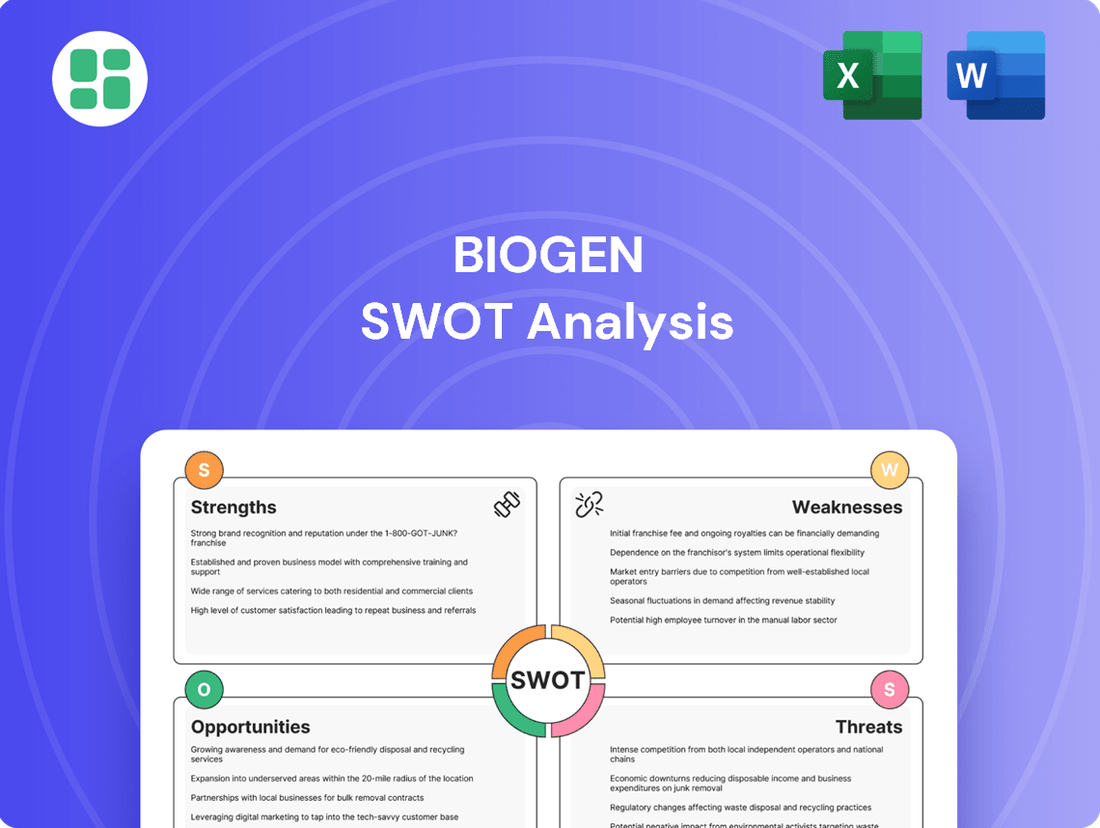

Biogen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biogen Bundle

Biogen's innovative pipeline and strong market presence in neurology present significant strengths, but its reliance on a few key products and intense competition pose notable challenges. Understanding these dynamics is crucial for any investor or strategist looking to navigate the complex biopharmaceutical landscape.

Want the full story behind Biogen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Biogen's deep neuroscience expertise is a significant strength, particularly in areas like multiple sclerosis (MS) and spinal muscular atrophy (SMA). For instance, in 2023, Biogen's MS franchise continued to be a major revenue driver, demonstrating the market's reliance on their specialized treatments. This focused approach allows for concentrated R&D investment, fostering a competitive edge in tackling challenging neurological conditions.

Biogen's strength lies in its evolving product portfolio, marked by successful recent launches. Leqembi for Alzheimer's, Skyclarys for Friedreich ataxia, and Zurzuvae for postpartum depression are showing significant commercial traction. These new therapies are becoming increasingly important revenue drivers, helping to balance out the performance of established products and showcasing a strategic diversification.

Biogen boasts a robust late-stage pipeline, a significant strength for the company. As of June 2025, they have nine programs in Phase 3 or Phase 3-ready development.

These promising candidates are primarily concentrated in neuroscience and rare diseases, areas where Biogen has established expertise. The company's strategic focus on high-conviction assets underscores its commitment to driving substantial growth through the next decade.

Strategic Collaborations and Acquisitions

Biogen's strategic collaborations and acquisitions are a significant strength, allowing it to expand its research and development capabilities and enter new therapeutic areas. For instance, its partnership with Eisai for Leqembi, a treatment for Alzheimer's disease, not only strengthens its market position but also shares the considerable costs associated with drug development.

The company has been actively pursuing acquisitions to diversify its pipeline. The acquisition of Reata Pharmaceuticals for approximately $7.3 billion in late 2023 significantly bolstered its presence in rare diseases.

Further strengthening its portfolio, Biogen has also entered into collaborations with companies like Stoke Therapeutics and City Therapeutics. These partnerships are focused on developing treatments for conditions in areas such as rare diseases, immunology, and nephrology, demonstrating a clear strategy to broaden its therapeutic reach and build a more resilient business model.

These strategic moves are crucial for maintaining a competitive edge in the fast-evolving biopharmaceutical landscape, especially with the increasing costs and complexities of bringing new therapies to market.

Strong Financial Position and Cost Efficiency

Biogen demonstrates a strong financial foundation, underscored by healthy gross margins and a commitment to cost efficiency. The company's strategic 'Fit for Growth' program is a key driver, targeting substantial net savings.

This program is projected to deliver between $800 million and $1 billion in net savings by the close of 2025, significantly enhancing operational efficiency. These financial gains are not merely for balance sheet improvement; they are purposefully channeled into critical areas.

- Robust Gross Margins: Biogen consistently maintains strong gross profit margins, indicating efficient production and pricing power.

- 'Fit for Growth' Program: On track to achieve $800 million to $1 billion in net savings by year-end 2025, boosting operational efficiency.

- Strategic Reinvestment: Savings are strategically allocated to high-impact R&D and new product launches, fueling future growth.

- Financial Flexibility: The strong financial position provides flexibility for strategic investments and navigating market challenges.

Biogen's deep neuroscience expertise is a significant strength, particularly in areas like multiple sclerosis (MS) and spinal muscular atrophy (SMA). For instance, in 2023, Biogen's MS franchise continued to be a major revenue driver, demonstrating the market's reliance on their specialized treatments. This focused approach allows for concentrated R&D investment, fostering a competitive edge in tackling challenging neurological conditions.

Biogen's strength lies in its evolving product portfolio, marked by successful recent launches. Leqembi for Alzheimer's, Skyclarys for Friedreich ataxia, and Zurzuvae for postpartum depression are showing significant commercial traction. These new therapies are becoming increasingly important revenue drivers, helping to balance out the performance of established products and showcasing a strategic diversification.

Biogen boasts a robust late-stage pipeline, a significant strength for the company. As of June 2025, they have nine programs in Phase 3 or Phase 3-ready development, primarily concentrated in neuroscience and rare diseases, underscoring their commitment to future growth.

Biogen's strategic collaborations and acquisitions are a significant strength, allowing it to expand its research and development capabilities and enter new therapeutic areas. Its partnership with Eisai for Leqembi and the acquisition of Reata Pharmaceuticals for approximately $7.3 billion in late 2023 highlight this strategic approach to portfolio enhancement.

Biogen demonstrates a strong financial foundation, underscored by healthy gross margins and a commitment to cost efficiency through its 'Fit for Growth' program. This program is on track to deliver between $800 million and $1 billion in net savings by the close of 2025, with these funds strategically reinvested into R&D and new product launches.

| Key Strength | Description | Supporting Data/Example |

| Neuroscience Expertise | Dominant position in MS and SMA markets. | MS franchise remains a significant revenue driver (2023 data). |

| Expanding Portfolio | Successful recent product launches gaining traction. | Leqembi, Skyclarys, and Zurzuvae showing commercial success. |

| Robust Late-Stage Pipeline | Nine programs in Phase 3 or Phase 3-ready by mid-2025. | Focus on neuroscience and rare diseases for future growth. |

| Strategic Partnerships & Acquisitions | Enhancing R&D and market access through collaborations. | Reata acquisition ($7.3B in late 2023), Eisai partnership for Leqembi. |

| Strong Financial Health | Commitment to efficiency and strategic reinvestment. | 'Fit for Growth' program targeting $800M-$1B net savings by end of 2025. |

What is included in the product

Analyzes Biogen’s competitive position through key internal and external factors, highlighting its strong product pipeline and market leadership alongside challenges like regulatory hurdles and patent expirations.

Offers a clear, actionable framework to identify and address Biogen's strategic challenges and opportunities.

Weaknesses

Biogen's foundational multiple sclerosis (MS) business is experiencing a notable downturn. Revenue from its established MS drugs, including Tecfidera and Tysabri, has been steadily decreasing. This decline is primarily driven by increasing competition from generic alternatives and biosimil products entering the market.

For instance, Tecfidera, a cornerstone of Biogen's MS portfolio, saw its sales drop by approximately 10% year-over-year in early 2024, a trend that continued into the latter half of the year. This persistent revenue erosion in its core MS franchise presents a significant challenge, requiring substantial growth from newer therapeutic areas to offset these losses.

Biogen's newer products, including Leqembi for Alzheimer's, have experienced a slower commercial launch than projected. This is partly due to intricate market infrastructure, difficulties in diagnosis, and the necessity for greater patient and caregiver understanding. For instance, Leqembi's net sales in the first quarter of 2024 reached $117.7 million, falling short of some analyst expectations, highlighting the adoption challenges.

This slower adoption rate directly affects Biogen's near-term financial outlook, as these new therapies are crucial for offsetting revenue declines from established products. The pace at which these innovative treatments gain traction is a key factor in the company's ability to maintain and grow its market position in the coming years.

Biogen's financial health in the near future hinges significantly on the successful rollout and market acceptance of its newer therapies, particularly Leqembi. While these new drugs represent a promising avenue for growth, their capacity to offset the ongoing revenue decline from Biogen's established multiple sclerosis (MS) franchise remains a key point of scrutiny for investors and analysts.

The company's reliance on these specific products introduces a considerable risk; any unforeseen challenges in their commercialization, such as slower-than-anticipated patient uptake or unexpected regulatory hurdles, could severely disrupt Biogen's financial forecasts. For instance, if Leqembi does not achieve its projected sales targets, which were estimated to reach billions in the coming years, it could create a substantial gap in revenue that the MS business cannot bridge.

Fluctuations in Research and Development Spending

Biogen's research and development (R&D) spending has shown a concerning trend recently. In the first quarter of 2025, R&D expenses saw a 2.5% decline, followed by a more significant 21% year-over-year drop in the second quarter of 2025. While this aligns with their 'Fit for Growth' strategy, a consistent reduction in R&D investment could hinder the replenishment of their future product pipeline and slow down innovation.

Despite plans to increase R&D investment specifically for rare disease initiatives, the overall downward trend in spending is a notable weakness. This strategic shift, while focused, raises questions about the company's capacity to maintain a robust and diverse innovation engine across all its therapeutic areas.

- Declining R&D Investment: Q1 2025 R&D spending down 2.5%, Q2 2025 down 21% year-over-year.

- Pipeline Risk: Sustained R&D cuts could jeopardize long-term pipeline replenishment.

- Innovation Pace: Reduced investment may slow the pace of future drug development.

- Strategic Focus: While rare diseases are prioritized, overall R&D reduction is a concern.

Geographic Concentration of Revenue

Biogen's revenue is significantly weighted towards North America, with this region accounting for over 60% of its sales in 2024. This heavy reliance on a single geographic market makes the company vulnerable to regional economic shifts, evolving healthcare regulations in the U.S., and specific pricing pressures within that system.

This lack of geographic diversification poses a risk to Biogen's long-term growth trajectory and its ability to weather global market fluctuations. A downturn or significant policy change in North America could disproportionately impact overall financial performance.

- Revenue Concentration: Over 60% of Biogen's 2024 revenue is generated in North America.

- Market Vulnerability: Exposure to U.S. economic conditions, regulatory changes, and pricing pressures.

- Growth Limitation: Geographic concentration can impede stable, long-term global expansion.

- Resilience Risk: Reduced ability to offset regional challenges with performance in other markets.

Biogen faces significant pressure from the declining sales of its established multiple sclerosis (MS) drugs, with Tecfidera sales down approximately 10% year-over-year in early 2024. This trend, coupled with slower-than-expected uptake for newer treatments like Leqembi, which generated $117.7 million in Q1 2024 sales, highlights commercialization challenges. Furthermore, a notable decrease in R&D spending, down 21% year-over-year in Q2 2025, raises concerns about future pipeline replenishment and the pace of innovation. The company's heavy reliance on the North American market, accounting for over 60% of 2024 revenue, also exposes it to regional economic and regulatory risks.

| Product/Area | 2024/2025 Data Point | Impact |

|---|---|---|

| Tecfidera Sales | Down ~10% YoY (early 2024) | Revenue erosion in core MS franchise |

| Leqembi Net Sales | $117.7 million (Q1 2024) | Slower than projected commercial launch |

| R&D Spending | Down 21% YoY (Q2 2025) | Potential impact on future pipeline |

| Geographic Revenue | >60% from North America (2024) | Vulnerability to regional market shifts |

Full Version Awaits

Biogen SWOT Analysis

This is the actual Biogen SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed analysis is crucial for strategic decision-making.

Opportunities

The global market for neurological and neurodegenerative disease therapies is experiencing robust expansion, with the Alzheimer's disease segment alone anticipated to reach $19.3 billion by 2033. This growth trajectory offers a substantial opportunity for Biogen, given its established portfolio and promising pipeline candidates.

Biogen's potential to capitalize on this expanding market is further bolstered by treatments like Leqembi, which shows promise in addressing pre-symptomatic stages of Alzheimer's disease. The increasing incidence of these debilitating conditions directly fuels the demand for novel and effective therapeutic solutions.

Biogen has a significant opportunity in developing and commercializing more patient-friendly drug delivery methods. For instance, subcutaneous formulations for Leqembi and Spinraza could greatly improve how patients receive treatment, potentially boosting adherence and overall market access.

The advancement in blood-based biomarkers for Alzheimer's disease diagnosis represents another key opportunity. This evolution allows for more streamlined patient identification and faster initiation of treatment, which could significantly accelerate the market penetration of Biogen's therapies in this critical area.

Biogen is strategically expanding beyond its core neuroscience focus through acquisitions and partnerships, notably entering immunology and nephrology. This diversification, seen in the $1.1 billion acquisition of HI-Bio in early 2024, aims to tap into new markets with high unmet needs.

The company's collaborations with Stoke Therapeutics and City Therapeutics further underscore this strategy, broadening Biogen's pipeline and potential revenue streams. These moves are designed to mitigate reliance on existing products and capitalize on areas with strong pricing power.

International Market Penetration

Biogen has a prime opportunity to expand its reach beyond North America, particularly with its promising newer treatments such as Leqembi and Skyclarys. The company's current stronghold is primarily in its home market, leaving considerable untapped potential globally.

Securing regulatory approvals in key international territories, including Europe and Asia, is a critical step. By establishing robust commercial infrastructure and sales networks in these regions, Biogen can tap into substantial new revenue streams. For instance, the Alzheimer's drug market outside North America is projected to grow significantly, with estimates suggesting it could reach tens of billions of dollars by the late 2020s. This geographic diversification would also reduce Biogen's reliance on a single market, enhancing its overall financial stability.

- Expand Leqembi and Skyclarys commercialization into Europe and Asia.

- Targeting key markets with high prevalence of neurological disorders.

- Leverage existing partnerships or establish new ones for market access.

Leveraging Technology for Operational Efficiency and Patient Care

Biogen has a significant opportunity to harness artificial intelligence (AI) and digital health technologies. These tools can refine operations, from pinpointing eligible patients for trials to smarter resource management. For instance, AI-driven analytics can accelerate drug discovery and development timelines, potentially reducing the multi-year process for new therapies.

The integration of these technologies offers a pathway to boost clinical trial efficiency. By leveraging AI for patient recruitment and data analysis, Biogen can streamline processes. This not only speeds up the delivery of new treatments but also enhances the quality of patient care and treatment outcomes.

- AI in Clinical Trials: Potential to reduce trial timelines by 20-30% through improved patient matching and data analysis.

- Digital Health Platforms: Opportunities to enhance remote patient monitoring and data collection, improving engagement and adherence.

- Commercialization Optimization: AI can refine market access strategies and personalize patient support programs.

Biogen can capitalize on the expanding global market for neurological therapies, with the Alzheimer's segment alone projected to reach $19.3 billion by 2033.

The company has a clear opportunity to enhance patient treatment by developing more user-friendly drug delivery methods, such as subcutaneous formulations for Leqembi and Spinraza, potentially improving adherence and market access.

Advancements in blood-based biomarkers for Alzheimer's diagnosis offer a streamlined patient identification process, accelerating treatment initiation and market penetration for Biogen's therapies.

Biogen's strategic diversification into immunology and nephrology, exemplified by the $1.1 billion acquisition of HI-Bio in early 2024, presents an opportunity to tap into new high-unmet-need markets and broaden its revenue base.

Threats

Biogen navigates a fiercely competitive environment, especially in Alzheimer's where Eli Lilly's Kisunla presents a significant challenge. This rivalry, alongside strong players like Roche and Novartis in the multiple sclerosis space, directly impacts market share and necessitates higher R&D spending for differentiation. The neurology sector is poised for considerable shifts in competitive standing, making strategic positioning critical.

The increasing competition from biosimilars and generics presents a substantial threat to Biogen's revenue streams. Patent expirations on key established products, particularly within the multiple sclerosis (MS) franchise, are already contributing to this erosion. For instance, the continued impact on sales of drugs like Tecfidera due to these market pressures is a significant concern.

Looking ahead, the potential entry of biosimilar versions of Tysabri in the U.S. market in late 2025 amplifies this threat. This trend directly impacts Biogen's sales and profitability, necessitating a continuous focus on research and development to introduce new, innovative therapies that can compensate for these anticipated revenue losses.

Biogen navigates a complex web of regulations and reimbursement policies, a constant threat to its market access. The approval process for new therapies is lengthy, and securing favorable pricing and reimbursement from payers, especially for innovative but costly treatments, proves consistently difficult. For instance, the slow initial uptake of Leqembi, a groundbreaking Alzheimer's drug, highlights how these reimbursement challenges can significantly impede commercial success and broad patient access, impacting revenue streams.

Pipeline Failures and Clinical Trial Risks

Pipeline failures and clinical trial risks are significant threats for Biogen. The company's future growth heavily relies on the success of its late-stage pipeline assets, particularly as it navigates a strategic pivot towards new product launches. Any failure or substantial delay in these crucial trials could have a severe detrimental effect on Biogen's financial projections and its long-term market position.

For instance, the development of Lecanemab (Leqembi), a treatment for Alzheimer's disease, faced initial setbacks and scrutiny, highlighting the inherent volatility in the drug approval process. While it has since received full FDA approval and shown promising sales growth, such early challenges underscore the risks. In 2023, Biogen reported $1.1 billion in net sales for Leqembi, a substantial increase from previous periods, but the path to this success was fraught with clinical and regulatory hurdles.

- Clinical Trial Failure: A setback in a Phase 3 trial for a key pipeline drug could lead to billions in lost potential revenue and significant R&D write-offs.

- Regulatory Delays: Extended review periods or requests for additional data by regulatory bodies can push back launch dates, impacting market entry and competitive advantage.

- Competitive Landscape: The emergence of competing therapies during the development or approval process can diminish the market potential of Biogen's pipeline assets.

Macroeconomic Headwinds and Market Volatility

Biogen faces significant threats from macroeconomic headwinds and market volatility. A strong U.S. dollar, for instance, can negatively impact its international revenue when translated back into dollars, potentially affecting profit forecasts for 2024 and beyond. For example, if the dollar strengthens by 5% against key currencies, it could reduce Biogen's reported earnings per share.

Broader market volatility, characterized by unpredictable swings in stock prices and investor sentiment, adds another layer of risk. This can make it harder for Biogen to secure favorable financing or maintain its market capitalization, especially during periods of economic uncertainty. The company's reliance on global supply chains also exposes it to disruptions from geopolitical events or changes in international trade policies, which could inflate manufacturing costs or hinder product distribution.

- Currency Fluctuations: A sustained strong dollar could reduce the value of overseas sales, impacting Biogen's reported profitability.

- Market Volatility: Unforeseen market downturns can affect Biogen's stock performance and access to capital.

- Supply Chain Risks: Geopolitical tensions or trade disputes could disrupt the flow of essential materials and finished products.

- Inflationary Pressures: Rising costs for raw materials, labor, and logistics could squeeze Biogen's operating margins.

The intensifying competition in key therapeutic areas, particularly Alzheimer's with rivals like Eli Lilly, poses a significant threat to Biogen's market share. Additionally, the increasing prevalence of biosimilar and generic alternatives, especially impacting its multiple sclerosis franchise, directly erodes revenue streams. The looming threat of Tysabri biosimilars entering the U.S. market in late 2025 further amplifies these revenue pressures.

Biogen faces substantial risks from clinical trial failures and regulatory hurdles, which can derail pipeline progress and future growth. For example, while Leqembi achieved full FDA approval and saw significant sales growth, its development path was marked by initial challenges. Macroeconomic factors like currency fluctuations and supply chain disruptions also present ongoing threats to profitability and operational stability.

| Threat Category | Specific Threat | Impact on Biogen | Data Point/Example |

|---|---|---|---|

| Competition | Alzheimer's Market Entry | Loss of market share, increased R&D investment | Eli Lilly's Kisunla development |

| Competition | Biosimilar/Generic Erosion | Reduced revenue from established products | Impact on Tecfidera sales |

| Regulatory & Reimbursement | Reimbursement Challenges | Slow commercial uptake, limited patient access | Initial uptake of Leqembi |

| Pipeline Risk | Clinical Trial Failure | Significant R&D write-offs, lost revenue potential | Potential Phase 3 setback in late-stage pipeline |

| Macroeconomic | Currency Fluctuations | Reduced international revenue translation | Potential EPS impact from a 5% stronger USD |

SWOT Analysis Data Sources

This Biogen SWOT analysis is built upon a foundation of credible data, including the company's financial filings, comprehensive market research reports, and expert industry analyses to provide a robust and accurate strategic overview.