Biogen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biogen Bundle

Biogen operates in a highly competitive biotech landscape, where the threat of new entrants is tempered by significant R&D barriers and regulatory hurdles. Understanding the interplay of these forces is crucial for navigating its market.

The complete report reveals the real forces shaping Biogen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Biogen's reliance on highly specialized raw materials and active pharmaceutical ingredients (APIs) for its neurological treatments places significant bargaining power in the hands of its suppliers. These critical components are often proprietary, meaning only a select few manufacturers can produce them to the required specifications.

The limited number of qualified suppliers for these specialized inputs can create a substantial leverage point for them. If Biogen faces high costs or difficulties in switching to alternative suppliers, these existing vendors can command higher prices, directly impacting Biogen's profitability. For instance, the development and approval process for APIs can take years, creating high switching costs.

Contract Research Organizations (CROs) hold significant bargaining power when serving the biotechnology sector, including companies like Biogen. The outsourcing of complex research and development, especially clinical trials, is a common practice. Biogen's need for specialized expertise in neurological and neurodegenerative disease trials means that experienced CROs in this niche can leverage their capabilities to negotiate higher prices for their services.

The intricate nature and stringent regulatory requirements associated with neurological research further bolster the bargaining position of these CROs. For instance, the global CRO market was valued at approximately $45.5 billion in 2023 and is projected to grow, indicating strong demand for their services. This demand, coupled with specialized knowledge, allows CROs to dictate terms more effectively.

The biotechnology sector, and by extension Biogen, relies heavily on a highly specialized workforce. This includes experts in fields like neurobiology, genetics, clinical trials, and regulatory affairs. The ability to discover, develop, and bring innovative therapies to market hinges on the expertise of these individuals.

The scarcity of top-tier talent, especially in specialized areas such as neurology, grants these skilled professionals considerable bargaining power. This can directly influence Biogen's operational expenses and its capacity for groundbreaking research and development. For instance, in 2024, the demand for experienced biopharmaceutical researchers outstripped supply, leading to increased salary expectations and signing bonuses.

Competition for these sought-after professionals is fierce. Major pharmaceutical and biotech firms are all vying for the same limited pool of highly qualified talent. This intense competition further amplifies the bargaining power of skilled labor, making it a critical factor in Biogen's strategic planning and talent acquisition efforts.

Proprietary Technologies and Equipment

Biogen's reliance on proprietary technologies and specialized equipment significantly amplifies the bargaining power of its suppliers. These suppliers provide advanced laboratory instruments, complex manufacturing machinery, and patented technological solutions that are critical for Biogen's research and development pipeline, as well as its precise manufacturing operations. For instance, the development of cutting-edge biologics often necessitates highly specialized bioreactors or gene sequencing equipment, where a limited number of suppliers can meet the stringent technical requirements.

The high capital expenditure associated with acquiring and implementing these advanced technologies, coupled with the intricate integration into Biogen's existing infrastructure, makes switching suppliers a costly and time-consuming endeavor. This switching cost further entrenches the power of incumbent suppliers. In 2024, the biotechnology sector saw continued investment in advanced R&D infrastructure, with companies like Biogen allocating substantial capital towards next-generation manufacturing capabilities, thereby increasing the leverage of suppliers of these essential technologies.

- Supplier Dependence: Biogen's need for specific, often patented, equipment for drug discovery and production creates a strong reliance on a select group of technology providers.

- High Switching Costs: The significant investment and technical expertise required to replace specialized R&D and manufacturing equipment makes it difficult and expensive for Biogen to change suppliers.

- Essential Nature of Technology: Suppliers of technologies crucial for maintaining Biogen's competitive edge in developing complex biologics and therapies hold considerable influence.

- Market Concentration: In certain niche technology areas vital to biopharmaceutical manufacturing, the market may be dominated by a few key players, concentrating supplier power.

Intellectual Property Licensors

Intellectual property licensors, such as universities and research institutions, can wield considerable bargaining power over Biogen. This is especially true when Biogen relies on their foundational intellectual property, like novel gene targets or advanced drug delivery systems, for its pipeline. The uniqueness and indispensability of this licensed IP are crucial determinants of the licensors' leverage.

These licensors can dictate terms such as royalty rates and exclusivity, significantly impacting Biogen's costs and competitive advantage. For instance, a breakthrough technology licensed from a top-tier university might command higher royalty percentages, potentially impacting Biogen's profitability on a specific drug. The exclusivity clauses can also limit Biogen's ability to collaborate with other entities on similar research.

- Critical IP: Biogen's reliance on licensed foundational IP, like gene targets or platform technologies, grants licensors significant leverage.

- Negotiating Power: Licensors can influence royalty rates and exclusivity terms, directly impacting Biogen's financial projections and strategic flexibility.

- Uniqueness Factor: The more unique and indispensable the licensed intellectual property, the stronger the bargaining position of the licensor.

- Industry Dependence: In 2024, the biotech sector continued to see significant value placed on novel IP, reinforcing the bargaining power of early-stage research providers.

Suppliers of specialized raw materials and active pharmaceutical ingredients (APIs) hold significant bargaining power over Biogen due to the proprietary nature and limited availability of these critical components. The high costs and lengthy timelines associated with qualifying new suppliers for neurological treatments create substantial switching costs, allowing existing vendors to command higher prices.

Contract Research Organizations (CROs) specializing in neurological and neurodegenerative disease trials also possess strong leverage. Biogen's reliance on their niche expertise and the outsourcing of complex R&D, including clinical trials, means these CROs can negotiate favorable terms. The global CRO market's robust growth, reaching approximately $45.5 billion in 2023, underscores the high demand for these specialized services.

The scarcity of highly skilled talent in fields like neurobiology and clinical research, particularly in 2024, grants these professionals considerable bargaining power. Fierce competition among pharmaceutical and biotech firms for this limited pool of experts drives up salary expectations and signing bonuses, impacting Biogen's operational expenses and R&D capacity.

Suppliers of proprietary technologies and specialized equipment essential for Biogen's advanced R&D and manufacturing operations also exert considerable influence. The high capital investment and technical integration required for these systems make switching suppliers costly and time-consuming, reinforcing the power of incumbent providers.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Biogen |

| Specialized Raw Materials/APIs | Proprietary nature, limited suppliers, high switching costs | Higher input costs, potential supply chain disruptions |

| Contract Research Organizations (CROs) | Niche expertise (neurology), high demand, outsourcing trend | Increased R&D service costs, negotiation on trial timelines |

| Skilled Labor (Biotech/Neurology) | Scarcity of talent, high competition, specialized knowledge | Increased labor costs, challenges in talent acquisition |

| Proprietary Technology/Equipment | Unique capabilities, high capital investment, integration complexity | Higher equipment costs, dependence on specific vendors |

What is included in the product

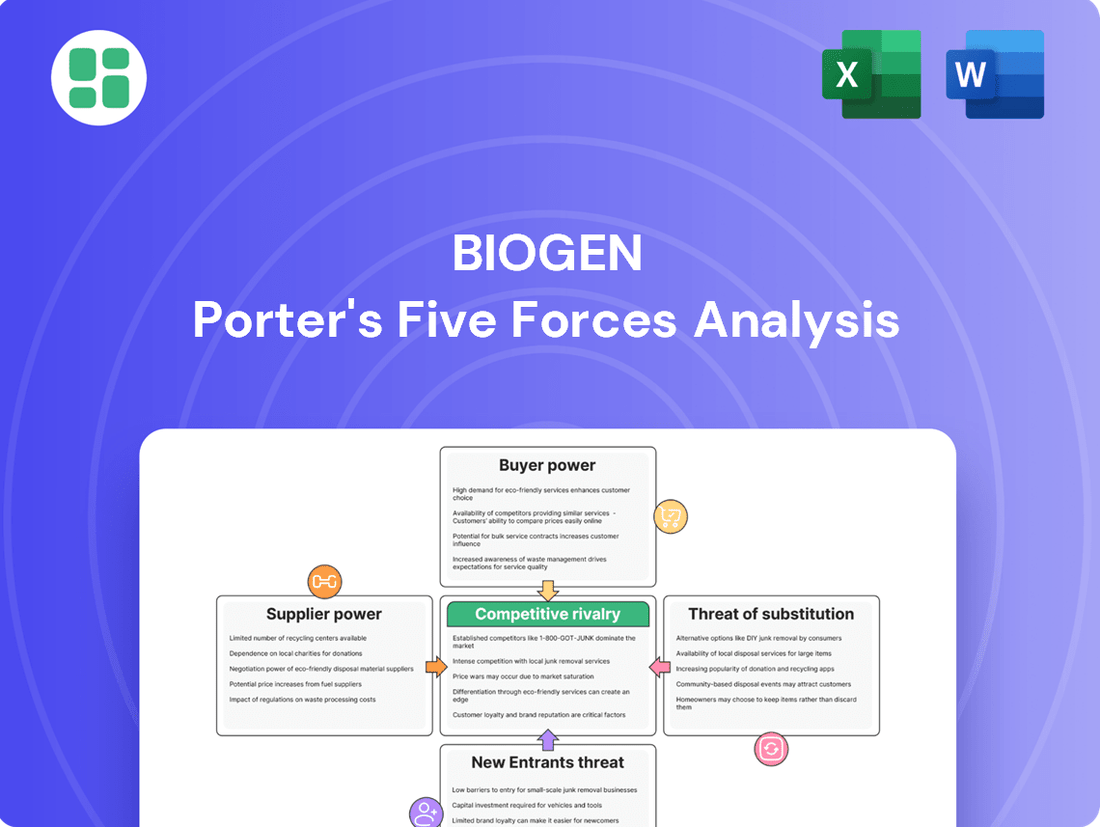

This analysis dissects Biogen's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the biotechnology sector.

Gain a competitive edge by quickly identifying and mitigating threats from rivals, new entrants, and substitutes, all within a single, actionable framework.

Customers Bargaining Power

Biogen's main customers are healthcare payers, including government bodies like Medicare and Medicaid, and private insurance firms. These large purchasers have significant leverage because they buy in bulk and control reimbursement. In 2024, payers continued to scrutinize the cost-effectiveness of Biogen's specialized neurological treatments, often pushing for rebates or limiting patient access to manage overall healthcare spending.

Large hospital networks and integrated healthcare systems are powerful buyers of Biogen's specialized therapies. These entities often centralize their purchasing decisions, giving them significant leverage to negotiate pricing and secure discounts. Their focus on managing overall healthcare costs and the demonstrated value of Biogen's treatments within their formularies directly impacts Biogen's pricing power.

Patient advocacy groups and public opinion wield considerable influence over Biogen's market, even if they aren't direct purchasers. These groups often lobby payers and policymakers, impacting drug pricing and access, particularly for conditions like multiple sclerosis and Alzheimer's. For instance, in 2024, numerous patient advocacy organizations actively campaigned for broader access to Biogen's spinal muscular atrophy treatment, Zolgensma, highlighting the critical need for such therapies.

Physicians and Prescribers

Physicians and prescribers hold significant sway over Biogen's success by acting as the primary decision-makers for therapy selection. Their clinical judgment on a drug's effectiveness, safety, and patient suitability directly drives product adoption, even if they don't directly negotiate pricing. For instance, in 2024, physician prescribing habits continued to be a key factor in the market penetration of Biogen's multiple sclerosis therapies, where detailed clinical trial data and real-world evidence heavily influenced uptake.

Their awareness of competing treatments and their willingness to switch patients based on clinical outcomes or formulary restrictions can impact Biogen's market share. This dynamic means Biogen must actively engage with physicians, providing robust data and support to ensure their therapies remain the preferred choice. The influence of Key Opinion Leaders (KOLs) within the medical community, who often shape the prescribing patterns of their peers, further amplifies this bargaining power.

- Physician influence on drug adoption: Their prescribing decisions are paramount for Biogen's revenue.

- Clinical judgment as a driver: Efficacy, safety, and patient suitability are key factors influencing their choices.

- Impact of treatment alternatives: Physician willingness to switch therapies affects Biogen's market position.

- Role of Key Opinion Leaders (KOLs): KOLs significantly shape prescribing patterns among their peers.

Competition from Biosimilars and Generics

The rise of biosimilars and generics significantly bolsters the bargaining power of Biogen's customers. Payers and healthcare providers can increasingly choose lower-cost alternatives that demonstrate comparable effectiveness and safety to Biogen's established biologic treatments. This shift directly intensifies price competition, placing downward pressure on Biogen's product pricing and enhancing customer leverage in negotiations.

For instance, the market for biosimilars is projected for substantial growth. By 2028, the global biosimilars market is expected to reach over $100 billion, indicating a significant increase in available alternatives for patients and providers. This growing competitive landscape empowers customers to demand more favorable pricing and terms from originator companies like Biogen.

- Increased Customer Choice: The availability of biosimilars provides customers, such as insurance companies and hospital systems, with viable, lower-cost alternatives to Biogen's branded biologics.

- Price Sensitivity: Healthcare systems and payers are highly sensitive to drug costs, making them more likely to switch to or negotiate harder for biosimilar options, especially when efficacy is proven to be comparable.

- Downward Price Pressure: This heightened competition directly translates into reduced pricing power for Biogen, as customers can leverage the availability of cheaper alternatives to secure better deals.

- Market Share Erosion: Originator products often experience market share erosion once biosimilars enter the market, further amplifying the bargaining power of customers who benefit from these competitive dynamics.

Biogen's customers, primarily large healthcare payers and integrated health systems, possess significant bargaining power due to their substantial purchasing volume and control over reimbursement. In 2024, these entities actively managed healthcare spending by scrutinizing drug costs and negotiating pricing. The growing availability of biosimilars further amplifies this power, offering lower-cost alternatives that pressure Biogen's pricing. Patient advocacy groups and influential physicians also shape market dynamics by advocating for access and influencing treatment choices.

| Customer Segment | Bargaining Power Drivers | 2024 Impact Example |

|---|---|---|

| Healthcare Payers (e.g., Medicare, Private Insurers) | Bulk purchasing, reimbursement control, cost-effectiveness scrutiny | Negotiated rebates and access restrictions to manage overall healthcare expenditure. |

| Large Hospital Networks/Integrated Systems | Centralized purchasing, formulary management, value demonstration | Leveraged purchasing power to secure discounts on specialized therapies. |

| Physicians/Prescribers | Clinical judgment, awareness of alternatives, KOL influence | Prescribing habits influenced by clinical data and formulary status, impacting market share. |

| Biosimilar Providers | Increased competition, comparable efficacy claims | Contributed to downward price pressure on Biogen's biologics, enhancing customer negotiation leverage. |

Full Version Awaits

Biogen Porter's Five Forces Analysis

This preview showcases the comprehensive Biogen Porter's Five Forces Analysis, detailing the competitive landscape within the biotechnology sector. You're viewing the exact, professionally formatted document you'll receive immediately after purchase, offering a complete breakdown of industry rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes. This is the final, ready-to-use analysis, ensuring you get precisely what you need without any placeholders or surprises.

Rivalry Among Competitors

Biogen operates in a sector where the upfront investment in research and development is staggering. For instance, developing a single new drug can cost upwards of $2.6 billion, with many of these costs incurred before any revenue is generated. This creates a significant barrier to entry and fuels intense rivalry among established players who must continuously innovate to justify these expenditures.

The pressure to recoup these massive R&D outlays, coupled with the long development timelines that can stretch over a decade, forces companies like Biogen to aggressively pursue market share. Success in clinical trials and subsequent product launches become critical determinants of survival and profitability, leading to fierce competition for patient populations and physician adoption.

Patent expirations are a significant force intensifying competition in the pharmaceutical sector. When Biogen's patents for blockbuster drugs expire, it faces a sharp decline in revenue as generic and biosimilar manufacturers enter the market, often with much lower pricing. For instance, the loss of exclusivity for drugs like Tecfidera, which had significant sales for Biogen, could open the door for multiple competitors. This dynamic directly fuels rivalry by creating price wars and a battle for market share.

Biogen also actively participates in this rivalry by developing its own biosimilars for competitor products. This strategy aims to capture market share from originator biologics, thereby increasing competitive pressure on other companies. By challenging established brands with more affordable alternatives, Biogen contributes to the overall intensity of competition and the ongoing battle for market dominance.

Competition in neurological diseases is a fierce battleground where demonstrating superior efficacy, safety, or convenience is paramount. Biogen, like its peers, invests heavily in R&D to create therapies that stand out. For instance, in the multiple sclerosis market, where Biogen has a significant presence, the introduction of new disease-modifying therapies (DMTs) constantly reshapes the competitive landscape, demanding clear clinical advantages to gain traction.

The drive for these advantages fuels an intense rivalry in clinical trials and subsequent marketing efforts. Companies pour billions into research, aiming to secure patents and market exclusivity for therapies that offer even marginal improvements in patient outcomes. In 2023, Biogen’s revenue from its multiple sclerosis portfolio, while facing generic competition for some older products, still represented a substantial portion of its overall sales, highlighting the ongoing importance of innovation in this segment.

Even minor differences in clinical outcomes can dramatically influence market adoption and physician prescribing habits. This creates a high-stakes environment where companies vie for patient and physician preference through robust clinical data and targeted marketing campaigns. The success of drugs like Biogen's Tysabri, which has maintained a strong position due to its efficacy profile, underscores how differentiated clinical performance can sustain competitive advantage.

Number and Diversity of Competitors

Biogen competes in crowded therapeutic markets, facing formidable rivals like Roche, Novartis, Sanofi, Eli Lilly, and Eisai. These giants possess substantial financial resources and robust research and development pipelines, directly challenging Biogen's market position. The sheer number of well-capitalized players intensifies competition across key areas such as multiple sclerosis, spinal muscular atrophy, and Alzheimer's disease. For instance, in the multiple sclerosis market, Biogen has historically been a leader, but companies like Novartis with Kesimpta and Sanofi with Aubagio have significantly gained market share, highlighting the fierce rivalry.

The diversity of competitors also plays a crucial role. Biogen contends not only with large, established pharmaceutical companies but also with agile, innovative biotechnology firms that can disrupt existing markets. This dynamic landscape necessitates continuous innovation and strategic maneuvering to maintain a competitive edge. For example, the race to develop effective Alzheimer's treatments sees Biogen facing competition from Eli Lilly's donanemab, which received FDA approval in mid-2024, demonstrating the rapid pace of innovation and the impact of new entrants.

- Number of Competitors: Biogen faces competition from dozens of companies in its core therapeutic areas.

- Key Competitors: Major rivals include Roche, Novartis, Sanofi, Eli Lilly, and Eisai.

- Market Share Battles: Intense competition for market leadership in multiple sclerosis, spinal muscular atrophy, and Alzheimer's disease.

- Impact of Innovation: New drug approvals, such as Eli Lilly's donanemab for Alzheimer's in 2024, underscore the dynamic and aggressive nature of the competitive environment.

Market Growth Rate and Strategic Alliances

The market for neurological diseases, while vast, experiences varied growth rates across its segments. For instance, the Alzheimer's disease drug market, a significant portion of this sector, saw its growth trajectory influenced by the introduction of new treatments in 2023 and 2024, which can intensify competition among existing players.

When growth in a particular neuro-segment moderates, or a breakthrough therapy gains significant traction, the rivalry among companies intensifies. This is particularly evident as Biogen navigates the competitive landscape for treatments like Alzheimer's and multiple sclerosis.

Strategic alliances are a key factor in shaping competitive rivalry. Companies form partnerships to share the high costs of R&D, access specialized expertise, or expand market reach. For example, collaborations in gene therapy for rare neurological disorders are becoming more common, pooling resources and expertise among Biogen, its competitors, and even academic institutions.

- Varied Segment Growth: While the overall neurological disease market is substantial, growth rates differ significantly by specific condition, impacting competitive intensity.

- Impact of New Therapies: Emergence of highly effective new treatments can rapidly shift market share and escalate rivalry among established and emerging players.

- Strategic Alliances: Partnerships are crucial for resource pooling, technology access, and risk mitigation, thereby altering the competitive dynamics for companies like Biogen.

- Increased Collaboration: The trend towards alliances, especially in areas like gene therapy for rare neurological conditions, consolidates competitive forces among remaining independent entities.

The competitive rivalry within Biogen's operating space is exceptionally high due to massive R&D costs, patent expirations, and the need for continuous innovation. Companies like Biogen must differentiate their therapies on efficacy and safety to capture market share in crowded therapeutic areas, such as multiple sclerosis and Alzheimer's disease.

Key rivals including Roche, Novartis, Sanofi, and Eli Lilly actively compete, with new drug approvals, like Eli Lilly's Alzheimer's treatment in 2024, constantly reshaping the market dynamics and intensifying the battle for dominance.

| Key Competitor | Therapeutic Area Focus | Recent Competitive Action |

|---|---|---|

| Roche | Multiple Sclerosis, Neuroscience | Ongoing development of new MS therapies and research into Alzheimer's. |

| Novartis | Multiple Sclerosis, Neuroscience | Gained significant market share in MS with therapies like Kesimpta. |

| Sanofi | Multiple Sclerosis, Rare Diseases | Competes with Aubagio in the MS market and explores new neurological treatments. |

| Eli Lilly | Alzheimer's Disease, Neuroscience | Received FDA approval for its Alzheimer's drug donanemab in mid-2024. |

SSubstitutes Threaten

Alternative therapies and non-pharmacological treatments pose a significant threat to Biogen. For conditions like multiple sclerosis or Alzheimer's, patients and doctors increasingly explore options such as specialized physical therapy, cognitive training, and digital therapeutics. For instance, the digital therapeutics market is projected to reach $14.6 billion by 2028, indicating growing patient adoption of non-drug solutions.

The threat of substitutes for Biogen's products can emerge from the off-label use of other pharmaceutical drugs. Physicians may prescribe medications approved for different conditions to treat diseases Biogen targets, especially if clinical evidence supports efficacy. For instance, in 2023, the off-label use of certain anti-inflammatory drugs for neurological conditions, areas Biogen is active in, continued to be a discussion point among prescribers, even without regulatory approval for those specific uses.

Biogen's branded neurological therapies face a significant threat from generic or biosimilar versions of competitor drugs. Even though Biogen is also developing biosimilars, its own innovative treatments are vulnerable. For instance, if a competitor's successful drug for a similar neurological condition gains a lower-cost generic or biosimilar equivalent, payers and physicians may opt for that alternative, even if Biogen's product offers a different mechanism of action.

This indirect substitution intensifies price competition across the entire market segment. In 2023, the global biosimilars market was valued at approximately $25.3 billion, and it's projected to grow substantially, indicating a strong trend towards these lower-cost alternatives. This growth directly translates to increased pressure on the pricing of branded drugs like those in Biogen's portfolio.

Emerging Gene and Cell Therapies

For certain neurological conditions, particularly rare genetic disorders like Spinal Muscular Atrophy (SMA), revolutionary gene therapies and advanced cell therapies are emerging as significant substitutes. These therapies, often designed to be curative or provide long-term remission with a single dose, fundamentally alter the treatment paradigm.

The emergence of such highly effective, potentially one-time treatments can substantially reduce the need for chronic, ongoing therapies that may be part of Biogen's portfolio. For instance, the market for SMA treatments has seen a shift with the introduction of gene therapies that offer a potentially permanent solution, impacting the long-term revenue potential of existing therapies.

- Curative Potential: Gene and cell therapies aim for a one-time, curative intervention, directly challenging the market for chronic treatment regimens.

- Treatment Paradigm Shift: These advanced therapies fundamentally change how diseases are managed, moving from symptom management to addressing the root cause.

- Market Disruption: The success of these substitutes can significantly erode the market share and revenue streams of traditional, long-term treatment providers.

Preventative Measures and Early Diagnostics

Advances in preventative medicine and early diagnostic tools present a significant threat of substitution for Biogen. For instance, breakthroughs in genetic screening and biomarkers could allow for the identification of neurological predispositions much earlier. This could lead to lifestyle interventions or preventative therapies that reduce the need for Biogen's later-stage treatments.

The increasing focus on non-pharmacological approaches, such as advanced physical therapy, cognitive training programs, and even novel digital therapeutics, also poses a risk. If these methods prove effective in managing or even reversing early-stage neurological decline, they could capture market share from traditional drug-based therapies. For example, by 2024, the digital therapeutics market was projected to reach tens of billions of dollars globally, indicating a growing acceptance of tech-driven health solutions.

- Early Detection: Technologies that identify neurological conditions before significant symptom onset can bypass the need for Biogen's treatments.

- Preventative Strategies: Lifestyle changes and non-pharmacological interventions that avert disease progression reduce reliance on pharmaceutical solutions.

- Digital Therapeutics: The growing digital health sector offers alternative management and treatment options for neurological disorders.

The rise of advanced therapies like gene and cell treatments presents a significant threat by offering potentially curative solutions for conditions Biogen targets, directly challenging the need for ongoing pharmaceutical interventions. These therapies aim for a one-time fix, fundamentally altering the treatment landscape and impacting the long-term revenue of chronic care models.

The increasing acceptance of digital therapeutics and non-pharmacological approaches, such as specialized physical therapy and cognitive training, also substitutes for traditional drug treatments. With the digital therapeutics market expected to reach substantial figures, these alternatives offer patients new ways to manage neurological conditions, potentially reducing reliance on Biogen's offerings.

| Substitute Type | Example | Market Impact Factor | 2024 Projection/Data |

|---|---|---|---|

| Advanced Therapies | Gene Therapy for SMA | Curative potential, single-dose treatment | SMA gene therapy market growth |

| Non-Pharmacological | Digital Therapeutics | Alternative disease management | Digital therapeutics market projected to reach $14.6 billion by 2028 |

| Generic/Biosimilar | Competitor drug equivalents | Lower cost, increased price pressure | Global biosimilars market valued at ~$25.3 billion in 2023 |

Entrants Threaten

The development of groundbreaking treatments for challenging neurological and neurodegenerative conditions requires massive financial outlays, frequently reaching billions of dollars, coupled with exceptionally lengthy development periods, often exceeding ten years. This significant capital commitment and extended journey to market serve as a substantial impediment, discouraging many prospective new players from vying in Biogen's primary therapeutic sectors.

The inherent risk of clinical trial failure amplifies this barrier, as setbacks can lead to the loss of substantial investments and further prolong the path to potential commercialization.

The threat of new entrants in the biotechnology sector, particularly for neurological therapies, is significantly mitigated by extremely stringent regulatory hurdles. Agencies like the U.S. Food and Drug Administration (FDA) impose rigorous demands for clinical trials, manufacturing standards, and drug approval processes. For instance, the average cost to bring a new drug to market was estimated to be over $2 billion in 2023, with a substantial portion dedicated to navigating these complex approval pathways.

Gaining regulatory approval for novel neurological therapies is especially difficult due to the intricate nature of these diseases and the paramount importance of patient safety. This demanding environment requires substantial investment in research and development, clinical testing, and regulatory affairs expertise, creating a formidable barrier for any new company attempting to enter the market.

Biogen's robust intellectual property portfolio, encompassing patents and orphan drug designations for its approved treatments and pipeline candidates, acts as a significant barrier to new entrants. These protections afford Biogen exclusive commercialization rights for extended periods, deterring competitors from introducing similar products due to the high risk of expensive litigation. For instance, Biogen has historically invested billions in R&D, with a substantial portion dedicated to securing and defending its patents, creating a formidable challenge for any newcomer aiming to replicate its innovations.

Need for Specialized Expertise and Infrastructure

The neurological biotechnology market demands highly specialized scientific knowledge in areas like neuroscience and genetics, alongside sophisticated clinical development processes. For instance, developing treatments for conditions like Alzheimer's or Parkinson's requires years of research and billions in investment, as seen with the substantial R&D expenditures of established players. Biogen, a leader in this space, reported approximately $2.4 billion in R&D expenses in 2023, highlighting the financial commitment needed.

Beyond scientific prowess, new entrants face significant hurdles in establishing the necessary infrastructure. This includes specialized manufacturing for complex biologics and advanced therapies, which is capital-intensive and requires strict regulatory compliance. Building global distribution networks and sales forces trained to handle intricate disease areas and engage with key opinion leaders is another substantial barrier.

- High R&D Investment: Neurological drug development can cost upwards of $2.6 billion per drug, with a high failure rate.

- Specialized Manufacturing: Biologics production requires advanced facilities and stringent quality control, often costing hundreds of millions to establish.

- Regulatory Hurdles: Navigating FDA and EMA approvals for novel neurological treatments is a lengthy and complex process, often taking over a decade.

- Market Access and Sales Force: Creating a specialized sales force for niche neurological indications and securing market access requires significant upfront investment and established relationships.

Brand Loyalty and Established Relationships

Biogen has cultivated deep-seated loyalty among key stakeholders, including neurologists, specialized clinics, hospitals, and patient advocacy groups, over many years. This extensive network and trust, built on decades of experience and successful therapies, present a significant barrier to new entrants. For instance, Biogen's strong position in multiple sclerosis therapies, where it holds a substantial market share, is partly due to these entrenched relationships.

The brand recognition Biogen enjoys for its existing treatments fosters a sense of reliability and preference among both prescribers and patients. New companies entering the market would face the daunting task of replicating these decades-long relationship-building efforts and overcoming established brand preferences. This requires substantial investment not only in product development but also in establishing trust and credibility within the medical community and patient populations.

- Established Stakeholder Relationships: Biogen has nurtured long-term connections with neurologists, specialized clinics, hospitals, and patient advocacy groups, creating a loyal ecosystem.

- Brand Recognition and Trust: The company's established therapies have built significant brand recognition and trust, influencing prescriber and patient choices.

- High Barriers to Entry for New Entrants: New competitors must invest heavily and over extended periods to build comparable relationships and overcome existing brand loyalty, making market penetration difficult.

The threat of new entrants in Biogen's specialized neurological market is low due to immense capital requirements, with drug development costs exceeding $2 billion and clinical trials often taking over a decade. Stringent regulatory approvals from bodies like the FDA, demanding rigorous safety and efficacy data, further erect substantial barriers. Biogen's extensive patent portfolio and orphan drug designations provide exclusive market rights, deterring competitors from entering without risking costly litigation.

The need for highly specialized scientific expertise in neuroscience and genetics, coupled with the significant investment in advanced manufacturing facilities for biologics, presents another formidable challenge. Establishing robust distribution networks and specialized sales forces to engage with key opinion leaders in niche therapeutic areas requires substantial upfront investment and time, making market penetration difficult for newcomers.

Biogen's long-standing relationships with neurologists, specialized clinics, and patient advocacy groups foster significant brand loyalty and trust, creating a strong competitive moat. New entrants would need years and considerable resources to replicate these established connections and overcome existing brand preferences within the medical community and patient populations.

| Barrier Type | Description | Estimated Cost/Timeframe |

|---|---|---|

| Capital Requirements | R&D, clinical trials, manufacturing | >$2 billion per drug, 10+ years |

| Regulatory Hurdles | FDA/EMA approval process | Extensive clinical data, lengthy review |

| Intellectual Property | Patents, orphan drug designations | Exclusive market rights, litigation risk |

| Specialized Expertise | Neuroscience, genetics, clinical development | Billions in R&D, years of research |

| Infrastructure | Manufacturing, distribution, sales force | Hundreds of millions for facilities, long-term relationship building |

| Brand Loyalty | Relationships with stakeholders | Decades of cultivation, trust-building |

Porter's Five Forces Analysis Data Sources

Our Biogen Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Biogen's annual reports, SEC filings, and investor presentations. We supplement this with industry-specific market research reports from firms like EvaluatePharma and FierceBiotech, alongside data from reputable financial databases such as S&P Capital IQ.