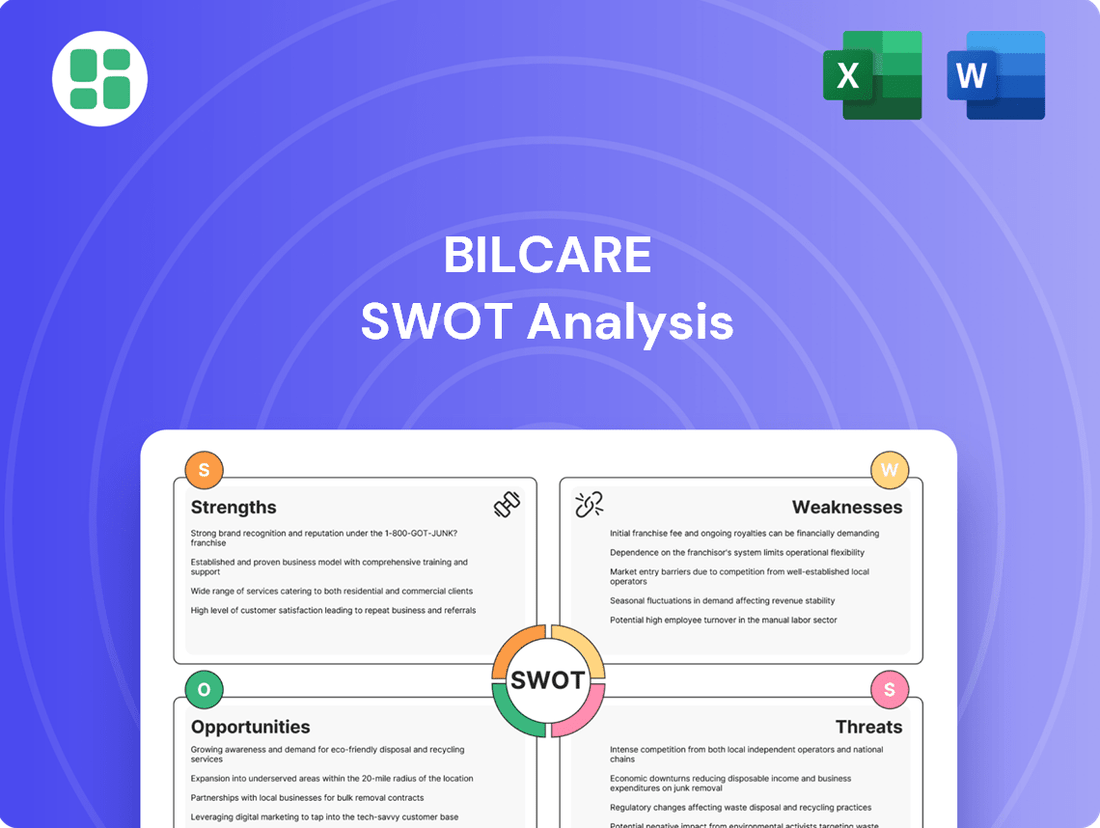

Bilcare SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilcare Bundle

Bilcare's SWOT analysis reveals a company with strong brand recognition and a diverse product portfolio, but also highlights potential challenges in fluctuating raw material costs and increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the pharmaceutical packaging sector.

Want the full story behind Bilcare's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bilcare Limited has demonstrated a notable financial recovery, achieving a net profit of ₹10.56 crore in the fourth quarter of FY2024-2025. This represents an impressive 196.97% increase over the corresponding period in the previous fiscal year, signaling a strong turnaround.

The company's revenue also experienced a positive trend, with a 3.02% rise in Q4 FY2024-2025. This growth in sales further underscores the improving operational performance and market traction.

Bilcare boasts a rich legacy and profound expertise in delivering comprehensive solutions for pharmaceutical packaging. This includes specialized polymer films and aluminum foils crucial for solid dose packaging, demonstrating their deep understanding of the sector's needs. Their long-standing presence signifies a well-established ability to meet the demanding and precise specifications of the pharmaceutical industry.

Bilcare excels by concentrating on niche and advanced packaging, offering specialized solutions like child-resistant, user-friendly, and tamper-evident features. This strategic focus directly addresses growing regulatory requirements and heightened consumer concern for drug safety and authenticity.

The company's commitment to research and development is evident in its pursuit of innovative and sustainable packaging materials, a critical differentiator in today's market. For instance, by 2024, the global pharmaceutical packaging market was projected to reach over $140 billion, with a significant portion driven by demand for these advanced functionalities.

Global Reach and Client Base

Bilcare's strength lies in its extensive global footprint, with operations and R&D centers strategically located in Europe, the USA, and Asia. This allows them to cater to a diverse clientele across more than 100 countries, demonstrating their robust international market penetration.

The company's customer base includes leading global pharmaceutical giants, underscoring Bilcare's established reputation and strong, long-standing relationships within the highly regulated pharmaceutical sector. This broad client engagement is a testament to their quality and reliability.

This expansive reach and esteemed client portfolio provide a solid foundation for Bilcare's future expansion strategies and opportunities to further penetrate new and existing markets. Their ability to serve major players globally highlights their competitive advantage.

Key aspects of Bilcare's global reach and client base include:

- Manufacturing and R&D presence in key regions: Europe, USA, and Asia.

- Customer service in over 100 countries, indicating significant market penetration.

- Clientele comprises major global pharmaceutical companies, signifying industry trust and recognition.

- Established relationships with key industry players provide a strong competitive edge.

Integrated Healthcare Services Approach

Bilcare's integrated healthcare services approach extends beyond its core packaging business. Historically, the company provided clinical trial supplies and anti-counterfeiting technologies, with stated intentions to re-engage in these healthcare services. This strategy aims to offer pharmaceutical clients a more complete suite of solutions.

By combining packaging with clinical trial support and security measures, Bilcare can present a more robust value proposition. This integration has the potential to unlock new revenue streams and deepen relationships with pharmaceutical partners. The company's focus remains on leveraging these offerings to positively impact patient healthcare outcomes through innovative solutions.

- Historical Services: Clinical trial supplies and anti-counterfeiting technologies.

- Strategic Intent: Revival of healthcare services operations.

- Value Proposition: Comprehensive solutions for pharmaceutical companies.

- Goal: Improve patient healthcare outcomes via novel solutions.

Bilcare's financial performance shows a strong rebound, with a net profit of ₹10.56 crore in Q4 FY2024-2025, a significant 196.97% increase year-over-year. This recovery is supported by a 3.02% revenue growth in the same quarter, indicating improved operational efficiency and market demand for its specialized pharmaceutical packaging solutions.

The company possesses deep expertise in pharmaceutical packaging, offering critical polymer films and aluminum foils for solid dose packaging, meeting stringent industry requirements. This includes a focus on advanced features like child-resistance and tamper-evidence, aligning with increasing regulatory and consumer safety demands. Bilcare's commitment to R&D for innovative and sustainable materials is a key differentiator in a global pharmaceutical packaging market projected to exceed $140 billion by 2024.

Bilcare's extensive global presence, with operations and R&D in Europe, the USA, and Asia, serves over 100 countries. This broad international reach, coupled with a client base of major global pharmaceutical companies, highlights its established reputation and strong market penetration. These relationships are built on quality and reliability, providing a solid foundation for future growth.

Furthermore, Bilcare's strategy to integrate healthcare services, including clinical trial supplies and anti-counterfeiting technologies, alongside its packaging business, offers a more comprehensive value proposition. This integrated approach aims to deepen client relationships and unlock new revenue streams by providing end-to-end solutions that can positively impact patient healthcare.

| Financial Performance (Q4 FY2024-2025) | Net Profit | Revenue Growth |

|---|---|---|

| Key Figures | ₹10.56 crore | 3.02% |

| Year-over-Year Change | +196.97% | N/A |

What is included in the product

Analyzes Bilcare’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, transforming potential threats into opportunities.

Weaknesses

Despite a strong fourth quarter performance, Bilcare Limited recorded an overall net loss for the fiscal year ending March 31, 2025. This suggests the company is still working through considerable financial hurdles, even with recent positive trends.

The company's financial stability remains a concern, with persistent high debt levels impacting its overall health. Furthermore, a negative return on equity for the period ending March 31, 2025, signals ongoing issues with profitability and shareholder value generation.

Bilcare's operational scope has been significantly curtailed following its extensive financial restructuring. This contraction directly impacts its ability to seize emerging market opportunities and compete robustly against larger, more established entities. For instance, the company's revenue in the fiscal year ending March 31, 2024, stood at INR 254.15 crore, a notable decrease from previous periods, reflecting this reduced operational footprint.

Bilcare has faced challenges with consistent revenue growth, showing a concerning trend of declining net sales over the past five years. For instance, in fiscal year 2023, the company reported net sales of INR 1,028.5 crore, a decrease from INR 1,150.2 crore in fiscal year 2022. This historical performance understandably breeds investor caution.

While a recent quarterly report might show a positive uptick, the overarching five-year trajectory points to difficulties in achieving sustained top-line expansion. This lack of consistent revenue growth can significantly impede the company's ability to reinvest in its operations and pursue strategic expansion initiatives.

Substantial Public Shareholding and Promoter Pledge

Bilcare Limited's public shareholding stands at a notable 44.96% as of June 2025, with promoter holding at 30.01%. A substantial portion of public shares, especially retail investors, can contribute to stock price volatility, making control less predictable, particularly in light of the company's historical financial challenges.

The relatively low promoter holding, coupled with a small percentage of pledged shares, can sometimes signal a weaker grip on the company's strategic direction. This structure might present challenges in maintaining long-term stability and executing decisive management actions.

- Public Shareholding: Approximately 44.96% (June 2025)

- Promoter Holding: Approximately 30.01% (June 2025)

- Pledged Shares: A small portion of promoter shares are pledged.

- Implication: Potential for increased stock volatility and less stable control due to significant public investor base.

Competitive Disadvantages in the Broader Market

Bilcare has faced significant headwinds in the broader market, evidenced by its underperformance in stock returns over the past three years. Compared to industry peers, the company has struggled to generate comparable growth, suggesting potential challenges in capturing market share or effectively leveraging its assets.

While the past year has shown some signs of resilience, the market's perception of Bilcare's long-term fundamental strength remains a concern. This perception can hinder its ability to attract crucial new investments and top-tier talent, especially when contrasted with competitors demonstrating more robust financial stability and growth trajectories.

- Underperformance in Stock Returns: Bilcare's stock has lagged behind its peers over the last three years, indicating a potential competitive disadvantage.

- Perceived Weak Long-Term Fundamentals: Despite recent stability, the market views the company's underlying financial health as less robust than some competitors.

- Challenges in Attracting Capital and Talent: This perceived weakness could make it more difficult for Bilcare to secure new funding or recruit skilled employees compared to more financially secure rivals.

Bilcare's financial performance remains a significant weakness, highlighted by a net loss for the fiscal year ending March 31, 2025, and a negative return on equity. The company's operational footprint has also contracted due to financial restructuring, limiting its ability to compete and capitalize on market opportunities. This contraction is reflected in declining net sales, with INR 1,028.5 crore reported in FY23, down from INR 1,150.2 crore in FY22, indicating persistent challenges in achieving top-line growth.

| Financial Metric | FY2023 (INR Crore) | FY2022 (INR Crore) | Trend |

|---|---|---|---|

| Net Sales | 1,028.5 | 1,150.2 | Decreasing |

| Net Loss (FY2025) | (Specific figure not provided, but a net loss was recorded) | N/A | Negative |

| Return on Equity (FY2025) | Negative | N/A | Negative |

What You See Is What You Get

Bilcare SWOT Analysis

This is the actual Bilcare SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct representation of the comprehensive report you'll download.

Opportunities

The Indian pharmaceutical packaging market is a significant growth area, expected to reach around USD 3.98 billion by 2034, growing at an 8.70% compound annual growth rate from 2025 to 2034. This expansion is fueled by India's robust pharmaceutical manufacturing capabilities, increasing public health consciousness, and a greater need for reliable and secure drug containment. Bilcare, with its existing infrastructure and expertise, is well-positioned to capitalize on this burgeoning market trend.

The pharmaceutical sector is experiencing a significant push for enhanced anti-counterfeiting and secure packaging solutions, driven by stringent regulatory mandates and critical public health considerations. This trend is underscored by the increasing adoption of technologies such as serialization, QR codes, and advanced smart packaging, aiming to bolster product integrity and consumer safety.

Bilcare's established proficiency in anti-counterfeiting technologies, particularly its proprietary nCID technology, strategically positions the company to capitalize on this escalating market demand. For instance, the global anti-counterfeiting packaging market was valued at approximately USD 38.5 billion in 2023 and is projected to reach USD 72.1 billion by 2030, growing at a CAGR of 9.4% during the forecast period, according to various market research reports.

The Indian clinical trial supply and logistics market is poised for substantial expansion, with projections indicating it will reach USD 148.3 million by 2030, growing at an impressive 8.9% compound annual growth rate from 2025. This presents a prime opportunity for Bilcare's Global Clinical Material Supplies (GCS) division, which specializes in crucial services such as packaging, labeling, cold chain storage, and distribution.

Bilcare's established GCS capabilities are well-positioned to capitalize on this burgeoning market. By leveraging its expertise, the company can effectively serve the increasing demand for specialized logistics solutions supporting clinical research within India.

India's appeal as a global hub for clinical trials is further amplified by its inherent cost-efficiency and access to a diverse patient population. These factors contribute to the attractiveness of the region for multinational pharmaceutical companies and research organizations, creating a fertile ground for Bilcare's growth.

Advancements in Packaging Technology and Sustainability

The pharmaceutical packaging sector is experiencing significant innovation with the introduction of smart packaging. Technologies like RFID tags, NFC chips, and QR codes are becoming crucial for enhancing product traceability and ensuring authenticity. This trend is driven by increasing regulatory demands and consumer expectations for secure supply chains.

There's a pronounced global shift towards eco-friendly and sustainable packaging solutions. The market for sustainable packaging is projected to grow substantially, with estimates suggesting it could reach over $400 billion by 2027, indicating a strong demand for environmentally conscious alternatives. This presents a clear opportunity for companies to align their offerings with these evolving preferences.

Bilcare's robust research and development capabilities position it well to capitalize on these trends. By focusing on innovation in advanced, sustainable packaging, Bilcare can develop solutions that meet both market demand and stringent regulatory requirements.

- Smart Packaging Integration: Developing and offering packaging with embedded RFID, NFC, or QR codes to enhance drug traceability and combat counterfeiting.

- Sustainable Material Innovation: Investing in R&D for biodegradable, recyclable, or compostable packaging materials to meet growing environmental concerns.

- Regulatory Compliance: Ensuring all new packaging solutions adhere to evolving global pharmaceutical packaging regulations, such as those from the FDA and EMA, which increasingly favor secure and sustainable options.

Potential for Strategic Partnerships and Acquisitions

Bilcare's strategic pivot towards niche pharmaceutical areas presents a fertile ground for forging alliances. Potential partners, recognizing Bilcare's existing client base and technical know-how, may seek collaborations to tap into India's expanding healthcare market, which is projected to reach $372 billion by 2022, according to a report by the Confederation of Indian Industry (CII). This opens doors for synergistic ventures that can accelerate growth and market penetration.

Acquisitions, particularly of smaller, specialized firms, could also be a viable avenue for Bilcare. By integrating complementary technologies or market access, the company can swiftly enhance its operational capabilities. For instance, acquiring a firm with advanced blister packaging technology could immediately elevate Bilcare's offering in the high-barrier packaging segment, a key area for pharmaceutical product integrity.

The company's historical strengths in polymer science and packaging solutions, coupled with a renewed focus, make it an attractive proposition for strategic investment. Companies looking to expand their footprint in the pharmaceutical supply chain, especially in emerging markets, might view Bilcare as a strategic acquisition target. This could provide them with immediate access to a well-established operational base and a skilled workforce.

- Niche Market Focus: Bilcare's intention to concentrate on specialized pharmaceutical packaging segments creates opportunities for partnerships with companies seeking to enter or expand within these high-growth areas.

- Leveraging Existing Relationships: The company's established ties with pharmaceutical clients can be a significant draw for potential partners looking for immediate market access and credibility in the Indian healthcare sector.

- Acquisition of Specialized Capabilities: Strategic acquisitions of smaller firms with advanced technologies or specific market expertise can rapidly bolster Bilcare's competitive edge, particularly in areas like high-barrier packaging solutions.

- Growth in Indian Healthcare: With the Indian healthcare market's substantial projected growth, Bilcare is well-positioned to attract strategic alliances and investments aimed at capitalizing on this expansion.

Bilcare's focus on specialized pharmaceutical packaging segments opens doors for strategic alliances with firms aiming to penetrate or expand within these high-growth niches. The company's existing client relationships provide immediate market access and credibility, making it an attractive partner for those looking to tap into India's expanding healthcare sector, which is projected to see significant growth through 2030.

Strategic acquisitions of smaller, specialized companies can rapidly enhance Bilcare's capabilities, particularly in advanced areas like high-barrier packaging. This approach allows for swift integration of complementary technologies and market expertise, strengthening Bilcare's competitive position.

The company's established strengths in polymer science and packaging solutions, combined with a strategic focus, position it as a desirable acquisition target for companies seeking to expand their presence in the pharmaceutical supply chain, especially in emerging markets.

| Opportunity Area | Key Driver | Bilcare's Advantage | Market Data Point |

| Niche Market Focus & Partnerships | High-growth specialized pharma packaging segments | Existing client base, technical expertise | Indian pharma packaging market to reach USD 3.98 billion by 2034 (8.70% CAGR 2025-2034) |

| Acquisitions for Specialized Capabilities | Advanced technologies (e.g., high-barrier packaging) | Rapid enhancement of operational capabilities | Global anti-counterfeiting packaging market valued at USD 38.5 billion in 2023 |

| Strategic Investment/Acquisition Target | Expansion in emerging markets, pharma supply chain | Established operational base, skilled workforce | Indian healthcare market projected to reach $372 billion by 2022 (CII report) |

Threats

The pharmaceutical packaging market, where Bilcare operates, is incredibly crowded. Think of it like a busy marketplace with many vendors vying for customer attention. This intense competition comes from both well-established companies and newer businesses entering the fray.

Major global players like Amcor Plc., Aptar Group Inc., and Huhtamaki Plc., alongside domestic giants such as Uflex Limited, represent significant threats. These companies often have vast resources, extensive distribution networks, and strong brand recognition, directly impacting Bilcare's ability to capture and retain market share and maintain healthy profit margins.

For Bilcare to thrive, it's crucial to carve out a distinct identity. This means offering unique products, superior quality, or innovative solutions that set it apart from the competition. Without strong differentiation, it becomes challenging to stand out and secure a competitive edge in this dynamic sector.

The cost of essential packaging materials like plastics, polymers, aluminum foil, and paperboard is inherently unpredictable. For Bilcare, these price swings directly affect manufacturing expenses and, consequently, profitability. This economic uncertainty presents an ongoing hurdle, particularly as the company navigates its restructuring efforts.

The pharmaceutical packaging sector faces a formidable challenge from stringent and ever-changing government regulations concerning product safety and integrity, impacting both domestic and international markets. Bilcare must navigate complex standards for materials, manufacturing processes, and serialization, a critical area for supply chain security.

Meeting these evolving compliance demands necessitates significant and ongoing investment in advanced technologies and updated operational processes. For instance, the push for enhanced track-and-trace capabilities, driven by regulations like the EU Falsified Medicines Directive, requires sophisticated data management and printing solutions.

Failure to adapt swiftly to new regulatory norms, such as those emerging around sustainable packaging or stricter impurity controls, could expose Bilcare to substantial risks. These include hefty financial penalties, restricted access to key markets, and a significant erosion of its competitive standing against more agile rivals.

Risk of Unsuccessful Revival and Financial Instability

Bilcare's past financial struggles, including previous restructuring, cast a shadow over its current revival efforts. Despite recent positive quarterly reports, the risk of these plans not fully succeeding or being sustained remains a significant concern. For instance, in the fiscal year ending March 31, 2023, the company reported a net loss of INR 13.75 crore, indicating ongoing financial pressures.

Continued operational losses or inadequate capital infusion could severely impede Bilcare's capacity to invest in crucial areas like product development, technological upgrades, and essential debt servicing. This financial instability could create a cycle where limited investment stifles growth, further exacerbating financial challenges.

- Sustained Profitability: The ability to consistently generate profits is crucial to overcome historical financial instability.

- Capital Access: Securing sufficient capital for investment and debt management is paramount for a successful revival.

- Operational Efficiency: Improving operational efficiency can directly impact profitability and reduce the risk of further losses.

- Market Demand: Fluctuations in market demand for their products can impact revenue and the ability to achieve financial stability.

Technological Disruption and Innovation by Competitors

Technological disruption poses a significant threat to Bilcare. Competitors are rapidly advancing in areas like smart packaging and anti-counterfeiting technologies, potentially introducing more effective or cheaper solutions. For instance, the global smart packaging market was valued at approximately USD 32.5 billion in 2023 and is projected to grow significantly, indicating a strong push for innovation in this sector.

If Bilcare doesn't invest sufficiently in research and development to match these advancements, it risks falling behind. A failure to adapt could lead to a loss of competitive advantage and diminish its market position. Companies that integrate advanced features, such as real-time tracking or enhanced tamper-evidence, could capture market share from those relying on older technologies.

- Rapid technological shifts in smart and anti-counterfeiting packaging could render Bilcare's current offerings obsolete.

- Competitors introducing more cost-effective innovative solutions could erode Bilcare's market share.

- Insufficient R&D investment by Bilcare could lead to a loss of competitive edge and market relevance.

The pharmaceutical packaging market is highly competitive, with major global and domestic players possessing significant resources and brand recognition. This intense rivalry, coupled with volatile raw material costs for plastics, polymers, and aluminum foil, directly impacts Bilcare's manufacturing expenses and profitability. Furthermore, evolving government regulations on product safety and serialization necessitate continuous investment in advanced technologies, posing a compliance challenge.

Bilcare's past financial difficulties, including a net loss of INR 13.75 crore for the fiscal year ending March 31, 2023, highlight the ongoing threat of sustained profitability and access to capital. Technological disruptions, particularly in smart and anti-counterfeiting packaging, could render current offerings obsolete if R&D investment lags, potentially leading to a loss of competitive edge.

| Threat Category | Specific Threat | Impact on Bilcare | Data Point/Example |

|---|---|---|---|

| Competition | Intense Market Rivalry | Reduced market share, pressure on profit margins | Major players: Amcor Plc., Aptar Group Inc., Huhtamaki Plc. |

| Cost Volatility | Fluctuating Raw Material Prices | Increased manufacturing costs, reduced profitability | Essential materials: plastics, polymers, aluminum foil |

| Regulatory Compliance | Stringent & Evolving Standards | Need for significant investment in technology and processes | EU Falsified Medicines Directive (track-and-trace) |

| Financial Instability | Past Losses & Restructuring | Impedes investment in R&D and growth | Net loss of INR 13.75 crore (FY ending March 31, 2023) |

| Technological Disruption | Advancements in Smart Packaging | Risk of obsolescence, loss of competitive advantage | Global smart packaging market valued at USD 32.5 billion (2023) |

SWOT Analysis Data Sources

This Bilcare SWOT analysis is constructed using a robust combination of financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded and accurate assessment.