenue Growth: BlackBerry's IoT division, driven by QNX, experienced an 11% year-over-year revenue increase in Q1 FY2025, reaching $66 million.

- Substantial Royalty Backlog: The company benefits from a significant backlog of future royalties from existing design wins, particularly in the automotive sector.

- Long-Term Revenue Visibility: This backlog translates into predictable future revenue streams, offering a strong foundation for sustained growth and financial planning.

- Market Leadership in Secure IoT: QNX's established position in safety-critical embedded systems, including automotive infotainment and advanced driver-assistance systems (ADAS), reinforces its competitive advantage.

Strategic Restructuring Towards Profitability

BlackBerry has actively pursued strategic restructuring to bolster its financial health. A key move was the sale of its Cylance endpoint security business to Arctic Wolf in early 2024, a transaction aimed at sharpening the company's focus on its core, higher-margin segments such as QNX and secure communications solutions.

This strategic realignment is already yielding positive financial results, with the company demonstrating improved performance metrics. Notably, BlackBerry achieved positive operating cash flow and adjusted EBITDA ahead of its previously stated targets for fiscal year 2025.

- Focus on Profitable Segments: Divestment of Cylance allows greater resource allocation to QNX and secure communications.

- Improved Financials: Achieved positive operating cash flow and adjusted EBITDA ahead of schedule in fiscal year 2025.

- Streamlined Operations: Strategic pivot designed to enhance overall operational efficiency and profitability.

BlackBerry's core strength lies in its deeply embedded QNX operating system, a leader in safety-critical embedded systems. This technology powers over 255 million vehicles as of early 2024, demonstrating its widespread adoption and reliability in the automotive sector.

The company also excels in cybersecurity, leveraging AI and machine learning through its Cylance platform, further enhanced by the recent introduction of the Cylance Assistant for proactive threat defense.

BlackBerry's secure communications portfolio remains a vital asset, particularly for government and regulated industries, evidenced by its cybersecurity contract with the Government of Malaysia.

Strategic restructuring, including the sale of its endpoint security business in early 2024, has sharpened its focus on high-margin segments like QNX and secure communications, leading to improved financial performance with positive operating cash flow and adjusted EBITDA achieved ahead of FY2025 targets.

| Segment | FY2025 Q1 Revenue | Year-over-Year Growth |

|---|---|---|

| IoT (QNX) | $66 million | 11% |

What is included in the product

Delivers a strategic overview of BlackBerry’s internal and external business factors, identifying key strengths in its cybersecurity software and services, while acknowledging weaknesses in its legacy hardware business and opportunities in IoT and automotive, alongside threats from intense competition.

Offers a clear understanding of BlackBerry's competitive landscape, helping to identify and address weaknesses before they become critical issues.

Weaknesses

BlackBerry operates in a fiercely competitive cybersecurity landscape. Major technology players like Microsoft and IBM, along with numerous nimble startups, pose significant challenges. This intense rivalry demands constant innovation and substantial R&D investment to safeguard its market position.

While BlackBerry's IoT segment demonstrates robust profitability, its cybersecurity division has encountered persistent headwinds. The acquisition of Cylance, in particular, has been a significant drain, with projections for substantial EBITDA losses in 2024. This ongoing profitability challenge within cybersecurity, despite company-wide streamlining efforts, remains a key weakness.

BlackBerry's historical association with physical keyboards and older mobile hardware, while once a strength, now presents a challenge. Despite its successful transition to cybersecurity software and services, some market segments may still perceive the brand through the lens of its past as a hardware manufacturer. This legacy perception could hinder its efforts to be fully recognized as a contemporary leader in enterprise software solutions.

Lower Revenue Guidance for Secure Communications

BlackBerry's Secure Communications segment faces headwinds, with guidance for Q1 FY26 and the full fiscal year FY26 indicating a potential revenue decrease compared to FY25. This contrasts with the projected growth in QNX revenue, highlighting a disparity in performance across BlackBerry's business units.

The company's outlook suggests challenges in retaining or expanding its market share within the secure communications space. For instance, the company's Q1 FY26 revenue guidance for the IoT segment, which includes QNX, was projected to be between $175 million and $181 million, indicating continued strength. However, the overall Secure Communications segment's performance needs careful monitoring against this backdrop.

- Revenue Dip Anticipated: Guidance for Secure Communications in FY26 points to a potential decline versus FY25 figures.

- Segmental Disparity: This contrasts with positive growth expectations for the QNX operating system within the IoT segment.

- Market Challenges: The guidance suggests potential difficulties in market penetration or customer retention for Secure Communications.

Dependence on Specific High-Security Niches

BlackBerry's strategic focus on high-security sectors like automotive and government, while a clear strength, also creates a significant weakness. This specialization means the company is heavily reliant on the continued demand and growth within these specific niches. For instance, while the automotive sector is a key area, the automotive cybersecurity market, though growing, is still a subset of the overall cybersecurity landscape. This dependence could hinder broader market penetration and diversification efforts compared to more generalized cybersecurity providers.

This concentrated approach might limit BlackBerry's ability to capitalize on opportunities in other rapidly expanding cybersecurity segments. In 2023, the global cybersecurity market was valued at approximately $216 billion, with projections to reach over $366 billion by 2028. While BlackBerry is well-positioned in its chosen areas, a broader cybersecurity company might have a more diversified revenue stream, mitigating risks associated with downturns or shifts in specific industries.

- Niche Reliance: BlackBerry's strength in automotive and government cybersecurity creates a dependency that could limit its overall market reach.

- Diversification Gap: Compared to generalist cybersecurity firms, this specialization may restrict its ability to tap into the wider cybersecurity market, estimated to grow significantly in the coming years.

- Market Penetration: The focus on specific, albeit critical, sectors could cap its potential for broader adoption and revenue growth outside these core areas.

BlackBerry faces significant challenges in its Secure Communications segment, with projected revenue declines for FY26 compared to FY25. This contrasts sharply with the continued strength anticipated in its IoT segment, particularly with QNX. The company's guidance suggests potential difficulties in maintaining or expanding its footprint in secure communications, indicating a need for strategic adjustments to address this performance disparity.

Preview the Actual Deliverable

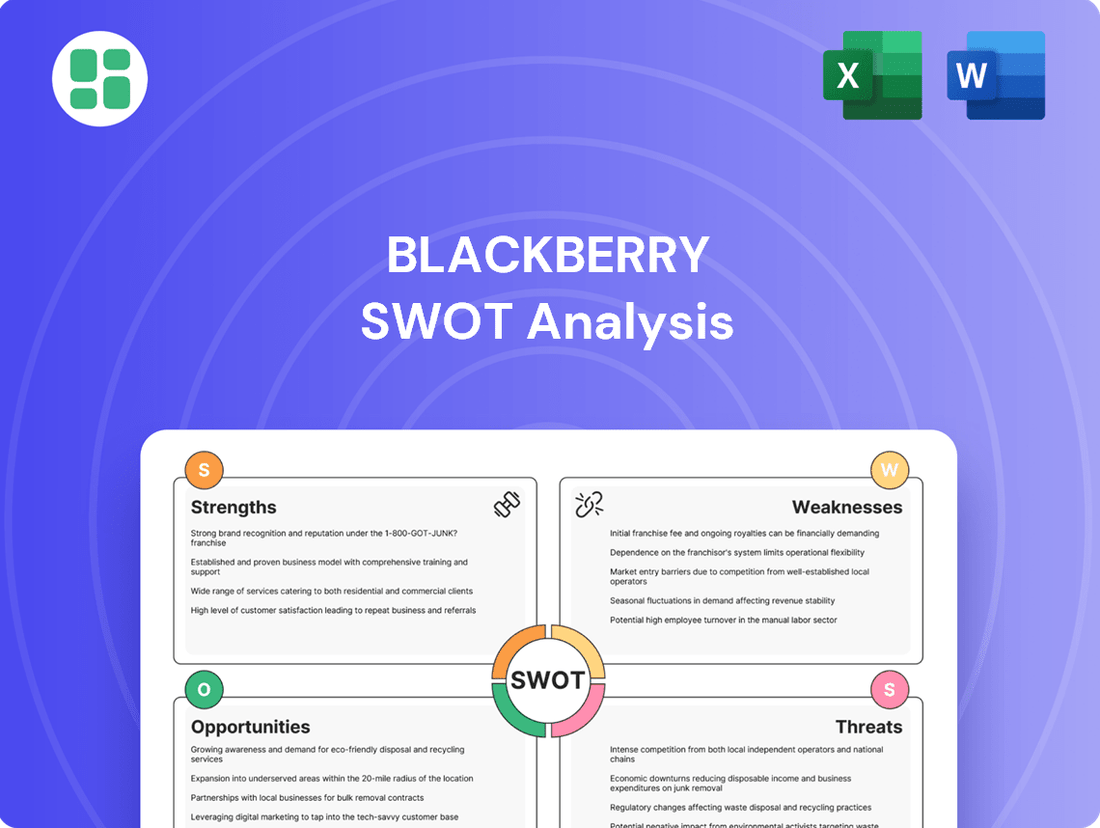

BlackBerry SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual BlackBerry SWOT analysis, so you know exactly what you're getting.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of BlackBerry's strategic position.

Opportunities

The cybersecurity market is booming, with projections indicating it will reach an impressive $2 trillion by 2025. This rapid expansion directly benefits BlackBerry, as its robust cybersecurity solutions are in high demand.

Furthermore, the Internet of Things (IoT) market is also experiencing substantial growth, expected to hit $3.3 trillion by 2030. BlackBerry's expertise in securing these connected devices positions it to capitalize on this massive opportunity.

The automotive industry's significant pivot towards software-defined vehicles (SDVs) offers a prime growth avenue for BlackBerry. Its QNX platform, a proven leader in mission-critical embedded automotive software, is exceptionally well-positioned to capitalize on this trend.

The increasing need for sophisticated hybrid cloud and edge computing functionalities within SDVs is expected to accelerate the adoption of QNX. This shift is driven by the demand for enhanced vehicle features, over-the-air updates, and advanced driver-assistance systems (ADAS). In 2024, the global automotive software market was valued at approximately USD 30 billion and is projected to grow substantially, with SDVs being a key driver.

BlackBerry's existing strengths in AI and machine learning offer a significant opportunity to integrate generative AI into its cybersecurity and IoT portfolios. This move could unlock new product development, enhancing efficiency and sophistication in security solutions.

By embedding advanced AI, BlackBerry can create more intelligent threat detection and response systems, offering a distinct competitive edge in the rapidly evolving cybersecurity landscape. For instance, generative AI could automate vulnerability patching or create more adaptive defense mechanisms.

This strategic focus aligns with the growing market demand for AI-powered security, potentially driving revenue growth and solidifying BlackBerry's position as an innovator. The company's QNX operating system, used in millions of vehicles, presents a prime area for AI-enhanced safety and infotainment features.

Strategic Partnerships and Acquisitions

Strategic partnerships are crucial for BlackBerry's expansion, particularly in the automotive sector. For instance, the Memorandum of Understanding with Vector Informatik in late 2023 to co-develop a new software platform for software-defined vehicles (SDVs) exemplifies this. This collaboration aims to leverage BlackBerry's QNX real-time operating system with Vector's expertise in automotive software and tools, potentially accelerating the development and adoption of advanced in-car systems.

Acquisitions present another significant opportunity. By strategically acquiring companies with complementary technologies or established market presence, BlackBerry can bolster its product offerings and broaden its customer base. This approach allows for rapid integration of new capabilities, such as advanced cybersecurity solutions or specialized IoT platforms, thereby enhancing its competitive edge in key growth markets.

These strategic moves are vital for BlackBerry to capitalize on emerging trends:

- Enhanced Market Penetration: Partnerships like the one with Vector Informatik can directly increase the adoption of QNX in new vehicle models and software architectures.

- Portfolio Expansion: Acquisitions can swiftly add critical technologies, such as AI-driven analytics or advanced connectivity solutions, to BlackBerry's existing portfolio.

- Synergistic Growth: Combining BlackBerry's strengths in secure software with partners' or acquired companies' specialized knowledge can unlock new revenue streams and market opportunities.

Increased Focus on Government and Critical Infrastructure Security

With cyber threats escalating, particularly against government bodies and essential services, BlackBerry's established track record in secure communication and critical event management offers a significant advantage. This expertise positions BlackBerry to secure a greater number of public sector contracts as these organizations prioritize robust security solutions.

BlackBerry's commitment to the U.S. government market is further solidified by its ongoing FedRAMP High authorization process for its AtHoc platform. This authorization is a crucial step for government agencies seeking cloud-based services that meet stringent security and compliance standards.

- Growing Demand for Secure Government Communications: As cyberattacks on critical infrastructure intensify, government agencies are actively seeking advanced security solutions.

- BlackBerry's FedRAMP High Authorization: The progress in achieving FedRAMP High authorization for AtHoc is a key enabler for securing U.S. federal contracts.

- Critical Event Management Expertise: BlackBerry's capabilities in managing critical events are highly relevant to government continuity and emergency response planning.

BlackBerry is well-positioned to benefit from the burgeoning cybersecurity and IoT markets, with projections indicating the cybersecurity sector will reach $2 trillion by 2025 and the IoT market hitting $3.3 trillion by 2030. The company's QNX platform is also poised for significant growth within the automotive sector, particularly with the rise of software-defined vehicles (SDVs), a market valued at approximately $30 billion in 2024.

Leveraging AI and strategic partnerships, such as the one with Vector Informatik, offers further avenues for expansion and portfolio enhancement. The company's focus on securing government communications, underscored by its FedRAMP High authorization progress for the AtHoc platform, addresses a critical need for robust security solutions in the public sector.

| Opportunity | Market Size/Growth | BlackBerry Relevance |

|---|---|---|

| Cybersecurity Market | Projected $2 trillion by 2025 | High demand for BlackBerry's robust solutions |

| IoT Market | Projected $3.3 trillion by 2030 | Expertise in securing connected devices |

| Software-Defined Vehicles (SDVs) | Automotive software market ~$30 billion (2024) | QNX platform leadership in embedded automotive software |

| AI Integration | Growing market demand for AI-powered security | Enhancing cybersecurity and IoT portfolios |

| Government Contracts | Increasing need for secure government communications | FedRAMP High authorization for AtHoc platform |

Threats

The cybersecurity world is a battlefield where threats are always advancing. We're seeing more sophisticated ransomware attacks and nation-state sponsored cyber espionage, meaning constant vigilance is key. This dynamic environment necessitates substantial and ongoing investment in research and development to ensure BlackBerry's solutions remain cutting-edge.

BlackBerry faces intense competition from tech giants like Apple and Google in the mobile and cybersecurity sectors, alongside numerous agile startups. This crowded landscape often leads to aggressive pricing strategies that can squeeze profit margins, especially if BlackBerry's solutions aren't perceived as uniquely valuable.

The company's ability to maintain market share and profitability hinges on its capacity to differentiate its cybersecurity and IoT offerings. For instance, in the automotive sector, while BlackBerry QNX is a leader, it competes with integrated solutions from chip manufacturers and other software providers, demanding continuous innovation and strategic partnerships to fend off pricing pressures.

Global economic uncertainties, including inflation and potential recessions, pose a significant threat. These factors can lead enterprises and governments to cut back on IT expenditures, directly impacting BlackBerry's revenue. For instance, a projected slowdown in global GDP growth for 2024 could translate into tighter IT budgets across key sectors.

Brand Perception and Market Credibility

BlackBerry's historical association with smartphones, despite its strategic shift, might still hinder its image as a cutting-edge cybersecurity and software provider, potentially impacting its ability to attract new clients. This lingering perception could make some potential customers hesitant to fully embrace its current offerings.

A significant security incident or data breach linked to BlackBerry's products could severely undermine the trust and credibility it has diligently rebuilt in the cybersecurity space. Such an event could quickly erode its hard-won reputation.

- Brand Perception Challenge: Past smartphone market difficulties could impact its image as a leading software and cybersecurity firm, potentially affecting new customer acquisition.

- Reputational Risk: Any high-profile security vulnerability or breach could severely damage its hard-earned reputation in the cybersecurity sector.

Regulatory Changes and Compliance Burden

BlackBerry faces significant challenges from evolving data privacy regulations, such as GDPR and CCPA, which demand constant adaptation of its software and services to ensure compliance across various global markets. The increasing stringency of cybersecurity standards also adds to this burden, requiring substantial investment in product development and ongoing audits. Failure to meet these evolving requirements could result in substantial fines, reputational damage, and a loss of competitive advantage, impacting revenue streams. For instance, the European Union's General Data Protection Regulation (GDPR) imposes strict rules on data handling, with potential fines up to 4% of annual global turnover.

The cybersecurity landscape is constantly evolving, with increasingly sophisticated threats like advanced ransomware and nation-state espionage demanding continuous R&D investment. Economic headwinds, such as inflation and potential recessions, could also lead to reduced IT spending, directly impacting BlackBerry's revenue streams, with global GDP growth forecasts for 2024 suggesting tighter enterprise budgets.

BlackBerry must navigate intense competition from established tech giants and agile startups, often facing aggressive pricing that pressures profit margins. Furthermore, lingering perceptions from its smartphone era may hinder its image as a modern cybersecurity leader, potentially affecting client acquisition and requiring significant effort to showcase its current capabilities.

| Threat Category | Specific Example | Impact on BlackBerry |

|---|---|---|

| Cybersecurity Landscape | Sophisticated Ransomware, Nation-State Espionage | Requires ongoing, substantial R&D investment to maintain competitive solutions. |

| Economic Factors | Inflation, Potential Recessions, Reduced IT Budgets | Could lead to decreased enterprise and government spending on cybersecurity solutions. |

| Competitive Landscape | Tech Giants (Apple, Google), Agile Startups | Intense competition may lead to pricing pressures and reduced profit margins. |

| Brand Perception | Lingering Smartphone Association | May hinder image as a leading cybersecurity and software provider, impacting new client acquisition. |

SWOT Analysis Data Sources

This BlackBerry SWOT analysis is built upon a foundation of credible data, including official financial filings, comprehensive market intelligence reports, and expert industry evaluations. These sources ensure that our assessment is both accurate and provides deep strategic insights.