BlackBerry Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackBerry Bundle

BlackBerry faces a dynamic competitive landscape shaped by intense rivalry and significant buyer power, demanding a strategic understanding of its market. The threat of substitutes and new entrants also presents considerable challenges, impacting its ability to innovate and maintain market share.

The complete report reveals the real forces shaping BlackBerry’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BlackBerry's reliance on highly specialized components, such as its QNX real-time operating system and secure communication technologies, grants significant bargaining power to its suppliers. These suppliers often possess niche expertise and intellectual property, making it difficult for BlackBerry to find readily available alternatives. For instance, in the realm of advanced cryptography and embedded systems, a limited number of vendors can meet BlackBerry's stringent requirements.

The company's strategic pivot towards artificial intelligence and machine learning further concentrates its supplier power. Access to specialized datasets and advanced processing capabilities from a select group of vendors is crucial for BlackBerry's innovation. This dependence on specialized vendors for AI/ML infrastructure means these suppliers can exert considerable influence over pricing and terms, given the unique nature of the technologies and data required.

Switching suppliers for critical software components or cloud infrastructure presents significant hurdles for BlackBerry, directly impacting supplier bargaining power. These challenges often involve complex technical integration, potential compatibility issues with current product lines, and the necessity of obtaining new certifications or regulatory approvals, all of which elevate the cost and effort of changing providers.

For example, if BlackBerry's cybersecurity solutions are deeply integrated with a particular cloud platform, a shift to a different provider could necessitate extensive and costly re-engineering. This dependence on specialized infrastructure or software makes it difficult and expensive for BlackBerry to switch, thereby strengthening the leverage of their existing suppliers.

Suppliers possessing advanced technological capabilities or a dominant market presence might consider moving into BlackBerry's core business, effectively becoming direct competitors. For instance, a leading cloud service provider could launch its own cybersecurity or Unified Endpoint Management (UEM) offerings, thereby diminishing BlackBerry's market share and increasing their own bargaining power.

This potential for forward integration by suppliers poses a significant challenge, especially within the dynamic cybersecurity and Internet of Things (IoT) industries. These sectors are characterized by rapid technological advancements and frequent convergence, making it easier for suppliers to leverage their existing strengths to enter new markets.

Importance of Supplier Inputs to BlackBerry's Business

The quality and dependability of components sourced by BlackBerry are paramount to its brand image and the performance of its products. This is particularly true for its QNX operating system, which is widely used in safety-critical sectors like the automotive industry.

Any interruption or defect stemming from a crucial supplier could significantly hinder BlackBerry's capacity to provide its secure and dependable software solutions. This situation inherently amplifies the significance of these suppliers and, consequently, their potential leverage.

- QNX Dominance: BlackBerry's QNX software is a leading real-time operating system in the automotive sector, powering over 210 million vehicles globally as of early 2024.

- Critical Components: Suppliers of specialized microprocessors, secure memory modules, and advanced sensor technologies are vital for BlackBerry's IoT and cybersecurity offerings.

- High Switching Costs: For automotive manufacturers integrating QNX, the cost and complexity of switching to an alternative operating system or supplier can be substantial, reducing BlackBerry's supplier bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs plays a crucial role in assessing the bargaining power of BlackBerry's suppliers. While BlackBerry historically relied on some specialized components, the broader technological landscape offers alternatives for certain aspects of its operations. For instance, the rise of open-source software and readily available hardware components can dilute the power of suppliers who might otherwise command higher prices or dictate terms.

However, this isn't a universal truth for all of BlackBerry's input needs. For highly specialized, certified, or proprietary technologies essential to its core products, such as advanced cybersecurity software or specific chipsets, the availability of substitutes can be quite limited. In these instances, suppliers of these unique inputs hold significant leverage, potentially impacting BlackBerry's costs and product development timelines.

BlackBerry's strategic focus on research and development is also a factor. By investing in developing its own proprietary solutions and technologies, the company aims to reduce its dependence on external suppliers for critical inputs. This internal innovation can gradually shift the balance, diminishing the bargaining power of suppliers over time as BlackBerry gains more control over its supply chain.

- Limited Substitutes for Core Technologies: Suppliers of highly specialized and certified components, like certain cybersecurity modules or proprietary processors, can exert significant influence due to the scarcity of viable alternatives.

- Impact of Open Source and Commodity Hardware: The availability of open-source software and more commoditized hardware components for less critical functions can reduce supplier power in those areas.

- R&D as a Mitigating Factor: BlackBerry's ongoing investment in developing in-house solutions aims to decrease reliance on external specialized inputs, thereby potentially weakening supplier bargaining power in the long run.

BlackBerry's suppliers, particularly those providing specialized components like its QNX operating system and cybersecurity technologies, hold considerable bargaining power. This is due to the niche expertise and limited availability of alternatives for these critical inputs, which are essential for BlackBerry's product integrity and innovation, especially in sectors like automotive where QNX is a dominant player.

The high switching costs associated with integrating these specialized technologies, coupled with the risk of forward integration by powerful suppliers, further strengthens their leverage. While open-source alternatives exist for some functions, the scarcity of substitutes for BlackBerry's core, high-performance needs means suppliers can significantly influence pricing and terms.

| Factor | Impact on BlackBerry | Evidence/Data (as of early 2024) |

|---|---|---|

| Supplier Specialization | High Bargaining Power | QNX is the leading RTOS in automotive, powering over 210 million vehicles. |

| Switching Costs | High for BlackBerry | Complex integration and regulatory hurdles for automotive clients using QNX. |

| Availability of Substitutes | Limited for Core Tech | Scarcity of viable alternatives for advanced cybersecurity modules and proprietary processors. |

| Supplier Forward Integration Risk | Potential Threat | Cloud providers could enter cybersecurity or UEM markets, impacting BlackBerry. |

What is included in the product

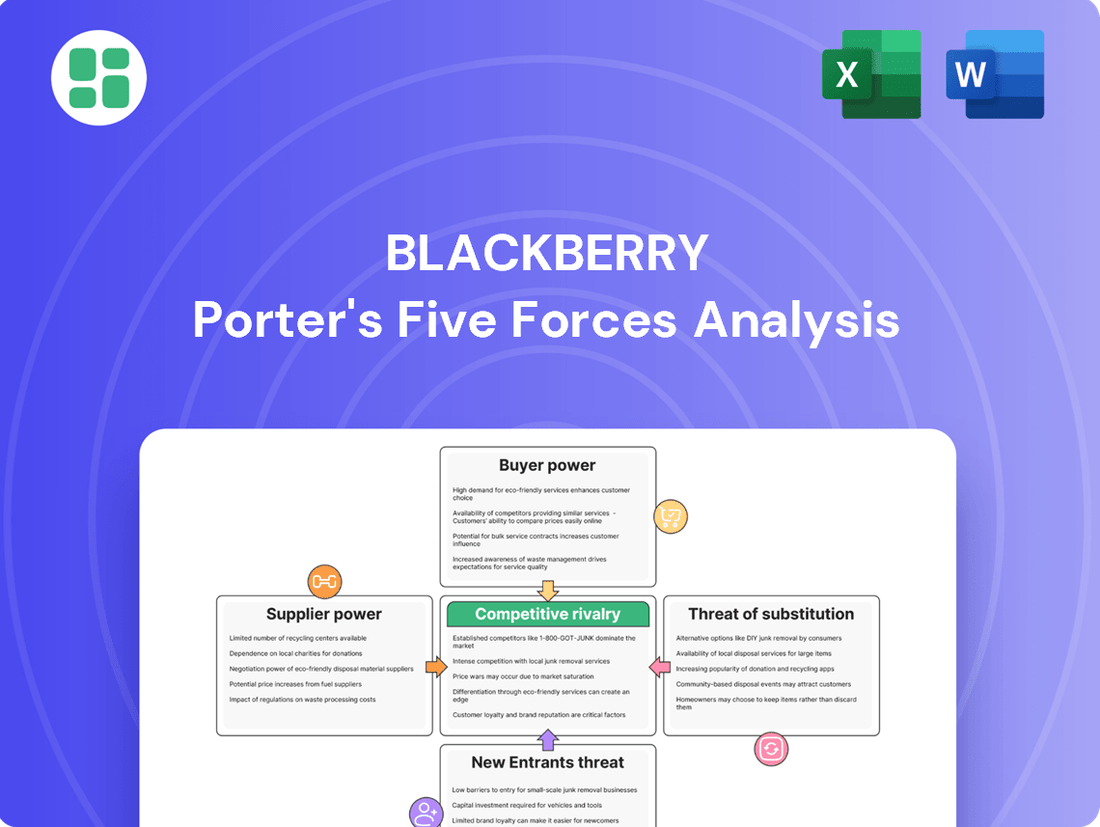

This Porter's Five Forces analysis for BlackBerry dissects the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Instantly grasp competitive threats and opportunities with a visually intuitive, interactive model that simplifies complex market dynamics.

Customers Bargaining Power

BlackBerry's customer concentration, particularly with large enterprises and governments, significantly amplifies customer bargaining power. These major clients, often purchasing in bulk, possess substantial negotiation leverage, enabling them to demand customized solutions and more favorable pricing structures.

For instance, in 2024, many government contracts and large enterprise deals were subject to rigorous tender processes where price and service level agreements were key determinants. This sophistication in procurement allows these customers to extract better terms and conditions, directly impacting BlackBerry's profit margins and strategic flexibility.

For enterprises and governments, the effort and expense involved in moving away from established cybersecurity and Unified Endpoint Management (UEM) systems like BlackBerry’s are substantial. These costs encompass data migration, re-training personnel, integrating with current IT frameworks, and managing potential security vulnerabilities during the transition phase, thereby diminishing the bargaining power of these customers.

While BlackBerry's core customer base prioritizes robust security, budget limitations and the presence of alternative solutions mean price sensitivity remains a factor. Many public sector clients, a key demographic for BlackBerry, operate under stringent financial regulations, often leading to rigorous price negotiations for cybersecurity investments.

Despite this, the critical nature of cybersecurity solutions can grant BlackBerry some leeway for premium pricing. For instance, in 2024, government cybersecurity spending globally continued to rise, with many agencies prioritizing effectiveness over absolute cost, acknowledging the significant financial and reputational damage a breach can inflict.

Customer Information and Transparency

BlackBerry's enterprise and government clients are typically highly informed about the competitive landscape, including pricing and available features. This knowledge, often gleaned from industry reports and peer comparisons, significantly strengthens their bargaining position.

The increased transparency allows these customers to readily benchmark BlackBerry's cybersecurity solutions and services against alternatives. For instance, in 2024, many large enterprises were actively evaluating integrated security platforms, putting pressure on vendors to demonstrate clear value propositions and competitive pricing.

- Informed Buyers: Enterprise and government customers possess substantial knowledge of market offerings and pricing.

- Access to Information: Industry reports, analyst reviews, and peer networks enhance customer transparency.

- Negotiating Leverage: This transparency empowers customers to negotiate more effectively with vendors like BlackBerry.

- Competitive Benchmarking: Customers can easily compare BlackBerry's products and services against those of rivals.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for BlackBerry’s core, specialized offerings, can still exert pressure. Large enterprises or governments with robust IT departments could theoretically develop in-house solutions for certain aspects of device management or security, though this is unlikely for highly complex areas like advanced cybersecurity or embedded operating systems.

While full backward integration is improbable for BlackBerry's highly technical products, the *potential* for customers to develop partial, less critical functionalities in-house acts as a latent bargaining tool. This capability can influence negotiations by suggesting alternative, albeit less sophisticated, internal options.

- Low Likelihood of Full Integration: Developing advanced cybersecurity or embedded systems comparable to BlackBerry's expertise is prohibitively complex and costly for most customers.

- Partial In-House Development: Customers might consider building internal solutions for less specialized functions, such as basic device management or data handling.

- Latent Bargaining Power: The mere possibility of partial in-house development can serve as leverage for customers during pricing or service negotiations with BlackBerry.

BlackBerry's bargaining power of customers is significant, driven by the concentration of its client base among large enterprises and governments. These major purchasers, often securing substantial volumes, wield considerable negotiation influence, enabling them to secure tailored solutions and more advantageous pricing. For instance, in 2024, many government and enterprise procurement processes heavily emphasized price and service level agreements, allowing these sophisticated buyers to negotiate better terms that impacted BlackBerry's profitability.

| Customer Type | Negotiation Leverage Factor | Impact on BlackBerry |

|---|---|---|

| Large Enterprises | Bulk purchasing, demand for customization | Pressure on pricing, need for flexible solutions |

| Governments | Rigorous tender processes, budget constraints | Intense price scrutiny, focus on compliance and security features |

| Informed Buyers | Market knowledge, competitive benchmarking | Reduced pricing power for BlackBerry, need for clear value proposition |

Full Version Awaits

BlackBerry Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for BlackBerry, analyzing the intensity of rivalry among existing firms, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive Porter's Five Forces analysis provides actionable insights into the strategic challenges and opportunities BlackBerry faced in its market.

Rivalry Among Competitors

The cybersecurity and enterprise software sectors are incredibly crowded, featuring a wide array of companies from massive technology corporations to highly specialized startups. BlackBerry faces competition from giants like Microsoft, IBM, Ivanti, and Cisco, alongside many newer cybersecurity innovators. This broad competitive field includes companies offering comprehensive solutions as well as those concentrating on specific areas like security or the Internet of Things (IoT).

The cybersecurity and Unified Endpoint Management (UEM) sectors are booming, with the UEM market alone anticipated to reach $20.6 billion by 2027, growing at a CAGR of 14.8%. This robust expansion, fueled by escalating cyber threats and the surge in connected devices, naturally intensifies competition. More players are entering the arena, and established companies are pushing to capture a larger piece of this expanding pie.

BlackBerry's competitive edge is built on its deep roots in secure communication, advanced AI/ML cybersecurity solutions, and a robust presence in embedded systems like QNX. These specialized offerings create significant barriers for customers looking to switch. For instance, in sectors like automotive and critical infrastructure, the integration of BlackBerry's QNX operating system is complex and costly to replace, effectively locking in existing clients and reducing the immediate threat from rivals.

While BlackBerry boasts high switching costs, particularly in mission-critical sectors, competitors are actively working to erode this advantage. Companies like Google with its Android Automotive OS and various Linux-based solutions are continuously introducing innovative features and more adaptable pricing models. These efforts aim to attract customers by offering perceived greater flexibility or cost savings, thereby intensifying the rivalry and challenging BlackBerry's established customer base.

Industry Concentration and Exit Barriers

The competitive rivalry within BlackBerry's operating landscape is characterized by a fragmented market structure rather than high industry concentration. This means there are numerous companies actively competing, which inherently fuels a more intense rivalry. For instance, in the cybersecurity sector, which is a key area for BlackBerry, the market includes a vast array of players, from large established tech giants to nimble startups, all vying for market share.

Exit barriers play a significant role in sustaining this intense competition. Companies have made substantial investments in research and development, requiring specialized technical expertise and often securing long-term commitments from customers. These factors make it difficult and costly for less profitable competitors to simply withdraw from the market, leading them to persist and continue competing even when returns are modest, thus perpetuating the rivalry.

- Fragmented Market: The presence of many active players intensifies competition.

- High R&D Investment: Significant capital outlay in innovation acts as an exit barrier.

- Specialized Talent: The need for unique skills makes workforce departure costly.

- Long-Term Contracts: Customer commitments lock companies into the market, even if unprofitable.

Strategic Stakes and Aggressiveness of Competitors

The cybersecurity landscape is characterized by intense rivalry, with competitors frequently innovating and pursuing mergers and acquisitions to expand their market share and technological prowess. Companies such as Microsoft and IBM are significantly increasing competitive pressure on specialized firms like BlackBerry by integrating Unified Endpoint Management (UEM) and Artificial Intelligence (AI) into their comprehensive enterprise solutions.

This aggressive market dynamic necessitates continuous investment in research and development and the cultivation of strategic partnerships for BlackBerry to maintain its competitive standing. For instance, in fiscal year 2024, BlackBerry reported cybersecurity revenue of $132 million for the third quarter, underscoring the ongoing need to innovate in a rapidly evolving market.

- Intense Innovation: Competitors in cybersecurity are constantly developing new solutions and features.

- Mergers & Acquisitions: Consolidation within the industry is common as companies seek to gain scale and complementary technologies.

- Large Enterprise Players: Giants like Microsoft and IBM leverage their broad portfolios to compete directly with specialized cybersecurity providers.

- Strategic Imperative: BlackBerry must prioritize R&D and partnerships to counter these competitive forces.

BlackBerry operates in a highly competitive environment, particularly within cybersecurity and enterprise software. The market is fragmented, with numerous players ranging from established tech giants to emerging startups, all vying for market share. This intense rivalry is driven by continuous innovation and significant investments in research and development.

Companies like Microsoft and IBM are major competitors, integrating Unified Endpoint Management (UEM) and Artificial Intelligence (AI) into their broad enterprise solutions, directly challenging specialized firms. BlackBerry's fiscal year 2024 third-quarter cybersecurity revenue of $132 million highlights the ongoing need for innovation in this dynamic sector.

The high cost of customer switching, especially in critical sectors where BlackBerry's QNX operating system is deeply integrated, provides some defense. However, competitors are actively developing alternatives to erode this advantage, intensifying the competitive pressure.

| Competitor | Key Offerings | Impact on BlackBerry |

|---|---|---|

| Microsoft | Comprehensive enterprise solutions, UEM, AI | Intensifies competition with broad integration |

| IBM | Enterprise security, AI-driven solutions | Challenges BlackBerry's specialized offerings |

| Android Automotive OS | Offers alternatives in embedded systems, potentially reducing switching costs | |

| Various Cybersecurity Startups | Niche security solutions, AI-focused innovations | Fragment the market and drive rapid innovation cycles |

SSubstitutes Threaten

Organizations may choose more general IT security tools from major tech companies instead of specialized cybersecurity products. These integrated platforms, found within operating systems or ERP systems, can replace some of BlackBerry's offerings, particularly for tasks not requiring the highest level of security.

For instance, many businesses leverage built-in security features of cloud providers like Microsoft Azure or Amazon Web Services, which offer a suite of security services that can be a viable substitute for standalone solutions. In 2024, the global cloud security market was valued at over $50 billion, indicating a significant adoption of these bundled security approaches.

The rise of sophisticated open-source security solutions poses a significant threat of substitution for certain aspects of BlackBerry's software offerings. For businesses with capable IT departments, these free or low-cost alternatives can fulfill specific security requirements, potentially diverting demand from BlackBerry's paid services. For instance, projects like OSSEC or Suricata offer robust intrusion detection and prevention capabilities that, while requiring internal expertise, can be a compelling substitute for some commercial endpoint security features.

Large enterprises and government bodies often possess the resources and expertise to develop their own bespoke security solutions. This trend is particularly pronounced in sectors dealing with highly sensitive data, where standard offerings might not meet stringent or unique compliance needs, thereby diminishing the need for external providers like BlackBerry.

For instance, a significant portion of the cybersecurity market is driven by custom solutions. In 2024, the global market for custom software development, which includes security, was projected to reach hundreds of billions of dollars, indicating a substantial appetite for tailored approaches over standardized ones.

Alternative Communication Methods

For secure communication needs, traditional encrypted voice and data services, or even custom-built private networks, can act as viable substitutes for BlackBerry's offerings. These alternatives might be deemed adequate for specific scenarios, depending on the user's security requirements and perceived threat level.

While BlackBerry has historically emphasized high-assurance security, other solutions may offer a sufficient level of protection for many users. The perceived sufficiency of these substitutes often hinges on the specific use case and the criticality of the data being transmitted.

The market for secure communication is evolving, and users have a growing array of options beyond dedicated enterprise mobile solutions. For instance, advancements in end-to-end encryption for consumer-grade messaging apps, while not always meeting the stringent requirements of government or defense sectors, can serve as a substitute for less sensitive communications.

- Encrypted Messaging Apps: Platforms like Signal and WhatsApp offer end-to-end encryption, providing a secure channel for many users, though often lacking the centralized management and audit capabilities of enterprise solutions.

- Virtual Private Networks (VPNs): VPNs can encrypt internet traffic, offering a layer of security for data transmitted over public networks, acting as a substitute for secure data transmission features.

- Dedicated Secure Hardware: For extremely high-security needs, specialized hardware devices or air-gapped systems can serve as substitutes, bypassing the need for mobile communication entirely.

- Custom Private Networks: Organizations with unique security mandates might opt for building and managing their own private, encrypted communication networks, bypassing third-party solutions.

Manual Processes and Policy-Based Security

Organizations might lean on manual processes and policy-driven security as a substitute for advanced software solutions. This approach, while less robust against complex cyber threats, can be a viable, albeit basic, alternative for smaller businesses or those facing budget constraints.

For instance, many small to medium-sized businesses (SMBs) in 2024 continue to rely on strong internal policies and employee training as their primary defense. A 2024 report indicated that over 60% of SMBs surveyed cited employee education on phishing and secure practices as their top security investment, rather than dedicated advanced threat detection software.

This reliance on manual oversight and policy adherence creates a substitute threat. It means that the demand for sophisticated, automated security software can be dampened if organizations perceive their existing manual controls as sufficient, especially if the cost of advanced solutions is prohibitive.

- Reliance on Manual Processes: Organizations may opt for strict manual security protocols and employee training instead of investing in advanced automated security software.

- Cost-Effectiveness for Smaller Entities: This manual approach can serve as a rudimentary substitute, particularly for smaller organizations or those with limited financial resources.

- Reduced Demand for Advanced Solutions: The perceived sufficiency of manual controls can lessen the market demand for sophisticated, automated security software.

- Vulnerability to Sophisticated Threats: While a substitute, manual processes are generally less effective against advanced and rapidly evolving cyber threats.

The threat of substitutes for BlackBerry's offerings stems from the availability of alternative solutions that can fulfill similar security and communication needs. These substitutes range from integrated IT platforms and open-source tools to custom-built solutions and even simpler manual processes.

For instance, the widespread adoption of cloud security services, valued at over $50 billion globally in 2024, demonstrates a significant shift towards bundled security features that can replace specialized products. Similarly, the substantial global market for custom software development, projected to reach hundreds of billions in 2024, highlights a demand for tailored security approaches that bypass off-the-shelf solutions.

| Substitute Category | Examples | Market Trend/Data Point (2024) |

|---|---|---|

| Integrated IT Platforms | Cloud provider security (Azure, AWS) | Global cloud security market > $50 billion |

| Open-Source Solutions | OSSEC, Suricata | Increasing adoption for specific security functions |

| Custom Solutions | Bespoke enterprise security systems | Global custom software development market in hundreds of billions |

| Secure Communication Alternatives | Encrypted messaging apps (Signal), VPNs | Growing use for less sensitive communications |

| Manual Processes | Policy-driven security, employee training | Over 60% of SMBs cite employee education as top security investment |

Entrants Threaten

Entering the cybersecurity and embedded systems sectors, especially those demanding advanced AI/ML and stringent certifications for industries like automotive, necessitates significant capital outlay for research and development. BlackBerry's sustained investment in R&D, exemplified by its QNX division, underscores the formidable financial hurdles that deter potential new competitors.

In the realm of cybersecurity and secure mobile communications, brand reputation and customer trust are not merely advantages; they are foundational pillars. BlackBerry, for instance, has cultivated a formidable reputation over decades, particularly for its commitment to secure enterprise solutions and its certified QNX software, which is trusted in critical sectors like automotive and industrial automation. This established trust, especially with government agencies and large enterprises that prioritize data security, presents a significant hurdle for any new entrant aiming to disrupt the market.

Building such deep-seated trust and securing the rigorous certifications required for government and enterprise-level contracts is a lengthy and resource-intensive process. New companies entering this space often lack the established track record and proven reliability that BlackBerry has demonstrably built. For example, BlackBerry's QNX operating system has been a critical component in millions of vehicles, underscoring its reliability and security in demanding environments, a testament to its hard-earned reputation.

BlackBerry operates in sectors like government and automotive, which demand rigorous security and safety standards. New companies entering these markets face substantial challenges due to the complex and expensive nature of obtaining necessary certifications, such as ISO 26262 for automotive functional safety or BSI clearance for government security. This lengthy and costly approval process acts as a significant barrier, deterring potential new entrants and protecting existing players like BlackBerry.

Proprietary Technology and Patents

BlackBerry's extensive portfolio of intellectual property, especially in secure communications and endpoint management, acts as a significant deterrent to new entrants. The company held over 38,000 patents globally as of early 2024, a testament to its innovation. This deep well of proprietary technology means newcomers must either undertake costly research and development to create comparable solutions or face licensing fees, thereby raising the barrier to entry.

The threat of new entrants is notably diminished by BlackBerry's established technological moat, particularly its patents in areas like secure mobile device management and embedded software. For instance, its QNX operating system, a leader in automotive and industrial embedded systems, requires substantial investment and expertise to replicate. This technological advantage forces potential competitors to either invest heavily in R&D or seek costly licensing agreements, effectively limiting the ease with which new players can enter the market.

- Proprietary Technology: BlackBerry's significant intellectual property in secure communications and endpoint management.

- Patent Portfolio: Over 38,000 patents globally as of early 2024, covering secure mobile and embedded systems.

- Barrier to Entry: New entrants face high R&D costs or licensing fees to match BlackBerry's technological capabilities.

- Competitive Advantage: The QNX operating system's market leadership in automotive and industrial embedded systems highlights this barrier.

Talent Acquisition and Expertise

The cybersecurity and AI/ML sectors are characterized by a significant demand for highly specialized talent. Acquiring and retaining individuals with expertise in threat intelligence, secure software development, and advanced machine learning algorithms presents a substantial hurdle for new entrants. This scarcity drives up labor costs, making it difficult for newcomers to assemble a competitive team. For instance, in 2024, the global cybersecurity workforce gap was estimated to be around 3.4 million professionals, underscoring the intense competition for skilled individuals.

Building a competent team capable of innovating and executing in these complex fields requires substantial investment and time. New companies must not only attract top talent but also foster an environment that encourages continuous learning and development to keep pace with evolving threats and technologies. This talent acquisition challenge significantly raises the barrier to entry, as established players often have well-developed recruitment pipelines and attractive compensation packages.

- Talent Scarcity: The cybersecurity industry faced a global talent shortage of approximately 3.4 million professionals in 2024.

- High Labor Costs: Specialized skills in AI/ML and cybersecurity command premium salaries, increasing operational expenses for new entrants.

- Expertise Requirements: New entrants need teams proficient in threat intelligence, secure coding, and machine learning to compete effectively.

The threat of new entrants into BlackBerry's core markets, particularly secure communications and embedded systems, is significantly mitigated by the immense capital required for research and development. BlackBerry's substantial ongoing R&D investments, notably through its QNX division, create formidable financial barriers that deter potential new competitors from entering these specialized fields.

Building a strong brand reputation and earning customer trust, especially in sectors demanding high security like government and automotive, is a lengthy and costly endeavor. BlackBerry's decades-long establishment of trust, particularly for its certified QNX software used in millions of vehicles, makes it difficult for newcomers to gain market acceptance and compete on reliability.

| Factor | Description | Impact on New Entrants | BlackBerry's Position |

| Capital Requirements | High R&D spending for AI/ML and certifications. | Significant barrier due to cost. | Established R&D infrastructure and investment. |

| Brand Loyalty & Trust | Crucial in secure enterprise and government sectors. | Difficult to replicate established trust. | Decades of proven security and certification. |

| Intellectual Property | Extensive patent portfolio in secure tech. | Requires costly R&D or licensing. | Over 38,000 patents globally (early 2024). |

| Talent Acquisition | Shortage of cybersecurity and AI/ML experts. | Increases labor costs and competition. | Established recruitment channels and expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BlackBerry leverages data from its annual reports, investor presentations, and SEC filings, alongside industry-specific market research reports and technology trend analyses.