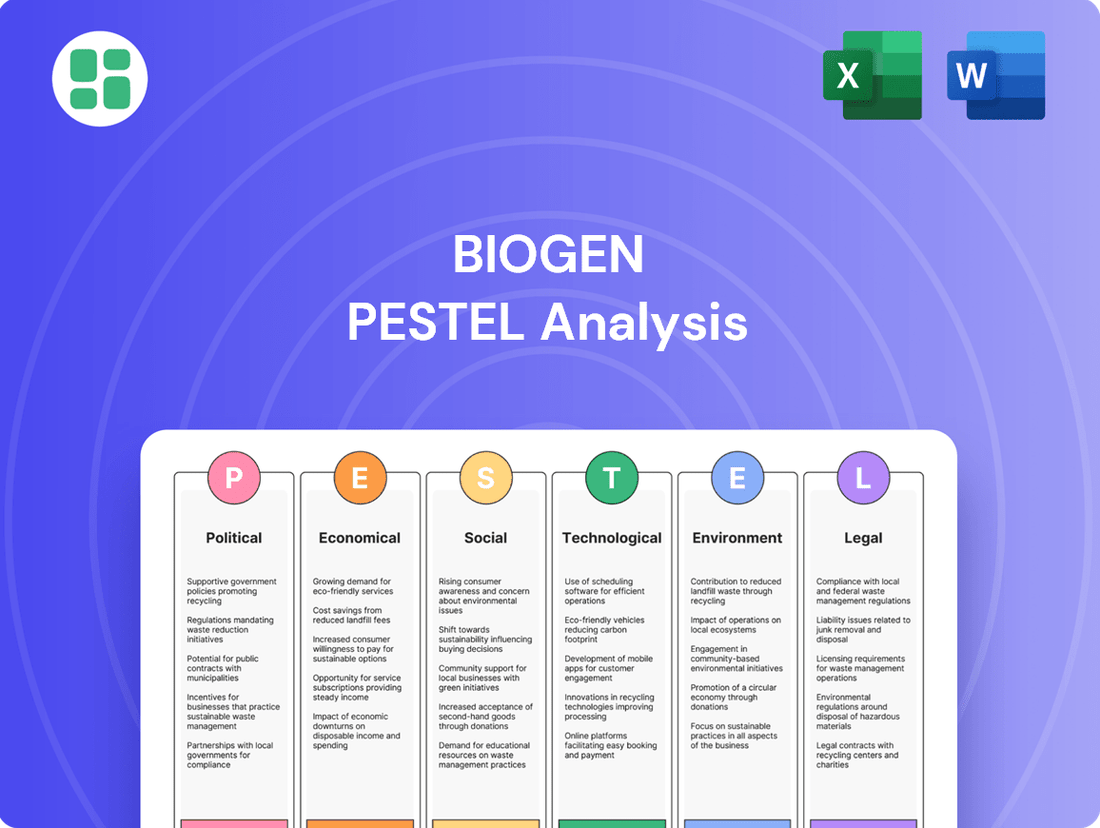

Biogen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biogen Bundle

Navigate the complex external forces shaping Biogen's future with our expert-crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this leading biotech firm. Gain a strategic advantage by leveraging these critical insights to inform your own market strategies and investment decisions. Download the full version now for actionable intelligence.

Political factors

Government healthcare policies, especially concerning drug pricing and reimbursement, are pivotal for Biogen's financial health and market reach. For example, ongoing debates about controlling drug expenses in key regions like the United States and Europe can directly influence the income from Biogen's expensive specialty treatments for neurological conditions.

Regulatory agencies such as the FDA and EMA play a crucial role in determining the pace and standards for drug approvals, impacting how quickly new therapies can enter the market.

Biogen's success hinges on navigating the rigorous approval processes of health authorities like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These bodies scrutinize clinical trial data and post-market safety, directly impacting Biogen's revenue streams and its capacity to deliver innovative treatments to patients.

The journey from drug discovery to market approval is lengthy and resource-intensive, with clinical trials often spanning many years and requiring substantial investment. For instance, the development of Alzheimer's treatments has historically been marked by high failure rates and extended timelines, underscoring the challenges Biogen faces.

Recent regulatory milestones, such as the accelerated approval of Leqembi (lecanemab) for Alzheimer's disease in 2023, demonstrate the critical impact of successful navigation through these complex pathways. This approval, following rigorous review, provided a significant boost to Biogen's pipeline and market presence.

Biogen's global operations are significantly influenced by international trade policies. For instance, changes in tariffs or the negotiation of new trade agreements, like those impacting the European Union or Asia, can alter the cost of raw materials and finished products, potentially affecting Biogen's supply chain efficiency and the affordability of its treatments in various markets. In 2023, Biogen's international sales represented a substantial portion of its revenue, highlighting its reliance on open global markets.

Geopolitical stability is another critical factor. Political instability or sudden policy shifts in regions where Biogen has a strong presence, such as Europe or certain emerging markets, could disrupt clinical trials, manufacturing, or distribution networks. For example, ongoing geopolitical tensions in Eastern Europe could indirectly impact supply chains or market access for certain therapies.

Biogen's trade profile shows it exports more than it imports, which can offer some buffer against the direct impact of import tariffs. However, retaliatory tariffs on its exported goods or disruptions to key international shipping routes due to geopolitical events remain a concern for its global market penetration and revenue streams.

Public Health Priorities and Funding

Government emphasis on particular public health issues, like boosting investment in Alzheimer's or rare neurological disease studies, can significantly shape Biogen's market position. These governmental focuses can translate into direct financial support through grants, accelerated regulatory processes, or public campaigns that elevate the visibility of Biogen's core therapeutic areas.

For instance, in 2024, the U.S. National Institutes of Health (NIH) allocated approximately $3.2 billion towards Alzheimer's disease research, a substantial increase that directly benefits companies like Biogen developing treatments for this condition. This funding surge can de-risk early-stage research and development, making Biogen's pipeline more attractive to investors and potentially speeding up the approval of new therapies.

- Increased NIH funding for Alzheimer's research in 2024: ~$3.2 billion

- Potential for expedited regulatory pathways for neurological treatments

- Government-backed public awareness campaigns can boost patient identification and treatment demand

Intellectual Property Protection Policies

Biogen's reliance on its innovative pipeline makes intellectual property (IP) protection paramount. Policies that strengthen patent enforcement directly support Biogen's market exclusivity for key therapies, such as its multiple sclerosis (MS) treatments, which have historically been significant revenue drivers. For instance, the U.S. Patent and Trademark Office (USPTO) continues to grapple with the complexities of patenting biological entities and the ever-evolving landscape of patent eligibility, directly impacting companies like Biogen.

The increasing prevalence of biosimilar competition for established drugs underscores the critical nature of robust patent protection. As patents expire, companies like Biogen face a significant threat to their revenue streams, making the ability to defend existing patents and secure new ones crucial for sustained profitability. In 2023, Biogen's MS franchise, including Tecfidera and Tysabri, continued to face generic and biosimilar pressures, highlighting the ongoing importance of IP strategy.

- Patent Cliff Management: Biogen actively manages patent expirations, aiming to transition patients to newer therapies or secure extended exclusivity where possible.

- Global IP Enforcement: The company engages in legal battles globally to defend its patents against infringement and to prevent unauthorized market entry of similar products.

- R&D Investment Protection: Strong IP policies are essential to protect the substantial investments Biogen makes in research and development, ensuring a return on innovation.

Government healthcare policies, particularly those concerning drug pricing and reimbursement, directly impact Biogen's revenue, especially for its high-cost neurological treatments. For example, ongoing efforts in the US and Europe to control drug expenses can significantly affect Biogen's profitability. Furthermore, government funding for specific disease research, such as the U.S. NIH's $3.2 billion allocation for Alzheimer's in 2024, can accelerate development and market access for Biogen's therapies.

What is included in the product

This Biogen PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

It provides actionable insights for stakeholders to navigate external challenges and leverage emerging opportunities within the biopharmaceutical landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable talking points for Biogen's strategic discussions.

Economic factors

Global economic growth directly impacts healthcare spending. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, which can influence how much governments and individuals can allocate to healthcare. This stability is crucial for Biogen, as it affects their revenue streams and the market's capacity to absorb their specialized treatments.

Economic downturns present significant challenges. A potential slowdown in major economies could lead to reduced government healthcare budgets, impacting reimbursement rates for Biogen's high-cost therapies. This also translates to decreased patient affordability, potentially limiting access to essential treatments for conditions like multiple sclerosis and Alzheimer's disease.

Global healthcare spending is projected to reach $11.6 trillion by 2025, a significant increase that also brings heightened scrutiny on drug pricing. This trend directly impacts Biogen's revenue, as payers, including governments and private insurers, are increasingly negotiating for value-based pricing and stricter reimbursement criteria for high-cost therapies.

The evolving reimbursement landscape, particularly for complex neurological treatments like those Biogen offers, means that market access for products such as Leqembi is subject to rigorous evidence of clinical and economic benefit. For instance, in 2024, many health systems are implementing stricter prior authorization requirements for specialty drugs, demanding robust real-world data to justify continued coverage.

Inflationary pressures significantly impact Biogen's operational costs, affecting everything from R&D expenses to manufacturing and supply chain logistics. For instance, the rising cost of raw materials and energy, key components in pharmaceutical production, directly translates to higher overhead. This is particularly relevant as Biogen continues to invest heavily in its robust pipeline and the commercialization of new therapies.

Managing these escalating costs is paramount for Biogen's profitability and its ability to sustain innovation. The company's financial health depends on its capacity to absorb or pass on these increased expenditures without jeopardizing its competitive edge or its investment in future growth. For example, in late 2023 and into 2024, many pharmaceutical companies reported increased cost of goods sold due to persistent inflation in key inputs.

Currency Exchange Rate Fluctuations

Biogen, as a global entity, faces considerable risk from currency exchange rate fluctuations, particularly given that approximately 55% of its 2024 product revenue originated from markets outside the United States. These shifts can significantly affect its reported financial performance.

When foreign currencies weaken against the U.S. dollar, Biogen's international earnings translate into fewer dollars, directly reducing reported revenue and profitability. Conversely, a strengthening dollar can make Biogen's products more expensive in foreign markets, potentially impacting sales volume.

- Impact on Revenue: Unfavorable currency movements can decrease the U.S. dollar value of sales made in foreign currencies.

- Profitability Concerns: Fluctuations can erode profit margins when converting overseas profits back to the reporting currency.

- Geographic Exposure: With a substantial portion of revenue from international sales, Biogen's financial results are inherently tied to global currency markets.

Competition and Market Access Challenges

Biogen faces intense economic pressure from a growing number of generic and biosimilar competitors in its core Multiple Sclerosis (MS) market. This competitive landscape directly impacts its pricing power and market share, as seen with the declining sales of its established MS therapies.

To counteract these economic headwinds, Biogen is strategically investing in its pipeline and prioritizing new product launches. This pivot aims to diversify its revenue streams and reduce reliance on its legacy MS franchise, which has been a significant, albeit increasingly challenged, contributor to its financial performance.

The economic reality of biosimilar erosion is stark: for instance, biosimilars to rituximab, a drug Biogen markets as Rituxan, have already captured a substantial portion of the market. This trend is expected to continue across Biogen's portfolio, underscoring the urgency for innovation and market access for new treatments.

- Intensified Competition: Generic and biosimilar versions of key Biogen MS drugs are gaining traction, impacting revenue.

- Pricing Pressure: Increased competition leads to downward pressure on drug prices, affecting Biogen's profitability.

- Pipeline Imperative: Biogen's economic strategy hinges on successful development and launch of new therapies to offset declining sales.

- Market Access Hurdles: Securing market access for new, potentially higher-priced treatments remains a critical economic challenge.

Global economic stability is a critical factor for Biogen, influencing healthcare spending and market demand for its specialized neurological treatments. With the IMF projecting global growth at 3.2% for 2024, Biogen's revenue streams are tied to this overall economic health, impacting both government and individual capacity to afford high-cost therapies.

Inflationary pressures directly affect Biogen's operational costs, from R&D to manufacturing, as seen in the rising costs of raw materials and energy impacting the pharmaceutical sector in 2023-2024. This necessitates careful cost management to maintain profitability and investment in innovation, especially as the company navigates the commercialization of new treatments.

Biogen's significant international revenue, with approximately 55% of its 2024 product sales originating outside the US, exposes it to currency exchange rate fluctuations. Unfavorable movements can reduce the dollar value of foreign earnings, impacting reported profitability and the competitiveness of its products in global markets.

The increasing prevalence of generic and biosimilar competition, particularly in Biogen's established Multiple Sclerosis market, exerts downward pressure on pricing and market share. This economic reality, exemplified by biosimilar erosion for rituximab (Rituxan), underscores the critical need for Biogen's pipeline development and successful launches of new therapies to offset declining sales and secure market access.

| Economic Factor | Impact on Biogen | Supporting Data/Trend (2024/2025) |

| Global Economic Growth | Influences healthcare spending and demand for Biogen's therapies. | IMF projects 3.2% global growth in 2024. |

| Inflation | Increases operational costs (R&D, manufacturing, supply chain). | Rising raw material and energy costs impacting pharmaceutical production. |

| Currency Fluctuations | Affects reported revenue and profitability due to international sales. | ~55% of Biogen's 2024 product revenue from outside the US. |

| Competition (Generic/Biosimilar) | Reduces pricing power and market share in key therapeutic areas. | Significant biosimilar penetration in the MS market. |

Preview Before You Purchase

Biogen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Biogen PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a thorough examination of Biogen's external environment, enabling informed strategic decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into the opportunities and threats Biogen faces within its global market.

Sociological factors

The world's population is getting older, and this is a major factor for Biogen. Diseases like Alzheimer's and Parkinson's, which Biogen works on, are much more common in older people. In 2023, over 10% of the global population was over 65, a number projected to rise significantly by 2050.

This growing older demographic means a larger potential patient base for Biogen's treatments. As more people live longer, the demand for therapies addressing age-related neurological conditions is expected to climb, presenting both a challenge and an opportunity for the company's product pipeline and market strategy.

Growing public awareness of neurological and neurodegenerative diseases is significantly impacting the demand for Biogen's innovative therapies. Patient advocacy groups, empowered by this awareness, are increasingly vocal, pushing for faster access to new treatments and influencing public perception. For instance, organizations like the Alzheimer's Association reported a 7% increase in engagement with their online resources in 2024, reflecting heightened public interest and a desire for information and support.

These advocacy efforts directly translate into pressure on regulatory bodies and healthcare providers to expedite approval processes and broaden patient access. This trend is particularly relevant for Biogen's pipeline, as demonstrated by the ongoing discussions around the accessibility of treatments like Aduhelm and Leqembi. The amplified voice of patient communities can shape market dynamics and investment priorities, compelling companies to focus on unmet needs and patient-centric solutions.

Shifting lifestyle patterns, including dietary habits and physical activity levels, are increasingly linked to the prevalence of neurological disorders. For instance, sedentary lifestyles and processed food consumption, prevalent in many developed nations, may contribute to conditions like Alzheimer's and Parkinson's. Biogen's strategic focus on these areas reflects an understanding of how societal changes directly impact the demand for its therapeutic solutions.

Ethical and Societal Acceptance of Biotechnology

Public sentiment towards advanced biotechnology, including gene therapies and treatments for conditions like Alzheimer's, significantly influences market adoption. Concerns about genetic modification and the long-term implications of such therapies can create hurdles for widespread acceptance. Biogen's commitment to transparent communication and demonstrating the tangible benefits of its innovations is crucial for building societal trust.

The ethical debate surrounding biotechnology is ongoing, with questions about accessibility, equity, and the potential for unintended consequences. For instance, in 2024, discussions intensified around the equitable distribution of new gene therapies, highlighting the need for careful consideration of pricing and patient access. Biogen's ability to navigate these complex societal considerations will directly impact its brand reputation and the market success of its product pipeline.

Biogen's strategy must actively address public concerns and foster a positive perception of its scientific endeavors. This involves not only clinical efficacy but also a clear articulation of the societal value proposition. For example, by emphasizing how their research addresses unmet medical needs and improves quality of life, Biogen can build a stronger foundation for acceptance.

Key considerations for Biogen include:

- Public Perception: Monitoring and responding to public opinion on genetic therapies and neurological treatments.

- Ethical Frameworks: Adhering to robust ethical guidelines in research and development, ensuring patient safety and informed consent.

- Societal Value: Clearly communicating the benefits of their innovations in addressing significant health challenges.

- Regulatory Landscape: Navigating evolving regulations that reflect societal ethical standards for biotechnology.

Access to Healthcare and Health Equity

Societal expectations for equitable access to healthcare and innovative treatments are on the rise. This trend puts pressure on pharmaceutical companies like Biogen to demonstrate their commitment to health equity. By 2024, global healthcare spending was projected to reach over $10 trillion, highlighting the significant resources dedicated to health, and the increasing demand for fairness in how those resources are distributed.

Biogen's corporate responsibility strategy actively addresses these expectations. Their initiatives focus on expanding access to their medicines, particularly in underserved populations. For instance, in 2023, Biogen reported efforts to improve patient access programs, reaching an additional 50,000 patients globally with their key therapies.

Ensuring clinical trials accurately reflect disease epidemiology is another crucial aspect of health equity. Biogen aims to diversify trial participation to better represent the real-world patient populations who will ultimately use their treatments. This commitment is vital as disparities in clinical trial representation can lead to treatments that are less effective or safe for certain demographic groups.

- Growing Societal Demand: Increasing public and governmental pressure for fair access to healthcare and advanced medicines.

- Biogen's Commitment: Corporate responsibility efforts are centered on improving access and promoting health equity.

- Access Initiatives: Biogen actively works to broaden access to its pharmaceutical products through various programs.

- Clinical Trial Diversity: A focus on ensuring clinical trials mirror the actual prevalence of diseases across diverse populations.

The aging global population presents a significant opportunity for Biogen, as diseases like Alzheimer's and Parkinson's, which the company targets, are more prevalent in older individuals. By 2024, over 10% of the world's population was aged 65 and above, a figure expected to climb, increasing the demand for Biogen's therapies.

Increased public awareness and advocacy for neurological conditions are driving demand for Biogen's treatments. Patient advocacy groups are pushing for faster access, with organizations like the Alzheimer's Association reporting a 7% rise in online engagement in 2024, reflecting heightened public interest and a need for information.

Societal shifts, including lifestyle changes like sedentary habits and processed food consumption, are increasingly linked to neurological disorders, directly impacting the market for Biogen's solutions. Public sentiment towards advanced biotechnology also plays a crucial role, with Biogen focusing on transparent communication to build trust around its innovations.

There's a growing societal expectation for equitable access to healthcare, pressuring companies like Biogen to demonstrate a commitment to health equity. Global healthcare spending was projected to exceed $10 trillion by 2024, underscoring the demand for fairness in resource distribution, which Biogen addresses through access programs.

Technological factors

Rapid advancements in neuroscience research are creating exciting new avenues for Biogen. Fields like genomics, proteomics, and neuroimaging are uncovering novel drug targets and refining development methodologies. For instance, breakthroughs in understanding the genetic underpinnings of diseases like Alzheimer's are directly informing Biogen's research pipeline.

Leveraging cutting-edge technologies such as artificial intelligence (AI) and machine learning is paramount for Biogen to accelerate the discovery of treatments for complex neurological disorders. In 2024, Biogen reported significant investment in AI platforms aimed at speeding up preclinical research, with early results showing a potential reduction in compound screening times by up to 30%.

Biogen's strategic focus on novel drug discovery platforms is crucial for its future growth. The company is heavily invested in technologies like antisense oligonucleotides (ASOs) and gene therapy, which allow for highly targeted treatments. For instance, Biogen's pipeline includes ASO therapies for neurological conditions, aiming to address the root cause of disease at the genetic level.

Monoclonal antibodies also represent a significant area of development for Biogen, with several promising candidates in late-stage trials for neurodegenerative diseases. These advanced modalities offer the potential for significant therapeutic breakthroughs, differentiating Biogen in a competitive landscape. The company's commitment to these cutting-edge platforms underscores its strategy to tackle complex and previously untreatable diseases.

Biogen is leveraging digital health advancements to streamline its operations. For instance, the company is exploring how remote patient monitoring can provide continuous data streams, enhancing the quality and efficiency of clinical trials. This approach is crucial for gathering real-world evidence, which can then inform the development and application of Biogen's neurological therapies.

The integration of advanced data analytics is a key technological driver for Biogen. By analyzing vast datasets from clinical trials and real-world sources, Biogen aims to accelerate drug discovery and development cycles. This data-driven approach can also lead to more personalized treatment strategies for patients, improving therapeutic outcomes.

In 2024, the digital health market is projected to reach over $600 billion globally, signaling a significant opportunity for companies like Biogen to adopt these technologies. Biogen's investment in data analytics is expected to optimize its R&D pipeline, potentially reducing the time and cost associated with bringing new treatments to market.

Biomanufacturing Innovations

Biomanufacturing innovations are absolutely key for Biogen to efficiently and affordably produce its intricate biologic therapies and biosimilars. These advancements directly impact how much product can be made, the associated costs, and the overall robustness of their supply chains. For instance, Biogen's significant investment in its North Carolina manufacturing facility underscores its commitment to leveraging these technological leaps.

Continuous advancements in biomanufacturing technology are driving tangible improvements. We're seeing higher product yields, which means more therapeutic doses from the same amount of raw materials. This also translates to reduced production costs, making treatments more accessible. Furthermore, these innovations bolster supply chain resilience, ensuring that vital medications can reach patients reliably, even amidst disruptions.

Biogen's strategic investments in its manufacturing infrastructure are directly tied to these biomanufacturing innovations. The company is actively enhancing its capabilities to stay at the forefront of production efficiency and quality. This focus is critical for maintaining a competitive edge in the rapidly evolving biopharmaceutical landscape.

Key areas of biomanufacturing innovation impacting companies like Biogen include:

- Single-use technologies: Offering flexibility and reducing contamination risks, leading to faster batch turnaround times.

- Process analytical technology (PAT): Enabling real-time monitoring and control of manufacturing processes for consistent quality and higher yields.

- Continuous manufacturing: Shifting from traditional batch processes to a continuous flow, potentially reducing facility footprint and operational costs.

- Advanced cell culture and fermentation techniques: Improving cell line productivity and optimizing growth conditions to maximize protein expression.

Competitive Landscape in Biotechnology Innovation

The competitive landscape in biotechnology innovation is intensifying, with rivals rapidly advancing in key therapeutic areas. For Biogen, this means staying ahead in fields like Alzheimer's disease and multiple sclerosis requires significant and ongoing investment in research and development. Competitors are not only developing new treatments but also exploring novel delivery mechanisms and diagnostic tools, creating a dynamic and challenging environment.

Biogen's ability to maintain its competitive edge hinges on its commitment to R&D and its strategic partnerships. For instance, in 2023, Biogen dedicated approximately $2.5 billion to R&D, a crucial investment to fuel its pipeline and counter the innovation pace of companies like Eli Lilly and Roche in the Alzheimer's space. These collaborations can provide access to cutting-edge technologies and talent, accelerating the discovery and development of breakthrough therapies.

- Intensified Competition: Competitors are making significant strides in Alzheimer's and multiple sclerosis, areas critical to Biogen's portfolio.

- R&D Investment: Biogen's 2023 R&D expenditure of around $2.5 billion underscores the necessity of continuous innovation funding.

- Strategic Collaborations: Partnerships are vital for accessing new technologies and talent to maintain a leading position in scientific discovery.

Biogen's technological trajectory is heavily influenced by rapid advancements in neuroscience, with AI and machine learning now critical for accelerating drug discovery, as evidenced by a 30% potential reduction in screening times in 2024. The company's focus on novel platforms like antisense oligonucleotides and gene therapy targets the root causes of neurological diseases. Furthermore, Biogen is integrating digital health for enhanced clinical trial data collection and leveraging advanced analytics to optimize its R&D pipeline, aiming to reduce time and cost for new treatments.

Legal factors

Intellectual property rights, particularly patents, are crucial for Biogen's revenue generation, safeguarding its groundbreaking therapies. The company's success heavily relies on maintaining exclusivity for its innovative products.

However, the impending expiration of patents for significant drugs, such as Tecfidera, presents a considerable legal and financial hurdle. This situation is further complicated by the anticipated market entry of biosimil versions of Tysabri, a key product, which directly threatens Biogen's market share and revenue streams.

Biogen operates under stringent regulatory frameworks for drug approval and ongoing market surveillance. For instance, the U.S. Food and Drug Administration (FDA) Fast Track designation for BIIB080 highlights the rigorous pathway to market for innovative therapies, requiring extensive clinical data and adherence to strict development timelines.

Maintaining compliance with post-market surveillance is critical, involving continuous safety reporting and accurate labeling. Biogen's commitment to post-marketing study obligations, such as those potentially required for its Alzheimer's treatments, adds layers of complexity and significant operational costs to ensure patient safety and product efficacy after initial approval.

Antitrust and competition laws significantly shape Biogen's strategic maneuvers within the pharmaceutical sector, impacting everything from its acquisition strategies to how it prices its innovative therapies. These regulations are designed to foster a competitive landscape, preventing any single entity from dominating the market through monopolistic practices.

For instance, the ongoing scrutiny of pharmaceutical pricing, particularly for high-cost specialty drugs, means Biogen must navigate complex legal frameworks to ensure its pricing models align with fair competition standards. Failure to comply can lead to substantial fines and reputational damage, directly influencing market positioning and future business development opportunities.

Data Privacy and Cybersecurity Regulations

Biogen’s operations, particularly in handling sensitive patient data from clinical trials and commercial activities, necessitate strict adherence to evolving data privacy and cybersecurity regulations. Failure to comply with mandates like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) can result in substantial financial penalties and severe reputational harm.

The increasing sophistication of cyber threats in 2024 and 2025 means Biogen must continually invest in robust cybersecurity measures to protect its vast datasets. For instance, in 2023, the healthcare sector experienced a significant rise in data breaches, with ransomware attacks targeting patient information becoming more prevalent, underscoring the critical need for proactive defense strategies.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- HIPAA Penalties: Violations can result in penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses.

- Cybersecurity Spending: Global cybersecurity spending was projected to exceed $200 billion in 2024, reflecting the escalating importance of data protection across industries, including pharmaceuticals.

Product Liability and Litigation Risks

Biogen, like all pharmaceutical companies, navigates significant product liability and litigation risks. These arise from the potential for adverse events or unexpected side effects from its therapies. For instance, ongoing litigation concerning the safety and efficacy of Aduhelm, its Alzheimer's drug, highlights these challenges. In 2023, Biogen and its partner Eisai faced continued scrutiny and potential legal actions related to the drug's performance and patient outcomes.

Legal battles over drug safety, efficacy claims, or manufacturing flaws can lead to substantial financial penalties and erode public confidence. These risks are amplified by the complex regulatory environment and the high stakes involved in bringing new treatments to market. The company's financial reports often detail provisions for potential legal settlements, reflecting the ongoing nature of these liabilities.

- Product Liability: Biogen faces potential lawsuits stemming from adverse patient reactions to its neurological and autoimmune disease treatments.

- Litigation Environment: The pharmaceutical sector is prone to class-action lawsuits and individual claims regarding drug side effects and marketing practices.

- Financial Impact: Settlements and legal defense costs can significantly impact Biogen's profitability and cash flow, as seen in past cases involving other biotech firms.

Biogen's legal landscape is heavily influenced by intellectual property protection, with patent expirations for key drugs like Tecfidera posing significant revenue risks. The company must also contend with biosimilar competition, as seen with Tysabri, impacting market share.

Navigating stringent regulatory approval processes, such as the FDA's Fast Track designation for BIIB080, requires extensive data and adherence to timelines. Post-market surveillance and compliance with safety reporting are critical and costly, especially for newer treatments like Alzheimer's therapies.

Antitrust laws and pricing scrutiny, particularly for high-cost specialty drugs, necessitate careful compliance to avoid fines and reputational damage. Data privacy regulations like GDPR and HIPAA are paramount, with increasing cyber threats in 2024-2025 demanding robust cybersecurity investments.

Product liability and litigation, exemplified by ongoing scrutiny of Aduhelm, represent substantial financial and reputational risks. Biogen must manage potential lawsuits related to adverse patient reactions and marketing practices, impacting profitability.

| Legal Factor | Impact on Biogen | Example/Data (2023-2025) |

|---|---|---|

| Patent Expirations | Revenue loss, increased competition | Tecfidera patent expiry approaching, impacting future revenue. |

| Biosimilar Competition | Market share erosion, price pressure | Tysabri facing biosimilar entry, threatening existing market share. |

| Regulatory Compliance | Approval delays, operational costs | FDA Fast Track for BIIB080 highlights rigorous approval pathway. |

| Data Privacy & Cybersecurity | Financial penalties, reputational damage | Global cybersecurity spending projected over $200 billion in 2024; GDPR fines up to 4% of global revenue. |

| Product Liability & Litigation | Financial losses, public trust erosion | Ongoing litigation regarding Aduhelm's safety and efficacy in 2023. |

Environmental factors

Biogen is actively pursuing environmental sustainability, focusing on reducing its carbon footprint and enhancing operational efficiencies. This commitment translates into concrete actions like managing energy consumption across its facilities and minimizing waste generated from its research and development and manufacturing processes.

The company is also dedicated to embedding sustainable practices throughout its extensive global supply chain. For instance, Biogen reported a 16% reduction in Scope 1 and 2 greenhouse gas emissions intensity by the end of 2023 compared to its 2020 baseline, demonstrating tangible progress in its environmental stewardship efforts.

Biogen, like other biotechnology firms, faces significant environmental considerations, particularly concerning waste management and pollution control. The specialized nature of its research and manufacturing processes often involves the generation of hazardous materials, requiring meticulous handling and disposal protocols.

Compliance with stringent environmental regulations is paramount. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste from cradle to grave. Failure to adhere to these standards can lead to substantial fines and reputational damage. Biogen's commitment to sustainability includes investing in advanced waste treatment technologies to minimize its ecological footprint.

Biogen's operations are increasingly shaped by evolving climate change regulations and ambitious greenhouse gas emission targets. These governmental and international mandates directly influence manufacturing processes, supply chains, and energy sourcing strategies for the biotechnology firm.

The company has proactively set significant climate commitments, including a goal to achieve net-zero emissions and a substantial increase in renewable electricity usage across its global facilities. For instance, Biogen aims for 100% renewable electricity for its purchased electricity by 2025, a target it was on track to meet, demonstrating a commitment to aligning with global efforts to combat climate change.

Ethical Sourcing and Resource Scarcity

Biogen is increasingly focused on the responsible sourcing of its raw materials, a critical environmental factor. The company recognizes that potential resource scarcity, particularly for specialized biological components, poses a growing challenge. This means actively working with suppliers to ensure sustainable practices throughout the supply chain.

In 2023, Biogen continued its efforts to engage suppliers on sustainability initiatives, aiming to reduce environmental impact. Life cycle assessments are a key tool Biogen employs to understand and mitigate the environmental footprint of its products from development through disposal. This proactive stance helps address concerns about resource depletion and ensures more resilient operations in the face of environmental pressures.

- Supplier Engagement: Biogen's supplier sustainability programs aim to promote environmentally responsible practices across its value chain.

- Life Cycle Assessments: The company utilizes LCAs to evaluate and minimize the environmental impact of its products.

- Resource Scarcity Mitigation: Proactive engagement with suppliers helps address potential future shortages of critical raw materials.

Corporate Social Responsibility (CSR) and ESG Reporting

Biogen faces growing pressure from stakeholders, including investors and the public, to demonstrate strong Corporate Social Responsibility (CSR) and provide transparent Environmental, Social, and Governance (ESG) reporting. This scrutiny directly impacts the company's reputation and its ability to attract investment.

In 2023, Biogen reported a 15% reduction in greenhouse gas emissions intensity compared to its 2020 baseline, a key metric for environmental performance. This commitment to reducing its environmental footprint is crucial for maintaining a positive public image and appealing to ESG-focused investors.

The company's ESG disclosures are becoming increasingly detailed, covering areas such as sustainable supply chain practices and employee well-being initiatives. For instance, Biogen aims to have 100% of its key suppliers adhere to its Supplier Code of Conduct by the end of 2025.

- Stakeholder Pressure: Increasing demand for CSR and ESG transparency impacts Biogen's public perception and investor appeal.

- Environmental Performance: Biogen reported a 15% reduction in greenhouse gas emissions intensity by 2023, showcasing its environmental commitment.

- Supply Chain Goals: The company targets 100% supplier adherence to its Code of Conduct by the end of 2025.

- Investor Relations: Robust ESG reporting is vital for attracting and retaining investors prioritizing sustainability.

Biogen's environmental strategy centers on reducing its carbon footprint, with a reported 16% reduction in Scope 1 and 2 greenhouse gas emissions intensity by the end of 2023 against a 2020 baseline. The company is also targeting 100% renewable electricity for its purchased power by 2025, showcasing a commitment to climate action. Furthermore, Biogen is actively addressing resource scarcity by engaging suppliers on sustainable practices and conducting life cycle assessments to minimize product environmental impact.

| Environmental Metric | Target/Status | Year |

|---|---|---|

| Scope 1 & 2 GHG Emissions Intensity Reduction | 16% reduction | 2023 (vs. 2020 baseline) |

| Renewable Electricity Usage | Target 100% | 2025 |

| Supplier Code of Conduct Adherence | Target 100% of key suppliers | End of 2025 |

PESTLE Analysis Data Sources

Our Biogen PESTLE Analysis is built on a robust foundation of data from reputable sources including government regulatory bodies, leading financial institutions like the IMF and World Bank, and specialized industry research firms. We meticulously gather insights on political stability, economic trends, technological advancements, environmental regulations, and societal shifts to provide a comprehensive macro-environmental overview.