BlackBerry Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackBerry Bundle

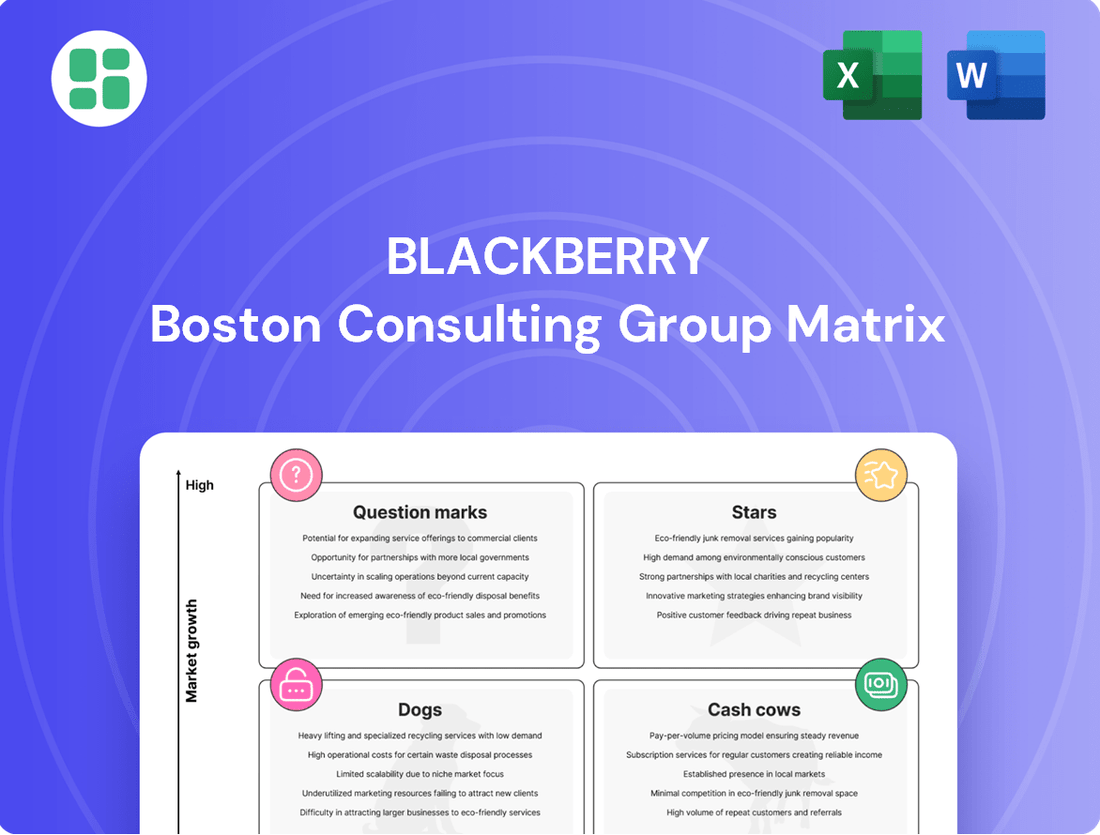

BlackBerry's strategic positioning can be illuminated through the lens of the BCG Matrix, revealing which product lines are driving growth and which may be holding the company back. Understanding whether their offerings fall into Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

Dive deeper into BlackBerry's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

BlackBerry's QNX operating system is a powerhouse in automotive embedded software, currently running in over 255 million vehicles globally. This strong market presence is fueled by the surging demand for software-defined vehicles and advanced driver-assistance systems, positioning QNX as a star performer with substantial growth prospects. BlackBerry's ongoing commitment to innovation and expansion in this vital area solidifies its leadership.

BlackBerry's QNX for General Embedded systems is a shining star in its portfolio, leveraging the platform's proven safety and reliability for industrial IoT, medical devices, and robotics. This segment, often termed GEM, is experiencing significant expansion, with its sales pipeline demonstrating a robust 55% year-over-year growth.

This strategic diversification into non-automotive sectors allows BlackBerry to capitalize on the increasing demand for secure, high-performance operating systems in critical applications. By applying its expertise to new and rapidly growing industries, QNX solidifies its position as a star, capturing new market share and driving future revenue.

The BlackBerry IVY platform, a collaboration with Amazon Web Services, represents a significant move into the connected automotive space. This cloud-connected, embedded edge platform is designed to handle in-vehicle data processing and unlock new monetization opportunities. Its early positioning in a burgeoning market, supported by strategic alliances, suggests strong future growth potential.

BlackBerry's AI-Powered Threat Detection & Prevention

BlackBerry is aggressively integrating artificial intelligence and machine learning into its cybersecurity offerings, focusing on advanced threat detection and prevention. This AI-powered approach is a key differentiator, enabling the company to proactively identify and neutralize sophisticated cyber threats. In 2024, BlackBerry reported its cybersecurity segment revenue grew by 7% year-over-year, reaching $360 million, highlighting the market's demand for these intelligent solutions.

The effectiveness of BlackBerry's AI-driven cybersecurity technology is evident in its ability to block millions of cyberattacks, including those targeting critical infrastructure sectors. This robust performance solidifies its position as a leader in a rapidly expanding cybersecurity market. For instance, in the first half of 2024, BlackBerry Cylance identified and blocked over 1.5 billion threats, showcasing the scale of its AI's impact.

- AI-Driven Threat Prevention: BlackBerry's core strength lies in its AI and machine learning algorithms that continuously learn and adapt to new threats.

- Proven Efficacy: The technology has successfully thwarted millions of cyberattacks, demonstrating its real-world protective capabilities.

- Market Leadership: This innovative defense strategy positions BlackBerry as a frontrunner in the high-growth cybersecurity sector.

- Critical Infrastructure Focus: The solutions are particularly vital for safeguarding essential services against increasingly complex cyber warfare.

BlackBerry's Secure Communications for Critical Event Management (AtHoc Expansion)

BlackBerry's secure communications, particularly through its AtHoc platform, is positioned as a Star in the BCG Matrix. While the overall secure communications market is mature, the recent FedRAMP High Authorization for BlackBerry AtHoc unlocks access to the substantial U.S. federal market, estimated at $40 billion.

This achievement significantly enhances BlackBerry's ability to serve critical event management needs within government agencies, a segment demanding the highest levels of security and reliability. The expansion into this lucrative, high-security government sector for critical event management represents a notable growth avenue for the company.

- Market Potential: The U.S. federal market for critical event management represents a $40 billion opportunity.

- Key Enabler: FedRAMP High Authorization for BlackBerry AtHoc is crucial for accessing this federal market.

- Strategic Advantage: Extends proven, highly secure solutions into new, high-value government applications.

- Growth Trajectory: Positions BlackBerry for increased market share in a demanding, high-security segment.

BlackBerry's QNX operating system, powering over 255 million vehicles, is a clear Star due to the booming demand for software-defined vehicles. Its expansion into industrial IoT and medical devices via the GEM segment, which saw a 55% sales pipeline growth, further solidifies its Star status. The IVY platform, a collaboration with AWS, is also positioned as a Star, tapping into the connected car market's potential.

BlackBerry's AI-driven cybersecurity, which blocked over 1.5 billion threats in the first half of 2024, is a Star performer, with its cybersecurity segment revenue growing 7% year-over-year to $360 million in 2024. The AtHoc secure communications platform, now FedRAMP High authorized, is also a Star, poised to capture a significant share of the $40 billion U.S. federal critical event management market.

| BlackBerry Product/Segment | BCG Matrix Category | Key Growth Drivers | 2024 Performance Indicators |

|---|---|---|---|

| QNX (Automotive) | Star | Software-defined vehicles, ADAS | 255M+ vehicles globally |

| QNX (General Embedded Systems - GEM) | Star | Industrial IoT, Medical Devices, Robotics | 55% sales pipeline growth |

| BlackBerry IVY | Star | Connected automotive, In-vehicle data | Early market positioning, AWS partnership |

| Cybersecurity (AI-Driven) | Star | Advanced threat detection, ML integration | $360M revenue (7% YoY growth), 1.5B+ threats blocked (H1 2024) |

| Secure Communications (AtHoc) | Star | Critical event management, Government sector | $40B U.S. federal market opportunity, FedRAMP High Authorization |

What is included in the product

BlackBerry's BCG Matrix analysis would highlight its legacy mobile devices as Dogs, while its cybersecurity software may be Stars or Question Marks.

A clear BlackBerry BCG Matrix overview pinpoints underperforming units, relieving the pain of resource misallocation.

Cash Cows

BlackBerry's Secure Communications division, featuring products like AtHoc and SecuSUITE, commands a significant market share in deeply regulated sectors such as government, finance, and healthcare. These clients place a premium on robust security and unwavering reliability, which translates into predictable, recurring revenue streams and healthy profit margins for BlackBerry.

The growth in these established, specialized markets is relatively modest. This maturity allows BlackBerry to leverage these secure communication assets as cash cows, generating consistent and dependable cash flow to support other business initiatives.

BlackBerry Unified Endpoint Management (UEM) serves as a robust cash cow for the company, leveraging its substantial installed base within established enterprise clients. This segment provides essential solutions for securing mobile workforces, a critical need for many organizations.

While the overall UEM market is considered mature with slower growth prospects, BlackBerry benefits from strong customer loyalty and predictable recurring subscription revenue. This stability translates into a consistent and reliable cash flow for the business.

In 2024, BlackBerry continued to focus its investments on maintaining the productivity of its existing UEM services and ensuring high customer retention rates. The strategy here is less about aggressive market expansion and more about capitalizing on the steady income generated by its loyal customer base.

BlackBerry Radar, a specialized IoT product, provides asset tracking for the transportation and logistics sectors, monitoring trailers, containers, and railcars. This niche offering generates consistent revenue by serving an established customer base with valuable data for fleet management and optimization.

The transportation tracking market, while not experiencing rapid expansion, exhibits stable demand, allowing BlackBerry Radar to function as a reliable cash cow. In 2024, the global IoT in logistics market was projected to reach approximately $30 billion, underscoring the significant, albeit mature, revenue potential within this segment for solutions like BlackBerry Radar.

Legacy QNX Infotainment System Deployments

Legacy QNX infotainment system deployments represent a classic Cash Cow for BlackBerry. These older versions of the QNX software are deeply embedded in a vast number of automotive infotainment systems, a testament to their reliability and widespread adoption over the years.

While BlackBerry is strategically pivoting towards more advanced areas like Advanced Driver-Assistance Systems (ADAS) and Software-Defined Vehicles (SDV), these established QNX systems continue to be a significant source of predictable revenue. This ongoing royalty income is generated from the sheer volume of existing vehicle installations, providing a stable financial base for the company.

This segment of BlackBerry's business fits the Cash Cow profile perfectly: it commands a high market share in a mature segment of the automotive software market, offering limited but consistent growth. The consistent cash flow generated from these legacy systems is crucial, enabling BlackBerry to fund its investments in newer, higher-growth technologies.

- High Market Penetration: QNX is a foundational technology in millions of vehicles, ensuring consistent demand for updates and support.

- Stable Royalty Income: Despite limited growth, these deployments generate predictable and substantial royalty streams.

- Mature Product Lifecycle: While not a growth engine, its stability provides essential cash flow for R&D in new automotive tech.

- Strategic Importance: The cash generated supports BlackBerry's transition to higher-value automotive software solutions.

Ongoing Patent Royalty Streams (from prior non-core sales)

BlackBerry continues to benefit from ongoing patent royalty streams, even after divesting a significant portion of its non-core patent portfolio. These agreements, established from prior licensing deals, represent a stable, high-margin revenue source. This intellectual property generates passive cash flow with minimal ongoing operational investment, fitting the profile of a cash cow.

- Low Growth, High Margin: These royalty streams are characterized by their stability and profitability, requiring little to no additional capital expenditure.

- Passive Income: The revenue is generated from existing assets, contributing to BlackBerry's cash flow without active management.

- Strategic Value: While not core to current operations, these patents provide a reliable financial cushion.

BlackBerry's legacy QNX infotainment systems represent a classic cash cow, deeply embedded in millions of vehicles and generating predictable royalty income. This segment, while mature with limited growth, provides essential cash flow to fund the company's strategic pivot towards advanced automotive technologies.

The Secure Communications division, including products like AtHoc and SecuSUITE, also acts as a cash cow. It serves regulated sectors with high demand for security and reliability, ensuring consistent revenue and healthy profit margins in a market with modest growth.

BlackBerry's Unified Endpoint Management (UEM) is another key cash cow, leveraging a substantial installed base for mobile workforce security. Despite a mature market, strong customer loyalty and recurring subscription revenue create a stable income stream.

BlackBerry Radar, a specialized IoT product for logistics, generates consistent revenue from an established customer base in a stable market. In 2024, the global IoT in logistics market was valued at approximately $30 billion, highlighting the significant, albeit mature, revenue potential.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Legacy QNX Infotainment | Cash Cow | High market penetration, stable royalty income, mature product lifecycle | Embedded in millions of vehicles, providing consistent revenue. |

| Secure Communications (AtHoc, SecuSUITE) | Cash Cow | Significant market share in regulated sectors, predictable recurring revenue | Serves government, finance, and healthcare with high demand for security. |

| Unified Endpoint Management (UEM) | Cash Cow | Substantial installed base, strong customer loyalty, recurring subscription revenue | Focus on maintaining productivity and high customer retention in a mature market. |

| BlackBerry Radar (IoT Logistics) | Cash Cow | Niche offering, established customer base, stable demand | Operates within the ~ $30 billion global IoT in logistics market. |

Preview = Final Product

BlackBerry BCG Matrix

The BlackBerry BCG Matrix preview you're examining is the precise, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final version, ensuring you get a professional and ready-to-use strategic analysis. The report is crafted with market-backed insights and is designed for immediate application in your business planning. What you see is exactly what you'll download, allowing for instant editing, printing, or presentation to stakeholders.

Dogs

Before its sale to Arctic Wolf in fiscal year 2025, BlackBerry Cylance was positioned as a Question Mark within the BCG Matrix. This endpoint security business struggled with profitability and saw its market share diminish, despite substantial prior capital injections.

The company's inability to achieve critical scale meant it operated as a consistent drain on BlackBerry's financial resources. This situation necessitated a strategic divestiture to stem further losses and reallocate capital towards more growth-oriented segments of the business.

BlackBerry's once-dominant handset business, powered by its proprietary operating systems like BlackBerry OS and BB10, is now a relic. These products have been officially discontinued, holding no market share and generating zero revenue.

This legacy segment represents a significant past investment with no viable future in today's competitive smartphone landscape. In 2023, BlackBerry's total revenue was $779 million, with the vast majority coming from its cybersecurity and IoT segments, highlighting the complete shift away from its hardware origins.

BlackBerry's foray into consumer devices using its QNX operating system, including the PlayBook tablet and BlackBerry 10 smartphones, unfortunately, did not capture substantial market share. These devices entered a fiercely competitive and low-profit consumer electronics arena where BlackBerry had limited presence.

The company's efforts to pivot its robust QNX technology, primarily known for embedded systems, into the consumer space proved unsuccessful. Despite significant investment, these products faced strong competition from established players like Apple and Samsung, leading to their eventual discontinuation.

The failure of these QNX-based consumer devices represents a significant strategic misstep for BlackBerry, highlighting the challenges of entering mature, high-volume markets with a new platform. The financial impact included substantial write-downs and a redirection of resources towards its core enterprise services business.

BBM Enterprise (low market share in competitive messaging)

BBM Enterprise, despite its historical significance in secure messaging, now finds itself in a fiercely competitive market. Players like Signal, WhatsApp Business, and Microsoft Teams offer robust, often more integrated, solutions, pushing BBM Enterprise into a niche position. Its ability to gain substantial market share against these giants is limited, impacting its revenue generation capabilities.

The enterprise messaging space in 2024 is characterized by rapid innovation and widespread adoption of cloud-based platforms. BBM Enterprise, while maintaining its focus on security, struggles to compete on features and ecosystem integration. This results in a low market share, likely confined to specific industries or organizations with legacy dependencies, contributing minimally to BlackBerry's overall financial performance.

- Market Share: BBM Enterprise likely holds a very small fraction of the enterprise secure messaging market in 2024, dwarfed by competitors.

- Revenue Contribution: Due to its low market penetration, BBM Enterprise's contribution to BlackBerry's revenue is expected to be minimal.

- Competitive Landscape: The market is dominated by established tech giants offering comprehensive collaboration suites, making differentiation difficult for BBM Enterprise.

- Differentiation Challenges: While security remains a strong point, it's often not enough to sway large enterprises away from feature-rich, widely adopted platforms.

Non-core, Deprecated Software and Services

BlackBerry's strategic shift has led to the deprecation of numerous non-core software and services. These legacy products, which once represented investments, now have negligible market share and contribute minimally to revenue, reflecting their misalignment with the company's current focus on intelligent security software.

These retired offerings are no longer supported or actively promoted by BlackBerry. For instance, the company phased out its BlackBerry OS and related services, a significant move away from its historical smartphone business.

- Low Market Share: Products like BlackBerry OS have virtually zero current market share in the smartphone operating system landscape.

- Minimal Revenue: The revenue generated from these deprecated services is insignificant, often falling below reporting thresholds.

- Strategic Divestment: This aligns with BlackBerry's 2023 financial reports, which highlight a focus on cybersecurity and IoT solutions, moving away from its past hardware and OS ventures.

BlackBerry's legacy handset business, including its once-popular operating systems, now firmly resides in the Dogs quadrant of the BCG Matrix. These products have been discontinued, holding no market share and generating no revenue, a stark contrast to BlackBerry's 2023 revenue of $779 million, which was dominated by cybersecurity and IoT.

The company's attempts to pivot its QNX operating system into consumer devices like the PlayBook tablet and BB10 smartphones also failed to capture significant market share, facing intense competition from established players. This strategic misstep resulted in substantial write-downs and a redirection of resources.

Similarly, BBM Enterprise, despite its security focus, struggles to gain traction against dominant messaging platforms, contributing minimally to BlackBerry's overall financial performance. These legacy products represent past investments with no viable future in the current market, reflecting BlackBerry's strategic pivot towards intelligent security software.

Question Marks

BlackBerry is actively expanding its cybersecurity portfolio beyond its core Unified Endpoint Management (UEM) and Secure Communications. New offerings focus on high-growth areas like advanced threat intelligence and specialized security services tailored for evolving cyber threats.

These innovative solutions are targeting markets experiencing rapid expansion, but they are still in the early stages of capturing significant market share. Competitors, often larger and with more resources, present a considerable challenge as BlackBerry works to establish its competitive edge in these emerging segments.

Significant investment is necessary to validate the viability and ensure the scalability of these new cybersecurity products. For instance, the global cybersecurity market was projected to reach $231.4 billion in 2024, highlighting the substantial opportunity and the need for robust development and market penetration strategies for BlackBerry's new ventures.

QNX is strategically positioned in emerging industrial and robotic applications, representing a potential star in BlackBerry's BCG matrix. While its presence in industrial IoT is growing, these newer, specialized markets like advanced robotics and medical tech are in their infancy, demanding substantial R&D and market entry efforts. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, offering QNX a fertile ground for expansion, though market share is currently nascent.

BlackBerry is leveraging its AI and machine learning capabilities to tackle evolving cybersecurity threats across diverse industries. This expansion into new, high-growth verticals, particularly in critical infrastructure segments where its current market share is minimal, represents a strategic "Question Mark" opportunity.

The success of this initiative hinges on BlackBerry's ability to secure targeted investments and achieve swift market penetration. For instance, if BlackBerry can secure a significant contract within the smart grid sector, which is projected to grow substantially by 2027, it would validate this strategic direction.

Strategic Partnerships for Future Automotive Technologies (e.g., QNX Sound, QNX Cabin)

BlackBerry's strategic partnerships for future automotive technologies like QNX Sound and QNX Cabin position them for high-growth opportunities within the evolving software-defined vehicle market. These initiatives aim to create new revenue streams by enhancing the in-car digital experience.

While these ventures represent significant potential, their market adoption and revenue generation are still in nascent stages. Substantial investment is necessary to capture substantial market share in this competitive landscape. For instance, the automotive software market, which includes areas like infotainment and connectivity, was projected to reach $60 billion by 2025, indicating the scale of the opportunity but also the investment required.

- QNX Sound: Focuses on delivering advanced audio experiences and acoustic management within vehicles.

- QNX Cabin: Aims to create a unified and intelligent digital cockpit experience, integrating various vehicle functions.

- Market Potential: The global automotive software market is experiencing rapid growth, driven by increasing demand for connected and autonomous features.

- Investment Needs: Significant R&D and market development are required to establish a strong foothold and achieve profitability in these emerging segments.

BlackBerry's Quantum Cryptography Initiatives

BlackBerry's Certicom division provides robust cryptography solutions, and the company is actively exploring the development of quantum-safe cryptographic technologies. This strategic move aims to preemptively address the security threats posed by the advent of quantum computing.

While the broader quantum computing market is experiencing significant growth, the specific niche of quantum cryptography remains in its early stages of development. Any products emerging from BlackBerry in this domain would represent high-potential future offerings but are likely to have minimal market share in the immediate term, necessitating substantial investment in research and development.

- Quantum-Safe Cryptography: BlackBerry's focus on developing quantum-resistant encryption methods positions them to address future cybersecurity vulnerabilities.

- Nascent Market: The quantum cryptography sector is still emerging, presenting both opportunities and challenges for market penetration.

- High Potential, Low Share: New quantum cryptography solutions are expected to have high future growth potential but currently low market share.

- R&D Investment: Significant research and development funding is crucial for BlackBerry to establish a competitive presence in this evolving technological landscape.

BlackBerry's new cybersecurity initiatives, particularly in advanced threat intelligence and specialized services, represent "Question Marks." These ventures target rapidly expanding markets, but they are in early stages with minimal market share against larger competitors. Significant investment is crucial for validation and scalability, especially given the global cybersecurity market's projected $231.4 billion value in 2024.

The QNX automotive software offerings, such as QNX Sound and QNX Cabin, are also categorized as Question Marks. These are high-potential ventures within the growing software-defined vehicle market, but they require substantial R&D and market development to gain traction. The automotive software market itself was valued at around $60 billion by 2025, underscoring the opportunity and investment needed.

BlackBerry's exploration into quantum-safe cryptography is another clear Question Mark. This area is nascent, demanding extensive research and development to preempt future threats from quantum computing. While the potential is high, current market share is negligible, necessitating significant investment to establish a competitive position in this emerging field.

| Category | BlackBerry Product/Initiative | Market Potential | Current Market Share | Investment Needs |

| Question Mark | Advanced Threat Intelligence & Specialized Cybersecurity Services | High (Global Cybersecurity Market $231.4B in 2024) | Low | High (R&D, Market Penetration) |

| Question Mark | QNX Sound & QNX Cabin (Automotive Software) | High (Automotive Software Market ~$60B by 2025) | Low | High (R&D, Market Development) |

| Question Mark | Quantum-Safe Cryptography | Very High (Future Threat Mitigation) | Negligible | Very High (Fundamental R&D) |

BCG Matrix Data Sources

Our BlackBerry BCG Matrix is built on a foundation of comprehensive market data, incorporating financial reports, industry analysis, and competitor intelligence to provide strategic clarity.