Bilcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilcare Bundle

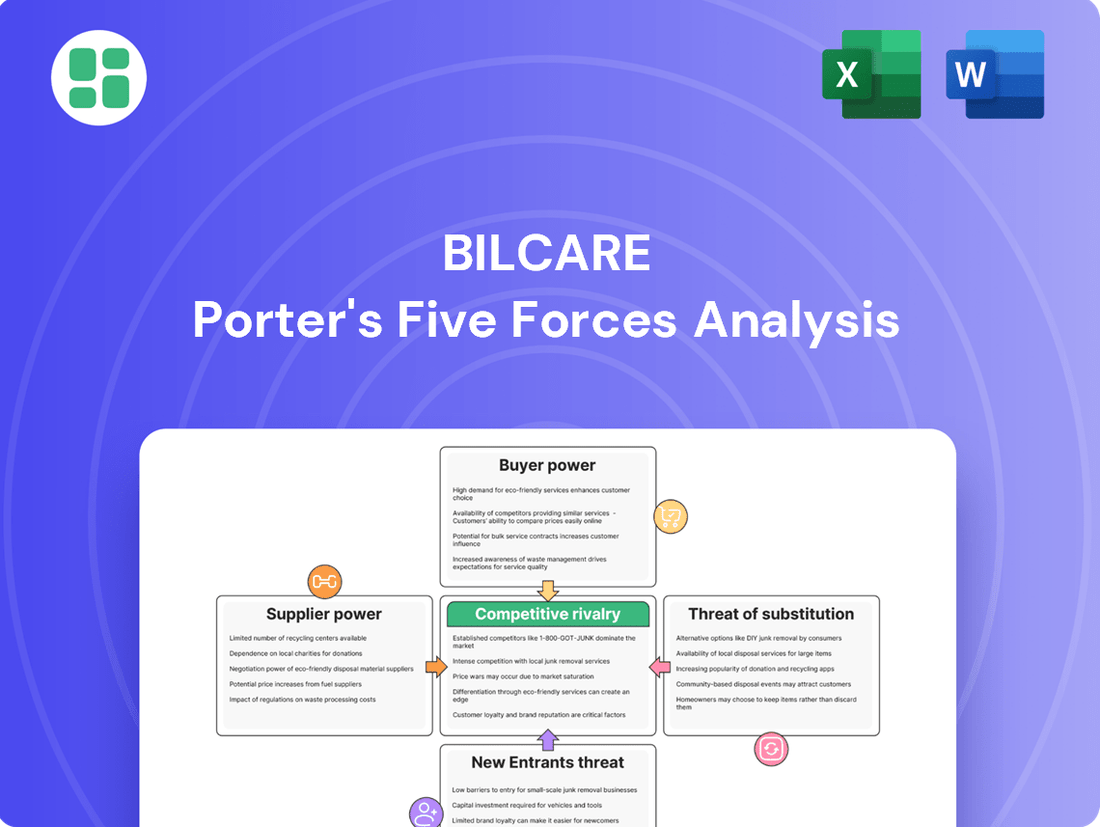

Bilcare's competitive landscape is shaped by powerful forces, from intense rivalry to the ever-present threat of substitutes. Understanding these dynamics is crucial for any strategic decision.

The complete Porter's Five Forces Analysis for Bilcare offers a comprehensive, data-driven view of these pressures, revealing hidden opportunities and potential risks.

Ready to gain a decisive edge? Unlock the full strategic breakdown to master Bilcare's market position and drive informed action.

Suppliers Bargaining Power

Bilcare's dependence on suppliers for specialized materials, like high-barrier polymers and advanced security foils crucial for pharmaceutical packaging and anti-counterfeiting solutions, significantly influences supplier bargaining power. If these materials are proprietary or have limited producers, suppliers gain considerable leverage.

The increasing demand for sustainable packaging, such as biopolymers, presents another dynamic. Limited supply chains for these newer, eco-friendly materials can elevate supplier negotiating power, potentially leading to higher costs for Bilcare. For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is projected to grow substantially, indicating a rising demand that could strain current supply capacities.

For commoditized raw materials like standard plastics or basic aluminum foils, Bilcare typically faces lower supplier bargaining power. This is because there are many global and regional suppliers available, allowing Bilcare to select from a broad range of vendors for these common inputs, thereby reducing reliance on any single source.

Switching suppliers for critical pharmaceutical packaging materials presents substantial hurdles for Bilcare. The process involves extensive re-validation, obtaining new regulatory approvals, and the inherent risk of disrupting established production lines. This inertia, a direct consequence of stringent quality and compliance mandates within the pharmaceutical sector, amplifies the bargaining power of existing suppliers.

Supplier Concentration in Niche Areas

In specialized segments of the pharmaceutical packaging market, like advanced anti-counterfeiting solutions or unique cold-chain logistics components, a limited number of suppliers often dominate. This concentration means a few key providers can wield significant influence over pricing and terms. For instance, if Bilcare's operations depend on proprietary anti-counterfeit inks or specialized temperature-controlled packaging materials, it faces a higher risk of suppliers dictating terms, thereby reducing Bilcare's bargaining power.

The impact of supplier concentration on Bilcare's bargaining power is directly tied to the uniqueness and availability of the materials or technologies it requires. For example, in 2023, the global market for pharmaceutical packaging solutions, estimated to be worth over USD 100 billion, saw significant growth driven by demand for specialized packaging. However, within niche segments like serialization technologies, the supplier landscape can be quite consolidated, with a few firms holding patents or advanced manufacturing capabilities.

- Supplier Concentration Impact: In areas where Bilcare requires highly specialized components, such as advanced holographic security features or specific barrier films, a concentrated supplier base can significantly increase supplier bargaining power.

- Reliance on Niche Suppliers: If Bilcare's competitive advantage or product integrity is heavily dependent on unique inputs from a few dominant suppliers, its ability to negotiate favorable terms is diminished.

- Market Dynamics: The overall bargaining power of suppliers is inversely related to the availability of alternative suppliers and the substitutability of the products or services they offer.

- 2024 Market Trend: The pharmaceutical packaging sector in 2024 continues to see innovation, but also consolidation in specialized technology providers, potentially increasing supplier leverage in those specific niches.

Forward Integration Potential of Suppliers

While large raw material suppliers could theoretically integrate forward into packaging manufacturing, this is a less common scenario for Bilcare. The highly specialized nature of pharmaceutical packaging, coupled with stringent regulatory requirements and significant capital investment, presents substantial barriers to entry. For instance, the pharmaceutical packaging industry demands adherence to Good Manufacturing Practices (GMP) and often requires specialized materials and sterile environments, making such a move complex and costly.

This high barrier significantly limits the direct threat of supplier forward integration. However, it doesn't diminish the suppliers' bargaining power concerning the pricing and consistent supply of critical raw materials. In 2024, the global pharmaceutical packaging market was valued at approximately USD 129.6 billion, highlighting the critical nature of these inputs.

- High Regulatory Hurdles: Pharmaceutical packaging requires compliance with FDA, EMA, and other health authority regulations, adding complexity and cost to forward integration.

- Specialized Manufacturing: Producing advanced pharmaceutical packaging often involves proprietary technologies and specialized machinery, which are difficult for raw material suppliers to replicate quickly.

- Capital Intensity: Establishing state-of-the-art pharmaceutical packaging facilities requires substantial upfront investment, deterring many raw material providers.

- Focus on Core Competencies: Most large raw material suppliers concentrate on their primary production, viewing diversification into a highly regulated sector like pharmaceutical packaging as outside their core strategic focus.

Bilcare faces significant supplier bargaining power when sourcing specialized materials like high-barrier polymers and advanced security foils, essential for pharmaceutical packaging and anti-counterfeiting. Limited producers or proprietary nature of these inputs grant suppliers leverage, potentially increasing costs.

The push for sustainable packaging, such as biopolymers, introduces another dynamic. In 2023, the bioplastics market was valued at USD 11.5 billion, and its projected growth may outpace current supply capacities, strengthening supplier negotiating positions for these eco-friendly materials.

Conversely, for commoditized raw materials like standard plastics, Bilcare benefits from lower supplier bargaining power due to a wide availability of multiple global and regional vendors, reducing dependence on any single source.

Switching suppliers for critical pharmaceutical packaging materials is challenging for Bilcare due to extensive re-validation, regulatory approvals, and production line disruption risks, which amplifies the power of existing suppliers.

In niche segments like advanced anti-counterfeiting solutions, a concentrated supplier base often dictates terms, impacting Bilcare's negotiation leverage. For instance, dependence on proprietary anti-counterfeit inks can empower suppliers.

| Factor | Impact on Bilcare | Supporting Data/Trend |

| Supplier Concentration | Increased Bargaining Power | Niche segments in the USD 129.6 billion pharmaceutical packaging market (2024) often have consolidated providers. |

| Material Specialization | Increased Bargaining Power | Proprietary barrier films or security features require specialized production, limiting alternatives. |

| Switching Costs | Increased Bargaining Power | Stringent pharmaceutical regulations (e.g., GMP) necessitate costly re-validation, deterring supplier changes. |

| Availability of Substitutes | Decreased Bargaining Power | Commoditized materials like standard plastics have numerous suppliers, reducing individual supplier leverage. |

What is included in the product

This analysis dissects Bilcare's competitive environment by examining industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Easily visualize competitive intensity across all five forces, streamlining strategic planning and identifying key areas of pressure.

Customers Bargaining Power

Bilcare's customer base is largely concentrated within the pharmaceutical and biotechnology sectors, featuring major multinational corporations. These significant players possess substantial purchasing power, allowing them to influence pricing, quality standards, and service expectations. For instance, in 2023, the top 10 global pharmaceutical companies accounted for over $500 billion in revenue, demonstrating their immense market leverage.

While major pharmaceutical companies certainly hold sway, the practicalities of switching packaging suppliers present considerable hurdles. These include the expense and time associated with re-validating packaging materials, navigating new regulatory filings, and the inherent risks to drug stability and the unbroken flow of their supply chains. For instance, a single change in a primary packaging component could necessitate months of testing and re-approval processes.

Customers in the pharmaceutical packaging sector, particularly those sourcing packaging for generic medications, often exhibit significant price sensitivity. This characteristic directly translates into pressure on suppliers like Bilcare to maintain highly competitive pricing structures. For instance, in 2024, the global pharmaceutical packaging market saw intense competition, with generic drug packaging being a key battleground for cost efficiency.

However, the dynamic shifts when considering specialized or highly differentiated packaging solutions. For products incorporating advanced features such as anti-counterfeiting technologies, smart packaging functionalities, or tailored solutions for clinical trial supplies, customers demonstrate a greater willingness to absorb premium pricing. This willingness stems from the added value and security these advanced features provide.

Bilcare's strategic emphasis on developing and marketing 'niche packaging and healthcare services' directly addresses this. By focusing on these less commoditized, value-added segments, the company aims to cultivate offerings that are less susceptible to price-based bargaining, thereby mitigating the bargaining power of price-sensitive customers.

Customer's Threat of Backward Integration

Large pharmaceutical firms, with substantial financial backing and technical know-how, could theoretically bring some packaging production or clinical trial supply management in-house. This backward integration capability, though less frequent for highly specialized packaging, serves as a negotiation tool. For instance, in 2024, the global pharmaceutical packaging market was valued at approximately $90 billion, with significant portions dedicated to specialized materials, making in-house production a complex undertaking for many.

While the threat of backward integration by major pharmaceutical clients is a constant factor, its practical application is often limited by the significant capital investment and specialized expertise required. The complexities involved in manufacturing advanced pharmaceutical packaging, such as those with unique barrier properties or serialization capabilities, often make outsourcing to specialized providers like Bilcare a more cost-effective and efficient strategy. This is particularly true given the rapid pace of technological advancement in the packaging sector.

- High Capital Investment: Establishing in-house production for specialized pharmaceutical packaging, including sterile barrier systems or advanced anti-counterfeiting features, can require hundreds of millions of dollars in new facilities and equipment.

- Technical Expertise Gap: Developing and maintaining the specialized knowledge for advanced packaging materials and regulatory compliance is a significant hurdle for many pharmaceutical companies.

- Focus on Core Competencies: Pharmaceutical giants typically prioritize their core business of drug research, development, and marketing, viewing packaging as a non-core activity best handled by expert suppliers.

- Market Dynamics: The dynamic nature of packaging innovations and evolving regulatory landscapes further disincentivize backward integration, as specialized suppliers can adapt more nimbly.

Regulatory Requirements and Compliance Demands

Pharmaceutical customers, such as major drug manufacturers, exert significant bargaining power due to their demand for strict adherence to global regulatory standards like those set by the FDA and EMA. Compliance requires substantial investment in quality control, advanced materials, and robust traceability systems from packaging suppliers.

These stringent regulatory demands empower customers to negotiate for higher quality packaging, enhanced product security, and detailed batch traceability. For instance, in 2024, the global pharmaceutical packaging market was valued at approximately $120 billion, with compliance being a key differentiator and cost driver for suppliers.

- Regulatory Compliance Costs: Suppliers must invest heavily in meeting evolving global pharmaceutical regulations, which can range from serialization requirements to specific material safety standards.

- Customer Leverage: Pharmaceutical companies can leverage these compliance needs to secure favorable pricing and service level agreements from packaging providers.

- Supplier Investment Pressure: The need to maintain certifications and invest in compliance infrastructure places continuous financial pressure on packaging suppliers, impacting their pricing flexibility.

Bilcare's customers, primarily large pharmaceutical firms, possess considerable bargaining power due to their substantial order volumes and the critical nature of packaging for drug integrity and market access. These clients can leverage their market position to demand competitive pricing and stringent quality standards, influencing Bilcare's operational costs and profit margins. In 2024, the pharmaceutical packaging market, valued at approximately $120 billion, saw intense competition where buyer power significantly shaped supplier strategies.

The switching costs for pharmaceutical companies, while present, are often outweighed by the potential for cost savings or access to superior packaging solutions that enhance drug safety and brand image. This dynamic encourages customers to actively negotiate terms, pushing suppliers like Bilcare to continually innovate and optimize their offerings. For instance, the development of advanced anti-counterfeiting features in packaging can become a key negotiation point, with clients seeking these innovations at favorable price points.

Furthermore, the pharmaceutical industry's regulatory landscape empowers buyers. Strict compliance requirements mean customers can demand packaging that meets rigorous global standards, such as those from the FDA and EMA. This necessitates significant investment from suppliers in quality control and advanced materials, giving customers leverage to negotiate for higher quality and assured compliance, as seen in the ongoing demand for serialization capabilities.

Bilcare's strategy of focusing on niche, value-added packaging solutions aims to counter this customer power by differentiating its offerings beyond price. By providing specialized services like advanced anti-counterfeiting or smart packaging, Bilcare can reduce the commoditization of its products and diminish the direct price-based bargaining leverage of its clients. This shift allows for more value-based negotiations, particularly with clients prioritizing innovation and product security over pure cost efficiency.

| Customer Segment | Bargaining Power Factor | Impact on Bilcare | 2024 Market Context |

|---|---|---|---|

| Major Pharmaceutical Corporations | High Volume Purchases | Price pressure, demand for concessions | Valued at ~$120 billion globally |

| Switching Costs (moderate) | Negotiation leverage for better terms | Focus on supply chain reliability | |

| Regulatory Compliance Demands | Need for supplier investment in quality | Stringent FDA/EMA standards | |

| Clients Seeking Specialized Packaging | Value-Added Features (e.g., anti-counterfeiting) | Reduced price sensitivity, premium pricing potential | Growth in smart and secure packaging |

Preview the Actual Deliverable

Bilcare Porter's Five Forces Analysis

This preview showcases the complete Bilcare Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document displayed here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring no surprises. You can confidently acquire this ready-to-use document, gaining immediate access to valuable strategic insights for Bilcare.

Rivalry Among Competitors

The pharmaceutical packaging market, including in India, is quite fragmented. While there are many smaller companies, a few large global players and established domestic firms hold significant sway. This means Bilcare faces competition not only from numerous smaller rivals but also from these larger, well-resourced entities.

Bilcare's own financial situation and operational scale mean it contends with competitors that are often more financially robust. This dynamic intensifies the battle for market share, particularly in those packaging segments that are more standardized and less differentiated, making it harder to command premium pricing.

The pharmaceutical packaging sector is inherently capital-intensive, demanding substantial investments in advanced machinery, specialized facilities, and ongoing research and development. This high upfront cost creates a significant barrier to entry and pressures existing players to operate at peak capacity.

Companies in this industry must achieve high capacity utilization to spread their considerable fixed costs across a larger production volume, thereby improving profitability and achieving economies of scale. For instance, in 2024, leading pharmaceutical packaging manufacturers reported average capacity utilization rates exceeding 85% to remain competitive.

This drive for volume can intensify competitive rivalry, pushing companies to adopt aggressive pricing strategies to secure orders and ensure their expensive assets are running efficiently. Firms may engage in price wars to fill excess capacity, making it challenging for less efficient players to survive.

Competitive rivalry in the pharmaceutical packaging sector is intense, driven by a constant need for product differentiation and a rapid pace of innovation. While basic packaging can become a commodity, companies like Bilcare are pushing boundaries with smart packaging, eco-friendly materials, and sophisticated anti-counterfeiting technologies. This focus on unique features aims to bolster patient safety, improve medication adherence, and secure the pharmaceutical supply chain.

Companies are channeling significant resources into research and development to stay ahead. For instance, the global smart packaging market was valued at approximately USD 30.1 billion in 2023 and is projected to grow substantially, indicating a strong investment in innovative solutions. Bilcare's success hinges on its agility in developing and delivering these differentiated, niche products that offer tangible value beyond basic containment.

High Exit Barriers

Companies in the pharmaceutical packaging sector, including Bilcare, face substantial exit barriers. These are primarily driven by the need for highly specialized manufacturing assets and significant capital investments, often running into millions of dollars for state-of-the-art machinery and compliance certifications. Furthermore, many firms operate under long-term contracts with pharmaceutical clients, making an abrupt departure economically unfeasible.

These high exit barriers mean that even struggling companies like Bilcare may remain in the market for extended periods, intensifying competition. This situation can prevent much-needed industry consolidation. For instance, Bilcare's ongoing restructuring efforts, initiated in response to market pressures, highlight the difficulty of simply ceasing operations when faced with such entrenched commitments and specialized infrastructure.

The implications for the industry are clear:

- Specialized Assets: The pharmaceutical packaging industry requires unique machinery and technology, making assets difficult to repurpose or sell quickly.

- Capital Intensity: High initial investments in plant, equipment, and regulatory compliance create a significant financial hurdle for exiting firms.

- Contractual Obligations: Long-term supply agreements with pharmaceutical companies bind manufacturers to the market, even during downturns.

- Brand Reputation: A sudden exit can damage a company's reputation, impacting future business opportunities in related sectors.

Market Growth and Niche Focus

The pharmaceutical packaging market is experiencing strong growth, which can help ease competitive pressures by creating more opportunities for everyone involved. For instance, the global pharmaceutical packaging market was valued at approximately $110 billion in 2023 and is projected to reach over $170 billion by 2030, indicating a healthy expansion. [1, 4, 5, 6, 8, 11, 14]

Bilcare's strategic focus on reviving operations, particularly in niche packaging and healthcare services, suggests a move towards specialized segments. These areas often experience less intense rivalry compared to the broader, more commoditized parts of the market. This allows companies like Bilcare to leverage their specific expertise and potentially achieve better margins.

- Market Growth: The pharmaceutical packaging market is expanding, offering more room for all players.

- Niche Focus: Bilcare's strategy targets specialized segments, potentially reducing direct competition.

- Healthcare Services: Expansion into healthcare services diversifies revenue and may tap into less crowded markets.

- Expertise Leverage: Focusing on niches allows Bilcare to utilize its specific capabilities more effectively.

Competitive rivalry in the pharmaceutical packaging sector is indeed fierce. Numerous players, from global giants to smaller domestic firms, vie for market share, often leading to aggressive pricing, especially in standardized packaging. Bilcare faces this challenge directly, needing to differentiate itself to avoid being drawn into price wars. For example, in 2024, many packaging companies focused on high capacity utilization, exceeding 85%, to manage costs, which can further fuel competition.

Innovation is key, with companies investing heavily in areas like smart packaging, which saw a global market valuation of approximately USD 30.1 billion in 2023. Bilcare's strategy to focus on niche products and healthcare services aims to sidestep some of this intense rivalry by targeting less commoditized segments where its expertise can command better value.

The industry's high exit barriers, due to specialized assets and contractual obligations, mean even less competitive firms can persist, prolonging rivalry. Despite this, the overall market growth, projected to expand from $110 billion in 2023 to over $170 billion by 2030, offers opportunities for well-positioned companies like Bilcare to thrive by focusing on specialized, high-value offerings.

SSubstitutes Threaten

The primary threat of substitution for pharmaceutical packaging stems from the evolving material landscape, with a notable shift from traditional plastics and glass towards advanced biopolymers and more sustainable, recyclable alternatives. While these new materials are driven by increasing eco-friendly demands, their adoption is often tempered by the necessity to meet rigorous regulatory standards and provide essential protective qualities, acting as a significant barrier to rapid market penetration.

Bilcare's core product offerings, particularly its films and foils, are directly positioned within this dynamic environment, facing the challenge of adapting to or leading this material evolution. The global bioplastics market, for instance, was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a tangible market shift that packaging providers like Bilcare must navigate.

The rise of innovative drug delivery systems like pre-filled syringes and auto-injectors poses a significant substitute threat. These advanced formats, offering greater patient convenience and improved medication adherence, challenge the dominance of traditional packaging like bottles and blister packs. For instance, the global pre-filled syringe market was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in demand away from older packaging methods.

The threat of substitutes for Bilcare's physical anti-counterfeiting technologies is significant, particularly from purely digital authentication solutions. Blockchain-based traceability systems and advanced serialization methods offer alternative ways to verify product authenticity without relying on physical security features. For instance, the global blockchain in supply chain market was projected to reach $10.5 billion by 2025, indicating a strong shift towards digital verification.

As the market increasingly favors integrated digital solutions, Bilcare faces the challenge of its physical security features being substituted by software-centric approaches. Companies are seeking comprehensive, end-to-end digital tracking, which could diminish the perceived value of traditional physical markers. This necessitates continuous innovation in Bilcare's offerings to remain competitive against these evolving digital substitutes.

In-house Solutions by Pharmaceutical Companies

Large pharmaceutical companies possess the potential to develop in-house packaging or clinical trial supply management, directly substituting services offered by specialized firms. This internal expansion could be driven by a desire for greater control over their supply chain and intellectual property.

However, the significant capital expenditure, extensive regulatory compliance, and specialized expertise required for these operations often present a formidable barrier. For instance, establishing a fully compliant pharmaceutical packaging facility can cost tens of millions of dollars, a substantial investment that many companies find more prudent to avoid by leveraging external specialists.

This complexity and cost inherently limit the direct threat of in-house solutions. Companies like Bilcare, with their established infrastructure and regulatory know-how, often provide a more economically viable and efficient alternative. In 2024, the global pharmaceutical packaging market was valued at approximately $100 billion, with a significant portion attributed to outsourced services, underscoring the continued reliance on specialized providers.

- High Capital Investment: Developing in-house packaging facilities can require millions in upfront costs for machinery, cleanrooms, and quality control systems.

- Regulatory Complexity: Navigating stringent pharmaceutical regulations (e.g., FDA, EMA) for packaging and supply chain management demands specialized knowledge and ongoing compliance efforts.

- Expertise Gap: Specialized providers possess deep expertise in areas like serialization, cold chain logistics, and tamper-evident packaging, which can be difficult and costly for pharma companies to replicate internally.

- Focus on Core Competencies: Pharmaceutical companies often prefer to concentrate their resources on research, development, and marketing, outsourcing non-core functions like packaging to specialists.

Regulatory and Performance Constraints

The threat of substitutes for pharmaceutical packaging is significantly mitigated by stringent regulatory and performance demands. Any alternative must adhere to rigorous standards set by bodies like the FDA or EMA concerning drug safety, stability, and the clarity of patient information. For instance, in 2024, the pharmaceutical industry continued to invest heavily in packaging that ensures product integrity, with global spending on pharmaceutical packaging projected to reach over $120 billion by 2027, highlighting the premium placed on compliant and effective solutions.

These regulatory hurdles create substantial barriers for potential substitutes. For example, material compatibility and barrier properties are critical; failure to meet these can result in severe penalties, including product recalls. This high compliance bar means that many seemingly viable substitutes are simply not feasible for pharmaceutical applications, leading to exceptionally high switching costs for drug manufacturers who prioritize patient safety and regulatory adherence.

- Regulatory Compliance: Pharmaceutical packaging must meet strict FDA and EMA guidelines for safety and efficacy.

- Performance Standards: Substitutes need to demonstrate equivalent or superior barrier properties and material compatibility.

- High Switching Costs: Non-compliance leads to recalls and penalties, making manufacturers reluctant to switch from proven solutions.

- Market Size: The global pharmaceutical packaging market is substantial, indicating a strong demand for specialized, compliant materials.

The threat of substitutes for Bilcare's pharmaceutical packaging is shaped by evolving material science and drug delivery systems. While new biopolymers offer sustainability, they must meet stringent regulatory and protective standards. Advanced drug delivery formats like pre-filled syringes also present a substitution risk, challenging traditional packaging. Furthermore, digital authentication methods are increasingly replacing physical anti-counterfeiting technologies.

| Substitute Category | Example | Market Context (2024/2025 Projections) | Impact on Bilcare |

|---|---|---|---|

| Material Innovation | Biopolymers, advanced recyclable materials | Global bioplastics market projected to grow significantly from its ~ $50 billion valuation in 2023. | Requires Bilcare to adapt its product line or risk obsolescence. |

| Drug Delivery Systems | Pre-filled syringes, auto-injectors | Global pre-filled syringe market valued at ~$6.5 billion in 2023, with substantial growth expected. | Potential shift away from traditional blister packs and bottles. |

| Digital Authentication | Blockchain traceability, serialization | Global blockchain in supply chain market projected to reach $10.5 billion by 2025. | Diminishes the value of Bilcare's physical anti-counterfeiting features. |

Entrants Threaten

The pharmaceutical packaging and clinical trial supply sectors, where Bilcare operates, demand significant initial capital. Establishing state-of-the-art manufacturing facilities, acquiring specialized machinery, and investing in robust research and development and quality control systems can easily run into tens of millions of dollars. For instance, a new sterile packaging line alone can cost upwards of $5 million to $10 million, excluding the building and associated infrastructure.

Stringent regulatory compliance is a significant hurdle for new entrants in the pharmaceutical packaging sector. Companies must meticulously adhere to global standards set by bodies like the FDA and EMA, a process that can take years and substantial investment. For instance, obtaining approval for new packaging materials often involves extensive compatibility testing with various drugs, a costly and time-consuming endeavor.

Established customer relationships and strong brand loyalty represent a significant barrier for new entrants looking to compete with companies like Bilcare. Pharmaceutical clients often have deep-seated trust in their existing suppliers, built over years of reliable service and proven compliance with stringent industry regulations.

Newcomers must overcome the hurdle of establishing credibility with a risk-averse customer base. Securing contracts requires demonstrating not only competitive pricing but also unwavering supply chain stability and rigorous quality assurance, making it challenging to displace incumbents who have already met these critical demands.

Proprietary Technology and Intellectual Property

Proprietary technology and intellectual property represent a significant hurdle for new entrants in the pharmaceutical packaging sector. Established companies, like Bilcare, often possess patents for unique packaging designs, advanced material compositions, and sophisticated anti-counterfeiting features. For instance, in 2024, the global pharmaceutical packaging market saw continued investment in R&D, with companies focusing on serialization and track-and-trace technologies, further solidifying existing IP portfolios.

New players entering this space would need substantial capital to either develop their own innovative solutions or secure licenses for existing patented technologies. This investment directly impacts their cost structure and extends their time to market, creating a competitive disadvantage against incumbents who have already amortized these development costs.

- Patented Innovations: Existing players hold patents covering specialized packaging designs and material science, acting as a barrier.

- R&D Investment: New entrants must invest heavily in research and development to create comparable proprietary solutions.

- Licensing Costs: Alternatively, acquiring licenses for existing technologies adds significant upfront expenses and delays market entry.

- Time-to-Market: The need for proprietary development or licensing directly impacts how quickly a new company can compete.

Economies of Scale and Cost Advantages

Established pharmaceutical packaging manufacturers, like Bilcare, leverage significant economies of scale. This allows them to secure bulk discounts on raw materials, optimize production processes, and achieve cost efficiencies in distribution. For instance, in 2024, major players in the pharmaceutical packaging sector reported operating margins that were, on average, 3-5% higher than smaller, emerging companies primarily due to these scale advantages.

New entrants face substantial hurdles in matching these cost advantages. Without the purchasing power and established operational efficiencies of incumbents, they would likely incur higher per-unit costs for materials and manufacturing. This disparity makes it challenging for new companies to compete on price, a critical factor in the highly competitive pharmaceutical packaging market, potentially impacting their ability to achieve profitability and sustainable growth.

- Economies of Scale: Larger firms can produce more at a lower average cost.

- Cost Advantages: This translates to lower prices for consumers or higher profit margins for the company.

- Barriers to Entry: High upfront investment and established cost structures deter new competitors.

- Market Share: New entrants struggle to gain traction against price-competitive incumbents.

The threat of new entrants for Bilcare is moderate. While the pharmaceutical packaging sector requires substantial capital investment for advanced manufacturing and regulatory compliance, which acts as a deterrent, established brands and proprietary technologies create significant barriers. New players must overcome these hurdles to gain market traction.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for specialized machinery and R&D. | Significant upfront investment needed. |

| Regulatory Compliance | Adherence to FDA/EMA standards is time-consuming and costly. | Delays market entry and increases operational expenses. |

| Proprietary Technology/IP | Patents on unique designs and anti-counterfeiting features. | Requires licensing or costly in-house development. |

| Customer Loyalty & Credibility | Established trust with risk-averse clients. | Difficult to displace incumbents without proven reliability. |

Porter's Five Forces Analysis Data Sources

Our Bilcare Porter's Five Forces analysis is built upon a robust foundation of data, including Bilcare's annual reports, investor presentations, and publicly available financial statements. We also incorporate industry-specific market research reports and analyses from reputable trade publications to provide a comprehensive view of the competitive landscape.